Académique Documents

Professionnel Documents

Culture Documents

504 Secondary Market-RMA Journal

Transféré par

Anonymous t5zVi8FYCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

504 Secondary Market-RMA Journal

Transféré par

Anonymous t5zVi8FYDroits d'auteur :

Formats disponibles

CREDITRISK

SECONDARY-MARKET

OPPORTUNITIES IN BY THOMAS WALLACE

AND JORDAN BLANCHARD

SBA 504 LENDING

The 504 loan product of the U.S. Small

Business Administration provides lenders

with a risk-mitigated credit extension that

can be applied to a wide range of borrow-

ers who need financing for capital assets.

The current renaissance of a second-

ary market for 504 loans offers a way to

enhance their marketability as a product

16 The RMA Journal May 2017 | Copyright 2017 by RMA

TABLE 1: STANDARD STRUCTURE OF A 504 LOAN

LENDER PARTICIPATION PERCENTAGE & SECURITY POSITION FACTORS

50% Can be less than 50%, under

Private Sector First position on all financed assets, other assets as available/required. limited circumstances, with

no specific upper limit.

Reduced by specific require-

30-40% ments for borrower equity, can

CDC Second position on all financed assets, other assets as available/required. never exceed the private-sector

exposure, and can exceed $5

million only in specific cases.

Starting from 10%, increasing

Borrower 10-20% in cumulative increments of

Injection may be financed under certain regulatory and credit considerations. 5%; applicable to start-ups or

special purpose structures.

by customizing the credit structure to fit the bor- impact of the 504 loan program. The loan is fully

rower’s needs. Secondary markets also allow the amortizing over either a 10- or 20-year term and

lender to manage issues related to the balance carries a fully fixed rate of interest. (The choice

sheet and revenue recognition. of term is effectively driven by the useful life of

the capital assets being financed, using IRS defini-

Program Overview tions of useful life.) The rates—set at auctions held

The SBA’s 504 loan program is a public-private monthly for the 20-year offering (Figure 1) and

partnership involving a certified development every other month for the 10-year offering—are

company (CDC), an SBA-licensed and -regulated highly correlated to the 10-year U.S. Treasury bond.

entity, and virtually any private-sector lender. Ap- The funding of the two loans is sequential, with

proximately 225 CDC licensees operate across the the originating private-sector lender making a loan

country, frequently as adjuncts to local economic to accomplish the transfer of title to the subject

development efforts. capital assets. A prudent lender will make sure the

SBA 504 allows a private-sector lender to partic- borrower’s complete equity requirement is injected

ipate out to a CDC a junior tranche of a loan for the at this closing.

acquisition of and costs related to capital assets, The complete permanent financing is thus

subject to SBA eligibility. The standard structure, structured as two loans: the proposed first-position

shown in Table 1, allows a qualified borrower to loan, which the private-sector lender may hold

make an equity injection that is smaller than gen- or sell into the secondary market, and an interim

erally contemplated in conventional loans. (or “swing”) loan. The interim loan is written to

The private-sector loan, while being well se- mirror the loan amount of the proposed junior

cured in first position on some 50% of the project’s loan backed by the SBA. That loan is acquired by

cost, does not carry a direct federal loan guarantee. the CDC through the sale of an SBA-backed de-

On the other hand, this loan is free of the heavy benture into a highly structured secondary market

compliance burden associated with preserving the at monthly auctions for 20-year term debentures.

federal guarantee under the SBA’s 7(a) program. If construction or significant renovation work is

The compliance requirements for the private- required, a construction loan agreement is execut-

sector loan are largely contained in a single SBA ed and the funds from it are added, as needed, to

document and are not dissimilar to those required the first and second loan notes and related security

by any participant in a conventional loan.1 Pric- instruments to preserve the proportionate expo-

ing is essentially unregulated beyond a maximum sures for the loans as required by SBA regulations.

rate.2 The private-sector loan must provide a term

of at least 10 years for a 20-year SBA-backed sec- Program Benefits

ond-position loan. However, there are no specific The limited equity injection from qualified small

requirements for amortization. business borrowers provides them with an imme-

The junior loan, backed by the SBA and moni- diate financial benefit and incentive. The stability

tored on its behalf by the CDC, provides the direct a small business gains from owning its place of

May 2017 The RMA Journal 17

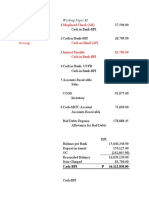

FIGURE 1: RATES SET AT AUCTION FOR THE 20-YEAR OFFERING to accommodate either expectations of

504 20 Year Debenture Offering occupancy or the need to manage debt

8.00%

8% 504 20 Year Debenture Offering service requirements through a longer

8.00% amortization.

