Académique Documents

Professionnel Documents

Culture Documents

Industry Profile: Chapter - 1

Transféré par

Goutham BindigaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Industry Profile: Chapter - 1

Transféré par

Goutham BindigaDroits d'auteur :

Formats disponibles

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

CHAPTER - 1

INDUSTRY PROFILE

1. a INTRODUCTION OF MANUFACTURING INDUSTRY:

MANUFACTURING IS the organized activity devoted to the transformation of raw

materials into marketable goods. Manufacturing sector is the backbone of any economy. It

fuels growth, productivity, employment, and strengthens agriculture and service sectors.

The manufacturing sector in India will grow as the nation grows. Indian

Manufacturing sector is broadly divided into - Capital Goods &Engineering, Chemicals,

Petroleum, Chemicals & Fertilizers, Packaging, Consumer non-Durables, Electronics, IT

Hardware & peripherals, Gems & Jewelry, Leather & Leather Products, Mining, Steel &

non-Ferrous Metals, Textiles & Apparels and Water Equipment.

1.b. KEY POINTS OF INDIAN MANUFACTURING SECTOR.

1. India's manufacturing sector is gaining momentum and has been ranked fourth in terms of

textiles, tenth in leather and leather products.

2. The manufacturing sector contributes around 9.8% of the India GDP.

3. It employs over 17% of the total workforce in the country.

4. India’s manufacturing sector contributes around 1.8% of the global manufacturing output.

5. It occupies 9th position among the leading manufacturing countries.

6. It has come out as a global manufacturing hub with presence of MNCs such as LG,

Samsung, Hyundai, Pepsi, GE, General Motors, Ford and Suzuki.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 1

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

1.c GLOBAL MANUFACTURING INDUSTRY:

Owing to the emerging technologies worldwide, the world manufacturing industry has

geared up and has incorporated several new technologies within it’s purview.

Economists consider the world manufacturing industry as a sector which generates a lot

of wealth. Generating employment, introducing latest techniques, real earnings from

shipments etc..have put the world manufacturing industry in a favorable position.

With the implementation of the concept of eco friendly environment , world

manufacturing industries worldwide abide by the eco friendly norms. world

manufacturing industry also plays an important role in the defense of a country. By

manufacturing aircrafts which play a vital role in the country’s defense, the aerospace

manufacturing industry acts as a shield. other industry in the manufacturing sectors

manufactures products which are indispensable in our daily lives. With regard to the

GDP or gross domestic product, world manufacturing industry contributes to the global

economy as well as the global GDP.

Surveys and analysis of trends and issues in manufacturing and investment around the

world focus things as;

The nature and sources of the considerable variations that occur cross-nationally

in levels of manufacturing and wider industrial-economic growth.

Competitiveness.

Attractiveness to foreign direct investors.

1.d MANUFACTURING INDUSTRY IN INDIA:

The ‘India Manufacturing’ sector has the potential to elevate much of the Indian

population above poverty by shifting the majority of the workforce out of low –wage

agriculture.

Manufacturing sector is the backbone of any economy .It fuels growth, productivity,

employment ,and strengthens agriculture and service sectors. Astronomical growth in

worldwide distribution systems and IT, coupled with opening of trade barriers, has led

DEPT. OF MBA, AIT, CHICKMAGALUR Page 2

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

to stupendous growth of global manufacturing networks, designed to take advantage of

low-waged yet efficient work force of India.

‘Indian manufacturing’ sector is broadly divided into:-

Capital Goods & Engineering.

Chemicals, Petroleum, Chemical & Fertilizers.

Packaging.

Consumer non-Durables.

Electronics, IT Hardware & peripherals.

Gems & Jewelry.

Leather & Leather products.

Mining.

Steel &non-Ferrous Metals.

Textiles & Apparels.

Water Equipment.

Indian Manufacturing Industry is successfully competing in the global marketplace and

registering high growth ,but large sections of ‘ Indian manufacturing’ sector still suffers

from bottlenecks like-

Use of primitive technology or under utilization of technology.

Poor infrastructure

Over staffed operations.

Expensive financing and bureaucracy.

GDP’s share of manufacturing industry in India as grown from 25.38% in 1991 to

27% in 2004. Its contribution to exports has increased from 52% in 1970 to 59% in

1980 and 71% in 1990,77% in 2000-01 .Manufacturing exports accounted for a little

over 5% of the value of output of the manufacturing sector in 1990 . It is now close to

10%. India’s currently exports manufactured products worth about $50 billion .A recent

study on’ scenario of Indian manufacturing industry ‘ has forecast an annual growth of

17% and to cross the $300 billion mark by 2015. Most of these off- business would be

in the auto components, pharmaceutical, apparel, specialty chemical ,electrical and

electronic equipment sectors.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 3

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Owing to the emerging technologies worldwide ,the world manufacturing industry has

geared up and has incorporated several new technologies with in its purview

.economists consider the world manufacturing industry as a sector which

Generates a lot of wealth .generating employment, introducing latest techniques, real

earning from shipments etc., have put the world manufacturing industry in a favorable

position.

1.e IMPORTANCE OF MANUFACTURING SECTOR IN INDIA’S ECONOMIC

GROWTH:

Manufacturing sector now accounts for about 50 per cent of the GDP.

manufacturing company is ideal for Indian education where more than 80% people

are below middle - school level

it can reform Indian economy which entirely rely on endemic unemployment

providing agricultural industry

DEPT. OF MBA, AIT, CHICKMAGALUR Page 4

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

CHAPTER - 2

COMPANY PROFILE

2.a BACKGROUND AND INCEPTION

Name of the company: Dynamatic Technologies Limited.

Incorporated on: 8 th march 1973.

Present Chairman: Mr. J.K .Malhoutra.

Major product lines: Hydraulics Gear Pumps.

Employees are: 1021.

DTL company produce: 2800 varieties products.

Company’s product range covers 2800 varieties of Hydraulics Gear Pumps and

Hydraulics Systems, which is their forte. They also have diversified applications in the

Defense & Aerospace Sectors and in Metallurgy. With that start thirty three years ago,

they have now come a long way with ever increasing scale of operations and plans for

expansion. Company’s main manufacturing plant as well as the Head Office is suited at

Dynamatic park, Peenya, Bangalore. They have two plants in Chennai and one plant in

Swindon, United Kingdom.

The company entered into a technical collaboration agreement with Dowty hydraulic

units limited, U.K It was then as Dynamatic Hydraulics Limited.

In 1981 the company hydraulics division developed declutching unit, integral with the

hydraulic pump for agricultural tractors

In 2001 the company had entered into a strategic alliance with Atos Spa of Italy

Company’s product range covers verities of Hydraulic Gear Pumps and Hydraulic

system. They also have diversified into the Defense and Aerospace sectors and in

Metallurgy. Company’s main manufacturing plant as well as the head office is situated

at Dynamatic Park, Peenya, Bangalore.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 5

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

2.b NATURE OF BUSINESS CARRIED:

Company is involved in transforming raw material in finished goods, which gets to

demands of automobile industry, aircraft, below are the subsidies of the company. Its

products and services are spread across wide areas such as

2.b 1.DYNAMATTC HYDROLICS:

Dynamatic is the market leader in the field of various hydraulics dynamitic products.

Literally each every conceivable hydraulic user in India, enjoy very high brand

recognition and flange market share

2.b 2.DYNAMATIC AEROSPACE:-

Dynamitic Aerospace, a division of Dynamatic technologies ltd division of Dynamatic

technology ltd, a pioneer and a recognized leader in the India private sector for the

development of temples aero sector for the development of 1995.

