Académique Documents

Professionnel Documents

Culture Documents

HawPia and Mijares

Transféré par

Hannah BonillaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HawPia and Mijares

Transféré par

Hannah BonillaDroits d'auteur :

Formats disponibles

G.R. No.

L-554 April 9, 1948

HAW PIA, plaintiff-appellant,

vs.

THE CHINA BANKING CORPORATION, defendant-appellee.

FACTS:

Plaintiff-appellant instituted this action in the Court of First Instance of Manila against the defendant

China Banking Corporation, to compel the latter to execute a deed of cancellation of the mortgage on the property

described in the complaint and to deliver to the said plaintiff the Transfer Certificate of Title with the mortgage

annotated already cancelled.

Plaintiff-appellant’s indebtedness to the defendant-appellee China Banking Corporation in the sum of P5,103.35

by way of overdraft in current account payable on demand together with its interests, has been completely paid,

on different occasions to the defendant Bank China Banking Corporation through the defendant Bank of Taiwan,

Ltd., that was appointed by the Japanese Military authorities as liquidator of the China Banking Corporation.

Trial Court rendered a decision in favor of China Banking Corp. on the basis that therewas no evidence to show

that Bank of Taiwan was authorized by China BankingCorp. to accept Haw Pia's payment and that Bank of

Taiwan, as an agency of the Japanese invading army, was not authorized under the international law toliquidate

the business of China Banking Corp. As such, Haw Pia's payment toBank of Taiwan has not extinguished his

indebtedness to China Banking Corp.

ISSUE:

Whether the Japanese Military Administration had authority to order theliquidation of the business of China

Banking Corp. and to appoint Bank of Taiwan as liquidator authorized as such to accept payment

HELD:

YES. The Japanese military authorities had power, under the international law, to order the liquidation of

the China Banking Corporation and to appoint and authorize the Bank of Taiwan as liquidator to accept the

payment in question, because such liquidation is not confiscation of the properties of the bank appellee, but

a mere sequestration of its assets which required the liquidation or winding up of the business of said bank.

The sequestration or liquidation of enemy banks in occupied territories is authorized expressly by the United

States Army and Navy Manual of Military Government and Civil Affairs F.M. 2710 OPNAV 50-E-3.

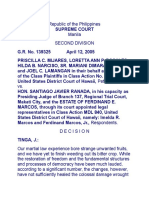

[G.R. No. 139325. April 12, 2005]

PRISCILLA C. MIJARES, LORETTA ANN P. ROSALES, HILDA B. NARCISO, SR.

MARIANI DIMARANAN, SFIC, and JOEL C. LAMANGAN in their behalf and

on behalf of the Class Plaintiffs in Class Action No. MDL 840, United States

District Court of Hawaii, petitioners,

vs.

HON. SANTIAGO JAVIER RANADA, in his capacity as Presiding Judge of Branch

137, Regional Trial Court, Makati City, and the ESTATE OF FERDINAND E.

MARCOS, through its court appointed legal representatives in Class Action

MDL 840, United States District Court of Hawaii, namely: Imelda R. Marcos

and Ferdinand Marcos, Jr., respondents.

On May 9, 1991, Ten Filipino citizens who each alleged having suffered human rights abuses such as arbitrary

detention, torture and rape in the hands of police or military forces during the Marcos regime, filed with the US

District Court, Hawaii, against the Estate Ferdinand E. Marcos.

US District Court and Affirmed by US CA: awarded them $1,964,005,859.90

The present petitioners filed Complaint with the Makati RTC for the enforcement of the Final Judgment. paying

Php 410 as docket and filing fees based on Rule 141, Section 7(b) where the value of the subject matter is

incapable of pecuniary estimation.

Marcos Estate filed a motion to dismiss, raising, among others, the non-payment of the correct filing fees paying

only Php 410

Petitioners submit that their action is incapable of pecuniary estimation as the subject matter of the suit is the

enforcement of a foreign judgment, and not an action for the collection of a sum of money or recovery of

damages. They also point out that to require the class plaintiffs to pay P472,000,000 in filing fees would negate

and render inutile the liberal construction ordained by the Rules of Court, particularly the inexpensive

disposition of every action.

