Académique Documents

Professionnel Documents

Culture Documents

PT Semen Gresik (Persero) TBK.: Summary of Financial Statement

Transféré par

Khaerudin RangersDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PT Semen Gresik (Persero) TBK.: Summary of Financial Statement

Transféré par

Khaerudin RangersDroits d'auteur :

Formats disponibles

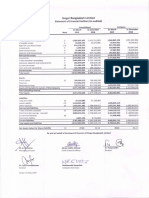

PT Semen Gresik (Persero) Tbk.

Cement

Head Office Gedung Utama Semen Gresik 9th-11th Floor Summary of Financial Statement

Jl. Veteran-Gresik 61122, Jawa Timur

Phone (031) 398-1731-3 (Million Rupiah)

Fax (031) 397-2264, 398-3209 2009 2010 2011

E-mail: ptsg@sg.sggrp.com Total Assets 12,951,308 15,562,999 19,661,603

Website: http://www.semengresik.com Current Assets 8,221,270 7,345,868 7,646,145

Toll Free: 0800-10-88888 of which

Cash and Cash Equivalents 3,410,263 3,664,278 3,375,645

Representative Office The East Building 18th Floor

Time dweposits 1,875,254 240,609 306,445

Jl. Lingkar Mega Kuningan Kav. E3.2 No. 1 Trade receivables 1,425,303 1,716,582 1,828,478

Jakarta Selatan Inventories 1,407,577 1,624,219 2,006,660

Phone (021) 526-1174-5, Fax (021) 526-1176 Non-Current Assets 4,730,038 8,217,131 12,015,458

Factory Desa Sumberarum, Kec. Kerek, of which

Fixed Assets-Net 4,014,143 7,662,560 11,640,692

Kab. Tuban 62356 Deffered Tax Assets 111,920 95,684 106,489

Phone (0356) 325-001-3, Fax (0356) 322-380 Investments 64,408 69,630 80,193

Business Cement Production Other Assets 17,462 17,202 18,029

Company Status BUMN Liabilities 2,625,604 3,423,246 5,046,506

Current Liabilities 2,293,769 2,517,519 2,889,137

Financial Performance: The company has managed of which

to book net profit in 2011 at IDR 3.955 trillion, rising from IDR Trade payables 822,100 892,022 1,182,562

Taxes payable 538,533 222,697 290,107

3.659 trillion in 2010. Current maturities of

Brief History: The Company is engaging in cement long-term debt 90,410 86,634 77,790

Non-Current Liabilities 331,835 905,727 2,157,369

industry. Officially inaugurated on August 7, 1957 by the first

Shareholders' Equity 10,325,704 12,139,753 14,615,097

President of the Republic of Indonesia with installed capacity of Paid-up capital 593,152 593,152 593,152

250,000 tons cement per year. On July 8, 1991, Semen Gresik Paid-up capital

in excess of par value 1,458,258 1,458,258 1,458,258

was listed at the Jakarta Stock Exchange and Surabaya Stock Retained earnings 8,274,294 10,088,343 12,563,687

Exchange and was the first State-owned Enterprise publicly list- Net Sales 14,387,850 14,344,189 16,378,794

ed by offering 40 million shares to the public. Its shareholding Cost of Goods Sold 7,613,709 7,534,079 8,891,868

Gross Profit 6,774,141 6,810,110 7,486,926

composition was Government 73% and the Public 27%. Operating Expenses 2,431,578 2,300,166 2,594,794

In September 1995, Semen Gresik performed right issue Operating Profit 4,342,563 4,509,944 4,892,132

Other Income (Expenses) 312,625 212,679 197,821

I, which changed the share ownership composition to the State Profit (loss) before Taxes 4,655,188 4,722,623 5,089,953

65% and the Public 35%. In September 15,1995 Semen Gresik Comprehensive Profit (loss) 3,326,488 3,659,114 3,955,273

acquired SP and ST, which was then known as Semen Gresik Per Share Data (Rp)

Group (SGG). The total installed capacity of SGG was 8.5 mil- Earnings per Share 561 617 667

Equity per Share 1,741 2,047 2,464

lion tons of cement per year. Dividend per Share 250 248 331

On September 17, 1998, the Government sold its 14% Closing Price 7,550 9,450 11,450

shares in SGG through an open tender, in which Cemex S.A. Financial Ratios

PER (x) 13.46 15.32 17.17

de C.V, a Mexicobased global cement company, was declared PBV (x) 4.34 4.62 4.65

as the winner. The share ownership composition was then Dividend Payout (%) 44.66 40.20 49.62

Dividend Yield (%) 14.39 12.12 13.43

changed to the Government 51 %, the Public 35%, and Cemex

Current Ratio (x) 3.58 2.92 2.65

14%. Debt to Equity (x) 0.25 0.28 0.35

As of September 30, 1999, the share ownership composi- Leverage Ratio (x) 0.20 0.22 0.26

Gross Profit Margin (x) 0.47 0.47 0.46

tion has changed to the Government 51 %, the Public 23.5%, Operating Profit Margin (x) 0.30 0.31 0.30

and Cemex 25.5%. Meanwhile, SGG has an installed capacity of Net Profit Margin (x) 0.23 0.26 0.24

Inventory Turnover (x) 5.41 4.64 4.43

15.82 million tons cement per year. On July 27 2006 Cemex Total Assets Turnover (x) 1.11 0.92 0.83

