Académique Documents

Professionnel Documents

Culture Documents

Theories in Financial Management - The Commerce Pedia

Transféré par

hasan mdDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Theories in Financial Management - The Commerce Pedia

Transféré par

hasan mdDroits d'auteur :

Formats disponibles

THEORIES IN FINANCIAL MANAGEMENT | the commerce pedia http://thecommercepedia.blogspot.com/2013/03/theories-in-financial-...

24th March 2013 THEORIES IN FINANCIAL MANAGEMENT

1. AGENCY THEORY

Agency theory suggests that the firm can be viewed as a nexus of contracts (loosely defined)

between resource holders. An agency relationship arises whenever one or more individuals, called

principals, hire one or more other individuals, called agents, to perform some service and then

delegate decision-making authority to the agents. The primary agency relationships in business are

those (1) between stockholders and managers and (2) between debt-holders and stockholders. These

relationships are not necessarily harmonious; indeed, agency theory is concerned with so-called

agency conflicts, or conflicts of interest between agents and principals. This has implications for,

among other things, corporate governance and business ethics. When agency occurs it also tends to

give rise to agency costs, which are expenses incurred in order to sustain an effective agency

relationship (e.g., offering management performance bonuses to encourage managers to act in the

shareholders' interests i.e., SWM). Accordingly, agency theory has emerged as a dominant model in

the financial economics literature, and is widely discussed in business ethics texts.

[http://www.blogger.com/blogger.g?blogID=5955590086477812415] CONFLICTS BETWEEN MANAGERS AND

SHAREHOLDERS

Agency theory raises a fundamental problem in organizations—self-interested behaviour. A

corporation's managers may have personal goals that compete with the owner's goal of

maximization of shareholder wealth. Since the shareholders authorize managers to administer the

firm's assets, a potential conflict of interest exists between the two groups.

SELF-INTERESTED BEHAVIOR

Agency theory suggests that, in imperfect labour and capital markets, managers will seek to

maximize their own utility at the expense of corporate shareholders. Agents have the ability to

operate in their own self-interest rather than in the best interests of the firm because of asymmetric

information (e.g., managers know better than shareholders whether they are capable of meeting the

shareholders' objectives) and uncertainty (e.g., myriad factors contribute to final outcomes, and it

may not be evident whether the agent directly caused a given outcome, positive or negative).

Evidence of self-interested managerial behaviour includes the consumption of some corporate

resources in the form of perquisites and the avoidance of optimal risk positions, whereby risk-

averse managers bypass profitable opportunities in which the firm's shareholders would prefer they

invest. Outside investors recognize that the firm will make decisions contrary to their best interests.

Accordingly, investors will discount the prices they are willing to pay for the firm's securities.

A potential agency conflict arises whenever the manager of a firm owns less than 100 percent of the

firm's common stock. If a firm is a sole proprietorship managed by the owner, the owner-manager

will undertake actions to maximize his or her own welfare. The owner-manager will probably

measure utility by personal wealth, but may trade off other considerations, such as leisure and

perquisites, against personal wealth. If the owner-manager forgoes a portion of his or her ownership

by selling some of the firm's stock to outside investors, a potential conflict of interest, called an

agency conflict, arises. For example, the owner-manager may prefer a more leisurely lifestyle and

not work as vigorously to maximize shareholder wealth, because less of the wealth will now accrue

to the owner-manager. In addition, the owner-manager may decide to consume more perquisites,

because some of the cost of the consumption of benefits will now be borne by the outside

shareholders.

In the majority of large publicly traded corporations, agency conflicts are potentially quite

significant because the firm's managers generally own only a small percentage of the common

stock. Therefore, shareholder wealth maximization could be subordinated to an assortment of other

managerial goals. For instance, managers may have a fundamental objective of maximizing the size

of the firm. By creating a large, rapidly growing firm, executives increase their own status, create

more opportunities for lower- and middle-level managers and salaries, and enhance their job

security because an unfriendly takeover is less likely. As a result, incumbent management may

pursue diversification at the expense of the shareholders who can easily diversify their individual

portfolios simply by buying shares in other companies.

