Académique Documents

Professionnel Documents

Culture Documents

Form No 3CE

Transféré par

123vidyaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form No 3CE

Transféré par

123vidyaDroits d'auteur :

Formats disponibles

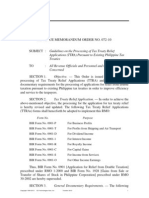

FORM NO.

3CE

[See rule 6GA]

Audit Report under sub-section (2) of section 44DA

of the Income-tax Act, 1961

1. I/We have examined the accounts and records of

[name and address of the non-resident with permanent account number] relating to the

business of the permanent establishment/fixed place of profession in India during the

year ended on the 31st day of March, .

2. I/We have obtained all the information and explanations which, to the best of my/our

knowledge and belief, were necessary for the purposes of the audit and for ascertaining

the amount of income by way of royalty/fees for technical services earned by the

assessee.

3. I/We certify that the right or property or contract in respect of which royalty/fees for

technical services is paid is effectively connected with the permanent

establishment/fixed place of profession in India.

4. I/We certify that the income by way of royalty/fees for technical services under

section 44DA of the Income -tax Act, 1961 in respect of the assessment year

is Rs. .

The information relating to the income by way of royalty/fees for technical services is

given in the Annexure to this Form. In my/our opinion and to the best of my/our

information and according to the information given to me/us, the particulars given above

are true and correct.

Signed

(Accountant)

Notes:

1. Delete whichever is not applicable.

2. This report is to be given by—

(a) a chartered accountant within the meaning of the Chartered Accountants Act,

1949 (38 of 1949); or

(b) any person who, in relation to any State, is, by virtue of the provisions in sub-

section (2) of section 226 of the Companies Act, 1956 (1 of 1956), entitled to

be appointed to act as an auditor of companies registered in that State.

3. “Fees for technical services”, “royalty”, and “permanent establishment” shall have

the same meaning as assigned to them in the Explanation to section 44DA of the

Income-tax Act, 1961.

4. Where any of the matter stated in this report is answered in the negative or with a

qualification, the report shall state the reasons therefor.

ANNEXURE

[See paragraph 3 of Form No. 3CE]

Details relating to income by way of royalty or fees

for technical s ervices

Printed from www.incometaxindia.gov.in Page 1 of 3

PART A

1. Name of the non-resident assessee :

2. Address of the permanent :

establishment/fixed place of profession in

India

3. Permanent account number :

4. Assessment year :

5. Status :

PART B

6. Nature of business or profession.

7. (a) Whether books of account are

prescribed under section 44AA, if yes,

list of books so prescribed.

(b) Books of account maintained.

(In case books of account are

maintained in a computer system,

mention the books of account

generated by such computer system.)

(c) List of books of account examined.

8. (a) Method of accounting employed in the

previous year.

(b) Whether there has been any change in Yes/No

the method of accounting employed

vis-a-vis the method employed in the

immediately preceding previous year.

(c) If answer to (b) above is in the

affirmative, give details of such

change, and the effect thereof on the

profit or loss.

PART C

9. Date of agreement with Government of

India or Indian concern (enclose a copy of

the agreement).

10. Details of the intangible property such as

know-how, copyrights, patents, etc. for use

in respect of which or the contract in

respect of which royalty/fees for technical

services is payable.

11. (a) Name and address of the payer

(b) Whether it is an associated enterprise Yes/No

12. (a) Is royalty/fees for technical services

payable in lump-sum or on other basis

Printed from www.incometaxindia.gov.in Page 2 of 3

payable in lump-sum or on other basis

(b) Details including rate, amount, etc.

13. Details of activity of the permanent

establishment/fixed place of profession in

India.

14. Nature of connection of the right or

property or contract in respect of

royalty/fees for technical services with the

permanent establishment/fixed place of

profession in India.

15. Details of expenditure or allowance which

is not wholly and exclusively incurred for

the business of the permanent establishment

or fixed place of profession in India.

16. Head-wise details of head office

expenditure or allowance allocable to the

permanent establishment/fixed place of

profession in India.

17. Details of reimbursement of actual expenses

by the permanent establishment/fixed place

of profession in India to head office or any

of its other offices.