7.00%

7% A common feature in the secondary

7.00% market is also the ability to prepay up

6.00%

6% to 20% of the outstanding loan balance

6.00%

annually without incurring prepayment

5.00%

5%

penalties. These structures exist side by

5.00%

4.00%

side with the long-term, fixed-rate pricing

4%

4.00%

R2R²==0.9007

0.9007 of the second-position loan, providing a

3.00%

3% R² = 0.9007 borrower with an inherent rate hedge.

3.00%

2.00%

2% Strategies for Secondary-Market

2.00% Participation

1.00%

1% Lenders offering secondary-market op-

1.00% tions can use this array of structures and

0.00%

0%

Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16

pricing modes to uncover and address

0.00%

Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 very specific borrower concerns, pro-

Sep-06Debenture

Sep-07RateSep-08 10

Sep-09 Sep-10 Sep-11

Year T-Note Sep-12

Spread Over T-Note Sep-13 Poly.

Sep-14 Sep-15

(Debenture Rate) Sep-16

R2 = 0.9007 R2

= 0.9007 R2 = 0.9007 viding a marketing edge that cannot be

Debenture

DebentureRate

Rate 102 Year T-Note

10-Year

R T-Note

= 0.9007 Spread

Spread Over

OverT-Note

T-Note Poly. (Debenture

Policy Rate)Rate)

(Debenture

overstated. This edge accrues particularly

Chart and Statistical Data is from September 2006 to January 2017

to the benefit of community banks, whose

Chart and Statistical Data is from September 2006 to January 2017

Debenture Rate 10 Year T-Note Spread Over T-Note internal treasury operations often cannot

Jan 2017 2.82% Rate 102.38% 0.44%

Debenture Year T-Note Spread Over T-Note match the resources of money center or

Jan 2017 2.82% 2.38% 0.44%

business

Meanand/or critical3.66%

equipment has2.86% fixed rate, and a junior collateral position.

0.80% super-regional competitors, particularly

equal appeal.

Median

Mean 3.24%

3.66% 2.86% The secondary

2.65% 0.80%market for 504 private-

0.62% in an environment of rising interest rates.

STDev

An additional

Median layer0.012522692

of 3.24%

stability for the0.009626853

2.65%sector loans 0.005569379

is0.62%

based on the ability to sell The off-balance-sheet participation of

STDev 0.012522692 0.009626853 0.005569379

borrower is added by the reduction in SBAthem

For Further on a nonrecourse

504 Information, Contact: and servicing- potentially both the first and the second

refinancing risk due to the low loan-to-Tom

ForWallace

Further SBAreleased basis.Contact:

At the point of sale, all

twallace@idscorp.org

504 Information, loans also provides the lender with the

Margaret Guzinski mguzinski@idscorp.org

value ratio of the first-position loan andWallace

Tom servicing responsibility, revenue, and

twallace@idscorp.org capacity for either extending additional

William

MargaretRidgeway

Guzinski wridgeway@idscorp.org

mguzinski@idscorp.org

the fully amortizing term of the second-Jeff Freeman costs accrue to the account of the buyer.

jfreeman@idscorp.org working capital to the same borrower

William Ridgeway wridgeway@idscorp.org

position loan. Finally, the long-term fixed

Jeff Freeman The buyer also becomes obligated to

jfreeman@idscorp.org or the ability to consider opportunities

8280 College Parkway, Suite 204

interest rate of the junior loan, particu- the regulatory requirements of the SBA- beyond either local market or portfolio

Fort

8280Myers, FL 33919

College Parkway,

larly in an environment of risingPhone: rates, (239) backedSuite

652-5588

204 loan.

