Académique Documents

Professionnel Documents

Culture Documents

Myplan 2018 - English

Transféré par

kleansoulCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Myplan 2018 - English

Transféré par

kleansoulDroits d'auteur :

Formats disponibles

Ref No.

myPlan Application Form

SECTION A - CUSTOMER PROFILE INFORMATION Customer Details - Individual/Minor

Name: Mr./ Mrs./ Ms./ Account No.:

Nationality: Gender: Male Female Date of Birth: dd/mm/yyyy

Place of Birth: City Country ID Type: Passport Emirates ID

ID No.: ID Expiry Date: dd/mm/yyyy

Mobile: Email ID:

Customer/Guardian Details

Name: Mr./ Mrs./ Ms./ Account No.: (If separate and existing account)

Nationality: Date of Birth: dd/mm/yyyy Place of Birth:

ID Type: Passport Emirates ID ID No.: ID Expiry Date: dd/mm/yyyy

Relationship w/ Minor: Gender: Male Female

Profile and Income Details of Customer/Guardian

Source of Income: Salary Family Savings Business Proceeds Other

Profession: Employer Name:

Marital Status: Married Single Salary / Income: Per Month

Country of Residence: Years in Country of Residence:

Address

Residence Address:

P.O. Box: City Country

Mailing Address: Address

If different from the

Residence Address P.O. Box: City Country

SECTION B - SELF-CERTIFICATION

FATCA

Are you a US Citizen / Resident/Green Card Holder Yes No If yes, please provide your TIN

CRS

Are you treated as a resident of any Country other than United Arab Emirates and USA for taxation purposes Yes If yes, complete the below No

Country of Residence for Tax Purposes and related Tax Payer Identification Number (“TIN”) or equivalent number

Please complete the following table indicating the Countries you are considered as Resident for Taxation purposes along with the TIN for each Country. If the TIN is

unavailable, please provide the appropriate reason A, B or C where indicated below:

Reason A: The Country where the Account Holder is resident does not issue TINs to its residents

Reason B: The Account Holder is otherwise unable to obtain a TIN

Reason C: No TIN is required as per the regulation of the Country you are considered a Resident for Taxation

Country of Tax Residence TIN If no TIN is available, please state the reason A, B or C.

If B, please outline the reason for being unable to obtain TIN

SECTION C - Setup myPlan

Please issue Saving Bonds worth of AED In figures In words

in the name of the above mentioned beneficiary on the of each month, starting on dd/mm/yyyy

for minimum number of monthly payments of 12 24 36 or until this plan is canceled

Monthly payments are made through Direct Debit Standing Order Salary Deduction mandate

I agree to be charged subscription fee of 1% of the total planned payment in case I cancel the plan or redeem the issued bonds before making the agreed

number of monthly payments.

SECTION D Upgrade existing recurring payments mandate to myPlan Ref:

Monthly payment amount AED Minimum number of monthly payments: 12 24 36

Payment date of each month.

Payment method Direct Debit Standing Order Salary Deduction mandate

I agree to be charged subscription fee of 1% of the total planned payment in case I cancel the plan or redeem the issued bonds before making the agreed

number of monthly payments.

SECTION E - Cancel an existing plan Ref:

I wish to cancel my plan with effect from: dd/mm/yyyy

If next payment due date is within 10 working days from cancellation date, cancellation will happen after next payment.

Disclaimer: With effect from 1st January 2018, Services by National Bonds Corporation PJSC shall be subject to Value Added Tax (‘VAT’), as applicable as per the Federal Decree-Law No. (8), 2017 on Value

Added Tax (‘VAT Law’) and Cabinet Decision No. (52), 2017 on the Executive Regulations. In the event of any non-compliance or mis-declaration by the Customer, the Company shall not be held responsible

for financial loss (if any) to the Customer. The Company reserves the right to recover VAT from the Customer as may be applicable under the provisions of the VAT Law.

Consent and Declaration

I confirm that all the information provided above are true and hereby indemnify National Bonds Corporation against any loss or damage that may be incurred due to incorrectness of such information. I hereby

declare that I have read and agree to be bound by the Terms and Conditions set out in a separate document. I agree to provide any additional information and/or supporting documents as when requested by

the Company.

If there is a change in the circumstances that affects the FATCA/CRS Tax Residency Self-Certification provided above or causes the information provided above to become incomplete or incorrect, I understand

that I am obligated to inform The Company of the change in circumstances within 30 days of its occurrence and to provide with suitably updated details.