Signed

Accountant

Printed from www.incometaxindia.gov.in Page 3 of 3

Vous aimerez peut-être aussi

- Empanelment Form IIDocument15 pagesEmpanelment Form IIANKESH SHRIVASTAVAPas encore d'évaluation

- Instruction Kit For Eform Inc-20A (Declaration For Commencement of Business)Document8 pagesInstruction Kit For Eform Inc-20A (Declaration For Commencement of Business)nshankla4Pas encore d'évaluation

- Format No. BCCM163458/PS-2 Schedule of Prices Withholding Tax For Non-Resident Bidders or Its Permanent Establishment (Pe) in IndiaDocument2 pagesFormat No. BCCM163458/PS-2 Schedule of Prices Withholding Tax For Non-Resident Bidders or Its Permanent Establishment (Pe) in IndiaBathina Srinivasa RaoPas encore d'évaluation

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABAAnonymous 2evaoXKKdPas encore d'évaluation

- KPMG - Change in Tax Audit ReportDocument5 pagesKPMG - Change in Tax Audit ReportDhananjay KulkarniPas encore d'évaluation

- Kansai Nerolac Software TDSDocument17 pagesKansai Nerolac Software TDSkumargaurav21281Pas encore d'évaluation

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABARajshree GuptaPas encore d'évaluation

- FORM A SEBIDocument17 pagesFORM A SEBIVibhor BhatiaPas encore d'évaluation

- Form CHG-1-16032017 Signe Cfil CDocument6 pagesForm CHG-1-16032017 Signe Cfil CsunjuPas encore d'évaluation

- Form INC-21 HelpDocument10 pagesForm INC-21 HelpranjitPas encore d'évaluation

- 1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023Document30 pages1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023ssb.corporateteamPas encore d'évaluation

- Public Ruling No. 11 - 2018 - Withholding Tax On Special Classses of IncomeDocument25 pagesPublic Ruling No. 11 - 2018 - Withholding Tax On Special Classses of IncomeNorsalzarinaPas encore d'évaluation

- Final Circular On Framework For Aircraft Operating Lease19022021010508Document8 pagesFinal Circular On Framework For Aircraft Operating Lease19022021010508VivekPas encore d'évaluation

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Republic of The Philippines Philippine Economic Zone AuthorityDocument1 pageRepublic of The Philippines Philippine Economic Zone AuthorityJude ItutudPas encore d'évaluation

- Notes To Form IDocument9 pagesNotes To Form ITauheedAlamPas encore d'évaluation

- Contractor Enlistment ProspectusDocument17 pagesContractor Enlistment Prospectusnit111Pas encore d'évaluation

- Guidance Note On CARO 2020 LatestDocument8 pagesGuidance Note On CARO 2020 Latestsanjaypunjabi78Pas encore d'évaluation

- taxation-sec-b-may-2024-1703583957Document19 pagestaxation-sec-b-may-2024-1703583957abhishekkapse654Pas encore d'évaluation

- CIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerDocument15 pagesCIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerSoftdynamitePas encore d'évaluation

- Taxguru Consultancy & Online Publication LLPDocument24 pagesTaxguru Consultancy & Online Publication LLPPiyush SharmaPas encore d'évaluation

- Form 3CD - Ajesh SoniDocument16 pagesForm 3CD - Ajesh SoniAditya AroraPas encore d'évaluation

- Eligibility Criteria For GSPsDocument2 pagesEligibility Criteria For GSPsSom Sekhar ThatoiPas encore d'évaluation

- Registration ApplicationDocument18 pagesRegistration ApplicationShri swamiPas encore d'évaluation

- Hindustan Urvarak & Rasayan Limited (A Joint Venture of Cil, NTPC, Iocl, Fcil & HFCL)Document5 pagesHindustan Urvarak & Rasayan Limited (A Joint Venture of Cil, NTPC, Iocl, Fcil & HFCL)Sachendra ChaudharyPas encore d'évaluation

- Form 3CDDocument8 pagesForm 3CDmahi jainPas encore d'évaluation

- Instruction Kit For Eform Adt - 2: Page 1 of 8Document8 pagesInstruction Kit For Eform Adt - 2: Page 1 of 8maddy14350Pas encore d'évaluation

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaPas encore d'évaluation

- Common Application Form For Units Above 10 LakhsDocument55 pagesCommon Application Form For Units Above 10 LakhsBilla NaganathPas encore d'évaluation

- Bid Evaluation Criteria & Evaluation MethodologyDocument5 pagesBid Evaluation Criteria & Evaluation MethodologyVipul MishraPas encore d'évaluation

