Académique Documents

Professionnel Documents

Culture Documents

Aglibot vs. Santia

Transféré par

Anonymous 5MiN6I78I0Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Aglibot vs. Santia

Transféré par

Anonymous 5MiN6I78I0Droits d'auteur :

Formats disponibles

34 AGLIBOT vs.

SANTIA value is not a holder in due course merely because at the time he acquired the

G.R. No. 185945 5 June 2012 | J. Reyes instrument, he knew that the indorser was only an accommodation party.

TOPIC: Guaranty and Suretyship

The mere fact, then, that Aglibot issued her own checks to Santia made her

FACTS: personally liable to the latter on her checks without the need for Santia to first

Santia loaned P2.5million to Pacific Lending (PL) through its manager, go after PLCC for the payment of its loan. It would have been otherwise had it

Aglibot. been shown that Aglibot was a mere guarantor. However, since checks were

To secure the loan, Aglibot issued 11 Post-Dated Cheques (PDCs) issued ostensibly in payment for the loan, the provisions of the Negotiable

drawn from her personal account with Metrobank. Instruments Law must take primacy in application. Aglibot cannot invoke the

When Santia presented the foregoing PDCs to the drawee bank for benefit of excussion. PETITION DENIED.

payment, the same were dishonored.

Santia then sued Aglibot for violation of BP 22.

Aglibot: She contracted the loan in behalf of PL; That the cheques were

issued as a security for the loan and that her understanding was that

upon remittance of the face value of the cheques, Santia would return

to her each cheques so paid.

Santia was acquitted from the criminal charge. CA: reversed the

decision of the RTC, maintained her civil liability, ordered to P3million

since “[B]y issuing her own post-dated checks, Aglibot thereby bound

herself personally and solidarily to pay Santia. It noted that she could

have issued PLCC’s checks, but instead she chose to issue her own

checks, drawn against her personal account with Metrobank. It

concluded that Aglibot intended to personally assume the repayment

of the loan xxx.”

ISSUE: Whether Aglibot is liable for the amounts of the cheques?

HELD: Yes. The facts clearly show that Aglibot, as the manager of PLCC, agreed

to accommodate its loan to Santia by issuing her own post-dated checks in

payment thereof. She is what the Negotiable Instruments Law calls an

accommodation party. An accommodation party is one who has signed the

instrument as maker, drawer, indorser, without receiving value therefor and for

the purpose of lending his name to some other person. Such person is liable on

the instrument to a holder for value, notwithstanding such holder, at the time of

the taking of the instrument knew him to be only an accommodation party. In

lending his name to the accommodated party, the accommodation party is in

effect a surety for the latter. He lends his name to enable the accommodated

party to obtain credit or to raise money. He receives no part of the consideration

for the instrument but assumes liability to the other parties thereto because he

wants to accommodate another.

The relation between an accommodation party and the party

accommodated is, in effect, one of principal and surety — the accommodation

party being the surety. It is a settled rule that a surety is bound equally and

absolutely with the principal and is deemed an original promisor and debtor

from the beginning. The liability is immediate and direct. It is not a valid defense

that the accommodation party did not receive any valuable consideration

when he executed the instrument; nor is it correct to say that the holder for

Vous aimerez peut-être aussi

- Mastering Credit - The Ultimate DIY Credit Repair GuideD'EverandMastering Credit - The Ultimate DIY Credit Repair GuideÉvaluation : 1 sur 5 étoiles1/5 (1)

- Alpha Insurance and Surety Co. Vs CastorDocument1 pageAlpha Insurance and Surety Co. Vs CastorAnonymous 5MiN6I78I0Pas encore d'évaluation

- Banking Operations: Cheques & EndorsementsDocument12 pagesBanking Operations: Cheques & EndorsementsSharath SaunshiPas encore d'évaluation

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsD'EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Equifax Personal Solutions - Credit Reports PDFDocument11 pagesEquifax Personal Solutions - Credit Reports PDFTara Stewart80% (5)

- Outline in Credit Transactions Law I. LOAN (1933-1961)Document36 pagesOutline in Credit Transactions Law I. LOAN (1933-1961)Salman Dimaporo RashidPas encore d'évaluation

- Film Devt Council V Colon HeritageDocument3 pagesFilm Devt Council V Colon HeritageAnonymous 5MiN6I78I0Pas encore d'évaluation

