Académique Documents

Professionnel Documents

Culture Documents

Entrepreneurship Development 279

Transféré par

Shubham VarshneyDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Entrepreneurship Development 279

Transféré par

Shubham VarshneyDroits d'auteur :

Formats disponibles

Particulars of its organization, functions and its duties

NABARD is a Development Bank with a mandate for providing and regulating credit and other facilities

for the promotion and development of agriculture, small-scale industries, cottage and village industries,

handicrafts and other rural crafts and other allied economic activities in rural areas with a view to

promoting integrated rural development and securing prosperity of rural areas, and for matters

connected therewith or incidental thereto.

In discharging its role as a facilitator for rural prosperity, NABARD is entrusted with

1. Providing refinance to lending institutions in rural areas

2. Bringing about or promoting institutional development and

3. Evaluating, monitoring and inspecting the client banks

Besides this pivotal role, NABARD also:

Acts as a coordinator in the operations of rural credit institutions

Extends assistance to the government, the Reserve Bank of India and other organizations in

matters relating to rural development

Offers training and research facilities for banks, cooperatives and organizations working in the

field of rural development

Helps the state governments in reaching their targets of providing assistance to eligible

institutions in agriculture and rural development

Acts as regulator for cooperative banks and RRBs

Some of the milestones in NABARD's activities are:

A. Business Operations:

Production Credit: NABARD sanctioned aggregating of 66,418 crore short term loans to

Cooperative Banks and Regional Rural Banks (RRBs) during 2012-13, against which, the

maximum outstanding was 65,176 crore.

Investment Credit : Investment Credit for capital formation in agriculture & allied sectors,

non-farm sector activities and services sector to commercial banks, RRBs and co-operative

banks reached a level of 17,674.29 crore as on 31 March 2013 registering an increase of 14.6 per

cent, over the previous year.

Rural Infrastructure Development Fund (RIDF):

Through the Rural Infrastructure Development Fund (RIDF) 16,292.26 crore was disbursed

during 2012-13. A cumulative amount of 1,62,083 crore has been sanctioned for 5.08 lakh

projects as on 31 March 2013 covering irrigation, rural roads and bridges, health and education,

soil conservation, drinking water schemes, flood protection, forest management etc.

B. New Business Initiatives:

NABARD Infrastructure Development Assistance (NIDA):

NABARD has set up NIDA, a new line of credit support for funding of rural infrastructure

projects. The sanctions under NIDA during the year 2012-13 was 2,818.46 crore and

disbursement was 859.70 crore.

Producers Organisations Development Fund (PODF):

In its endeavour to support Producer’s Organizations in a comprehensive manner, NABARD

sanctioned as assistance of 55.95 crore out of Producer Organization Development Fund (PODF)

to 34 PO’s during 2012-13. The disbursment amounted to 29.18 crore covering major activities

like dairy, fishery, marketing infrastructure and agro processing infrastructure.

Direct refinance assistance to CCBs for short term multipurpose credit:

Direct refinance assistance to CCBs was conceived and additional line of finance for CCBs in the

light of recommendations of the “Task Force on Revival of Short Term Rural Cooperative Credit

Structutre, which enables the latter to raise financial resources other than from StCBs. During

2012-13, refinance assistance aggregating 3,385 crore was sanctioned to 42 CCBs and three

StCBs and disbursement stood at 2,363.45 crore.

Support to develop PACS as Multi Service Centres:

Keeping in mind the wide coverage of PACS at the ground level and the limited products at their

disposal, NABARD extended financial support to StCBs/CCBs/PACS to develop PACS as Multi

Service Centre (MSCs) so as to serve as “one Stop Shop”unit for meeting the various

requirements of the farmers. During 212-13,747 PACS were supported with sanction of 141.17

crore and the disbursements thereagainst stood at 48.84 core, assistance for estabilishment of

agro service, processing, storage and information centres, etc.