- Public Works EnlistmentDocument8 pagesPublic Works EnlistmentRefat ahmedPas encore d'évaluation

- Form 8: Particulars For Creation or Modification of Charges (Other Than Those Related To Debentures)Document4 pagesForm 8: Particulars For Creation or Modification of Charges (Other Than Those Related To Debentures)sunbPas encore d'évaluation

- Tax Audit Form 3CDDocument18 pagesTax Audit Form 3CDaishwarya raikarPas encore d'évaluation

- GST - Input Tax Credit - Edition 5Document17 pagesGST - Input Tax Credit - Edition 5Vineet PandeyPas encore d'évaluation

- Haryana Labour :: Terms & ConditionDocument1 pageHaryana Labour :: Terms & Conditionpranav sharmaPas encore d'évaluation

- US Internal Revenue Service: I1028Document2 pagesUS Internal Revenue Service: I1028IRSPas encore d'évaluation

- Union Budget 2018-19 proposes key amendments to international tax provisionsDocument4 pagesUnion Budget 2018-19 proposes key amendments to international tax provisionsManoj GuptaPas encore d'évaluation

- 06 A Idt Ammentments 2 in 1Document33 pages06 A Idt Ammentments 2 in 1Venkat RamanaPas encore d'évaluation

- Gel Form 3ca-3cdDocument11 pagesGel Form 3ca-3cdravibhartia1978Pas encore d'évaluation

- Empanelment of ContractorsDocument8 pagesEmpanelment of ContractorsSumit SinghalPas encore d'évaluation

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocument10 pagesForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuPas encore d'évaluation

- Income Tax Proof Documents Submission Guidelines (2019-2020)Document13 pagesIncome Tax Proof Documents Submission Guidelines (2019-2020)Jigar PatelPas encore d'évaluation

- Know Your JurisdictionDocument10 pagesKnow Your JurisdictionsamaadhuPas encore d'évaluation

- Format of Reporting For Registration Ofvaluerunder Section 34 Ab of Thewealth Tax ActDocument2 pagesFormat of Reporting For Registration Ofvaluerunder Section 34 Ab of Thewealth Tax ActManoj KumarPas encore d'évaluation

- Guidelines Streamline Tax Treaty ReliefDocument18 pagesGuidelines Streamline Tax Treaty ReliefEmil A. MolinaPas encore d'évaluation

- FTS Course PPT - 07112020Document55 pagesFTS Course PPT - 07112020sanket.tatedPas encore d'évaluation

- 19996-2010-Guidelines On The Processing of Tax Treaty20210424-12-O8b2ssDocument14 pages19996-2010-Guidelines On The Processing of Tax Treaty20210424-12-O8b2ssAlea MalabananPas encore d'évaluation

- Bir 072-10Document25 pagesBir 072-10Emil A. MolinaPas encore d'évaluation

- Q419 Financial StatementsDocument141 pagesQ419 Financial StatementsDana VisanPas encore d'évaluation

- FormDocument19 pagesFormadselcableindustryPas encore d'évaluation

- Permanent Establishment.Document60 pagesPermanent Establishment.Mandira PriyaPas encore d'évaluation

- Application For Grant of Immunity Certificate Under CLSS 2010 201210 PDFDocument3 pagesApplication For Grant of Immunity Certificate Under CLSS 2010 201210 PDFVarun RameshPas encore d'évaluation

- Indian Oil Corporation Limited (Refineries Division) Panipat Naphtha Cracker Notice Inviting Tender (E Tender)Document5 pagesIndian Oil Corporation Limited (Refineries Division) Panipat Naphtha Cracker Notice Inviting Tender (E Tender)Tanpreet SinghPas encore d'évaluation

- Key Taxation Updates for Tax Year 2018 ReturnsDocument47 pagesKey Taxation Updates for Tax Year 2018 ReturnsMuhammad RamzanPas encore d'évaluation

- Chg1 V2608 - MOTD 16082016 - Ram Charan Company P LTD - Arun M, R Karthik Digittaly SignedDocument6 pagesChg1 V2608 - MOTD 16082016 - Ram Charan Company P LTD - Arun M, R Karthik Digittaly SignedAnonymous KnUvRMH6NPas encore d'évaluation

