Académique Documents

Professionnel Documents

Culture Documents

FB Valuation

Transféré par

Rogelio RodriguezCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FB Valuation

Transféré par

Rogelio RodriguezDroits d'auteur :

Formats disponibles

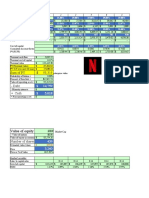

DISCOUNTED EARNINGS MODEL

FACEBOOK

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Earnings 6.47 7.44 8.56 9.84 11.32 13.01 14.31 15.75 17.32 19.05 20.96

PV Earnings 0 6.64 6.82 7.00 7.19 7.38 7.25 7.12 7.00 6.87 6.75

Present Value 160.41

2013 2014 2015 2016 2017 2018

earnings (In $B) 1.49 2.94 3.69 10.22 15.93 20

percent change 0.97 0.26 1.77 0.56 0.26

average 0.76

Terminal Value 1.15 Next 5 years Growth

314.38 1.1 5 to 10 years Growth

90.38 0.12 Required ROR

15 Terminal multiple

DISCOUNTED CASH FLOW MODEL

1

0.9

Name of stock FB 0.8

Operating cash 0.7

flow ttm $ 27.956

0.6

Total debt

Short + long term $ - 0.5

Cash and short 0.4

term investments $ 42.309 0.3

(in billions) Shares outstanding 2.895

0.2

CF Growth 1-3 yr 0.24

CF Growth 4-6 yr 0.15 0.1

CF Growth 7-10yr 0.15 0

0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5

Year 2019 2020 2021 2022 2023

Projected CF $ 34.67 $ 42.99 $ 53.30 $ 48.90 $ 56.23

(in billions) PV Cash Flow $ 33.01 $ 38.99 $ 46.04 $ 40.23 $ 44.06

ttm up to mid 2012 2013 2014 2015 2016

(in billions) 0.569 2.01 3.21 6.23 10.28

2.53251318 0.59701493 0.94080997 0.65008026

-0.7642599 0.5758567 -0.30902065

-0.2594444

cf growth1 0.17336557 0.12838684 0.0950776 0.07041025 0.0521427

Year 2019 2020 2021 2022 2023

Projected CF $ 32.80 $ 37.01 $ 40.53 $ 43.39 $ 45.65

(in billions) PV Cash Flow $ 31.24 $ 33.57 $ 35.01 $ 35.69 $ 35.77

cf growth1 0.13979718 0.08348177 0.04985227 0.02976995 0.01777753

Year 2019 2020 2021 2022 2023

Projected CF $ 31.86 $ 34.52 $ 36.25 $ 37.32 $ 37.99

(in billions) PV Cash Flow $ 30.35 $ 31.31 $ 31.31 $ 30.71 $ 29.76

H FLOW MODEL

PV of 10 yr

$ 494.14 cash flow (in billions)

Intrinsic value

$ 170.69 before cash & debt

Row 25 0 Less debt per share

14.65 Plus cash per share

Final intrisic value

$ 185.34 per share

2018 Current Year

0.05 Discount rate

.5 4 4.5 5 5.5

2024 2025 2026 2027 2028

$ 64.66 $ 74.36 $ 85.52 $ 98.35 $ 113.10

$ 48.25 $ 52.85 $ 57.88 $ 63.39 $ 69.43

2017 2018

14.31 17.66

0.39202335 0.23410203

-0.39696162 -0.40283652

PV of 20 yr

$ 581.62 cash flow (in billions)

Intrinsic value

$ 200.91 before cash & debt

0 Less debt per share

14.65 Plus cash per share

Final intrisic value

$ 215.56 per share

2018 Current Year

0.05 Discount rate

0.03861457 0.02859624 0.0211771 0.015683 0.011614

2024 2025 2026 2027 2028 2029 2030

$ 47.41 $ 48.77 $ 49.80 $ 50.58 $ 51.17 $ 51.17 $ 51.17

$ 35.38 $ 34.66 $ 33.71 $ 32.61 $ 31.41 $ 29.92 $ 28.49

PV of 20 yr

$ 469.25 cash flow (in billions)

