Académique Documents

Professionnel Documents

Culture Documents

Steps To Transfer

Transféré par

Gretch Calangi0 évaluation0% ont trouvé ce document utile (0 vote)

63 vues2 pagesThe document outlines the 5 key steps to extrajudicial partition of an estate:

1. All heirs sign a deed documenting the decedent's property and their heir status.

2. The deed is notarized by a notary public.

3. The deed is published in a newspaper for 3 consecutive weeks.

4. Estate taxes are paid to the Bureau of Internal Revenue.

5. The notarized deed is registered with the Register of Deeds.

Description originale:

transfer property

Titre original

Steps to transfer

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document outlines the 5 key steps to extrajudicial partition of an estate:

1. All heirs sign a deed documenting the decedent's property and their heir status.

2. The deed is notarized by a notary public.

3. The deed is published in a newspaper for 3 consecutive weeks.

4. Estate taxes are paid to the Bureau of Internal Revenue.

5. The notarized deed is registered with the Register of Deeds.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

63 vues2 pagesSteps To Transfer

Transféré par

Gretch CalangiThe document outlines the 5 key steps to extrajudicial partition of an estate:

1. All heirs sign a deed documenting the decedent's property and their heir status.

2. The deed is notarized by a notary public.

3. The deed is published in a newspaper for 3 consecutive weeks.

4. Estate taxes are paid to the Bureau of Internal Revenue.

5. The notarized deed is registered with the Register of Deeds.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

STEPS IN EXTRAJUDICIAL PARTITION

The step by step procedure for extrajudicial partition of estate is as follows:

1. Prepare a “Deed of Extrajudicial Settlement of Estate andAdjudication of Estate” to be signed by

all of the heirs, which must contain the following information:

That the decedent left no will;

That the decedent left no debt;

Each heir’s relationship to the decedent (e.g. spouse, son, daughter, father, mother etc.);

That they are the decedent’s only surviving heirs;

An enumeration and a brief description of the decedent‘s properties, both real and personal,

which the heirs are now dividing among themselves.

2. The “Deed of Extrajudicial Settlement and Adjudication of Estate” should be notarized before a

Notary Public after all the heirs have signed it.

3. “Deed of Extrajudicial Settlement and Adjudication of Estate” will be published in a newspaper of

general circulation once a week for three (3) consecutive weeks.

4. Estate Taxes should be paid before the Bureau of Internal Revenue (BIR).

5. The notarized “Deed of Extrajudicial Settlement and Adjudication of Estate” shall be registered with

the Register of Deeds.

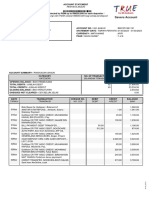

Steps and Procedures in Transferring a Title in the Philippines

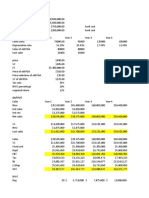

Agency Activity Requirements Duration

1. Local few

Notarization Deed of Absolute Sale (DOAS)

Attorney minutes

Affidavit of No

2.

Improvement (if there is Tax Declaration, Photocopy of

Assessors 1 Day

no house built on the DOAS, Residence Certificate

Office

land)

3. Land

Land Tax Receipt, Tax

Tax Order of Payment 1 Day

Declaration

Division

4.

Two Sets of DOAS and tax

Assessors Payment of Transfer Tax 1 day

declaration (photocopy)

Office

Payment of Documentary Title, Affidavit of No

5. BIR 30 days

Stamps and Expanded Improvement, certificate of no

Withholding Tax (EWT) improvement, tax declaration,

tax receipt

Original copies of title/s, DOAS

6. Register with stamp, doc stamp receipt,

Registration of Title 5 days

of Deeds EWT receipt, tax clearance,

transfer tax, tax declaration

Request for a new copy of

7. Photocopy of new title, DOAS,

tax declaration of the lot

Assessors transfrer tax, tax declaration, 1 day

or house and lot under

Office tax receipt, tax clearance

the buyer’s name

Vous aimerez peut-être aussi

- 2017 Commercial & Industrial Common Interest Development ActD'Everand2017 Commercial & Industrial Common Interest Development ActPas encore d'évaluation

- Electronic Signature A Complete Guide - 2019 EditionD'EverandElectronic Signature A Complete Guide - 2019 EditionPas encore d'évaluation

- Personal and Confidential Privileged Offer To CompromiseDocument11 pagesPersonal and Confidential Privileged Offer To CompromiseAdam JustinoPas encore d'évaluation