NABARD Initiated Project on Core Banking Solutions (CBS) in Co-operatives :

Through Core Banking Solution (CBS), Co-operatives are being brought to a higher technology

platform so as to compete with other banks for business and growth. The programme made

rapid strides with 5,543 branches of 163 banks across 10 States joining the platform in the first

phase and 42 banks joining in the second phase, a total of 7,088 branches of 205 StCBs and

CCBs across 16 States and three UTs came into the umbrella of the programme as on 31 March

2013.

C. Development Initiatives:

Watershed Development Fund (WDF):

The cumulative number of watershed projects sanctioned under Watershed Development Fund

(WDF) stood at 586 in 16 States covering an area of 5.40 lakh ha with total commitment (loan

and grant component) of 306.36 crore as on 31 March 2013.

Farm Innovation and Promotion Fund (FIPF) and Farmers’ Technology Transfer

Fund (FTTF):

The funds were created out of the operating profits of NABARD to support innovative ventures

and to support technology transfer in farm sector and its corpus stood at 50.00 crore and 61.21

crore respectively as on 31 March 2013. Grant assistance of 9.90 croreand 39.79 crore,

respectively, were disbursed for various interventions under the programme during 2012-13.

Farmers’ Clubs:

With the launching of 24,802 new Farmers’ Clubs during the year, the number of clubs reached

1.27 lakh as on 31 March 2013.

Umbrella Programme on Natural Resource Management (UPNRM):

UPNRM aims to boost rural livelihoods by supporting community-managed sustainable natural

resource management projects. Assistance of 174.30 crore was sanctioned during 2012-13 taking

the cumulative sanction to 386.92 crore as at the end of March 2013. The cumulative

disbursment under the programme amounted to 217.57 crore, including 207.23 crore as loan

and 10.34 crore as grant.

Tribal Development Fund (TDF):

During the year 2012-13, financial assistance of 224.26 crore was sanctioned for 69 projects

benefiting 53,700 tribal families in 14 States. The cumulative sanction as on 31 March 2013 was

1,432 crore, covering 3.80 lakh families in 484 projects across 26 States/UTs.

Financial Inclusion Fund (FIF) and the Financial Inclusion Technology Fund

(FITF) :

As on 31 March 2013, the cumulative sanctions under FIF and FITF were 181.64 crore and

365.49 crore, respectively againstwhich disbursements were 69.77 crore and 201.30 crore,

respectively.

SHG-Bank Linkage Programme:

As on 31 March 2013, there were more than 73.18 lakh savings linked Self Help Groups (SHG)

and more than 44.51 lakh credit-linked SHGs covering over 10.3 crore poor households under

the micro-finance programme. NABARD carried forward its guiding role in the microfinance

programme during 2012-13 by taking a host of new initiatives and consolidating some of the

already operational interventions.

Vous aimerez peut-être aussi

- 1z0 1056 AR PDFDocument34 pages1z0 1056 AR PDFkishore bv100% (2)

- Agricultural Credit in BangladeshDocument40 pagesAgricultural Credit in Bangladeshaluka porota80% (5)

- Presentation On NABARDDocument27 pagesPresentation On NABARDSameer R. KhanPas encore d'évaluation

- 2018 Case and Course Outline in Banking Laws - Dean DivinaDocument14 pages2018 Case and Course Outline in Banking Laws - Dean DivinaA.A DizonPas encore d'évaluation

- Role of Microfinance in Women EmpowermentDocument25 pagesRole of Microfinance in Women EmpowermentDevansh MoyalPas encore d'évaluation

- Ivalua Hackett-Group Procurement-Value-Measurement ReportDocument26 pagesIvalua Hackett-Group Procurement-Value-Measurement ReportVigneshwar A SPas encore d'évaluation

- Aliasghar-Java DeveloperDocument6 pagesAliasghar-Java DeveloperJoshElliotPas encore d'évaluation

- Report on NABARDDocument15 pagesReport on NABARDAnkit TiwariPas encore d'évaluation

- Nabard - A New High: Highlights of NABARD's Operations During 2009-10Document6 pagesNabard - A New High: Highlights of NABARD's Operations During 2009-10Rohitt MathurPas encore d'évaluation