Intrinsic value

$ 162.09 before cash & debt

0 Less debt per share

14.65 Plus cash per share

Final intrisic value

$ 176.74 per share

2018 Current Year

0.05 Discount rate

0.01061609 0.00633954 0.00378574 0.002261 0.00135001

2024 2025 2026 2027 2028 2029 2030

$ 38.39 $ 38.63 $ 38.78 $ 38.87 $ 38.92 $ 38.92 $ 38.92

$ 28.65 $ 27.46 $ 26.25 $ 25.05 $ 23.89 $ 22.76 $ 21.67

2031 2032 2033 2034 2035 2036 2037

$ 51.17 $ 51.17 $ 51.17 $ 51.17 $ 51.17 $ 51.17 $ 51.17

$ 27.14 $ 25.84 $ 24.61 $ 23.44 $ 22.32 $ 21.26 $ 20.25

2031 2032 2033 2034 2035 2036 2037

$ 38.92 $ 38.92 $ 38.92 $ 38.92 $ 38.92 $ 38.92 $ 38.92

$ 20.64 $ 19.66 $ 18.72 $ 17.83 $ 16.98 $ 16.17 $ 15.40

2038

$ 51.17

$ 19.29

2038

$ 38.92

$ 14.67

Vous aimerez peut-être aussi

- Intrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Document41 pagesIntrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Clarence Ryan100% (2)

- Tata Technologies FinancialsDocument22 pagesTata Technologies FinancialsRitvik DuttaPas encore d'évaluation

- Money and The MythDocument2 pagesMoney and The MythVanshica SahniPas encore d'évaluation

- 20 Year Intrinsic ValueDocument27 pages20 Year Intrinsic ValueCaleb100% (2)

- ADRODocument41 pagesADROClarence Ryan100% (1)

- DCF Template BofA - VFDocument1 pageDCF Template BofA - VFHunter Hearst LevesquePas encore d'évaluation

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument10 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatPas encore d'évaluation

- Titan Company Limited Intrinsic Value Estimation and WACC CalculationDocument6 pagesTitan Company Limited Intrinsic Value Estimation and WACC CalculationKS UnofficialPas encore d'évaluation

- Class 9 SolutionsDocument14 pagesClass 9 SolutionsvroommPas encore d'évaluation

- The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94Document3 pagesThe Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94NarinderPas encore d'évaluation

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaPas encore d'évaluation

- PE Exit AnalysisDocument5 pagesPE Exit AnalysisgPas encore d'évaluation

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoPas encore d'évaluation

- Varma Capitals - Modeling TestDocument6 pagesVarma Capitals - Modeling TestSuper FreakPas encore d'évaluation

- DCF Textbook Model ExampleDocument6 pagesDCF Textbook Model ExamplePeterPas encore d'évaluation

- China Construction Bank Corporation SEHK 939 FinancialsDocument54 pagesChina Construction Bank Corporation SEHK 939 FinancialsJaime Vara De ReyPas encore d'évaluation

- Pepsico, Inc. (Nasdaqgs:Pep) Financials Key StatsDocument28 pagesPepsico, Inc. (Nasdaqgs:Pep) Financials Key StatsJulio CesarPas encore d'évaluation

- Abc CompanyDocument3 pagesAbc CompanyJOHN MITCHELL GALLARDOPas encore d'évaluation

- Aircraft lease payment and depreciation figuresDocument4 pagesAircraft lease payment and depreciation figuresbananahoverboardPas encore d'évaluation

- KR Valuation 28 Sept 2019Document54 pagesKR Valuation 28 Sept 2019ket carePas encore d'évaluation

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72Pas encore d'évaluation

- Money and The MythDocument11 pagesMoney and The MythpankajsinhaPas encore d'évaluation

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- DCF ModelDocument4 pagesDCF Modeljuilee bhoirPas encore d'évaluation

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Georgetown University Public Real Estate Fund Valuation ModelDocument35 pagesGeorgetown University Public Real Estate Fund Valuation Modelmzhao8Pas encore d'évaluation

- Infosys Ltd. Financial Analysis and ValuationDocument14 pagesInfosys Ltd. Financial Analysis and Valuationswaroop shettyPas encore d'évaluation

- Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Document1 pageCalculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Prachi NavgharePas encore d'évaluation

- Forward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Document19 pagesForward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Wahid Arief AuladyPas encore d'évaluation

