Académique Documents

Professionnel Documents

Culture Documents

Philippine Health Insurance Corporation vs. Commission On Audit Digest

Transféré par

Emir MendozaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Philippine Health Insurance Corporation vs. Commission On Audit Digest

Transféré par

Emir MendozaDroits d'auteur :

Formats disponibles

Philippine Health Insurance Corporation vs.

Commission on Audit (2018)

Petitioners: PHILIPPINE HEALTH INSURANCE CORPORATION

Respondents: COMMISSION ON AUDIT (COA), CHAIRPERSON MICHAEL G. AGUINALDO, DIRECTOR

JOSEPH B. ANACAY, AND SUPERVISING AUDITOR ELENA L. AGUSTIN

Ponente: Jardeleza (En Banc)

Topic: Remedial Law; Political Law

SUMMARY: COA disallowed the Institutional Meeting Expenses of the PhilHealth for the calendar year 2010.

SC affirmed.

DOCTRINE: There is no incompatibility with respect to the definition of a month under the Civil Code and the

Administrative Code. A month is understood under both laws to be 30 days.

---

Appointment is the selection by the proper authority of an individual who is to exercise the functions of an office.

Designation, on the other hand, connotes merely the imposition of additional duties, upon a person already in

the public service by virtue of an earlier appointment or election.

FACTS:

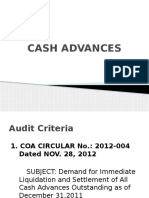

On May 24, 2011, the COA Supervising Auditor issued an Audit Observation Memorandum (AOM) which

showed that reimbursements of Extraordinary and Miscellaneous Expense (EME) totaling P19.95 million in

calendar year 2010 were charged to the Representation Expenses account under the sub-accounts "Institutional

Meeting Expenses (865-10) and Committee Meeting Expenses (865-20)." The AOM noted that PhilHealth had

been using IME and Committee Meeting Expenses accounts to accommodate reimbursements of EME since

charges to the EME account already far exceeded the General Appropriations Act (GAA) prescribed limitation

for each official. The COA Supervising Auditor viewed the charging of EME against other accounts to be irregular

because the nature and purpose of these expenses fall under the budgetary controls in the disbursement of EME

as stated in the GAA and COA Circular No. 2006-01. The charging of EME against other accounts likewise

increased the amount of the excess from the GAA-prescribed annual rate for EME.[10] The Supervising Auditor

also observed that P5.63 million of the total amount was reimbursement of expenses made by members of the

PhilHealth BOD and personnel whose positions were not entitled to EME.

The COA affirmed the disallowance of the Institutional Meeting Expenses (IME) for 2010 paid to members

of the Board of Directors (BOD) of Philippine Health Insurance Corporation (PhilHealth) in the total amount of

P2,965,428.59.

ISSUES:

WoN PhilHealth’s appeal to the COA was timely filed

o NO. Firstly, PhilHealth maintains that the term "month" in the six-month reglementary period to

file an appeal under the 2009 Revised Rules of Procedure of COA should be understood to mean

the 30-day month and should, accordingly, not use the equivalent of 180 days. We are not

persuaded.

o Section 4, Rule V of the 2009 Revised Rules of Procedure of the COA provides that an appeal

before the Director of a Central Office Audit Cluster in the National, Local or Corporate Sector, or

of a Regional Office of the Commission, must be filed within six months after receipt of the

decision appealed from.

o Glaringly, however, the issue in CIR vs. Primetown, which PhilHealth relies upon, was with

respect to the two-year prescriptive period within which to file for a tax refund or credit under the

National Internal Revenue Code. In computing this legal period, the Court held that there was a

manifest incompatibility with regard to the manner of computing legal periods, particularly as to

what constitutes a year, under Article 13 of the Civil Code and Section 31, Chapter VIII, Book I of

the Administrative Code of 1987.

o What is at issue here, conversely, is the computation of the legal period for a "month." Unlike in

Primetown, there is no incompatibility with respect to the definition of a month under the Civil

Code and the Administrative Code. A month is understood under both laws to be 30 days. In

ascertaining the last day of the reglementary period to appeal, one month is to be treated as

equivalent to 30 days, such that six months is equal to 180 days. Thus, the period began to run

on July 27, 2012 upon receipt of the ND and ended on January 23, 2013. The COA was correct,

therefore, in denying the appeal on the ground that the six-month period within which to file an

appeal from the ND had already lapsed when PhilHealth filed its appeal to the COA-CGS on

January 24, 2013.

