Académique Documents

Professionnel Documents

Culture Documents

Week 8

Transféré par

Nikunj D PatelCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Week 8

Transféré par

Nikunj D PatelDroits d'auteur :

Formats disponibles

Week 8 – Specific Deductions - Chapter 13Question 13.

1 Advise Cheryl of her tax consequences from the

following transactions?

a)Donation of $300 to the building fund of her local public primary schoolIssueWhether the donation is

deductible for income tax purpose?RuleDivision 30 of ITAA 1997 provides taxpayers with a deduction for

gifts or contributions made to particular recipients. The gift or contribution can be of money or

property. There are 2 conditions:•A gift or contribution must be made to a deductible gift recipient that

is an entity which meets the requirements to be registered as such by the relevant body (public

universities, public hospitals, charities or research organizations)•The gift must be a true gift and made

with no expectation of material advantage in return (FCT v McPhail 1968 117 CLR 111.ApplicationIn this

case, Cheryl gives a contribution ($300) to the building fund of her local public primary school which is

the deductible gift recipient. The gift is a true gift because she receives no material advantage in

return.ConclusionCheryl would be entitled to a deduction for $300 donation to the public school under

Div 30 of ITAA 1997 as it is donation to a deductible gift recipient.

(b) Donation of $50 to her local public library (as a result she does not need to pay membership fees of

$20 that year to borrow books from the library).IssueWhether the donation of $5 to library is deductible

for income tax purpose?Rules:Division 30 of ITAA 1997 provides taxpayers with a deduction for gifts or

contributions make to particular recipients. The gift or contribution can be of money or property.

Surfs Up P/L is a national retailer that sells a range of surfing and water sport equipment

(surfboards, clothing, etc.) with an annual turnover of $60 million. Surfs Up purchases “Billapro”

surfboards for $440 each from Billapong P/L, a large manufacturer of surfboards located at Gold

Coast with an annual turnover of around $45 million, this was their only sale for the month. Surfs

Up plans to sell the Surfboards at a 200% mark-up to its customers. In October last year it

purchased 370 surfboards but a couple of months later (December) they discovered that 14 of the

surfboards were faulty and subsequently returned these faulty surfboards to the manufacturer,

obtaining a full refund. Assume both apply the accrual method of accounting.

Consequence for Billapong P/L :-

When Goods sold by Billapong P/L in the month of October :-

Billapong P/L had sold the goods to Surfs Up P/L in the month of October and included in GST

liability for the month of October and Paid GST thereon.

When Goods returned by the Surfs Up P/L in the month of December:-

In the month of December when Surf Up P/L returned faulty surfboards it issued credit note to

Billapong. When billapong received credit note it reduced its GST Liabiltiy for such Credit Note from

the GST Liability for the month of December.

Consequence for Surf Up P/l:-

When Goods purchased by Surfs Up P/L in the month of October :-

When surfboard were purchased in the month of October it booked Input Tax Credit on 370

surfboards purchased and adjusted the same from output GST Liability.

When Goods returned to the Billapong P/L in the month of December:-

When Surf Up P/L returnd 14 faulty surfboards to Billapong P/L it issued a credit note to Billapong

P/L and it will reversed its GST Input Tax Credit in the month of December for the goods purchased

in the month of october and returned in the month of December.

Vous aimerez peut-être aussi

- AICPA - CPA Reg 2017Document12 pagesAICPA - CPA Reg 2017Gene'sPas encore d'évaluation

- 2021 2nd AC - Acctg Gov Quiz 04Document4 pages2021 2nd AC - Acctg Gov Quiz 04Merliza JusayanPas encore d'évaluation

- FABM1 Quarter 1 Week 3Document47 pagesFABM1 Quarter 1 Week 3FERNANDO TAMZ2003Pas encore d'évaluation

- Questions & Answers: For Camp InvestorsDocument1 pageQuestions & Answers: For Camp Investorsapi-238524059Pas encore d'évaluation

