Académique Documents

Professionnel Documents

Culture Documents

The 2016 990 Form For The VDare Foundation

Transféré par

ThinkProgress100%(1)100% ont trouvé ce document utile (1 vote)

9K vues39 pagesThis is the 2016 990 form for the white supremacist VDare Foundation, which is able to raise more money due to its tax-exempt status

Titre original

The 2016 990 form for the VDare Foundation

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis is the 2016 990 form for the white supremacist VDare Foundation, which is able to raise more money due to its tax-exempt status

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

9K vues39 pagesThe 2016 990 Form For The VDare Foundation

Transféré par

ThinkProgressThis is the 2016 990 form for the white supremacist VDare Foundation, which is able to raise more money due to its tax-exempt status

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 39

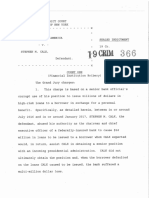

[efile GRAPHIC print DO NOT PROCESS As Filed Data-[ DLN: 93493208000357]

rom990 Return of Organization Exempt From Income Tax ee

2 Under section 504(c), 527, or 4947(a)(1) ofthe Internal Revenue Code (excent private | D(V1G6

Deets the Teun

foundations)

> Do not enter social security numbers on this form as it may be made public ‘Open to Public

intemal Revenie Serice ee atad

Information about Form 990 and its instructions Is at ww IRS gov/form990

A For the 2016 calendar year, or tax year beginning 01-01-2016, and ending 12-31-2016

B check t appicavle [Tamers mamarten Employer identification number

adress change 2

22-3691487

Dame change

Dinnal seu Dong anes we

Fina

Burntermnatad -irber and Sra for FO” Box Fras ak dlvared Wo Sree dies Roomate i eeane aay

TD Apptcation pending (860) 361-6231

‘Gipj ar own, state or province, couniy, Sn ZIP or Toregn posal code

pet Oe 6 cross recnts $441,752

F Name and address of principal offic

PETER BRIMELOW

447 SOUTH STREET subordinates? Dyes no

1H(@) Ts this a group return for

LITCHFIELD, CT_06759 SS eee Ores Do

1 Toceremet sas FF sovexa) C1 souey( ya inceto) Cl eserannr Os I1°No," attach a ist (see instructions)

J Websiter> WWW VDARE CONS] A) Group exemption number

Krom oferanzavon SA corporton C trst CO Asscavon CI oer Year offormaton 1989, TM State ofa domcle NY

EEE summary,

1 Bray desenbe the organzabr’s mason or mast agnieant aches

CREATE AND MANAGE INTERNET PUBLICATION

2 | 2 check this box » C1 if the organization discontinued its operations or disposed of more than 25% of its net assets

5 | 3 umber of voting members ofthe governing body (Part Vi ine Ta) 3 5

| 4 umber of independent voting members of the governing body (Part VI,ine 15). + ws 4 3

£ 5 Total number of individuals employed in calendar year 2016 (Part V, line 2a) 5 °

5 | 6 otal number of volinteers (estimate rfnecessay) se se ee 6 3

& | 7a Total unrelated business revenue from Part VIII, column (C),line12 6 + + sw ew 7a 0

b Net unrelated business taxable ncome from Form 990°, ine 34. vs vv + we 7 2

Prior Year Current Year

gg | ® Contnbutons and grants (Pare VIE, Ine tH) vv ee ee ee 267,038] 440,988

2 | 9 Program service revenue (Part VIIE,ne 25). +e ss vee 0] 3

B | 10: tovestment mcome (Part VI, column (A), lines 3, 4,and 74) sss 26,625] 768

AL other revenue (Part VII, column (A), lines 5, 64, 8, c, 10¢, and Ae) G 3

12 Total revenue—add lines 8 throug! {must equal Part VIII, column (A), line 12) 293,663) 441,752

43 Grants and smlar amounts paid (Park IX, column (A), nes £3) = s+ a] 3

44 Benefits paid to or for members (Part IX, column (A), ine 4) : 0] 3

4g, [15 Salanes, ether compensation, employee benefits (Part If, column (A), lines 5-10) 0] 3

2 | 6a Professional fundraising fees (Part I, column (A), line tte) 9] 3

& |b roxaitnarassing expenses (Por 1s, oki (0), ne 25) PO

| 47 otner expenses (Part 1%, column (A), ines 11a-114, 1iF24e) . = 333,727| S764