WoN the disallowance of the IME had legal basis

o YES. Even if we were to relax the rules and entertain the appeal, we find that PhilHealth's case

would still fail on its merits.

o Section 18(d) of RA No. 7875, which allows the members of the BOD to receive per diems for

every meeting they actually attend, must be understood to refer only to the appointive members

and not to those who are designated in an ex officio capacity or by virtue of their title to a certain

office. The ex officio position being actually and in legal contemplation part of the principal office,

it follows that the official concerned has no right to receive any other form of additional

compensation for his services in the said position; otherwise, it would run counter with the

constitutional prohibitions against holding multiple positions in the government and receiving

additional or double compensation.

o Contrary to the posturing of PhilHealth, its charter does not authorize the grant of additional

allowances to the BOD beyond per diems. For one, while Section 18(d) of RA No. 7875 is entitled

"allowances and per diems," its body significantly fails to mention any other allowances or benefits

besides per diems. It is a basic precept of statutory construction that the express mention of one

person, thing, act, or consequence excludes all others, as expressed in the oft-repeated maxim

expressio unius est exlusio alterius. Elsewise stated, expressium facit cessare tacitum—what is

expressed puts an end to what is implied. Casus omissus pro omisso habendus est. A person,

object or thing omitted must have been omitted intentionally. If the legislature intended to give

PhilHealth the authority to grant allowances to the BOD other than the per diems, it could have

facilely mentioned so.

o Secondly, PhilHealth, cannot take refuge behind its assertion that it may grant additional benefits

on the strength of its fiscal autonomy under Section 16(n) of RA No. 7875, as tempered by the

limitations provided in Section 26(b). We have already ruled on this same argument in PhilHealth

v. COA, where it was posited that it is the intent of the legislature to limit the determination and

approval of allowances to the PhilHealth BOD alone, subject only to the 12% to 13% limitation.

We have declared in that case that PhilHealth does not have unbridled discretion to issue any

and all kinds of allowances, limited only by the provisions of its charter. even on the fair

assumption that RA No. 7875 grants PhilHealth the power to fix compensation, the same is limited

to; as expressly worded in Section 16(n); the personnel of PhilHealth. In BCDA vs. COA, the Court

upheld DBM Circular Letter No. 2002-2 which states that "[m]embers of the Board of Directors of

agencies are not salaried officials of the government. As non-salaried officials they are not entitled

to PERA, ADCOM, YEB and retirement benefits unless expressly provided by law."

o Neither can PhilHealth find solace in the alleged approval or confirmation by former President

Gloria Macapagal-Arroyo of PhilHealth's fiscal autonomy through two executive communications

relative to its request to exercise fiscal authority in line with the PhilHealth Rationalization Plan.

We observe that the alleged presidential approval was merely on the marginal note of the said

communications and was never reduced in any formal memorandum. So, too, the Court has

previously held in BCDA that the presidential approval of a new compensation and benefit scheme

which included the grant of allowances found to be unauthorized by law shall not estop the State

from correcting the erroneous application of a statute.

o In line with managing the Program, RA No. 7875 speaks of ensuring fund viability, as well as

carrying out a fiduciary responsibility such that the Program shall provide effective stewardship,

funds management, and maintenance of reserves. In a lot of ways, therefore, it is also imperative

for PhilHealth to utilize funds for the salaries and allowances of its BOD members with as much

circumspection and restraint as the SSS. Like the latter, the funds under the PhilHealth's

stewardship need to be devoted primarily to providing universal and affordable health care to all

Filipinos.

