Académique Documents

Professionnel Documents

Culture Documents

Round: 8 Dec. 31, 2026: Selected Financial Statistics

Transféré par

udayTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Round: 8 Dec. 31, 2026: Selected Financial Statistics

Transféré par

udayDroits d'auteur :

Formats disponibles

Round: 8

Dec. 31, C101711

2026

Andrews Baldwin Chester

Neeraj Ghatge shagun sidana Amit Birla

Sambhav Goel Saurabh Chandra

Pratity Ray Mrunmayi Deshpande

Resham Sahni Aniket Deshpande

Aanal Shah Kalyani Dharmadhika

NIHIT SHARMA Amit Jha

Digby Erie Ferris

Tanushree Singhal Sparsh Wadhwa Arunabha Banerjee

Neeraj Agrawal Bhavesh Mehta Varshil Nandu

Vaibhav Arora Madhura Mestry Udaykiran Raviteja

Subhojit Das Pratik More Nikhil Singh

Abhishek Iyengar Snehalata Mundra Dharmik Soni

Prachi Lakhotia Tanay Purnesh Himanshi Taneja

Selected Financial Statistics

Andrews Baldwin Chester Digby Erie Ferris

ROS -82.4% 6.1% 9.9% 12.1% 9.3% -5.9%

Asset Turnover 0.85 1.18 1.23 1.20 1.41 1.31

ROA -70.5% 7.2% 12.2% 14.5% 13.1% -7.8%

Leverage -0.3 2.1 1.7 1.9 1.9 -5.2

ROE -19.0% 15.5% 21.1% 27.5% 25.1% -40.3%

Emergency Loan $283,319,410 $0 $0 $0 $13,640,773 $25,064,084

Sales $66,536,903 $206,764,793 $209,782,534 $203,964,652 $231,510,035 $91,946,781

EBIT ($15,479,073) $31,518,512 $40,645,362 $48,493,289 $44,240,791 $4,506,612

Profits ($54,849,317) $12,710,138 $20,852,541 $24,669,665 $21,542,518 ($5,448,590)

Cumulative Profit ($339,625,330) $17,224,365 $59,816,947 $39,837,480 $32,775,567 ($62,257,238)

SG&A / Sales 14.9% 12.4% 17.4% 14.5% 16.0% 30.3%

Contrib. Margin % 39.0% 36.6% 43.6% 42.7% 31.7% 37.3%

CAPSTONE ® COURIER Page 1

Round: 8

Stock & Bonds C101711 Dec. 31, 2026

Stock Market Summary

MarketCap

Company Close Change Shares Book Value EPS Dividend Yield P/E

($M)

Andrews $1.00 $0.00 5,607,232 $6 ($51.47) ($9.78) $0.00 0.0% -0.1

Baldwin $32.57 $8.39 4,404,642 $143 $18.57 $2.89 $1.35 4.2% 11.3

Chester $103.08 $19.34 2,044,870 $211 $48.23 $10.20 $2.00 1.9% 10.1

Digby $77.36 $26.52 2,817,872 $218 $31.79 $8.75 $0.00 0.0% 8.8

Erie $48.20 $34.15 2,604,646 $126 $32.96 $8.27 $0.00 0.0% 5.8

Ferris $1.00 $0.00 2,863,634 $3 ($4.72) ($1.90) $0.00 0.0% -0.5

Bond Market Summary

Company Series# Face Yield Close$ S&P Company Series# Face Yield Close$ S&P

Andrews Digby

12.9S2030 $20,000,000 14.7% 88.00 DDD 13.3S2030 $23,177,292 14.0% 95.15 B

14.1S2031 $500,000 15.7% 89.83 DDD 13.9S2031 $10,000,000 14.4% 96.31 B

16.3S2035 $60,000,000 17.1% 95.59 DDD 12.9S2033 $14,900,000 14.1% 91.26 B

Baldwin 14.6S2034 $22,000,000 14.9% 98.20 B

13.8S2032 $9,565,448 14.8% 93.30 CCC Erie

12.9S2033 $22,234,667 14.5% 88.97 CCC 14.2S2032 $21,079,069 14.6% 96.97 B

14.5S2034 $16,451,484 15.2% 95.16 CCC 15.5S2035 $30,000,000 15.1% 102.39 B

Chester Ferris

11.3S2029 $8,449,561 12.2% 92.85 BB 12.9S2030 $23,570,000 14.7% 88.00 DDD

12.4S2030 $25,000,000 13.2% 94.22 BB 13.6S2031 $1,456,000 15.4% 88.24 DDD

13.7S2031 $13,500,000 14.0% 97.62 BB 14.3S2032 $12,251,000 16.0% 89.32 DDD

12.7S2033 $15,000,000 13.7% 92.80 BB 14.7S2034 $200,000 16.5% 89.16 DDD

16.3S2035 $17,627,000 17.1% 95.59 DDD

Next Year's Prime Rate11.00%

CAPSTONE ® COURIER Page 2

Round: 8

Financial Summary C101711 Dec. 31, 2026

Cash Flow Statement Survey Andrews Baldwin Chester Digby Erie Ferris

CashFlows from operating activities

Net Income(Loss) ($54,849) $12,710 $20,853 $24,670 $21,543 ($5,449)

Adjustment for non-cash items:

Depreciation $7,920 $14,714 $14,325 $10,880 $10,731 $8,103

Extraordinary gains/losses/writeoffs $23,612 ($1,925) $0 ($1,973) ($19,363) ($6,133)