48 Total expenses Add lines 13-17 (must equal Part IX, column (A), ine 25) 333,727 374,642

19 Revenue les expenses Subtract ine 18 fromline 12. ws 240,064] 229,690

3e Beginning of Current Year] End of Year

Be

Sg | 21 Total labiives (Par X, ne 26) oe 2,384] 6.142

Za | 22 Net assets or fund balances Subtract ine 21 from line 20... ++ 335,219 178,813

EEENSEE Signature Block

Under penalties of perjury, I declare that I have examined this return, indluding accompanying schedules and statements, and to the best of my

knowledge and belie, ts true, correct, and complete Declaration of preparer (other than officer) is based on all information of which preparer has

any knowledge

\ et 2017-07-06

i Signature oF oc Date

Sign "

Here PETER BRIMELOW CHAIRMAN

ype oF pnnt name and ttle

Paniiype preparers name Treparers spnature Date oa

5 ‘CHERYL A BAKEWELL CPA CHERYL A BAKEWELL CPA 2017-07-06 | check C) «| po0370023

Paid sel-amaloved

Preparer | fimanane_> SAGNEL# WUMREUE ris EIN Be 27-3305747

Use Only rr one z

NEW MILFORD, CT_0676

May the IRS discuss this return with the preparer shown above? (see instructions) oe . oe . es No

For Paperwork Reduction Act Notice, see the separate instructions. Cat No 112827 Form 990 (2016)

Form 990 (2026) Page 2

[EEEIE) Stotement of Program Service Accomplishments

Check if Schedule © contains a response or note to any line inthis Parti]. + + + + + oe . . a

1

Briefly describe the organization's mission

TO CREATE AND MANAGE INTERNET PUBLICATION

2 Did the organization undertake any significant program services during the year which were not listed on

the prior Form $90 or 990-E2? rT oe . . Oves Mino

If "Yes," describe these new services on Schedule 0

3. Did the organization cease conducting, or make significant changes in how it conducts, any program

[yin od oo olo goo Do blo ooo ood ood ooo Ores

If "Yes," describe these changes on Schedule 0

4 Desenbe the organization's program service accomplishments for each of its three largest program services, as measured by expenses

Section 501(¢)(3) and 501(c)(4) organizations are required to report the emount of grants and allocations to others, the total

expenses, and revenue, if any, for each program service reported

4a (Code Veepenses 5 S7i,G82 eluding grants oF § ) (Revenue s y

‘See Additional Osta

4b (Code Veepenses 5 including orants oF ) (Revenue s y

ae (Code Vepenses 5 Tncluding rants of ) (Revenue s Y

“4d__ Other program services (Desenbe in Schedule 0)

(Expenses $ including grants of $ ) (Revenue $ )

de _Total program service expenses. 571,642

Fon 990 (2016)

Form 990 (2026)

10

a

14a

15

16

v7

18

19

Se

Page 3

EEMEM checkiist of Required Schedules

Yes [ No

1s the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? If “Yes,” complete Yes

Schedule A) a ace re

Is the erganzaton required to complete Schedule B, Schedule of Contnbutos (see mstrucions)? z Ne

Did the orgaruzation engage n director indirect poliveal campaign activites on behalf of or n opposition to candidates Ne

for public oie? IF"Yes," complete Schedule C, Part T 3

3 501(c)(3) organizations.

Did the organization engage lobbying achvites, oF have a section 501(h) election in effet during the tax year?

1 Ves," complete Schedule C, Pat TT 4 No

Is the organization a section 501(c)(4), $04(c)(S), or $03(c)(6) organization that receives membership dues,

assessments, or simlar amounts 25 defined in Revenue Procedure 96-197

"Ves," complete Schedule C, Pare IIT 5 No

Did the organization maintan any doner advised funds or any similar funds or accounts for which éonors have the right

to provide advice on the distvoution oy rvestment of amounts in such funds or secounts?