o Having established that RA No. 7875 does not authorize the grant of additional allowances and

benefits to the BOD, it does not follow (as we have already mentioned) that such grants are strictly

and absolutely proscribed. The authority to grant EMEs may be derived from the GAA.

o However, the Supervising Auditor observed that the EMEs granted were irregularly charged to

other accounts of PhilHealth in order to accommodate reimbursements of EMEs which have

already far exceeded the prescribed limitation set under the 2010 GAA. This act of charging was

found to be irregular because it was conducted in a manner that deviated from the set standards,

which in this case were the budgetary controls in the disbursement of the EME as stated in the

GAA and COA Circular No. 2006-001. The irregular charging also resulted to an increase in the

"excess from the GAA prescribed annual rate for EME." There is no cogent reason to overturn

these findings of the Supervising Auditor, which PhilHealth failed to refute squarely in their

comment to the AOM.

o Finally, the defense of PhilHealth that its BOD members were reimbursed the IME in good faith

and must, therefore, be not required to refund the disallowed amount, does not lie. Insofar as ex

officio members are concerned, we reiterate our ruling in Tetangco that, by jurisprudence, patent

disregard of case law and COA directives amounts to gross negligence; hence, good faith on the

part of the the approving officers cannot be presumed.

o Neither can good faith be appreciated with respect to the appointive members of the BOD. The

Court can understand that the BOD might have merely relied on, albeit erroneously: (1)

PhilHealth's power to fix the compensation of its personnel and for the BOD to exercise fiscal

management; and (2) the fact that RA No. 7875 does not expressly prohibit Board members from

receiving benefits other than the per diem authorized by law. There are findings, however, from

the COA-CGS that the BOD members already knew at the time of their receipt of the IMEs that

said benefits had no legal basis. This findings remain unrebutted by PhilHealth

NOTES: Petition DENIED.

Vous aimerez peut-être aussi

- Philippine Health Insurance Corporation vs. Commission On Audit (July 2018) DigestDocument3 pagesPhilippine Health Insurance Corporation vs. Commission On Audit (July 2018) DigestEmir MendozaPas encore d'évaluation

- Plopenio Vs - Dar Case DigestDocument2 pagesPlopenio Vs - Dar Case DigestMichelle Villamora100% (3)

- Ursua Vs CA Case DigestDocument2 pagesUrsua Vs CA Case DigestAngelica Garces100% (3)

- People v. Dulay y PascualDocument2 pagesPeople v. Dulay y PascualNoreenesse SantosPas encore d'évaluation

- Philippine International Trade Corp V COA G R No 183517 June 22 2010Document1 pagePhilippine International Trade Corp V COA G R No 183517 June 22 2010Carlo Jose BactolPas encore d'évaluation

- I-26 Mercado Et Al V NLRCDocument1 pageI-26 Mercado Et Al V NLRCG SPas encore d'évaluation

- G.R. No. 141386 Digested CaseDocument2 pagesG.R. No. 141386 Digested CaseRoselyn Reyes100% (3)

- 1 People v. Estonilo Direct AssaultDocument3 pages1 People v. Estonilo Direct AssaultcatePas encore d'évaluation

- Valencia vs. Court of AppealsDocument2 pagesValencia vs. Court of AppealsMang Jose100% (2)

- Anonymous Complaint Against Presiding Judge Analie CDocument1 pageAnonymous Complaint Against Presiding Judge Analie CChristine LaguraPas encore d'évaluation

- People vs. Delantar-1Document2 pagesPeople vs. Delantar-1Jonaz EnriquezPas encore d'évaluation

- 15 Philhealth Vs COADocument2 pages15 Philhealth Vs COAmei atienzaPas encore d'évaluation

- Statcon DigestDocument2 pagesStatcon Digestronithanne100% (1)

- People V CabalquintoDocument2 pagesPeople V CabalquintoPeter Joshua OrtegaPas encore d'évaluation

- The Solicitor General For PetitionerDocument4 pagesThe Solicitor General For PetitionerJorela Tipan100% (1)