- NabardDocument36 pagesNabardRahul Singh100% (1)

- Adb Role in Indian Economy: Presentation OnDocument12 pagesAdb Role in Indian Economy: Presentation OnPraveen MayarPas encore d'évaluation

- Objectives of NABARDDocument5 pagesObjectives of NABARDAbhinav Ashok ChandelPas encore d'évaluation

- Banking LAWDocument20 pagesBanking LAWRohit DangiPas encore d'évaluation

- NABARDDocument25 pagesNABARDAmit KumarPas encore d'évaluation

- National Seminar OnDocument12 pagesNational Seminar Onniharika_missnehaPas encore d'évaluation

- Economics SEM 2 RPDocument13 pagesEconomics SEM 2 RPVansh Batch 2026Pas encore d'évaluation

- To The Study On Basic NabardDocument23 pagesTo The Study On Basic NabardKunal DeorePas encore d'évaluation

- On Nabard: Presentation DescriptionDocument4 pagesOn Nabard: Presentation DescriptionManisha MishraPas encore d'évaluation

- NABARD: India's Apex Bank for AgricultureDocument9 pagesNABARD: India's Apex Bank for AgricultureKumar Prince RajPas encore d'évaluation

- NABARD financing pattern analysisDocument9 pagesNABARD financing pattern analysisFizan NaikPas encore d'évaluation

- Promotional Efforts by NabardDocument9 pagesPromotional Efforts by NabardJimmy Vohera100% (1)

- Asian Development Bank Pakistan Fact SheetDocument18 pagesAsian Development Bank Pakistan Fact SheetMuhammad Ahsan AkramPas encore d'évaluation

- Bharat Campaign Under Agriculture Infrastructure Fund: Ministry of Agriculture & Farmers WelfareDocument2 pagesBharat Campaign Under Agriculture Infrastructure Fund: Ministry of Agriculture & Farmers WelfareVivek SapariaPas encore d'évaluation

- Group7 - Finance (2) - 1Document27 pagesGroup7 - Finance (2) - 1Kartikay MishraPas encore d'évaluation

- Nabard Offers CSR Schemes To Corporates in JharkhandDocument56 pagesNabard Offers CSR Schemes To Corporates in JharkhandDatta MorePas encore d'évaluation

- NABARD Presentation BankDocument56 pagesNABARD Presentation BankYashkjJawale100% (1)

- Reserve Bank of IndiaDocument10 pagesReserve Bank of IndiaKinjal BhanushaliPas encore d'évaluation

- LDPP Research PaperDocument8 pagesLDPP Research PaperPrajwal GugnaniPas encore d'évaluation

- Credit Banking in AgriDocument12 pagesCredit Banking in AgriAnkit MaruPas encore d'évaluation

- Major Activities of NabardDocument13 pagesMajor Activities of NabardAbhishek .SPas encore d'évaluation

- Nabard Credit To Priority Sector and Neglected SectorDocument15 pagesNabard Credit To Priority Sector and Neglected SectorsharanashutoshPas encore d'évaluation

- Nabard InterviewDocument7 pagesNabard InterviewAmit GodaraPas encore d'évaluation

- "A Study On The Role of NABARD in The Country, S Agriculture/rural Development''Document6 pages"A Study On The Role of NABARD in The Country, S Agriculture/rural Development''Gauri Shankar RaiPas encore d'évaluation

- Services Provided by NabardDocument10 pagesServices Provided by NabardPreethi RaviPas encore d'évaluation

- Integrated Scheme On Agriculture CooperationDocument47 pagesIntegrated Scheme On Agriculture CooperationChandan100% (2)

- NABARD - Rural BankDocument4 pagesNABARD - Rural BankBenedict AbrahamPas encore d'évaluation

- Rationalization of Centrally Sponsored SchemesDocument4 pagesRationalization of Centrally Sponsored SchemesmkshrighyPas encore d'évaluation

- NABARD: India's apex development bank for agriculture and rural developmentDocument9 pagesNABARD: India's apex development bank for agriculture and rural developmentpradeep jadavPas encore d'évaluation