Changes in current assets and liablilities

Accounts payable $2,603 $2,558 $1,405 $2,081 $4,227 $397

Inventory $67,167 ($4,990) ($44) ($7,771) ($10,965) $19,175

Accounts Receivable $161 ($1,521) ($1,232) ($821) ($15,858) $2,053

Net cash from operations $46,615 $21,547 $35,306 $27,066 ($9,687) $18,148

Cash flows from investing activities

Plant improvements(net) ($4,381) $0 ($9,900) $2,470 $64,922 $15,648

Cash flows from financing activities

Dividends paid $0 ($5,958) ($4,090) $0 $0 $0

Sales of common stock $900 $0 $0 $0 $0 $0

Purchase of common stock $0 $0 $0 $0 ($1,000) $0

Cash from long term debt issued $0 $0 $0 $0 $0 $0

Early retirement of long term debt $0 ($21,767) $0 ($10,000) ($50,000) $0

Retirement of current debt ($326,453) ($34,040) $0 $0 ($17,876) ($58,860)

Cash from current debt borrowing $0 $34,239 $0 $0 $0 $0

Cash from emergency loan $283,319 $0 $0 $0 $13,641 $25,064

Net cash from financing activities ($42,233) ($27,526) ($4,090) ($10,000) ($55,235) ($33,796)

Net change in cash position $0 ($5,980) $21,317 $19,536 $0 $0

Balance Sheet Survey Andrews Baldwin Chester Digby Erie Ferris

Cash $0 $49,262 $49,150 $54,783 $0 $0

Accounts Receivable $5,469 $16,994 $17,242 $16,764 $38,056 $4,534

Inventory $25,032 $12,411 $7,422 $19,144 $39,972 $13,005

Total Current Assets $30,500 $78,667 $73,814 $90,692 $78,028 $17,540

Plant and equipment $118,800 $220,709 $214,880 $163,200 $160,960 $121,552

Accumulated Depreciation ($71,467) ($124,057) ($118,465) ($84,167) ($74,914) ($68,912)

Total Fixed Assets $47,333 $96,652 $96,415 $79,033 $86,046 $52,640

Total Assets $77,833 $175,320 $170,229 $169,724 $164,075 $70,180

Accounts Payable $2,603 $11,056 $9,651 $10,056 $13,502 $3,538

Current Debt $283,319 $34,239 $0 $0 $13,641 $25,064

Long Term Debt $80,500 $48,252 $61,950 $70,077 $51,079 $55,104

Total Liabilities $366,422 $93,547 $71,601 $80,133 $78,222 $83,707

Common Stock $25,643 $48,578 $19,860 $24,360 $30,880 $23,337

Retained Earnings ($314,232) $33,195 $78,769 $65,231 $54,974 ($36,864)

Total Equity ($288,589) $81,773 $98,629 $89,591 $85,853 ($13,527)

Total Liabilities & Owners Equity $77,833 $175,320 $170,229 $169,724 $164,075 $70,180

Income Statement Survey Andrews Baldwin Chester Digby Erie Ferris

Sales $66,537 $206,765 $209,783 $203,965 $231,510 $91,947

Variable Costs(Labor,Material,Carry) $40,557 $131,019 $118,266 $116,875 $158,102 $57,637

Depreciation $7,920 $14,714 $14,325 $10,880 $10,731 $8,103

SGA(R&D,Promo,Sales,Admin) $9,882 $25,712 $36,545 $29,539 $37,035 $27,832

Other(Fees,Writeoffs,TQM,Bonuses) $23,657 $3,802 $0 ($1,823) ($18,598) ($6,133)

EBIT ($15,479) $31,519 $40,645 $48,493 $44,241 $4,507

Interest(Short term,Long term) $68,904 $11,504 $7,809 $9,607 $10,318 $12,889

Taxes ($29,534) $7,005 $11,493 $13,610 $11,873 ($2,934)

Profit Sharing $0 $299 $491 $607 $507 $0

Net Profit ($54,849) $12,710 $20,853 $24,670 $21,543 ($5,449)

CAPSTONE ® COURIER Page 3

Round: 8

Production Analysis C101711 Dec. 31, 2026

2nd

Shift Auto

Unit & mation Capacity

Primary Units Inven Revision Age Pfmn Size Material Labor Contr. Over- Next Next Plant

Name Segment Sold tory Date Dec.31 MTBF Coord Coord Price

Cost

Cost Marg. time Round Round Utiliz.

Able Low 1,881 0 2/28/2026 3.1 17000 8.5 11.5 $16.50 $7.37 $1.88 43% 90% 10.0 1,000 188%

Acre Low 1,782 0 4/30/2025 4.1 15500 4.2 15.8 $14.00 $4.52 $1.69 55% 28% 10.0 1,400 127%

Adam Trad 227 1,216 2/27/2027 5.5 25000 9.5 10.7 $21.00 $10.07 $3.07 -39% 0% 9.0 100 99%

A_Bid Trad 257 193 1/6/2027 5.3 25000 10.0 10.1 $22.50 $10.38 $3.07 15% 0% 9.0 100 99%

Baker Low 1,782 0 9/19/2025 4.7 14000 6.0 14.0 $18.50 $5.25 $5.45 41% 50% 8.0 1,200 149%

Bead Low 2,178 0 11/14/2025 4.9 14000 5.5 14.5 $18.50 $4.96 $5.51 43% 57% 8.0 1,400 156%

Bid Trad 1,153 133 7/17/2026 1.9 17000 10.4 9.8 $26.00 $8.58 $8.58 33% 25% 6.0 1,000 124%

Bold Trad 1,065 161 7/17/2026 1.9 17000 11.0 10.2 $26.00 $8.65 $8.45 33% 20% 6.0 1,000 119%

Buddy Trad 1,077 135 7/17/2026 1.9 17000 9.8 9.2 $26.00 $8.59 $8.50 34% 22% 6.0 944 121%

Brass High 715 104 7/23/2026 1.4 24900 16.3 3.6 $36.00 $14.30 $8.61 36% 0% 5.5 700 99%

