Académique Documents

Professionnel Documents

Culture Documents

FINMAN GENERAL ASSURANCE CORPORATION, Petitioner, vs. THE HONORABLE COURT OF APPEALS and JULIA SURPOSA, Respondents.

Transféré par

Jessie Albert CatapangTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FINMAN GENERAL ASSURANCE CORPORATION, Petitioner, vs. THE HONORABLE COURT OF APPEALS and JULIA SURPOSA, Respondents.

Transféré par

Jessie Albert CatapangDroits d'auteur :

Formats disponibles

FINMAN GENERAL ASSURANCE CORPORATION, petitioner, vs.

THE HONORABLE

COURT OF APPEALS and JULIA SURPOSA, respondents.

FACTS:

Carlie Surposa was insured with petitioner Finman General Assurance Corporation under

Finman General Teachers Protection Plan Master Policy No. 2005 and Individual Policy No.

08924 with his parents, spouses Julia and Carlos Surposa, and brothers Christopher, Charles,

Chester and Clifton, all surnamed, Surposa, as beneficiaries.

While said insurance policy was in full force and effect, the insured, Carlie Surposa, died

on October 18, 1988 as a result of a stab wound inflicted by one of the three (3) unidentified

men without provocation and warning on the part of the former as he and his cousin, Winston

Surposa, were waiting for a ride on their way home along Rizal-Locsin Streets, Bacolod City

after attending the celebration of the "Maskarra Annual Festival."

Thereafter, private respondent and the other beneficiaries of said insurance policy filed a

written notice of claim with the petitioner insurance company which denied said claim

contending that murder and assault are not within the scope of the coverage of the insurance

policy.

The petitioner contended alleging grove abuse of discretion on the part of the appellate

court in applying the principle of "expresso unius exclusio alterius" in a personal accident

insurance policy since death resulting from murder and/or assault are impliedly excluded in said

insurance policy considering that the cause of death of the insured was not accidental but rather

a deliberate and intentional act of the assailant in killing the former as indicated by the location

of the lone stab wound on the insured. Therefore, said death was committed with deliberate

intent which, by the very nature of a personal accident insurance policy, cannot be indemnified.

ISSUE: Whether or not death petitioner is correct that results from assault or murder deemed are

not included in the terms “accident” and “accidental”.

HELD:

The terms “accident” and “accidental” as used in insurance contracts have not acquired

any technical meaning, and are construed by the courts in their ordinary and common acceptation.

Thus, the terms have been taken to mean that which happen by chance or fortuitously, without

intention and design, and which is unexpected, unusual, and unforeseen. An accident is an event

that takes place without one’s foresight or expectation — an event that proceeds from an unknown

cause, or is an unusual effect of a known cause and, therefore, not expected.

It is well settled that contracts of insurance are to be construed liberally in favor of the

insured and strictly against the insurer. Thus ambiguity in the words of an insurance contract

should be interpreted in favor of its beneficiary.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Cruz and Co. V HR Construction CorpDocument3 pagesCruz and Co. V HR Construction CorpJessie Albert CatapangPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Heirs of Malabanan Vs Republic of The PhilippinesDocument2 pagesHeirs of Malabanan Vs Republic of The PhilippinesJessie Albert CatapangPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Poe VS COMELECDocument3 pagesPoe VS COMELECJessie Albert CatapangPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Quita Vs CADocument1 pageQuita Vs CAJessie Albert CatapangPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Cruz Vs DENRDocument1 pageCruz Vs DENRJessie Albert CatapangPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- DOHLE-PIDLMAN Vs GazzinganDocument1 pageDOHLE-PIDLMAN Vs GazzinganJessie Albert CatapangPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Bona V BrionesDocument2 pagesBona V BrionesJessie Albert CatapangPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- SMDC V AngDocument3 pagesSMDC V AngJessie Albert CatapangPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Systems Factors Corporation and Modesto Dean V NLRCDocument2 pagesSystems Factors Corporation and Modesto Dean V NLRCJessie Albert CatapangPas encore d'évaluation

- JESUS REYES Vs Glaucoman Research FoundationDocument1 pageJESUS REYES Vs Glaucoman Research FoundationJessie Albert CatapangPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Dacles Vs Millenium ErectorsDocument1 pageDacles Vs Millenium ErectorsJessie Albert CatapangPas encore d'évaluation

