Académique Documents

Professionnel Documents

Culture Documents

Cir Vs United Salvage and Towage Case Digest

Transféré par

jovifactorTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cir Vs United Salvage and Towage Case Digest

Transféré par

jovifactorDroits d'auteur :

Formats disponibles

COMMISSIONER

OF INTERNAL REVENUE

VS

UNITED SALVAGE AND TOWAGE PHILS

FACTS:

Petitioner issued demand letters with attached assessment notices for

withholding tax on compensation (WTC) and expanded withholding tax (EWT)

for taxable years 1992, 1994, and 1998 against respondent.

On January 29, 1998 and October 24, 2001, USTP filed administrative

protests against the 1994 and 1998 assessments, respectively.

On February 21, 2003, USTP appealed alleging that the Notices of

Assessments are void for not containing facts, law, rules and regulations or

jurisprudence; thus, since the assessments are void, the right of the government

to assess and collect deficiency taxes from it has prescribed on account of the

failure to issue a valid notice of assessment within the applicable period.

ISSUE:

Whether or not the period to issue an assessment has already prescribed,

therefore, the government can no longer collect

HELD:

The statue of limitations on assessment and collection of national internal

revenue taxes was shortened from five (5) years to three (3) years by virtue of

BP Blg. 700. Thus, a petitioner has three (3) years from the date of actual filing of

the tax return to assess a national internal revenue tax or to commence court

proceedings for the collection thereof without an assessment. However, when it

validly issues an assessment within the three-year period, it has another three

(3) years within which to collect the tax due by distraint, levy, or court

proceeding. The assessment of the tax is deemed made and the three-year period

for collection of the assessed tax begins to run on the date the assessment notice

had been released, mailed or sent to the taxpayer.

Nevertheless, as correctly held by the CTA En Banc, the Preliminary

Collection Letter for deficiency taxes for taxable year 1992 was only issued on

February 21, 2002, despite the fact that the FANs for the deficiency EWT and

WTC for taxable year 1992 was issued as early as January 9, 1996. Clearly, five

(5) long years had already lapse, beyond the three-year prescriptive period,

before collection was pursued by petitioner.

FACTOR, J.V.

Vous aimerez peut-être aussi

- Samar-I Electric Cooperative vs. CirDocument2 pagesSamar-I Electric Cooperative vs. CirRaquel DoqueniaPas encore d'évaluation

- Pagcor V Bir: Information Request Item Approval OthersDocument7 pagesPagcor V Bir: Information Request Item Approval OthersJohn Evan Raymund Besid100% (1)

- Cir v. Febtc DigestDocument2 pagesCir v. Febtc DigestNelly HerreraPas encore d'évaluation

- Advertising Associates vs. CADocument2 pagesAdvertising Associates vs. CAJyrnaRhea75% (4)

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate Garo100% (2)

- CIR V Fitness by DesignDocument3 pagesCIR V Fitness by Designsmtm06100% (4)

- CIR v. Pascor Realty and Development DigestDocument1 pageCIR v. Pascor Realty and Development DigestKristineSherikaChy100% (1)

- Aznar vs. CTA - Case DigestDocument2 pagesAznar vs. CTA - Case DigestKaren Mae ServanPas encore d'évaluation

- Kepco Vs CIR Case DigestDocument2 pagesKepco Vs CIR Case DigestFrancisca Paredes100% (1)

- CIR vs. Raul Gonzales (Digest)Document2 pagesCIR vs. Raul Gonzales (Digest)Bam Bathan100% (1)

- Cir vs. Metro Super Rama DigestDocument3 pagesCir vs. Metro Super Rama DigestClavel TuasonPas encore d'évaluation

- Tax 2 Case DigestsDocument22 pagesTax 2 Case DigestsAndrea Juarez100% (4)

- 23 Cir Vs Mindanao Sanitarium and HospitalDocument5 pages23 Cir Vs Mindanao Sanitarium and HospitalSecret Secret0% (1)

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosPas encore d'évaluation

- Samar-I Electric Coop V CIR (2014) DigestDocument2 pagesSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- Republic V Salud HIzonDocument2 pagesRepublic V Salud HIzonPJ Hong100% (1)

- Cir vs. Pascor Realty and Development CorporationDocument2 pagesCir vs. Pascor Realty and Development Corporationmaki Amancio100% (1)

- CIR v. Liquigaz Case DigestDocument3 pagesCIR v. Liquigaz Case DigestKian Fajardo100% (3)

- BPI vs. CIRDocument2 pagesBPI vs. CIRAldrin TangPas encore d'évaluation

- Smi-Ed vs. Cir - 2016Document2 pagesSmi-Ed vs. Cir - 2016Anny Yanong100% (3)