- Cabungcal vs. LorenzoDocument2 pagesCabungcal vs. LorenzoAnonymous 5MiN6I78I0Pas encore d'évaluation

- Pioneer Concrete Philippines Inc vs. TodaroDocument1 pagePioneer Concrete Philippines Inc vs. TodaroAnonymous 5MiN6I78I0Pas encore d'évaluation

- De Leon v. Dela LlanaDocument2 pagesDe Leon v. Dela LlanaAnonymous 5MiN6I78I0100% (1)

- Bago vs. NLRCDocument1 pageBago vs. NLRCAnonymous 5MiN6I78I0Pas encore d'évaluation

- Laban NG Demokratikong Pilipino v. COMELECDocument1 pageLaban NG Demokratikong Pilipino v. COMELECAnonymous 5MiN6I78I0100% (1)

- Resignation and F&F Process Ver1.0Document7 pagesResignation and F&F Process Ver1.0Piyush SinhaPas encore d'évaluation

- Case Digest Part IIDocument8 pagesCase Digest Part IIfinserglen0% (1)

- FinalsDocument11 pagesFinalsAlexandrea SagutinPas encore d'évaluation

- Nego Chapter V NotesDocument40 pagesNego Chapter V Notesmelaniem_1Pas encore d'évaluation

- Grave Misconduct Is Defined As The Transgression of Some Established and Definite Rule of ActionDocument1 pageGrave Misconduct Is Defined As The Transgression of Some Established and Definite Rule of ActionAnonymous 5MiN6I78I0Pas encore d'évaluation

- 1 Guaranty Effect Digest Part 1Document4 pages1 Guaranty Effect Digest Part 1Joseph MacalintalPas encore d'évaluation

- Trust Receipts Law (Ampil)Document9 pagesTrust Receipts Law (Ampil)yassercarlomanPas encore d'évaluation

- Republic vs. SareñogonDocument2 pagesRepublic vs. SareñogonAnonymous 5MiN6I78I0100% (2)

- Cir Vs Fitness by DesignDocument2 pagesCir Vs Fitness by DesignAnonymous 5MiN6I78I0Pas encore d'évaluation

- Metroguards Security Agency Corporation vs. HilongoDocument2 pagesMetroguards Security Agency Corporation vs. HilongoAnonymous 5MiN6I78I0Pas encore d'évaluation

- 011-015 DigestDocument5 pages011-015 DigestJed CaraigPas encore d'évaluation

- Cases On Credit TransactionDocument20 pagesCases On Credit TransactionJanine GallantesPas encore d'évaluation

- Republic Vs BenignoDocument2 pagesRepublic Vs BenignoAnonymous 5MiN6I78I0Pas encore d'évaluation

- Negotiable Instruments Case Digest 6 PDF FreeDocument50 pagesNegotiable Instruments Case Digest 6 PDF FreeJr MateoPas encore d'évaluation

- Present Values and Future ValuesDocument50 pagesPresent Values and Future Valueskaylakshmi8314100% (1)

- KALAW V FERNANDEZDocument1 pageKALAW V FERNANDEZAnonymous 5MiN6I78I0Pas encore d'évaluation

- Letters of CreditDocument3 pagesLetters of Creditmay castanarPas encore d'évaluation

- Guaranty Case DigestDocument3 pagesGuaranty Case DigestCJ FaPas encore d'évaluation

- Ocampo vs. FlorencianoDocument1 pageOcampo vs. FlorencianoAnonymous 5MiN6I78I0Pas encore d'évaluation

- People V OdtuhanDocument1 pagePeople V OdtuhanAnonymous 5MiN6I78I0Pas encore d'évaluation

- Case DigestDocument56 pagesCase DigestShie La Ma RiePas encore d'évaluation

- Aglibot Vs SantiaDocument1 pageAglibot Vs SantiaAlexylle Garsula de Concepcion100% (1)

- Associated Bank vs. Hon. Court of Appeals, and Merle V. Reyes G.R. No. 89802, May 7, 1992 Cruz, J. FactsDocument50 pagesAssociated Bank vs. Hon. Court of Appeals, and Merle V. Reyes G.R. No. 89802, May 7, 1992 Cruz, J. FactsAlexir MendozaPas encore d'évaluation