- Agpalo Notes - Statutory Construction, CH 7Document1 pageAgpalo Notes - Statutory Construction, CH 7Chikoy AnonuevoPas encore d'évaluation

- Facts:: Amatan v. Aujero A.M. No. RTJ-93-956. September 27, 1995Document32 pagesFacts:: Amatan v. Aujero A.M. No. RTJ-93-956. September 27, 1995akonik22Pas encore d'évaluation

- CASE DIGEST VELEZ vs. DEMETRIODocument1 pageCASE DIGEST VELEZ vs. DEMETRIOAlia del RosarioPas encore d'évaluation

- Puyo vs. Judge Go (2018)Document2 pagesPuyo vs. Judge Go (2018)Mara VinluanPas encore d'évaluation

- Ralph P. Tua Vs Hon. Cesar A. Mangrobang and Rossana Honrado-TuaDocument3 pagesRalph P. Tua Vs Hon. Cesar A. Mangrobang and Rossana Honrado-TuaGeline Joy D. SamillanoPas encore d'évaluation

- People v. Regalario CDDocument3 pagesPeople v. Regalario CDjustine bayosPas encore d'évaluation

- US v. Ten Yu Et - Al. G.R. No. 7482 December, 28, 1912Document3 pagesUS v. Ten Yu Et - Al. G.R. No. 7482 December, 28, 1912Aaron Ariston50% (2)

- DigestsDocument2 pagesDigestsTurboyNavarro100% (1)

- Maria Clara DoctrineDocument1 pageMaria Clara DoctrineRaiza SartePas encore d'évaluation

- Hacienda Luisita Vs PARC DigestDocument3 pagesHacienda Luisita Vs PARC DigestMegan Mateo100% (3)

- Stat ConDocument4 pagesStat ConaddyPas encore d'évaluation

- LBP Vs Amado (Case Digest)Document4 pagesLBP Vs Amado (Case Digest)Dyannah Alexa Marie Ramacho100% (1)

- People V Tamani DigestDocument1 pagePeople V Tamani DigestNori Lola100% (1)

- Case No. 20 Escalante Vs SantosDocument2 pagesCase No. 20 Escalante Vs SantosDossPas encore d'évaluation

- Spouses Mercado vs. LBPDocument2 pagesSpouses Mercado vs. LBPSORITA LAWPas encore d'évaluation

- U.S. vs. Pompeya 31 Phil. 245Document1 pageU.S. vs. Pompeya 31 Phil. 245FranzMordenoPas encore d'évaluation

- Espinas Vs CoaDocument3 pagesEspinas Vs Coachatmche-06Pas encore d'évaluation

- Sec. de Lima v. GatdulaDocument2 pagesSec. de Lima v. GatdulaKrisha Marie CarlosPas encore d'évaluation

- Chapter 25 Legal Reasoning 2011 Christopher Enright PDFDocument21 pagesChapter 25 Legal Reasoning 2011 Christopher Enright PDFPiayaPas encore d'évaluation

- Navarro Vs Navarro - PersonsDocument1 pageNavarro Vs Navarro - PersonsWu CM JessicaPas encore d'évaluation

- Bank of The Philippine Islands Vs DandoDocument2 pagesBank of The Philippine Islands Vs DandoLovelyPas encore d'évaluation

- 5 People vs. YabutDocument2 pages5 People vs. YabutKJPL_1987Pas encore d'évaluation

- People Vs DomasianDocument2 pagesPeople Vs DomasianJaz SumalinogPas encore d'évaluation

- Ombudsman V. Apolonio Article XI - Section 13 Petitioners RespondentsDocument2 pagesOmbudsman V. Apolonio Article XI - Section 13 Petitioners RespondentsHazel P.Pas encore d'évaluation

- Consti Page 23-12 PhilConsa Vs GPH, GR 218406 (Nov. 29, 2016)Document9 pagesConsti Page 23-12 PhilConsa Vs GPH, GR 218406 (Nov. 29, 2016)Lu CasPas encore d'évaluation