Issue:

Whether or not the amount paid by the Petitioners is the proper filing fee?

Ruling:

Yes, but on a different basis—amount merely corresponds to the same amount required for “other actions not

involving property”. The Regional Trial Court of Makati erred in concluding that the filing fee should be computed

on the basis of the total sum claimed or the stated value of the property in litigation. The Petitioner’s Complaint

was lodged against the Estate of Marcos but it is clearly based on a judgment, the Final Judgment of the US

District Court. However, the Petitioners erred in stating that the Final Judgment is incapable of pecuniary

estimation because it is so capable. On this point, Petitioners state that this might lead to an instance wherein a

first level court (MTC, MeTC, etc.) would have jurisdiction to enforce a foreign judgment. Under Batasang

Pambansa 129, such courts are not vested with such jurisdiction. Section 33 of Batasang Pambansa 129 refers

to instances wherein the cause of action or subject matter pertains to an assertion of rights over property or a

sum of money. But here, the subject matter is the foreign judgment itself. Section 16 of Batasang Pambansa 129

reveals that the complaint for enforcement of judgment even if capable of pecuniary estimation would fall under

the jurisdiction of the Regional Trial Courts. Thus, the Complaint to enforce the US District Court judgment is

one capable of pecuniary estimations but at the same time, it is also an action based on judgment against an

estate, thus placing it beyond the ambit of Section 7(a) of Rule 141. What governs the proper computation of the

filing fees over Complaints for the enforcement of foreign judgments is Section7(b)(3), involving “other actions

not involving property.”

Vous aimerez peut-être aussi

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionD'EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionPas encore d'évaluation

- Digest BankingDocument8 pagesDigest BankingJas MinePas encore d'évaluation

- California Supreme Court Petition: S173448 – Denied Without OpinionD'EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionÉvaluation : 4 sur 5 étoiles4/5 (1)

- Mijares v. RanadaDocument17 pagesMijares v. RanadaquasideliksPas encore d'évaluation

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)D'EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Pas encore d'évaluation

- Mijares vs. Ranada, G.R. No. 139325, April 12, 2005Document12 pagesMijares vs. Ranada, G.R. No. 139325, April 12, 2005mordo tigasPas encore d'évaluation

- Mijares VS RanadaDocument6 pagesMijares VS Ranadaabakada_kayePas encore d'évaluation

- Mijares Vs Ranada - Case DigestDocument1 pageMijares Vs Ranada - Case DigestOM Molins100% (1)

- 2 Mijares v. RanadaDocument17 pages2 Mijares v. RanadajrPas encore d'évaluation

- China Bank v. CA GR. No. 129644Document2 pagesChina Bank v. CA GR. No. 129644Mary Rose Borras ArmarioPas encore d'évaluation

- Mijares Vs MarcosDocument2 pagesMijares Vs MarcosRomy Oyeth R. MaligayaPas encore d'évaluation

- Mijares v. Ranada, G.R. No. 139325, (April 12, 2005), 495 PHIL 372-399)Document14 pagesMijares v. Ranada, G.R. No. 139325, (April 12, 2005), 495 PHIL 372-399)RJCenitaPas encore d'évaluation

- China Bank Vs CADocument3 pagesChina Bank Vs CACattleyaPas encore d'évaluation

- Human Rights To Digest (Exam)Document105 pagesHuman Rights To Digest (Exam)Ron AceroPas encore d'évaluation

- Mijares V RanadaDocument24 pagesMijares V RanadaJake AriñoPas encore d'évaluation

- 5-Mijares v. RanadaDocument19 pages5-Mijares v. RanadaMelfay ErminoPas encore d'évaluation

- Conflicts DigestDocument4 pagesConflicts DigestkriztelanncPas encore d'évaluation

- Article III - Bill of Rights Digests Part 1Document72 pagesArticle III - Bill of Rights Digests Part 1goateneo1bigfight100% (2)

- G.R. No. 139325 April 12, 2005Document9 pagesG.R. No. 139325 April 12, 2005mindeePas encore d'évaluation