- Secretary of DPWH Vs HeracleoDocument2 pagesSecretary of DPWH Vs HeracleoAnonymous 5MiN6I78I0Pas encore d'évaluation

- NEGO Case DigestDocument13 pagesNEGO Case DigestptbattungPas encore d'évaluation

- Case 1: Tidcorp vs. AspacDocument8 pagesCase 1: Tidcorp vs. AspacpjPas encore d'évaluation

- Cir VS DlsuDocument3 pagesCir VS DlsuAnonymous 5MiN6I78I0Pas encore d'évaluation

- Business Math Reviewer ShortDocument12 pagesBusiness Math Reviewer ShortJames Earl AbainzaPas encore d'évaluation

- Lico vs. ComelecDocument3 pagesLico vs. ComelecAnonymous 5MiN6I78I0Pas encore d'évaluation

- Bank of The Philippine Islands VS LAND INVESTORS GR 198237Document2 pagesBank of The Philippine Islands VS LAND INVESTORS GR 198237Rizza Angela Mangalleno67% (3)

- Aglibot vs. SantiaDocument4 pagesAglibot vs. SantiaRando TorregosaPas encore d'évaluation

- JR ManualDocument11 pagesJR ManualOvidiu MateiciucPas encore d'évaluation

- Valdes v. QC RTCDocument1 pageValdes v. QC RTCAnonymous 5MiN6I78I0Pas encore d'évaluation

- Ramzan Ali PP ApoDocument1 pageRamzan Ali PP ApoAshok RauniarPas encore d'évaluation

- Conejero v. CADocument1 pageConejero v. CAAnonymous 5MiN6I78I0Pas encore d'évaluation

- Aglibot VS SantiaDocument3 pagesAglibot VS SantiaRyan SuaverdezPas encore d'évaluation

- Hernandez-Nievera vs. HernandezDocument1 pageHernandez-Nievera vs. HernandezAnonymous 5MiN6I78I0Pas encore d'évaluation

- Mirasol V CADocument3 pagesMirasol V CAAnonymous 5MiN6I78I0Pas encore d'évaluation

- Pentacapital Investment Corporation vs. MahinayDocument1 pagePentacapital Investment Corporation vs. MahinayAnonymous 5MiN6I78I0Pas encore d'évaluation

- Case Digest CompilationDocument10 pagesCase Digest CompilationpreiquencyPas encore d'évaluation

- Republic V TampusDocument1 pageRepublic V TampusAnonymous 5MiN6I78I0Pas encore d'évaluation

- Inciong v. CADocument1 pageInciong v. CAMaicko PhilPas encore d'évaluation

- Cred Trans Surety DigestsDocument7 pagesCred Trans Surety DigestsJappy AlonPas encore d'évaluation

- Cebu International Finance Corporation v. CADocument2 pagesCebu International Finance Corporation v. CAAbbyElbambo0% (1)

- 12 DIGEST Fideliza J. Aglibot vs. Ingersol R. Santia, G.R. No. 185945, Dec. 5, 2012Document2 pages12 DIGEST Fideliza J. Aglibot vs. Ingersol R. Santia, G.R. No. 185945, Dec. 5, 2012Sarah CruzPas encore d'évaluation

- Fideliza J. Aglibot vs. Ingersol L. Santia G.R. No. 185945 December 05, 2012 J. ReyesDocument2 pagesFideliza J. Aglibot vs. Ingersol L. Santia G.R. No. 185945 December 05, 2012 J. ReyesRaf BartolomePas encore d'évaluation

- Aglibot V SantiaDocument3 pagesAglibot V SantiaSam SaripPas encore d'évaluation

- Aglibot vs. SantiaDocument9 pagesAglibot vs. SantiaKaren RefilPas encore d'évaluation

- Aglibot V Santia DigestDocument1 pageAglibot V Santia DigestJoshua LanzonPas encore d'évaluation

- Aglibot vs. Santia G.R. No. 185945 December 5, 2012Document1 pageAglibot vs. Santia G.R. No. 185945 December 5, 2012Arianne Klaire Marcos VoluntadPas encore d'évaluation

- Case DigestDocument1 pageCase DigestAnDrew Bautista CayabyabPas encore d'évaluation

- Case No #1 Aglibot Vs SantiaDocument7 pagesCase No #1 Aglibot Vs SantiaJappy AlonPas encore d'évaluation

