Académique Documents

Professionnel Documents

Culture Documents

DCM Shriram PO

Transféré par

Project Sales CorpTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DCM Shriram PO

Transféré par

Project Sales CorpDroits d'auteur :

Formats disponibles

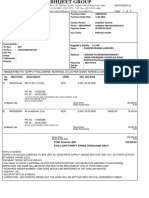

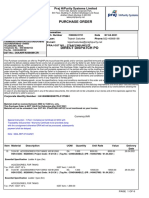

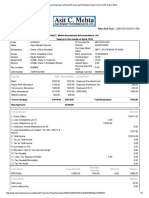

Shriram Alkali & Chemicals

(A Division of DCM Shriram Consolidated Ltd.)

749, GIDC Industrial Estate Jhagadia, Dist. Bharuch, Gujarat-393 110

Ph:Ph : +91-2645-20355, 26021-27 Fax +91-2645-26037

PURCHASE ORDER

1 of 2

M/s. PROJECT SALES CORP ORDER NO : SAC/AMG/910503

28 FOUNTA PLAZA, ORDER DATE : 06.06.2008

SURYABAGH QUOTATION REF : E-MAIL

VISAKHAPATNAM - 530020 QUOTATION DATE: 03.06.2008

VENDOR CODE : 112800

VENDOR TIN NO.: 28690102571

Attn:Mr SATISH AGRAWAL

Dear Sirs,

Please supply following items as per terms and conditions mentioned

Item No Item Details Qty / Unit Amount

Code Component Unit Price

Plant

00001 BIRKOSIT ANTI SEIZE& LEAKPROOF COMPOUND MAKE-GERMANY,)

196554

P48

Birkosit antiseize and leakproof compound for BHEL Turbine

parting plane sealing.

- Pressure Range -105 kg/cm2

- Temp. Range- 545 deg.C

- MAKE : A I SCHULZE, GERMANY

- PNUMBER: 51001

Quantity: 4.00 Kilogram

Basic Price 4,250.00 INR 17,000.00

CST 3% (FORM C) + 3.00 % 510.00

Net payable amount 4,377.50 INR 17,510.00

Delivery date : 07.06.2008

Total net value in INR. 17510.00

INR SEVENTEEN THOUSAND FIVE HUNDRED TEN ONLY.

________________________________________________________________________

Terms of Payment: IN 30 DAYS ON RECEIPT & APPROVAL OF MATERIAL

Price Basis: FOR JHAGADIA

PACKING

The packing of ordered material shall be road-worthy, i.e. the ordered

items shall be despatched in a manner so as to avoid any loss / damage

during transit.

.

TRANSPORTATION

You shall arrange despatch of ordered material duly properly packed

through GATI on direct door delivery basis at our works at Jhagadia,

without any transshipment.

.

Contd..

PURCHASE ORDER NO. SAC/AMG/910503 DATED 06.06.2008 PAGE 2 of 2

Item No Item Details Qty / Unit Amount

Code Component Unit Price

Plant

VAT

In view of implementation of vat in Gujarat w.e.f 01.04.06, declaration

in form 403 is required from vendor. Please find copy of declaration

(form 403) under section 68 of Gujarat value added tax act for goods

entering in the state of Gujarat from outside the state.

.

1) The carrier of the goods entering into the Gujarat state shall carry

duly filled in form 403 in 'triplicate'.

2) During the movement of the goods if any of the designated check post

or barrier is encountered, the 'original' of form 403 shall be deposited

with check post officer and 'duplicate' & 'triplicate' of the 403 shall

be got endorsed by such check post officer.

3) 'Duplicate' of the form 403 shall be forwarded to the consignee of

goods & 'triplicate' copy of form 403 shall be retained by the carrier

of the vehicle throughout its journey in the state of Gujarat.

________________________________________________________________________

All invoices to be raised in the name of "DCM Shriram Consolidated Ltd

(Unit :Shriram Alkali & Chemicals)"

Our PAN based Excise Registration No. and ECC no. is : AAACD0097RXM002.

Our Sales Tax TIN nos. are as under :

TIN No. (GST) : 24210800187 Dt. 27.09.05.

TIN No. (CST) : 24710800187 Dt. 27.09.05.