- Banking Law Digests FinalsDocument10 pagesBanking Law Digests FinalsErnest Talingdan CastroPas encore d'évaluation

- Second Division: (G.R. No. 139325. April 12, 2005)Document49 pagesSecond Division: (G.R. No. 139325. April 12, 2005)Prime Mover Skyd3monPas encore d'évaluation

- CHINA BANKING CORP v. CADocument3 pagesCHINA BANKING CORP v. CAJustinePas encore d'évaluation

- Mijares V Ranada DigestDocument30 pagesMijares V Ranada DigestPrincess AyomaPas encore d'évaluation

- Mijares Vs Ranada G.R. No. 139325 April 12, 2005Document18 pagesMijares Vs Ranada G.R. No. 139325 April 12, 2005herbs22225847Pas encore d'évaluation

- Mijares v. Ranada, G.R. No. 139325, April 12, 2005 PDFDocument12 pagesMijares v. Ranada, G.R. No. 139325, April 12, 2005 PDFEmerson NunezPas encore d'évaluation

- Mijares v. RanadaDocument2 pagesMijares v. RanadaSean HinolanPas encore d'évaluation

- Ponente: Carpio-Morales, JDocument15 pagesPonente: Carpio-Morales, JCristelle Elaine ColleraPas encore d'évaluation

- UntitledDocument7 pagesUntitledMOISES JOSHUA BAUTISTAPas encore d'évaluation

- Haw Pia Vs China BankingDocument39 pagesHaw Pia Vs China Bankingchristine jimenezPas encore d'évaluation

- Asiavest Merchant Bankers v. Court of Appeals G.R. 110263Document6 pagesAsiavest Merchant Bankers v. Court of Appeals G.R. 110263FeBrluadoPas encore d'évaluation

- G.R. No. 139325 - Mijares Vs RanadaDocument13 pagesG.R. No. 139325 - Mijares Vs RanadaKenneth EsquilloPas encore d'évaluation

- Rule 110 DigestsDocument8 pagesRule 110 DigestsMCPas encore d'évaluation

- 15 Mijares V RanadaDocument1 page15 Mijares V RanadaMark Bryant VitorPas encore d'évaluation

- Cases PilDocument17 pagesCases PilAlberto NicholsPas encore d'évaluation

- Hur Tin Yang Vs PeopleDocument11 pagesHur Tin Yang Vs Peoplediamajolu gaygonsPas encore d'évaluation

- Haw Pia Vs China Banking CorpDocument1 pageHaw Pia Vs China Banking CorpJude IklamoPas encore d'évaluation

- China Banking Corp. vs. CADocument6 pagesChina Banking Corp. vs. CAYong NazPas encore d'évaluation

- 13 - Mijares v. Ranada PDFDocument2 pages13 - Mijares v. Ranada PDFloschudentPas encore d'évaluation

- China Banking Corporation vs. Court of AppealsDocument13 pagesChina Banking Corporation vs. Court of AppealsJesh RadazaPas encore d'évaluation

- Case Digest: Law On Banking and FinanceDocument25 pagesCase Digest: Law On Banking and FinanceHelen Joy Grijaldo JuelePas encore d'évaluation

- Philippine Bank of Communications v. Court of Appeals and Chua, G.R. No. 106858Document6 pagesPhilippine Bank of Communications v. Court of Appeals and Chua, G.R. No. 106858Noela Glaze Abanilla DivinoPas encore d'évaluation

- China Banking vs. CADocument6 pagesChina Banking vs. CAPatrisha AlmasaPas encore d'évaluation

- Consti1 Case Digest Part 2Document15 pagesConsti1 Case Digest Part 2pamplonalina3Pas encore d'évaluation

- Haw Pia vs. China Banking CorporationDocument47 pagesHaw Pia vs. China Banking CorporationCases M7Pas encore d'évaluation

- Mellon Bank vs. Magsino Case Digest G.R. No. 61011 October 18, 1990Document2 pagesMellon Bank vs. Magsino Case Digest G.R. No. 61011 October 18, 1990JPas encore d'évaluation

