Académique Documents

Professionnel Documents

Culture Documents

County Sues Myrtle Beach Over Market Common Development

Transféré par

ABC15 NewsTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

County Sues Myrtle Beach Over Market Common Development

Transféré par

ABC15 NewsDroits d'auteur :

Formats disponibles

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

STATE OF SOUTH CAROLINA IN THE COURT OF COMMON PLEAS

COUNTY OF HORRY CASE NO. 2018-CP-

School District of Horry County and Horry

County,

Plaintiffs,

vs. SUMMONS

City of Myrtle Beach and Myrtle Beach Air

Force Base Redevelopment Authority,

Defendants.

YOU ARE HEREBY SUMMONED and required to answer the Complaint in this action, a copy

of which is herewith served upon you, and to serve a copy of your answer to this complaint upon

the subscriber, at the address shown below, within thirty (30) days after the service hereof,

exclusive of the day of such service. If you fail to answer the Complaint within the time

aforesaid, the plaintiff in this action will apply to the Court for a judgment by default for the

relief demanded in the Complaint.

Respectfully Submitted,

Respectfully submitted, WOMBLE BOND DICKINSON (US), LLP

/s/ Brent O.E. Clinkscale

Brent O.E. Clinkscale (S.C. Bar No. 8451)

Brent.Clinkscale@wbd-us.com

S. Sterling Laney, III, Esq. (S.C. Bar No. 6933)

Sterling.Laney@wbd-us.com

Thomas M. Cull (S.C. Bar No. 102222)

Thomas.Cull@wbd-us.com

550 S Main St, Suite 400,

Greenville, SC 29601

Phone: (864) 255-5400

Counsel for Horry County School District

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

HARRISON WHITE, P.C.

/s/ Marghretta H. Shisko

Marghretta H. Shisko (S.C. Bar No. 100106)

mshisko@spartanlaw.com

John B. White, Jr. (S.C. Bar No. 5996)

jwhite@spartanlaw.com

178 W. Main Street (29306)

P.O. Box 3547

Spartanburg, SC 29304

Phone: (864) 585-5100

Counsel for Horry County

December 21, 2018

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

STATE OF SOUTH CAROLINA IN THE COURT OF COMMON PLEAS

COUNTY OF HORRY FIFTEENTH JUDICIAL CIRCUIT

School District of Horry County; C.A. No. 2018-CP-_______________

Horry County,

Plaintiffs, COMPLAINT

vs. (Jury Trial Demanded)

City of Myrtle Beach, South Carolina; Myrtle

Beach Air Force Base Redevelopment

Authority,

Defendants.

Plaintiffs School District of Horry County and Horry County, by and through their

undersigned counsel, complain against Defendants, the City of Myrtle Breach (the “City”) and

Myrtle Beach Air Force Base Redevelopment Authority (the “Authority”) (collectively

“Defendants”) as follows:

NATURE OF THE ACTION

1. This is a legal and equitable action for declaratory judgment, constructive trust,

conversion, unjust enrichment, promissory estoppel, accounting, a writ of mandamus, and

injunctive relief, arising out of the Defendants’ misuse of tax increment financing and taxpayer

funds intended for the redevelopment of the former Myrtle Beach Air Force Base, including, but

not limited to, Defendants’ failure to include the construction and funding of a new school in the

redevelopment plan. As set forth herein, Defendants have exceeded the authority granted by the

Federal Defense Facilities Redevelopment Law, S.C. Code Ann. §§ 31-12-10 et seq., and the

South Carolina Constitution, and have abused (and continue to abuse) the tax increment

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

financing mechanism and have misused (and continue to misuse) incremental tax revenues

derived from properties located within the former Myrtle Beach Air Force Base.

THE PARTIES

2. Plaintiffs are the School District of Horry County (the “School District”) and Horry

County (the “County”). Both the School District and the County are affected taxing districts and

political subdivisions with the power to levy taxes.

3. Defendant City is a political subdivision under the laws of the State of South Carolina.

The defendant is an incorporated municipality within the meaning of S.C. Code § 31-12-30(3).

4. The City, the School District, and the County are all governmental entities that assess and

levy ad valorem property taxes, and they share a geographic overlapping tax base with respect to

real property located within the City’s municipal limits. Each of these parties must, on an annual

basis, determine the amount of property tax revenues that they need to support their respective

operations and debt service, and they must set a millage rate that will generate that amount of

revenue. The County Treasurer collects and disburses the taxes levied on taxable real property

within Horry County.

5. Defendant Authority is a redevelopment authority within the meaning of S.C. Code Ann.

§ 31-12-30(2). The Authority has the power to sue and be sued. Id. § 31-12-70(A)(4). The

Authority was created by Executive Order of the Governor in 1994, as authorized by S.C. Code

Ann. § 31-12-40(A).

