Académique Documents

Professionnel Documents

Culture Documents

Sample Income Statement

Transféré par

Ren EstebandresCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sample Income Statement

Transféré par

Ren EstebandresDroits d'auteur :

Formats disponibles

Sample Document

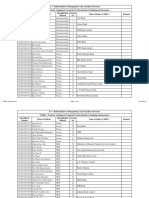

THE INCOME STATEMENT

The Income Statement (Profit and Loss) records all income and expenses of the business during a specified time period, and is

the accepted method of determining profits and losses. The Internal Revenue Service requires all businesses to submit this report

at the end of each year.

PROFIT AND LOSS STATEMENT

From: 20 to 20

Sales or Gross Receipts1 .............................................................................. $

Less Cost of Goods Sold ..................................................................................

2

$

Gross Profit ...................................................................................................... $

3

Less Operating Expenses

Rent ............................................................................

Depreciation ................................................................

Repairs & Maintenance ...............................................

Salaries & Wages .........................................................

Payroll Taxes & Fringe Benefits ...................................

Taxes, Licenses & Fees ................................................

Insurance ....................................................................

Accounting, Legal and Professional Fees .....................

Bad Debts ...................................................................

Telephone ....................................................................

Utilities .......................................................................

Supplies ......................................................................

Security .......................................................................

Auto and Truck ...........................................................

Advertising and Promotion ..........................................

Interest .......................................................................

Miscellaneous ..............................................................

Total Operating Expenses ............................ $

Net Profit Before Taxes4 ............................................................................... $

Federal Income Taxes (Corporation Only) ..................................................... $

Net Profit (or Loss) ....................................................................................... $

1

Sales or Gross Receipts – represents total amount of money that the business makes from the sale of its merchandise, less

discounts and refunds.

2

Cost of Goods Sold – the cost of the merchandise that the business sells. These costs differ with each type of business.

3

Operating Expenses – all business costs other than the costs of merchandise.

4

Net Profit (Loss) – sales less cost of goods sold less operating expenses.

Vous aimerez peut-être aussi

- Sample Contract To SellDocument3 pagesSample Contract To SellCandice Tongco-Cruz100% (4)

- Day 1Document11 pagesDay 1Abdullah EjazPas encore d'évaluation

- Module 1 - FA at FVDocument5 pagesModule 1 - FA at FVNorfaidah Didato GogoPas encore d'évaluation

- Voucher SystemDocument2 pagesVoucher Systemnatalie_sportyPas encore d'évaluation

- Foreign Currency TranslationDocument38 pagesForeign Currency TranslationAnmol Gulati100% (1)

- Ias 37 Provisions Contingent Liabilities and Contingent Assets SummaryDocument5 pagesIas 37 Provisions Contingent Liabilities and Contingent Assets SummaryChristian Dela Pena67% (3)

- Corporate Finance Theory and Practice 10th EditionDocument674 pagesCorporate Finance Theory and Practice 10th EditionrahafPas encore d'évaluation

- Isb540 - HiwalahDocument16 pagesIsb540 - HiwalahMahyuddin Khalid100% (1)

- Ramo 1-2019Document74 pagesRamo 1-2019Donato Vergara IIIPas encore d'évaluation

- IntangiblesDocument7 pagesIntangiblesWertdie stanPas encore d'évaluation

- Chapter - 8Document26 pagesChapter - 8Rathnakar SarmaPas encore d'évaluation

- Pas 20, 23Document32 pagesPas 20, 23Angela WaganPas encore d'évaluation

- Trade Receivable & AllowancesDocument7 pagesTrade Receivable & Allowancesmobylay0% (1)

- Cash Vs Accrual Accounting 1Document65 pagesCash Vs Accrual Accounting 1Nassir CeellaabePas encore d'évaluation

- Module1 - Foreign Currency Transaction and TranslationDocument3 pagesModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- Chapter 18 IAS 2 InventoriesDocument6 pagesChapter 18 IAS 2 InventoriesKelvin Chu JYPas encore d'évaluation

- Toa Interim ReportingDocument17 pagesToa Interim ReportingEmmanuel SarmientoPas encore d'évaluation

- Chapter Two LatestDocument13 pagesChapter Two LatestOwolabi PetersPas encore d'évaluation

- M1 - Introduction To Valuation HandoutDocument6 pagesM1 - Introduction To Valuation HandoutPrince LeePas encore d'évaluation

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesDivine CuasayPas encore d'évaluation

- Management Accounting Chap 003Document67 pagesManagement Accounting Chap 003kenha2000Pas encore d'évaluation

- IFRS 15 RevenueDocument8 pagesIFRS 15 RevenueEmezi Francis ObisikePas encore d'évaluation

- Depreciation Accounting PDFDocument42 pagesDepreciation Accounting PDFASIFPas encore d'évaluation

