Académique Documents

Professionnel Documents

Culture Documents

Accounting & Financial Management

Transféré par

Nitin Varman0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues2 pagesFinance management

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentFinance management

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues2 pagesAccounting & Financial Management

Transféré par

Nitin VarmanFinance management

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Course Code: 173MC1T05

ADITYA ENGINEERING COLLEGE (A)

MCA I Semester End Examinations (Regular) January 2018

ACCOUNTING & FINANCIAL MANAGEMENT

Time: 3 hours Max. Marks: 60

________________________________________________________________________________________________________________________________________________________________________________________________________________________

Answer any FIVE Questions

All Questions Carry Equal Marks

All parts of the questions must be answered at one place only

1 a Explain the role of an Accountant in the modern organizations [12M]

What is a Trail Balance? What are the objectives of preparing a Trail

Balance

2 a What are the limitations of Accounting Ratios? [4M]

b Identify the three major types of activities classified in a cash flow statement [8M]

and explain each activity’s cash inflows and cash outflows.

3 a Distinguish between Absorption costing and Marginal costing [6M]

b What are the basic assumptions and limitations of CVP analysis [6M]

4 a What is a sales budget? How is it prepared? [4M]

b A Company manufacturing ‘distempers’ operated a costing system. The [8M]

standard cost of one of the products of the company shows the following

standards:

Materials Quantity Standard price per kg Total

(Rs.)

A 40 kg 75 3,000

B 10 kg 50 500

C 50 kg 20 1,000

Total material cost per unit = 4,500

The standard input mix is 100 kg. and the standard output of the finished

product is 90 kg. The actual results for the period are:

A = 2,40,000 kg @ Rs. 80 per kg

B – 40,000 kg @Rs. 52 per kg.

C= 2,00,000 kg @ Rs. 21 per kg.

Actual output of the finished product = 4,20,000 kg.

You are required to calculate the material price, mix and yield variance

5 a What do you understand about the computerized accounting system? [8M]

b Write about the documents that are used for data collection? [4M]

6 a Explain the ‘Accounting Cycle” [5M]

b How do you classify the accounts? Explain the rules of debit and credit with [7M]

respect to different types of accounts.

7 a The following information is provided to you [8M]

Selling price per unit Rs. 40

Variable cost per unit Rs. 24

Fixed cost per unit Rs. 6

Profit per unit Rs. 10

Present sales volume is 2,000 units

Your are required to calculate

i. P/V ratio and Breakeven point

ii. Margin of safety

iii. Sales required to earn a profit of Rs. 26,000

iv. Profit at a sales volume of 2,500 units

b What are the advantages of Ratio analysis? [4M]

8 a What do you understand by the terms over capitalization and under [6M]

capitalization?

b Distinguish between forecasting and budgeting? [6M]

*****

Vous aimerez peut-être aussi

- Schaum's Outline of Principles of Accounting I, Fifth EditionD'EverandSchaum's Outline of Principles of Accounting I, Fifth EditionÉvaluation : 5 sur 5 étoiles5/5 (3)

- Ford Taurus Service Manual - Disassembly and Assembly - Automatic Transaxle-Transmission - 6F35 - Automatic Transmission - PowertrainDocument62 pagesFord Taurus Service Manual - Disassembly and Assembly - Automatic Transaxle-Transmission - 6F35 - Automatic Transmission - Powertraininfocarsservice.dePas encore d'évaluation

- Gel Electrophoresis Lab ReportDocument10 pagesGel Electrophoresis Lab Reportapi-31150900783% (6)

- Autoridad Myles Munroe Poder de La El Proposito y PDF Autoridad Myles MunroeDocument5 pagesAutoridad Myles Munroe Poder de La El Proposito y PDF Autoridad Myles MunroeMaricarmen MorenoPas encore d'évaluation

- Alchemical Psychology Uniform Edition o - HillmanDocument207 pagesAlchemical Psychology Uniform Edition o - HillmanElsy Arana95% (22)

