Académique Documents

Professionnel Documents

Culture Documents

CRC-ACE PW-Audtheory PDF

Transféré par

PrincessDiana Doloricon Escrupolo0 évaluation0% ont trouvé ce document utile (0 vote)

44 vues27 pagesTitre original

CRC-ACE PW-Audtheory.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

44 vues27 pagesCRC-ACE PW-Audtheory PDF

Transféré par

PrincessDiana Doloricon EscrupoloDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 27

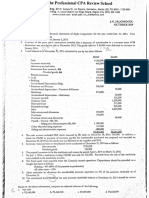

CRC-ACE REVIEW SCHOOL

‘The Professional CPA Review School

‘MLA (02) 735-9031 BAG (074) 422-1420

AUDITING THEORY A J.G. SALOSAGCOL

PREWEEK JULY 2014

&

9.

“The objective of an audit of financial statements is

a. To assist an entity in the preparation of financial statements."

b. To express an opinion whether the financial statements are prepared, in all matetial respects, in

accordance with an identified financial reporting framework. .

c. To enable an auditor to state whether, on the basis of the procedures performed, anything has come to

the auditor's attention thet causes the auditor to believe that the financial statements arc not prepared,

in all rantetial respects in accordance with an identified financial reporting framework. facr/

4. To guarantee that all material misstatements in the financial statements are detected. faq x crore

Which of the following best describes the reason why an independent auditor reports on financial

‘statements? Ee OR ne act ser Aes

‘a. A management feaud may exist and itis shore lifely to be detected by independent auditors.

b, Different interests may exist between the company preparing the statements and the persons

Goring the statoments.

¢. A misstatement of account balances may exist and is genctally corrected as the result of the

independent auditor's work.

4..A poorly designed internal contzol system may be in existence.

Which of the following statements does not describe a condition that creates a demand for auditing?

a. Conflict between an information preparer and a user can result in biased information. |

b, Information.can have substantial economic consequences for a decision-maker.

c. Expertise is often required for information preparation and verification :

4. Users can dizeetly aeaess the quality of information,

‘Material misstatements may emanate from all of the following except

a fenud € non-compliance with laws and regulations

b. errors 4d. limitations of the audit

“The primary difference between financial sistement errors and fraud is that

1. “Errore are intentional misstatements by misnagement, while fraud involves unintentional

mistakes of omissions

bb. Eerots ate unintentional mistakes or omissions, while fraud involves intentional misstatements.

c. There is no difference as erzors and frauds have the sume meaning.

G. Exrors are more likely to provide an indication that an illegal act has occuzred.

Which of the following statements best identifies the two types of fraud?

‘a. Theft of assets and employee fraud.

bb. Misappropriation of asset and defaleation

¢. Management fraud and fraudulent financial reposting

Gi. Praudulenf financial reporting and misappropriation of assets. figleia /entestensy q onch

Which of the following is not an example of fraud?

‘i. misappropsiation of assets. «. Misinterpeetation of facts

b. Reenrding transactions without substance. _d. Omission of the effecte of transactions

“Which of the following, if material, would be an fEregularity> feet ee

‘nistakes in the application of accounting peiaeiples

clerical mistakes in the accounting data underlying the financial statements

misappropriation of an astet or groups of assets

misinterpretstions of facts that existed when the fisisincial statements were prepared

nog?

Peaudulent financial reporting is often called

a. management feaud. bb, theft of assets. _. defalcation, dv employee fraud,

D1.

pv.

ee Co. re

te oF cased Cone se

sage Tired Come tate) Peter fa 3

Fi cap ame Hemel Co ta i gna Dre me te bth

I sek einen! Otis PB

ct 3

Pavan Syp60) ——_ 4g

Page 2 of 27

CRC-ACE/AT_Preweek GULY 2014 Batch) age

When is the auditor responsible (or detecting fraud?

2. When dhe faud did not result from colsion. Wi ments

Ef Wien thied pasties are likely to rely qn the client's financial statements.