junior limit considerations. The ability to table

Fort Myers, FL 33919

appeals to borrowers. Sales are largely arranged on a case-by-

Phone: (239) 652-5588 fund these loans also allows a lender to

Benefits for participating lenders in- case basis and can be either table funded avoid Regulation H issues and HVCRE

clude significant over-collateralization, or purchased after closing by the buyer. complications, given that the loan is

preservation of the borrower’s working Table funding, in this context, means that conceivably never on the books of the

capital, mitigation of interest rate risk, the purchaser, rather than the origina- originator. In this vein, some secondary-

and a lower cost structure compared to tor, directly funds the actual loan at the market buyers also have the capacity

an SBA 7(a) loan because of the limited closing table. to fund the junior portion of the debt

regulatory requirements. The small business borrower can be of- structure, until the takeout by the CDC/

fered an extensive variety of possible rate SBA-backed debenture.

Secondary-Market Enhancements structures and amortizations for the first- The benefits to revenue recognition

The bifurcated credit extensions and col- position loan, given the limited regulato- issues are equally impressive. The sale

lateral positions, in the existing regula- ry impositions on its structure. Base rates of a 504 first-position loan in the second-

tory context, create the opportunity for a most commonly offered are Libor swap ary market is structured as a whole loan

On Previous Page: Shutterstock.com

secondary market and define the possible and the Wall Street Journal prime rate. sale on a nonrecourse basis with servicing

offerings. The junior loan, backed by the However, other choices do exist. Fixed- released. As such, the loans can be sold

SBA and managed by the CDC, is the fixed rate offerings across these base rates cover for premiums that can be accounted for

assumption for the credit structure. It will virtually any time frame, from quarterly as immediate gains under GAAP, because

adhere to very clear requirements with a adjustable to 25-year fixed. Likewise, the transaction is accounted for as a sale,

fully amortizing 10- or 20-year term, a a variety of amortizations are available not as a secured borrowing—unlike with

18 The RMA Journal May 2017 | Copyright 2017 by RMA

TABLE 2: PRICING EXAMPLE FOR A 504 LOAN SALE*

Basic 504 Structure $1,000,000 acquisition of building &

equipment, with eligible installation/closing costs

First-Position Loan $500,000 50% Five-Year Fixed @ 5.1%

Second-Position Loan $400,000 40% ulated. Execution risk exists, as in any

participated credit extension. However, as

Borrower Equity $100,000 10% SBA regulations allow taking additional

collateral during the interim loan period,

504 Secondary Market collateral positions can be conditionally

constructed to mitigate this risk.6

Eligible Loan $500,000 Execution risk also needs to be con-

sidered in the overall 504 credit-approval

Five process, which involves multiple parties

(originating lender, secondary-market

Markup to Par Pricing 0.75% buyer, the CDC, and the SBA itself) and

can become unwieldy. The best way for

Premium 3% any originating lender to manage this risk

is to know the CDC involved, as CDCs are

Prepayment Structure Declining 7%, 6, 5,4,3,2,1

effectively the gatekeepers to the entire

process. CDC licenses can be readily dif-

Premium 0.75%

ferentiated by two measures: accredited

1/2 of 1% charged to loan program (ALP) status and abridged

Net Lender Origination 0% borrower on first-position

permanent loan submission method (ASM) status.

Originating Lender

ALP status is a measure of long-term

3.7500%

Premium & Fees commitment and overall SBA regulatory

compliance. ASM is a more medium-term

*December 2016

measure of SBA confidence in the CDC’s

capability, allowing for a reduced level of

the SBA 7(a) program.3 These premiums fees. The critical drivers to the premium application documentation required by

are commonly in the range of 1% to 4% are the spread to the par rate and the SBA for the approval process. Accord-

of the face value. prepayment structure. ingly, the two measures should be taken

Additionally, origination fees can be Par rates are the base above which final as a whole.

retained by the lender, assuming that the borrower pricing earns a premium, usu-

payment of the SBA third-party lender ally at a rate of 1% for every incremental Conclusion

participation fee is accounted for in the 0.25% in the borrower rate. In today’s The 504 program offers a risk-mitigated

transfer.4 low-rate environment, up-pricing a rate way to offer a highly customized credit