- SAM Project 1bDocument13 pagesSAM Project 1bNolan Blair0% (2)

- Baroque MusicDocument15 pagesBaroque Musicthot777100% (2)

- Top Ten Nutrients That Support Fat Loss - Poliquin ArticleDocument4 pagesTop Ten Nutrients That Support Fat Loss - Poliquin Articledjoiner45Pas encore d'évaluation

- Autocad s'13 NittDocument38 pagesAutocad s'13 NittNitin VarmanPas encore d'évaluation

- 3.5 ExercisesDocument13 pages3.5 ExercisesGeorgios MilitsisPas encore d'évaluation

- HazopDocument4 pagesHazopbaaziz2015Pas encore d'évaluation

- Principles of World Class Manufacturing PDFDocument171 pagesPrinciples of World Class Manufacturing PDFkaniappan sakthivel100% (1)

- Cp-117-Project EngineeringDocument67 pagesCp-117-Project Engineeringkattabomman100% (1)

- D5092 - Design and Installation of Ground Water Monitoring Wells in AquifersDocument14 pagesD5092 - Design and Installation of Ground Water Monitoring Wells in Aquifersmaxuelbestete100% (1)

- Reference Guide for Pineapple JuiceDocument5 pagesReference Guide for Pineapple JuiceLayfloPas encore d'évaluation

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrPas encore d'évaluation

- MANAGERIAL ECONOMICS &FINANCIAL ANALYSIS March 2021Document7 pagesMANAGERIAL ECONOMICS &FINANCIAL ANALYSIS March 2021Ma NiPas encore d'évaluation

- Afs 94th JaibbDocument4 pagesAfs 94th JaibbMahmudul HassanPas encore d'évaluation

- Postal Test Papers_P8_Intermediate_Syllabus 2012Document23 pagesPostal Test Papers_P8_Intermediate_Syllabus 2012nivedita_h42404Pas encore d'évaluation

- WWW - Manaresults.co - In: (Common To Ce, Eee, Me, Ece, Cse, Eie, It, MCT, Etm, MMT, Ae Mie, PTM, Cee, MSNT)Document2 pagesWWW - Manaresults.co - In: (Common To Ce, Eee, Me, Ece, Cse, Eie, It, MCT, Etm, MMT, Ae Mie, PTM, Cee, MSNT)NIMMANAGANTI RAMAKRISHNAPas encore d'évaluation

- Befa Regular 22019Document2 pagesBefa Regular 22019reddy reddyPas encore d'évaluation

- Exam Roll No. & Financial Management ExamDocument1 pageExam Roll No. & Financial Management ExamakshatPas encore d'évaluation

- MCO-05 ENG IgnouDocument51 pagesMCO-05 ENG Ignousanthi0% (1)

- 2013 PatternDocument232 pages2013 PatternPrayank RajePas encore d'évaluation

- Knowledge Level Business Finance May Jun 2014Document2 pagesKnowledge Level Business Finance May Jun 2014Laskar REAZPas encore d'évaluation

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeonePas encore d'évaluation

- Assignment For First Sem CMDocument4 pagesAssignment For First Sem CMnishant khadkaPas encore d'évaluation

- USN Dayananda Sagar College of Engineering: UG Semester End Examination TemplateDocument3 pagesUSN Dayananda Sagar College of Engineering: UG Semester End Examination Templaterockurocky gaPas encore d'évaluation

- Campusexpress - Co.in: Set No. 1Document8 pagesCampusexpress - Co.in: Set No. 1skssushPas encore d'évaluation

- P1 Question JUNE 2020Document6 pagesP1 Question JUNE 2020S.M.A AwalPas encore d'évaluation

- 0102 Managerial Economics and Financial AnalysisDocument7 pages0102 Managerial Economics and Financial AnalysisFozia PanhwerPas encore d'évaluation

