Académique Documents

Professionnel Documents

Culture Documents

Tax Provisions Printout

Transféré par

jrvyee0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues4 pagesTax provisions

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentTax provisions

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues4 pagesTax Provisions Printout

Transféré par

jrvyeeTax provisions

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

SECTION 5. Each local government unit shall SECTION 20.

No person shall be imprisoned for

have the power to create its own sources of debt or non-payment of a poll tax.

revenues and to levy taxes, fees, and charges

subject to such guidelines and limitations as Section 156. Community Tax. - Cities or

the Congress may provide, consistent with the municipalities may levy a community tax in

basic policy of local autonomy. Such taxes, accordance with the provisions of this Article.

fees, and charges shall accrue exclusively to

the local governments. Section 157. Individuals Liable to Community

Tax. - Every inhabitant of the Philippines

ARTICLE VI, SECTION 28. (2) The Congress may, eighteen (18) years of age or over who has

by law, authorize the President to fix within been regularly employed on a wage or salary

specified limits, and subject to such limitations basis for at least thirty (30) consecutive

and restrictions as it may impose, tariff rates, working days during any calendar year, or

import and export quotas, tonnage and who is engaged in business or occupation, or

wharfage dues, and other duties or imposts who owns real property with an aggregate

within the framework of the national assessed value of One thousand pesos

development program of the Government. (P1,000.00) or more, or who is required by law

to file an income tax return shall pay an

Sec. 1608. Flexible Clause annual additional tax of Five pesos (P5.00)

Flexible Clause. – (a) In the interest of general welfare and an annual additional tax of One peso

and national security, and subject to the limitations (P1.00) for every One thousand pesos

prescribed under this Act, the President, upon the

(P1,000.00) of income regardless of whether

recommendation of the NEDA, is hereby empowered

to: from business, exercise of profession or from

(1) Increase, reduce, or remove existing rates of property which in no case shall exceed Five

import duty including any necessary change in thousand pesos (P5,000.00).

classification…

(2) Establish import quotas or ban imports of any In the case of husband and wife, the

commodity, as may be necessary; and

additional tax herein imposed shall be based

(3) Impose an additional duty on all imports not

exceeding ten percent (10%) ad valorem whenever upon the total property owned by them and

necessary: the total gross receipts or earnings derived by

them.

ARTICLE II, SECTION 2. The

Section 158. Juridical Persons Liable to

Philippines…adopts the generally Community Tax. - Every corporation no matter

accepted principles of international law how created or organized, whether domestic

as part of the law of the land… or resident foreign, engaged in or doing

business in the Philippines shall pay an annual

SEC. 32. Gross Income. - (B) Exclusions from community tax of Five hundred pesos

Gross Income. - The following items shall not (P500.00) and an annual additional tax,

be included in gross income and shall be which, in no case, shall exceed Ten thousand

exempt from taxation under this Title: pesos (P10,000.00) in accordance with the

following schedule:

(7) Miscellaneous Items. -

(1) For every Five thousand pesos (P5,000.00)

(a) Income Derived by Foreign

worth of real property in the Philippines owned

Government. - Income derived from by it during the preceding year based on the

investments in the Philippines in loans, valuation used for the payment of real

stocks, bonds or other domestic property tax under existing laws, found in the

securities, or from interest on deposits in assessment rolls of the city or municipality

banks in the Philippines by (i) foreign where the real property is situated - Two pesos

governments, (ii) financing institutions (P2.00); and

owned, controlled, or enjoying (2) For every Five thousand pesos (P5,000.00)

of gross receipts or earnings derived by it from

refinancing from foreign governments, its business in the Philippines during the

and (iii) international or regional preceding year - Two pesos (P2.00).

financial institutions established by The dividends received by a corporation from

foreign governments. another corporation however shall, for the

purpose of the additional tax, be considered

(b) Income Derived by the Government as part of the gross receipts or earnings of said

or its Political Subdivisions. - Income corporation.

derived from any public utility or from Section 159. Exemptions. - The following are

the exercise of any essential exempt from the community tax:

governmental function accruing to the

Government of the Philippines or to any (1) Diplomatic and consular representatives;

political subdivision thereof. and

(2) Transient visitors when their stay in the

SECTION 27(C) Government-owned or - Philippines does not exceed three (3) months.