10 "Yes," complete Schedule D, Part! 6 o

Did the organization receive or hold a conservation easement, inclusing easements to preserve open space,

the environment, histone land areas, or historic structures? If "Yes," complete Schedule D, Part IT 2)» 7 No

Did the organization maintain collections of works of art, hstoncl treasures, or other similar assets? 7

11 Ves,” complete Schedule D, Par 11 ae : 8 e

Did the orpantation report an amount n Part X, ne 21 for escrow or custedalsecountlabity, serve as a custodian

foramen ates ak pone cre eunslng, cet Nenageren, ea en, Of det eg

serwces?If "Yes," complete Schedule D, Pa IV&%) evs Se 2 No

Did the organization, rectly or through a related organization, hold assets in temporanly rest 10 No

permanent endowments, or quasv-endowments? If "Yes," complete Schedule D, Part VI... «+ «

IF the organization's answer to any ofthe flloming questions is "Yes," then complete Schecule D, Parts VE, VIL, VII, Ix

or Xas applicable

Did the organization report an amount for land, buldings, and equipment in Part X, line 10

1 'Ves," complete Schedule D, Port Dee we et tal Ye

Did the organization ceport an amount for investments—other securities in Part X, ne 12 that 1s 5% or more ofits total

assets reported in Part X, line 167 If "Yes,” complete Schedule D, Part VII %) . 2b Ne

Did the organization report an amount for investments—program related in Part Xine 13 that 6 5% or more of ts

total assets reported in Part X, line 16? If Yes,” complete Schedule D, Part VIII) tc No

Did the organization report an amount for ether assets in Part X, lie 15 thats 5% or more of ts total assets reported

in Part X, line 167 1f “Yes,” complete Schedule O, Pare IX eee tia No

Did the organization report an amount for other lables in Part X, line 257 If Yes," complete Schedule 0, Pare xt) fy No

Did the organization's separate or consolidated financial statements for the tax year include 2 footnote that addresses °

the organization’ lablty for uncertan tax positions under FIN 48 (ASC 740)? IF "Yes," complete Schedule D, Part x | Hf a

Did the organization obtain separate, independent audited financial statements for the tax year?

Ves,” complete Schedule O, Parts XT and x1T *) Den ee 120 No

Was the organzation included in consolidate, independent audited financial statements for the tax year?

a2 No

1f es,” and if the erganizabon answered "No" to line 12a, then completing Schedule D, Parts XI and XIt 1s optional

1s the organization a school desenbed in section 170(b)(4)(A)(u)? JF "Yes," complete Schedule E 2 Ne

Did the organization maintain an office, employees, or agents outside ofthe United States? a 4a No

Did the organization have agoregate revenues or expenses of more than $10,000 from grantmaking, fundrasing

Buses estment and rogram eric ates outse te United States, or aggregntefregh vestments

valued at $100,000 er more? iF "Ves," complete Schedule F, Parts and IV. « am 1a No

Did the organization report on Part IX, column (A), ne 3, more than $5,000 of grants or other assistance to oF for any

foreign organization? If"Yes,” complete Schedule F, Parts Itand V+ as No

Od the oxganatn eprt on Par I; clumn (A), ine 3, re than 3,000 aggregate gras or other asitance to

or for foreign ineviduale? If "Yes," complete Schedule F, Parts Ill and IV. 16 No

Did the orgaruzation report a total of more than $15,000 of expenses for professional fundraising services on Part 1X, [47 Ne

column (A) lines 6 and 12e? If Yes," complete Schedule G, Part (see instructions)

Did the organization ceport more than $15,000 total of fundraising event gross income an contributions on Part VII,

and 8a? I Yes,” complete Schedule G, Part Il = 18 No

Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, Ine 9a? If Yes,”

3 i $15,000 of gaming : Voy No

complete Schedule G, Part I.» + + + ++ caer te

es

Vous aimerez peut-être aussi

- Letter From FEC Chair Regarding NRA/Russia LinksDocument5 pagesLetter From FEC Chair Regarding NRA/Russia LinksThinkProgressPas encore d'évaluation

- United States v. Maria ButinaDocument4 pagesUnited States v. Maria ButinaZerohedge100% (3)

- 5-21-19 Verified Complaint (File-Stamped) (00607747xACD46)Document104 pages5-21-19 Verified Complaint (File-Stamped) (00607747xACD46)Mike EckelPas encore d'évaluation

- 1 July 2019 Letter From Trump Defendants v. IthacaDocument2 pages1 July 2019 Letter From Trump Defendants v. IthacaThinkProgressPas encore d'évaluation

- 28 June 2019 Letter From Ithaca Plaintiffs v. Trump PanamaDocument70 pages28 June 2019 Letter From Ithaca Plaintiffs v. Trump PanamaThinkProgressPas encore d'évaluation