- Kohat University Mid Term Exam Questions on Managerial AccountingDocument2 pagesKohat University Mid Term Exam Questions on Managerial Accountingilyas muhammadPas encore d'évaluation

- MS-4 Dec 2007Document4 pagesMS-4 Dec 2007Saket DubeyPas encore d'évaluation

- Operation Management 2014 QuestionsDocument5 pagesOperation Management 2014 QuestionsAshutosh AgalPas encore d'évaluation

- Xaviers Institute of Business Management StudiesDocument2 pagesXaviers Institute of Business Management StudiesJay KrishnaPas encore d'évaluation

- Management AccountingDocument8 pagesManagement AccountingVinu VaviPas encore d'évaluation

- Working Capital ManagementDocument5 pagesWorking Capital ManagementDiya MukherjeePas encore d'évaluation

- Bcom 5 Sem Cost Accounting 1 20100106 Feb 2020Document4 pagesBcom 5 Sem Cost Accounting 1 20100106 Feb 2020sandrabiju7510Pas encore d'évaluation

- Business Accounting FinalDocument12 pagesBusiness Accounting FinalNikesh Munankarmi100% (1)

- MEFA Most Important QuestionsDocument15 pagesMEFA Most Important Questionsapi-26548538100% (5)

- Question PaperDocument3 pagesQuestion PaperAmbrishPas encore d'évaluation

- C-Scheme) : Re-AppearDocument8 pagesC-Scheme) : Re-AppearANUJ MANGLAPas encore d'évaluation

- Issues in Management Accounting Bac 4407Document6 pagesIssues in Management Accounting Bac 4407Rugeyye RashidPas encore d'évaluation

- Master of Commerce Term-End Examination / 1:3 1-June, 2019Document4 pagesMaster of Commerce Term-End Examination / 1:3 1-June, 2019Tushar SharmaPas encore d'évaluation

- Wef2012 Pilot MAFDocument9 pagesWef2012 Pilot MAFdileepank14Pas encore d'évaluation

- MEFA Important QuestionsDocument14 pagesMEFA Important Questionstulasinad123Pas encore d'évaluation

- Every Sheet of Answers Should Bear Your Roll NoDocument5 pagesEvery Sheet of Answers Should Bear Your Roll NoKushalPas encore d'évaluation

- Perunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiDocument4 pagesPerunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiAlbert JuliePas encore d'évaluation

- Managerial Economics Financial Accountancy June July 2022 PDFDocument8 pagesManagerial Economics Financial Accountancy June July 2022 PDFblack mailPas encore d'évaluation

- Advanced Financial Management Elective PaperDocument3 pagesAdvanced Financial Management Elective PaperRamakrishna NagarajaPas encore d'évaluation

- FM IiDocument5 pagesFM IiDarshan GandhiPas encore d'évaluation

- Mefa Imp+ Arryasri Guide PDFDocument210 pagesMefa Imp+ Arryasri Guide PDFvenumadhavPas encore d'évaluation

- Commerce Syllabus Degree Part 3Document21 pagesCommerce Syllabus Degree Part 3मनोज गुप्ता उपाध्यक्षPas encore d'évaluation

- BhaDocument25 pagesBharishu jainPas encore d'évaluation

- Managerial Economics Financial Analysis June July 2022Document8 pagesManagerial Economics Financial Analysis June July 2022Ashwik YadavPas encore d'évaluation

- (2008 Pattern) PDFDocument231 pages(2008 Pattern) PDFKundan DeorePas encore d'évaluation

- Finance For ProcurementDocument3 pagesFinance For ProcurementAlex MuhweziPas encore d'évaluation

- MBA Managerial Accounting TestDocument3 pagesMBA Managerial Accounting TestasdePas encore d'évaluation

- E Book Mgt705Document20 pagesE Book Mgt705haf472Pas encore d'évaluation

- MCS Question BankDocument4 pagesMCS Question BankVrushali P.Pas encore d'évaluation