Controlled Corporations, Agencies or

Instrumentalities. - The provisions of existing Section 160. Place of Payment. - The

special or general laws to the contrary community tax shall be paid in the place of

notwithstanding, all corporations, agencies, or residence of the individual, or in the place

instrumentalities owned or controlled by the where the principal office of the juridical

Government, except the Government Service entity is located.

Insurance System (GSIS), the Social Security

System (SSS), the Philippine Health Insurance Section 161. Time for Payment; Penalties for

Corporation (PHIC), the local water districts Delinquency. –

(LWDs), and the Philippine Charity

Sweepstakes Office (PCSO) and the Philippine (a) The community tax shall accrue on the

Amusement and Gaming Corporation first (1st) day of January of each year

(PAGCOR), shall pay such rate of tax upon which shall be paid not later than the

their taxable income as are imposed by this last day of February of each year. If a

Section upon corporations or associations person reaches the age of eighteen (18)

engaged in s similar business, industry, or years or otherwise loses the benefit of

activity. exemption on or before the last day of

June, he shall be liable for the

community tax on the day he reaches

such age or upon the day the

exemption ends.

, if a person reaches the age of eighteen (18) years or

efit of exemption on or SECTION 28. (2) The Congress may, by law,

he last day of March, he shall have twenty (20) days to authorize the President to fix within specified

community tax without becoming delinquent. limits, and subject to such limitations and

restrictions as it may impose, tariff rates, import

who come to reside in the Philippines or reach the age of and export quotas, tonnage and wharfage

(18) years on or after the first (1st) day of July of any dues, and other duties or imposts within the

who cease to belong to an exempt class or after the framework of the national development

ate, shall not be subject to the community tax for that program of the Government.

(3) Charitable institutions, churches and

parsonages or convents appurtenant thereto,

orations established and organized on or before the last mosques, non-profit cemeteries, and all lands,

une shall be liable for the community tax for that year. But buildings, and improvements, actually,

ons established and organized on or before the last day directly, and exclusively used for religious,

h shall have twenty (20) days within which to pay the charitable, or educational purposes shall be

ity tax without becoming delinquent. Corporations exempt from taxation.

ed and organized on or after the first day of July shall not (4) No law granting any tax exemption shall

ct to the community tax for that year. be passed without the concurrence of a

majority of all the Members of the Congress.

is not paid within the time prescribed above, there shall

ed to the unpaid amount an interest of twenty-four ARTICLE XIV. SECTION 4(3) All revenues and

(24%) per annum from the due date until it is paid. assets of non-stock, non-profit educational

institutions used actually, directly, and

exclusively for educational purposes shall be

exempt from taxes and duties. Upon the

dissolution or cessation of the corporate

existence of such institutions, their assets shall

be disposed of in the manner provided by

law.

Proprietary educational institutions, including

those cooperatively owned, may likewise be

entitled to such exemptions subject to the

limitations provided by law including

restrictions on dividends and provisions for

reinvestment.

(4) Subject to conditions prescribed by law, all

grants, endowments, donations, or

contributions used actually, directly, and

exclusively for educational purposes shall be

exempt from tax.

SECTION 28(4) No law granting any tax

exemption shall be passed without the

concurrence of a majority of all the

Members of the Congress.

SECTION 29. (1) No money shall be paid

out of the Treasury except in pursuance

of an appropriation made by law.

(2) No public money or property shall be

appropriated, applied, paid, or

employed, directly or indirectly, for the

use, benefit, or support of any sect,

church, denomination, sectarian

institution, or system of religion, or of any

priest, preacher, minister, or other

religious teacher, or dignitary as such,

except when such priest, preacher,

minister, or dignitary is assigned to the

armed forces, or to any penal institution,

or government orphanage or

leprosarium.