The gain realized by the lender, 3.75% may be difficult, owing to competition or structure to a small business. Given that

(Table 2), does not compare to the levels borrower perceptions. The prepayment the structure carries significant benefits

achievable in the 7(a) program’s secondary structure offers a way to offset this, as to the small business concern, it offers

market. Nor does it carry the significant it commonly includes an allowance for lenders an approach with a high likeli-

costs of origination and compliance essen- a prepayment of up to 20% of the out- hood of both internal credit approval and

tial to preserving the SBA guarantee under standing balance without incurring any market acceptance.

7(a). The impact is no less significant in costs. Thus, a borrower can commit to The SBA 504 product, with selective

ROE considerations: There is no remain- a substantial prepayment structure, ef- use of the secondary market, also offers

der asset on the balance sheet and thus no fectively as a pricing inducement to the a cost-effective alternative to large-scale

accounting complications as implied in originating lender, with limited financial SBA 7(a) operations with fewer compli-

ASC Topic 860: Transfers and Servicing.5 implications. ance and financial reporting complica-

Pricing a 504 secondary-market loan The participants in the 504 secondary tions. Any lender making an extension

sale is a balancing act between provid- market are a diverse group ranging from of credit must keep its borrower’s needs

ing a marketable offer to a borrower and nationally chartered banks to closed- and long-term financial health in mind

maximizing the originating lender’s gain end fund. In the time since the Great since these are critical to the repayment

on the sale from premium and retained Recession, the market has been re-pop- of the loan.

May 2017 The RMA Journal 19

TABLE 3: CHART AND STATISTICAL DATA FROM SEPTEMBER 2006 TO JANUARY 2017 co-founder and one of two portfolio managers for

The 504 Fund, a closed-end mutual fund that makes

DEBENTURE RATE 10 YEAR T-NOTE SPREAD OVER T-NOTE a market in SBA 504 first-lien loans sold by banks,

credit unions, and nonbank lenders. He can be

JAN. 2017 2.82% 2.38% 0.44% reached at jblanchard@504fa.com.

MEAN 3.66% 2.86% 0.80% Notes

1. See Third Party Lender Agreement, SBA Form 2287.

MEDIAN 3.24% 2.65% 0.62% 2. Regulatory requirements for structuring these first-

position loans amount to a minimum term of either

STDEV 0.012522692 0.009626853 0.005569379 seven or 10 years and a reasonable interest rate, the

latter defined as “6% over the New York Prime Rate.”

See 13 CFR 120.921: Terms of Third-Party Loans.

3. ASC 860 constitutes the principal guidance on the

The low and long-term fixed rates of reminds us, the surest and soundest way transfer of a portion of an entire financial asset for

the 504 program and the preservation to grow your lending institution is to sales accounting.

of working capital, when customized grow your community. 4. According to 13 CFR 120.972, this is “a one-time fee

equal to 50 basis points on the Third Party Lender’s

to a borrower, clearly serve any small

participation”—namely, the permanent loan in first

business well—and lead to growth. And position.

Thomas Wallace is president of IDS Corporation, a

growing small businesses create jobs and CDC. He currently serves on the board of directors 5. See note 3.

economic opportunity in a local com- of both NAGGL and NADCO. He can be reached 6. See Third Party Lender Agreement, SBA Form 2287,

munity. And as an old banking adage at twallace@idscorp.org. Jordan Blanchard is a Terms and Conditions, Section 6.