For other terms, please refer our enclosed Annexure 'G'.

Please acknowledge receipt of the order and send us your confirmation

reference.

AUTHORISED SIGNATORY

NOTE: HELP US IN MAKING TIMELY PAYMENT

-Please send you BILL alonwith MATERIAL being supplied to us

-If bill sent later, please send it ONLY to our STORES DEPTT.

-Bills sent to Accounts/Purchase/Other Deptts.can get misplaced causing delay

FORMAT NO. : MM-2A

Vous aimerez peut-être aussi

- Requ. No.: Date: Date: Amd. No.:: B.G.Shirke Const. Tech. Pvt. LTDDocument1 pageRequ. No.: Date: Date: Amd. No.:: B.G.Shirke Const. Tech. Pvt. LTDVarunn Vel100% (1)

- Chambal Fertilizer PO. PDFDocument2 pagesChambal Fertilizer PO. PDFRizvan QureshiPas encore d'évaluation

- PO No 33225004100210 DESIGN, SUPPLY, INSTALLATION, COMMISSIONING & MAINTENANCE OF ASPIRATION TYPE AUTOMATIC SMOKE FIRE DETECTION WITH ALARM SYSTEMDocument3 pagesPO No 33225004100210 DESIGN, SUPPLY, INSTALLATION, COMMISSIONING & MAINTENANCE OF ASPIRATION TYPE AUTOMATIC SMOKE FIRE DETECTION WITH ALARM SYSTEMSrDEN CoordinationPas encore d'évaluation

- Requested To Supply Following Material (S) As Per Given Terms & ConditionsDocument2 pagesRequested To Supply Following Material (S) As Per Given Terms & ConditionsAsis SahooPas encore d'évaluation

- PO 4700071443 ECC SMS-2 SuppDocument33 pagesPO 4700071443 ECC SMS-2 SuppEngineering Construction CorporationPas encore d'évaluation

- GE Oil & Gas PO Copy For Arexons MotorsilDocument1 pageGE Oil & Gas PO Copy For Arexons MotorsilProject Sales CorpPas encore d'évaluation

- Purchase Order: Praj Hipurity Systems LimitedDocument6 pagesPurchase Order: Praj Hipurity Systems LimitedRohit PrasadPas encore d'évaluation

- Purchase Order: Other Terms and ConditionsDocument6 pagesPurchase Order: Other Terms and Conditionspraveen gautamPas encore d'évaluation

- Purchase Order for RAV Gear MotorDocument4 pagesPurchase Order for RAV Gear MotorShashank HPas encore d'évaluation

- Grasim PO 1Document8 pagesGrasim PO 1rakesh kumar pandeyPas encore d'évaluation

- Thyssenkrupp Elevator (India) Pvt. LTD.: Purchase OrderDocument2 pagesThyssenkrupp Elevator (India) Pvt. LTD.: Purchase OrderVasant TolePas encore d'évaluation

- Mask Fasteners PVT - LTD.: Regd - Office:S Block 72/4 MIDC Bhosari, Pune-411026 (Maharashtra)Document2 pagesMask Fasteners PVT - LTD.: Regd - Office:S Block 72/4 MIDC Bhosari, Pune-411026 (Maharashtra)GauravPas encore d'évaluation

- Purchase Order: GSTN 27AAHCR3225L1Z6 Phone: 022-Cin No.Document2 pagesPurchase Order: GSTN 27AAHCR3225L1Z6 Phone: 022-Cin No.Sanjay SolankarPas encore d'évaluation

- Sigachi Industries Limited: Purchase OrderDocument1 pageSigachi Industries Limited: Purchase Orderbikofax543Pas encore d'évaluation

- Reliance Gadimoga PO For Spill KitsDocument4 pagesReliance Gadimoga PO For Spill KitsProject Sales CorpPas encore d'évaluation

- Indcon Projects & Equipment Limited Purchase OrderDocument4 pagesIndcon Projects & Equipment Limited Purchase OrderDeepak DayalPas encore d'évaluation

- Imperial Crop Sciences (PVT.) LTDDocument1 pageImperial Crop Sciences (PVT.) LTDSyed Imran HaiderPas encore d'évaluation

- PO Osna 4700002842Document2 pagesPO Osna 4700002842vijen33Pas encore d'évaluation