JURISDICTION AND VENUE

6. The jurisdiction of this Court is founded on S.C. Const. Art. V § 11, which grants the

circuit courts general jurisdiction over civil actions.

7. This Court has personal jurisdiction over the Defendants named herein.

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

8. Venue is proper in this County pursuant to the South Carolina Code of Laws and South

Carolina Rules of Civil Procedure.

FACTUAL ALLEGATIONS

The Statutory Scheme.

9. The Federal Defense Facilities Redevelopment Law, S.C. Code Ann. §§ 31-12-10 et seq.

(the “Defense Redevelopment Law”), provides a funding mechanism for the redevelopment of

properties in South Carolina on which defense sites were formally located.

10. The South Carolina General Assembly enacted the Defense Redevelopment Law so that

local governments could redevelop former military base properties and reintegrate those areas

back into the surrounding community.

11. The Defense Redevelopment Law authorizes the adoption of a “redevelopment plan,”

which is defined as “the comprehensive program of the authority for redevelopment intended by

the payment of redevelopment costs to redevelop properties scheduled for disposal which may

tend to return properties to the tax rolls, replace lost jobs, and integrate the properties back into

the community, enhancing the tax bases of the taxing districts which extend into the project

redevelopment area and the economic health of the community in which it lies.” S.C. Code Ann.

§ 31-12-30(5).

12. “Each redevelopment plan must set forth in writing the program to be undertaken to

accomplish the objectives and must include, but not be limited to, estimated redevelopment

project costs, possible sources of funds to pay costs, the most recent equalized assessed valuation

of the project area as of the time of creation of a tax increment finance district pursuant to

Section 31-12-200, an estimate as to the equalized assessed valuation after redevelopment, and

the general land uses to apply in the redevelopment project area.” S.C. Code Ann. §31-12-30(5).

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

13. A redevelopment plan must set forth any “redevelopment projects” to be undertaken,

which are defined to include “buildings, improvements, including street improvements, water

and storm drainage facilities, parking facilities, and recreational facilities.” S.C. Code Ann. §

31-12-30(6).

14. The plan must also include “estimated redevelopment project costs” and “possible

sources of funds to pay costs.” S.C. Code Ann. § 31-12-30(5). The statute defines

redevelopment project costs to include “the total of all reasonable or necessary costs incurred or

estimated to be incurred and any costs incidental to a redevelopment project,” including, for

example, “costs of studies and surveys,” “property assembly costs,” “costs of rehabilitation,

reconstruction, repair, or remodeling or a redevelopment project,” “costs of the construction of a

redevelopment project,” “financing costs,” and “relocation costs.” Id. § 31-12-30(8). All

redevelopment project costs must be related to “the comprehensive program” for redevelopment

of the former military base. See id.

15. In developing a redevelopment plan, an Authority is required to, among other things,

“take into account the needs of the surrounding community” and “attempt to reintegrate the

redevelopment of properties scheduled for disposition with any adjacent areas.” S.C. Code Ann.

§ 31-12-70(C)(1), (2).

16. South Carolina Constitution Article X, § 14(10) provides the Constitutional purpose of

and authorization for the Defense Redevelopment Law and the use of tax increment financing,

and specifically, it provides that the "General Assembly may authorize by general law that

indebtedness for the purpose of redevelopment within incorporated municipalities and counties

may be incurred, and that the debt service of such indebtedness be provided from the added

increments of tax revenues to result from any such project." (emphasis added).

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

17. When the Constitutional purpose of the Defense Redevelopment Law, i.e.

“redevelopment,” has been achieved, the redevelopment authority and redevelopment plan must

be dissolved and surplus incremental tax revenues generated from properties in a redevelopment

project area must be returned to the respective taxing districts for distribution according to their

respective millage rates.

The Myrtle Beach Air Force Base.

18. The former Myrtle Beach Air Force Base property consists of approximately 4,000 acres

located within the city limits of the City of Myrtle Beach, South Carolina. The Air Force Base

operated as such until the early 1990s, when the federal government announced that the Base

was scheduled for closure as part of a nationwide program to reduce defense spending and to

wind-down operations at unneeded federal defense facilities.

19. The Air Force Base closed permanently in 1993.

20. In 1994, when the Myrtle Beach Air Force Base Redevelopment Authority was created,

the former Air Force Base became a tax increment financing district by operation of S.C. Code

Ann. § 31-12-200, which provides:

Upon creation of a redevelopment authority by the Governor, properties

scheduled for disposal within a particular municipality, whether

contiguous or not, including to the extent that the State may then or

afterwards have or acquire jurisdiction, all properties over which the State

has ceded jurisdiction in whole or in part to the United States of America,

and including both the real property to be disposed of by an authority as

well as any other properties disposed of directly by the federal government

to public or private persons or entities, other than disposal to the federal

government for other federal defense uses, in connection with military

installation closure and realignment or other federal defense site closure,

realignment, or drastic downsizing, without further action being necessary,

constitute a tax increment finance district in accordance with the

remaining provisions of this chapter.

