Académique Documents

Professionnel Documents

Culture Documents

Capela

Transféré par

JungJessicaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capela

Transféré par

JungJessicaDroits d'auteur :

Formats disponibles

1. Another factor affecting exchange rates is market expectations of future exchange rates.

Like other

financial markets, foreign exchange markets react to any news that may have a future effect. *baca slide*

Day-to-day speculation on future exchange rate movements is commonly driven by signals of future

interest rate movements,but it can also be driven by other factors. Signals of the future economic

conditions that affect exchange rates can change quickly, so the speculative positions in currencies may

adjust quickly, causing unclear patterns in exchange rates.

2. Trade-related foreign exchange transactions are generally less responsive to news. Financial flow

transactions are very responsive to news, however, because decisions to hold securities denominated in a

particular currency are often dependent on anticipated changes in currency values. Sometimes trade-

related factors and financial factors interact and simultaneously affect exchange rate movements.

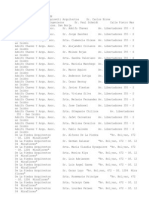

Exhibit 4.8 separates payment flows between countries into trade-related and financerelated flows and

summarizes the factors that affect these flows

3. In some periods, most currencies move in the same direction against the dollar. This is typically because

of a particular factor in the United States that is having impact on the demand and supply conditions

across all currencies in that period. It is common for these European currencies to move in the same

direction against the dollar because their economic conditions tend to change over time. However, it is

possible for one of the countries to experience different economic conditions in a particular period, which

may cause its currency’s movement against the dollar to deviate from the movements of the other

European currencies.

4. The cross exchange rate changes when either currency’s value changes against the

dollar. the following relationships for two non-dollar currencies called currency A and currency B:

5. Anticipation

Some large financial institutions attempt to anticipate how the equilibrium exchange rate will change in

the near future based on existing economic conditions. They need to consider the prevailing interest rates

at which they can invest or borrow, along with their expectations of exchange rates, in order to determine

whether to take a speculative position in a foreign currency.

6. individuals whose careers have nothing to do with foreign exchange markets speculate in foreign

currencies. They can take positions in the currency futures market or options market.

7. One of the most commonly used strategies by institutional and individual investors to speculate in the

foreign exchange market is the “carry trade,” whereby investors attempt to capitalize on the differential in

interest rates between two countries. Specifically, the strategy involves borrowing a currency that has a

low interest rate, and investing the funds in a currency that has a high interest rate.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hilado v. CIRDocument5 pagesHilado v. CIRclandestine2684Pas encore d'évaluation

- Brochure FT TBR Final 2018Document13 pagesBrochure FT TBR Final 2018Cico LisadonPas encore d'évaluation

- Delhi To Mumbai PDFDocument2 pagesDelhi To Mumbai PDFAshutosh YadavPas encore d'évaluation

- Kiat Penulisan Proposal PKM Unand - CahyadiDocument43 pagesKiat Penulisan Proposal PKM Unand - CahyadinugrahaPas encore d'évaluation

- New Ra April 2023Document279 pagesNew Ra April 2023Jagdamba OverseasPas encore d'évaluation

- IRR and NPV Conflict - IllustartionDocument27 pagesIRR and NPV Conflict - IllustartionVaidyanathan RavichandranPas encore d'évaluation

- Lucian A 1Document17 pagesLucian A 1keylaelizabehtPas encore d'évaluation

- Basic Documents and Transactions Related To Bank DepositsDocument15 pagesBasic Documents and Transactions Related To Bank DepositsJessica80% (5)

- Stitch Classes and Stitch DefectsDocument59 pagesStitch Classes and Stitch DefectsMaanvizhi Moorthi100% (1)

- Cost CurveDocument8 pagesCost CurvearunPas encore d'évaluation

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorPas encore d'évaluation

- 8294 PDFDocument174 pages8294 PDFManjeet Pandey100% (1)

- Air Transport Beyond The Crisis - Pascal Huet - WTFL 2009Document18 pagesAir Transport Beyond The Crisis - Pascal Huet - WTFL 2009World Tourism Forum LucernePas encore d'évaluation

- Spicejet TicketDocument2 pagesSpicejet TicketAnonymous qEh0BxrPas encore d'évaluation

- Part B - GR/PP Procedure Disposal of Copies of Export Declaration Forms 6B.1Document3 pagesPart B - GR/PP Procedure Disposal of Copies of Export Declaration Forms 6B.1Vimala Selvaraj VimalaPas encore d'évaluation

- Monday To Friday: - Solihull To Coventry Via Catherine-de-Barnes, Hampton-in-Arden & MeridenDocument2 pagesMonday To Friday: - Solihull To Coventry Via Catherine-de-Barnes, Hampton-in-Arden & MeridenanuragrathorePas encore d'évaluation

- Hydropower in NepalDocument16 pagesHydropower in NepalJONAMPas encore d'évaluation

- PIT HomeworkDocument2 pagesPIT HomeworkNhi Nguyen0% (1)

- NovDec Flowertown Knitting Guild NewsletterDocument5 pagesNovDec Flowertown Knitting Guild NewsletterScarlett McCrary Jones LmtPas encore d'évaluation

- Exam2 Solutions 40610 2008Document8 pagesExam2 Solutions 40610 2008blackghostPas encore d'évaluation

- Price Elasticity of Supply (PES)Document23 pagesPrice Elasticity of Supply (PES)SyedPas encore d'évaluation

- 06 GDP and Economic GrowthDocument3 pages06 GDP and Economic GrowthAkash Chandak0% (2)

- The Beauty of The GP Co-Investment Structure - CrowdStreetDocument6 pagesThe Beauty of The GP Co-Investment Structure - CrowdStreetJerry WilliamsonPas encore d'évaluation

- Terex LiftaceDocument2 pagesTerex LiftaceEduardo SaaPas encore d'évaluation

- Business London's 20 Under 40 - London's New Economic TrailblazersDocument2 pagesBusiness London's 20 Under 40 - London's New Economic TrailblazersrtractionPas encore d'évaluation

- CIFDocument2 pagesCIFSaikumar SelaPas encore d'évaluation

- Land Meant For Petrol Station or Has The Potential For Petrol StationDocument2 pagesLand Meant For Petrol Station or Has The Potential For Petrol StationselvarajPas encore d'évaluation

- Comparative Analysis of VAT and GSTDocument39 pagesComparative Analysis of VAT and GSTsaahilp_10% (5)

- 2016 HSC Maths General 2Document40 pages2016 HSC Maths General 2HIMMZERLANDPas encore d'évaluation

- Lecture 3Document14 pagesLecture 3skye080Pas encore d'évaluation