- People of The Philippines, G.R. Nos. 148682-85 Appellee, - Versus - Angel A. Enfermo, AppellantDocument4 pagesPeople of The Philippines, G.R. Nos. 148682-85 Appellee, - Versus - Angel A. Enfermo, AppellantHemsley Battikin Gup-ayPas encore d'évaluation

- 08 GR No. 112170 - FINAL DIGESTEDDocument2 pages08 GR No. 112170 - FINAL DIGESTEDKishalyn Dao-inesPas encore d'évaluation

- Siquian Vs ComelecDocument2 pagesSiquian Vs ComelecAthena SantosPas encore d'évaluation

- Montelibano V FerrerDocument2 pagesMontelibano V FerrerMarius Rodriguez100% (1)

- GORDON and LOPEZDocument3 pagesGORDON and LOPEZLei Tacang100% (1)

- People Vs Genosa 419 SCRADocument1 pagePeople Vs Genosa 419 SCRAreyPas encore d'évaluation

- People v. BayaniDocument2 pagesPeople v. BayaniPhoebe KatesPas encore d'évaluation

- Statutory Construction - Course OutlineDocument5 pagesStatutory Construction - Course OutlineFernanPas encore d'évaluation

- 10 Digest For Stat ConDocument4 pages10 Digest For Stat ConAbbie KwanPas encore d'évaluation

- Land Bank v. Heirs of TañadaDocument3 pagesLand Bank v. Heirs of TañadaPaul Joshua SubaPas encore d'évaluation

- Home Development Mutual Fund v. SagunDocument4 pagesHome Development Mutual Fund v. SagunShella Hannah SalihPas encore d'évaluation

- 45 People V AycardoDocument1 page45 People V AycardoSui JurisPas encore d'évaluation

- Perez v. Palomar (2 Phil 682)Document3 pagesPerez v. Palomar (2 Phil 682)Ashley Kate PatalinjugPas encore d'évaluation

- Legamia Vs IACDocument1 pageLegamia Vs IACCelinka ChunPas encore d'évaluation

- People vs. Lopez DigestDocument2 pagesPeople vs. Lopez DigestRussell John HipolitoPas encore d'évaluation

- Floralde V CADocument1 pageFloralde V CACzar Ian AgbayaniPas encore d'évaluation

- Compiled Cases IV 1987 ConstiDocument15 pagesCompiled Cases IV 1987 ConstiDeonna FernandezPas encore d'évaluation

- Galicto vs. Aquino IIIDocument14 pagesGalicto vs. Aquino IIIJosine ProtasioPas encore d'évaluation

- Tejada v. DomingoDocument3 pagesTejada v. DomingoRaymond RoquePas encore d'évaluation

- Module 2: Effect and Application of Laws: Cawad vs. Abad Et. Al. G.R. No. 207145 FactsDocument5 pagesModule 2: Effect and Application of Laws: Cawad vs. Abad Et. Al. G.R. No. 207145 FactsLeyyPas encore d'évaluation

- Labay vs. Sandiganbayan DigestDocument4 pagesLabay vs. Sandiganbayan DigestEmir Mendoza100% (2)

- Pacho vs. Judge Lu DigestDocument3 pagesPacho vs. Judge Lu DigestEmir MendozaPas encore d'évaluation

- Comelec 2025 Aes TorDocument70 pagesComelec 2025 Aes TorEmir MendozaPas encore d'évaluation

- People vs. San Jose DigestDocument7 pagesPeople vs. San Jose DigestEmir Mendoza100% (1)

- People vs. Rojas DigestDocument3 pagesPeople vs. Rojas DigestEmir MendozaPas encore d'évaluation

- People vs. Gajila DigestDocument3 pagesPeople vs. Gajila DigestEmir MendozaPas encore d'évaluation

- People vs. Olarbe DigestDocument4 pagesPeople vs. Olarbe DigestEmir Mendoza100% (5)