20 The RMA Journal May 2017 | Copyright 2017 by RMA

Vous aimerez peut-être aussi

- Unlocking Capital: The Power of Bonds in Project FinanceD'EverandUnlocking Capital: The Power of Bonds in Project FinancePas encore d'évaluation

- Summary On Additional Refinance Fund For COVID-19 - CMSMEDocument2 pagesSummary On Additional Refinance Fund For COVID-19 - CMSMESuman kunduPas encore d'évaluation

- Money & Banking PresentationDocument14 pagesMoney & Banking PresentationMuaaz NaeemPas encore d'évaluation

- Presented byDocument48 pagesPresented byAli KhanPas encore d'évaluation

- Empowering Development Finance Corporation For Greater ImpactDocument2 pagesEmpowering Development Finance Corporation For Greater ImpactThe Wilson CenterPas encore d'évaluation

- Local Economic Enterprise and Non-Traditional Revenue SourcesDocument57 pagesLocal Economic Enterprise and Non-Traditional Revenue SourcesGlyzel SaplaPas encore d'évaluation

- Risk at Freddie MacDocument10 pagesRisk at Freddie MacAbhishek Anand100% (2)

- RFP For Firm UnderWritten Syndicated LoansDocument9 pagesRFP For Firm UnderWritten Syndicated Loansoratschilde.aiPas encore d'évaluation

- Sba 504 Loan Program Fact SheetDocument3 pagesSba 504 Loan Program Fact SheetStephen GallutiaPas encore d'évaluation

- Exposure NormsDocument30 pagesExposure NormsNarayan ChanyalPas encore d'évaluation

- Notes of Consumer FinanceDocument8 pagesNotes of Consumer Financemuneebmateen01Pas encore d'évaluation

- PIK FacilitiesDocument4 pagesPIK FacilitiesChaz SilvestriPas encore d'évaluation

- 6 File General Term Loan Scheme Oct 2017 2Document1 page6 File General Term Loan Scheme Oct 2017 2Ashwet GaonkarPas encore d'évaluation

- GAO On GSEsDocument73 pagesGAO On GSEsZerohedgePas encore d'évaluation

- 94mso010709 FDocument25 pages94mso010709 FSyed FaisalPas encore d'évaluation

- Layered FinanceDocument25 pagesLayered Financethasan_1Pas encore d'évaluation

- Can TakeOut Financing Takeoff in IndiaDocument5 pagesCan TakeOut Financing Takeoff in Indiamishatyagi11Pas encore d'évaluation

- Important Lending Regulations: Credmfi/FincredDocument11 pagesImportant Lending Regulations: Credmfi/FincredNina CruzPas encore d'évaluation

- S&P Debt Rating DefinitionsDocument6 pagesS&P Debt Rating DefinitionsilyakostPas encore d'évaluation

- Extract of Prudentials (Corporate)Document24 pagesExtract of Prudentials (Corporate)Khalil ShaikhPas encore d'évaluation

- USDA Guaranteed Rural Housing Loans (Section 502) : PurposeDocument2 pagesUSDA Guaranteed Rural Housing Loans (Section 502) : PurposeSUPER INDUSTRIAL ONLINEPas encore d'évaluation

- IMChap 020Document29 pagesIMChap 020Roger TanPas encore d'évaluation

- Direct Lending: Benefits, Risks and Opportunities: OaktreeDocument13 pagesDirect Lending: Benefits, Risks and Opportunities: OaktreeIshan ShuklaPas encore d'évaluation

- The Fed - Private Credit - Characteristics and RisksDocument18 pagesThe Fed - Private Credit - Characteristics and RisksThimmapuram Piyush DattaPas encore d'évaluation

- Navigating Today'S "Credit Jungle" An Overview of Sba Financing An Overview of Sba Financing AlternativesDocument36 pagesNavigating Today'S "Credit Jungle" An Overview of Sba Financing An Overview of Sba Financing AlternativesHesham TabarPas encore d'évaluation

- Glossary: This Appendix Provides A Glossary of Terms That Are Used Throughout The Context of This ReportDocument12 pagesGlossary: This Appendix Provides A Glossary of Terms That Are Used Throughout The Context of This Reportsubsidyscope_bailout100% (2)

- Chapter 9 Leveraged BuyoutDocument24 pagesChapter 9 Leveraged Buyoutmansisharma8301Pas encore d'évaluation

- Construction Project Finance Module 2019 LATEST2111Document88 pagesConstruction Project Finance Module 2019 LATEST2111Trevor T ParazivaPas encore d'évaluation

- Wa0005.Document4 pagesWa0005.ParveshPas encore d'évaluation

- Borrower in Custody (BIC) ArrangementsDocument15 pagesBorrower in Custody (BIC) ArrangementsMichael Focia100% (1)