Brat High 613 115 6/29/2026 1.4 25000 16.6 3.6 $36.00 $14.41 $9.56 32% 30% 5.5 500 129%

Cake Trad 1,741 16 7/24/2026 1.4 18000 10.6 9.4 $20.00 $8.56 $4.41 35% 19% 8.0 1,150 118%

Cedar Low 2,673 0 11/27/2025 2.8 15500 5.5 14.2 $15.00 $5.18 $1.69 53% 100% 10.0 1,400 198%

Cid High 752 96 8/18/2026 1.4 25000 16.1 3.9 $36.50 $13.43 $9.92 35% 78% 5.0 480 176%

Coat Pfmn 808 0 7/14/2026 1.5 27000 17.4 10.4 $31.50 $12.94 $8.47 32% 100% 6.0 450 198%

Cure Size 1,015 245 6/24/2026 1.4 21000 9.6 2.6 $31.50 $11.36 $8.33 36% 85% 6.0 700 183%

Curry Pfmn 463 0 11/21/2026 1.1 27000 14.7 10.9 $31.50 $11.91 $1.51 58% 29% 10.0 350 127%

Cero High 535 12 11/17/2026 1.0 25000 14.9 5.1 $36.00 $12.77 $1.52 61% 31% 10.0 400 130%

CTrad Trad 807 0 3/4/2025 1.8 17000 9.9 10.1 $20.00 $7.91 $1.66 51% 81% 10.0 550 179%

Daze Trad 1,204 480 8/23/2026 1.3 19000 10.1 10.0 $23.00 $8.52 $4.70 41% 75% 8.0 800 173%

Dell Low 2,376 0 11/23/2024 5.2 17000 4.1 15.8 $15.00 $4.75 $1.61 57% 100% 10.0 1,200 198%

Dixie High 198 0 4/17/2026 1.4 25000 15.2 5.0 $36.50 $12.89 $8.06 42% 100% 6.0 100 198%

Dot Pfmn 709 0 9/23/2026 1.3 27000 17.4 10.4 $31.00 $12.95 $8.06 33% 100% 6.0 350 198%

Dune Size 835 88 7/19/2026 1.4 21000 9.6 2.6 $32.00 $11.36 $8.06 39% 100% 6.0 450 198%

Disco Pfmn 978 147 7/19/2026 1.4 27000 17.4 10.4 $31.00 $12.95 $8.06 32% 100% 6.0 500 198%

Divine Size 779 14 9/21/2026 1.2 21000 9.6 2.6 $32.00 $11.36 $4.84 50% 100% 8.0 400 198%

Damper High 808 411 9/27/2026 1.0 25000 16.1 3.9 $36.50 $13.44 $6.20 44% 67% 7.0 600 165%

Eat Trad 2,164 427 9/19/2026 1.3 19000 10.8 9.6 $17.00 $8.82 $3.97 24% 100% 8.5 1,160 198%

Ebb Low 1,005 0 7/8/2026 4.7 17200 4.8 15.3 $11.50 $5.13 $1.59 45% 100% 10.0 260 198%

Echo High 792 0 8/19/2026 1.4 25000 15.5 4.3 $30.00 $13.16 $8.73 27% 100% 5.5 400 198%

Edge Pfmn 792 0 8/6/2026 1.4 27000 17.0 10.8 $28.50 $12.74 $7.15 31% 100% 6.5 400 198%

Egg Size 1,189 249 7/15/2026 1.4 21000 9.6 2.6 $31.00 $11.36 $7.15 39% 100% 6.5 650 198%

Elbuli High 965 631 7/22/2026 1.4 25000 16.1 3.9 $36.00 $13.43 $8.73 34% 100% 5.5 550 198%

Eon Pfmn 1,133 611 8/6/2026 1.4 27000 17.4 10.4 $30.00 $12.94 $7.15 29% 100% 6.5 725 198%

ETA Size 1,116 208 5/30/2026 1.3 21000 9.7 2.6 $28.00 $11.37 $7.15 32% 100% 6.5 600 198%

Fast Trad 1,346 105 8/3/2026 1.5 14000 9.8 9.7 $19.00 $7.22 $4.65 36% 38% 7.9 800 135%

Feat Low 1,575 0 8/15/2026 1.4 12500 4.8 14.5 $13.00 $4.14 $2.87 46% 78% 9.4 900 175%

Fist High 467 0 6/27/2026 1.4 20500 14.8 4.2 $29.00 $11.84 $8.61 24% 0% 4.1 350 28%

Foam Pfmn 384 50 7/29/2026 1.4 22500 16.0 10.4 $25.00 $11.29 $6.11 21% 0% 6.1 250 59%

Fume Size 131 559 6/8/2027 3.1 16000 10.5 5.6 $25.00 $0.00 $0.00 -17% 0% 6.1 280 0%

Fcuk Low 1,083 0 7/20/2026 1.4 12500 5.0 14.5 $18.00 $4.18 $3.51 57% 57% 8.6 700 155%

CAPSTONE ® COURIER Page 4

Traditional Segment Analysis C101711 Round: 8

Dec. 31, 2026

Traditional Statistics

Total Industry Unit Demand 11,649

Actual Industry Unit Sales |11,649

Segment % of Total Industry |26.5%

Next Year's Segment Growth Rate |9.2%

Traditional Customer Buying Criteria

Expectations Importance

1. Age Ideal Age = 2.0 47%

2. Price $16.00 - 26.00 23%

3. Ideal Position Pfmn 10.6 Size 9.4 21%

4. Reliability MTBF 14000-19000 9%

Top Products in Traditional Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Eat 19% 2,164 9/19/2026 10.8 9.6 $17.00 19000 1.27 $2,400 96% $1,060 100% 86