2.b.3POWERMETRIC DESIGN:-

It is a world class design Venter capable for total product and system design with

advanced capacity in sector, Dynamatic engineering for design validation. Analysis and

optimization.

2.b.4DYNAMETAL:-

Dynametal a division of dynamitic technologies produces high quality non ferrous alloy

and castings for industrial automotives and aerospace’s applications this foundry is

located in CHENNAI.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 6

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

With a proven track record spanning over a quarter of a century, DTL are the largest

producer of Hydraulic Gear pumps in Asia. In addition to leading the Indian market

with a share of 70%, it has also made a mark in the international arena as the fourth

DEPT. OF MBA, AIT, CHICKMAGALUR Page 7

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

largest producer world-wide. DTL are the original equipment manufacturer for all the

major tractor and earth moving equipment manufacturers in India like.

Mahindra and Mahindra, Eicher, Punjab Tractor, TAFE, HMT, BEML, BHEL, Telco,

Godrej and Boyce, Bajaj, Larsen and Toubro, McNeil Engineering, Ingersoll Rand,

Ashok Leyland, Hindustan Motors, Crompton Greaves, etc. In the recent past DTL has

made inroads into the Aerospace and Defense sectors, expanding the horizons, the pilot

less Target Aircraft LAKSHYA was a prestigious project for industry aerospace

division, where they manufactured its wings and rear fuselage DTL has also bagged the

National Awards for Excellence in Indigenization of Defense Equipment awarded by

the Ministry Defense.

DYNAMATIC RESEARCH AND DEVELOPMENT UNIT, BANGALORE:

Dynamatic Technologies Ltd, an Indian maker of components for Airbus SAS, Deere &

Co. and Ford Motor Co., plans to invest 900 million rupees ($19.3 million) to tap rising

demand for defense equipment and automobiles in India. Dynamatic is betting on more

opportunity at home as India upgrades its military capabilities. The South Asian nation

plans to buy 126 combat aircraft valued at $11 billion. As part of an offset clause, the

government wants 50 percent of the value of the order to be met through local

production and procurement.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 8

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Boeing Co., Lockheed Martin Corp., BAE Systems Plc, Saab AB, Desalt Aviation SA

and Russia’s United Aircraft Corp. are among the manufacturers vying for the Indian

fighter jet order. India has tripled defense spending in a decade as it competes with

China’s military expansion. It aims to increase the proportion of defense equipment

produced at home from about 30 percent to 70 percent in the next 10 years.

2. c. VISION, MISSION AND QUALITY POLICY

2. c. 1.VISION:

Be it the ISO 9000 certification for quality systems or the ISO 14000 certification for

environmental standards. DTL believes that the role in society is that of a responsible

and accountable organization, that is actively contributing to the society. DTL vision

has been to

Develop products and technologies in line with national priorities

Achieve global competence

To operate at the international level, to think global and to be the world’s largest

producer of hydraulic gear pumps.

Transform our organization in to a knowledge based organization

DTL value system too reflects the commitments to quality and innovation in a societal

context.

2. c. 2. MISSION:

“To achieve GLOBAL LEADERSHIP through TOTAL CUSTOMER

SATIAFACTION’

Aimed to develop diversified products

To expands towards more functional area

Focused on continuous quality management

To achieve rapid growth

DEPT. OF MBA, AIT, CHICKMAGALUR Page 9

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

2. c. 3. QUALITY POLICY

Dynamatic technology limited is involved in the design and manufacture of highly

engineered components and systems for hydraulic, Aerospace and Automotive

applications.

It is the policy to provide creative and innovative solutions to delight the

customers at cost effective prices on a continuous basis.

By delivering superior value to the customers, they will build a successful

business model for themselves, capable of returning high yields to investors and

improving the quality of life of all employees.

All processes will be eco friendly and be designed to eliminate wastage, and all

employees will strive to constantly expand the boundaries of knowledge through

imagination and diligence.

2. d. PRODUCT / SERVICE PROFILE:

Automotive Sector

Aerospace & Defense Sector

Agricultural Equipment Industry

Construction Equipment Industry

DTL is the largest supplier for the tractor industry and major force in

Earth moving Equipment

Drilling Equipment

Material Handling Equipment

Machine Tools

Apart from Gear pump, DTL also provides

Hand Pumps

Manually operated DC Valves

DEPT. OF MBA, AIT, CHICKMAGALUR Page 10

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Hydraulic Motors

2. d.1 A brief classification of the product range:

Hydraulic gear motors, Hydraulic power packs

Directional Control Valves

Servo Test Equipments for Helicopters

Hydraulic Biogases Components

Automatic Depth & Control Valves for Tractors

Aluminum Casting

Specially Heat treated components

High precision Airframe Structures.

Break Actuating System

Transmission Products for Battle tanks

Load sensing Hydraulic valves

Ground support Equipment for military jets

Complete Tractor Hydraulic System.

2.d.2 Automotive Components:

Water Pumps

Oil Pumps

Intake Material

Exhaust Manifold

Rocker Arms

Rocker Covers

Shift Forks

Rear Case Oil Seals.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 11

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

DYNAMATIC

HYDRAULICS is one of the

world’s largest Hydraulic Gear

Pumps makers, and, is focused

on being number one. It has

two state-of-the-art

manufacturing facilities,

located in Bangalore, India,

and Swindon, U.K.

AUTOMOTIVE

In June 2007, Dynamatic® acquired the manufacturing facilities of Sauer Danfoss

Limited, UK, at Swindon through its subsidiary Dynamatic Limited, UK. This

acquisition has conferred upon Dynamatic®, a global delivery chain, a vastly

broadened product offering, a world-class design laboratory as well as better

technologies to support its growth plans.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 12

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

DYNAMATIC

AEROSPACE® is a pioneer

& a recognized leader in the

Indian Private Sector for the

development of exacting

Airframe Structures and

Precision Aerospace

Components.

PUMPS AND AUTOPARTS

Dynamatic, which has also entered into an agreement to supply Lockheed Martin, will

invest 700 million rupees on a factory to make aerospace components and spend 200

million rupees to modernize its automobile parts plants this fiscal year, Malhoutra said.

The company has an accord with Wichita, Kansas- based Spirit Aero Systems Holdings

Inc. to supply the flap-track beams to Airbus.

2.e. Areas of Operation:

The main manufacturing plant as well as office is located at Dynamatic Park Peenya,

Bangalore. in India.

Branch across INDIA

Chennai

Mumbai

Gujarat

Around the Globe:

Swindon, United Kingdom.

Singapore.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 13

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

2.f. Ownership Pattern:

Dynamatic technologies limited are a widely held public limited company and the

shares of the company are listed on Bangalore and Bombay Stock Exchanges.

Share Holding Pattern in Percentage:

(As on 30 June 2011)

Promoters : 25.6%

Corporate Bodies : 31.91%

Public : 31.30%

FIIs : 10.2%

Banks & Institutions: 0.01%

Mutual Funds : 0.98%

0.98

0.01

10.2

25.6 Promoters

Corporate Bodies

Public

31.3 FIIs

Banks & Institutions

Mutual Funds

31.91

Figure 1

DEPT. OF MBA, AIT, CHICKMAGALUR Page 14

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

C.E.O. & .M.D. : Udayant Malhotra

Chairman of the Board : Vijay Kapoour

Directors : Dr.K. Aprameyan

Mr. Govind Mirchandhini

Malavika Jayaram

Mr. Raymond Keith Lawton

Air chief Marshal. Krishnamurthy

Ms. Shanthi Ekambaram

2.g. COMPETITORS INFORMATION:

DTL is a market leader in Hydraulic as learnt in the beginning it holds 70% of the

Indian Market. In other Industries the company in an infant, but still it is doing well.