- Department of Transportation vs. Philippine Petroleum Sea Transport Association DigestDocument8 pagesDepartment of Transportation vs. Philippine Petroleum Sea Transport Association DigestEmir Mendoza100% (1)

- People vs. Salga DigestDocument5 pagesPeople vs. Salga DigestEmir Mendoza100% (2)

- People vs. Ubungen DigestDocument3 pagesPeople vs. Ubungen DigestEmir MendozaPas encore d'évaluation

- Office of The Court Administrator vs. Alaras DigestDocument3 pagesOffice of The Court Administrator vs. Alaras DigestEmir MendozaPas encore d'évaluation

- Juego-Sakai vs. Republic DigestDocument2 pagesJuego-Sakai vs. Republic DigestEmir Mendoza100% (3)

- Radiowealth Finance Company, Inc. vs. Pineda, JR PDFDocument7 pagesRadiowealth Finance Company, Inc. vs. Pineda, JR PDFEmir MendozaPas encore d'évaluation

- Ramos vs. People DigestDocument2 pagesRamos vs. People DigestEmir Mendoza100% (1)

- Montejo vs. Commission On Audit DigestDocument2 pagesMontejo vs. Commission On Audit DigestEmir MendozaPas encore d'évaluation

- Revilla vs. Sandiganbayan DigestDocument7 pagesRevilla vs. Sandiganbayan DigestEmir Mendoza50% (2)

- Heirs of Arce vs. Department of Agrarian Reform DigestDocument3 pagesHeirs of Arce vs. Department of Agrarian Reform DigestEmir MendozaPas encore d'évaluation

- Anonymous vs. Judge Buyucan DigestDocument4 pagesAnonymous vs. Judge Buyucan DigestEmir MendozaPas encore d'évaluation

- Department of Education vs. Dela Torre DigestDocument2 pagesDepartment of Education vs. Dela Torre DigestEmir Mendoza100% (2)

- Land Bank vs. Prado Verde Corporation DigestDocument3 pagesLand Bank vs. Prado Verde Corporation DigestEmir MendozaPas encore d'évaluation

- Republic vs. Decena DigestDocument3 pagesRepublic vs. Decena DigestEmir MendozaPas encore d'évaluation

- People vs. de Vera DigestDocument4 pagesPeople vs. de Vera DigestEmir MendozaPas encore d'évaluation

- Bar 2018 ResultsDocument15 pagesBar 2018 ResultsEmir MendozaPas encore d'évaluation

- Radiowealth Finance Company, Inc. vs. Pineda, Jr. DigestDocument2 pagesRadiowealth Finance Company, Inc. vs. Pineda, Jr. DigestEmir Mendoza100% (2)

- Moreno vs. Kahn DigestDocument2 pagesMoreno vs. Kahn DigestEmir Mendoza100% (3)

- People vs. Balubal DigestDocument3 pagesPeople vs. Balubal DigestEmir MendozaPas encore d'évaluation

- Philippine Assisted Reproductive Technologies Act (Proposed Version by Emir Mendoza)Document5 pagesPhilippine Assisted Reproductive Technologies Act (Proposed Version by Emir Mendoza)Emir MendozaPas encore d'évaluation

- Masbate vs. Relucio DigestDocument3 pagesMasbate vs. Relucio DigestEmir Mendoza100% (5)

- Bangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestDocument3 pagesBangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestEmir Mendoza100% (3)

- C89 300Document2 pagesC89 300Sherhan KahalanPas encore d'évaluation

- Feliciano v. Commission On Audit - Full TextDocument8 pagesFeliciano v. Commission On Audit - Full TextDino Bernard LapitanPas encore d'évaluation

- Coa M2014-008Document8 pagesCoa M2014-008KeleePas encore d'évaluation

- Coa Guidelines For The Prevention and Disallowance of Iueeu PDFDocument71 pagesCoa Guidelines For The Prevention and Disallowance of Iueeu PDFleah santosPas encore d'évaluation

- COMMISSION ON AUDIT CIRCULAR NO. 87-282 December 22, 1987Document2 pagesCOMMISSION ON AUDIT CIRCULAR NO. 87-282 December 22, 1987Prateik RyukiPas encore d'évaluation