- Intrinsic Value Estimate of Telkom Indonesia Using DCF ValuationDocument19 pagesIntrinsic Value Estimate of Telkom Indonesia Using DCF ValuationWahid Arief AuladyPas encore d'évaluation

- Inputs (Billions) Year Free Cash FlowDocument5 pagesInputs (Billions) Year Free Cash FlowBenny OngPas encore d'évaluation

- IFM11 Solution To Ch08 P15 Build A ModelDocument2 pagesIFM11 Solution To Ch08 P15 Build A ModelDiana Soriano50% (2)

- Infosys LTD 774.60: Nse: InfyDocument5 pagesInfosys LTD 774.60: Nse: InfybezirksvorPas encore d'évaluation

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghPas encore d'évaluation

- Bank of China Limited SEHK 3988 FinancialsDocument47 pagesBank of China Limited SEHK 3988 FinancialsJaime Vara De ReyPas encore d'évaluation

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoPas encore d'évaluation

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoPas encore d'évaluation

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoPas encore d'évaluation

- COSCO - PH Cosco Capital Inc. Financial Statements - WSJDocument1 pageCOSCO - PH Cosco Capital Inc. Financial Statements - WSJjannahaaliyahdPas encore d'évaluation

- Industrial and Commercial Bank of China Limited SEHK 1398 FinancialsDocument49 pagesIndustrial and Commercial Bank of China Limited SEHK 1398 FinancialsJaime Vara De ReyPas encore d'évaluation

- NI3039 Inc. P&L SummaryDocument1 pageNI3039 Inc. P&L SummaryCarolina Parra ZaldivarPas encore d'évaluation

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202Pas encore d'évaluation

- G25 - Hospitality Sector - Excel FA RatiosDocument19 pagesG25 - Hospitality Sector - Excel FA RatiosIIM Sambalpur Annual FestPas encore d'évaluation

- 3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsDocument3 pages3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsQudsiya KalhoroPas encore d'évaluation

- 2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionDocument1 page2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionShabnam ShahPas encore d'évaluation

- Tarea Razones RentabilidadDocument12 pagesTarea Razones RentabilidadEmilio BazaPas encore d'évaluation

- Corse Cod: ACT328 Section: 1 Name: Shaheed AhmedDocument3 pagesCorse Cod: ACT328 Section: 1 Name: Shaheed AhmedSidad KurdistaniPas encore d'évaluation

- Evaluating Reliance's Dividend Policy and ValuationDocument11 pagesEvaluating Reliance's Dividend Policy and ValuationYash Aggarwal BD20073Pas encore d'évaluation

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocument2 pagesLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaPas encore d'évaluation

- DCF ModelDocument3 pagesDCF ModelNomore MupfupiPas encore d'évaluation

- Valution ModelDocument10 pagesValution ModelVivek WaradePas encore d'évaluation

- Current Assets: Liabilities and Stockholders' EquityDocument9 pagesCurrent Assets: Liabilities and Stockholders' EquityIrakli SaliaPas encore d'évaluation

- September 2021 Casino Revenue DataDocument14 pagesSeptember 2021 Casino Revenue DataWJZPas encore d'évaluation

- SVA ModelDocument15 pagesSVA ModelArshdeep SaroyaPas encore d'évaluation

- What Is Leveraged Buyout Model Aka LBO Model?Document5 pagesWhat Is Leveraged Buyout Model Aka LBO Model?bhumiklalka999Pas encore d'évaluation

- Group2 - Assignment 1Document9 pagesGroup2 - Assignment 1RiturajPaulPas encore d'évaluation

- Valuation of AppleDocument25 pagesValuation of AppleQuofi SeliPas encore d'évaluation

- Common Stock ValuationDocument10 pagesCommon Stock ValuationDeep AnjarlekarPas encore d'évaluation

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsD'EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsPas encore d'évaluation

- Price # of Shares Earnings EPS Assets Dates Costco $ 151.24 438,680,000 Berk-B Black RockDocument3 pagesPrice # of Shares Earnings EPS Assets Dates Costco $ 151.24 438,680,000 Berk-B Black RockRogelio RodriguezPas encore d'évaluation

- PDE FinanceDocument16 pagesPDE FinanceRogelio RodriguezPas encore d'évaluation

- Top 3 companies financial data comparisonDocument3 pagesTop 3 companies financial data comparisonRogelio RodriguezPas encore d'évaluation

