Académique Documents

Professionnel Documents

Culture Documents

Asset Product Purpose Margin Limit Repayment Other Features

Transféré par

jyottsnaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Asset Product Purpose Margin Limit Repayment Other Features

Transféré par

jyottsnaDroits d'auteur :

Formats disponibles

SME PRODUCTS

Asset Product PURPOSE MARGIN LIMIT REPAYMENT OTHER FEATURES

1. Min Score- 60% (36 out of 60)

2. Assessment- For SSI- as per Nayak committee, SBF & Retail-20% of

Annual T/O, SE & Prof -50% of Gross A.I.

Unit with 2 years of satisfactory upto 25000-

TL- 5 Years 3. Credit summation in the a/c should not be less than 50% of

track record. NIL

SME CREDIT CARD Max 10.00 Lacs CC- Valid for 3 years projected sales

No Collaterals to be insisted for 25000-10 Lacs-

subject to annual review 4. Submission of audited B/S waived

SSI Units. 20%

5. Stock statement to be obtained yearly on 28/29th Feb.

6. SSI limits to be covered under CGTMSE compulsory.

T/L - 5 Years (excluding 1. Promoter's Age - below 66 years (18 yrs - 65 yrs)

Loan as per scoring model -

6M moratorium) 2. Minimum Score - 60% (50% in each group -

Rationale: (1) To cut down delays, 25% for WC 5-50 Lacs (Mfg)

SME SMART SCORE W/C Limit valid for 2 Personal+Business+Collateral: 30+50+20)

(2) To simplify the approval 33% for T/L 5-25 Lacs (Trade)

Years subject to yearly 3. CRA applicable for loans above Rs.25 lacs.

process.

review 4. SSI-20% of P.S., T&S-15% of Projected Sales

NAI - Rs. 4 lac, No OD Facility. No additional security - only hypothecation of

TL to promoter/partner/ family 15%, SA can

Max - 2.5 X NAI, vehicle. PDCs to be obtained. P-Seg Doc. Used Vehicle - Yes, but less

members in Own/Unit's Name - reduce 5%,

SME CAR LOAN EMI/NMI should not 7 years than 5 years - Max loan: 15 lacs -Single ownership -

Spouse Income can be added if AGM - 5%, Min

exceed 50% (60% by NO insurance claim - Take over - Only Standard Assets,

she agrees to be a guarantor. reqd margin-5%

AGM) Care : No loan for Duplicate RC

1. Collateral value should be minimum 143% of loan amount,

LEASE RENTAL To meet borrower Liquidity NBG - Min 10L, Max 2. For New Accounts, CRA to be SB-3 & better.

DISCOUNTING mismatch - No speculative 50 Cr. MCG - Min 3. Loan to be recalled if a/c irregular for 3 months

30%, 50% for 10 years or residual

SCHEME purpose - Owners of resi & comml >50Cr, Max 500 Cr. 4. DSCR : 1.20, 5. Valuation once in 3 years.

Maals lease period

(ERSTWHILE RENT properties - Rented to : Maals - Max 200 Cr

PLUS) MNCs/Banks/Corp./Govt.

1. For Non Allopathic Doctors- Not applicable

Qualified Allopathic medical 2.Min DSCR- 1.5:1

practitioners. Given as MTL for Corporates, 3. PRICING

Buying equipment, Setting up of Partnerships & Trusts - For Loan more than 25 Lacs- CRA below SB 9 will not be considered.

Max 7 Yrs with 12

DOCTOR PLUS Clinics, Purchase of Ambulance, 15% Individuals - All 4. for Loan upto 2 Crs- No tangible security, to be covered under

months moratorium

Computers, Vehicles - Centres - Min - 10 CGTMSE. Above 2 Crs - Minimum 25% Tangible Security & Personal

Expansion/modernisation of Lacs & Max 5 Cr. Guarantee of promoters required.

existing premises, etc.