- I. Jurisdiction of COA To Adjudicate Money ClaimsDocument2 pagesI. Jurisdiction of COA To Adjudicate Money ClaimsAllen AnceroPas encore d'évaluation

- Gaminde V COADocument1 pageGaminde V COASig G. MiPas encore d'évaluation

- PDS Revised 2016Document4 pagesPDS Revised 2016erwin sarmientoPas encore d'évaluation

- Commission On Audit: Prepared By: Jobel FraynaDocument16 pagesCommission On Audit: Prepared By: Jobel FraynaEdmund Earl Timothy Hular Burdeos IIIPas encore d'évaluation

- Melchor v. COA, G.R No. 95398, August 16, 1991Document2 pagesMelchor v. COA, G.R No. 95398, August 16, 1991Carie LawyerrPas encore d'évaluation

- Petitioners, vs. Philippine Veterans Bank, The Ex-OfficioDocument61 pagesPetitioners, vs. Philippine Veterans Bank, The Ex-OfficioLiDdy Cebrero BelenPas encore d'évaluation

- Rpofiling The Philippine Adminstrative SystemDocument39 pagesRpofiling The Philippine Adminstrative SystemLucille Gacutan Aramburo100% (4)

- T10 Government AccountingDocument10 pagesT10 Government AccountingAiya LumbanPas encore d'évaluation

- Gov Acc Post TestDocument15 pagesGov Acc Post Test수지100% (1)

- Dingcong vs. Guingona PDFDocument8 pagesDingcong vs. Guingona PDFAlthea Angela GarciaPas encore d'évaluation

- Form 57A 1Document3 pagesForm 57A 1RaulJunioRamos100% (1)

- Pale Digest Pool PDFDocument49 pagesPale Digest Pool PDFmarie labatosPas encore d'évaluation

- COA Accounting C2006-002Document3 pagesCOA Accounting C2006-002norbelyn villaneraPas encore d'évaluation

- Cash AdvancesDocument25 pagesCash Advancesvangie75% (4)

- The NAC Is Tasked To Receive, Process and Review Amnesty Applications. It IsDocument2 pagesThe NAC Is Tasked To Receive, Process and Review Amnesty Applications. It IsCes CamelloPas encore d'évaluation

- The Commission On AuditDocument5 pagesThe Commission On AuditJunDagz100% (1)

- T10 - Government AccountingDocument9 pagesT10 - Government AccountingTheProdigal Son44% (9)

- NTC Vs COADocument8 pagesNTC Vs COARomy Ian LimPas encore d'évaluation

- G.R. No. 222710 Philippine Health Insurance Corp v. Commission On AuditDocument31 pagesG.R. No. 222710 Philippine Health Insurance Corp v. Commission On AuditKarla KarlaPas encore d'évaluation

- 01 Feliciano v. COA, GR No. 147402, January 14, 2004Document12 pages01 Feliciano v. COA, GR No. 147402, January 14, 2004JPas encore d'évaluation

- 21 The Law Firm of Laguesma vs. COADocument2 pages21 The Law Firm of Laguesma vs. COACheeno PelayoPas encore d'évaluation

- Mechanism and Practice of Accountability in The City of Tagaytay, Trece Martirez and Municipality of IndangDocument17 pagesMechanism and Practice of Accountability in The City of Tagaytay, Trece Martirez and Municipality of IndangJastine Salazar100% (1)

- Montejo vs. Commission On Audit DigestDocument2 pagesMontejo vs. Commission On Audit DigestEmir MendozaPas encore d'évaluation

- Chapter 1 - Nature and Scope of NGAS Questions & Answers:: 2018 EditionDocument117 pagesChapter 1 - Nature and Scope of NGAS Questions & Answers:: 2018 EditionAira ArinasPas encore d'évaluation

- Leg Pro CasesDocument150 pagesLeg Pro CasesRegieReyAgustinPas encore d'évaluation