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

21. In 1998, the General Assembly earmarked Sunday alcohol permit sales (estimated at

about $1.8 million per year) to go to the Authority for its operating costs. The Authority

continued to receive that revenue for five years.

22. The Authority developed and adopted an Original Redevelopment Plan for the former Air

Force base in 1998 (the “1998 Plan”).

23. The 1998 Plan set forth a list of redevelopment projects to be constructed to meet the

objectives of providing “[i]nfrastructure improvements required for desired investments by

private businesses and developers,” “[i]mprovements necessary to the provision of services to

citizens and businesses,” and “[i]mprovements that integrate the Air Force Base properties into

the surrounding community.”

24. The projects listed in the 1998 Plan were as follows:

a. Redevelopment Planning and Design Activities;

b. Project Management;

c. Economic Development Marketing and Management;

d. Property Acquisition;

e. Financing Costs;

f. Demolition;

g. South Park Village Capital Improvement Projects (with South Park Village First

Phase Projects and South Park: Later Phase Projects);

h. Phyllis Boulevard Improvements;

i. Harrelson Boulevard Improvements; and

j. Water and Sewer Improvements.

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

25. Each project listed in the 1998 Plan was accompanied by a budget estimate for that

project. The total budget estimate for all redevelopment projects in the 1998 Plan (20-year time

frame) was $83,683,000.

26. None of the projects listed in the 1998 Plan include ongoing maintenance, repairs, or

upfits as an anticipated redevelopment project cost. Elsewhere, the 1998 Plan contemplated that

improvements to redevelopment projects could be funded by sources other than TIF bonds or

incremental tax revenues—e.g., the City’s Capital Improvements Budget, Utilities Enterprise

Fund, and Impact Fees.

27. The 1998 Plan expressly stated that “completion of these projects will depend on the

availability of funding from a number of sources including tax incremental revenues, other

funding from the Authority and the City, support from County, State and Federal governments,

and investments by private partners.” The Plan further stated that “[r]edevelopment financing

will come from a variety of sources,” including tax increment financing as well as land sales

revenues, rental income, beer and wine permit revenues, the City’s capital improvement budget

(and other City sources), and participation from federal and state governments, Horry County

Schools, and other entities.

28. The 1998 Plan further stated, “Upon completion of the redevelopment projects, the

Redevelopment Project Area will be dissolved and the full financial benefit of all growth that has

occurred within the Redevelopment Project Area will accrue to each local government’s tax

base.”

29. In 2004, tax revenues were essentially frozen for the properties comprising the former Air

Force Base. Since that time, the City, the School District, and the County have all received

property tax revenues based on the amount generated by applying their respective millage rates

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

for the 2004 assessed value of the former Air Force Base parcels. The total assessed value of

those parcels for 2004 was $4,247,212. Since 2004, the property values of parcels located in the

former Air Force Base have generally increased, and the aggregate and individual assessed

values have increased as well.

30. The amount that each taxing entity receives each year is based on the 2004 baseline

values: $4,247,212.

31. In September 2004, it was announced to the public that the Authority had found

developers to develop the area that would become Market Common. The Market Common area

is an “urban village” concept that the Authority developed early on in its existence. In order to

attract private developers, the City had agreed to issue bonds to pay for public infrastructure at

the Air Force Base site. This public infrastructure was intended to spur development and

included such things as roads, parks, and water and sewer lines.

32. On or about June 27, 2005, the Authority adopted an Amended Redevelopment Plan (the

“2005 Plan”). The 2005 Plan provided an updated land use plan, made minor revisions to the

design of the development of an urban village to be known as “South Park Village,” and

provided revised cost estimates.

33. In December 2005, the City officially concurred in the Amended Redevelopment Plan of

the Authority.

34. In 2006, the first series of TIF bonds were issued to build infrastructure within the

redevelopment area.

35. The City issued another series of bonds in 2010 to help finance the project known as

“Grand Park.”

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

36. The final maturity date of both the 2006 bonds and the 2010 bonds was 2035. The City’s

authority to issue additional TIF bonds for the Air Force Base expires in 2020.

37. The Market Common area opened for business in 2008. It consists of retail and office

space, restaurants, entertainment, and residences.

38. The County’s ITAP project was added to the Plan in 2010.

39. In 2013, the Sun News published an article declaring the redevelopment of the former Air

Force Base to be a “resounding success.”

40. In 2016, the City refinanced its outstanding bond debt of approximately $40.13

million by issuing new bonds at lower rates. The 2016 refunding bonds did not extend the

original maturity date(s) of 2035.