- Balacuit Vs CFIDocument1 pageBalacuit Vs CFIJessie Albert CatapangPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- MAGSAYSAY MARITIME CORP. vs. PANOGALINOGDocument1 pageMAGSAYSAY MARITIME CORP. vs. PANOGALINOGJessie Albert CatapangPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Awatin Vs AvantgardeDocument1 pageAwatin Vs AvantgardeJessie Albert CatapangPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Tan V COMELECDocument1 pageTan V COMELECJessie Albert CatapangPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Flores v. Drisadasdasdsadlon G.R. No. 104732: FactsDocument2 pagesFlores v. Drisadasdasdsadlon G.R. No. 104732: FactsJessie Albert CatapangPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Borja v. COMELEC G.R. No. 133495 FactsDocument1 pageBorja v. COMELEC G.R. No. 133495 FactsJessie Albert CatapangPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Balacuit Vs CFIDocument1 pageBalacuit Vs CFIJessie Albert CatapangPas encore d'évaluation

- Public Corporations DigestDocument11 pagesPublic Corporations DigestJessie Albert CatapangPas encore d'évaluation

- Disqualification of Elected Official Removed from Prior PositionDocument1 pageDisqualification of Elected Official Removed from Prior PositionAmir Nazri Kaibing100% (1)

- Macasiano Vs DioknoDocument1 pageMacasiano Vs DioknoJessie Albert CatapangPas encore d'évaluation

- Estrada vs. ArroyoDocument10 pagesEstrada vs. ArroyoJessie Albert CatapangPas encore d'évaluation

- Solicitor General V Metropolitan Manila AuthorityDocument2 pagesSolicitor General V Metropolitan Manila AuthorityJessie Albert CatapangPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Heirs of Andora v. ReyesDocument1 pageHeirs of Andora v. ReyesJessie Albert CatapangPas encore d'évaluation

- Vazquez Vs VazquezDocument2 pagesVazquez Vs VazquezJessie Albert CatapangPas encore d'évaluation

- Samahang Manggagawa Sa Permex VS Sec. of LaborDocument1 pageSamahang Manggagawa Sa Permex VS Sec. of LaborJessie Albert CatapangPas encore d'évaluation

- Verendia vs. CA & Fidelity Surety CoDocument1 pageVerendia vs. CA & Fidelity Surety CoJessie Albert CatapangPas encore d'évaluation

- RIZAL SURETY Vs CADocument2 pagesRIZAL SURETY Vs CAJessie Albert CatapangPas encore d'évaluation

- Subic Bay v. COMELEC G.R. No. 125416 FactsDocument3 pagesSubic Bay v. COMELEC G.R. No. 125416 FactsJessie Albert CatapangPas encore d'évaluation

- Chavez vs. Court of Appeals DigestDocument1 pageChavez vs. Court of Appeals DigestJessie Albert CatapangPas encore d'évaluation

- 01 Gercio Vs Sunlife AssuranceDocument2 pages01 Gercio Vs Sunlife AssurancePiaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Court upholds validity of birth certificate over petition for sex changeDocument30 pagesCourt upholds validity of birth certificate over petition for sex changeNina Rose BenatiroPas encore d'évaluation

- The Proper Law of The ContractDocument24 pagesThe Proper Law of The ContractrajPas encore d'évaluation

- BSTR PN 003E Noise Barriers With Transparent PanelsDocument7 pagesBSTR PN 003E Noise Barriers With Transparent PanelsPeter ChanPas encore d'évaluation

- Delos Reyes vs. CADocument7 pagesDelos Reyes vs. CARhona MarasiganPas encore d'évaluation

- Federation of Oils, Seeds and Fats Associations Limited: Fosfa InternationalDocument2 pagesFederation of Oils, Seeds and Fats Associations Limited: Fosfa InternationalJohn Carlos Lopez Malaga100% (1)

- Civil Law BasicsDocument6 pagesCivil Law BasicsCC OoiPas encore d'évaluation

- SPINCAT-USER-MANUAL SC-168 Manual InsertDocument20 pagesSPINCAT-USER-MANUAL SC-168 Manual InsertColinPas encore d'évaluation