- Po SampleDocument1 pagePo SampleHaroon. HPas encore d'évaluation

- Job Work Order: For JSW Steel LimitedDocument3 pagesJob Work Order: For JSW Steel Limitedomprakash mokaPas encore d'évaluation

- Q218 ReddyDocument1 pageQ218 ReddyavinashPas encore d'évaluation

- Ss 316l 3.0 MTC NewDocument2 pagesSs 316l 3.0 MTC NewSahil Hashmi100% (1)

- Paradeep Phosphates Limited issues Purchase Order for Conveyor BeltDocument3 pagesParadeep Phosphates Limited issues Purchase Order for Conveyor BeltCaspian DattaPas encore d'évaluation

- P.C.PROCESS PRIVATE LIMITED QUOTATION FOR FLOW SENSOR, MAIN-CTRL AND IF-BOARDSDocument1 pageP.C.PROCESS PRIVATE LIMITED QUOTATION FOR FLOW SENSOR, MAIN-CTRL AND IF-BOARDSVenkatesh HaPas encore d'évaluation

- Apl Apollo Tubes Limited Unit-Iii: Works-Vill-Kudavali Plot No-M-1, Murbad, 421401, Thane (MS)Document1 pageApl Apollo Tubes Limited Unit-Iii: Works-Vill-Kudavali Plot No-M-1, Murbad, 421401, Thane (MS)devanshbhuvansht.823Pas encore d'évaluation

- Purchase Order: Number: 14 - SOODocument4 pagesPurchase Order: Number: 14 - SOOLê Đức ThiệnPas encore d'évaluation

- Purchase Order: Po No. DatedDocument3 pagesPurchase Order: Po No. DatedHolly SmithPas encore d'évaluation

- Gillanders Arbuthnot & Co., LTD.: Micco DivisionDocument1 pageGillanders Arbuthnot & Co., LTD.: Micco DivisionSouvik DeyPas encore d'évaluation

- TAQA Power Plant Purchase Order DetailsDocument2 pagesTAQA Power Plant Purchase Order DetailsParmasamy SubramaniPas encore d'évaluation

- Purchase Order NoDocument1 pagePurchase Order NoSourav MaitraPas encore d'évaluation

- To Site:: TPR-PO/ 115110/2011-2012Document1 pageTo Site:: TPR-PO/ 115110/2011-2012Dattu BogaPas encore d'évaluation

- Bectochem Consultants & Engineers Pvt. LTD.: Junction Box FLP/ Weather Proof 240 Length 155 Width 100 HeightDocument1 pageBectochem Consultants & Engineers Pvt. LTD.: Junction Box FLP/ Weather Proof 240 Length 155 Width 100 HeightBhavin VoraPas encore d'évaluation

- National Aluminium Company Limited: (Purchase Dept)Document19 pagesNational Aluminium Company Limited: (Purchase Dept)Hytech Pvt. Ltd.Pas encore d'évaluation

- Sander PODocument3 pagesSander POarunkumar1991.srPas encore d'évaluation

- Date. India Certificate of Conformance DIN EN 10204-3.1 Test Certificate No. B03940807000335712 30.03.2019 Deepak Fasteners Limited Quality Control Test CertificateDocument1 pageDate. India Certificate of Conformance DIN EN 10204-3.1 Test Certificate No. B03940807000335712 30.03.2019 Deepak Fasteners Limited Quality Control Test CertificateNaresh SainiPas encore d'évaluation

- GeM Invoice for Security ServicesDocument2 pagesGeM Invoice for Security ServicesSandeep KumarPas encore d'évaluation

- 2010 Storm 18 Invoice 1 - QuestionsDocument9 pages2010 Storm 18 Invoice 1 - QuestionsNewsdayPas encore d'évaluation

- Hex 33 X 80Document1 pageHex 33 X 80PurchasePas encore d'évaluation

- Ib-4325 Circuit Diagram (New Era Dairy Engineers Pvt. LTD.)Document11 pagesIb-4325 Circuit Diagram (New Era Dairy Engineers Pvt. LTD.)Electrical GyanPas encore d'évaluation