(3) All money collected on any tax

levied for a special purpose shall be

treated as a special fund and paid out

for such purpose only. If the purpose for

which a special fund was created has

been fulfilled or abandoned, the

balance, if any, shall be transferred to

the general funds of the Government.

SECTION 25(2) No provision or enactment shall

be embraced in the general appropriations

bill unless it relates specifically to some

particular appropriation therein. Any such

provision or enactment shall be limited in its

operation to the appropriation to which it

relates.

SECTION 27(2) The President shall have the

power to veto any particular item or items in

an appropriation, revenue, or tariff bill, but the

veto shall not affect the item or items to which

he does not object.

ARTICLE VIII. SECTION 2. The Congress shall

have the power to define, prescribe, and

apportion the jurisdiction of various courts but

may not deprive the Supreme Court of its

jurisdiction over cases enumerated in Section

5 hereof.

No law shall be passed reorganizing the

Judiciary when it undermines the security of

tenure of its Members.

ARTICLE VIII (b) All cases involving the legality

of any tax, impost, assessment, or toll, or any

penalty imposed in relation thereto.

ARTICLE X SECTION 5. Each local government

unit shall have the power to create its own

sources of revenues and to levy taxes, fees,

and charges subject to such guidelines and

limitations as the Congress may provide,

consistent with the basic policy of local

autonomy. Such taxes, fees, and charges shall

accrue exclusively to the local governments.

SECTION 1. No person shall be deprived of life,

liberty, or property without due process of law,

nor shall any person be denied the equal

protection of the laws.

SECTION 5. No law shall be made respecting

an establishment of religion, or prohibiting the

free exercise thereof. The free exercise and

enjoyment of religious profession and worship,

without discrimination or preference, shall

forever be allowed. No religious test shall be

required for the exercise of civil or political

rights.

SECTION 29(2) No public money or property

shall be appropriated, applied, paid, or

employed, directly or indirectly, for the use,

benefit, or support of any sect, church,

denomination, sectarian institution, or system

of religion, or of any priest, preacher, minister,

or other religious teacher, or dignitary as such,

except when such priest, preacher, minister,

or dignitary is assigned to the armed forces, or

to any penal institution, or government

orphanage or leprosarium.

SECTION 10. No law impairing the obligation of

contracts shall be passed.

SECTION 11. No franchise, certificate, or any

other form of authorization for the operation

of a public utility shall be granted except to

citizens of the Philippines or to corporations or

associations organized under the laws of the

Philippines at least sixty per centum of whose

capital is owned by such citizens, nor shall

such franchise, certificate, or authorization be

exclusive in character or for a longer period

than fifty years. Neither shall any such

franchise or right be granted except under

the condition that it shall be subject to

amendment, alteration, or repeal by the

Congress when the common good so

requires. The State shall encourage equity

participation in public utilities by the general

public.

The participation of foreign investors in the governing body of any

public utility enterprise shall be limited to their proportionate share

in its capital, and all the executive and managing officers of such

corporation or association must be citizens of the Philippines.

Vous aimerez peut-être aussi

- RR No. 2-98 (As Amended by TRAIN Law)Document125 pagesRR No. 2-98 (As Amended by TRAIN Law)Magenic Manila IncPas encore d'évaluation

- Revenue Regulation 2-98Document52 pagesRevenue Regulation 2-98Jeanne Pabellena Dayawon100% (1)

- RR 2-98Document136 pagesRR 2-98hizelaryaPas encore d'évaluation

- Local Government TaxationDocument5 pagesLocal Government TaxationDiane UyPas encore d'évaluation

- BIR Revenue Regulation No. 02-98 Dated 17 April 1998Document74 pagesBIR Revenue Regulation No. 02-98 Dated 17 April 1998wally_wanda93% (14)

- RR 2-98Document85 pagesRR 2-98Elaine LatonioPas encore d'évaluation

- CSK IPL ValuationDocument19 pagesCSK IPL ValuationDhananjayan JayabalPas encore d'évaluation