41. The 2004 baseline total assessed value for the former Air Force base is $4,247,212. As

of 2018, the total assessed value for the former Air Force Base had increased to $38,214,901.

The amounts in excess of the baseline value are referred to herein as “incremental tax revenues.”

42. Incremental tax revenues are not distributed to the School District or the County

according to their millage rates but are, instead, used by the City to pay principal and interest on

outstanding TIF bonds and for other expenses.

43. On or about August 14, 2018, the City accepted a recommendation from the Authority

regarding improvements to the former Air Force Base site and approved an amendment to the

Redevelopment Plan that removed the proposed school from the list of projects and approved

almost $47,000,000 in additional improvements to the project area.

44. Upon information and belief, the TIF is set to expire in 2035.

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

45. Upon information and belief, throughout the duration of the redevelopment of the Myrtle

Beach Air Force Base, the City has exceeded the authority granted to it by the Defense

Redevelopment Law.

46. The City indicated that it would begin to have surplus money to distribute to the County

and School Board, beginning in 2018, but the City did not ask the Authority to declare a surplus

for 2018.

47. Additionally, the City plans to issue $15,000,000 in additional bonds to pay for “projects”

in the former Air Force Base.

48. The former Air Force Base has been reintegrated into the surrounding community and the

redevelopment is complete.

Project 19.

49. On October 7, 1998, the Authority approved the original, 1998 Plan, which included

funding, in the amount of $20,000,000.00, for the construction of a school (“Project 19”) in the

redevelopment district.

50. The School Board had been seeking the inclusion of a school in the Air Force Base site,

since, at least, 1991.

51. The financing for Project 19 was to come from the issuance of TIF bonds derived under

the Defense Redevelopment Law.

52. On or around November 19, 1998, the City and School Board held a joint workshop,

during which the School Board expressed concerns that the Plan will increase operating costs for

the School Board and that revenue would be diverted from schools in the School District during

the pendency of the plan.

10

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

53. The Plan was amended on June 27, 2005, and Project 19 became one of several City

Development Projects, which consisted of projects 12-19.

54. On or around September 21, 2005, Thomas Leath, Myrtle Beach City Manager (“Mr.

Leath”), informed the School District Superintendent, Gerrita Postlewait, that the Authority had

identified a site for Project 19 but that the location ultimately was deemed unacceptable by the

School District. Mr. Leath subsequently stated that the school could be built anywhere in the

TIF district.

55. During a City Council meeting in late 2005, Mr. Leath informed the City Council that the

School Board had requested that Project 19 be given priority.

56. On or around May 31, 2006, Mr. Leath informed Horry County Schools that, of all the

projects in the second tier, the City Council agreed that Project 19 had priority and would be

constructed.

57. For approximately nineteen (19) years, Project 19 was a part of the Plan, and

throughout that time, the Authority and City made promises and assurances that Project 19

would remain a part of the Plan.

58. Based on more than nineteen years of representations by Defendants, Plaintiffs have

expended funds in anticipation of the school project and forborne opportunities to develop a

school on economically advantageous terms, among other things.

59. On November 14, 2017, nineteen years after the creation of the Plan, the Authority held a

public hearing, removing Project 19 from the Plan.

60. The redevelopment of the former Myrtle Beach Air Force Base has increased the number

of students for which the School District must provide services and has caused the School

District to incur costs to make accommodations for those students.

11

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

61. Because of the City and Redevelopment Authority’s actions, there is no longer land

suitable for the construction of a school in the redevelopment district.

62. Because of the City and Redevelopment Authority’s actions, the School Board will be at

a disadvantage when they will, inevitably, be required to construct a school at its own expense.

63. The City has substantially modified and changed its redevelopment plan on multiple

occasions since the Original Plan was adopted in 1998. In substantially modifying its plan,

the City has failed to follow the procedures and requirements delineated by the Defense

Redevelopment Statute.

64. Additionally, the City's modification and changing of the redevelopment plan on

multiple occasions has resulted in the unlawful diversion of property tax revenues to the City at

the expense of the Horry County School District, Horry County, and other affected taxing

districts.

65. Upon information and belief, the City has redirected funds and plans to redirect funds

from community development projects, such as the Horry County School Plan to other sources,

which are not contemplated or authorized by the statute.

66. As the City has fully paid for its projects under the Plan or collected sufficient funds to

pay for them using tax increment proceeds, the City unlawfully retained and continues to

unlawfully retain tax increment proceeds, including those not used to service debt obligations

for redevelopment projects and costs, instead of returning those surplus funds to Horry County

and the School District as required by the Defense Redevelopment Statute.

67. Upon information and belief, the inclusion of Project 19 made the City and

Redevelopment Authority’s Plan more attractive, and Defendants received tangible benefits as a

result of its inclusion.