Customer Signature, Date

MKT/2018/01/MPAPP/01

For Company’s Official use only

Distributor Code

Outlet Code

Stamp & Signature: Signature Admitted ID is verified & true copy is certified

All supporting documents are attached

Vous aimerez peut-être aussi

- TermSukuk App Form Individual E Mrs ANISHADocument2 pagesTermSukuk App Form Individual E Mrs ANISHAsunij.chackoPas encore d'évaluation

- Current Account ApplicationDocument4 pagesCurrent Account ApplicationSourabh TiwariPas encore d'évaluation

- Business Loan Application PacketDocument9 pagesBusiness Loan Application PacketSupreet Kaur100% (1)

- Apply for an Auto Loan in 4 StepsDocument2 pagesApply for an Auto Loan in 4 StepsKarl LabagalaPas encore d'évaluation

- SafariDocument10 pagesSafarishakthi54321Pas encore d'évaluation

- Member LOI GenericDocument1 pageMember LOI GenericMárcio MartinhoPas encore d'évaluation

- Loan Application FormDocument10 pagesLoan Application FormAlexanderDaviesPas encore d'évaluation

- PHFA Housing Assistance FormDocument5 pagesPHFA Housing Assistance FormPedro G. SotoPas encore d'évaluation

- Transmission Request FormDocument4 pagesTransmission Request FormVinayak SavanurPas encore d'évaluation

- Hekima Plan Application Form-EDocument4 pagesHekima Plan Application Form-ExeniaPas encore d'évaluation

- VISA Corporate Card Application Form Clarien EDT Feb1120Document4 pagesVISA Corporate Card Application Form Clarien EDT Feb1120Mihai ConstantinescuPas encore d'évaluation

- PFS Via EmailDocument2 pagesPFS Via Emailshairaziu4uPas encore d'évaluation

- Hohm Energy Credit AppDocument3 pagesHohm Energy Credit Appsolarfincorp2Pas encore d'évaluation

- Standard Withdrawal FormDocument8 pagesStandard Withdrawal FormAntónio MoreiraPas encore d'évaluation

- Corporate Account FormDocument6 pagesCorporate Account FormHari HsePas encore d'évaluation

- HCJXDocument4 pagesHCJXAdi GuptaPas encore d'évaluation

- Birla Policy Surrender Form - January 2024Document2 pagesBirla Policy Surrender Form - January 2024rishsomzavPas encore d'évaluation

- NRI Form Ver5Document12 pagesNRI Form Ver5enterprisesshreemarutiPas encore d'évaluation

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoPas encore d'évaluation

- Loan Application Form 1Document6 pagesLoan Application Form 1John ChukwuemekaPas encore d'évaluation

- Account Opening FormDocument10 pagesAccount Opening FormGk MageshPas encore d'évaluation

- Corporate Partnership FormDocument4 pagesCorporate Partnership FormOnyekachukwu Akaekpuchionwa OkonkwoPas encore d'évaluation

- Waiver Application Form 101: Primary Applicant InformationDocument1 pageWaiver Application Form 101: Primary Applicant InformationLogia GamerPas encore d'évaluation

- Kotak Multi Currency World Travel Card Application FormDocument2 pagesKotak Multi Currency World Travel Card Application FormVivek ShuklaPas encore d'évaluation

- Life Insurance Surrender FormDocument2 pagesLife Insurance Surrender FormpghoshPas encore d'évaluation

- Photo SB Account FormDocument1 pagePhoto SB Account FormShyam RoutPas encore d'évaluation

- WEL TB PAY002 Account Activation Form PDFDocument1 pageWEL TB PAY002 Account Activation Form PDFAnonymous Z6ve7AqWKPas encore d'évaluation

- Policy Fund Withdrawal Form: FWP/FSC CodeDocument2 pagesPolicy Fund Withdrawal Form: FWP/FSC CodeEra gasperPas encore d'évaluation

- Member Loan ApplicationDocument2 pagesMember Loan ApplicationsandyolkowskiPas encore d'évaluation

- Retirement Notification FormDocument2 pagesRetirement Notification FormAbongile PhinyanaPas encore d'évaluation

- Additional Request Form (ARF) - FDocument2 pagesAdditional Request Form (ARF) - FAtif SyedPas encore d'évaluation