- QuestionDocument29 pagesQuestionMichael Johnson0% (1)

- CH 05 Alt ProbDocument10 pagesCH 05 Alt ProbxlovemadnessPas encore d'évaluation

- Tax 3 Community TaxDocument3 pagesTax 3 Community TaxPaul TaborPas encore d'évaluation

- Community Tax HandoutsDocument3 pagesCommunity Tax HandoutsKana Lou Cassandra BesanaPas encore d'évaluation

- Revenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Document13 pagesRevenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Cuayo JuicoPas encore d'évaluation

- Chapter Vii - Community Tax Sec. 285. Community Tax The City Hereby Levy's Community Tax in Lieu of Former Residence Tax Levied andDocument12 pagesChapter Vii - Community Tax Sec. 285. Community Tax The City Hereby Levy's Community Tax in Lieu of Former Residence Tax Levied andJascinth Sabanal - LumahangPas encore d'évaluation

- Rev Reg 2-98Document86 pagesRev Reg 2-98Anonymous ghNvoT2Pas encore d'évaluation

- RR No 7-10 Senior CitizensDocument19 pagesRR No 7-10 Senior CitizensGil PinoPas encore d'évaluation

- Taxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesDocument8 pagesTaxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesIon FashPas encore d'évaluation

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument14 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL Exclusivesbce14Pas encore d'évaluation

- Pagcor V BirDocument14 pagesPagcor V BirPatricia Anne GonzalesPas encore d'évaluation

- TAX3Document1 pageTAX3Elaine Joyce GarciaPas encore d'évaluation

- Taxation Reviewer 1Document110 pagesTaxation Reviewer 1bigbully23Pas encore d'évaluation

- CREATE Bill - Draft Enrolled Copy 02.16.21Document77 pagesCREATE Bill - Draft Enrolled Copy 02.16.21Joshua CustodioPas encore d'évaluation

- RR 2-98Document41 pagesRR 2-98matinikki100% (2)

- RR 02-98Document60 pagesRR 02-98Michelle Ann OrendainPas encore d'évaluation

- BIR Ruling 013-2004Document8 pagesBIR Ruling 013-2004RNicolo BallesterosPas encore d'évaluation

- Implementing regulations for expanded withholding taxDocument74 pagesImplementing regulations for expanded withholding taxRichard CanetePas encore d'évaluation

- Nirc As Amended by TrainDocument16 pagesNirc As Amended by TrainKDAPas encore d'évaluation

- Tax Codal ReviewerDocument37 pagesTax Codal ReviewerPaulo BurroPas encore d'évaluation

- Pagcor VS Bir, GR No. 172087Document13 pagesPagcor VS Bir, GR No. 172087RAINE BARANDAPas encore d'évaluation

- G.R. No. 172087Document12 pagesG.R. No. 172087monica may ramosPas encore d'évaluation

- Chapter Ii - General P RinciplesDocument19 pagesChapter Ii - General P RincipleskkkPas encore d'évaluation

- Revenue Regulations 2-1998Document44 pagesRevenue Regulations 2-1998Jaypee LegaspiPas encore d'évaluation

- Revenue Regulations No 2-98Document70 pagesRevenue Regulations No 2-98azzy_km100% (1)

- RR 2-98Document85 pagesRR 2-98restless11Pas encore d'évaluation

- PAGCOR Vs BIRDocument14 pagesPAGCOR Vs BIRGladys BantilanPas encore d'évaluation

- B. PAGCOR v. BIR (Non-Impairment Clause) PDFDocument14 pagesB. PAGCOR v. BIR (Non-Impairment Clause) PDFKaloi GarciaPas encore d'évaluation

- Section 5. Section 25 of The National Internal Revenue Code of 1997, AsDocument5 pagesSection 5. Section 25 of The National Internal Revenue Code of 1997, As0506sheltonPas encore d'évaluation

- TaxLawRev1 UpdatedDocument277 pagesTaxLawRev1 UpdatedKaira TanhuecoPas encore d'évaluation