G.V. Giri, SBLC, Trichy

Page 1

SME PRODUCTS

Asset Product PURPOSE MARGIN LIMIT REPAYMENT OTHER FEATURES

1. Min CRA SB 9 and above

New/existing 2. Max 12 times in a year the scheme can be availed with the gap of

To meet unforeseen expenditure/

units with 15 days.

bulk orders/tax /repairs - No 20% of FBWC,

SME CREDIT PLUS FBWC of Rs.25 2 Months 3. Standard for 2 years.

cheque book to be issued - Clean Max 25 Lacs

lacs & over are 4. Customers of High standing and integrity.

Cash Credit - EM to be extended.

eligible 5. Existing security to be extended.

6. Limit to be renewed along with working capital every year

If availed SME Credit Plus no SLC - Export orders - WC funds at short

SSI & C&I borrowers rated SB 10

STANDBY LINE OF 15% of WC notice in times of urgent need. EM to be extended - Sufficient DP to

& abv - ECR above 'D' mandatory 3 Months

CREDIT Max 20 Crores be available - Can be availed any no. of times in a year.

for Rs.10 cr & above

DISCONTINUED

SBI SHOPPE

SCHOOL PLUS DISCONTINUED

Margin : 1. Minimum of CRA SB-9 & above, Min CIBIL 680

CONSTRUCTION Term loan for funding of purchase 10%/15% - Min - 25 Lacs; 2. Profit in last financial year, Gross DSCR > 1.25%

Not to exceed 5 years. 3. Satisfactory track record with no SMA/NPA.

EQPT LOAN of new Construction Equipments With Coll./No Max - 10 Crs.

Collaterals 4. Pricing based on CRA rating. Min Collaterals : 25%

T/L: 15-25%,

5-7 Yrs, excluding Loan upto 50 Lacs - No Collateral - obtain CGTMSE Cover,

Loan as T/L, CC, LC, BG, Credit WC Stocks -

DAL MILL PLUS Not specified gestation period of 50 L-1 Cr : only if Guarantee fee to be borne by borrower.

Plus 15-20%, Book

1 year Without CGTMSE - 75% collateral to be insisted.

Debts-25-40%

SME OPEN TERM Scheme for CRA upto SB 6 only, Max 3 Years,

10% Max 2.5 Crore Limits to be utilized within 12 months of sanction

LOAN ECR - BBB and above 5 yrs-On selective basis

SHISHU : Upto 50,000, Daily Cash/POS

Covers Non-Farm activities in Manufacturing, TARUN : 5,00,001 to Rs. 10 lacs,

withdrawal limit : 10,000/15,000

PRADHAN MANTRI Trading & Services with credit limit upto Rs.10 lacs KISHORE : 50,001 to Rs. 5 lakhs,

Daily Cash/POS withdrawal limit : 20,000/30,000

MUDRA YOJNA under SME and RBU. Accounts are guaranteed by CGFMU.

Daily Cash/POS limit : 15,000/25,000

Greenfield enterprises may be in manufacturing, services or trading

Objective : To facilitate loans to CTL - 7 years incl. sector. SIDBI to maintain web-portal, NABARD will take care of the

Standup India Min: 10 lacs,

atleast One SC, 1 ST or One 10% to 25% moratorium of 18 training, LDMs to serve as contact points for SIDBI, NABARD & Banks,

Scheme Maximum: 1 Crore

Women borrower per branch. months Guarantee cover available from

Credit Guarantee Scheme for Standup India (CGSSI).

G.V. Giri, SBLC, Trichy

Page 2

SME PRODUCTS

Asset Product PURPOSE MARGIN LIMIT REPAYMENT OTHER FEATURES

Drop-line Overdraft facility - Units engaged in LTV % - 50% of Realisable Value of property, SARFAESI Complaint exclusive property, Property to be

Min > 10 Lac,

within 25 km radius from the branch, 2 TIRs for loans above Rs.25 lacs, Half-yearly Inspection, CRA to be

manufacturing and services activities along with Max: 20 Crores,

ABL done but not related to Pricing, Renewal not applicable - Only Yearly Review, Borrower to submit Cash

self-employed & professional individuals covered Repayment : 12 M to Flow Statement for the entire tenor initially itself and annually therafter during review. Valuation of

by MSMED Act 2006, wholesale/ retail trade. 180 M. Property: Once in 3 years.