- Debt Settlement PrintDocument2 pagesDebt Settlement PrintNica Joy AplicadorPas encore d'évaluation

- J1 Visa Waiver: Law Office of Samira NicholsDocument6 pagesJ1 Visa Waiver: Law Office of Samira NicholsmruthyunjayamPas encore d'évaluation

- Certificate of ExemptionDocument5 pagesCertificate of ExemptionsandyolkowskiPas encore d'évaluation

- 2016 Administrative Complaint On Personal BelongingsDocument25 pages2016 Administrative Complaint On Personal BelongingssinembargoPas encore d'évaluation

- Debt Acknowledgment Form inDocument3 pagesDebt Acknowledgment Form inClement Ayobami OladejoPas encore d'évaluation

- TemplateDocument6 pagesTemplateMD SUMON MIAHPas encore d'évaluation

- Sole Prop LetterDocument2 pagesSole Prop LettertamilmaranPas encore d'évaluation

- Habeas Corpus CasesDocument38 pagesHabeas Corpus CasesVernie BacalsoPas encore d'évaluation

- Notracial Certificates and AffidavitsDocument23 pagesNotracial Certificates and AffidavitsluckyPas encore d'évaluation

- Oal Board ResolutionsDocument10 pagesOal Board ResolutionsGracemarie CollinsPas encore d'évaluation

- (Note: This Is A Sample Template From Online Source) Release Waiver and QuitclaimDocument2 pages(Note: This Is A Sample Template From Online Source) Release Waiver and QuitclaimJimmy BalilingPas encore d'évaluation

- Notification Form Foreign CorporationDocument2 pagesNotification Form Foreign CorporationJenel ChuPas encore d'évaluation

- FOI Manual 2017Document20 pagesFOI Manual 2017Clea LagcoPas encore d'évaluation

- Commercial Law Review Lecture by GlennDocument64 pagesCommercial Law Review Lecture by GlennMaureen Christine LizarondoPas encore d'évaluation

- Fidelity Bond Application Form FBAFDocument2 pagesFidelity Bond Application Form FBAFARMIE JOY PALMARES CATUNAOPas encore d'évaluation

- Request Letter For Birth Certi Cate From Municipal CorporationDocument5 pagesRequest Letter For Birth Certi Cate From Municipal CorporationRajesh IthaPas encore d'évaluation

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasPas encore d'évaluation

- Expungement PDFDocument6 pagesExpungement PDFViwe MazingiPas encore d'évaluation

- Affidavit Master DeedDocument1 pageAffidavit Master DeedNhez LacsamanaPas encore d'évaluation

- Checklist of Requirements For Housing Loan Revaluation (HQP-HLF-168, V02)Document1 pageChecklist of Requirements For Housing Loan Revaluation (HQP-HLF-168, V02)Engr Edmond CorpuzPas encore d'évaluation

- Process of A Foreclosure SaleDocument6 pagesProcess of A Foreclosure SaleGirlie Ray Surig100% (1)

- Affidavit of Discrepancy (Date of Marriage of Parents)Document1 pageAffidavit of Discrepancy (Date of Marriage of Parents)Caoili MarceloPas encore d'évaluation

- Promissory Note Chattel MortgageDocument17 pagesPromissory Note Chattel MortgageFelip MatPas encore d'évaluation

- Marriage Without LicenseDocument2 pagesMarriage Without LicenseZoe Gacod Takumii UsuiiPas encore d'évaluation

- SpaDocument3 pagesSpaAhcai SepetPas encore d'évaluation

- Demand For Payment by Andrzej SapkowskiDocument5 pagesDemand For Payment by Andrzej SapkowskiPolygondotcom100% (1)

- Laws and Legislations Vis-À-Vis Accountability of Government LibrariansDocument18 pagesLaws and Legislations Vis-À-Vis Accountability of Government Librariansclarkky88Pas encore d'évaluation

- Blank Residential LeaseDocument7 pagesBlank Residential Leasesean100% (1)

- Marketing AgreementDocument10 pagesMarketing AgreementNicolaCastelnuovoPas encore d'évaluation

- California Rental Application: Personal InformationDocument2 pagesCalifornia Rental Application: Personal InformationFatima ArmentaPas encore d'évaluation

- Consumer Complaints ResolutionDocument10 pagesConsumer Complaints ResolutionlambajosepgPas encore d'évaluation