- 90-17 Cpar - Local Government TaxesDocument37 pages90-17 Cpar - Local Government TaxesJellah NavarroPas encore d'évaluation

- 186-PAGCOR v. BIR G.R. No. 172087 March 15, 2011Document13 pages186-PAGCOR v. BIR G.R. No. 172087 March 15, 2011Jopan SJPas encore d'évaluation

- RR No. 11-2018Document47 pagesRR No. 11-2018Micah Adduru - RoblesPas encore d'évaluation

- Community Tax CertificateDocument13 pagesCommunity Tax CertificatePETERWILLE CHUAPas encore d'évaluation

- FINAL CREATE BICAM BILL (As of 1 Feb 540pm)Document198 pagesFINAL CREATE BICAM BILL (As of 1 Feb 540pm)KimPas encore d'évaluation

- Midterm Reviewer - Taxation Key ConceptsDocument5 pagesMidterm Reviewer - Taxation Key ConceptsMaria RochellePas encore d'évaluation

- Individual Income Tax Rates and Capital Gains Tax in the PhilippinesDocument4 pagesIndividual Income Tax Rates and Capital Gains Tax in the PhilippinesangelaggabaoPas encore d'évaluation

- Chapter Iii - Tax On Individuals SEC. 24. Income Tax RatesDocument2 pagesChapter Iii - Tax On Individuals SEC. 24. Income Tax RatesvocksPas encore d'évaluation

- 2.4 Tax On Income - Tax On CorporationsDocument15 pages2.4 Tax On Income - Tax On CorporationsfelixacctPas encore d'évaluation

- RR 02-98 AmendedDocument136 pagesRR 02-98 AmendedPaul Angelo TombocPas encore d'évaluation

- Responsibility Accounting and Transfer PricingDocument68 pagesResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaPas encore d'évaluation

- 4 Create RR - 2-2021 - WT FullDocument15 pages4 Create RR - 2-2021 - WT FullTreb LemPas encore d'évaluation

- Income Tax Notes of IbanezDocument11 pagesIncome Tax Notes of IbanezJoy RaguindinPas encore d'évaluation

- Income Tax Principles and Rates in the PhilippinesDocument5 pagesIncome Tax Principles and Rates in the PhilippinesLoren MandaPas encore d'évaluation

- Custom Search: Create PDF in Your Applications With The PdfcrowdDocument22 pagesCustom Search: Create PDF in Your Applications With The Pdfcrowdthelionleo1Pas encore d'évaluation

- Michael Evans C Pastor Taxation OverviewDocument28 pagesMichael Evans C Pastor Taxation OverviewEks WaiPas encore d'évaluation

- Administration 3-19Document2 pagesAdministration 3-19AtiaTahiraPas encore d'évaluation

- TAX Reviewer 2Document9 pagesTAX Reviewer 2Krystal MaciasPas encore d'évaluation

- Inherent and Constitutional LimitationsDocument3 pagesInherent and Constitutional LimitationsJoseph CameronPas encore d'évaluation

- Revenue Regulations No 2-1998Document72 pagesRevenue Regulations No 2-1998RELLYPas encore d'évaluation

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- The Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryD'EverandThe Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryPas encore d'évaluation

- 122 - Gabriel V Monte de PiedadDocument2 pages122 - Gabriel V Monte de Piedadjrvyee100% (1)

- 120 - DKC Holdings Corp V CADocument2 pages120 - DKC Holdings Corp V CAjrvyeePas encore d'évaluation

- Fabian Heirs Lose Land Due to Laches and PrescriptionDocument2 pagesFabian Heirs Lose Land Due to Laches and PrescriptionjrvyeePas encore d'évaluation

- 194 - Tamayo V CalejoDocument1 page194 - Tamayo V CalejojrvyeePas encore d'évaluation

- 124 - Cui v. ArellanoDocument3 pages124 - Cui v. ArellanojrvyeePas encore d'évaluation