Not much information about it as they are all well known companies like,

Bosch Limited

Eaton Corporation

Yuken India Limited

They are all the competitors in the field of Electro Components.

Competitors Hydraulic pumps for tractors Industrial pumps

DYNAMATIC 85% 60-70 %

BOSCH EATEN 15% ------------

YUKEN INDIA LTD --------- 30-40 %

In aerospace industry though the competition is not that much because of the sustained

conservative approach of the government. And complementing nature of the industry.

This makes the companies on each other rather than making them rivals. Automotive

industry is a vast industry and in world context there are thousands of companies, and

Bosch stands as the rival again, but there are some components which the company has

control over for which there are no competitors.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 15

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

2.h.. Infrastructural facilities:

Aiming to achieve and sustain product excellence, DTL has cut no corners in

establishing comprehensive world-class facilities for its entire range of products, the

main assembly shops, the manufacturing and testing operations.

DTL has got well equipped class rooms with the facilities of LCD’s and OHP’s which

are use to train the employees and trainee students.

Internal communication:

Internal communication is usually through Inter Office Memos, which are sent to the

required persons/department. If the communication is intended for all the people in the

company, it has to be put up on the notice board. They have three notice boards, one on

the Hydraulics shop Floor, one on the aerospace floor, the other on the first floor

landing near the canteen and the third in the Aerospace Machine Shop.

Telephones and Intercom:

Company has three telephone lines. All incoming and outgoing calls are sourced

through the EPABX at the reception. A few departments have external lines or can dial

‘0’ to access external lines.

E-mail:

Almost all the departments have access to e-mail. Check out with their Departmental

Head whether the department has access to the Internet. Normally, based on the

requirement of the department, their own personal email id with @dynamatics.net

address is created within 3 working days.

Quality Policy Cards:

All employees are required to have one of our quality policy cards at all times with

their premises. The personnel department will give the card at the time of joining.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 16

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

2. i. ACHIEVEMENTS/AWARDS:

2. i.a .Awards

HAL Best Vendor Award for Dynamatic Aerospace – 2003

DTL receives National Award for Excellence – 2003.

In 2001, Dynamatic was awarded the status of ‘Recognized In-house R&D

Unit’, by the Department of Scientific and Industrial Research (DSIR),

Government of India.

LRQA approves DTL’s Quality Management Systems- 2000

2. i. b Achievements

Dynamatic exports its products to over 30 countries and its export segment

Dynamatic is the only Indian manufacturer of pumps in this segment and

therefore, has a cost advantage over its competitors. It expects expanding

activity in this segment over the next decade.

Dynamatic Aerospace has the largest infrastructure in the Indian Private

Sector for manufacture of exacting Air Frame Structures and Precision

Aerospace Components.

Dynamatic is the market leader in the field of Hydraulics.

Dynamatic bags maiden order from John Deere, Germany – 2003

Dynamatic Technologies Limited has acquired the Hydraulic Business

Division (Swindon Unit) of Sauer Danfoss limited, UK, through its

subsidiary Dynamatic Limited. UK, on 15 June 2007.

Efficient collaboration for customer satisfaction – 2003

DEPT. OF MBA, AIT, CHICKMAGALUR Page 17

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

2.j. WORK FLOW MODEL (END TO END:

DTL uses a generic model for all the components, through some slight changes are

made at the floor level by the people responsible. Atypical cam be depicted like this’

PURCHASE

PLAN FOR PRODUCTION

PRODUCTION

FINISHED GOODS

FINAL

FINAL DESIGN

PACKING AND DISTRIBUTION

WORK FLOW MODEL :

Purchase order, DTL that is taking (purchase) order from, which is one regular

customer.

Plan for production: According to the purchase order of quality quantity, the

production department is preparing the schedule for production.

Production and assembly: The production department is producing the product

and services and the basis of schedule and requirements. Then they will assign

in assembly department.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 18

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Finished goods: The finally company is preparing the finished products

according to purchase order.

Final inspection: The final inspection is taken by the inspection department of

the company on quality of products.

Final design: The design is one of the lost stages of packing list that is dividing

a basis quantity and customer requirement.

Packaging and distribution: After packing the products the company is taking

initiatives to delivery products through various mode of transportation.

2.k. FUTURE GROWTH AND PROSPECTUS:

DTL is growing rapidly with the turnover growing strongly over the past few

years.

Exports are expected to constitute 15-20 percent of the company’s turnover, in

the next 2 years.

The company also expects to acquire better technologies to support over all

business and gain overall inorganic business growth with a better synergy

effect.

Company looks forward to working closely with Northrop Grumman’s

Electronic Systems sector to help meet the advanced technology aerospace and

defense product and service needs indentified by the Indian ministry of defense

going forward, a world-leading provider of advanced military radar, electronic

warfare and other avionics system

DEPT. OF MBA, AIT, CHICKMAGALUR Page 19

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

CHAPTER - 3

MCKENSY’S 7S FRAME WORK

3.a. INTRODUCTION

The 7’s frame work for management analysis was developed by Mckensy’s &

company. 7’s model provides an effective way of analyzing an organization, in terms of

dynamic relationship among 7 key elements namely Structure, Skill, Style, Strategy,

System, Staff, Shared values.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 20

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

3.1 STRUCTURE

The basic organization of the company. It prescribes the formal relationships among

various positions and activities, how an organization member is to communicate with

other member.

CEO & Managing Director

President & Group CFO

Executive Director & COO, Executive Director& Vice president &

Hydraulics & Dynamental COO, Automotive COO, Aerospace

Personal & GM SGM

Administration Production operations

GM

Dynament

Corporate GM al

AGM

planning Marketing Materials

GM

Facility

Secretarial AGM Mgt

AGM PPC

Marketing

SGM

HR/Legal/Admi

R&D

n AGM Exports DGM

Production

Corporate

AGM

Communications

R&D

AGM DGM

Marketing PLANT

GM Compliance

Company

Secretary

DEPT. OF MBA, AIT, CHICKMAGALUR Page 21

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

3.2 STRATEGY:

Strategy refers to a coherent set of actions aimed at gaining a suitable advantage over

competitors, improving positions of customers and allocation sources.

Here the strategy explained with reference to DTL is:

Continuous efforts for developing innovative and cost effective products

through constant research and development activities.

To transform the company into a global R&D organization, with a pre-eminent

market position in the Hydraulic, Automotive and Defense sectors in Asia.

Introduction of product life cycle management tools

Engaging all employees through participative management to instill a sense of

ownership of all business process of the company.

Design and redesign products that are safe, energy saving and environmental

friendly.

Energy consumption in each plant is monitored optimized and minimized.

Practice open dialogue with employees, customers, government agencies, trade

associations and with communities all around our facilities.

3.3 SYSTEM:

Internal control system and their adequacy:

The company has deployed a comprehensive internal audit system, which is

commensurate with the scale of operations. Competent and qualified professionals,

who are external to the company’s business, conduct regular and detailed audits, both at

the manufacturing locations and its branch offices. The board level audit committee of

the company meets at regular internal control systems and takes stock of the situation

from time to time.