- Dental Public Health and Research 4th Edition Nathe Test BankDocument37 pagesDental Public Health and Research 4th Edition Nathe Test Banksoojeebeautied9gz3h100% (13)

- 3.concept of SupplyDocument3 pages3.concept of SupplyBhuvaneswari karuturiPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Free Consent: Definition of Consent: According To SectionDocument12 pagesFree Consent: Definition of Consent: According To SectionMehwish JamilPas encore d'évaluation

- Cee 583 Physical Education Facilities and Sports Event ManagementDocument6 pagesCee 583 Physical Education Facilities and Sports Event ManagementXia Al-HaqPas encore d'évaluation

- Topic 9 & 10 - 3rd Party & InterpleaderDocument9 pagesTopic 9 & 10 - 3rd Party & InterpleaderPrisyaRadhaNairPas encore d'évaluation

- Moot 3 Minor Contracts RespondentDocument14 pagesMoot 3 Minor Contracts RespondentRiya HadaPas encore d'évaluation

- Alchemy PayDocument31 pagesAlchemy PayejejdjfjPas encore d'évaluation

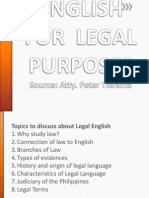

- English For Legal PurposesDocument14 pagesEnglish For Legal PurposesHanah Abegail Navalta100% (3)

- Property ReviewerDocument7 pagesProperty ReviewerKim BalauagPas encore d'évaluation

- SHS CR Agmt Lad New Version in Usd - Draft 8jun22Document10 pagesSHS CR Agmt Lad New Version in Usd - Draft 8jun22Carlos Augusto Pereira QuijanoPas encore d'évaluation

- E-Public - Fire Proofing of Structural Steel Suuports..Document40 pagesE-Public - Fire Proofing of Structural Steel Suuports..rahulgehlot2008Pas encore d'évaluation

- Business Law Chapter 4Document61 pagesBusiness Law Chapter 4ماياأمالPas encore d'évaluation

- Composition of The BAT - June 2018Document22 pagesComposition of The BAT - June 2018Victor LopezPas encore d'évaluation

- Rafael Zulueta Vs Pan AmDocument2 pagesRafael Zulueta Vs Pan AmRaymond Alhambra100% (3)

- Inform Practice Note #27: ContentDocument9 pagesInform Practice Note #27: ContentTSHEPO DIKOTLAPas encore d'évaluation

- Iringan V CADocument2 pagesIringan V CAArren Relucio0% (1)

- 8.L4 - CoCu 5 - Network Procurement (PG 93 - 104)Document13 pages8.L4 - CoCu 5 - Network Procurement (PG 93 - 104)Norasmanina NinaPas encore d'évaluation

- Files Example Darty PDFDocument12 pagesFiles Example Darty PDFMalick DiattaPas encore d'évaluation

- 2special MockBar Exam Labor LawDocument6 pages2special MockBar Exam Labor LawNoisette ParcPas encore d'évaluation

- DRAFT SA MATOC Management ApproachDocument25 pagesDRAFT SA MATOC Management Approachdenys.castanedatPas encore d'évaluation

- A Paper On Adr and Article 159 of ConstitutionDocument47 pagesA Paper On Adr and Article 159 of Constitutionmustafa100% (1)

- From (Prachi Waikar (Prachiwaikar1412@gmail - Com) ) - ID (879) - Labour Law II Proj.Document23 pagesFrom (Prachi Waikar (Prachiwaikar1412@gmail - Com) ) - ID (879) - Labour Law II Proj.Nikhil AradhePas encore d'évaluation

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryD'EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryÉvaluation : 5 sur 5 étoiles5/5 (1)

- Hearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBID'EverandHearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIÉvaluation : 4 sur 5 étoiles4/5 (19)

- Why We Die: The New Science of Aging and the Quest for ImmortalityD'EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityÉvaluation : 3.5 sur 5 étoiles3.5/5 (2)

- Cult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryD'EverandCult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryÉvaluation : 4 sur 5 étoiles4/5 (44)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.D'EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Évaluation : 5 sur 5 étoiles5/5 (43)

- Roxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingD'EverandRoxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingÉvaluation : 5 sur 5 étoiles5/5 (4)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeD'EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BePas encore d'évaluation

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessD'EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (327)