- Child CustodyDocument10 pagesChild CustodyZohaib AhmedPas encore d'évaluation

- Extrajudicial Settlement of An EstateDocument4 pagesExtrajudicial Settlement of An EstatePAMELA DOLINA100% (1)

- A. Chart of Accounts: Salaries PayableDocument12 pagesA. Chart of Accounts: Salaries PayableJerome SerranoPas encore d'évaluation

- DEED OF DONATION BonitaDocument2 pagesDEED OF DONATION BonitaHuey CalabinesPas encore d'évaluation

- Procedures For The Issue of Pre/Post-possession DocumentsDocument18 pagesProcedures For The Issue of Pre/Post-possession Documentsabc_dPas encore d'évaluation

- Department of Probation, Parole and Pardon Services: Henry Mcmaster Jerry B. AdgerDocument4 pagesDepartment of Probation, Parole and Pardon Services: Henry Mcmaster Jerry B. Adgerashish14321100% (1)

- Certification NotaryDocument1 pageCertification NotaryAlfred Hernandez CampañanoPas encore d'évaluation

- Instructions For Form 709: Pager/SgmlDocument12 pagesInstructions For Form 709: Pager/SgmlIRSPas encore d'évaluation

- Deed of Donation: - Registry of Deeds of (INDICATE WHAT CITY), As Follows To WitDocument3 pagesDeed of Donation: - Registry of Deeds of (INDICATE WHAT CITY), As Follows To WitJon Enrique Fernando Jr.Pas encore d'évaluation

- Example - Assignable Purchase AgreementDocument2 pagesExample - Assignable Purchase AgreementRiangelli Exconde100% (1)

- Sample Loan ProposalDocument24 pagesSample Loan ProposalFarhan TariqPas encore d'évaluation

- Blank LOIDocument4 pagesBlank LOIslapointe01Pas encore d'évaluation

- PassportDocument1 pagePassportAmanda HernandezPas encore d'évaluation

- Meg Letter of Intent - Hedge Road, PlymouthDocument3 pagesMeg Letter of Intent - Hedge Road, PlymouthmegcostsusmillionsPas encore d'évaluation

- Tradename RegistrationDocument1 pageTradename RegistrationKayla Jordan Blaylock-ElPas encore d'évaluation

- Course Syllabus Special Proceedings 2 Semester, AY 2014-2015Document3 pagesCourse Syllabus Special Proceedings 2 Semester, AY 2014-2015Earnswell Pacina TanPas encore d'évaluation

- Joint Sworn AffidavitDocument1 pageJoint Sworn AffidavitjparrojadoPas encore d'évaluation

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationHusnain AfzalPas encore d'évaluation

- What Is A MortgageDocument6 pagesWhat Is A MortgagekrishnaPas encore d'évaluation

- Small Claims Writ of Execution Blank 112311Document2 pagesSmall Claims Writ of Execution Blank 112311J Gregory WrightPas encore d'évaluation

- Engagement Letter For Business Bookkeeping and TaxDocument2 pagesEngagement Letter For Business Bookkeeping and TaxLois Yanzeigh Habbiling BalachawePas encore d'évaluation

- Manual of Regulations For Non Banks Financial Inst Vol 2Document337 pagesManual of Regulations For Non Banks Financial Inst Vol 2Neneng KunaPas encore d'évaluation

- Deed of Absolute Sale-PersonalDocument3 pagesDeed of Absolute Sale-PersonalResci Angelli Rizada-NolascoPas encore d'évaluation

- Warehouse Receipt LawDocument8 pagesWarehouse Receipt LawChristian Paul ChungtuycoPas encore d'évaluation

- The Law On Obligations and ContractsDocument11 pagesThe Law On Obligations and ContractsEliPas encore d'évaluation

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsDocument1 pageAnnual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsCarolina AldanaPas encore d'évaluation

- Summary Notes For Land RegistrationDocument6 pagesSummary Notes For Land RegistrationGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- Affidavit of SupportDocument1 pageAffidavit of SupportGretch CalangiPas encore d'évaluation

- Affidavit of Single StatusDocument1 pageAffidavit of Single StatusGretch CalangiPas encore d'évaluation

- Certificate of RecognitionDocument2 pagesCertificate of RecognitionGretch CalangiPas encore d'évaluation

- AffidavitDocument1 pageAffidavitGretch CalangiPas encore d'évaluation

- Philippine Legal Forms 2015bDocument394 pagesPhilippine Legal Forms 2015bJoseph Rinoza Plazo100% (14)