- Circular No. 01/2013 Subject: Issues Relating To Export of Computer Software-Direct Tax Benefits-Clarification RegDocument4 pagesCircular No. 01/2013 Subject: Issues Relating To Export of Computer Software-Direct Tax Benefits-Clarification Regbharath289Pas encore d'évaluation

- New Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orDocument24 pagesNew Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orCA.Shreehari KutsaPas encore d'évaluation

- OFI GST E-Invoicing Functionality1Document24 pagesOFI GST E-Invoicing Functionality1Rajesh KumarPas encore d'évaluation

- GUWAHATIDocument3 pagesGUWAHATIshafaquesameen2001Pas encore d'évaluation

- CEGP013091: T.E. (E & TC) Industrial ManagementDocument2 pagesCEGP013091: T.E. (E & TC) Industrial Management123vidyaPas encore d'évaluation

- ManagementDocument8 pagesManagement123vidya50% (2)

- Sl. No. Name of The Programme Faculty of Civil EngineeringDocument2 pagesSl. No. Name of The Programme Faculty of Civil EngineeringAravind SeetharamanPas encore d'évaluation

- Resume Pooja MusaleDocument2 pagesResume Pooja Musale123vidyaPas encore d'évaluation

- Ketan ResumeDocument2 pagesKetan Resume123vidyaPas encore d'évaluation

- III-sem - EX - Syllabus RGPVDocument10 pagesIII-sem - EX - Syllabus RGPV123vidyaPas encore d'évaluation

- UG Table - 13.02.2018Document10 pagesUG Table - 13.02.2018123vidyaPas encore d'évaluation

- Design Analysis of Experiments Objective ExamDocument8 pagesDesign Analysis of Experiments Objective Examush_ush_ush2005Pas encore d'évaluation

- Analysis of Different PN SequencesDocument6 pagesAnalysis of Different PN SequencesShanmukh GollapudiPas encore d'évaluation

- SyllabusDocument118 pagesSyllabusecessecPas encore d'évaluation

- SSVPS'S Bapusaheb Shivajirao Deore College of Engineering, DhuleDocument1 pageSSVPS'S Bapusaheb Shivajirao Deore College of Engineering, Dhule123vidyaPas encore d'évaluation

- Anna University Part-Time BE/BTech Programmes 2009Document1 pageAnna University Part-Time BE/BTech Programmes 2009vasanthanbPas encore d'évaluation

- A Comparison Study of 3G System Proposals: Cdma2000 vs. WCDMADocument17 pagesA Comparison Study of 3G System Proposals: Cdma2000 vs. WCDMA123vidyaPas encore d'évaluation

- Vacuum GaugesDocument2 pagesVacuum Gauges123vidyaPas encore d'évaluation

- Notes4 Sparams PDFDocument20 pagesNotes4 Sparams PDFaozgurluk_scribdPas encore d'évaluation

- RAPDDocument4 pagesRAPD123vidyaPas encore d'évaluation

- Capital Recovery CostDocument2 pagesCapital Recovery CostShahnaz NadivaPas encore d'évaluation

- CN Revision 2017Document1 pageCN Revision 2017123vidyaPas encore d'évaluation

- RGPV SyllabusBE I II Common Chemistry NEW July 2017 1 4Document9 pagesRGPV SyllabusBE I II Common Chemistry NEW July 2017 1 4123vidyaPas encore d'évaluation

- System and Networks SecurityDocument3 pagesSystem and Networks Security123vidyaPas encore d'évaluation

- Analysis of Different PN SequencesDocument6 pagesAnalysis of Different PN SequencesShanmukh GollapudiPas encore d'évaluation

- III-sem EX Syllabus RGPVDocument11 pagesIII-sem EX Syllabus RGPV123vidyaPas encore d'évaluation

- Light SourcesDocument5 pagesLight Sources123vidyaPas encore d'évaluation

- Business Plan TemplateDocument9 pagesBusiness Plan TemplateRafael FalconPas encore d'évaluation

- Six SigmaDocument15 pagesSix Sigmapravit08Pas encore d'évaluation

- Computer HardwareDocument42 pagesComputer HardwareSandeep SharmaPas encore d'évaluation

- RAPDDocument4 pagesRAPD123vidyaPas encore d'évaluation

- Pinto Pm2 Ism Ch09Document44 pagesPinto Pm2 Ism Ch09pronckPas encore d'évaluation