- Land Bank v. Monet's Export and ManufacturingDocument3 pagesLand Bank v. Monet's Export and ManufacturingAndre Philippe RamosPas encore d'évaluation

- Annex A - RMC 103 2019 Revised Etar PDFDocument2 pagesAnnex A - RMC 103 2019 Revised Etar PDFJester AlejandroPas encore d'évaluation

- 119 - Manila Railroad Co v. La CompaniaDocument2 pages119 - Manila Railroad Co v. La CompaniajrvyeePas encore d'évaluation

- 123 - Pakistan International Airlines V OpleDocument2 pages123 - Pakistan International Airlines V Oplejrvyee100% (1)

- 194 - Tamayo V CalejoDocument1 page194 - Tamayo V CalejojrvyeePas encore d'évaluation

- 191 - Salao v. SalaoDocument3 pages191 - Salao v. SalaojrvyeePas encore d'évaluation

- 187 - Fisher V RobbDocument1 page187 - Fisher V RobbjrvyeePas encore d'évaluation

- 11 Phil. Virginia Tobacco Administration v. de Los Angeles (Magbanua)Document2 pages11 Phil. Virginia Tobacco Administration v. de Los Angeles (Magbanua)jrvyeePas encore d'évaluation

- 11 Phil. Virginia Tobacco Administration v. de Los Angeles (Magbanua)Document2 pages11 Phil. Virginia Tobacco Administration v. de Los Angeles (Magbanua)jrvyeePas encore d'évaluation

- Opic IN Yllabus Ummary: HERRERA-LIM, Andrea Paola CDocument2 pagesOpic IN Yllabus Ummary: HERRERA-LIM, Andrea Paola CjrvyeePas encore d'évaluation

- 32 Ching v. Secretary of Justice (Lua)Document3 pages32 Ching v. Secretary of Justice (Lua)jrvyeePas encore d'évaluation

- Opic IN Yllabus Ummary: CASE #13Document1 pageOpic IN Yllabus Ummary: CASE #13jrvyeePas encore d'évaluation

- Consolidated Bank v. CADocument2 pagesConsolidated Bank v. CAjrvyeePas encore d'évaluation

- PNB Entitled to Delivery of Sugar Under Warehouse ReceiptsDocument2 pagesPNB Entitled to Delivery of Sugar Under Warehouse ReceiptsjrvyeePas encore d'évaluation

- Court orders release of palay deposits despite lost receiptsDocument2 pagesCourt orders release of palay deposits despite lost receiptsjrvyeePas encore d'évaluation

- Consolidated Bank v. CADocument2 pagesConsolidated Bank v. CAjrvyeePas encore d'évaluation

- 127 Consolidated Terminals V Artex DevtDocument1 page127 Consolidated Terminals V Artex DevtjrvyeePas encore d'évaluation

- Philippines - FRIADocument66 pagesPhilippines - FRIAmariellePas encore d'évaluation

- Letter of Credit Payment Quasi-ContractDocument2 pagesLetter of Credit Payment Quasi-ContractjrvyeePas encore d'évaluation

- Opic IN Yllabus Ummary: Sollano, Jose GabrielDocument3 pagesOpic IN Yllabus Ummary: Sollano, Jose GabrieljrvyeePas encore d'évaluation

- Creser Precision Systems, Inc. vs. Court of AppealsDocument4 pagesCreser Precision Systems, Inc. vs. Court of AppealsjrvyeePas encore d'évaluation

- Land Bank v. Monet's Export and ManufacturingDocument3 pagesLand Bank v. Monet's Export and ManufacturingAndre Philippe RamosPas encore d'évaluation

- Ladiana v. People examines right to counsel during preliminary investigationsDocument3 pagesLadiana v. People examines right to counsel during preliminary investigationsjrvyeePas encore d'évaluation

- People v. HindoyDocument2 pagesPeople v. Hindoyjrvyee0% (1)

- 028 - Normandy v. DuqueDocument2 pages028 - Normandy v. DuquejrvyeePas encore d'évaluation