- Nca - Credit Application1Document2 pagesNca - Credit Application1api-25801172Pas encore d'évaluation

- Credit ApplicationDocument3 pagesCredit Applicationcharlenealvarez59Pas encore d'évaluation

- Applicant Information (If More Than One Applicant, Copy Form and Complete For Each)Document1 pageApplicant Information (If More Than One Applicant, Copy Form and Complete For Each)NoePas encore d'évaluation

- AMD Form No. 03-003 Buyer's Information Sheet (Individual)Document1 pageAMD Form No. 03-003 Buyer's Information Sheet (Individual)Keanne TradingPas encore d'évaluation

- Interben Trustees Limited Withdrawal FormDocument8 pagesInterben Trustees Limited Withdrawal FormAmenAllah DghimPas encore d'évaluation

- SBP Prescribed Application Form For Governments Profit Subsidy Facility (English)Document6 pagesSBP Prescribed Application Form For Governments Profit Subsidy Facility (English)muhammadTzPas encore d'évaluation

- Cigna Claim FormDocument2 pagesCigna Claim FormLoganBohannonPas encore d'évaluation

- Account Holder: AEOI Self-Certification For An Individual/Controlling PersonDocument3 pagesAccount Holder: AEOI Self-Certification For An Individual/Controlling PersonNigil josephPas encore d'évaluation

- personal-share-applicationDocument3 pagespersonal-share-applicationbstinson829Pas encore d'évaluation

- A1 Loan Application FormDocument1 pageA1 Loan Application FormAngie DuranPas encore d'évaluation

- Canada EngDocument3 pagesCanada Engpaolomarabella8Pas encore d'évaluation

- Supplemental Customer Relationship FormDocument2 pagesSupplemental Customer Relationship FormMay Rojas Mortos100% (1)

- Third Party Payment Declaration Form - PgimDocument2 pagesThird Party Payment Declaration Form - PgimmayankPas encore d'évaluation

- School Fees Advance Application Form 2019Document4 pagesSchool Fees Advance Application Form 2019Mary KimberlyPas encore d'évaluation

- Personal Account Application Form PDFDocument2 pagesPersonal Account Application Form PDFHugh O'Brien GwazePas encore d'évaluation

- FLH060A Pag-IBIG Housing Loan Application - Co-Borrowers Folio052009 - FDocument2 pagesFLH060A Pag-IBIG Housing Loan Application - Co-Borrowers Folio052009 - FGenessa Sabejon RiveraPas encore d'évaluation

- Wa0000 PDFDocument4 pagesWa0000 PDFprosper wonderPas encore d'évaluation

- Current Account Opening FormDocument3 pagesCurrent Account Opening FormGopal GPas encore d'évaluation

- Application Form Account Opening10012024011549Document5 pagesApplication Form Account Opening10012024011549Chithralekha AnanthPas encore d'évaluation

- OM UnitTrust DO AmendmentForm (FINAL) ElectronicDocument6 pagesOM UnitTrust DO AmendmentForm (FINAL) ElectronicMonika ShanikaPas encore d'évaluation

- 15 Wage Payment Election PDFDocument2 pages15 Wage Payment Election PDFHenry MorenoPas encore d'évaluation

- Personal - Ac - App - Form - V 2 - 29 - Nov2013Document3 pagesPersonal - Ac - App - Form - V 2 - 29 - Nov2013nzekwesiliekenedilichukwuPas encore d'évaluation

- Housing Finance Application Form: Purpose of FacilityDocument6 pagesHousing Finance Application Form: Purpose of Facilitymuhammadtariq730Pas encore d'évaluation

- Open savings account online in Fino Payments BankDocument6 pagesOpen savings account online in Fino Payments BankMd Shaban AnzerPas encore d'évaluation

- 28130185Document8 pages28130185Abhi ChandranPas encore d'évaluation

- Application For Student Bursary Scheme 2022Document3 pagesApplication For Student Bursary Scheme 2022Prashant Singh RajputPas encore d'évaluation

- HBL Additional Request Form (Conventional Banking)Document2 pagesHBL Additional Request Form (Conventional Banking)zakir soomroPas encore d'évaluation

- GUIDE TO COMPLETING FORM E & OVER 200 QUESTIONS ANSWERED ON FINANCES IN DIVORCE: Helping You To Complete the Form E, With Hints and Tips and Answering Questions on the Financial Aspects of DivorceD'EverandGUIDE TO COMPLETING FORM E & OVER 200 QUESTIONS ANSWERED ON FINANCES IN DIVORCE: Helping You To Complete the Form E, With Hints and Tips and Answering Questions on the Financial Aspects of DivorcePas encore d'évaluation