- CMA Srilanka PDFDocument7 pagesCMA Srilanka PDFFerry SihalohoPas encore d'évaluation

- bt31R07 12 11 09rahulDocument40 pagesbt31R07 12 11 09rahulPradeep NelapatiPas encore d'évaluation

- Managerial Accounting and FinanceDocument8 pagesManagerial Accounting and FinanceKiarsPas encore d'évaluation

- 3 Business FinanceDocument2 pages3 Business FinanceTanvir PrantoPas encore d'évaluation

- KABARAK UNIVERSITY ACCT 520 EXAMDocument5 pagesKABARAK UNIVERSITY ACCT 520 EXAMMutai JoseahPas encore d'évaluation

- August 2022 R: Page 1 of 7Document6 pagesAugust 2022 R: Page 1 of 7Salai SivagnanamPas encore d'évaluation

- Accounting For Management Question BankDocument65 pagesAccounting For Management Question BankAnish KumarPas encore d'évaluation

- AIOU Managerial Accounting Assignment 1Document9 pagesAIOU Managerial Accounting Assignment 1AR KhanPas encore d'évaluation

- Code No: 25079Document8 pagesCode No: 25079SRINIVASA RAO GANTAPas encore d'évaluation

- Tutorial Questions FMF June 2022 Tutorial 3 B - 6Document12 pagesTutorial Questions FMF June 2022 Tutorial 3 B - 6Clarinda LeePas encore d'évaluation

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalPas encore d'évaluation

- Supply Chain Management and Business Performance: The VASC ModelD'EverandSupply Chain Management and Business Performance: The VASC ModelPas encore d'évaluation

- 2018 Market Guide For Transportation Mobility Technology: Bart de MuynckDocument32 pages2018 Market Guide For Transportation Mobility Technology: Bart de MuynckNitin Varman100% (2)

- IRDAI (Trade Credit Insurance) Guidelines, 20212021-09-08Document10 pagesIRDAI (Trade Credit Insurance) Guidelines, 20212021-09-08Nitin VarmanPas encore d'évaluation

- Rules For Harmony Cup 2020Document2 pagesRules For Harmony Cup 2020Nitin VarmanPas encore d'évaluation

- Key Technology Trends and Considerations For Transportation Mobility SolutionsDocument15 pagesKey Technology Trends and Considerations For Transportation Mobility SolutionsNitin VarmanPas encore d'évaluation

- Chapter 18Document11 pagesChapter 18Nitin VarmanPas encore d'évaluation

- Case Study Rational ExuberanceDocument2 pagesCase Study Rational ExuberanceNitin VarmanPas encore d'évaluation

- Annual ReportDocument54 pagesAnnual ReportNitin VarmanPas encore d'évaluation

- Turnitin Originality: Ie Services by NITINVARMAN MDocument4 pagesTurnitin Originality: Ie Services by NITINVARMAN MNitin VarmanPas encore d'évaluation

- Operations Interest GRP Events For 2019-2020Document1 pageOperations Interest GRP Events For 2019-2020Nitin VarmanPas encore d'évaluation

- Tata MagnaDocument2 pagesTata MagnaNitin VarmanPas encore d'évaluation

- MM ServicesDocument22 pagesMM ServicesNitin VarmanPas encore d'évaluation

- MM SERVICESDocument10 pagesMM SERVICESNitin VarmanPas encore d'évaluation

- Unit II - Concept of Accident, Accident ReportingDocument5 pagesUnit II - Concept of Accident, Accident ReportingNitin VarmanPas encore d'évaluation

- ME451 Industrial Safety SyllabusDocument20 pagesME451 Industrial Safety SyllabusNitin VarmanPas encore d'évaluation

- MM SERVICESDocument10 pagesMM SERVICESNitin VarmanPas encore d'évaluation

- Ergonomics of BAJA ATVDocument1 pageErgonomics of BAJA ATVNitin Varman100% (1)