ABL-CRE-CP Drop-line Overdraft facility - Min > 10 Lac, Max: 50

Proprietorship/Partnership/ Cr Repayment : 12 M for TIER I - Rs. 50 Cr, Tier II & III - Rs.20 Cr, Tier IV, V, VI - Rs.5 Crores

(Commercial LTV - 50%

LTV% - 50% of Realisable Value of property

Project) Company to 72 M

Financing of inventory purchases SCFU operations -

Electronic Dealer of the Dealers - 24 x7 MIS 100% financing Nodal Br. - SME Comfort Letter to be 1. Bipartite agreement to be signed by IM & our Bank

Finance Scheme Support, of invoices - Shivsagar Estate issued by Industry Major 2. Electronic mode of transactions reduces branch visit by dealers -

(e-DFS) NIL Margin to its Dealer Cheapest rate of interest

No cheque book Branch, Mumbai 3. Flexible Collateral terms - 25% in the form of TDR/EM

1. Minimum Gross DSCR of 1.75

For all general commerical

Maximum : 50 lacs, 2. TOL/TNW not be ordinarily exceed 3

purposes such as capital 3 years - Can be

General Purpose Minimum Loan 3. Total Long Term Liabilities to equity not to exceed 2:1

expenditure, R&D, repaying high 25% extended to 5 yrs in

Term Loans for SSIs preferred - 25 lacs 4. Current Ratio not to be less than 1

cost debits, shoring up of NWC, deserving cases

and above 5. Minimum CRA of SB7 and above

etc.

6. Should have earned pretax Profits for 3 proceeding yrs

WC/TL - Smart Assessment as per SME Credit Card Scheme - Prof & SE : 50% of

To increase flow of credit to

Revised General Card/Debit Card to be Valid for 3 years, subject Gross Income, SSI/Traders : 20% of Projected Annual Turnover. TIN

individuals for entrepreneurial 20%

Credit Card issued. to annual review No./Service Tax Registration No. to be obtained and Sales to be

activity in the non-farm sector

Maximum - 5 lacs verified with VAT & Service Tax returns, wherever applicable.

For working capital requirements Upto 25000-

as well as cost of tools & NIL Valid for 3 years, subject Assessment by Nayak Committee norms and will be based on

Artisan Credit Card equipments required for CC - Max 2 lacs

25000-2 Lacs- to annual review simplified scoring model. Minimum Score: 60%

manufacturing process 20%

Working capital requirements for purchase of tools

Minimum Marks 60% as per Scoring Model. Loan is provided @ 6%.

& equipments required for carrying out weaving CC valid for 3 years,

By way of Term Loan Margin money assistance @ 20% of the project cost subject to

Weaver Credit activity. Possession of Photo ID Card issued by subject to annual

and Cash Credit - maximum of Rs.10,000/- available. Loans guaranteed under CGTMSE

Card Development Commissioner (Handlooms) or the review. TL - 3

Max 2 lacs to the tune of 85%. Cir Ref: NBG/SMEBU-Weaver/CRE/85/2013-14

State Govt. is a necessary pre-condition for availing years

dtd 13/3/14

the scheme.

DISCONTINUED SCHEMES : TRANSPORT PLUS, RENT PLUS, RICE MILL PLUS, PARYATAN PLUS, SBI SHOPPE, SBI SHOPPE PLUS, SCHOOL PLUS, TRADERS EASY LOAN, STREE

SHAKTI, SBI SMILE.