- The Impacts of Unemployment in Zimbabwe From The 2009-2019Document12 pagesThe Impacts of Unemployment in Zimbabwe From The 2009-2019Tracy AlpsPas encore d'évaluation

- Standard Costing I SolutionDocument7 pagesStandard Costing I SolutionDheeraj DoliyaPas encore d'évaluation

- An Irate Distributor: The Question of Profitability: Team 4Document12 pagesAn Irate Distributor: The Question of Profitability: Team 4Surbhi SabharwalPas encore d'évaluation

- Due Diligence DocumentationDocument4 pagesDue Diligence DocumentationSivakumar KrishnamurthyPas encore d'évaluation

- Module 1, Chapter 1 Handout Introduction To Financial StatementsDocument5 pagesModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbPas encore d'évaluation

- Samudera Indonesia TBK - 30 September 2023 - FinalDocument114 pagesSamudera Indonesia TBK - 30 September 2023 - Finalade.yulyansyahPas encore d'évaluation

- Financial ReportingDocument23 pagesFinancial ReportingHandayani Mutiara Sihombing100% (1)

- 9706 Accounting: MARK SCHEME For The May/June 2015 SeriesDocument8 pages9706 Accounting: MARK SCHEME For The May/June 2015 Seriesasad HgdfjjPas encore d'évaluation

- Sam Walton Made in America PDF SummaryDocument16 pagesSam Walton Made in America PDF SummaryMilind BidvePas encore d'évaluation

- Joy Global Inc: FORM 10-QDocument44 pagesJoy Global Inc: FORM 10-QfiahstonePas encore d'évaluation

- Rashtriya Chemicals standalone financial ratiosDocument18 pagesRashtriya Chemicals standalone financial ratiosritikPas encore d'évaluation

- Optimize General Ledger TitleDocument1 pageOptimize General Ledger TitleMinn TunPas encore d'évaluation

- Final Tfa CompiledDocument109 pagesFinal Tfa CompiledAsi Cas JavPas encore d'évaluation

- National IncomeDocument4 pagesNational Incomesubbu2raj3372Pas encore d'évaluation

- Marketing Plan of Bkash - Group 2Document11 pagesMarketing Plan of Bkash - Group 2Sharmin A. Salma100% (1)

- John Hamerski (Jack)Document3 pagesJohn Hamerski (Jack)jackhamerskiPas encore d'évaluation

- Digitizing Cash Eco - After Demon - TrendsDocument126 pagesDigitizing Cash Eco - After Demon - Trendschimp64100% (1)

- A Roadmap To Applying The New Revenue Recognition Standard - 2017Document838 pagesA Roadmap To Applying The New Revenue Recognition Standard - 2017zahidsiddiqui75Pas encore d'évaluation

- Substance Over FormDocument4 pagesSubstance Over FormAnyta TiarmaPas encore d'évaluation

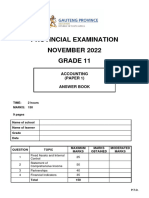

- GR 11 Accounting P1 (English) November 2022 Answer BookDocument9 pagesGR 11 Accounting P1 (English) November 2022 Answer BookDoryson CzzlePas encore d'évaluation

- CHAPTER 5 ADJUSTING PROCESS - AssignmentDocument1 pageCHAPTER 5 ADJUSTING PROCESS - AssignmentjepsyutPas encore d'évaluation

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruProfit MartPas encore d'évaluation

- The Home Depot IncDocument12 pagesThe Home Depot IncKhushbooPas encore d'évaluation

- SLM-Unit 01Document25 pagesSLM-Unit 01nikilraj123Pas encore d'évaluation

- Caf 7 Far2 STDocument690 pagesCaf 7 Far2 STMuhammad YousafPas encore d'évaluation

- Income Feereimbursement Application Form PDFDocument2 pagesIncome Feereimbursement Application Form PDFPavanPas encore d'évaluation

- Comprehensive Income Statement BreakdownDocument42 pagesComprehensive Income Statement BreakdownClove WallPas encore d'évaluation