- Federal Reserve Adopts Single Counterparty Credit LimitsDocument15 pagesFederal Reserve Adopts Single Counterparty Credit LimitsRohit AroraPas encore d'évaluation

- Corporate Hybrids 2013 05Document3 pagesCorporate Hybrids 2013 0525pgtf49kvPas encore d'évaluation

- Brief Note On Covid-19 SahayataDocument3 pagesBrief Note On Covid-19 SahayataSonal GodambePas encore d'évaluation

- Babson Capital Mezz Middle Market WPDocument8 pagesBabson Capital Mezz Middle Market WPrhapsody1447Pas encore d'évaluation

- BaselDocument27 pagesBaselSimran MehrotraPas encore d'évaluation

- The Changing Landscape of Real Estate Finance in EuropeDocument4 pagesThe Changing Landscape of Real Estate Finance in EuropeLena StolerPas encore d'évaluation

- Risk ManagementDocument14 pagesRisk ManagementMichelle TPas encore d'évaluation

- Faq C855 PDFDocument6 pagesFaq C855 PDFKaren TacadenaPas encore d'évaluation

- Banking ReviewerDocument5 pagesBanking ReviewerBianca MalinabPas encore d'évaluation

- Reading Material On Term LoanDocument23 pagesReading Material On Term LoanNayana GoswamiPas encore d'évaluation

- Credit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRDocument73 pagesCredit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRHaRa TPas encore d'évaluation

- A Primer On Syndicated Term Loans PDFDocument4 pagesA Primer On Syndicated Term Loans PDFtrkhoa2002Pas encore d'évaluation

- XVZDXCBFBDocument16 pagesXVZDXCBFBMizan KhanPas encore d'évaluation

- CLD - BAO3404 TUTORIAL GUIDE WordDocument49 pagesCLD - BAO3404 TUTORIAL GUIDE WordShi MingPas encore d'évaluation

- Single Borrower ExposureDocument7 pagesSingle Borrower ExposureSiam HasanPas encore d'évaluation

- I.e.', of Is: or The ofDocument2 pagesI.e.', of Is: or The ofAnand ChoudhariPas encore d'évaluation

- Functions of Credit Administration DepartmentDocument4 pagesFunctions of Credit Administration Departmentsamaritasaha100% (1)

- Jan 162022 BRPD 01 eDocument7 pagesJan 162022 BRPD 01 epk ghoshPas encore d'évaluation

- Policies and Structure For Credit ManagementDocument41 pagesPolicies and Structure For Credit ManagementNeeRaz KunwarPas encore d'évaluation

- Banking: Loan Function of BanksDocument4 pagesBanking: Loan Function of BanksmelfabianPas encore d'évaluation

- PR PresentationDocument25 pagesPR PresentationSumair SaleemPas encore d'évaluation

- Trust Receipt, Loan and CA - Revised ReviewerDocument3 pagesTrust Receipt, Loan and CA - Revised ReviewerJoey SultePas encore d'évaluation

- MainMenuEnglishLevel-2 FAQ PDFDocument19 pagesMainMenuEnglishLevel-2 FAQ PDFmadhumay23Pas encore d'évaluation

- Apollo Global Asset Backed Finance White PaperDocument16 pagesApollo Global Asset Backed Finance White PaperstieberinspirujPas encore d'évaluation

- Tips of The Week: How Is A Private Equity DealDocument5 pagesTips of The Week: How Is A Private Equity DealLavabear120Pas encore d'évaluation

- Chang Test Bank Exam 4Document5 pagesChang Test Bank Exam 4Nicholas GiaquintoPas encore d'évaluation

- Infra Debt FundDocument3 pagesInfra Debt FundMana Bhanjan BeheraPas encore d'évaluation

- Fact Sheet Fha 203bDocument10 pagesFact Sheet Fha 203bmptacly9152Pas encore d'évaluation

- European LL GlossaryDocument6 pagesEuropean LL GlossarybharathaPas encore d'évaluation

- Medical Bill KhajaDocument2 pagesMedical Bill KhajaNagesh AdumullaPas encore d'évaluation