12

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

68. Upon information and belief, the City is using and plans to use incremental tax revenues

to fund normal City expenditures, such as maintenance, operations, and repairs, which are not

directly connected to the purpose of the Defense Redevelopment Statute and the purpose of

redevelopment.

69. The School District, already damaged by the plan, will incur additional, considerable

expenses in providing a the means for students to attend school in Horry County, either by

building a new school or by expanding other schools.

FOR A FIRST CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Declaratory Judgment)

70. Plaintiffs incorporate each of the allegations set forth above as if fully set forth herein.

71. The School District of Horry County, Horry County, the City of Myrtle Beach, and the

Redevelopment Authority have a valid dispute regarding the construction, application, and effect

of the Defense Redevelopment Law. Accordingly, a declaratory judgment defining the rights,

privileges, and duties of and between the parties is appropriate pursuant to S.C. Code § 15-53-10

et seq.

72. In particular, Plaintiffs are entitled to a declaratory judgment in their favor as to the

following:

a. Plaintiffs are entitled to declaratory relief declaring that the City has acted

unlawfully in retaining excess tax increment funds not required for the payment of

bonds, notes, or other obligations of the City related to any properly adopted or

modified redevelopment project.

b. Plaintiffs are entitled to declaratory relief declaring that the City has acted

unlawfully in retaining excess tax increment funds with the intent to appropriate

those funds for future projects.

13

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

c. Plaintiffs are entitled to declaratory relief, declaring that the Defendants have

exceeded the authority and powers granted under the Defense Redevelopment

Law by, among other things, funding initiatives that are not statutorily authorized.

d. Plaintiffs are entitled to declaratory relief, declaring that the City has exceeded

and plans to exceed its authority under the Defense Redevelopment Law by,

among other things, controlling and directing the redevelopment, when such

authority lies with the Authority.

e. Plaintiffs are entitled to an order of this Court determining that the Constitutional

purpose of the Defense Redevelopment Law has been achieved, the program

should be dissolved, and funds distributed to the Plaintiffs.

f. Plaintiffs are entitled to an order of this Court commanding the City to pay to the

County Treasurer all excess tax increment funds illegally retained by the City for

distribution according to law.

g. Plaintiffs further are entitled to an order of this Court setting forth the School

District’s and the County’s rights under the statute.

FOR A SECOND CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Preliminary and Permanent Injunction)

73. Plaintiffs incorporate each of the allegations set forth above as if fully set forth herein.

74. As set forth herein, Defendants have, do, and will continue to wrongfully possess and use

excess tax funds issued to which Plaintiffs are entitled.

75. Additionally, Defendants plan to implement the amendment to the Redevelopment and

Financing Plan of the Myrtle Beach Air Force Base Redevelopment Authority (the

“Amendment”), which the City approved on August 14, 2018, even though the Amendment does

14

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

not meet the statutory purpose of the Redevelopment Law and is inconsistent with the

constitutional authorization for the use of tax increment financing.

76. The balance of hardships between the parties justifies a remedy in equity.

77. Injunctive relief is necessary in this case in order to preserve the status quo.

78. The City has consistently spent TIF monies over and above the amounts necessary to pay

the annual debt service on the 2016 refunding bonds and has publicly announced that it will

continue to do so. As a result, as a practical matter, those funds, once spent, cannot be recaptured

in the event of a judgment in favor of the Plaintiffs. As a result, there is no adequate remedy at

law.

79. As set forth herein, Plaintiffs are likely to succeed on the merits.

80. The Plaintiffs will suffer irreparable harm if injunctive relief is not granted.

81. Plaintiffs seek an order of this Court enjoining the City from spending excess tax

increment revenue and enjoining the City from implementing the Amendment until the issues in

the lawsuit, regarding the validity of the Plan, the amendments to the Plan, and the Defendants’

conduct, have been resolved.

FOR A THIRD CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Unjust Enrichment/Quantum Meruit)

82. Plaintiffs incorporate each of the allegations set forth above as if fully set forth herein.

83. Plaintiffs have relinquished monies and resources for the benefit of City and

Redevelopment Authority.

84. Upon information and belief, the City has used the funds received unlawfully.

85. The Plaintiffs conferred a benefit to the City and Redevelopment Authority.

86. The City and Redevelopment Authority have retained these benefits.

15

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

87. The City and Redevelopment Authority’s retention of these benefits, without paying their

value, is inequitable.

FOR A FOURTH CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Accounting)

88. Plaintiffs incorporate each of the allegations set forth above as if fully set forth herein.

89. Plaintiffs ask this Court to require the City and the Authority to provide them with a

complete and accurate accounting of all revenues and expenditures related to the development,

planning, and funding of projects and the payment of bond issuance expenses and debt service

since the development and adoption of the 1998 Plan and continuing through the trial of this

matter.