- PartnershipsDocument27 pagesPartnershipssamuel debebePas encore d'évaluation

- IAS 40 - Investment PropertyDocument6 pagesIAS 40 - Investment PropertyAllana NicdaoPas encore d'évaluation

- Audit II 7new - 3Document15 pagesAudit II 7new - 3Muktar Xahaa100% (1)

- Kinney 8e - CH 09Document17 pagesKinney 8e - CH 09Ashik Uz ZamanPas encore d'évaluation

- Financial Statements Are A Collection of SummaryDocument10 pagesFinancial Statements Are A Collection of Summarygbless ceasarPas encore d'évaluation

- IAS 1 Presentations of Financial StatementsDocument3 pagesIAS 1 Presentations of Financial StatementsPradyut KumarPas encore d'évaluation

- Impairment of Assets - IAS 36Document17 pagesImpairment of Assets - IAS 36charanteja9Pas encore d'évaluation

- Ias 20 Accounting For Government Grants and Disclosure of Government Assistance SummaryDocument5 pagesIas 20 Accounting For Government Grants and Disclosure of Government Assistance SummaryKenncyPas encore d'évaluation

- ch03 SM Leo 10eDocument72 pagesch03 SM Leo 10ePyae PhyoPas encore d'évaluation

- Financial Reporting and Changing PricesDocument6 pagesFinancial Reporting and Changing PricesFia RahmaPas encore d'évaluation

- Accounting Adjustments and Constructing The Financial StatementsDocument12 pagesAccounting Adjustments and Constructing The Financial StatementsKwaku DanielPas encore d'évaluation

- Property, Plant and EquipmentDocument6 pagesProperty, Plant and EquipmenthemantbaidPas encore d'évaluation

- IAS-16 (Property, Plant & Equipment)Document20 pagesIAS-16 (Property, Plant & Equipment)Nazmul HaquePas encore d'évaluation

- Risk ResponseDocument4 pagesRisk ResponseLevi AckermannPas encore d'évaluation

- Revenue From Contracts With CustomersDocument21 pagesRevenue From Contracts With Customersnot mePas encore d'évaluation

- Chapter 2 - Determinants of Interest RatesDocument3 pagesChapter 2 - Determinants of Interest RatesJean Stephany100% (1)

- EU Directive On Disclosure of Non-Financial and Diversity InformationDocument28 pagesEU Directive On Disclosure of Non-Financial and Diversity InformationLUCIAN GOGUPas encore d'évaluation

- Auditing Chapter 3Document38 pagesAuditing Chapter 3FarrukhsgPas encore d'évaluation

- Responsibility and Segment Accounting CRDocument24 pagesResponsibility and Segment Accounting CRAshy LeePas encore d'évaluation

- Section VI: NRV Vs Fair Value: ExampleDocument5 pagesSection VI: NRV Vs Fair Value: ExamplebinuPas encore d'évaluation

- Ias-40 - Investment PropertyDocument16 pagesIas-40 - Investment PropertyPue Das100% (2)

- Ch18 - 2 - Accounting For Revenue Recognition IssuesDocument45 pagesCh18 - 2 - Accounting For Revenue Recognition Issuesselvy anaPas encore d'évaluation

- Chapter One Accounting Principles and Professional PracticeDocument22 pagesChapter One Accounting Principles and Professional PracticeHussen Abdulkadir100% (1)

- Chap 24 - Investment in Associate - Basic Principle Fin Acct 1 - Barter Summary Team PDFDocument5 pagesChap 24 - Investment in Associate - Basic Principle Fin Acct 1 - Barter Summary Team PDFSuper JhedPas encore d'évaluation

- Cash Cash Equivalents: Philippine Accounting Standards 7 Statement of Cash FlowsDocument2 pagesCash Cash Equivalents: Philippine Accounting Standards 7 Statement of Cash FlowsTrisha AlaPas encore d'évaluation

- Week 1 Conceptual Framework For Financial ReportingDocument17 pagesWeek 1 Conceptual Framework For Financial ReportingSHANE NAVARROPas encore d'évaluation

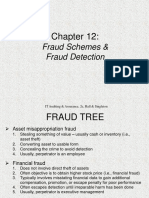

- Ch12 Fraud Scheme DetectionDocument18 pagesCh12 Fraud Scheme DetectionPanda BoarsPas encore d'évaluation

- WRD 27e - IE PPT - Ch03 - ADADocument60 pagesWRD 27e - IE PPT - Ch03 - ADAYuchen WangPas encore d'évaluation

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument38 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont Collegee s tPas encore d'évaluation

- Advance Chapter 1Document16 pagesAdvance Chapter 1abel habtamuPas encore d'évaluation

- Accounting Information SystemDocument24 pagesAccounting Information Systembea6089Pas encore d'évaluation

- Chapter 22Document19 pagesChapter 22Betelehem GebremedhinPas encore d'évaluation