G.V. Giri, SBLC, Trichy

Page 3

SME PRODUCTS

Liability Product MIN BALANCE

FEATURES/REMARKS

1. A product to provide fee collection for institute, colleges 2.

Cheque book not provided and No Overdraft permitted,3. Txn other

Penalty for non maintaining MAB Rs.1000/- + ST

POWER JYOTI 50000/- (MAB) than fee collection not permitted at Non home branch, 4. In single

challan- Max 10 types of fees can be collected (Challan in 3 parts)

POWER BASE 20000/- (QAB) PENALTY: Non maintaining QAB - 3000/-, Closing A/c within 12 months- 750/-, RTGS/NEFT-Normal, DD-2/1000

POWER GAIN 2 LACS (MAB) PENALTY: Non maintaining MAB - 1500/- + ST, Closing A/c after 14 days - 1000/- + ST, RTGS/NEFT-Free, DD-1/1000

POWER PACK 5 LACS (MAB) PENALTY: Non maintaining MAB - 2500/- + ST, Closing A/c after 14 days - 1000/- + ST, RTGS/NEFT/DD/BC -Free

Account may be opened with ZERO balance. Non-maintenance of MAB - Rs.500/-, Closing A/c after 14 days - 1000/- + ST, DD/BC/IOI -

POWER POS MAB - Rs. 5000 At par, Outstation cheque collection - 50% of normal card rates - Cash handling charges : free upto Rs.25,000/- . Duplicate Statements -

Chargeable, Standing Instructions - Free. POS-OD - 25% of last 6 months transactions, Min Loan : Rs. 25000/-, Max : Rs. 5 lacs (e-Cir

No. NBG/TBU-LTP/4/2016 - 17 dated 9/8/2016)

PENALTY : Non maintaining QAB - 300/-, To provide basic banking facility to the low profile business community - Drawings per cheque

SME Sahaj QAB - Rs.1000

and also in ATMs is limited to Rs.15,000/- The account holder is permitted to remit Cash to the extent of Rs.10,000/- on any one

working day.

Normal CA MAB 10,000/- Penalty : Rs.500/- + ST for not maintaining MAB.

Penalty : Rs.500/- + ST for not maintaining MAB. Period : 1-3 yrs, Threshold limit : Rs. 1 lac, Initial Deposit : Rs. 1 lac and in multiples of

Surabhi MAB 10,000/-

Rs.10,000/-, No loan facility available.

G.V. Giri, SBLC, Trichy

Page 4

Vous aimerez peut-être aussi

- Jibo Question BankDocument43 pagesJibo Question Bankjyottsna27% (15)

- Judicial Affidavit Collection of Sum of MoneyDocument4 pagesJudicial Affidavit Collection of Sum of Moneypatricia.aniya80% (5)

- JiboDocument33 pagesJibojyottsna67% (3)

- Forecasting: Questions and Answers Q6.1 Q6.1 AnswerDocument28 pagesForecasting: Questions and Answers Q6.1 Q6.1 AnswerjyottsnaPas encore d'évaluation

- Mba HW Prob 1Document2 pagesMba HW Prob 1Mercedes JPas encore d'évaluation

- Machine Tooling Business PlanDocument35 pagesMachine Tooling Business PlanDeepak DileepPas encore d'évaluation

- 14Document69 pages14Shoniqua Johnson100% (2)

- PDFDocument49 pagesPDFSreedhar SrdPas encore d'évaluation

- SBIDocument45 pagesSBILakisha GriffinPas encore d'évaluation

- Model Test Paper 2023 Master FileDocument21 pagesModel Test Paper 2023 Master FileDinesh BabuPas encore d'évaluation

- Global Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Document9 pagesGlobal Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Rajkot academyPas encore d'évaluation

- Updates On Global Credit Exposure Policy 2020 - KEDAR KULKARNIDocument11 pagesUpdates On Global Credit Exposure Policy 2020 - KEDAR KULKARNIShilpa JhaPas encore d'évaluation

- Sme LoanDocument3 pagesSme LoanHemrajSainiPas encore d'évaluation

- Global Exposure PolicyDocument19 pagesGlobal Exposure PolicyRajkot academyPas encore d'évaluation