Managers can be encouraged to act in the stockholders' best interests through incentives,

constraints, and punishments. These methods, however, are effective only if shareholders can

1 of 20 1/5/2019, 2:49 AM

Vous aimerez peut-être aussi

- Agency TheoryDocument3 pagesAgency TheoryLynaPas encore d'évaluation

- Agency Theory Suggests That The Firm Can Be Viewed As A Nexus of ContractsDocument5 pagesAgency Theory Suggests That The Firm Can Be Viewed As A Nexus of ContractsMilan RathodPas encore d'évaluation

- Political Science Economics Asymmetric Information Principal AgentDocument7 pagesPolitical Science Economics Asymmetric Information Principal AgentPrashant RampuriaPas encore d'évaluation

- The Principal-Agent ProblemDocument9 pagesThe Principal-Agent ProblemAssignmentLab.comPas encore d'évaluation

- Agency CostsDocument14 pagesAgency Costsహరీష్ చింతలపూడిPas encore d'évaluation

- Agency Theory & Conflicts of InterestDocument16 pagesAgency Theory & Conflicts of InterestVaidyanathan RavichandranPas encore d'évaluation

- The Agency Issue: Shareholders VS ManagersDocument4 pagesThe Agency Issue: Shareholders VS ManagersSyed ZainulabideenPas encore d'évaluation

- Agency ProbDocument2 pagesAgency ProbtuhangPas encore d'évaluation

- Agency Theory - PresentationDocument14 pagesAgency Theory - PresentationSaeed AhmadPas encore d'évaluation

- Agency Theory ProjectDocument3 pagesAgency Theory ProjectHassan Ali BurkiPas encore d'évaluation

- Agency ProblemDocument26 pagesAgency ProblemDauood MustafaPas encore d'évaluation

- Agency TheoryDocument5 pagesAgency TheoryalfritschavezPas encore d'évaluation

- Business Ethics MidtermDocument65 pagesBusiness Ethics MidtermAshwini PatadePas encore d'évaluation

- Agency ConflictsDocument5 pagesAgency ConflictsAnisha KhandelwalPas encore d'évaluation

- Agency TheoryDocument12 pagesAgency TheoryAjeesh MkPas encore d'évaluation

- 0 Agency ProblemDocument3 pages0 Agency ProblemAnonymous KRQaT2PnYqPas encore d'évaluation

- Strategic Financial ManagementDocument213 pagesStrategic Financial ManagementShubha Subramanian100% (5)

- Agency TheoryDocument18 pagesAgency TheoryAakankshaVatsPas encore d'évaluation

- Module 6 Agency ProblemsDocument6 pagesModule 6 Agency ProblemsRod Jessen A. VillamorPas encore d'évaluation

- Corporate Goals and Managerial Incentives - 2022 VersionDocument14 pagesCorporate Goals and Managerial Incentives - 2022 VersionJeremiah KhongPas encore d'évaluation

- References in atDocument21 pagesReferences in atalfritschavezPas encore d'évaluation

- Maasai Mara University School of Business and EconomicsDocument12 pagesMaasai Mara University School of Business and Economicsjohn wambuaPas encore d'évaluation

- Fnancial Management ReportDocument5 pagesFnancial Management ReportPearl RagasajoPas encore d'évaluation

- Stockholders Versus ManagersDocument2 pagesStockholders Versus Managerswildflower2604Pas encore d'évaluation

- Understanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsDocument5 pagesUnderstanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsManuel BoahenPas encore d'évaluation

- Agency Theory CourseworkDocument11 pagesAgency Theory CourseworkMuhammad HarisPas encore d'évaluation

- Agency Problem - Its Solution and Involvement in Financial ManagementDocument10 pagesAgency Problem - Its Solution and Involvement in Financial ManagementSultana SultanaPas encore d'évaluation

- Continue For FM Chapter 1Document15 pagesContinue For FM Chapter 1Erica GallurPas encore d'évaluation

- Corporate Governance and Capital Structure DecisionDocument41 pagesCorporate Governance and Capital Structure DecisionBabandi IbrahimPas encore d'évaluation

- Key Concepts of Agency TheoryDocument3 pagesKey Concepts of Agency TheorySharon AmondiPas encore d'évaluation

- Corporate Governance and ESG An IntroductionDocument27 pagesCorporate Governance and ESG An IntroductionahmedPas encore d'évaluation

- Agency TheoryDocument27 pagesAgency TheoryWilsonPas encore d'évaluation

- Corporate Governance by Ibrahim YahayaDocument38 pagesCorporate Governance by Ibrahim Yahayaib ibrahimPas encore d'évaluation