Cake 15% 1,741 7/24/2026 10.6 9.4 $20.00 18000 1.44 $2,000 90% $2,005 100% 76

Fast 12% 1,346 8/3/2026 9.8 9.7 $19.00 14000 1.45 $1,500 85% $2,628 100% 57

Daze 10% 1,204 8/23/2026 10.1 10.0 $23.00 19000 1.31 $1,600 79% $904 100% 51

Bid 10% 1,153 7/17/2026 10.4 9.8 $26.00 17000 1.86 $2,200 93% $885 100% 60

Buddy 9% 1,077 7/17/2026 9.8 9.2 $26.00 17000 1.87 $2,200 93% $885 100% 56

Bold 9% 1,065 7/17/2026 11.0 10.2 $26.00 17000 1.87 $2,200 93% $885 100% 55

CTrad 7% 807 3/4/2025 YES 9.9 10.1 $20.00 17000 1.83 $2,700 68% $1,697 100% 67

Able 5% 600 2/28/2026 YES 8.5 11.5 $16.50 17000 3.15 $300 41% $2,025 73% 14

A_Bid 2% 257 1/6/2027 10.0 10.1 $22.50 25000 5.33 $300 34% $225 73% 10

Adam 2% 227 2/27/2027 9.5 10.7 $21.00 25000 5.53 $300 34% $225 73% 8

Fume 0% 7 6/8/2027 10.5 5.6 $25.00 16000 3.08 $1,450 44% $2,336 100% 1

CAPSTONE ® COURIER Page 5

Low End Segment Analysis C101711 Round: 8

Dec. 31, 2026

Low End Statistics

Total Industry Unit Demand 16,186

Actual Industry Unit Sales |15,737

Segment % of Total Industry |36.8%

Next Year's Segment Growth Rate |11.7%

Low End Customer Buying Criteria

Expectations Importance

1. Price $11.00 - 21.00 53%

2. Age Ideal Age = 7.0 24%

3. Ideal Position Pfmn 5.7 Size 14.3 16%

4. Reliability MTBF 12000-17000 7%

Top Products in Low End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Cedar 17% 2,673 11/27/2025 YES 5.5 14.2 $15.00 15500 2.81 $2,000 90% $1,851 100% 43

Dell 15% 2,376 11/23/2024 YES 4.1 15.8 $15.00 17000 5.17 $1,600 80% $904 100% 18

Bead 14% 2,178 11/14/2025 YES 5.5 14.5 $18.50 14000 4.89 $2,200 93% $1,012 95% 30

Baker 11% 1,782 9/19/2025 YES 6.0 14.0 $18.50 14000 4.66 $2,200 93% $1,012 95% 28

Acre 11% 1,782 4/30/2025 YES 4.2 15.8 $14.00 15500 4.11 $300 55% $2,025 100% 16

Feat 10% 1,575 8/15/2026 YES 4.8 14.5 $13.00 12500 1.38 $1,650 87% $2,774 100% 37

Able 8% 1,281 2/28/2026 YES 8.5 11.5 $16.50 17000 3.15 $300 46% $2,025 100% 13

Fcuk 7% 1,083 7/20/2026 YES 5.0 14.5 $18.00 12500 1.42 $1,500 85% $2,336 100% 14

Ebb 6% 1,005 7/8/2026 YES 4.8 15.3 $11.50 17200 4.69 $2,400 96% $1,590 100% 80

CAPSTONE ® COURIER Page 6

High End Segment Analysis C101711 Round: 8

Dec. 31, 2026

High End Statistics

Total Industry Unit Demand 5,846

Actual Industry Unit Sales |5,846

Segment % of Total Industry |13.3%

Next Year's Segment Growth Rate |16.2%

High End Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 16.1 Size 3.9 43%

2. Age Ideal Age = 0.0 29%

3. Reliability MTBF 20000-25000 19%

4. Price $26.00 - 36.00 9%

Top Products in High End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Elbuli 17% 965 7/22/2026 16.1 3.9 $36.00 25000 1.37 $2,400 96% $1,166 100% 77

Damper 14% 808 9/27/2026 16.1 3.9 $36.50 25000 1.01 $2,300 78% $1,921 100% 68

Echo 14% 792 8/19/2026 YES 15.5 4.3 $30.00 25000 1.35 $2,400 96% $1,272 100% 81

Cid 13% 752 8/18/2026 16.1 3.9 $36.50 25000 1.36 $1,780 90% $1,697 100% 65

Brass 12% 715 7/23/2026 16.3 3.6 $36.00 24900 1.39 $2,000 92% $885 79% 60

Brat 10% 613 6/29/2026 16.6 3.6 $36.00 25000 1.37 $2,000 84% $759 79% 54

Cero 9% 535 11/17/2026 14.9 5.1 $36.00 25000 1.04 $2,100 89% $2,005 100% 54

Fist 8% 467 6/27/2026 YES 14.8 4.2 $29.00 20500 1.41 $1,400 85% $1,898 99% 36

Dixie 3% 198 4/17/2026 YES 15.2 5.0 $36.50 25000 1.43 $750 73% $791 100% 41

Fume 0% 1 6/8/2027 10.5 5.6 $25.00 16000 3.08 $1,450 44% $2,336 99% 0

CAPSTONE ® COURIER Page 7

Performance Segment Analysis C101711 Round: 8

Dec. 31, 2026

Performance Statistics

Total Industry Unit Demand 5,265

Actual Industry Unit Sales |5,265

Segment % of Total Industry |12.0%

Next Year's Segment Growth Rate |19.8%

Performance Customer Buying Criteria

Expectations Importance

1. Reliability MTBF 22000-27000 43%

2. Ideal Position Pfmn 17.4 Size 10.4 29%

3. Price $21.00 - 31.00 19%

4. Age Ideal Age = 1.0 9%

Top Products in Performance Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Eon 22% 1,133 8/6/2026 17.4 10.4 $30.00 27000 1.36 $2,200 96% $1,166 100% 84