- BOI MSME Loan ProductsDocument95 pagesBOI MSME Loan ProductsganpatigajanandganeshPas encore d'évaluation

- Role of Sidbi - 2019Document16 pagesRole of Sidbi - 2019Kiran KesariPas encore d'évaluation

- Credit Process Manual For Lending Against GoldDocument28 pagesCredit Process Manual For Lending Against GoldAmit SinghPas encore d'évaluation

- Discretionary Lending Power Updated Sep 2012Document28 pagesDiscretionary Lending Power Updated Sep 2012akranjan888Pas encore d'évaluation

- Promopedia - MSME Products Special 2020Document23 pagesPromopedia - MSME Products Special 2020Ananda Shingade100% (1)

- Sme GoonjDocument2 pagesSme GoonjDEVENDRA PRAKASHPas encore d'évaluation

- Details of Rooftop Solar - Dec'20Document3 pagesDetails of Rooftop Solar - Dec'20shahnawaz1709Pas encore d'évaluation

- JLR Special Scheme For Salaried CustomersDocument5 pagesJLR Special Scheme For Salaried CustomersJay ShahPas encore d'évaluation

- Banking OadsdDocument85 pagesBanking Oadsdkalis vijayPas encore d'évaluation

- DSA Business Loans PolicyDocument28 pagesDSA Business Loans PolicyS GothamPas encore d'évaluation

- Mudra: I. Scheduled Commercial BanksDocument8 pagesMudra: I. Scheduled Commercial BanksAAradhya PharmaceuticalsPas encore d'évaluation

- Mudra: I. Scheduled Commercial BanksDocument8 pagesMudra: I. Scheduled Commercial BanksThe small TraderPas encore d'évaluation

- Car LoanDocument16 pagesCar LoanRajkot academyPas encore d'évaluation

- Bcc:Br:104:404 20.11.2012 Circular To All Branches and Offices in IndiaDocument12 pagesBcc:Br:104:404 20.11.2012 Circular To All Branches and Offices in IndiaamilcarPas encore d'évaluation

- Hand Book On Retail Loan Products PDFDocument78 pagesHand Book On Retail Loan Products PDFparadise_27Pas encore d'évaluation

- SME 2012 QuestionsDocument7 pagesSME 2012 QuestionsraviPas encore d'évaluation

- Eligibility Criteria EngDocument5 pagesEligibility Criteria EngUjwal BarmanPas encore d'évaluation

- 1 Oriental Sme Development Scheme EligibilityDocument4 pages1 Oriental Sme Development Scheme EligibilitydocsanshmPas encore d'évaluation

- Introduction To MSME ProductSDocument24 pagesIntroduction To MSME ProductSPraveen TiwariPas encore d'évaluation

- Credit Processing For CVDocument5 pagesCredit Processing For CVBhaskar GarimellaPas encore d'évaluation

- MSMEs BookletDocument72 pagesMSMEs Bookletlucky_rishikPas encore d'évaluation

- Business Loan: Normal Current AccountDocument16 pagesBusiness Loan: Normal Current AccountUthaiah CmPas encore d'évaluation

- Chartered Accountant Meet Ao Nagpur Welcomes YouDocument15 pagesChartered Accountant Meet Ao Nagpur Welcomes YouEmmy RoyPas encore d'évaluation

- Ns Industry ChampDocument2 pagesNs Industry ChampBina ShahPas encore d'évaluation

- MSME Schemes Key Points 16.01Document6 pagesMSME Schemes Key Points 16.01Ananda ShingadePas encore d'évaluation

- Axis - Microfinance Industry - Sector Report - Bandhan Bank and CreditAccess Grameen - 04-03-2021Document40 pagesAxis - Microfinance Industry - Sector Report - Bandhan Bank and CreditAccess Grameen - 04-03-2021anil1820Pas encore d'évaluation

- Car LoanDocument16 pagesCar LoanRajkot academyPas encore d'évaluation

- L&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Document15 pagesL&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Tejas GaubaPas encore d'évaluation