- Systra Philippines vs. Cir G.R. No. 176290 September 21, 2007Document2 pagesSystra Philippines vs. Cir G.R. No. 176290 September 21, 2007Armstrong BosantogPas encore d'évaluation

- Philamlife V Cta Case DigestDocument2 pagesPhilamlife V Cta Case DigestAnonymous BvmMuBSwPas encore d'évaluation

- Gibbs vs. Cir and Cta - RemediesDocument2 pagesGibbs vs. Cir and Cta - RemediesIrish Asilo PinedaPas encore d'évaluation

- GR 220835 CIR vs. Systems TechnologyDocument2 pagesGR 220835 CIR vs. Systems TechnologyJoshua Erik Madria100% (1)

- Spouses Pacquiao vs. CTA and CIRDocument3 pagesSpouses Pacquiao vs. CTA and CIRRhea CaguetePas encore d'évaluation

- 1smied Vs CirDocument2 pages1smied Vs CirBam BathanPas encore d'évaluation

- CIR vs. FMF Development Corporation 167765Document1 pageCIR vs. FMF Development Corporation 167765magenPas encore d'évaluation

- Case #38 - CIR vs. United Cadiz SugarDocument2 pagesCase #38 - CIR vs. United Cadiz SugarJeffrey Magada100% (2)

- Bpi V Cir DigestDocument3 pagesBpi V Cir DigestkathrynmaydevezaPas encore d'évaluation

- Tax-Cir VS Phil Assoc. Smelting and Refining CorpDocument2 pagesTax-Cir VS Phil Assoc. Smelting and Refining CorpJoesil DiannePas encore d'évaluation

- Fishwealth Canning v. CIRDocument1 pageFishwealth Canning v. CIRRia Kriselle Francia PabalePas encore d'évaluation

- Contex vs. CIR, GR No. 151135, 2 July 2004Document3 pagesContex vs. CIR, GR No. 151135, 2 July 2004Clarissa SawaliPas encore d'évaluation

- Republic V Ricarte, GR L-46893, November 12, 1985Document2 pagesRepublic V Ricarte, GR L-46893, November 12, 1985Diane Dee YaneePas encore d'évaluation

- Lascona Land Vs CIRDocument2 pagesLascona Land Vs CIRJOHN SPARKSPas encore d'évaluation

- 9.BPI vs. CIRDocument1 page9.BPI vs. CIRBam Bathan100% (1)

- CIR Vs Toledo DigestDocument2 pagesCIR Vs Toledo DigestClar Napa100% (2)

- Philippine Journalists Inc V CIR GR No 162852Document2 pagesPhilippine Journalists Inc V CIR GR No 162852crizaldedPas encore d'évaluation

- BPI v. CIR, G.R. No. 139736Document2 pagesBPI v. CIR, G.R. No. 139736shookt panboi100% (3)

- Oceanic Wireless Network v. CIR - G.R. No. 148380 (2005)Document3 pagesOceanic Wireless Network v. CIR - G.R. No. 148380 (2005)SophiaFrancescaEspinosaPas encore d'évaluation

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Document1 pageCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoPas encore d'évaluation

- Miramar Fish Company, Inc. V Cir G.R. No. 185432, June 04, 2014 Perez, J.Document2 pagesMiramar Fish Company, Inc. V Cir G.R. No. 185432, June 04, 2014 Perez, J.Kate GaroPas encore d'évaluation

- Renato Diaz V Secretary of FinanceDocument2 pagesRenato Diaz V Secretary of FinanceDexter MantosPas encore d'évaluation

- CIR vs. Phoenix (TAX)Document2 pagesCIR vs. Phoenix (TAX)Teff Quibod100% (3)

- Cyanamid Philippines vs. CADocument2 pagesCyanamid Philippines vs. CAj guevarraPas encore d'évaluation

- Valley Trading Co v. CFI of IsabelaDocument1 pageValley Trading Co v. CFI of IsabelaArahbells100% (2)

- Lascona Land Co vs. CIRDocument2 pagesLascona Land Co vs. CIRAnnePas encore d'évaluation

- CIR vs. Ayala Securities Corp., GR No. L-29485Document1 pageCIR vs. Ayala Securities Corp., GR No. L-29485Alyza Montilla BurdeosPas encore d'évaluation

- Eastern Telecommunications Phil Inc V CIR - DigestDocument1 pageEastern Telecommunications Phil Inc V CIR - DigestKate GaroPas encore d'évaluation