- Steam Fab PDFDocument6 pagesSteam Fab PDFDeepali ShahPas encore d'évaluation

- Ac Info TechDocument2 pagesAc Info Techrkpatel40Pas encore d'évaluation

- Material Test ReportDocument3 pagesMaterial Test ReportJuan Carlos Sua SuaPas encore d'évaluation

- Po 00028 1Document3 pagesPo 00028 1Ferry AwanPas encore d'évaluation

- Mahindra Aerostructures Pvt. LTDDocument2 pagesMahindra Aerostructures Pvt. LTDsharon nathanPas encore d'évaluation

- Service Order: For JSW Steel LimitedDocument32 pagesService Order: For JSW Steel LimitedEngineering Construction CorporationPas encore d'évaluation

- Indian Oil Corporation Limited: Supplier ConsigneeDocument1 pageIndian Oil Corporation Limited: Supplier ConsigneeMONTUPROPas encore d'évaluation

- Techno-Commercial OfferDocument6 pagesTechno-Commercial OfferharishPas encore d'évaluation

- 20-2572-MTC - 2 PDFDocument1 page20-2572-MTC - 2 PDFQualityPas encore d'évaluation

- Technical Instruments Calibration QuoteDocument1 pageTechnical Instruments Calibration QuoteSandip ChaudhariPas encore d'évaluation

- Po For PVC PipesDocument2 pagesPo For PVC PipesSarinPas encore d'évaluation

- Boilers MFG CompanyDocument3 pagesBoilers MFG CompanyJackson ButlerPas encore d'évaluation

- ISO 9001-2015 Certified Co. supplies ASME certified pipe fittingsDocument1 pageISO 9001-2015 Certified Co. supplies ASME certified pipe fittingsSACHIN PATELPas encore d'évaluation

- FLSmidth A/S Purchasing Department Purchase OrderDocument169 pagesFLSmidth A/S Purchasing Department Purchase OrderPrabhavathi RamasamyPas encore d'évaluation

- Purchase Order: This Is An Electronically Generated Document. No Signatures Are RequiredDocument3 pagesPurchase Order: This Is An Electronically Generated Document. No Signatures Are RequiredNarendraPas encore d'évaluation

- Purchase Order: (Revised)Document8 pagesPurchase Order: (Revised)bajoesapoetraPas encore d'évaluation

- Details of Receiver (Billed To) Details of Consignee (Shipped To)Document1 pageDetails of Receiver (Billed To) Details of Consignee (Shipped To)VESTIGE JVRATNAMPas encore d'évaluation

- Lead Waste Recyclers ListDocument72 pagesLead Waste Recyclers ListukalPas encore d'évaluation

- Er PoDocument3 pagesEr PoManojPas encore d'évaluation

- ACFrOgBLj8r70mNiBr1ESgeP2eXr7Uxxcz7veA4IwKzmzelTO2-RKi Cu3zWpc0S2CK-JFxgps zJti9MSuGe9XLUHS5BnJJvtG4XGZTKDYy4ba-6y0s6D5 iwZMYBkDocument23 pagesACFrOgBLj8r70mNiBr1ESgeP2eXr7Uxxcz7veA4IwKzmzelTO2-RKi Cu3zWpc0S2CK-JFxgps zJti9MSuGe9XLUHS5BnJJvtG4XGZTKDYy4ba-6y0s6D5 iwZMYBkar199Pas encore d'évaluation

- Garg FKC00172-L - 9045101918Document2 pagesGarg FKC00172-L - 9045101918Sanju DhatwaliaPas encore d'évaluation

- PSC Hands-Free Push Pull Safety ToolsDocument1 pagePSC Hands-Free Push Pull Safety ToolsProject Sales CorpPas encore d'évaluation

- Birkosit Steam and Gas Turbine ApplicationsDocument2 pagesBirkosit Steam and Gas Turbine ApplicationsProject Sales CorpPas encore d'évaluation

- Cameron 700668 From Project Sales Corp, IndiaDocument1 pageCameron 700668 From Project Sales Corp, IndiaProject Sales CorpPas encore d'évaluation

- PSC Hands-Free Hands-Off Tools Range 2021Document1 pagePSC Hands-Free Hands-Off Tools Range 2021Project Sales CorpPas encore d'évaluation