Steps in the system

Overseeing the company’s financial reporting process and the disclosure of its

financial statement is correct, sufficient and credible.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 22

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Recommending to the broad, the appointment, re-appointment and if required,

replacement or removal of the statutory auditor, fixation of audit fee as well as

approval of payments to the statutory auditors for any other services rendered to

the company.

Reviewing with the management the annual financial statements before

submission to the board for approval.

Reviewing with the management the performance of statutory and internal

auditors, and adequacy of internal control systems of the company.

Reviewing adequacy of internal audit function.

Discussion with internal auditors about any significant findings and follow up

thereon.

3.4 SHARED VALUE:

Dynamatic’s long standing commitment to high standards of corporate

governance and ethical business practices is a fundamental shared value of its

board of directors, management and employees. The company’s philosophy of

corporate governance stems from its belief that timely disclosures, transparent

accounting policies, and a strong and independent board go a long way

preserving shareholder’s trust while maximizing long term shareholder value.

Whilst simultaneously enabling the company to fulfill its obligations to other

stakeholders such as customers, suppliers, financiers, employees, the

government and to the society at large. The company firmly believes that such

practices are founded upon the core values of transparency, professionalism,

empowerment, equity and accountability.

3.5 SKILL:

Applicants with less than a year’s experience are appointed as trainees. After training,

the employee will be on probation for the prescribed period of time. The performance

of the employee determines the duration of the training and t

The probation experienced candidates are appointed as probationers. The

management will decide the period of the training/probation.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 23

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

3.6 STAFF:

Staffing is the process of acquiring human resources for the organization and assuring

that they have the potential to contribute to the achievement of the organization’s goals.

The total number of staff in the company is 1021.

The strength of DTL is the experience. Many of the employees working in the

organization are employed working in the organization are employed for than 10 years

and the recruitment process in the last 10 years has been very less. Every employee is

carrying with him a lot of experience. Other important strength of DTL is the

employees association with the company, almost every employee working in DTL is

proud to be working here which is a very important thing for the company. Other

strengths include highly skilled and efficient employees.

3.7 STYLE:

The organization follows Participative style of decision making process:

As a process of good corporate governance for corporate affairs and all matters

requiring discussion / decisions by the board / committee, the company has a policy for

board and committee meetings. This policy ensures that the decision making process at

board / committee meetings is done in an informed, systematic and in the most efficient

manner.

Developing and using top down / bottom up communication channels:

The communication needs were evolved over the years and refined based on

experiences gained by leaders and the requirements of organization. Feedback for the

improvement is taken from the employee’s perception survey.

Top down communication

Communication meetings (unit heads to functional heads, functional heads to

managers and executives, executives to supervisors and workers).

Interoffice memos,

DEPT. OF MBA, AIT, CHICKMAGALUR Page 24

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

E-mail and intranet websites.

Bulletin board of departments

Notice boards

Upward communication:

Participative forum.

Meeting with union & associations.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 25

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

CHAPTER - 4

SWOT ANALYSIS

A scan of the internal and external environment is an important part of the strategic

planning process. Environmental factors internal to the firm usually can be classified as

strength (S) or weaknesses (W), and that external to the firm can be classified as

opportunities (O) or threats (T). Such an analysis of the strategic Environment is

referred to as SWOT analysis.

The SWOT analysis provides information that is helpful in matching the firm’s

resources and capabilities to the competitive environment in which it operate. As such,

it is instrumental in strategy formulation and selection. The following diagram shows

how a SWOT analysis fits into an environmental scan.

4.1 STRENGTHS:

The company is Asia’s largest producer of Hydraulic Gear pumps and one of

the top five worldwide.

The company imparts training to workmen for working on multiple machines

along with combination of reengineering of processes, which has constantly

increased the productivity levels.

Excellent engineering laboratory.

Export continues to be the growth driver. Company has now been approved as a

global strategic source by the world’s leading agricultural and construction

equipment manufacturers such as John Deere, Case New Holland, CLASS,

JCB, etc.

Highly experienced, competitive and creative staff of the company is their main

strength.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 26

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Company has wide variety of product range which helps them to enter into

different sectors.

The company imparts training to workmen for working on multiple machines

along with combination of reengineering of processes, which has constantly

increased the productivity levels.

4.2 WEAKNESS:

Inconsistency in the supply of raw materials due to poor supplier evaluation.

Power intensive, department on power and any miscarriage here results in under

utilization of capacity.

Needs updating with the times in terms of plant and machinery.

4.3 OPPORTUNITIES:

The market for tractors in India constitutes 36 percentage of the world market ,

and is still not fully mechanized in India , thus creating an opportunity For

the company.

The rapidly growing infrastructure sector has opened a gateway to the company.

The automotive components industry is poised to witness significant change

over the next decade.

Company presently operates predominantly in the highway vehicle segment

which is characterized by high volumes and thin margins.

Company is continuing to develop numerous of pumps used in the industrial

sector , with an aim of increasing penetration in this lucrative and growing

market.

4.4 THREATS:

Climatic conditions are one important threat ,as tractors being agriculture based

product and are empowered by hydraulic pumps.

New players engaged with new innovations and updating materials are bought

to market.

Competition

DEPT. OF MBA, AIT, CHICKMAGALUR Page 27

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

CHAPTER - 5

5. ANALYSIS OF FINANCIAL STATEMENTS

Introduction:-

The study financial performance analysis was conducted in Dynamitic Technologies

Limited. In order to know the financial status or position of the company. The analysis

and inter predation of data to the financial position and operation as well. A number of

numbers of techniques are used to study the R/S...Different statement.

Meaning:-

One of steps of accounting is the analysis & interpretation of the financial statement

which result in presentation of data. That helps various categories of persons in forming

opinion about the profitability and financial position of business counter.

In the words of Myers:-

Financial performance statement analysis is longest study of relationship among the

various financial factors in a business as disclosed by a single set of statement and a

study of the trend of the set factors as shown in a series of statement.

Steps in Performance analysis:-.

The major steps in adapting through the performance analysis. There are three types

ANALYSIS

INTERPRETATION

COMPARISION

A) ANALYSIS:-

Financial statement means. Splitting up or regrouping of the figures funds in the

financial statement in to derived homogeneous comparable parts. In other words it is

the Reclassification & rearrangement of the Data

DEPT. OF MBA, AIT, CHICKMAGALUR Page 28

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

B) INTERPRETATION:-

After the analysis and comparison of financial statement the result must means the

formation of national judgment and drawing of proper conclusion about the progress

financial position and future prospects of the business through careful study of the

relationship of component parts obtained through analysis and compares.

C) COMPARISON:-

It required to inter connected figures must be compared with each other and their

relative magnitude on relationship must be measured.

Objectives of the study:

To overview the financial position of the company.

Indentify the factors affecting the finance and operational performance.

To analysis the performance of the company by ratio analysis.

To predict the market value added oft the company.