Disco 19% 978 7/19/2026 17.4 10.4 $31.00 27000 1.37 $1,650 82% $1,695 100% 72

Coat 15% 808 7/14/2026 YES 17.4 10.4 $31.50 27000 1.45 $1,550 88% $2,005 100% 67

Edge 15% 792 8/6/2026 YES 17.0 10.8 $28.50 27000 1.37 $2,200 96% $1,272 100% 86

Dot 13% 709 9/23/2026 YES 17.4 10.4 $31.00 27000 1.30 $1,400 84% $1,695 100% 73

Curry 9% 463 11/21/2026 YES 14.7 10.9 $31.50 27000 1.08 $1,550 88% $2,005 100% 41

Foam 7% 384 7/29/2026 16.0 10.4 $25.00 22500 1.36 $1,250 86% $2,336 97% 26

CAPSTONE ® COURIER Page 8

Size Segment Analysis C101711 Round: 8

Dec. 31, 2026

Size Statistics

Total Industry Unit Demand 5,056

Actual Industry Unit Sales |5,056

Segment % of Total Industry |11.5%

Next Year's Segment Growth Rate |18.3%

Size Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 9.6 Size 2.6 43%

2. Age Ideal Age = 1.5 29%

3. Reliability MTBF 16000-21000 19%

4. Price $21.00 - 31.00 9%

Top Products in Size Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Egg 24% 1,189 7/15/2026 9.6 2.6 $31.00 21000 1.42 $2,250 95% $1,272 100% 99

ETA 22% 1,116 5/30/2026 9.7 2.6 $28.00 21000 1.32 $2,900 81% $1,802 100% 98

Cure 20% 1,015 6/24/2026 9.6 2.6 $31.50 21000 1.45 $1,950 91% $2,160 100% 85

Dune 17% 835 7/19/2026 9.6 2.6 $32.00 21000 1.40 $1,550 82% $1,695 100% 71

Divine 15% 779 9/21/2026 9.6 2.6 $32.00 21000 1.18 $1,600 74% $1,695 100% 67

Fume 2% 123 6/8/2027 10.5 5.6 $25.00 16000 3.08 $1,450 87% $2,336 98% 6

CAPSTONE ® COURIER Page 9

Round: 8

Market Share C101711 Dec. 31, 2026

Actual Market Share in Units Potential Market Share in Units

Trad Low High Pfmn Size Total Trad Low High Pfmn Size Total

Industry Unit Sales 11,649 15,737 5,846 5,265 5,056 43,554 Units Demanded 11,649 16,186 5,846 5,265 5,056 44,003

% of Market 26.8% 36.1% 13.4% 12.1% 11.6% 100.0% % of Market 26.5% 36.8% 13.3% 12.0% 11.5% 100.0%

Able 5.1% 8.1% 4.3% Able 5.0% 4.1% 2.9%

Acre 11.3% 4.1% Acre 9.5% 3.5%

Adam 1.9% 0.5% Adam 1.9% 0.5%

A_Bid 2.2% 0.6% A_Bid 2.1% 0.6%

Total 9.3% 19.5% 9.5% Total 9.0% 13.6% 7.4%

Baker 11.3% 4.1% Baker 9.6% 3.5%

Bead 13.8% 5.0% Bead 11.6% 4.3%

Bid 9.9% 2.6% Bid 9.5% 2.5%

Bold 9.1% 2.5% Bold 8.7% 2.3%

Buddy 9.3% 2.5% Buddy 8.8% 2.3%

Brass 12.2% 1.6% Brass 11.0% 1.5%

Brat 10.5% 1.4% Brat 9.4% 1.3%

Total 28.3% 25.2% 22.7% 19.7% Total 27.0% 21.2% 20.4% 17.7%

Cake 14.9% 4.0% Cake 14.3% 3.8%

Cedar 17.0% 6.1% Cedar 16.8% 6.2%

Cid 12.9% 1.7% Cid 11.5% 1.5%

Coat 15.3% 1.9% Coat 15.3% 1.8%

Cure 20.1% 2.3% Cure 20.1% 2.3%

Curry 8.8% 1.1% Curry 8.1% 1.0%

Cero 9.2% 1.2% Cero 8.3% 1.1%

CTrad 6.9% 1.8% CTrad 10.9% 2.9%

Total 21.9% 17.0% 22.0% 24.1% 20.1% 20.2% Total 25.2% 16.8% 19.8% 23.4% 20.1% 20.6%

Daze 10.3% 2.8% Daze 9.9% 2.6%

Dell 15.1% 5.5% Dell 10.9% 4.0%

Dixie 3.4% 0.4% Dixie 10.2% 1.4%

Dot 13.5% 1.6% Dot 15.7% 1.9%

Dune 16.5% 1.9% Dune 16.5% 1.9%

Disco 18.6% 2.2% Disco 16.3% 2.0%

Divine 15.4% 1.8% Divine 15.4% 1.8%

Damper 13.8% 1.9% Damper 12.4% 1.6%

Total 10.3% 15.1% 17.2% 32.0% 31.9% 18.1% Total 9.9% 10.9% 22.6% 32.0% 31.9% 17.1%

Eat 18.6% 5.0% Eat 17.8% 4.7%

Ebb 6.4% 2.3% Ebb 14.3% 5.2%

Echo 13.6% 1.8% Echo 14.2% 1.9%

Edge 15.0% 1.8% Edge 19.3% 2.3%

Egg 23.5% 2.7% Egg 23.5% 2.7%

Elbuli 16.5% 2.2% Elbuli 14.8% 2.0%

Eon 21.5% 2.6% Eon 18.9% 2.3%

ETA 22.1% 2.6% ETA 22.1% 2.5%

Total 18.6% 6.4% 30.1% 36.6% 45.6% 21.0% Total 17.8% 14.3% 29.0% 38.2% 45.6% 23.6%