- Mr. Mukund Sonyabapu Lalge: E-Mail: Mobile NoDocument2 pagesMr. Mukund Sonyabapu Lalge: E-Mail: Mobile No123vidyaPas encore d'évaluation

- CP575Notice 1645023110303Document2 pagesCP575Notice 1645023110303MannatechESPas encore d'évaluation

- Skate Helena 02-06.01.2024Document1 pageSkate Helena 02-06.01.2024erkinongulPas encore d'évaluation

- Week 6 - Introduction To Optimal TaxationDocument26 pagesWeek 6 - Introduction To Optimal TaxationZyra Angela BlasPas encore d'évaluation

- Configure Down Payment Processing Using Document ConditionsDocument7 pagesConfigure Down Payment Processing Using Document ConditionsJayakumarVasudevanPas encore d'évaluation

- Individual Customer Relation Form: ApplicationDocument7 pagesIndividual Customer Relation Form: ApplicationJay JaniPas encore d'évaluation

- Bank statement activity and dispute rights under $1Document3 pagesBank statement activity and dispute rights under $1shani ChahalPas encore d'évaluation

- Customer Account and Transaction Service ManualDocument96 pagesCustomer Account and Transaction Service ManualTemesgen DentamoPas encore d'évaluation

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesJeneshPas encore d'évaluation

- Pune Municipal Corporation: Property Id: Financial Year: 2020-2021 Bill No: 112407 Nonresi Meter NoDocument1 pagePune Municipal Corporation: Property Id: Financial Year: 2020-2021 Bill No: 112407 Nonresi Meter NoRajesh NayakPas encore d'évaluation

- For Any Transactional Queries Related To Donations Please ContactDocument1 pageFor Any Transactional Queries Related To Donations Please ContactChristo JeniferPas encore d'évaluation

- Bitumen Price List - 16.4.2020 PDFDocument1 pageBitumen Price List - 16.4.2020 PDFChakravarthy PinnamaneniPas encore d'évaluation

- SC Rules on Lung Center's Tax Exemption ClaimDocument2 pagesSC Rules on Lung Center's Tax Exemption ClaimKylie Kaur Manalon DadoPas encore d'évaluation

- Capital OneDocument6 pagesCapital Oneapi-285064294Pas encore d'évaluation

- #15 Notes in Allowable DeductionsDocument15 pages#15 Notes in Allowable DeductionsJaypee Palcis100% (1)

- Income From House PropertyDocument26 pagesIncome From House PropertysnehalgaikwadPas encore d'évaluation

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonPas encore d'évaluation

- Cash Receipts Journal (CRJ)Document1 pageCash Receipts Journal (CRJ)KristineMarzanPas encore d'évaluation

- PAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)Document5 pagesPAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)sourabh6chakrabort-1Pas encore d'évaluation

- Lesson 5 Part 2 TranscriptionDocument10 pagesLesson 5 Part 2 TranscriptionErica Joy M. SalvaneraPas encore d'évaluation

- Elements of Cost Accounting Exam QuestionsDocument2 pagesElements of Cost Accounting Exam QuestionsEmilia JacobPas encore d'évaluation

- GLs and Tax Codes For ProdnDocument9 pagesGLs and Tax Codes For ProdnAbhishek MehtaPas encore d'évaluation

- Cfa Mock 3Document9 pagesCfa Mock 3jayPas encore d'évaluation

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainPas encore d'évaluation

- CBexam Mockexam Draft01Document5 pagesCBexam Mockexam Draft01Mark Lord Morales BumagatPas encore d'évaluation

- Modernisation of Banking Sector in IndiaDocument64 pagesModernisation of Banking Sector in IndiaMaria Nunes100% (5)

- MIIA vs. Court of Appeals GR No. 155650Document2 pagesMIIA vs. Court of Appeals GR No. 155650ClarickJoshuaVijandrePas encore d'évaluation

- LicenseDocument6 pagesLicenseRazvannusPas encore d'évaluation

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- 2018-24353-Lawson-04 16 2023-04 30 2023-17 08 18Document1 page2018-24353-Lawson-04 16 2023-04 30 2023-17 08 18Bryle YvesPas encore d'évaluation

- Unadjusted Part of Mobilization Advance Received Prior To July 01Document3 pagesUnadjusted Part of Mobilization Advance Received Prior To July 01CA Ishu BansalPas encore d'évaluation