FOR A FIFTH CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Conversion)

90. Plaintiffs incorporate each of the allegations set forth above as if fully set forth herein.

91. Defendants have intentionally used funds, to which Plaintiffs’ are entitled, without

Plaintiffs’ consent.

92. Defendants’ continued use of funds for improper and unauthorized purposes constitutes

wrongful possession.

93. As a result of Defendants’ wrongful ownership, retention, and misuse of funds, Plaintiffs

have suffered actual damages for the lost value of the property, ongoing expenses in furtherance

of recovering its property, among other damages to be shown at trial.

FOR A SIXTH CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Constructive Trust)

94. Plaintiffs incorporate each of the allegations set forth above as if fully set forth herein.

95. Plaintiffs ask this Court to exercise its equitable powers and impose a constructive trust

upon all such funds for the benefit of the Plaintiffs and any other affected taxing district.

16

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

96. Plaintiffs are informed and believe that Defendants have in the past, and continue to this

day, held and appropriated funds which were held for the benefit of the Plaintiffs and other

taxing districts.

97. Defendants’ retention and misuse of funds, as set forth above, was in bad faith and

constitutes an abuse of confidence entrusted.

FOR A SEVENTH CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Promissory Estoppel)

98. Plaintiffs incorporate each of the allegations set forth above as if fully set forth herein.

99. The Authority and the City made promises to the Plaintiffs that the construction and

funding of a school would be achieved through the Plan.

100. The School Board relied upon these promises.

101. The City and Authority expected the School Board to rely on these promises, and

it was foreseeable that the School Board would do so.

102. As a direct and proximate result of the City and Authority’s promises, the School

Board suffered damages, the amount of which is to be determined at trial.

103. For the reasons set forth above, the Plaintiffs are entitled to relief under the

doctrine of promissory estoppel.

FOR AN EIGHTH CAUSE OF ACTION AGAINST BOTH DEFENDANTS

(Mandamus)

104. Plaintiffs repeat and re-allege all of the above paragraphs and all subsequent

paragraphs as if each were set forth herein verbatim.

105. The Authority has a non-discretionary duty under the Defense Redevelopment

Law to, among other things, return all surplus tax increment revenues to affected taxing districts

for distribution according to law.

17

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

106. To date, Defendants have failed to declare a surplus and distribute funds under the

circumstances required by the Defense Redevelopment Law. Defendants’ retention of tax

increment revenues contravenes the Defense Redevelopment Law and is unlawful.

107. Defendants’ failure to perform its statutory obligations under the Defense

Redevelopment Law has resulted in substantial harm to Plaintiffs. In particular, Defendants have

wrongfully withheld millions of dollars of funds due to the Plaintiffs, which are necessary for the

provision of public services and public works projects.

108. Defendants should be compelled to perform a statutorily imposed duty owed to

Plaintiffs, to cease spending tax revenues beyond those authorized by the Defense

Redevelopment Law, and to make all necessary distributions to Plaintiffs.

PRAYER FOR RELIEF

WHEREFORE, Plaintiffs respectfully requests that this Court enter judgment against

Defendants as follows:

1. Ordering Defendants to return all funds wrongfully withheld and pay Plaintiffs for

all damages sustained;

2. Ordering Defendants to pay Plaintiffs’ costs and reasonable attorneys’ fees

incurred in this action;

3. Enjoining Defendants from spending, distributing, or otherwise disposing of

funds during the resolution of this matter so as to preserve the property central to this dispute;

4. Enjoining Defendants from taking any action to implement to implement the

amendment to the Redevelopment and Financing Plan of the Myrtle Beach Air Force Base

Redevelopment Authority, which the City approved on August 14, 2018; and

5. Awarding Plaintiffs such additional and further relief as the Court deems just and

proper.

18

WBD (US) 45029189v18

ELECTRONICALLY FILED - 2018 Dec 21 3:28 PM - HORRY - COMMON PLEAS - CASE#2018CP2607249

This the 21st of December 2018.

WOMBLE BOND DICKINSON (US), LLP

/ s/ Brent O.E. Clinkscale

Brent O.E. Clinkscale (S.C. Bar No. 8451)

Brent.Clinkscale@wbd-us.com

S. Sterling Laney, III, Esq. (S.C. Bar No. 6933)

Sterling.Laney@wbd-us.com

Thomas M. Cull (S.C. Bar No. 102222)

Thomas.Cull@wbd-us.com

550 S Main St, Suite 400,

Greenville, SC 29601

Phone: (864) 255-5400

Counsel for Horry County School District

HARRISON WHITE, P.C.