- SuperannuationDocument12 pagesSuperannuationNetaji DasariPas encore d'évaluation

- Documentation of Bank (Bank of Baroda)Document40 pagesDocumentation of Bank (Bank of Baroda)Devesh Verma100% (1)

- Statement of Axis Account No:918010022379745 For The Period (From: 01-01-2022 To: 31-12-2022)Document75 pagesStatement of Axis Account No:918010022379745 For The Period (From: 01-01-2022 To: 31-12-2022)Murugesh SalemPas encore d'évaluation

- 2021-2022 Genap Off. QDocument3 pages2021-2022 Genap Off. Qarga badaraPas encore d'évaluation

- Early Days of Investing: Ramdeo AggarwalDocument2 pagesEarly Days of Investing: Ramdeo AggarwalAditya SinghalPas encore d'évaluation

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedPas encore d'évaluation

- Sgap Presentation DTB 2018Document13 pagesSgap Presentation DTB 2018David IbironkePas encore d'évaluation

- IA 1 - 1 Cash and Cash EquivalentsDocument7 pagesIA 1 - 1 Cash and Cash EquivalentsVJ MacaspacPas encore d'évaluation

- E StatementpdfDocument3 pagesE StatementpdfgarrettloehrPas encore d'évaluation

- Test Ii: Misplaced Check (AR)Document10 pagesTest Ii: Misplaced Check (AR)Hannaniah PabicoPas encore d'évaluation

- Indian Financial MarketDocument114 pagesIndian Financial MarketmilindpreetiPas encore d'évaluation

- Vodafone Quick BillPayDocument1 pageVodafone Quick BillPaysgplPas encore d'évaluation

- Gay7e Irm Ch04Document18 pagesGay7e Irm Ch04Thùy Linh Lê ThịPas encore d'évaluation

- Control of Cash & CreditDocument2 pagesControl of Cash & CreditFayisaa Taasoo GalataaPas encore d'évaluation

- Tally ERP 2017-18 - Basic LevelDocument44 pagesTally ERP 2017-18 - Basic LevelAnonymous 3yqNzCxtTzPas encore d'évaluation

- New Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00Document2 pagesNew Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00RasakPas encore d'évaluation

- AlmiraDocument4 pagesAlmiraAlmira GregorioPas encore d'évaluation

- CAIIB Retail Products Module B Retail Banking PDFDocument29 pagesCAIIB Retail Products Module B Retail Banking PDFmansiPas encore d'évaluation

- Gonder IndictmentDocument9 pagesGonder IndictmentChris GothnerPas encore d'évaluation

- PPT On Raghunandan MoneyDocument17 pagesPPT On Raghunandan MoneyAmarkantPas encore d'évaluation

- Credit Repair Secrets ExposedDocument69 pagesCredit Repair Secrets ExposedJulian Williams©™86% (14)

- Mam Karina Template Periodic 1Document21 pagesMam Karina Template Periodic 1Claudine bea NavarretePas encore d'évaluation

- Moneter 1 - Minggu Ke 2 - LanjutanDocument23 pagesMoneter 1 - Minggu Ke 2 - LanjutanAdrian DewandaPas encore d'évaluation

- Mortgage Assumption Agreement Template PDFDocument4 pagesMortgage Assumption Agreement Template PDFMarcLouieMagbitangTiraoPas encore d'évaluation

- 01 Forensic Accounting, Fraud, Fraudster ProfileDocument27 pages01 Forensic Accounting, Fraud, Fraudster ProfileArif Ahmed100% (1)

- Reading 34 Hedge Fund StrategiesDocument20 pagesReading 34 Hedge Fund Strategiestristan.riolsPas encore d'évaluation

- Organogram - State Bank of Pakistan: Approved by The Board On October 26, 2020Document1 pageOrganogram - State Bank of Pakistan: Approved by The Board On October 26, 2020Bilal ZaidiPas encore d'évaluation

- Subscriber Dispute FormDocument2 pagesSubscriber Dispute FormBryan BagayasPas encore d'évaluation

- NEw IC 38 Question Bank 366Document58 pagesNEw IC 38 Question Bank 366Kit Cat83% (6)