- Reserve Bank of IndiaDocument4 pagesReserve Bank of IndiaUmesh GuptaPas encore d'évaluation

- Banking Law NotesDocument17 pagesBanking Law NotesgoluPas encore d'évaluation

- Institutional Finance in RajasthanDocument4 pagesInstitutional Finance in RajasthanEnaksheePas encore d'évaluation

- Nabard BankDocument60 pagesNabard Bankjaiswalpradeep507100% (3)

- BRAC Microfinance Program in Bangladesh and its International ReplicationsDocument26 pagesBRAC Microfinance Program in Bangladesh and its International ReplicationsRevamp TwentyonePas encore d'évaluation

- KALIA-Case Study-Government of OdishaDocument70 pagesKALIA-Case Study-Government of OdishaNickazaz1Pas encore d'évaluation

- NABARDDocument58 pagesNABARDbibinPas encore d'évaluation

- Presentation On NABARDDocument27 pagesPresentation On NABARDSameer R. Khan100% (1)

- Green Banking in Bangladesh sees significant progressDocument11 pagesGreen Banking in Bangladesh sees significant progressShohana AhmedPas encore d'évaluation

- NABARD FinalDocument29 pagesNABARD Finalshashank1611100% (1)

- Asian Development Bank AdbDocument14 pagesAsian Development Bank AdbRakeshPas encore d'évaluation

- 29 NRSP Sdpi Assessing The Economic Impacts of NRSP Microcredit Prog in BWP 2009Document69 pages29 NRSP Sdpi Assessing The Economic Impacts of NRSP Microcredit Prog in BWP 2009Farhan SarwarPas encore d'évaluation

- Micro Finance and Rural BankingDocument7 pagesMicro Finance and Rural Bankingfarhadcse30Pas encore d'évaluation

- Saman Waseem Saud I Khan Nabila Siddiqui Omar Fahmeed Sana AshrafDocument12 pagesSaman Waseem Saud I Khan Nabila Siddiqui Omar Fahmeed Sana AshrafEr Siraj AzamPas encore d'évaluation

- 2410163218mizoram StateFocusPaper 2016 17.split and MergedDocument8 pages2410163218mizoram StateFocusPaper 2016 17.split and MergedAndrew 28Pas encore d'évaluation

- Business India Corporate ReportDocument4 pagesBusiness India Corporate ReportRavi Kumar SharmaPas encore d'évaluation

- Rural Banking & MicrofinanceDocument31 pagesRural Banking & MicrofinanceAshish AggarwalPas encore d'évaluation

- Axis BANK CSRDocument4 pagesAxis BANK CSRSibamSainPas encore d'évaluation

- Objectives of NABARDDocument4 pagesObjectives of NABARDmanojbhatia1220Pas encore d'évaluation

- NABARD Promotes Rural Development Through Credit and RefinanceDocument3 pagesNABARD Promotes Rural Development Through Credit and RefinanceSreekanth KetharapuPas encore d'évaluation

- Dr. Swapan Kumar Roy, Rural Development in India: What Roles Do Nabard & Rrbs Play?Document19 pagesDr. Swapan Kumar Roy, Rural Development in India: What Roles Do Nabard & Rrbs Play?ABHIJEETPas encore d'évaluation

- Pib Insights 14 12 23Document18 pagesPib Insights 14 12 23SriHariKalyanBPas encore d'évaluation

- Fostering Asian Regional Cooperation and Open Regionalism in an Unsteady World: 2019 Conference HighlightsD'EverandFostering Asian Regional Cooperation and Open Regionalism in an Unsteady World: 2019 Conference HighlightsPas encore d'évaluation

- Snapshot of Sustainable Development Goals at the Subnational Government Level in IndonesiaD'EverandSnapshot of Sustainable Development Goals at the Subnational Government Level in IndonesiaPas encore d'évaluation

- Public Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectiveD'EverandPublic Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectivePas encore d'évaluation

- ADB Annual Report 2014: Improving Lives Throughout Asia and the PacificD'EverandADB Annual Report 2014: Improving Lives Throughout Asia and the PacificPas encore d'évaluation