To summaries the findings and suggest the corrective action.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 29

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

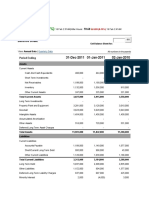

5.b Profit & Loss

(Rs in Crores)

INCOME 31/3/2011 31/3/2010

Sale of manufactured products 34,10,250 30,60,557

Less: Excise duty 3,04,843 2,29,534

Sale of manufactured products, Net 31,05,407 28,31,023

Income from project execution service 4,36,558 1,42,379

Service income 1,022 3,825

Other income 61,615 49,751

36,04,602 30,26,978

EXPENDITURE

Cost of materials consumed 19,05,118 16,39,690

Personnel expenses 5,19,104 4,04,034

Other operating expenses 5,18,194 4,43,908

29,42,416 24,87,632

EBITDA 6,62,186 5,39,346

Depreciation 2,04,065 1,85,63

Interest and finance charges 2,40,543 2,14,265

PROFIT BEFORE TAXATION 2,17,578 1,39,418

Provision for tax

------- current tax 44,170 21,817

-------Minimum alternate tax credit entitlement (6,432) (11,928)

-------deferred tax charge 31,076 21,126

-----wealth tax 343 229

PROFIT AFTER TAX 1,48,421 1,08,174

Balance brought forward from previous year 3,32,483 2,82,638

Amount available for appropriation 4,80,904 3,90,812

--interim dividend 32,488 24,366

--proposed dividend 21,659 16,244

---tax on dividend 8,909 6,901

Transferred to general reserve 14,842 10,818

Balance carried forward 4,03,006 3,32,483

4,80,904 3,90,812

Earning per share(E P S) (Equity share per value 27.41 19.98

Rs 10 each)

DEPT. OF MBA, AIT, CHICKMAGALUR Page 30

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

5. a Balance Sheet

(Rs in Crores)

SOURCES OF FUNDS As on 31/3/2011 As on 31/3/2010

Shareholders funds

Share capital 54,147 54,147

Reserves and surplus 16,61,748 14,06,538

LONS FUND

Secured loans 24,52,440 17,37,888

Unsecured loans 2,30,844 1,19,232

Deferred tax liability, net 2,61,977 2,30,901

46,61,156 35,48,706

APPLICATION OF FUNDS

Fixed assets

Gross block 38,77,018 32,45,297

Less: Accumulated depreciation 12,64,967 10,62,007

Net block 26,12,051 21,83,290

Capital work-in-progress 5,08,933 84,382

31,20,984 22,67,672

Investments 5,24,357 5,09,857

CURRENT ASSETS,LOANS AND

ADVANVCES

Inventories 5,72,013 4,25,880

Sundry debtors 8,68,251 6,64,174

Cash and bank balances 70,109 52,594

Other current assets 71,601 37,857

Loans and advances 4,54,295 3,24,736

2,036,269 1,505,241

CURRENT LIABILITIES AND 9,59,226 6,98,769

PROVISIONS

Current liabilities 61,228 35,295

Provisions 10,20,454 7,34,064

10,15,815 7,71,177

Net Current assets 46,61,156 35,48,706

DEPT. OF MBA, AIT, CHICKMAGALUR Page 31

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

INTERPRETATION OF RATIOS

CURRENT RATIO-

(In Crores)

Particulars 2009-10 2010-11

Current assets 150.52 73.42

Current liabilities 203.62 10.20

Current ratio 2.05 1.99

Current ratio is calculated to establish relationship between the current assets and

current liabilities. It is also called as working capital ratio or banker’s ratio. The

difference between current assets and current liabilities is called working capital. It

attempts to measure the firm’s ability to meet its short term obligation.

In any operating concern, the current ratio should be 2:1 it is called as ideal ratio. In

DTL current ratio is 1.99:1. It shows that the company is performing well as there is a

higher current assets compared to current liabilities.

QUICK RATIO cid Test Ratio= LIQUID ASSET

Current liabilities (In Crores)

Particulars 2009-10 2010-11

Liquid assets 107.93 146.42

Current liabilities 73.42 10.20

Acid Test Ratio 1.47 1.43

DEPT. OF MBA, AIT, CHICKMAGALUR Page 32

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Liquid ratio is the ratio of liquid asset to current liabilities. It is the more severe and

stringent test of a firms ability to meet its current obligations. Liquid assets are those

assets which are readily converted into cash. It is wise to keep liquid assets at least

equal to current liabilities. The ideal quick ratio is 1:1 for any business concern but

DTL has quick ratio of 1.43:1. Here the quick assets are more than quick liabilities so

this is a favorable condition.

NET PROFIT RATIO

(in Crores)

Particulars 2009-10 2010-11

PAT 10.82 14.84

Net sales 297.73 354.29

Net profit ratio 0.03 0.04

This ratio establishes relationship between net profit and sales which is generally

expressed as a percentage. It indicates operational efficiency or inefficiency of an

enterprise. High net profit is the index of better operational efficiency. DTL has a net

profit of 0.04%.

DEBT EQUITY RATIO

Debt-Equity Ratio= Long Term Debt

Shareholder’s equity

DEPT. OF MBA, AIT, CHICKMAGALUR Page 33

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

(in Crores)

Particulars 2009-10 2010-11

Long Term Debt 185.71 253.59

Shareholder’s equity 354.86 466.11

Debt-Equity Ratio 0.52 0.54

This Ratio shows relative contribution of creditors and owners. It is used to

analyze long term solvency of the firm. Debt equity ratio describes the lenders

contribution for each rupee of the owner’s contribution. DTL has a debt equity ratio of

0.54:1. the ideal debt equity ratio is 2:1.

WORKING CAPITAL TURNOVER

Net working capital turnover ratio= Total sales

Net current assets

(in Crores)

Particulars 2009-10 2010-11

Total sales 77.10 78.20

Net current assets 428.28 411.57

Net working capital turnover ratio 0.18 0.19 Wor

king

capital turnover ratio is calculated to study the efficiency with which the working

capital is utilized in the business. This ratio is also called net current assets turnover.

This ratio indicates speed with which working capital is turned over during the year.

Higher the working capital indicates better management of working capital and vice

versa.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 34

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

FIXED ASSETS TO NETWORTH

Fixed assets ratio= Fixed assets

Net worth

(In Crores)

Particulars 2009-10 2010-11

Total sales 297.73 354.29

Net fixed assets 261.20 218.33

Fixed asset turnover 0.88 0.62

This ratio establishes the relationship between fixed assets and proprietor’s funds. The

ratio indicates the extent to which fixed assets are financed by owner’s funds. The

DTL has fixed assets to Net worth ratio of 0.62

FIXED ASSETS TURNOVER

Fixed asset turnover = Total sales

Net fixed assets

(in Crores)

Particulars 2009-10 2010-11

Fixed assets 29.22 38.00

Net worth 297.73 354.29

Fixed assets ratio 1.36 1.35

This ratio is calculated to measure the adequacy or otherwise of investment in fixed

assets. This ratio is very significant for the manufacturing concerns. High ratio

DEPT. OF MBA, AIT, CHICKMAGALUR Page 35

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

indicates efficiency in performance and vice versa. The DTL shows high fixed assets

turnover ratio i.e. 1.35 times and managing better.

INVENTORY TURNOVER

Inventory Turnover Ratio = Cost of Goods Sold

Average Inventory

(in Crores)

Particulars 2009-10 2010-11

Cost of Goods Sold 297.73 354.29

Average Inventory 42.59 57.20

Inventory Turnover Ratio 6.99 6.19

Average Inventory

This ratio indicates the velocity of the movement of the goods during the year.

Movement or otherwise of goods decide the success or failure of a business concern,

because it has direct influence on the profits of any business concern. If the ratio is high

that indicates that the efficiency of management in converting stock into cash quickly,

sound liquidity position and quality of goods maintained. The DTL shows 6.19 times

inventory turnover ratio which is an average condition.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 36

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

CHAPTER-6

LEARNING EXPERIENCE

• It was a great experience working in the Dynamatic Technologies Ltd when It’s

a good opportunities to interact with Industrial Experience

• The company has given full support for me to learn new things ,Ignoring my

mistakes

• Very happy with the A.G.M. (Finance) for his great support, & the way he

thought us.