- Effective Financial Statement Analysis Requires An Understanding of A Firm S Economic CharacteristicDocument1 pageEffective Financial Statement Analysis Requires An Understanding of A Firm S Economic CharacteristicM Bilal SaleemPas encore d'évaluation

- Impairment of AssetsDocument4 pagesImpairment of AssetsNath BongalonPas encore d'évaluation

- ch05 SM Leo 10eDocument31 pagesch05 SM Leo 10ePyae Phyo100% (2)

- Adv Fa I CH 1Document30 pagesAdv Fa I CH 1Addi Såïñt GeorgePas encore d'évaluation

- Borrowing Cost PDFDocument2 pagesBorrowing Cost PDFVillaruz Shereen MaePas encore d'évaluation

- Notre Dame University College of Business and Accountancy Cotabato CityDocument10 pagesNotre Dame University College of Business and Accountancy Cotabato CityKarenmae Casas IntangPas encore d'évaluation

- Income Tax: Year of Assessment 2009 - 2010 Return of Income - CompanyDocument6 pagesIncome Tax: Year of Assessment 2009 - 2010 Return of Income - CompanyYogeeta RughooPas encore d'évaluation

- Business Expense List: A. Expenses AmountDocument2 pagesBusiness Expense List: A. Expenses AmountMoutazMohsenPas encore d'évaluation

- Profit and Loss StatementDocument1 pageProfit and Loss StatementAladeenPas encore d'évaluation

- On MAT and AMT WRO0533356 - FinalDocument25 pagesOn MAT and AMT WRO0533356 - FinalOffensive SeriesPas encore d'évaluation

- DirectoryDocument2 pagesDirectoryapi-268301176Pas encore d'évaluation

- TallyPrime Essential Level 2Document26 pagesTallyPrime Essential Level 2Lavanya TPas encore d'évaluation

- SAP MiningDocument2 pagesSAP Miningsaikiran100% (1)

- Ra 6977Document12 pagesRa 6977Kobe MambaPas encore d'évaluation

- Z003800101201740141305080572 448187Document51 pagesZ003800101201740141305080572 448187Dian AnitaPas encore d'évaluation

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDocument79 pages(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakPas encore d'évaluation

- BobredDocument430 pagesBobredNikunj OlpadwalaPas encore d'évaluation

- Karla Company P-WPS OfficeDocument14 pagesKarla Company P-WPS OfficeKris Van HalenPas encore d'évaluation

- 2307 For EBS Private Individual Percenateg TaxDocument4 pages2307 For EBS Private Individual Percenateg TaxAGrace MercadoPas encore d'évaluation

- Jabatan Bendahari: Tarikh Kredit Debit Keterangan Nombor Rujukan KampusDocument1 pageJabatan Bendahari: Tarikh Kredit Debit Keterangan Nombor Rujukan KampusArief HakimiPas encore d'évaluation

- Coi Ay 22-23Document2 pagesCoi Ay 22-23vikash pandeyPas encore d'évaluation

- GA502166-New Policy Welcome LetterDocument1 pageGA502166-New Policy Welcome LetterNelly HPas encore d'évaluation

- List of Groups and Topic For Practical Assignment 1Document5 pagesList of Groups and Topic For Practical Assignment 1pareek gopalPas encore d'évaluation

- Rental AgreementDocument2 pagesRental AgreementKipyegon CheruiyotPas encore d'évaluation

- The - Faber.report CNBSDocument154 pagesThe - Faber.report CNBSWilly Pérez-Barreto MaturanaPas encore d'évaluation

- Employees' Provident Fund Scheme: (0.18 %)Document9 pagesEmployees' Provident Fund Scheme: (0.18 %)Shubhabrata BanerjeePas encore d'évaluation

- Suppose The Government Borrows 20 Billion More Next Year ThanDocument2 pagesSuppose The Government Borrows 20 Billion More Next Year ThanMiroslav GegoskiPas encore d'évaluation

- Testing Point FigureDocument4 pagesTesting Point Figureshares_leonePas encore d'évaluation

- School Building Valuation in Rural AreasDocument66 pagesSchool Building Valuation in Rural AreasMurthy BabuPas encore d'évaluation

- Financial Daily: Putrajaya Files Rm680M Forfeiture ActionDocument33 pagesFinancial Daily: Putrajaya Files Rm680M Forfeiture ActionPG ChongPas encore d'évaluation

- Transfer Pricing II: Rajan Baa 3257Document15 pagesTransfer Pricing II: Rajan Baa 3257Rajan BaaPas encore d'évaluation

- UntitledDocument3 pagesUntitledapi-234474152Pas encore d'évaluation

- Jean Keating and Jack SmithDocument10 pagesJean Keating and Jack SmithStephen Monaghan100% (2)

- Audit Problems CashDocument18 pagesAudit Problems CashYenelyn Apistar Cambarijan0% (1)

- Syllabus For Sap Fico TrainingDocument8 pagesSyllabus For Sap Fico TrainingManoj KumarPas encore d'évaluation