- LIC Housing Finance LTD FDDocument6 pagesLIC Housing Finance LTD FDBiswa Jyoti GuptaPas encore d'évaluation

- Mudra Eligibility Criteria For Partner Institutions: I. Scheduled Commercial BanksDocument6 pagesMudra Eligibility Criteria For Partner Institutions: I. Scheduled Commercial BanksI. SarithaPas encore d'évaluation

- Sample Credit PolicyDocument5 pagesSample Credit Policykrishna chandraPas encore d'évaluation

- Msme Product-Baroda Academy KolkataDocument28 pagesMsme Product-Baroda Academy KolkataSAMBITPRIYADARSHI100% (1)

- Bard NoteDocument20 pagesBard NoteAmulya Kumar SahuPas encore d'évaluation

- Indian Overseas BankDocument7 pagesIndian Overseas BankElora NandyPas encore d'évaluation

- Ftcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)Document10 pagesFtcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)rohinidhebe1Pas encore d'évaluation

- Ticket Mukesh AhmedabadDocument26 pagesTicket Mukesh AhmedabadSURANA1973Pas encore d'évaluation

- GOB Stimulus PackagesDocument28 pagesGOB Stimulus PackagesshuvojitPas encore d'évaluation

- Bank Audit Sheet ImpDocument3 pagesBank Audit Sheet ImpPULKIT MURARKAPas encore d'évaluation

- MSME Overview PNBDocument29 pagesMSME Overview PNBshobhita_9Pas encore d'évaluation

- What Is Ns Mid & Small Cap?Document2 pagesWhat Is Ns Mid & Small Cap?Bina ShahPas encore d'évaluation

- Mutual Fund:: Asset Management CompanyDocument43 pagesMutual Fund:: Asset Management CompanymalaynvPas encore d'évaluation

- The Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsDocument37 pagesThe Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsvelankanniamPas encore d'évaluation

- Series TEN - Day TwoDocument5 pagesSeries TEN - Day TwoMaghesh BishtPas encore d'évaluation

- Pmfme Loan PolicyDocument7 pagesPmfme Loan PolicyHarika VenuPas encore d'évaluation

- Indian Bank: IB TradewellDocument10 pagesIndian Bank: IB TradewellElora NandyPas encore d'évaluation

- BOB - 15032022 Detailed-Advertisement-Frm-Rmd-23-03Document27 pagesBOB - 15032022 Detailed-Advertisement-Frm-Rmd-23-03Sandeep kumar TanwarPas encore d'évaluation

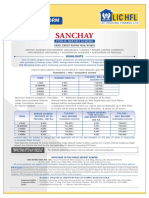

- Sanchay Public Deposit Scheme FormDocument6 pagesSanchay Public Deposit Scheme FormChilly IvaPas encore d'évaluation

- Sme WC AssessmentDocument8 pagesSme WC Assessmentvalinciamarget72Pas encore d'évaluation

- Kishore.m ED PaperDocument12 pagesKishore.m ED Paperbalaji shanmugamPas encore d'évaluation

- Final Project ReportDocument18 pagesFinal Project ReportUsamaNaeemPas encore d'évaluation

- Tata Capital Latest 1 PAGER POLICYDocument2 pagesTata Capital Latest 1 PAGER POLICYPRIYANKA DASPas encore d'évaluation

- Brew The Beer : Learn The Business of Brewing: Alcohol, #1D'EverandBrew The Beer : Learn The Business of Brewing: Alcohol, #1Pas encore d'évaluation

- New Leave Travel Concesssion (LTC) / Home Travel Concession (HTC) Scheme"Document35 pagesNew Leave Travel Concesssion (LTC) / Home Travel Concession (HTC) Scheme"jyottsnaPas encore d'évaluation

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesjyottsnaPas encore d'évaluation

- Timetable Routes From Shimla 1 PDFDocument2 pagesTimetable Routes From Shimla 1 PDFjyottsnaPas encore d'évaluation