• To survive in corporate by handling pressure from superior authority strong

dedication towards job is very require

I learnt many things about the functioning of an organization in accordance with the

present market trends. I had learnt within the classroom being practiced in real life

situation.

The main purpose of the organization study is to make acquainted with the practical

knowledge about the overall functioning of the organization. It gave me an opportunity

to study the human behavior and make myself ready different situations, which

normally would come across while in factory environment. It has given me lot of

exposure as to the working of the organization.

In spite of their busy schedules the officials were very much kind towards me to take

time and explain to me the different concepts of the organization. It always gave me a

use fill insight in to the topic. There is great attitude of the employees that keeps them

in to social fabric of a work place and greatly contributes to the success and heightened

performance of the organization. Employees from every corner of the department

helped me in getting required information for the successful completion of this training.

The atmosphere was friendly and I didn’t feel any difficulty during the training period

Finally I would like to conclude that this in plant training provided me a greatest

opportunity to study the financial performance and the study includes ratio analysis of

financial performance of Dynamatic Technologies Ltd last 6 years.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 37

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

PART B:

1a. GENERAL INTRODUCTION

Financial statement analysis is the process of identifying the financial strength and

weakness of the firm by properly establishing relationships between the items of the

balance sheet and profit and loss account. Financial statement analysis can be

undertaken by the management of the firm or by parties outside of the firm viz, owners,

creditors, investors, and others.

Financial statement analysis is also known as analysis and interpretation of financial

statements. Financial statements are prepared primarily for decision-making. They play

a dominant role in setting the framework of managerial decisions. But, the information

provided in the financial statement is not an end in itself as no meaningful conclusion

can be drawn from these statements alone.

However the information provided in the financial statement is of immense use in

making designs through analysis and interpretation of financial statements. Typically,

the major financial statements which results from the process of accounting are:

Profit and loss account.

Balance sheet

Financial statements analysis is an attempt to determine the significance and meaning

of the financial statement data so that forecast may be made of the future earnings,

ability to pay interest and debt maturities (both current and long-term) and profitability

of sound dividend policy.

Types of Ratios:

Liquidity ratios

Turn Over ratios

Profitability ratios

Leverage ratios

DEPT. OF MBA, AIT, CHICKMAGALUR Page 38

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

I. Liquidity Ratios

Liquidity refers to the ability of a firm to meet its obligations in the short-run,

usually one year. Liquidity ratios measure the ability of the firm to meet its current

obligations. Liquidity ratios are generally based on the relationship between current

assets and current liabilities. . A firm should ensure that it does not suffer from lack of

liquidity, and also that it does not have excess liquidity, will result in a poor

creditworthiness, loss of creditors confidence or even in legal tangles resulting in the

closure of the company. A very high degree of liquidity is also bad idle assets earn

nothing. The firm’s funds will be unnecessarily tied up in current assets. Therefore, it is

necessary to strike a proper balance between high liquidity and lack of liquidity.

To measure the liquidity of a firm, the following ratios can be calculated:

Current Ratios

Quick or Acid Test or Liquid Ratios

Absolute Liquid Ratio or Cash Ratios

Current Ratio

Current ratio may be defined as the relationship between current assets and current

liabilities. This ratio, also known as working capital ratio, is a measure of general

liquidity and is most widely used to make the analysis of a short-term financial position

or liquidity of a firm. It is calculated by dividing the total of current assets by total of

the current liabilities.

Current assets include cash and those assets which can be easily converted into cash

within a short period of time generally, one year, such as marketable securities, bills

receivables, sundry debtors, prepaid expenses, inventories, work in progress, etc.

Current liabilities are those which are payable within a short period generally one year

and include outstanding expenses, bills payable, sundry creditors, accrued expenses,

short-term advances, income tax payable, dividend payable, bank over draft, etc.

Standard Current ratio in India is ‘1.33’ and internationally is ‘2’. It indicates the

availability of current assets in rupees for every one rupee of current liabilities.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 39

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Quick Ratio

Quick ratio is a fairly stringent measure of liquidity than the current ratio. It is based on

those current assets which are highly liquid i.e. inventories are excluded from the

current assets of this ratio because inventories are deemed to be least liquid component

of current assets. It establishes a relationship between quick assets and current

liabilities.

As a rule of thumb or as a convention quick ratio of 1:1 is considered

satisfactory.

Cash Ratio

Cash ratio is perhaps the most stringent measure of liquidity because cash and bank

balances and short-term marketable securities are the most liquid assets of a firm. The

ideal ratio for absolute liquid ratios is 0.5:1

II. Turnover Ratios

Turnover ratios, also referred to as activity ratios or asset management ratios, measures

how efficiently the assets are employed by a firm. These ratios are based on the

relationship between the level of activity, represented by sales or cost of goods sold and

levels of various assets. The various turn over ratios are:

a. Inventory Turnover Ratio

b. Debtor Turnover Ratio

c. Creditor Turnover Ratio

d. Working Capital Turnover Ratio

e. Fixed Assets Turnover Ratio

f. Current Assets Turnover Ratio

g. Total Assets Turnover Ratio

Inventory Turnover Ratio

Inventory turnover ratios indicate the number of times inventory is replaced during the

year. It measures the velocity of conversion of stock into sales. Usually, a high

inventory turnover indicates efficient management of inventory because more

DEPT. OF MBA, AIT, CHICKMAGALUR Page 40

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

frequently the stocks are sold; the lesser amount of money is required to finance the

inventory. A low inventory turnover implies over-investment in inventories, dull

business and so on.

Debtor Turnover Ratio

Debtor turnover ratio indicates the velocity of debt collection of firm. In simple words,

it indicates the number of times average debtors (Receivables) are turned over during

the year. Generally, the higher the value of debtor’s turnover the more efficient is the

management of debtors or more liquid are the debtors and vice versa. An increase in the

period will result in greater blockage of funds in debtors. A longer collection period

implies too liberal and inefficient credit collection performance.

Creditor Turnover Ratio

The creditor’s turnover ratio indicates the speed with which the payments for credit

purchases are made to the creditors. It indicates the promptness or otherwise in making

payment of credit purchases. A higher ‘creditors turnover ratio’ or a ‘lower credit

period enjoyed ratio’ signifies that the creditors are being paid promptly, thus

enhancing the credit worthiness of the company. However a very favorable ratio to this

effect also shows that the business is not taking full advantage of credit facilities, which

can be allowed by creditors.

Working Capital Turnover Ratio

Working capital turnover ratio indicates the velocity of the utilization of net working

capital. This ratio indicates the number of times the working capital is turned over in

the course of a year. This measures the efficiency with which the working capital is

being utilized by a firm.

If a firm makes higher volume of sales with relatively small amount of working capital,

it is an indicator of the operating efficiency of the company.

Fixed Assets Turnover Ratio

The fixed assets turnover ratio underlines the relationship between a company sales and

fixed assets. This ratio measures sales per rupee of investment in fixed assets.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 41

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Current Assets Turnover Ratio

The current assets turnover ratio underlines the relationship between a company sales

and current assets.

Total Assets Turnover Ratio

The total assets turnover ratios underline the relationship between a company sales and

total assets.