- Draft - Rig Spares-2Document10 pagesDraft - Rig Spares-2Project Sales CorpPas encore d'évaluation

- Nightstick XPR-5592Document2 pagesNightstick XPR-5592Project Sales CorpPas encore d'évaluation

- Draft - Rig Spares - Miscellaneous Stock Items-1Document65 pagesDraft - Rig Spares - Miscellaneous Stock Items-1Project Sales CorpPas encore d'évaluation

- Draft - Rig Spares-3Document30 pagesDraft - Rig Spares-3Project Sales CorpPas encore d'évaluation

- Nightstick XPR-5586Document2 pagesNightstick XPR-5586Project Sales CorpPas encore d'évaluation

- Beware of Duplicates - Fingersaver Hands-Off Safety ToolDocument8 pagesBeware of Duplicates - Fingersaver Hands-Off Safety ToolProject Sales CorpPas encore d'évaluation

- THINKY Performance DatasheetDocument7 pagesTHINKY Performance DatasheetAnand AgrawalPas encore d'évaluation

- PSC Specialty Lubricant 2021Document43 pagesPSC Specialty Lubricant 2021Project Sales CorpPas encore d'évaluation

- Nightstick XPR 5584gmx Integritas 84Document2 pagesNightstick XPR 5584gmx Integritas 84Project Sales CorpPas encore d'évaluation

- Nightstick XPR-5562-DICATADocument2 pagesNightstick XPR-5562-DICATAProject Sales CorpPas encore d'évaluation

- Nightstick XPR-5582-INTEGRITAS-82Document2 pagesNightstick XPR-5582-INTEGRITAS-82Project Sales CorpPas encore d'évaluation

- Nightstick XPR 5561gseriesDocument2 pagesNightstick XPR 5561gseriesProject Sales CorpPas encore d'évaluation

- PSC Guide-It Safety Rigger Taglines - 2020 CompressedDocument9 pagesPSC Guide-It Safety Rigger Taglines - 2020 CompressedProject Sales CorpPas encore d'évaluation

- Nightstick XPR 5568 IntrantDocument2 pagesNightstick XPR 5568 IntrantProject Sales CorpPas encore d'évaluation

- Nightstick XPP 5465r ForgeDocument2 pagesNightstick XPP 5465r ForgeProject Sales CorpPas encore d'évaluation

- Nightstick XPP 5566 IntrantDocument2 pagesNightstick XPP 5566 IntrantProject Sales CorpPas encore d'évaluation

- Nightstick XPR 5542gmxDocument2 pagesNightstick XPR 5542gmxProject Sales CorpPas encore d'évaluation

- Nightstick XPP 5411gxDocument2 pagesNightstick XPP 5411gxProject Sales CorpPas encore d'évaluation

- PSC Load-It Load Positioning Safety ToolsDocument13 pagesPSC Load-It Load Positioning Safety ToolsProject Sales CorpPas encore d'évaluation

- Nightstick XPR 5522gmxDocument2 pagesNightstick XPR 5522gmxProject Sales CorpPas encore d'évaluation

- Nightstick XPP 5452gDocument2 pagesNightstick XPP 5452gProject Sales CorpPas encore d'évaluation

- Nightstick XPP 5450gDocument2 pagesNightstick XPP 5450gProject Sales CorpPas encore d'évaluation

- Nightstick XPP 5414gx SeriesDocument2 pagesNightstick XPP 5414gx SeriesProject Sales CorpPas encore d'évaluation

- Rig Spares - Used New Surplus InventoryDocument16 pagesRig Spares - Used New Surplus InventoryProject Sales CorpPas encore d'évaluation

- LP250 Anti-Seize From Project Sales CorpDocument1 pageLP250 Anti-Seize From Project Sales CorpProject Sales CorpPas encore d'évaluation

- PSC Rescue Sheets For All Weather ProtectionDocument1 pagePSC Rescue Sheets For All Weather ProtectionProject Sales CorpPas encore d'évaluation

- Public Finance and Fiscal Policy S.6 Eco NotesDocument43 pagesPublic Finance and Fiscal Policy S.6 Eco NotesNdagire DorahPas encore d'évaluation

- CIR V BurmeisterDocument3 pagesCIR V BurmeisterGenevieve Kristine ManalacPas encore d'évaluation