Wren the elencs system of internal control is judged by the auditor to be inadequate:

5, When the applicalon of generally accepted auditing standards would have uncovered ‘Ne

fh respect to errors and itregularities, the auditor should plan to ;

With erp te erovs that would have 2 material effect and for irregularities that would have cither material

‘or immaterial effect on the financial statements. :

bb. Scurch for inegulasitis that would have a material effeet and for errors that would have either material

or immaterial effect on the Gnancial statements. 1 :

ec Souch for emors or itreglasites that would have a material effect on the financial statements.

Saree eer ce inegulasties chat have either material or immaterial effect on the financi!

statements,

With respect to exrors and fisud, which of the following should be past of an auditor's planning’ of the

audit engagement? ‘

an plonning to search for errors or fraud that would have a matesal or immaterial effect on the financial

statements :

planning to discover errors or fraud that ate cither material or immaterial

c._ planning to discover errors or fraud that are immaterial i

4. planning to consider factors affecting the risk of material misstatement both st the financial statement

and the account balance level Rete 0, seanplbth 4 be?

peat, D He 7 He othe] Seep AD, be

“The auditor is most likely 10 presume that a highctisk of 2 Gefaleatiopbonsts if wits

4. The client is a multinational company that does business in numerous foreign countries. ‘sida

\b. The client does business with several related parties. Qos ert

c. Inadequate segregation of duties places an employee in a position to pespetzate and conceal thefts; = settee

d. Inadequate employee training results in leagthy EDP exception reports cach month. 9) talichy chenodhit

Because an examination in accordance with generally accepted auditing standasds is influenced by the

possibility of material errors, the auditor should conduct the examination with an attitude of

2 Professional responsiveness €. Objective judgment

b. Conservative advocacy 4d. Professional skepticism,

3. Which of the following is a category of risk factors that should be considered in relation to misstatements

atising from misapproptiation of assets?

a. Industry conditions

¢. Management characteristics.

b. Operating chasacteristics i

. Controls.

. Which of the following is a category of risk factors that should be considered in relation to misstatements

‘ising from fraudulent financial reporting?

2. Susceptibility of assets to misappropriation

¢. Industry conditions

b, Assets that can be easily be converted to cash =

d. Internal Controls.

W ite oct DR ered EL cane

Based on PSA 250, noncompliance cefei{"to” * ~~

a. intentional acts of one or more individuals which result in misstatement in financial statemé

b, unintentional mistakes in the financial statements ee

& personal misconduct hy the entity’s management or employees

4. cts of omission or commission by the client which are contrary to prevailing laws and regulations

‘Tn making a decision to accept of continue with a client, the auditor should consider:

: a ob « 4g

Its competence : YES YES YES YES

Its own independence YES NO YES NO

Its ability to service the client properly

bi YES YES YES NO

‘The integrity of the client’s management © YES YES NO YES

7

CCRC-ACE/AT.Prewek QULY 2014 Buch) pagedof7

B 10. What wil an auditor who bus been proposed for an audit engagement uualy do prior accePtng #268

lien? .

eet ye fnmcinl statements ofthe clint as x mensure of goodwill | % ;

De he och per he pnp chy, conte oe prdaceor stort determine

With the Pa disagreements between che client andthe audit firms

veik ce he former auditor and seview work papers: ( ob» et)

e. Obmin the potential elent’s permission to

Senin ee eee review on the potential client in aecordunce with professional standards.

sm an independent aditor is sppronched to perform an audit for the Gt time, he oF she should make

Dy 2 Winn nero crsr nadie, Tngues ne necesry cau che predcenor may Be le fo

reid the successor with inforroaton that wil asst the successor in determining whether

fh the predecessor's work should be used

the company rotates auditors

€._ in the predecessor's opinion, control tisk is low

ithe engagement should be accepted

request the

© 21. When one auditor sueceeds another; the successor auditor should .

voncerning the status of the prior yeat's

2. Client to instruct its atorney to send a letter of audit inquiry ©

ligauon, claims, and assessments.

b. Predecessor auditor to submit a lst of

corrected.

Client to authorize the predecessor auditor to alow a review of the predecessor auditor's working

papers. :

4. Predecessor auditor to update t

interna) accounting control weaknesses that have not been

the prior year’s report to thé date of the change of auditors.

22. Which of the following should an auditor obtain from the predecessor auditor prior to accepting an audit

engagement?

‘a. Analysis of balance sheet accounts.

b. Analysis of income statement accounts

€. All marters of continuing accounting significance.