- Entrepreneurship & SBMDocument94 pagesEntrepreneurship & SBMRomil VermaPas encore d'évaluation

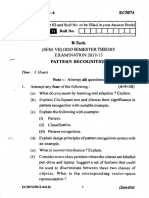

- Pattern Recognition - (Ecs-074) PDFDocument4 pagesPattern Recognition - (Ecs-074) PDFShubham VarshneyPas encore d'évaluation

- Labs/Lab Manual 6Document12 pagesLabs/Lab Manual 6Shubham VarshneyPas encore d'évaluation

- Labs/Lab Manual 6Document12 pagesLabs/Lab Manual 6Shubham VarshneyPas encore d'évaluation

- SIP Report PriyaDocument18 pagesSIP Report Priyarucha gaurkhedePas encore d'évaluation

- Documents - Pub Neo and Challenger BankDocument10 pagesDocuments - Pub Neo and Challenger BankkarolinPas encore d'évaluation

- Project Exports PresentationDocument21 pagesProject Exports PresentationRavula RekhanathPas encore d'évaluation

- SWOT Analysis of Mutual FundsDocument31 pagesSWOT Analysis of Mutual FundsALEXANDAR0% (1)

- MPRA Paper 81201Document29 pagesMPRA Paper 81201shagun khandelwalPas encore d'évaluation

- Charitable organizations and bank account detailsDocument1 pageCharitable organizations and bank account detailsSasha EddyPas encore d'évaluation

- PolicySoftCopy 104667249Document1 pagePolicySoftCopy 104667249Masum PatthakPas encore d'évaluation

- ICICI Pru LifeTime Super: A regular premium unit-linked planDocument3 pagesICICI Pru LifeTime Super: A regular premium unit-linked planmniarunPas encore d'évaluation

- Exhibits - Bates 22-201 PDFDocument180 pagesExhibits - Bates 22-201 PDFajPas encore d'évaluation

- SG Cowen: New RecruitsDocument12 pagesSG Cowen: New RecruitsSonal GuptaPas encore d'évaluation

- Role of Centrel Bank and Monetary Policy - ClassDocument52 pagesRole of Centrel Bank and Monetary Policy - ClassalioPas encore d'évaluation

- Final Policy Copy 2020 To 2021Document28 pagesFinal Policy Copy 2020 To 2021Immanuel SPas encore d'évaluation

- Bank GuaranteeDocument14 pagesBank Guaranteesmg26thmay100% (1)

- Neft Form.Document1 pageNeft Form.Amit AroraPas encore d'évaluation

- Tutorial 6 - Cost of Short Term Credit PDFDocument1 pageTutorial 6 - Cost of Short Term Credit PDFChamPas encore d'évaluation

- Leading Bank in BangladeshDocument4 pagesLeading Bank in BangladeshSamina Ashrabi UpomaPas encore d'évaluation

- BANKING TERMS EXPLAINEDDocument23 pagesBANKING TERMS EXPLAINEDSajal SinghalPas encore d'évaluation

- Ar 2020 21Document72 pagesAr 2020 21Joey KamPas encore d'évaluation

- Anil BokilDocument3 pagesAnil BokilNishant GhugePas encore d'évaluation

- Cash account and bank statement of CANAL COMPANY for DecemberDocument3 pagesCash account and bank statement of CANAL COMPANY for DecemberephraimPas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBalajiPas encore d'évaluation

- 10000017314Document85 pages10000017314Chapter 11 DocketsPas encore d'évaluation

- Insurance FinalDocument154 pagesInsurance FinalRashesh Doshi0% (1)

- Assume That You Recently Graduated With A Degree in FinanceDocument1 pageAssume That You Recently Graduated With A Degree in FinanceAmit PandeyPas encore d'évaluation

- Zain Traders Assignment 2Document2 pagesZain Traders Assignment 2Bilal Ahmed100% (1)

- Seec Form 20Document27 pagesSeec Form 20str3268Pas encore d'évaluation