/ s/ Marghretta H. Shisko

Marghretta H. Shisko (S.C. Bar No. 100106)

mshisko@spartanlaw.com

John B. White, Jr. (S.C. Bar No. 5996)

jwhite@spartanlaw.com

178 W. Main Street (29306)

P.O. Box 3547

Spartanburg, SC 29304

Phone: (864) 585-5100

Counsel for Horry County

19

WBD (US) 45029189v18

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- South Carolina Attorney General Files Lawsuit Against Companies Over Toxic Forever Chemicals'Document46 pagesSouth Carolina Attorney General Files Lawsuit Against Companies Over Toxic Forever Chemicals'Tiffany TranPas encore d'évaluation

- Palmetto Preschool & Learning Center LawsuitDocument7 pagesPalmetto Preschool & Learning Center LawsuitABC15 NewsPas encore d'évaluation

- Gamma World Character SheetDocument1 pageGamma World Character SheetDr8chPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Manika Jefferson-Davis vs. G Spot Arcade Bar & Grill LawsuitDocument15 pagesManika Jefferson-Davis vs. G Spot Arcade Bar & Grill LawsuitABC15 NewsPas encore d'évaluation

- Solidwork Flow Simulation TutorialDocument298 pagesSolidwork Flow Simulation TutorialMilad Ah100% (8)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Plants Life Cycles and PartsDocument5 pagesPlants Life Cycles and PartsseemaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Lawsuit Against Georgetown Co. and Covington HomesDocument87 pagesLawsuit Against Georgetown Co. and Covington HomesABC15 NewsPas encore d'évaluation

- Georgia 2023 SB44 EngrossedDocument5 pagesGeorgia 2023 SB44 EngrossedABC15 NewsPas encore d'évaluation

- Pharma Pathway SopDocument350 pagesPharma Pathway SopDinesh Senathipathi100% (1)

- Constitutional Carry SummaryDocument2 pagesConstitutional Carry SummaryABC15 NewsPas encore d'évaluation

- Georgia Power Utility AssistanceDocument2 pagesGeorgia Power Utility AssistanceABC15 NewsPas encore d'évaluation

- Fire Fee ComplaintDocument34 pagesFire Fee ComplaintABC15 News100% (1)

- Popular Tools CatalogDocument24 pagesPopular Tools CatalogCarbide Processors IncPas encore d'évaluation

- 021SAACK Burner Operating Instructions PDFDocument136 pages021SAACK Burner Operating Instructions PDFmekidmu tadesse100% (1)

- Arcelor Mittal - Bridges PDFDocument52 pagesArcelor Mittal - Bridges PDFShamaPas encore d'évaluation

- Siegfried Kracauer - Photography (1927)Document17 pagesSiegfried Kracauer - Photography (1927)Paul NadeauPas encore d'évaluation

- SRS documentation of Virtual Classroom System , SRS documentation of Personal Identity Management ,SRS documentation of EMentoring for women system , SRS Documentation of Employee Performance Management SRS Documentation of Online TicketingDocument79 pagesSRS documentation of Virtual Classroom System , SRS documentation of Personal Identity Management ,SRS documentation of EMentoring for women system , SRS Documentation of Employee Performance Management SRS Documentation of Online Ticketingsaravanakumar1896% (26)

- Case Presentation - Bipolar Affective Disorder 2Document73 pagesCase Presentation - Bipolar Affective Disorder 2Hemant's galaxy All is herePas encore d'évaluation

- Parenteral NutritionDocument78 pagesParenteral NutritionImen YuniePas encore d'évaluation

- Marketability ReportDocument15 pagesMarketability ReportABC15 NewsPas encore d'évaluation

- Kenneth Hofmann Resignation LetterDocument1 pageKenneth Hofmann Resignation LetterABC15 NewsPas encore d'évaluation

- Injunction Against Worden Butler, Janet Butler, Alexis HartnettDocument11 pagesInjunction Against Worden Butler, Janet Butler, Alexis HartnettMichael OwensPas encore d'évaluation

- Kenneth Hofmann Resignation LetterDocument1 pageKenneth Hofmann Resignation LetterABC15 NewsPas encore d'évaluation

- NESA Region 2024 Economic UpdateDocument10 pagesNESA Region 2024 Economic UpdateABC15 NewsPas encore d'évaluation

- Robert Childs III LawsuitDocument8 pagesRobert Childs III LawsuitABC15 NewsPas encore d'évaluation

- Kingcrest Drive Murder & Burglary WarrantsDocument6 pagesKingcrest Drive Murder & Burglary WarrantsABC15 NewsPas encore d'évaluation

- Florence City Council Agenda - Dangerous Animal OrdinanceDocument149 pagesFlorence City Council Agenda - Dangerous Animal OrdinanceABC15 NewsPas encore d'évaluation

- Lula Mae Woods House ResolutionDocument4 pagesLula Mae Woods House ResolutionABC15 NewsPas encore d'évaluation

- Governor's Office For Atlantic Beach ElectionDocument3 pagesGovernor's Office For Atlantic Beach ElectionABC15 NewsPas encore d'évaluation