- 5 - CIR vs. Hon. Raul M. GonzalezDocument6 pages5 - CIR vs. Hon. Raul M. GonzalezJaye Querubin-FernandezPas encore d'évaluation

- Lascona Land Co., Inc. v. CIRDocument2 pagesLascona Land Co., Inc. v. CIRAron Lobo100% (1)

- Case Digest - CIR v. Fitness by Design (Tax II)Document1 pageCase Digest - CIR v. Fitness by Design (Tax II)Nin BritanucciPas encore d'évaluation

- Cir v. MeralcoDocument2 pagesCir v. MeralcoKhaiye De Asis AggabaoPas encore d'évaluation

- BPI Vs CIR, 473 SCRA 205, Oct. 17, 2005Document8 pagesBPI Vs CIR, 473 SCRA 205, Oct. 17, 2005katentom-1Pas encore d'évaluation

- Taxation Review - Samar I Electric Cooperative Vs CIRDocument3 pagesTaxation Review - Samar I Electric Cooperative Vs CIRMaestro LazaroPas encore d'évaluation

- Phil Journalist Vs CIR - Case DigestDocument2 pagesPhil Journalist Vs CIR - Case DigestKaren Mae Servan100% (1)

- Bantillo - CIR Vs PNBDocument3 pagesBantillo - CIR Vs PNBAto TejaPas encore d'évaluation

- Estate of Reyes V CIR Case DigestDocument2 pagesEstate of Reyes V CIR Case DigestAlexis Anne P. ArejolaPas encore d'évaluation

- CIR v. United Salvage (Prescription)Document12 pagesCIR v. United Salvage (Prescription)Roma MicuPas encore d'évaluation

- j1 - CIR-vs.-United-Salvage-TowageDocument2 pagesj1 - CIR-vs.-United-Salvage-TowageMae Ellen AvenPas encore d'évaluation

- Cir Vs Tours - SpecialistDocument9 pagesCir Vs Tours - SpecialistjovifactorPas encore d'évaluation

- 15 Moreno Vs KahnDocument2 pages15 Moreno Vs Kahnjovifactor100% (2)

- TRANSPO Pal Vs CA Case DigestDocument2 pagesTRANSPO Pal Vs CA Case DigestjovifactorPas encore d'évaluation

- 14 Leriou Vs LongaDocument2 pages14 Leriou Vs Longajovifactor100% (1)

- 15 Moreno Vs KahnDocument2 pages15 Moreno Vs Kahnjovifactor100% (2)

- 22 Villamil Vs Spouses ErguizaDocument2 pages22 Villamil Vs Spouses ErguizajovifactorPas encore d'évaluation

- 14 Leriou Vs LongaDocument2 pages14 Leriou Vs LongajovifactorPas encore d'évaluation

- 20 Sarto Vs PeopleDocument2 pages20 Sarto Vs PeoplejovifactorPas encore d'évaluation

- 19 Mayuga Vs AtienzaDocument2 pages19 Mayuga Vs AtienzajovifactorPas encore d'évaluation

- 23 Gatchalian Vs FloresDocument2 pages23 Gatchalian Vs Floresjovifactor100% (1)

- 21 Salazar Vs FeliasDocument2 pages21 Salazar Vs Feliasjovifactor100% (1)

- Aquino Vs AguirreDocument2 pagesAquino Vs AguirrejovifactorPas encore d'évaluation

- 5 Jose Moreno Vs Rene KhanDocument5 pages5 Jose Moreno Vs Rene KhanjovifactorPas encore d'évaluation

- Peralta Vs Municipality of Kalibo Case DigestDocument2 pagesPeralta Vs Municipality of Kalibo Case Digestjovifactor75% (4)

- Tortal Vs TaniguchiDocument2 pagesTortal Vs TaniguchijovifactorPas encore d'évaluation

- Mayuga Vs AtienzaDocument2 pagesMayuga Vs Atienzajovifactor100% (1)

- Spouses Carlos Vs TolentinoDocument3 pagesSpouses Carlos Vs Tolentinojovifactor100% (2)

- 1 Jarque Vs JarqueDocument2 pages1 Jarque Vs Jarquejovifactor100% (2)

- 19 Santos Cruz Vs HiongDocument8 pages19 Santos Cruz Vs HiongjovifactorPas encore d'évaluation

- 15 Abegael Espina Dan Vs Marco DanDocument16 pages15 Abegael Espina Dan Vs Marco DanjovifactorPas encore d'évaluation

- 3 Iona Leriou Vs Yohanna LongaDocument16 pages3 Iona Leriou Vs Yohanna LongajovifactorPas encore d'évaluation