Fast 11.6% 3.1% Fast 11.1% 2.9%

Feat 10.0% 3.6% Feat 16.8% 6.2%

Fist 8.0% 1.1% Fist 8.2% 1.1%

Foam 7.3% 0.9% Foam 6.4% 0.8%

Fume 2.4% 0.3% Fume 2.4% 0.3%

Fcuk 6.9% 2.5% Fcuk 6.4% 2.4%

Total 11.6% 16.9% 8.0% 7.3% 2.4% 11.5% Total 11.1% 23.2% 8.2% 6.4% 2.4% 13.6%

CAPSTONE ® COURIER Page 10

Round: 8

Perceptual Map C101711 Dec. 31, 2026

Andrews Baldwin Chester

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Able 8.5 11.5 2/28/2026 Baker 6.0 14.0 9/19/2025 Cake 10.6 9.4 7/24/2026

Acre 4.2 15.8 4/30/2025 Bead 5.5 14.5 11/14/2025 Cedar 5.5 14.2 11/27/2025

Adam 9.5 10.7 2/27/2027 Bid 10.4 9.8 7/17/2026 Cid 16.1 3.9 8/18/2026

A_Bid 10.0 10.1 1/6/2027 Bold 11.0 10.2 7/17/2026 Coat 17.4 10.4 7/14/2026

Buddy 9.8 9.2 7/17/2026 Cure 9.6 2.6 6/24/2026

Brass 16.3 3.6 7/23/2026 Curry 14.7 10.9 11/21/2026

Brat 16.6 3.6 6/29/2026 Cero 14.9 5.1 11/17/2026

CTrad 9.9 10.1 3/4/2025

Digby Erie Ferris

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Daze 10.1 10.0 8/23/2026 Eat 10.8 9.6 9/19/2026 Fast 9.8 9.7 8/3/2026

Dell 4.1 15.8 11/23/2024 Ebb 4.8 15.3 7/8/2026 Feat 4.8 14.5 8/15/2026

Dixie 15.2 5.0 4/17/2026 Echo 15.5 4.3 8/19/2026 Fist 14.8 4.2 6/27/2026

Dot 17.4 10.4 9/23/2026 Edge 17.0 10.8 8/6/2026 Foam 16.0 10.4 7/29/2026

Dune 9.6 2.6 7/19/2026 Egg 9.6 2.6 7/15/2026 Fume 10.5 5.6 6/8/2027

Disco 17.4 10.4 7/19/2026 Elbuli 16.1 3.9 7/22/2026 Fcuk 5.0 14.5 7/20/2026

Divine 9.6 2.6 9/21/2026 Eon 17.4 10.4 8/6/2026

Damper 16.1 3.9 9/27/2026 ETA 9.7 2.6 5/30/2026

CAPSTONE ® COURIER Page 11

Round: 8

HR/TQM Report C101711 Dec. 31, 2026

HUMAN RESOURCES SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Needed Complement 91 825 445 474 687 194

Complement 91 825 445 474 687 194

1st Shift Complement 62 642 265 249 344 135

2nd Shift Complement 29 183 180 225 343 59

Overtime Percent 0.0% 0.0% 0.1% 0.0% 0.0% 0.2%

Turnover Rate 21.7% 11.1% 7.9% 6.4% 7.8% 10.5%

New Employees 111 164 71 93 153 20

Separated Employees 0 0 0 0 0 67

Recruiting Spend $400 $2,200 $2,000 $2,000 $5,000 $2,500

Training Hours 50 35 75 70 80 65

Productivity Index 132.6% 110.6% 116.6% 122.3% 121.7% 121.0%

Recruiting Cost $155 $524 $213 $279 $916 $71

Separation Cost $0 $0 $0 $0 $0 $335

Training Cost $91 $577 $668 $664 $1,099 $252

Total HR Admin Cost $246 $1,101 $881 $943 $2,015 $658

Labor Contract Next Year

Wages $34.08 $34.86 $36.50 $37.10 $35.72 $34.08

Benefits 2,875 2,875 2,925 3,000 2,958 2,875

Profit Sharing 2.3% 2.3% 2.3% 2.4% 2.3% 2.3%

Annual Raise 5.7% 5.7% 5.8% 6.0% 5.9% 5.7%

Starting Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Ceiling Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Adjusted Labor Demands

Wages

Benefits

Profit Sharing

Annual Raise

Strike Days

TQM SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Process Mgt Budgets Last Year

CPI Systems $0 $0 $0 $0 $0 $0

VendorJIT $0 $0 $0 $0 $0 $0

Quality Initiative Training $0 $0 $0 $0 $0 $0

Channel Support Systems $0 $900 $0 $0 $0 $0

Concurrent Engineering $0 $900 $0 $0 $0 $0

UNEP Green Programs $0 $900 $0 $0 $0 $0

TQM Budgets Last Year

Benchmarking $0 $900 $0 $0 $0 $0

Quality Function Deployment Effort $0 $900 $0 $0 $0 $0

CCE/6 Sigma Training $0 $0 $0 $0 $0 $0

GEMI TQEM Sustainability Initiatives $0 $900 $0 $0 $0 $0

Total Expenditures $0 $5,400 $0 $0 $0 $0

Cumulative Impacts

Material Cost Reduction 8.94% 6.90% 11.80% 11.78% 11.80% 11.54%

Labor Cost Reduction 10.19% 0.92% 14.00% 14.00% 14.00% 13.77%

Reduction R&D Cycle Time 34.37% 40.01% 40.01% 40.01% 40.01% 39.85%

Reduction Admin Costs 54.87% 60.02% 60.02% 60.02% 60.02% 60.02%

Demand Increase 9.55% 14.40% 14.40% 14.40% 14.40% 13.78%

CAPSTONE ® COURIER Page 12

Round: 8

Ethics Report C101711 Dec. 31, 2026

ETHICS SUMMARY

Other (Fees, Writeoffs, etc.) The actual dollar impact. Example, $120 means Other increased by $120.