- EFD - Annual Report For 2018 - McSally, Martha EDocument9 pagesEFD - Annual Report For 2018 - McSally, Martha EThinkProgressPas encore d'évaluation

- Letter From Undocumented Former Trump EmployeesDocument2 pagesLetter From Undocumented Former Trump EmployeesThinkProgressPas encore d'évaluation

- DOJ Indictment of Stephen CalkDocument26 pagesDOJ Indictment of Stephen CalkThinkProgressPas encore d'évaluation

- Wyden, Heinrich, Harris 6 March 2019 Letter To Coats On Chinese InterferenceDocument1 pageWyden, Heinrich, Harris 6 March 2019 Letter To Coats On Chinese InterferenceThinkProgressPas encore d'évaluation

- Senators' Sept. 5 2018 Letter Inquiring About FARA Status of Rudy Giuliani's WorkDocument3 pagesSenators' Sept. 5 2018 Letter Inquiring About FARA Status of Rudy Giuliani's WorkThinkProgressPas encore d'évaluation

- Rasky Partners and Azerbaijan FARA RegistrationDocument8 pagesRasky Partners and Azerbaijan FARA RegistrationThinkProgressPas encore d'évaluation

- Chick Fil A Foundation 2017Document49 pagesChick Fil A Foundation 2017ThinkProgress0% (1)

- 1 May 2019 Letter To Rep. Jerry Nadler (D-NY) From Assistant AG Stephen BoydDocument5 pages1 May 2019 Letter To Rep. Jerry Nadler (D-NY) From Assistant AG Stephen BoydThinkProgressPas encore d'évaluation

- Spectrum Group Flier On Foreign Governmental ClientsDocument2 pagesSpectrum Group Flier On Foreign Governmental ClientsThinkProgressPas encore d'évaluation

- Rosenstein Resignation LetterDocument1 pageRosenstein Resignation Letterblc88100% (5)

- The 2017 990 Form For The Charles Martel SocietyDocument24 pagesThe 2017 990 Form For The Charles Martel SocietyThinkProgressPas encore d'évaluation

- March 30 2017 Letter From Brown, Cardin, Feinstein On Trump Organization and AzerbaijanDocument2 pagesMarch 30 2017 Letter From Brown, Cardin, Feinstein On Trump Organization and AzerbaijanThinkProgressPas encore d'évaluation

- Govt 390 - Fall 2017 SyllabusDocument4 pagesGovt 390 - Fall 2017 SyllabusThinkProgressPas encore d'évaluation

- Letter From U.S. Senators To Google CEO Sundar Pichai On "Dragonfly"Document3 pagesLetter From U.S. Senators To Google CEO Sundar Pichai On "Dragonfly"ThinkProgressPas encore d'évaluation

- Global Witness Report On Trump's Deal in Dominican RepublicDocument20 pagesGlobal Witness Report On Trump's Deal in Dominican RepublicThinkProgressPas encore d'évaluation

- The 2015 990 Form For The National Policy InstituteDocument13 pagesThe 2015 990 Form For The National Policy InstituteThinkProgressPas encore d'évaluation

- Order Granting Subpoena of American University For Maria Butina DefenseDocument3 pagesOrder Granting Subpoena of American University For Maria Butina DefenseThinkProgressPas encore d'évaluation

- FullDocument1 pageFullthepressprojectPas encore d'évaluation

- The 2017 990 Form For The New Century FoundationDocument15 pagesThe 2017 990 Form For The New Century FoundationThinkProgressPas encore d'évaluation

- Letter From 14 Human Rights Groups To Google About "Dragonfly" ProjectDocument4 pagesLetter From 14 Human Rights Groups To Google About "Dragonfly" ProjectThinkProgressPas encore d'évaluation

- Resignation Letter From Google Employee Over "Dragonfly" ProjectDocument6 pagesResignation Letter From Google Employee Over "Dragonfly" ProjectThinkProgressPas encore d'évaluation

- Clear Answers and Standards On Data Privacy Protection."Document2 pagesClear Answers and Standards On Data Privacy Protection."Anonymous ZXXhPuYZXPas encore d'évaluation

- June 2018 Letter From DOJ FARA Registration Unit To RM BroadcastingDocument4 pagesJune 2018 Letter From DOJ FARA Registration Unit To RM BroadcastingThinkProgressPas encore d'évaluation

- Louis Klemp Resignation LetterDocument1 pageLouis Klemp Resignation LetterThinkProgressPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)