- Einvoice 04Document1 pageEinvoice 04veeragPas encore d'évaluation

- 2004 - Full File ExampleDocument7 pages2004 - Full File ExampleApanar OoPas encore d'évaluation

- Babcock University Acct 434 Lecture 4 Double Taxation ReliefDocument24 pagesBabcock University Acct 434 Lecture 4 Double Taxation ReliefdemolaojaomoPas encore d'évaluation

- Itemized DeductionsDocument23 pagesItemized DeductionsAbhishek JaiswalPas encore d'évaluation

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANPas encore d'évaluation

- Cir vs. Aichi Forging G.R. No. 184823Document14 pagesCir vs. Aichi Forging G.R. No. 184823Eiv AfirudesPas encore d'évaluation

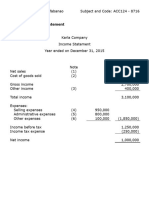

- ACC124 - Assignment On Income StatementDocument6 pagesACC124 - Assignment On Income StatementRuzuiPas encore d'évaluation

- F6-Dec 2007 PYQDocument16 pagesF6-Dec 2007 PYQTan Wan ChingPas encore d'évaluation

- Taco 0294334031000005Document1 pageTaco 0294334031000005Govinda RajuluPas encore d'évaluation

- Nepal Budget Highlights 2078Document36 pagesNepal Budget Highlights 2078shankarPas encore d'évaluation

- 4.1accruals Prepayments Lecture Notes Student Versio4nDocument6 pages4.1accruals Prepayments Lecture Notes Student Versio4nDarshna KumariPas encore d'évaluation

- RMO No. 10-2019 - DigestDocument3 pagesRMO No. 10-2019 - DigestAMPas encore d'évaluation

- Singapore Income Tax - KPMG GLOBALDocument14 pagesSingapore Income Tax - KPMG GLOBALumi fitriaPas encore d'évaluation

- (ACCLIME) Quick Guide - Vietnam Capital Gains 2023Document1 page(ACCLIME) Quick Guide - Vietnam Capital Gains 2023Khoi NguyenPas encore d'évaluation

- Payroll Fundamentals Practice TestDocument10 pagesPayroll Fundamentals Practice Testmohitkashap869Pas encore d'évaluation

- 08 Handout 1 PDFDocument6 pages08 Handout 1 PDFJanleoRosalesPraxidesPas encore d'évaluation

- Calculate Income Tax for Individual TaxpayersDocument4 pagesCalculate Income Tax for Individual TaxpayersKenneth Pimentel100% (1)

- TDG Insurance Management and Agency, Inc.: Payment InstructionDocument2 pagesTDG Insurance Management and Agency, Inc.: Payment InstructionLj JadulcoPas encore d'évaluation

- Sri Ganesh TradersDocument1 pageSri Ganesh TradersHumera nawazPas encore d'évaluation

- Eti10-002800 - 24-12-2023 08 - 18 - 38Document1 pageEti10-002800 - 24-12-2023 08 - 18 - 38Anurag KushwahaPas encore d'évaluation

- Sunway T4 (TX4014) - Tax Computation (Business Income)Document4 pagesSunway T4 (TX4014) - Tax Computation (Business Income)Ee LynnPas encore d'évaluation

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezPas encore d'évaluation

- ManishDocument2 pagesManishRobin SinghPas encore d'évaluation

- House Property-Income TaxDocument26 pagesHouse Property-Income TaxSwetaPas encore d'évaluation

- Tax invoice for professional servicesDocument1 pageTax invoice for professional servicesPankaj AzadPas encore d'évaluation

- 11.2 Auditing Working PapersDocument119 pages11.2 Auditing Working PapersJohn Carlo D MedallaPas encore d'évaluation

- QUOTEDocument1 pageQUOTESagar ButaniPas encore d'évaluation

- The Regalia Group Corporation: BIR RULING (DA-295-08)Document4 pagesThe Regalia Group Corporation: BIR RULING (DA-295-08)Johnallen MarillaPas encore d'évaluation

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDocument4 pagesTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- Tds Tcs Adv TaxDocument22 pagesTds Tcs Adv TaxrachitPas encore d'évaluation