- Civil Law - Aglibot v. Santia, G.R. No. 185945, December 5, 2012Document3 pagesCivil Law - Aglibot v. Santia, G.R. No. 185945, December 5, 2012Dayday AblePas encore d'évaluation

- UROT-Agibot V SantiaDocument2 pagesUROT-Agibot V SantiaDave UrotPas encore d'évaluation

- Finals Cases Credit - MGBDocument17 pagesFinals Cases Credit - MGBmicah badilloPas encore d'évaluation

- Libertas (Jurisprudence On Nego)Document106 pagesLibertas (Jurisprudence On Nego)Vince AbucejoPas encore d'évaluation

- Oblicon CasesDocument11 pagesOblicon CasesCess LazagaPas encore d'évaluation

- Travel-On Vs CADocument4 pagesTravel-On Vs CAjoshstrike21Pas encore d'évaluation

- Answer To Quiz No 6Document5 pagesAnswer To Quiz No 6Your Public ProfilePas encore d'évaluation

- MaimaiDocument3 pagesMaimaiJonathan ClarusPas encore d'évaluation

- Cifc vs. CA, Vicente Alegre DigestDocument1 pageCifc vs. CA, Vicente Alegre DigestDara RomPas encore d'évaluation

- Suggested Answers To Bar Exam Questions 2008 On Mercantile LawDocument9 pagesSuggested Answers To Bar Exam Questions 2008 On Mercantile LawsevenfivefivePas encore d'évaluation

- Aglibot vs. SantiaDocument11 pagesAglibot vs. SantiaPMVPas encore d'évaluation

- Nego Jan 7Document23 pagesNego Jan 7Michelle AsagraPas encore d'évaluation

- Liability Sadaya V. Sevilla 19 SCRA 924: Defense Ilusorio V. Court of AppealsDocument10 pagesLiability Sadaya V. Sevilla 19 SCRA 924: Defense Ilusorio V. Court of AppealsTats YumulPas encore d'évaluation

- State Investment House Inc. vs. CADocument18 pagesState Investment House Inc. vs. CAJeremy MorenoPas encore d'évaluation

- Pointers in Mercantile Law 2017Document30 pagesPointers in Mercantile Law 2017Grace MagnayePas encore d'évaluation

- Fiscal Tramat Mercantile, Inc., Petitioner RTC Petitioner CADocument4 pagesFiscal Tramat Mercantile, Inc., Petitioner RTC Petitioner CAEloise Coleen Sulla PerezPas encore d'évaluation

- E. Que v. People, 154 SCRA 160: G.R. No. 75217-18Document36 pagesE. Que v. People, 154 SCRA 160: G.R. No. 75217-18Rolly HeridaPas encore d'évaluation

- Suggested Answers To Bar Exam Questions 2008 On Mercantile LawDocument28 pagesSuggested Answers To Bar Exam Questions 2008 On Mercantile LawRJay JacabanPas encore d'évaluation

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelPas encore d'évaluation

- Com Rev CD 2Document7 pagesCom Rev CD 2Dawn LumbasPas encore d'évaluation

- Agency Bar Q and ADocument3 pagesAgency Bar Q and ADeneb DoydoraPas encore d'évaluation

- Baldomero Inciong vs. CADocument2 pagesBaldomero Inciong vs. CAPrincess JonasPas encore d'évaluation

- People vs. Concepcion, 44 Phil. 126Document22 pagesPeople vs. Concepcion, 44 Phil. 126Sam FajardoPas encore d'évaluation

- Case Digests - Pacific Banking Corp. To Mira HermanosDocument41 pagesCase Digests - Pacific Banking Corp. To Mira Hermanosmi4keePas encore d'évaluation

- Digest CredtransDocument19 pagesDigest Credtransmlucagbo80773Pas encore d'évaluation

- G.R. No. L-42735, January 22, 1990 Ramon L. Abad vs. CaDocument6 pagesG.R. No. L-42735, January 22, 1990 Ramon L. Abad vs. CaChloe Sy Galita100% (1)

- Cases:: Acme Shoe VS CA, 260 SCRA 714Document8 pagesCases:: Acme Shoe VS CA, 260 SCRA 714OmsimPas encore d'évaluation

- Heirs of Go V ServacioDocument1 pageHeirs of Go V ServacioAnonymous 5MiN6I78I0Pas encore d'évaluation