- Tybee City Council Agenda ResolutionDocument2 pagesTybee City Council Agenda ResolutionABC15 NewsPas encore d'évaluation

- Tyler Doyle Boating Accident ReportDocument1 pageTyler Doyle Boating Accident ReportABC15 NewsPas encore d'évaluation

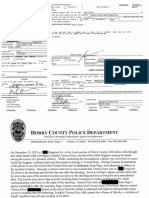

- Kenard and Chelsea Burley vs. Horry County Police Dept. Lawsuit Document #1Document6 pagesKenard and Chelsea Burley vs. Horry County Police Dept. Lawsuit Document #1ABC15 NewsPas encore d'évaluation

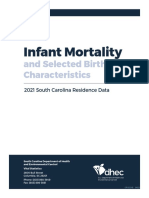

- SC DHEC Infant Mortality Rate ReportDocument40 pagesSC DHEC Infant Mortality Rate ReportABC15 NewsPas encore d'évaluation

- South Carolina Maternal Morbidity and Mortality Review CommitteeDocument4 pagesSouth Carolina Maternal Morbidity and Mortality Review CommitteeABC15 NewsPas encore d'évaluation

- Tyler Doyle Phone Log - January 26, 2023Document2 pagesTyler Doyle Phone Log - January 26, 2023ABC15 News0% (1)

- Glynn County Police April 3 StatementDocument2 pagesGlynn County Police April 3 StatementABC15 NewsPas encore d'évaluation

- District Attorney's Office On Lehrkamp InvestigationDocument2 pagesDistrict Attorney's Office On Lehrkamp InvestigationActionNewsJaxPas encore d'évaluation

- Christian Holden's Call Log - January 26, 2023Document1 pageChristian Holden's Call Log - January 26, 2023ABC15 NewsPas encore d'évaluation

- Savannah Sqaure Naming GuidelinesDocument2 pagesSavannah Sqaure Naming GuidelinesABC15 NewsPas encore d'évaluation

- 2022.09.16 - Pendarvis Complaint FiledDocument92 pages2022.09.16 - Pendarvis Complaint FiledABC15 NewsPas encore d'évaluation

- DHEC vs. Carriage House LawsuitDocument8 pagesDHEC vs. Carriage House LawsuitABC15 NewsPas encore d'évaluation

- 2 Case StudyDocument8 pages2 Case Studysehrish khawerPas encore d'évaluation

- Funny Physics QuestionsDocument3 pagesFunny Physics Questionsnek tsilPas encore d'évaluation

- Marketing of Agriculture InputsDocument18 pagesMarketing of Agriculture InputsChanakyaPas encore d'évaluation

- Design of Steel Structures Handout 2012-2013Document3 pagesDesign of Steel Structures Handout 2012-2013Tushar Gupta100% (1)

- Speech TravellingDocument4 pagesSpeech Travellingshafidah ZainiPas encore d'évaluation

- KCL Thesis PrintingDocument4 pagesKCL Thesis PrintingMelinda Watson100% (2)

- Verification of First Law V-SonometerDocument3 pagesVerification of First Law V-SonometerRick astley's microphonePas encore d'évaluation

- Case Study On Vivekananda Flyover BridgeDocument8 pagesCase Study On Vivekananda Flyover BridgeHeta PanchalPas encore d'évaluation

- 114 ArDocument254 pages114 ArJothishPas encore d'évaluation

- What Is Inventory Management?Document31 pagesWhat Is Inventory Management?Naina SobtiPas encore d'évaluation

- UTC awarded contracts with low competitionDocument2 pagesUTC awarded contracts with low competitioncefuneslpezPas encore d'évaluation

- Operation Manual TempoLink 551986 enDocument12 pagesOperation Manual TempoLink 551986 enBryan AndradePas encore d'évaluation

- Networks Lab Assignment 1Document2 pagesNetworks Lab Assignment 1006honey006Pas encore d'évaluation

- After EffectsDocument56 pagesAfter EffectsRodrigo ArgentoPas encore d'évaluation

- JTIL Purchase Requisition for Plasma Machine SparesDocument3 pagesJTIL Purchase Requisition for Plasma Machine Sparesshivam soniPas encore d'évaluation

- Costos estándar clase viernesDocument9 pagesCostos estándar clase viernesSergio Yamil Cuevas CruzPas encore d'évaluation

- IS 2848 - Specition For PRT SensorDocument25 pagesIS 2848 - Specition For PRT SensorDiptee PatingePas encore d'évaluation

- Working With Session ParametersDocument10 pagesWorking With Session ParametersyprajuPas encore d'évaluation

- Bosch Committed to Outsourcing to Boost CompetitivenessDocument4 pagesBosch Committed to Outsourcing to Boost CompetitivenessPriya DubeyPas encore d'évaluation