- China Bank Vs CADocument2 pagesChina Bank Vs CAVanya Klarika NuquePas encore d'évaluation

- Mijares V RanadaDocument1 pageMijares V RanadaRhev Xandra AcuñaPas encore d'évaluation

- Case Digest BankingDocument35 pagesCase Digest BankingEKANG0% (1)

- ACCOMODATION MORTGAGE Spouses Nilo Ramos and Eliadora Ramos vs. Raul Obispo and Far East Bank and Trust Co.Document9 pagesACCOMODATION MORTGAGE Spouses Nilo Ramos and Eliadora Ramos vs. Raul Obispo and Far East Bank and Trust Co.Arvi GerongaPas encore d'évaluation

- Mijares v. RanadaDocument2 pagesMijares v. RanadaRaineir PabiranPas encore d'évaluation

- Cayetano v. LeonidasDocument12 pagesCayetano v. LeonidasDino Bernard LapitanPas encore d'évaluation

- Salvacion v. CBP PDFDocument14 pagesSalvacion v. CBP PDFCris LegaspiPas encore d'évaluation

- G.R. No. 141278 March 23, 2004 MICHAEL A. OSMEÑA, Petitioner, CITIBANK, N.A., ASSOCIATED BANK and FRANK TAN, RespondentsDocument59 pagesG.R. No. 141278 March 23, 2004 MICHAEL A. OSMEÑA, Petitioner, CITIBANK, N.A., ASSOCIATED BANK and FRANK TAN, RespondentsSheree Joie PolonanPas encore d'évaluation

- G R - No - L-33112Document2 pagesG R - No - L-33112Roadtoforever123Pas encore d'évaluation

- Viray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentDocument13 pagesViray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentCarren Paulet Villar CuyosPas encore d'évaluation

- Osmena V Citibank NaDocument6 pagesOsmena V Citibank NaKatz Betito100% (1)

- Mijares vs. RanadaDocument10 pagesMijares vs. RanadaDANICA FLORESPas encore d'évaluation

- Mijares Vs Hon. Ranada Digest For Conflict of LAwsDocument28 pagesMijares Vs Hon. Ranada Digest For Conflict of LAwsRob ClosasPas encore d'évaluation

- A Judgment Creditor Only Acquires at An Execution Sale The Identical Interest Possessed by The Judgment DebtorDocument6 pagesA Judgment Creditor Only Acquires at An Execution Sale The Identical Interest Possessed by The Judgment DebtorHangul Si Kuya AliPas encore d'évaluation

- Mijares v. Hon. Ranada, GR 139325Document12 pagesMijares v. Hon. Ranada, GR 139325VernettePas encore d'évaluation

- BONILLATorts and Damages - Midterm ExamDocument10 pagesBONILLATorts and Damages - Midterm ExamHannah BonillaPas encore d'évaluation

- Domestic Adoption Inter-Country Adoption Governing LawsDocument6 pagesDomestic Adoption Inter-Country Adoption Governing LawsHannah BonillaPas encore d'évaluation

- BONILLATorts and Damages - Midterm ExamDocument10 pagesBONILLATorts and Damages - Midterm ExamHannah BonillaPas encore d'évaluation

- 59678RMC 35-2011Document1 page59678RMC 35-2011Hannah BonillaPas encore d'évaluation

- Roño Vs Gomez (May 31, 1949) .Digested - BackupDocument1 pageRoño Vs Gomez (May 31, 1949) .Digested - BackupHannah BonillaPas encore d'évaluation

- Francisco Vs PunoDocument1 pageFrancisco Vs PunoJL A H-Dimaculangan100% (1)

- Hidden DefectsDocument6 pagesHidden DefectsSK Tim RichardPas encore d'évaluation

- 2012 Final Judgment IMPERIAL HOUSE (Draft)Document5 pages2012 Final Judgment IMPERIAL HOUSE (Draft)Nate TeplitskyPas encore d'évaluation

- STATCON Statutory DefinitionDocument2 pagesSTATCON Statutory DefinitionChek IbabaoPas encore d'évaluation

- Alonzo Vs PaduaDocument4 pagesAlonzo Vs PaduaRichard BalaisPas encore d'évaluation