- Prefinals Exam in Income TaxationDocument3 pagesPrefinals Exam in Income TaxationYen YenPas encore d'évaluation

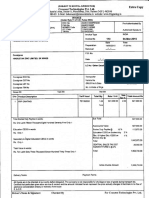

- Goods and Services Tax: B2B - Invoice DetailsDocument1 pageGoods and Services Tax: B2B - Invoice DetailsSOURAV GUPTAPas encore d'évaluation

- 2019 Report of Gad. UtilizationDocument1 page2019 Report of Gad. UtilizationJoji Matadling TecsonPas encore d'évaluation

- RTGS Merits Demerits To The Retail BankerDocument61 pagesRTGS Merits Demerits To The Retail BankerDayananda Kumar N RPas encore d'évaluation

- E-Ticket For Agra Fort: Important InformationDocument3 pagesE-Ticket For Agra Fort: Important InformationAshish RaiPas encore d'évaluation

- Chapter 5 TaxationDocument3 pagesChapter 5 TaxationAngela Nicole NobletaPas encore d'évaluation

- E-CASH': A Seminar ReportDocument15 pagesE-CASH': A Seminar ReportPushkar WanePas encore d'évaluation

- Corporate Income TaxationDocument3 pagesCorporate Income TaxationKezPas encore d'évaluation

- FPDocument20 pagesFPRadhika ParekhPas encore d'évaluation

- Internal Revenue Allotment DependencyDocument10 pagesInternal Revenue Allotment DependencyRheii EstandartePas encore d'évaluation

- 3jgo Manpower Provider, Inc. Tisado, Joylit Cadiente: Payroll Period: Jun 10 2019-Jun 24 2019 Emp. NameDocument1 page3jgo Manpower Provider, Inc. Tisado, Joylit Cadiente: Payroll Period: Jun 10 2019-Jun 24 2019 Emp. NameJoylit Garcia CadientePas encore d'évaluation

- CIR v. PAL (Ortega)Document5 pagesCIR v. PAL (Ortega)Peter Joshua OrtegaPas encore d'évaluation

- Seabank Statement 20230331Document3 pagesSeabank Statement 20230331Cahyo DioPas encore d'évaluation

- EDocument17 pagesEMark Cyphrysse Masiglat67% (3)

- 05 Corporate Tax Planning and ManagementDocument34 pages05 Corporate Tax Planning and ManagementHimanshu SharmaPas encore d'évaluation

- QVLFUIk MRDWGZR 1 UDocument7 pagesQVLFUIk MRDWGZR 1 UShubham TyagiPas encore d'évaluation

- Recharge Receipt Template 1Document1 pageRecharge Receipt Template 1harshitagarwal381Pas encore d'évaluation

- HZL 4100070676 Inv Pay Slip PDFDocument12 pagesHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniPas encore d'évaluation

- Payslip February 2023Document2 pagesPayslip February 2023Abdul Khadar Jilani ShaikPas encore d'évaluation

- ITAD Ruling 14-01Document5 pagesITAD Ruling 14-01Ylmir_1989100% (1)

- Income Collection Deposit System With ConversionDocument5 pagesIncome Collection Deposit System With ConversionRichel ArmayanPas encore d'évaluation

- Conveyance Invoice StarDocument1 pageConveyance Invoice StarALOKE GANGULYPas encore d'évaluation

- The History of MoneyDocument30 pagesThe History of MoneyBea Nicole AugustoPas encore d'évaluation

- CA Finals Notes On Custom Valuation 02VEX0GHDocument8 pagesCA Finals Notes On Custom Valuation 02VEX0GHAnshul SinghalPas encore d'évaluation

- July 2021 STRFDocument11 pagesJuly 2021 STRFYae'kult VIpincepe QuilabPas encore d'évaluation

- Auchi PolyDocument1 pageAuchi PolyESECHIE CEPHASPas encore d'évaluation

- Rutendo KamukonoDocument3 pagesRutendo KamukonoHazel ChatsPas encore d'évaluation

- Suma Latha Account StatementDocument6 pagesSuma Latha Account StatementManjunath VaskuriPas encore d'évaluation

- Philippine Span Asia Carrier Corp.: From RF14 Engineering Dept. DateDocument10 pagesPhilippine Span Asia Carrier Corp.: From RF14 Engineering Dept. DateJezrell JaravataPas encore d'évaluation

- Wise Ltd. 56 Shoreditch High Street London E1 6JJ United KingdomDocument1 pageWise Ltd. 56 Shoreditch High Street London E1 6JJ United KingdomA VPas encore d'évaluation