Demand Factor The % of normal. 98% means demand fell 2%.

Material Cost Impact The % of normal. 104% means matieral costs rose 4%.

Admin Cost Impact The % of normal. 103% means admin costs rose 3%.

Productivity Impact The % of normal. 104% means productivity increased by 4%.

Awareness Impact The % of normal. 105% means normal awareness was multiplied by 1.05.

Accessibility Impact The % of normal. 98% means normal accessiblity was multiplied by 0.98.

Normal means the value that would have been produced if the problem had not been presented.

No Impact Andrews Baldwin Chester Digby Erie Ferris

Total

Other (Fees, Writeoffs, etc.) $0 $0 $0 $0 $0 $0 $0

Demand Factor 100% 100% 100% 100% 100% 100% 100%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 100%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

CAPSTONE ® COURIER Page 13

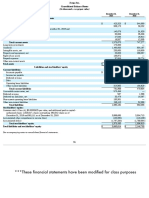

Annual Report

Round: 8

Annual Report Ferris C101711

Dec. 31, 2026

Balance Sheet

DEFINITIONS: Common Size: The common size column

simply represents each item as a percentage of total ASSETS 2026 2025

assets for that year. Cash: Your end-of-year cash Common

position. Accounts Receivable: Reflects the lag between

Size

delivery and payment of your products. Inventories: The Cash $0 0.0% $0

current value of your inventory across all products. A zero

Account Receivable $4,534 6.5% $6,587

indicates your company stocked out. Unmet demand

would, of course, fall to your competitors. Plant & Inventory $13,005 18.5% $32,181

Equipment: The current value of your plant. Accum Total Current Assets $17,539 25.0% $38,768

Deprec: The total accumulated depreciation from your

plant. Accts Payable: What the company currently owes

Plant & Equipment $121,552 173.0% $146,552

suppliers for materials and services. Current Debt: The

debt the company is obligated to pay during the next year Accumulated Depreciation ($68,912) -98.2% ($76,294)

of operations. It includes emergency loans used to keep Total Fixed Assets $52,640 75.0% $70,258

your company solvent should you run out of cash during Total Assets $70,180 100.0% $109,026

the year. Long Term Debt: The companys long term debt

is in the form of bonds, and this represents the total value LIABILITIES & OWNERS

of your bonds. Common Stock: The amount of capital

EQUITY

invested by shareholders in the company. Retained

Earnings: The profits that the company chose to keep Accounts Payable $3,538 5.0% $3,141

instead of paying to shareholders as dividends.

Current Debt $25,064 35.7% $58,860

Long Term Debt $55,104 78.5% $55,104

Total Liabilities $83,706 119.0% $117,105

Common Stock $23,337 33.3% $23,337

Retained Earnings ($36,864) -52.5% ($31,415)

Total Equity ($13,527) -19.3% ($8,078)

Total Liab. & O. Equity $70,180 100.0% $109,026

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account Cash Flows from Operating Activities 2026 2025

during the year. Cash injections appear as positive numbers and cash Net Income(Loss) ($5,449) ($13,917)

withdrawals as negative numbers. The Cash Flow Statement is an excellent Depreciation $8,103 $9,770

tool for diagnosing emergency loans. When negative cash flows exceed Extraordinary gains/losses/writeoffs ($6,133) ($5,257)

positives, you are forced to seek emergency funding. For example, if sales Accounts Payable $397 ($5,087)

are bad and you find yourself carrying an abundance of excess inventory,

Inventory $19,175 $27,480

the report would show the increase in inventory as a huge negative cash

Accounts Receivable $2,053 $2,670

flow. Too much unexpected inventory could outstrip your inflows, exhaust

your starting cash and force you to beg for money to keep your company Net cash from operation $18,148 $15,660

afloat. Cash Flows from Investing Activities

Plant Improvements $15,648 ($3,392)

Cash Flows from Financing Activities

Dividends paid $0 $0

Sales of common stock $0 $0

Purchase of common stock $0 $0

Cash from long term debt $0 $17,627

Retirement of long term debt $0 $0

Change in current debt(net) ($33,796) ($29,895)

Net cash from financing activities ($33,796) ($12,268)

Net change in cash position $0 $0

Closing cash position $0 $0

Annual Report Page 14

Round: 8

Annual Report Ferris C101711

Dec. 31, 2026

2026 Income Statement

2026 Common

(Product Name) Fast Feat Fist Foam Fume Fcuk

Total

Size

Sales $25,579 $20,475 $13,534 $9,590 $3,278 $19,491 $0 $0 $91,947 100.0%

Variable Costs:

Direct Labor $6,404 $4,514 $4,280 $2,707 $1,124 $3,805 $0 $0 $22,833 24.8%

Direct Material $9,866 $6,591 $6,077 $4,721 $1,404 $4,585 $0 $0 $33,244 36.2%

Inventory Carry $152 $0 $0 $117 $1,292 $0 $0 $0 $1,561 1.7%

Total Variable $16,422 $11,104 $10,357 $7,544 $3,819 $8,390 $0 $0 $57,637 62.7%

Contribution Margin $9,157 $9,371 $3,177 $2,046 ($541) $11,100 $0 $0 $34,309 37.3%

Period Costs:

Depreciation $2,005 $2,616 $523 $507 $567 $1,885 $0 $0 $8,103 8.8%

SG&A: R&D $596 $630 $494 $583 $1,000 $556 $0 $0 $3,858 4.2%

Promotions $1,500 $1,650 $1,400 $1,250 $1,450 $1,500 $0 $0 $8,750 9.5%

Sales $2,628 $2,774 $1,898 $2,336 $2,336 $2,336 $0 $0 $14,308 15.6%

Admin $255 $204 $135 $96 $33 $194 $0 $0 $916 1.0%

Total Period $6,984 $7,874 $4,449 $4,771 $5,386 $6,472 $0 $0 $35,936 39.1%

Net Margin $2,173 $1,497 ($1,273) ($2,725) ($5,927) $4,629 $0 $0 ($1,626) -1.8%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce the product Other ($6,133) -6.7%

that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation: Calculated on EBIT $4,507 4.9%

straight-line. 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each Short Term Interest $4,996 5.4%

product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget Long Term Interest $7,893 8.6%

for each product. Sales: The sales force budget for each product. Other: Chargs not included in other Taxes ($2,934) -3.2%

categories such as Fees, Write offs, and TQM. The fees include money paid to investment bankers and Profit Sharing $0 0.0%

brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs Net Profit ($5,449) -5.9%

include the loss you might experience when you sell capacity or liquidate inventory as the result of

eliminating a production line. If the amount appears as a negative amount, then you actually made money

on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest:

Interest expense based on last years current debt, including short term debt, long term notes that have

become due, and emergency loans, Long Term Interest: Interest paid on outstanding bonds. Taxes:

Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor

contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Annual Report Page 15

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- AC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Document30 pagesAC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Shawn TayPas encore d'évaluation

- 02 ChapDocument41 pages02 ChapTanner Womble100% (1)

- Fam PPT 2Document40 pagesFam PPT 2Varun RaiPas encore d'évaluation

- Proposed IFRS® Taxonomy Update PTU/2021/1Document25 pagesProposed IFRS® Taxonomy Update PTU/2021/1Issa BoyPas encore d'évaluation

- 1.introduction To AccountingDocument14 pages1.introduction To AccountingBhuvaneswari karuturiPas encore d'évaluation

- Ias 1 PDFDocument65 pagesIas 1 PDFOTTILIA MAIKOKERAPas encore d'évaluation

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierPas encore d'évaluation

- Business Combi and Conso FSDocument56 pagesBusiness Combi and Conso FSlachimolaluv chim50% (12)

- 3 Year Projected Balance SheetDocument4 pages3 Year Projected Balance SheetJohn Cedrick0% (1)

- Month End Close ChecklistDocument10 pagesMonth End Close ChecklistKv kPas encore d'évaluation

- Zynga 2019 Annual Report - Excerpts - FinalDocument7 pagesZynga 2019 Annual Report - Excerpts - FinalAlexa WilcoxPas encore d'évaluation

- LK Semen Indonesia TRW1 2019 - Final - r1Document191 pagesLK Semen Indonesia TRW1 2019 - Final - r1Ika WinantiPas encore d'évaluation

- Management of Current AssetsDocument8 pagesManagement of Current AssetsBeth Diaz Laurente100% (1)

- AFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSDocument7 pagesAFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSRonna Mae Mendoza100% (1)

- FFS & CFSDocument15 pagesFFS & CFSNishaTripathiPas encore d'évaluation

- II Practice of Horizontal & Vertical Analysis Activity IIDocument9 pagesII Practice of Horizontal & Vertical Analysis Activity IIZarish AzharPas encore d'évaluation

- Quiz and Performance Tasks For 2nd QTR 21 22Document22 pagesQuiz and Performance Tasks For 2nd QTR 21 22Cipher Amoz100% (1)

- CFAB Accounting Chapter 12. Company Financial Statements Under IFRSDocument17 pagesCFAB Accounting Chapter 12. Company Financial Statements Under IFRSHuy NguyenPas encore d'évaluation

- Conceptual Frameworks For Accounting Standards I - Chapter 1Document3 pagesConceptual Frameworks For Accounting Standards I - Chapter 1Khey ManuelPas encore d'évaluation

- Far670 Tutorial Basis of AnalysisDocument3 pagesFar670 Tutorial Basis of Analysis2020482736Pas encore d'évaluation

- Financial Report Analysis: Date of Submission CDocument18 pagesFinancial Report Analysis: Date of Submission CVikraman SridharPas encore d'évaluation

- Cash Versus Accrual Basis AccountingDocument6 pagesCash Versus Accrual Basis AccountingomoshPas encore d'évaluation

- Financial Accounting and Accounting StandardsDocument16 pagesFinancial Accounting and Accounting StandardsJayakrishna BommasamudramPas encore d'évaluation

- Statement of Cash FlowsDocument25 pagesStatement of Cash FlowsLimitless PlaysPas encore d'évaluation

- Rohan SoftwareDocument5 pagesRohan Softwarechinum1Pas encore d'évaluation

- D2 S3 ISAK 16 - IFRIC 12 Illustrative Examples-HTDocument22 pagesD2 S3 ISAK 16 - IFRIC 12 Illustrative Examples-HTHendri Pecinta KedamaiAnPas encore d'évaluation

- FR - Slide - 22.23 - Update 210622Document274 pagesFR - Slide - 22.23 - Update 210622erickson tyronePas encore d'évaluation

- Full Download:: TRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseDocument42 pagesFull Download:: TRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseManpreet BaliPas encore d'évaluation

- Sipack Fabm2 1st QTR FinalDocument106 pagesSipack Fabm2 1st QTR FinalAlexa SalvadorPas encore d'évaluation

- CH 04Document73 pagesCH 04kevin echiverriPas encore d'évaluation