- SpecPro - Judicial Settlement of Estate of Deceased Person - MDABarcomaDocument2 pagesSpecPro - Judicial Settlement of Estate of Deceased Person - MDABarcomaMa. Danice Angela Balde-BarcomaPas encore d'évaluation

- Mercantile Law: Section ADocument4 pagesMercantile Law: Section AadnanPas encore d'évaluation

- VP0721Document16 pagesVP0721Anonymous 9eadjPSJNgPas encore d'évaluation

- Tax 1 Digest CompilationDocument13 pagesTax 1 Digest CompilationxyrakrezelPas encore d'évaluation

- Tli4801 01 Mark093100Document9 pagesTli4801 01 Mark093100Zororai Nkomo100% (1)

- Boracay Foundation, Inc. vs. Province of AklanDocument70 pagesBoracay Foundation, Inc. vs. Province of AklanKKCDIALPas encore d'évaluation

- MR Holdings vs. Bajar, G.R. No. 153478Document9 pagesMR Holdings vs. Bajar, G.R. No. 153478Kimber LeePas encore d'évaluation

- United States v. Bosket, 4th Cir. (2009)Document6 pagesUnited States v. Bosket, 4th Cir. (2009)Scribd Government DocsPas encore d'évaluation

- COCOFED V RepDocument7 pagesCOCOFED V RepTheodore BallesterosPas encore d'évaluation

- Labor Relations Digest 20151216 (61-66)Document11 pagesLabor Relations Digest 20151216 (61-66)James Andrew BuenaventuraPas encore d'évaluation

- Gati LTD Vs Air India LTDDocument13 pagesGati LTD Vs Air India LTDAbhineet KaliaPas encore d'évaluation

- Preliminary Attachment SampleDocument6 pagesPreliminary Attachment SampleLyleTheresePas encore d'évaluation

- Van Dorn Vs Romillo and UptonDocument2 pagesVan Dorn Vs Romillo and UptonAmandoron Dash AdevaPas encore d'évaluation

- Springfield Municipal Code (Springfield, Oregon)Document2 pagesSpringfield Municipal Code (Springfield, Oregon)Sinclair Broadcast Group - EugenePas encore d'évaluation

- Banks Cant Lend Their Own MoneyDocument11 pagesBanks Cant Lend Their Own Money4EqltyMom100% (4)

- Rongavilla Vs Court of AppealsDocument1 pageRongavilla Vs Court of AppealsMariel FelizmenioPas encore d'évaluation

- 2017-10-31 Petitioners Opening Brief Iso Petition For Writ of MandateDocument22 pages2017-10-31 Petitioners Opening Brief Iso Petition For Writ of Mandateapi-392139141Pas encore d'évaluation

- Mundkars Protection From Eviction Act and RulesDocument42 pagesMundkars Protection From Eviction Act and RulesPius DiasPas encore d'évaluation

- Gaisano Cagayan Inc. vs. Insurance Co. of North AmericaDocument5 pagesGaisano Cagayan Inc. vs. Insurance Co. of North AmericaCamil Ram FerrerPas encore d'évaluation

- Ramirez v. BaltazarDocument2 pagesRamirez v. BaltazarBALA CHRISTINA JESSAPas encore d'évaluation

- Romualdez Vs Civil Service CommissionDocument1 pageRomualdez Vs Civil Service CommissionFrancis Gillean OrpillaPas encore d'évaluation

- Boiler Insurance Policy - Proposal FormDocument4 pagesBoiler Insurance Policy - Proposal FormAnjali SinghPas encore d'évaluation

- Aquilian ActionDocument5 pagesAquilian ActionClayton MutsenekiPas encore d'évaluation

- LTD Cases 5Document60 pagesLTD Cases 5Jalieca Lumbria GadongPas encore d'évaluation

- Rogelio Picazo Romero, A074 083 669 (BIA Feb. 18, 2016)Document9 pagesRogelio Picazo Romero, A074 083 669 (BIA Feb. 18, 2016)Immigrant & Refugee Appellate Center, LLCPas encore d'évaluation