- 7 Approaches To Corporate GovernanceDocument14 pages7 Approaches To Corporate GovernanceccapgomesPas encore d'évaluation

- Corporate GovernanceDocument47 pagesCorporate GovernanceShivaniPas encore d'évaluation

- Agency CostDocument3 pagesAgency CostA Senthilkumar100% (1)

- Role of Finance ManagerDocument4 pagesRole of Finance ManagerDoreen AwuorPas encore d'évaluation

- CG NotesDocument10 pagesCG NotesPranay Singh RaghuvanshiPas encore d'évaluation

- Original Research Paper Law: 3 Year Student, BBA LLB (Hons.), School of Law, ChristDocument3 pagesOriginal Research Paper Law: 3 Year Student, BBA LLB (Hons.), School of Law, ChristMadhumitha KesavanPas encore d'évaluation

- Module 3Document6 pagesModule 3Marjalino Laicell CrisoloPas encore d'évaluation

- Corporate Governance: Theory and Practice: Dr. Malek Lashgari, CFA, University of Hartford, West Hartford, CTDocument7 pagesCorporate Governance: Theory and Practice: Dr. Malek Lashgari, CFA, University of Hartford, West Hartford, CTNaod MekonnenPas encore d'évaluation

- Agency TheoryDocument17 pagesAgency TheoryLegend GamePas encore d'évaluation

- Agency CostsDocument27 pagesAgency CostsDepankan DasPas encore d'évaluation

- Strategic Financial Management: An Overview: After Reading This Chapter, You Will Be Conversant WithDocument9 pagesStrategic Financial Management: An Overview: After Reading This Chapter, You Will Be Conversant WithAnish MittalPas encore d'évaluation

- Solutions Manual: Ross, Westerfield, and Jaffe Asia Global EditionDocument3 pagesSolutions Manual: Ross, Westerfield, and Jaffe Asia Global EditionLogeswary VijayakumarPas encore d'évaluation

- Intro To Corp GovDocument84 pagesIntro To Corp Govarun achariPas encore d'évaluation

- Corporate Governance - Agency TheoryDocument11 pagesCorporate Governance - Agency TheoryHarish ChoudharyPas encore d'évaluation

- Agency TheoryDocument7 pagesAgency TheorySue100% (1)

- Wealth MaximizationDocument6 pagesWealth MaximizationPeter KinyanjuiPas encore d'évaluation

- Corporate Governance & Ethics Meghna Sharma 20020341208 HR 2020-22Document18 pagesCorporate Governance & Ethics Meghna Sharma 20020341208 HR 2020-22Meghna SharmaPas encore d'évaluation

- Corporate Finance - Ch-1Document2 pagesCorporate Finance - Ch-1aryanigneousPas encore d'évaluation

- Corporate Finance Self-Learning ManualDocument219 pagesCorporate Finance Self-Learning ManualMohit AroraPas encore d'évaluation

- Principal Agent Conflict & Financial Strategies-1Document38 pagesPrincipal Agent Conflict & Financial Strategies-1Vikas Sharma100% (3)

- Shareholders and Lenders Can Conflict. Lenders Have A Contract in Place To Receive A Relatively FixedDocument3 pagesShareholders and Lenders Can Conflict. Lenders Have A Contract in Place To Receive A Relatively FixedfoodPas encore d'évaluation

- Theories of Corporate GovernanceDocument5 pagesTheories of Corporate GovernanceRishabh DuttaPas encore d'évaluation

- Goodgov Module 3bDocument43 pagesGoodgov Module 3bAila IntalanPas encore d'évaluation

- Agency ProblemDocument2 pagesAgency ProblemmudeyPas encore d'évaluation

- Agency Theory FinalDocument5 pagesAgency Theory FinalBonzaiPas encore d'évaluation

- Assignmen 1Document8 pagesAssignmen 1Justice DzamaPas encore d'évaluation

- Corporate Finance: A Beginner's Guide: Investment series, #1D'EverandCorporate Finance: A Beginner's Guide: Investment series, #1Pas encore d'évaluation

- Lars Part Ix - Safety Managment System Requirements-SmsDocument24 pagesLars Part Ix - Safety Managment System Requirements-SmssebastienPas encore d'évaluation

- RMJ PDF Min v2 PDFDocument17 pagesRMJ PDF Min v2 PDFAli AhmadPas encore d'évaluation