- Business Tax Activity 1Document10 pagesBusiness Tax Activity 1Michael AquinoPas encore d'évaluation

- Mock Exam - Revision 1Document15 pagesMock Exam - Revision 1Quỳnh VõPas encore d'évaluation

- Coverage of The Tax "Gifts"Document3 pagesCoverage of The Tax "Gifts"Jeneth OrtuaPas encore d'évaluation

- DonorsDocument11 pagesDonorsboniglai50% (1)

- Tax ComprehensiveDocument11 pagesTax ComprehensiveDawn digolPas encore d'évaluation

- Basic Concept of Donation and Donor's TaxDocument20 pagesBasic Concept of Donation and Donor's TaxKarl BasaPas encore d'évaluation

- Business TaxDocument19 pagesBusiness TaxMichael AquinoPas encore d'évaluation

- Quiz Inter2Document2 pagesQuiz Inter2Dea Aulia AmanahPas encore d'évaluation

- NPO AssignmentDocument4 pagesNPO AssignmentZyrah Mae SaezPas encore d'évaluation

- B) in The Case of Gifts Made by A Nonresident Not A Citizen of The PhilippinesDocument23 pagesB) in The Case of Gifts Made by A Nonresident Not A Citizen of The PhilippinesNissi JonnaPas encore d'évaluation

- KatolDocument5 pagesKatoljemPas encore d'évaluation

- AFAR-non ProfitDocument21 pagesAFAR-non ProfitJessica Pama EstandartePas encore d'évaluation

- Quiz POPDocument2 pagesQuiz POPKarina RachmaPas encore d'évaluation

- Donors TaxDocument4 pagesDonors TaxRo-Anne LozadaPas encore d'évaluation

- CH 4 & 5 Extra Practic Summer 2023Document9 pagesCH 4 & 5 Extra Practic Summer 2023Ruth KatakaPas encore d'évaluation

- Test MidtermDocument4 pagesTest MidtermcirujeffPas encore d'évaluation

- Tax2 Bar QsDocument7 pagesTax2 Bar QsAlex RabanesPas encore d'évaluation

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarPas encore d'évaluation

- Accounting Tutorial 1Document2 pagesAccounting Tutorial 1AmalinaIsaPas encore d'évaluation

- Howes Tax 2013 Charitable Contributions GuideDocument2 pagesHowes Tax 2013 Charitable Contributions GuideShawn M. CoxPas encore d'évaluation

- Western Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Document2 pagesWestern Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Marc William SorianoPas encore d'évaluation

- AssignmentDocument2 pagesAssignmentLois JosePas encore d'évaluation

- Taxation Law 1 Compiled QuestionsDocument4 pagesTaxation Law 1 Compiled QuestionsTiffany HuntPas encore d'évaluation

- Test QuestionsDocument24 pagesTest Questionsjmp8888Pas encore d'évaluation

- Harvard Financial Accounting Final Exam 3Document10 pagesHarvard Financial Accounting Final Exam 3Bharathi Raju25% (4)

- Condonation or Cancellation of IndebtednessDocument4 pagesCondonation or Cancellation of IndebtednessArceño, Advrelyn Frances C.Pas encore d'évaluation

- Home Fin HelpDocument14 pagesHome Fin HelpBharathi RajuPas encore d'évaluation

- Accounting For Non Profit Making Organisations PDFDocument23 pagesAccounting For Non Profit Making Organisations PDFrain06021992Pas encore d'évaluation

- 02 Exercises - Accounting For NPOs v2Document3 pages02 Exercises - Accounting For NPOs v2Peter Andre GuintoPas encore d'évaluation

- TAX 2 BAR Q&A For MidtermDocument5 pagesTAX 2 BAR Q&A For MidtermMike E DmPas encore d'évaluation

- Assignment No.2Document5 pagesAssignment No.2mohamed atlamPas encore d'évaluation

- Donor's TaxDocument5 pagesDonor's TaxKeithPas encore d'évaluation

- Harvard Financial Accounting Final Exam 3Document11 pagesHarvard Financial Accounting Final Exam 3Bharathi Raju0% (1)