- Munoz, Jr. V RamirezDocument1 pageMunoz, Jr. V RamirezAnonymous 5MiN6I78I0Pas encore d'évaluation

- 264 Cheesman V. Iac TOPIC: Disposition and Encumbrance, FC 124-125 FC 97, 121, 122 FactsDocument1 page264 Cheesman V. Iac TOPIC: Disposition and Encumbrance, FC 124-125 FC 97, 121, 122 FactsAnonymous 5MiN6I78I0Pas encore d'évaluation

- Ravina V Villa-AbrilleDocument1 pageRavina V Villa-AbrilleAnonymous 5MiN6I78I0Pas encore d'évaluation

- 294 Signey V. Sss TOPIC: Unions Under FC 148, 35, 37, 38 FactsDocument1 page294 Signey V. Sss TOPIC: Unions Under FC 148, 35, 37, 38 FactsAnonymous 5MiN6I78I0Pas encore d'évaluation

- 3 Nava Vs YaptinchayDocument1 page3 Nava Vs YaptinchayAnonymous 5MiN6I78I0Pas encore d'évaluation

- Jurnal WahyuDocument18 pagesJurnal WahyuyukiosharisaPas encore d'évaluation

- Sici PDFDocument12 pagesSici PDFaathavan1991Pas encore d'évaluation

- Final AccountsDocument12 pagesFinal Accountsanandm1986100% (1)

- Annual Report FY 17 18Document156 pagesAnnual Report FY 17 18Seada AliyiPas encore d'évaluation

- KYC Know Your CustomerDocument29 pagesKYC Know Your CustomerAsad AliPas encore d'évaluation

- British Gas Acquisition Verbal Script 06-01-2014Document3 pagesBritish Gas Acquisition Verbal Script 06-01-2014asdasdsadPas encore d'évaluation

- Sample Credit Control PolicyDocument21 pagesSample Credit Control PolicyMozitomPas encore d'évaluation

- Account Office University of Central Punjab Bank Copy University of Central Punjab Student Copy University of Central PunjabDocument1 pageAccount Office University of Central Punjab Bank Copy University of Central Punjab Student Copy University of Central Punjabھاشم عمران واھلہPas encore d'évaluation

- AisDocument6 pagesAisSamonte JemimahPas encore d'évaluation

- Comparative Study of HDFC Bank SBI Bank MBA ProjectDocument9 pagesComparative Study of HDFC Bank SBI Bank MBA ProjectAsif shaikhPas encore d'évaluation

- IFCI Long Term Infra Bonds Application FormDocument2 pagesIFCI Long Term Infra Bonds Application FormPrajna CapitalPas encore d'évaluation

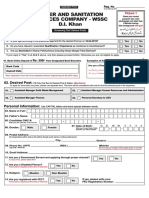

- Water and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriaDocument4 pagesWater and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriakabirPas encore d'évaluation

- SA20230322Document4 pagesSA20230322C KPas encore d'évaluation

- Alfacurrate AAA PMS Jul16Document39 pagesAlfacurrate AAA PMS Jul16flytorahulPas encore d'évaluation

- Struktur Organisasi KC Cirebon Okt 2023Document13 pagesStruktur Organisasi KC Cirebon Okt 2023wulandariPas encore d'évaluation

- Application Form: Loan Requested Purpose of Loan DateDocument2 pagesApplication Form: Loan Requested Purpose of Loan DateZulueta Jing MjPas encore d'évaluation

- SAP Customer Account Groups Vs SAP Partner FunctionsDocument10 pagesSAP Customer Account Groups Vs SAP Partner FunctionsbwupendraPas encore d'évaluation

- Iifl Gold LoanDocument52 pagesIifl Gold LoanuiopoiuyPas encore d'évaluation

- Banking System in PakistanDocument4 pagesBanking System in PakistanIrfan RashidPas encore d'évaluation

- Key Fact DocumentDocument7 pagesKey Fact Documentdeepak799sgPas encore d'évaluation

- Guidelines On Preventing and Combating Fraud and Corruption (Section 1.10, PG 11)Document7 pagesGuidelines On Preventing and Combating Fraud and Corruption (Section 1.10, PG 11)Chirag RajpuriaPas encore d'évaluation

- SMC R&P FY 2022-Final FormatsDocument3 pagesSMC R&P FY 2022-Final Formatsacge nrptPas encore d'évaluation