- Detail List of 3330 BGL-CGL AccountsDocument93 pagesDetail List of 3330 BGL-CGL Accountsjyottsna0% (1)

- Reading Material Dec2020Document14 pagesReading Material Dec2020jyottsnaPas encore d'évaluation

- Shivali Fashion Private LimitedDocument5 pagesShivali Fashion Private LimitedjyottsnaPas encore d'évaluation

- Scanned by CamscannerDocument26 pagesScanned by CamscannerjyottsnaPas encore d'évaluation

- TLP Phase 2 - Day 17 SynopsisDocument7 pagesTLP Phase 2 - Day 17 SynopsisjyottsnaPas encore d'évaluation

- Commerce MCQ HUB PDFDocument301 pagesCommerce MCQ HUB PDFjyottsna100% (1)

- Draft Not To Be Quoted Wage Differentials Between Union and Non-Union Workers: An Econometric AnalysisDocument28 pagesDraft Not To Be Quoted Wage Differentials Between Union and Non-Union Workers: An Econometric AnalysisjyottsnaPas encore d'évaluation

- 10 July Sbi Car LoanDocument8 pages10 July Sbi Car LoanjyottsnaPas encore d'évaluation

- Sociology Social Sciences PDFDocument13 pagesSociology Social Sciences PDFjyottsnaPas encore d'évaluation

- Bank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)Document30 pagesBank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)jyottsnaPas encore d'évaluation

- Discussion On Rbi Grade B 2019 Notification + Study PlanDocument28 pagesDiscussion On Rbi Grade B 2019 Notification + Study PlanjyottsnaPas encore d'évaluation

- CH - 2.1 Concept of Proverty and Various Estimation CommitteeDocument24 pagesCH - 2.1 Concept of Proverty and Various Estimation CommitteejyottsnaPas encore d'évaluation

- Fee Structure USOL PDFDocument2 pagesFee Structure USOL PDFjyottsnaPas encore d'évaluation

- Sr. No. Name of The Course Semester-I/III/V Semester-II/IV/VI Fee CodeDocument2 pagesSr. No. Name of The Course Semester-I/III/V Semester-II/IV/VI Fee CodejyottsnaPas encore d'évaluation

- Discussion On Rbi Grade B 2019 Notification + Study PlanDocument28 pagesDiscussion On Rbi Grade B 2019 Notification + Study PlanjyottsnaPas encore d'évaluation

- Passage Based Questions 1 2 3:: Destiny Series Day 1: Total Questions 20 For Phase 1 +2Document4 pagesPassage Based Questions 1 2 3:: Destiny Series Day 1: Total Questions 20 For Phase 1 +2jyottsnaPas encore d'évaluation

- UPSC Prelims 2018 - Question Paper With Detailed Solutions & Answer KeyDocument27 pagesUPSC Prelims 2018 - Question Paper With Detailed Solutions & Answer KeyjyottsnaPas encore d'évaluation

- Easy Way To Remember CurrenciesDocument5 pagesEasy Way To Remember Currenciesjyottsna100% (2)

- Pu - CHD Post-Graduate Examination Fee: Admn Office Sec 14 Panjab University,, Chd-160014Document2 pagesPu - CHD Post-Graduate Examination Fee: Admn Office Sec 14 Panjab University,, Chd-160014jyottsnaPas encore d'évaluation

- Form No. SH-4 - Securities Transfer Form: (Share Capital and Debentures) Rules 2014)Document2 pagesForm No. SH-4 - Securities Transfer Form: (Share Capital and Debentures) Rules 2014)jyottsnaPas encore d'évaluation

- VKDocument4 pagesVKjyottsnaPas encore d'évaluation

- Advocacy Strategy ManualDocument53 pagesAdvocacy Strategy ManualINFID JAKARTA100% (1)

- Annuity Calculator: Withdrawal PlanDocument2 pagesAnnuity Calculator: Withdrawal PlanAjay SinghPas encore d'évaluation