III. Profitability Ratios

Primary objective of a business undertaking is to earn profits. Profit earning is

considered essential for the survival of the business. A business needs profits not

only for survival but also for expansion and diversification. Profitability ratios are

calculated either in relation to sales or in relation to investment. The various types

of profitability ratios are:

a. Gross Profit Ratio

b. Net Profit Ratio

c. Return on Shareholders’ Investment

d. Return on Equity

e. Return on Assets

f. Return on Capital Employed

Gross Profit Ratio

Gross profit ratio measures the relationship of gross profit to net sales and is usually

represented as a percentage. Thus, it is calculated by dividing the gross profit by sales.

Net Profit Ratio

Net profit ratio establishes a relationship between net profit (after tax) and sales, and

indicates the efficiency of the management in manufacturing, selling, administration

and other activities of the firm.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 42

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Return on Shareholders’ Investment

Return on shareholders’ investment is popularly known as return on investment is the

relationship between net profits and shareholders fund. It determines whether the

investments in the firm are attractive or not as the investors would like to invest only

where the return is higher.

Return on equity

Return on equity capital is the relationship between profits of the company and its

equity capital. Ordinary shareholders are more interested in the profitability of a

company and the performance of a company should be judged on the basis of return on

equity capital of the company.

Return on Capital Employed

Return on capital employed establishes the relationship between profits and the capital

employed. It is the primary ratio and most widely used to measure the overall

profitability and efficiency of a business.

Leverage Ratios or Solvency Ratios

The term ‘Solvency’ refers to the ability of a concern to meet its long term obligations.

The long term indebtedness of a firm includes debenture holders, financial institutions

providing medium and long-term loans and other creditors selling goods on installment

basis. Long term solvency ratios indicate a firm’s ability to meet the fixed interest and

costs and repayment schedules with its long term borrowings. The various types of

solvency ratios are:

a. Debt –equity Ratio

b. Debt-assets Ratio

c. Proprietary Ratio

d. Fixed assets to net worth

e. Current assets to net worth

f. Sales to net worth

g. Interest coverage Ratio

DEPT. OF MBA, AIT, CHICKMAGALUR Page 43

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Debt-equity Ratio

Debt-equity ratio, also known as External-Internal Equity Ratio is calculated to

measure the relative claims of outsiders and the owners against the firm’s assets. This

ratio indicates the relationship between the external equities or the outsider’s funds and

the internal equities or the shareholders’ funds.

Proprietary Ratio

Proprietary ratio is also known as equity ratio or shareholders to total equities ratio.

This ratio establishes the relationship between shareholders funds to total assets of the

firm. It is important ratio for determining the solvency of a firm. Higher the ratio better

is the long-term solvency position of the company.

Fixed Assets to Net Worth

The ratio establishes the relationship between fixed assets and shareholder’s funds, i.e.

share capital plus reserves, surplus and retained earnings. It indicates the extent to

which shareholders funds are sunk into the fixed assets.

Current Assets to Net worth

The ratio establishes the relationship between current assets and shareholder’s funds,

i.e. share capital plus reserves, surplus and retained earnings.

Interest Coverage Ratio

This ratio is calculated by dividing the net profit before interest and taxes by fixed

interest charges. It indicates the number of times interest is covered by the profits

available to pay the interest charges. Long term creditors of a firm are interested in

knowing the firm’s ability to pay interest on their long-term borrowing.

Comparative Financial Statement

The Comparative financial statements are statements of the financial position at

different periods of time. The elements of financial position are shown in a comparative

form so as to give an idea of financial position at two or more periods. Any statements

prepared in a comparative form will be covered in comparative statements. From

practical point of view, generally, two financial statements are prepared in comparative

form for financial analysis purpose.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 44

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

The comparative statements may show:

a. Absolute figures.

b. Changes in absolute figures i.e. increase or decrease in absolute figures.

c. Absolute data in terms of percentages.

d. Increase or decrease in terms of percentage.

The two comparative financial statements are:

a. Comparative Balance Sheet

b. Comparative Income Statements

Comparative Balance Sheet

The comparative balance sheet analysis is the study of the trend of the same items,

group of items and computed items in two or more balance sheets of the same business

enterprise on different dates. The changes in periodical balance sheet items reflect the

conduct of a business. . The changes can be observed by comparison of the balance

sheet at the forming an opinion about the progress of an enterprise. The comparative

balance sheet has two columns for the data of original balance sheets. A third column is

used to show increases in figures. The fourth column may be added for giving

percentages of increases or decreases.

Comparative Income Statements

The income statement gives the results of the operation of a business. The comparative

income statement gives an idea of the progress of a business over a period of time. The

changes in absolute data in money values and percentages can be determined to analyze

the profitability of the business. Like comparative balance sheet, income statement also

has four columns. First two columns give figures of various items for two years. Third

and fourth columns are used to show increase or decreases in figures in absolute

amounts and percentages respectively.

Common Size Statements

The common-size statements i.e. balance sheet and income statement are shown in

analytical percentages. The figures are shown as percentages of total assets, total

liabilities and total sales. The total assets are taken as 100 and different assets are

expressed as a percentage of the total. Similarly, various liabilities are taken as a part of

total liabilities. These statements are also known as component percentage or 200

DEPT. OF MBA, AIT, CHICKMAGALUR Page 45

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

percent statements because every individual item is stated as a percentage of the total

100. The shortcomings in comparative statements and trend percentages where changes

in items could not be compared with the totals have been covered up. The analyst is

able to assess the figures in relation to total values.

The common-size statements may be prepared in the following way:

The totals of assets or liabilities are taken as 100.

The individual assets are expressed as a percentage of total assets, i.e., 100 and

different liabilities are calculated in relation to total liabilities.

Common Size Balance Sheet

A statement in which balance sheet items are expressed as the ratio of each asset to

total assets and the ratio of each liability is expressed as a ratio of total liabilities is

called common-size balance sheet.

Common Size Income statements:

The items in income statement can be shown as percentages of sales to show the

relation of each item to sales. A significant relationship can be established between

items of income statement and volume of sales. The increase in sales will certainly

increases selling expenses and not administrative or financial expenses. In case the

volume of sales increases to a considerable extent, administrative and financial

expenses may go up. In case the sales are declining, the selling expenses should be

reduced at once. So, a relationship is established between sales and other items in

income statement and this relationship is helpful in evaluating operational activities of

the enterprise.

Trend Analysis:

The financial statement may be analyzed by computing trends of series of information.

This method determines the direction upwards or downwards and involves the

computation of the percentage relationship that each statement item bears to the same

item in the base year. The information for a number of years is taken up and one year,

generally the first year, is taken as a base year. The figures of the base are taken as 100

and trend ratios for other years are calculated on the basis of base year.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 46

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

1a1. STATEMENT OF PROBLEM/NEED OF THE STUDY:- :

Evaluation of the financial statement of any industry is very important as the success of

the industry mainly depends on its effective performance to understand the general

direction in which the company is moving and the steps is taken to correct the

deviations against the set standards is of supreme importance. Whenever we analyze the

financial statements i.e the income statement and balance sheet it is very difficult to

analysis the complete picture of financial statement.

Thus. “A Study On An Analysis Of Financial Statement By Using The Technique of

Ratio Analysis” in order to give a better scope to the investors, shareholders, creditors

and the management themselves about rating of Dynamitic technologies limited and its

performance in the market.

1a2. OBJECTIVES OF THE PROJECT:

To study the liquidity and profitability of DTL, Bangalore.

To study the factor affecting the operating performance of DTL,

Bangalore.

To analyze the turnover efficiency of DTL, Bangalore.

To study the efficiency of the company, in utilizing the financial resource.