- GST Practical 1-39Document88 pagesGST Practical 1-39HarismithaPas encore d'évaluation

- Hilton Hotel PDFDocument1 pageHilton Hotel PDFTadas KubiliusPas encore d'évaluation

- Section A: 40, Main Street, GeorgetownDocument1 pageSection A: 40, Main Street, GeorgetownKatty DeFreitasPas encore d'évaluation

- Quiz 4Document3 pagesQuiz 4Brier Jaspin AguirrePas encore d'évaluation

- SEO-Optimized Title for Retail InvoiceDocument2 pagesSEO-Optimized Title for Retail InvoiceManish LahotiPas encore d'évaluation

- Earning Rate Amount (RS.) Deductions Amount (RS.)Document2 pagesEarning Rate Amount (RS.) Deductions Amount (RS.)Ajay KharwarPas encore d'évaluation

- Pre-Week (Llamado)Document25 pagesPre-Week (Llamado)Mischievous MaePas encore d'évaluation

- Law of Taxation: Concept of Salary Under Income Tax Act, 1961Document28 pagesLaw of Taxation: Concept of Salary Under Income Tax Act, 1961Sapna RajmaniPas encore d'évaluation

- BIR Payment Form ExplainedDocument2 pagesBIR Payment Form ExplainedElbert Natal100% (1)

- A) Residential Status of An IndividualDocument7 pagesA) Residential Status of An IndividualFaisal NurPas encore d'évaluation

- Atal Pension Yojana: Page 1 of 4Document4 pagesAtal Pension Yojana: Page 1 of 4Bhanu Satya SaiPas encore d'évaluation

- ACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XDocument8 pagesACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XAngelica PagaduanPas encore d'évaluation

- Highlights of key changes under the TRAIN LawDocument13 pagesHighlights of key changes under the TRAIN LawMiguel Anas Jr.Pas encore d'évaluation

- Solved Jokan Contributes A Nondepreciable Asset To The Mahali LLC inDocument1 pageSolved Jokan Contributes A Nondepreciable Asset To The Mahali LLC inAnbu jaromiaPas encore d'évaluation

- 0968 Hostplus Additional Contributions BrochureDocument9 pages0968 Hostplus Additional Contributions BrochureSepehrPas encore d'évaluation

- IAS 12 Income Taxes Standard ExplainedDocument40 pagesIAS 12 Income Taxes Standard ExplainedfurqanPas encore d'évaluation

- ITC Annual Report Contents SummaryDocument10 pagesITC Annual Report Contents SummaryRohit singhPas encore d'évaluation

- 2008-BIR Ruling (DA - C-182 559-08)Document8 pages2008-BIR Ruling (DA - C-182 559-08)Jay MirandaPas encore d'évaluation

- Financial Statements, Cash Flow, and TaxesDocument33 pagesFinancial Statements, Cash Flow, and TaxesAyame KusuragiPas encore d'évaluation

- Estate Tax PornDocument52 pagesEstate Tax PornPJ HongPas encore d'évaluation

- 2.03 Sharing With Uncle SamDocument3 pages2.03 Sharing With Uncle SamJakeFromStateFarmPas encore d'évaluation

- Leaflet For Public HearingDocument1 pageLeaflet For Public HearingharrymattisonPas encore d'évaluation

- Prerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument62 pagesPrerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniPas encore d'évaluation

- Tax Invoice for Kindle and Cover PurchaseDocument2 pagesTax Invoice for Kindle and Cover PurchaseAmit rajPas encore d'évaluation

- TeresaZhou (US Tax Resume 06.01. 2015) CADocument3 pagesTeresaZhou (US Tax Resume 06.01. 2015) CALin ZhouPas encore d'évaluation

- CIR vs. Kudos Metal Tax AssessmentDocument2 pagesCIR vs. Kudos Metal Tax AssessmentMeAnn TumbagaPas encore d'évaluation

- Estate Tax (Single) ReportDocument18 pagesEstate Tax (Single) ReportPatricia RodriguezPas encore d'évaluation

- 2022-11-Course Syllabus-Public Finance and TaxationDocument4 pages2022-11-Course Syllabus-Public Finance and TaxationYonas BamlakuPas encore d'évaluation