4. Facts that might bear on the integrity of management.

23, Before accepting an audit engagement, a successor auditor should make specific inquiries of the

pting gas

predecessor auditor regarding the predecessor's

‘a. Awareness of the consistency in the application of generally accepted accounting principles between

periods.

Evaluation of all matters of continuing accounting significance.

Opinion of any subsequent events occurzing since the predecessor’ audit report was istued.

‘d._ Understanding as to the reasons for the change of auditors.

B According ro PSA 210, the auditor and the lent should agree on the terms of engagement, The agreed

tesms would need to be recorded in a(n)

‘4. memorandum to be placed in the permanent section of the auditing working papers

b. engagement letter

client representation letter

d. comfort letter :

D_ 25. The form and content of the engagement leters may vary for each client, but they would generally include

reference to all of the following, except:

4. Objective and the scope of the audit of financial statements. on

b. The fact that because of the inherent limitations of the audit, there isa risk that material misstatement

may remain undiscovered.

| Form of the reports to be issued. 0G Me rin bh itn =X

4. A statement that other consulting services may be made available upon request.

‘

xe

e

E

f

:

26. In wi ing situati is

D fs wich of the following situations would the suditor be unlikely to send a new engagement letter to a

4. a change in terms of the engagement

». a significant change in the nature or size of the client’s business .

© s recent change of client management

4. a recent change in the partner and/or staff in the audit engagement

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnPas encore d'évaluation

- Income Taxation Answer Key Only 1 1Document60 pagesIncome Taxation Answer Key Only 1 1Paul Justin Sison Mabao88% (32)

- Quiz #4 Ans KeyDocument7 pagesQuiz #4 Ans KeyMarriz Bustaliño Tan57% (7)

- Quiz #4 Ans KeyDocument7 pagesQuiz #4 Ans KeyMarriz Bustaliño Tan57% (7)

- TOA - InvestmentsDocument8 pagesTOA - InvestmentsPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- TOA - InvestmentsDocument8 pagesTOA - InvestmentsPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- #01 Accounting ProcessDocument36 pages#01 Accounting ProcessPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Statement of Financial Accounting Standards No. 2: Accounting For Research and Development CostsDocument19 pagesStatement of Financial Accounting Standards No. 2: Accounting For Research and Development CostsKath OPas encore d'évaluation

- Net Present Value and Other Investment Criteria: Mcgraw-Hill/IrwinDocument50 pagesNet Present Value and Other Investment Criteria: Mcgraw-Hill/IrwinPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Survey QuestionnaireDocument1 pageSurvey QuestionnairePrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Answer Keys Final PB CPAR P1 '11Document1 pageAnswer Keys Final PB CPAR P1 '11PrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Income Taxation Answer Key Only 1 1Document26 pagesIncome Taxation Answer Key Only 1 1PrincessDiana Doloricon EscrupoloPas encore d'évaluation

- PW Mas PDFDocument33 pagesPW Mas PDFPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Accountancy ProgramDocument1 pageAccountancy ProgramPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Annex 1 Fuzzy Time Series Forecasting: T Academic Year Semester Population MA (2) CMA (2) S, I S T ForecastDocument16 pagesAnnex 1 Fuzzy Time Series Forecasting: T Academic Year Semester Population MA (2) CMA (2) S, I S T ForecastPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- DoleDocument1 pageDolePrincessDiana Doloricon EscrupoloPas encore d'évaluation

- DoleDocument1 pageDolePrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Internal Audit CharterDocument4 pagesInternal Audit CharterPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Executive SummaryDocument4 pagesExecutive SummaryPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Chap 003Document47 pagesChap 003PrincessDiana Doloricon Escrupolo75% (4)

- Internal Audit CharterDocument4 pagesInternal Audit CharterPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Inventory MGTDocument17 pagesInventory MGTPrincessDiana Doloricon EscrupoloPas encore d'évaluation

- PuzzleDocument8 pagesPuzzlePrincessDiana Doloricon EscrupoloPas encore d'évaluation

- Preparing Game:: Sta RTDocument12 pagesPreparing Game:: Sta RTPrincessDiana Doloricon EscrupoloPas encore d'évaluation