1a3. SCOPE OF THE STUDY:

Scope of the study in general terms means the extent to which it is possible to cover the

subject. This study attempts to cover some of the tools and techniques for the purpose

of evaluating the comparative statement analysis at Dynamatic Technologies Limited.

However the following areas are covered:

Various ratios of different categories like liquidity ratios, Turn over ratios,

Profitability ratios, and leverage ratios are calculated to know the financial

soundness of the company.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 47

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Trend analysis is done to know the performance of the company over a number

of years. This study trend is calculated for a period of 6 years from 2005-06 to

2010-11.

Comparative statements and Common size statements are prepared to know the

financial position of the company.

1a 4. METHODOLOGY:

Type of study

Analytical study

SOURCES OF DATA:

As the data is related to analysis and interpretation of financial performance there was

no need for the collection of structured data. For collected from various sours they are,

1. Primary data:

It was collected mainly with the interactions and discussions with company’s

executives.

2. Secondary data

Annual reports and financial statements of the company like (balance sheet and

profit and loss account)

Various publications and manuals of Dynamatic Technologies Limited

Company websites.

Tools of analysis

Ratio Analysis is the tool used for analyzing the financial reports.

1a5. LIMITATIONS OF THE STUDY:

The efforts have been made to study completely and as exhaustively as possible.

However the following problems were faced during the study is as follows:

Figures for the analysis are taken from the annual reports.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 48

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

The study is limited only for 6 years hence broad generalization about the

company is not be possible.

The study is based on the data given by the officials and reports of the company

and assumed to be true..

The ratios are generally calculated from past financial statement so they are not

the indicators of future.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 49

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

1.b. ANALYSIS OF DATA AND FINDINGS OF THE STUDY

INTRODUCTION

The analysis and interpretation of financial statements is used to determine the financial

position and results of operations as well. A number of methods are used to study the

relationship different statements. An effort is made to use those devices which clearly

analyze are generally used.

RATIO ANALYSIS

This is the most important tool available to financial analyst for team work. It shows

the relationship between accounting figures. The figures have to be interrelated. Eg:

Profit and sales, current assets and current liabilities) because no useful purpose will be

served it ratio’s are calculated between two figures, which are not at all related to each

other. (Example: sales and discount o issue and debentures).

Analysis of the liquidity position of the company

o Liquidity Ratio

It refers to the ability of the firm to meet its current liabilities. The liquidity ratio,

therefore, are also called ‘Short-term Solvency Ratio’.

These ratio include the following ratios:

a. Current Ratio

b. Quick Ratio or Acid Test Ratio

c. Cash Ratio

CURRENT RATIO:

Current ratio may be defined as the relationship between current assets and current

liabilities. This ratio, also known as working capital ratio, is a measure of general

liquidity and is most widely used to make the analysis of a short-term financial position

or liquidity of a firm. It is calculated by dividing the total of current assets by total of

the current liabilities.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 50

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

CURRENT RATIO = CURRENT ASSETS / CURRENT LIABILITIES

Table:-2 (Rs in Crores)

Year Current assets Current liabilities Current ratio

2005-06 56.74 37.46 1.80

2006-07 62.30 39.06 1.59

2007-08 125.75 75.57 1.66

2008-09 153.80 74.24 2.07

2009-10 150.52 73.42 2.05

2010-11 203.62 10.20 1.99

Sources: Computed from balance sheet for the year 2005-11

current ratio

2.5

2.07 2.05 1.99

2 1.8

1.59 1.66

1.5

current ratio

1

0.5

0

2005-06 2006-07 2007-08 2008-09 2009-10 2010-11

Graph: 2

Analysis and Interpretation

A company with reasonable financial health must have a current ratio > 1 and a

company with poor financial health will have a current ratio of < 1.

According to current ratio data, DTL plant achieves highest current ratio in 2008-09

with 2.07 and the in 2006-07 with lowest current ratio 1.59.

DEPT. OF MBA, AIT, CHICKMAGALUR Page 51

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

The firm is having more current assets than the current liabilities. So it is in good

position maintaining twice the current liabilities. So the company is utilizing its current

assets effectively.

CASH RATIO:

Cash ratio is perhaps the most stringent measure of liquidity because cash and bank

balances and short-term marketable securities are the most liquid assets of a firm. The

ideal ratio for absolute liquid ratios is 0.5:1

CASH RATIO = CASH & BANK + SHORT TERM MAKETABLE

SECURITIES/CURRENT LIABILITIES

Table 3 (Rs in Crores)

YEAR CASH & BANK CURRENT CASH RATIO

LIABILITIES

2005-06 1.77 31.46 0.05

2006-07 1.69 39.06 0.04

2007-08 5.29 75.57 0.07

2008-09 7.30 74.24 0.09

2009-10 5.26 73.42 0.07

2010-11 7.01 10.20 0.06

Source: Computed from balance sheet for the year 2005-11

Cash Ratio

0.1 0.09

0.08 0.07 0.07

0.06

0.06 0.05

RATIO

0.04

0.04

0.02

0

2005-06 2006-07 2007-08 2008-09 2009-10 2010-11

YEAR

Graph 3

DEPT. OF MBA, AIT, CHICKMAGALUR Page 52

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

Analysis and Interpretation

According to cash ratio data, DTL has achieved Its highest cash ratio , 0.09 in the year

2008-09 and the lowest, 0.04 in the year 2006-07

The cash ratio of the company is less than the ideal ratio of 1:1, so the company’s

liquidity position is not satisfied because the company maintaining cash and bank

balance is not sufficient to meet emergency consequences. Hence the cash ratio of the

company is fluctuating year to year.

QUICK RATIO

Quick ratio is a fairly stringent measure of liquidity than the current ratio. It is

based on those current assets which are highly liquid i.e. inventories are excluded

from the current assets of this ratio because inventories are deemed to be least

liquid component of current assets. It establishes a relationship between quick

assets and current liabilities.

QUICK RATIO = LIQUID ASSETS/CURRENT LIABILITIES

Table:4 (Rs in Crores)

Year Liquid assets Current liabilities Quick ratio

2005-06 41.24 31.46 1.31

2006-07 45.97 39.06 1.17

2007-08 91.77 75.57 1.21

2008-09 116.35 74.24 1.56

2009-10 107.93 73.42 1.47

2010-11 146.42 10.20 1.43

Source: Computed from balance sheet for the year 2005-11

DEPT. OF MBA, AIT, CHICKMAGALUR Page 53

AN ANALYSIS OF FINANCIAL STATEMENT BY USING THE TECHNIQUE OF RATIO ANALYSIS AT DTL

QUICK RATIO

2 1.56 1.47 1.43

1.31 1.21

1.5 1.17

RATIO

0.5

0

2005-06 2006-07 2007-08 2008-09 2009-10 2010-11

YEAR

Graph 4

Analysis and Interpretation

From the above table it can be analyzed that the company achives its highest quick

ratio 1.56 in 2008-09 and lowest, 1.17 in 2006-07

The ideal liquid ratio is supposed to be 1:1 i.e. liquid assets must be equal to the current

liabilities. The company is having more liquid assets than current liabilities, it is more

than 1:1, it shows a better financial position.

To Identify the Factors Affecting the Finance and Operational Performance

NET PROFIT MARGIN:

Net profit ratio establishes a relationship between net profit (after tax) and sales,

and indicates the efficiency of the management in manufacturing, selling,

administration and other activities of the firm.

NET PROFIT RATIO = PROFIT AFTER TAX / SALES