- Annex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsDocument1 pageAnnex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsEliza Corpuz Gadon89% (19)

- Name: - Date: - Section: - ScoreDocument5 pagesName: - Date: - Section: - ScoreGretch CalangiPas encore d'évaluation

- Merida v. People PDFDocument15 pagesMerida v. People PDFNinaPas encore d'évaluation

- RA8550Document53 pagesRA8550Gretch CalangiPas encore d'évaluation

- Mamc Ortho PG Course 2019Document2 pagesMamc Ortho PG Course 2019Pankaj VatsaPas encore d'évaluation

- Ayesha SajjadDocument1 pageAyesha SajjadPak FFPas encore d'évaluation

- Account StatementDocument12 pagesAccount StatementRajneesh Jhorad0% (1)

- Tax Saving ProductsDocument10 pagesTax Saving ProductsAbhijeet BosePas encore d'évaluation

- 7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFDocument6 pages7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFanorith88Pas encore d'évaluation

- Section 10 (34) Dividend ExemptionDocument2 pagesSection 10 (34) Dividend ExemptionNarender MOdiPas encore d'évaluation

- Chartered Accountants Program Course FeesDocument2 pagesChartered Accountants Program Course FeesPeper12345Pas encore d'évaluation

- Excel RepublicDocument4 pagesExcel RepublicAlfia safraocPas encore d'évaluation

- Aie Credit WebquestDocument2 pagesAie Credit Webquestapi-267815068Pas encore d'évaluation

- CIR vs. CADocument2 pagesCIR vs. CABruno GalwatPas encore d'évaluation

- Solution Capital StatementDocument10 pagesSolution Capital StatementhilmanPas encore d'évaluation

- Wahab UpdateDocument1 pageWahab UpdateSumairPas encore d'évaluation

- Gocash - ProposalDocument4 pagesGocash - ProposalGirishPas encore d'évaluation

- Larsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000642 WOMDocument2 pagesLarsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000642 WOMKannan GnanaprakasamPas encore d'évaluation

- Point of Sale PoSDocument21 pagesPoint of Sale PoSBenhur LeoPas encore d'évaluation

- Ans Taxation 1Document23 pagesAns Taxation 1Priscilla AdebolaPas encore d'évaluation

- View StatementDocument2 pagesView StatementMarissa MPas encore d'évaluation

- Attachments For NLC 1 1Document34 pagesAttachments For NLC 1 1Jessica CrisostomoPas encore d'évaluation

- Bank MARCHDocument6 pagesBank MARCHAbdul HannanPas encore d'évaluation

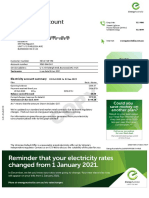

- Electricity Account: Could You Save Money On Another Plan?Document3 pagesElectricity Account: Could You Save Money On Another Plan?ThaiNguyenPas encore d'évaluation

- November 06, 2018 PDFDocument4 pagesNovember 06, 2018 PDFJoan HulburtPas encore d'évaluation

- Nsefutures Contract 20211231 924P857 0571802Document2 pagesNsefutures Contract 20211231 924P857 0571802PIVOT GRAVITYPas encore d'évaluation

- Company Unit 4th - Aug - 2021Document17 pagesCompany Unit 4th - Aug - 2021cubadesignstudPas encore d'évaluation

- Quezon City v. ABS CBNDocument4 pagesQuezon City v. ABS CBNJunmer OrtizPas encore d'évaluation

- Income TaxationDocument13 pagesIncome TaxationJpagPas encore d'évaluation

- Gcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceDocument3 pagesGcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceJessica CravePas encore d'évaluation

- Manjanbazam Cadet Colleges System Tarbela Cantt Manjanbazam Cadet Colleges System Tarbela Cantt Manjanbazam Cadet Colleges System Tarbela CanttDocument1 pageManjanbazam Cadet Colleges System Tarbela Cantt Manjanbazam Cadet Colleges System Tarbela Cantt Manjanbazam Cadet Colleges System Tarbela Canttwaqas haroonPas encore d'évaluation

- Gocardless Direct Debit GuideDocument53 pagesGocardless Direct Debit GuideGregory CarterPas encore d'évaluation

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacillotePas encore d'évaluation

- ACCA Fundamentals Level Paper F6 (FA 2012) Taxation (UK) Final Mock ExaminationDocument0 pageACCA Fundamentals Level Paper F6 (FA 2012) Taxation (UK) Final Mock Examinationkumassa kenyaPas encore d'évaluation