- FEM Problems With SolutionsDocument28 pagesFEM Problems With SolutionsNitin VarmanPas encore d'évaluation

- B.Tech. Mechanical Engineering SyllabusDocument33 pagesB.Tech. Mechanical Engineering SyllabusNitin VarmanPas encore d'évaluation

- Design of Machines PracticeDocument2 pagesDesign of Machines PracticeNitin VarmanPas encore d'évaluation

- Mechanica TutorialDocument20 pagesMechanica TutorialIwan IstantoPas encore d'évaluation

- MacPherson Strut Doc: Car Suspension SystemDocument7 pagesMacPherson Strut Doc: Car Suspension SystemNitin VarmanPas encore d'évaluation

- AutomobileDocument25 pagesAutomobileNitin VarmanPas encore d'évaluation

- Sujet Dissertation Sciences PolitiquesDocument7 pagesSujet Dissertation Sciences PolitiquesDoMyPaperSingapore100% (1)

- Adjectives For A Businessman 2023Document2 pagesAdjectives For A Businessman 2023elyvuujavierPas encore d'évaluation

- SDH PDFDocument370 pagesSDH PDFClaudia GafencuPas encore d'évaluation

- MARS Motor Cross Reference InformationDocument60 pagesMARS Motor Cross Reference InformationLee MausPas encore d'évaluation

- DP4XXX PricesDocument78 pagesDP4XXX PricesWassim KaissouniPas encore d'évaluation

- Production of Carotenoids From Rhodotorula Mucilaginosa and Their Applications As Colorant Agent in Sweet CandyDocument7 pagesProduction of Carotenoids From Rhodotorula Mucilaginosa and Their Applications As Colorant Agent in Sweet CandyEspinosa Balderas GenaroPas encore d'évaluation

- Equilibrium of Supply and DemandDocument4 pagesEquilibrium of Supply and DemandJuina Mhay Baldillo ChunacoPas encore d'évaluation

- Metaswitch Datasheet Network Transformation OverviewDocument5 pagesMetaswitch Datasheet Network Transformation OverviewblitoPas encore d'évaluation

- The Biologic Width: - A Concept in Periodontics and Restorative DentistryDocument8 pagesThe Biologic Width: - A Concept in Periodontics and Restorative DentistryDrKrishna DasPas encore d'évaluation

- Kiribati, Gilbertese BibleDocument973 pagesKiribati, Gilbertese BibleAsia BiblesPas encore d'évaluation

- Totally New Term Dates 2013.20Document9 pagesTotally New Term Dates 2013.20nabub8Pas encore d'évaluation

- History of Technical Writing HardDocument4 pagesHistory of Technical Writing HardAllyMae LopezPas encore d'évaluation

- Land, Soil, Water, Natural Vegetation& Wildlife ResourcesDocument26 pagesLand, Soil, Water, Natural Vegetation& Wildlife ResourcesKritika VermaPas encore d'évaluation

- Wet Specimen Preservation MethodsDocument24 pagesWet Specimen Preservation Methodstamil selvanPas encore d'évaluation

- Lipofectamine3000 ProtocolDocument2 pagesLipofectamine3000 ProtocolSamer AshrafPas encore d'évaluation

- 2 Science Animals Practise TestDocument2 pages2 Science Animals Practise TestThrisha WickramasinghePas encore d'évaluation

- CHAPTER 8 SULLIVAN MyReviewerDocument7 pagesCHAPTER 8 SULLIVAN MyReviewerFrances LouisePas encore d'évaluation

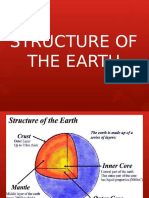

- Earth's StructureDocument10 pagesEarth's StructureMaitum Gemark BalazonPas encore d'évaluation

- Apostolic Faith: Beginn NG of World REV VALDocument4 pagesApostolic Faith: Beginn NG of World REV VALMichael HerringPas encore d'évaluation