- 1)Document2 pages1)Tom BinfieldPas encore d'évaluation

- Financial&managerial Accounting - 15e Williamshakabettner Chap 6Document15 pagesFinancial&managerial Accounting - 15e Williamshakabettner Chap 6mzqace100% (1)

- Mock Test 1Document20 pagesMock Test 1Quỳnh'ss Đắc'ssPas encore d'évaluation

- DT1Document5 pagesDT1iris claire gamadPas encore d'évaluation

- 1 The Jones Family Lost Its Home in A Fire: Unlock Answers Here Solutiondone - OnlineDocument1 page1 The Jones Family Lost Its Home in A Fire: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghPas encore d'évaluation

- On The First Day of Year 4 The City Receives: Unlock Answers Here Solutiondone - OnlineDocument1 pageOn The First Day of Year 4 The City Receives: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghPas encore d'évaluation

- Audit & Assurance 1 Test 1 2022Document3 pagesAudit & Assurance 1 Test 1 2022kp107416Pas encore d'évaluation

- Solutiondone 2-457Document1 pageSolutiondone 2-457trilocksp SinghPas encore d'évaluation

- DONORS TAX and ESTATE TAXDocument39 pagesDONORS TAX and ESTATE TAXmarjorie blancoPas encore d'évaluation

- Sample FinalDocument18 pagesSample FinalDavid MendietaPas encore d'évaluation

- Chapter 10 HWDocument6 pagesChapter 10 HWAlysha Harvey EAPas encore d'évaluation

- Question and Answer - 8Document30 pagesQuestion and Answer - 8acc-expertPas encore d'évaluation

- Accounting II-Review Chapters12,13,14 (8thed)Document10 pagesAccounting II-Review Chapters12,13,14 (8thed)JacKFrost1889Pas encore d'évaluation

- MidTerm ExamDocument15 pagesMidTerm ExamYonatan Wadler100% (2)

- Donors TaxDocument4 pagesDonors TaxTrisha Nicole FloresPas encore d'évaluation

- Policy5 Fundraising Legal and Ethical PracticesDocument2 pagesPolicy5 Fundraising Legal and Ethical PracticesWood River Land TrustPas encore d'évaluation

- Taxation 2023 QuestionsDocument5 pagesTaxation 2023 QuestionsjanaPas encore d'évaluation

- Tax 2 Reviewer LectureDocument13 pagesTax 2 Reviewer LectureShiela May Agustin MacarayanPas encore d'évaluation

- MSJG Chap 1 10 QuestionsDocument6 pagesMSJG Chap 1 10 QuestionsMar Sean Jan Gabiosa100% (2)

- 401(k) Plans Made Easy: Understanding Your 401(k) PlanD'Everand401(k) Plans Made Easy: Understanding Your 401(k) PlanPas encore d'évaluation

- J.K. Lasser's 1001 Deductions and Tax Breaks 2009: Your Complete Guide to Everything DeductibleD'EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2009: Your Complete Guide to Everything DeductibleÉvaluation : 3 sur 5 étoiles3/5 (1)

- The Encyclopedia of Real Estate Forms & Agreements: A Complete Kit of Ready-to-Use Checklists, Worksheets, Forms, and ContractsD'EverandThe Encyclopedia of Real Estate Forms & Agreements: A Complete Kit of Ready-to-Use Checklists, Worksheets, Forms, and ContractsPas encore d'évaluation

- 201 FormDocument16 pages201 FormJennylyn DoronioPas encore d'évaluation

- Manahan v. FloresDocument3 pagesManahan v. FloresbrownboomerangPas encore d'évaluation

- Gonzales Vs CaDocument2 pagesGonzales Vs CaReth GuevarraPas encore d'évaluation

- TOMAS LAO CONSTRUCTION VsDocument2 pagesTOMAS LAO CONSTRUCTION Vshime mej100% (2)