- Ra 9184 Nea PDFDocument39 pagesRa 9184 Nea PDFMu SePas encore d'évaluation

- International Trade and Finance GuidanceMultipleChoiceQuestionsDocument12 pagesInternational Trade and Finance GuidanceMultipleChoiceQuestionsBhagyashree DevPas encore d'évaluation

- Business Analysis ReportDocument13 pagesBusiness Analysis Reporthassan_401651634Pas encore d'évaluation

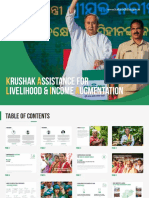

- WWW - Kalia.odisha - Gov.in: Rushak Ssistance For Ivelihood & Ncome UgmentationDocument44 pagesWWW - Kalia.odisha - Gov.in: Rushak Ssistance For Ivelihood & Ncome UgmentationBhabasankar DasPas encore d'évaluation

- Original Report of JEUFODocument86 pagesOriginal Report of JEUFOroni jeufoPas encore d'évaluation

- Labasan V LacuestaDocument3 pagesLabasan V LacuestaGracia SullanoPas encore d'évaluation

- Model Agreement For An Assured Shorthold Tenancy and Accompanying GuidanceDocument50 pagesModel Agreement For An Assured Shorthold Tenancy and Accompanying GuidancesokrisbaPas encore d'évaluation

- List of Tally LedgersDocument20 pagesList of Tally LedgersRanjanPas encore d'évaluation

- Assignment 2 - Stock ValuationDocument1 pageAssignment 2 - Stock ValuationMary Yvonne AresPas encore d'évaluation

- VP Director Strategic Marketing in New York City Resume Valerie ObenDocument2 pagesVP Director Strategic Marketing in New York City Resume Valerie ObenValerieObenPas encore d'évaluation

- Ia04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1Document11 pagesIa04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1mohanraokp2279Pas encore d'évaluation

- Katherine Gaal ResumeDocument1 pageKatherine Gaal Resumeapi-302146400Pas encore d'évaluation

- Transfer Vehicle Ownership ProcedureDocument2 pagesTransfer Vehicle Ownership ProcedureAnonymous JmiKPByYwhPas encore d'évaluation

- Tds - Tax Deducted at Source: FCA Vishal PoddarDocument22 pagesTds - Tax Deducted at Source: FCA Vishal PoddarPalak PunjabiPas encore d'évaluation

- Chapter 6 Solutions Interest Rates and Bond ValuationDocument7 pagesChapter 6 Solutions Interest Rates and Bond ValuationTuvden Ts100% (1)

- InvoiceDocument1 pageInvoicePIYUSH CHETARIYAPas encore d'évaluation

- How To Game Your Sharpe RatioDocument21 pagesHow To Game Your Sharpe RatioCervino InstitutePas encore d'évaluation

- Harrison Chapter 5 Student 6 CeDocument46 pagesHarrison Chapter 5 Student 6 CeAliyan AmjadPas encore d'évaluation

- BES EE Batch 2023Document46 pagesBES EE Batch 2023Rufa Mae CabatinganPas encore d'évaluation

- Housing Development Control and Licensing Amendment Act 2012 Amendment Regulations 2015Document2 pagesHousing Development Control and Licensing Amendment Act 2012 Amendment Regulations 2015Kalaiyalagan KaruppiahPas encore d'évaluation

- 14 Financial Statement Analysis: Chapter SummaryDocument12 pages14 Financial Statement Analysis: Chapter SummaryGeoffrey Rainier CartagenaPas encore d'évaluation

- Pair Nifty Bank NiftyDocument3 pagesPair Nifty Bank NiftyRavi KiranPas encore d'évaluation

- Lista Acte CanadaDocument2 pagesLista Acte CanadaDinulescu Marius0% (1)

- PAS 29 Finanacial Reporting in Hyperinflationary EconomiesDocument17 pagesPAS 29 Finanacial Reporting in Hyperinflationary Economiesrena chavezPas encore d'évaluation