- Life in The Middle Ages Unit Study - Grade 8Document21 pagesLife in The Middle Ages Unit Study - Grade 8HCSLearningCommonsPas encore d'évaluation

- All State CM and Governers List 2022Document4 pagesAll State CM and Governers List 2022Tojo TomPas encore d'évaluation

- Interjections Worksheet PDFDocument1 pageInterjections Worksheet PDFLeonard Patrick Faunillan Bayno100% (1)

- Curriculum Implementation & EvaluationDocument121 pagesCurriculum Implementation & Evaluationwaseem555100% (2)

- Giving Counsel PDFDocument42 pagesGiving Counsel PDFPaul ChungPas encore d'évaluation

- Intersection of Psychology With Architecture Final ReportDocument22 pagesIntersection of Psychology With Architecture Final Reportmrunmayee pandePas encore d'évaluation

- Wardruna-Yggdrasil Bio EngDocument3 pagesWardruna-Yggdrasil Bio EngCristian RamirezPas encore d'évaluation

- Chartered AccountancyDocument28 pagesChartered AccountancyNidhi ShrivastavaPas encore d'évaluation

- Reincarnated As A Sword Volume 12Document263 pagesReincarnated As A Sword Volume 12Phil100% (1)

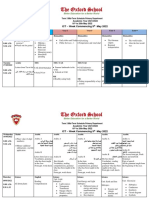

- Term 3 Mid-Term Assessment ScheduleDocument9 pagesTerm 3 Mid-Term Assessment ScheduleRabia MoeedPas encore d'évaluation

- Attitude On The Job PerformanceDocument11 pagesAttitude On The Job PerformanceMarry Belle VidalPas encore d'évaluation

- Practice in KeyboardingDocument16 pagesPractice in KeyboardingRaymart GonzagaPas encore d'évaluation

- EBM SCM ReportDocument22 pagesEBM SCM ReportRabia SiddiquiPas encore d'évaluation

- CatalysisDocument50 pagesCatalysisnagendra_rdPas encore d'évaluation

- Youcastr Case StudyDocument2 pagesYoucastr Case StudyMomina NadeemPas encore d'évaluation

- Translator Resume SampleDocument2 pagesTranslator Resume SampleIsabel JimenezPas encore d'évaluation

- Karrnathi Undead P2Document2 pagesKarrnathi Undead P2Monjis MonjasPas encore d'évaluation

- Is 456 - 2016 4th Amendment Plain and Reinforced Concrete - Code of Practice - Civil4MDocument3 pagesIs 456 - 2016 4th Amendment Plain and Reinforced Concrete - Code of Practice - Civil4Mvasudeo_ee0% (1)

- The Traditional of The Great Precept Transmission Ordination Ceremony in Vietnam BuddhistDocument20 pagesThe Traditional of The Great Precept Transmission Ordination Ceremony in Vietnam BuddhistAn NhiênPas encore d'évaluation

- Ejercicios de Relative ClausesDocument1 pageEjercicios de Relative ClausesRossyPas encore d'évaluation

- 1st Year Unit 7 Writing A Letter About A CelebrationDocument2 pages1st Year Unit 7 Writing A Letter About A CelebrationmlooooolPas encore d'évaluation

- How Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaDocument3 pagesHow Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Debt Policy and Firm Performance of Family Firms The Impact of Economic AdversityDocument21 pagesDebt Policy and Firm Performance of Family Firms The Impact of Economic AdversityMiguel Hernandes JuniorPas encore d'évaluation

- PPSC Lecturer Mathematics 2004Document1 pagePPSC Lecturer Mathematics 2004Sadia ahmadPas encore d'évaluation

- Gripped by The Mystery: Franziska Carolina Rehbein SspsDocument70 pagesGripped by The Mystery: Franziska Carolina Rehbein SspsdonteldontelPas encore d'évaluation

- M03 Study GuideDocument5 pagesM03 Study GuideMartina Vegel DavidsonPas encore d'évaluation

- Graduate Alumni of Elvel School Class of 1991Document3 pagesGraduate Alumni of Elvel School Class of 1991Ramón SilvaPas encore d'évaluation

- Compiler Design MCQ Question Bank Last Update 29-Dec-20202 Page 1 of 18Document18 pagesCompiler Design MCQ Question Bank Last Update 29-Dec-20202 Page 1 of 18SOMENATH ROY CHOUDHURYPas encore d'évaluation