- Causes of Failure of League of Nations: 1. Absence of Great PowersDocument4 pagesCauses of Failure of League of Nations: 1. Absence of Great PowersTAYYAB ABBAS QURESHIPas encore d'évaluation

- Human Rights in Undp: Practice NoteDocument29 pagesHuman Rights in Undp: Practice NoteVipul GautamPas encore d'évaluation

- Plea BargainingDocument10 pagesPlea Bargainingtunkucute05Pas encore d'évaluation

- 9 - The Confederation and The Constitution, 1776 - 1790Document111 pages9 - The Confederation and The Constitution, 1776 - 1790dssguy99Pas encore d'évaluation

- Bail 23 A Sindh Arms Act HC KarachiDocument3 pagesBail 23 A Sindh Arms Act HC Karachilittle hopePas encore d'évaluation

- A Paramilitary Policing JuggernautDocument17 pagesA Paramilitary Policing JuggernautFranklinBarrientosRamirezPas encore d'évaluation

- Chapter-4: Programme of Law Reform (1999) Pp. 18 and 43Document72 pagesChapter-4: Programme of Law Reform (1999) Pp. 18 and 43Humanyu KabeerPas encore d'évaluation

- Catiis v. CADocument1 pageCatiis v. CAMia AngelaPas encore d'évaluation

- Areola Vs CADocument2 pagesAreola Vs CAEarlcen MinorcaPas encore d'évaluation

- Free Look Period:: Life Insurance Corporation of IndiaDocument2 pagesFree Look Period:: Life Insurance Corporation of IndiaDebendra nayakPas encore d'évaluation

- Sample Quiz 4 On ObliconDocument4 pagesSample Quiz 4 On ObliconRegina MuellerPas encore d'évaluation

- Sample Document: Prenuptial AgreementDocument3 pagesSample Document: Prenuptial AgreementEulaArias JuanPabloPas encore d'évaluation

- Background of Company LawDocument30 pagesBackground of Company LawsidaneyPas encore d'évaluation

- Lastra Professional EthicsDocument5 pagesLastra Professional EthicsFederico R LastraPas encore d'évaluation

- Order Granting Release of Austin Harrouff's Interview With The 'Dr. Phil Show'Document7 pagesOrder Granting Release of Austin Harrouff's Interview With The 'Dr. Phil Show'WXYZ-TV Channel 7 DetroitPas encore d'évaluation

- Flynote: HeadnoteDocument6 pagesFlynote: HeadnoteFrancis Phiri100% (1)

- Elliot Currie Su Left RealismDocument15 pagesElliot Currie Su Left RealismFranklinBarrientosRamirezPas encore d'évaluation

- Household Helpers Entitled To 13th Month Pay Under The LawDocument1 pageHousehold Helpers Entitled To 13th Month Pay Under The Lawyurets929Pas encore d'évaluation

- Tavaana Exclusive Case Study: The Velvet Revolution - A Peaceful End To Communism in CzechoslovakiaDocument9 pagesTavaana Exclusive Case Study: The Velvet Revolution - A Peaceful End To Communism in CzechoslovakiaTavaana E-InstitutePas encore d'évaluation

- Elisco Vs CADocument6 pagesElisco Vs CAjessapuerinPas encore d'évaluation

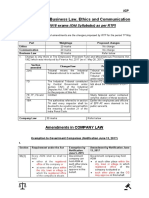

- Amendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Document3 pagesAmendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Neha jainPas encore d'évaluation

- Land Bank of The Philippines V Belle CorpDocument2 pagesLand Bank of The Philippines V Belle CorpDan Marco GriartePas encore d'évaluation

- Polity Study PlanDocument8 pagesPolity Study Plansarwat fatmaPas encore d'évaluation

- Ablaza v. RepublicDocument8 pagesAblaza v. Republiclavyne56Pas encore d'évaluation

- M.P.warehousng & Logistics Policy 2012 Rules - EnglishDocument6 pagesM.P.warehousng & Logistics Policy 2012 Rules - EnglishSantoshh MishhPas encore d'évaluation