- Anatomy ParkDocument1 pageAnatomy ParkRogelio RodriguezPas encore d'évaluation

- Financial Risk Management (PROJECT)Document72 pagesFinancial Risk Management (PROJECT)Vinayak Halapeti100% (2)

- Auxilo EIL Schedule of ChargesDocument2 pagesAuxilo EIL Schedule of ChargesArun KumarPas encore d'évaluation

- NEPALESE RETAIL INVESTOR STOCK MARKET PREFERENCEDocument7 pagesNEPALESE RETAIL INVESTOR STOCK MARKET PREFERENCEraazoo19Pas encore d'évaluation

- NISM SORM Certification RequirementDocument5 pagesNISM SORM Certification RequirementMayank ShahPas encore d'évaluation

- IBS BUSINESS SCHOOL PGPM SEMESTER IV EXAM DETAILSDocument6 pagesIBS BUSINESS SCHOOL PGPM SEMESTER IV EXAM DETAILSKrishan SharmaPas encore d'évaluation

- Risk, Stop Loss and Position Size: Author ofDocument7 pagesRisk, Stop Loss and Position Size: Author offendy100% (1)

- Bab 20 Direct Costing PDFDocument7 pagesBab 20 Direct Costing PDFSandi Setiawan100% (1)

- Solution To Ch12 P10 Build A ModelDocument2 pagesSolution To Ch12 P10 Build A Modelscuevas_10100% (7)

- Invoice: Order SummaryDocument1 pageInvoice: Order SummaryELFIRA UTAMIPas encore d'évaluation

- 33 Money LessonsDocument37 pages33 Money Lessonsraj100% (3)

- Sbi Statement PDFDocument8 pagesSbi Statement PDFSUNIL GUPTAPas encore d'évaluation

- Wealth ManagementDocument16 pagesWealth ManagementSarbarup BanerjeePas encore d'évaluation

- Adam McCullough Resume 12.5.2017Document1 pageAdam McCullough Resume 12.5.2017lugers1234Pas encore d'évaluation

- Contact Us: An Investment in Knowledge Pays The Best InterestDocument6 pagesContact Us: An Investment in Knowledge Pays The Best InterestJaisankar KailasamPas encore d'évaluation

- Equity Derivatives - Nism Series 8 PDFDocument162 pagesEquity Derivatives - Nism Series 8 PDFektapatelbms100% (1)

- 14-MNC Capital BudgetingDocument22 pages14-MNC Capital BudgetingRoopa Shree100% (1)

- Investment AppraisalDocument20 pagesInvestment AppraisalBishwajit ChowdhuryPas encore d'évaluation

- SEBIDocument6 pagesSEBISusan sophia.YPas encore d'évaluation

- Financial Inclusion School PresentationDocument16 pagesFinancial Inclusion School PresentationpraxiePas encore d'évaluation

- Introduction To DerivativesDocument7 pagesIntroduction To DerivativesRashwanth TcPas encore d'évaluation

- Multinational Business Finance 12th Edition Slides Chapter 19Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 19Alli Tobba100% (1)

- IFS Chapter 3Document26 pagesIFS Chapter 3riashahPas encore d'évaluation

- Acctg3 5 RevaluationDocument2 pagesAcctg3 5 Revaluationflammy07Pas encore d'évaluation

- A2 FormDocument2 pagesA2 FormmajithiyaPas encore d'évaluation

- 180 Sample-Chapter PDFDocument15 pages180 Sample-Chapter PDFhanumanthaiahgowdaPas encore d'évaluation

- Chapter 18Document25 pagesChapter 18fyoonPas encore d'évaluation

- Optimizing Your Collateral Management Strategy:, Head of Collateral Optimization, State StreetDocument3 pagesOptimizing Your Collateral Management Strategy:, Head of Collateral Optimization, State StreetVikramPas encore d'évaluation

- Indifference EBITDocument3 pagesIndifference EBITsumitbaba100% (1)

- Sample EB5 Business Plan (Unlocked by WWW - Freemypdf.com)Document116 pagesSample EB5 Business Plan (Unlocked by WWW - Freemypdf.com)mtbroadbentPas encore d'évaluation

- UCP AssignmentDocument16 pagesUCP AssignmentSaniya SaddiqiPas encore d'évaluation