S.A. de C.V. shares were sold to Blue Valley Holdings PTE Ltd., ROI (%) 25.68 23.51 20.12

so that the share ownership composition has changed to the ROE (%) 32.22 30.14 27.06

Government 51,01%, Blue Valley Holdings PTE Ltd. 24,90% and

PER = 16.38x ; PBV = 4.59x (June 2012)

public 24,09%. Financial Year: December 31

Presently, the real installed capacity of SGG has reached Public Accountant: Purwantono, Suherman & Surja

16,92 million tons per year, and it covers about 46% of domes- (million rupiah)

tic cement market. 2012 2011

Total Assets 22,278,132 18,037,737

Current Assets 8,679,253 7,834,263

Non-Current Assets 13,598,879 10,203,474

Liabilities 7,526,290 5,482,085

Shareholders' Equity 14,602,416 12,555,653

Net Sales 8,657,562 7,605,787

Profit after Taxes 2,115,257 1,896,114

Shareholders ROI (%) 9.49 10.51

Indonesia Government 51.01% ROE (%) 14.49 15.10

Public 48.99% In June

318 Indonesian Capital Market Directory 2012

PT Semen Gresik (Persero) Tbk. Cement

Board of Commissioners Board of Directors

President Commissioner Mahendra Siregar President Director Dwi Soetjipto

Commissioners Setia Purwaka, Achmad Jazidie, Directors Bambang Sugeng, Suparni,

Hadi Waluyo, Sumaryanto Widayatin, Suharto, Amat Pria Darma,

Djawahir Adnan Erizal Bakar, Ahyanizzaman

Number of Employees 6,517

No Type of Listing Listing Date Trading Date Number of Shares Total Listed

per Listing Shares

1 First Issue 08-Jul-91 08-Jul-91 40,000,000 40,000,000

2 Partial Listing 08-Jul-91 17-May-92 30,000,000 70,000,000

3 Company Listing 02-Jun-95 02-Jun-95 78,288,000 148,288,000

4 Right Issue 10-Aug-95 10-Aug-95 444,864,000 593,152,000

5 Stock Split 07-Aug-07 07-Aug-07 5,338,368,000 5,931,520,000

Underwriters

PT Danareksa Sekuritas, PT Deutsche Securities Indonesia, PT Trimegah Securities Tbk

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price Shares Traded Trading Listed Market

Month High Low Close Volume Value Frequency Day Shares Capitalization

(Rp) (Rp) (Rp) (Thousand Shares) (Rp Million) (Rp Million)

January-11 10,000 7,250 7,750 279,407.00 2,371,780.00 28,860 21 5,931,520,000 45,969,280.00

February-11 8,850 7,800 8,650 157,200.00 1,307,341.00 16,970 18 5,931,520,000 51,307,648.00

March-11 9,350 8,250 9,100 169,216.00 1,488,654.00 21,543 23 5,931,520,000 53,976,832.00

April-11 9,800 9,100 9,500 120,939.00 1,153,198.00 13,301 20 5,931,520,000 56,349,440.00

May-11 9,800 9,200 9,700 144,637.00 1,378,004.00 13,524 21 5,931,520,000 57,535,744.00

June-11 9,750 9,150 9,600 128,580.00 1,218,512.00 14,410 20 5,931,520,000 56,942,592.00

July-11 10,000 9,350 9,450 241,451.00 2,367,029.00 13,494 21 5,931,520,000 56,052,864.00

August-11 9,650 8,400 9,100 206,839.00 1,864,386.00 22,705 19 5,931,520,000 53,976,832.00

September-11 9,450 7,400 8,300 145,732.00 1,234,343.00 23,699 20 5,931,520,000 49,231,616.00

October-11 9,500 7,700 9,500 149,227.00 1,282,433.00 24,322 21 5,931,520,000 56,349,440.00

November-11 9,550 8,650 9,250 129,289.00 1,181,110.00 18,215 22 5,931,520,000 54,866,560.00

December-11 11,450 9,300 11,450 195,126.00 2,008,194.00 21,806 21 5,931,520,000 67,915,904.00

January-12 12,950 10,750 11,300 210,657.00 2,414,273.00 31,022 21 5,931,520,000 67,026,176.00

February-12 11,700 10,400 11,250 290,757.00 3,283,417.00 29,475 21 5,931,520,000 66,729,600.00

March-12 12,650 11,050 12,250 156,721.00 1,871,958.00 23,712 21 5,931,520,000 72,661,120.00

April-12 12,650 11,600 12,150 134,207.00 1,629,480.00 17,193 20 5,931,520,000 72,067,968.00

May-12 12,400 10,400 10,950 217,770.00 2,436,384.00 23,702 21 5,931,520,000 64,950,144.00

June-12 11,650 9,900 11,300 150,083.00 1,665,904.00 24,678 21 5,931,520,000 67,026,176.00

Stock Price and Traded Chart

Institute for Economic and Financial Research 319

Vous aimerez peut-être aussi

- 3.kingsun Financial Statement FinalDocument22 pages3.kingsun Financial Statement FinalDharamrajPas encore d'évaluation

- Ceres Gardening CalculationsDocument9 pagesCeres Gardening CalculationsJuliana Marques0% (2)

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14Pas encore d'évaluation

- Eliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick ForumDocument122 pagesEliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick Forumbruce1976@hotmail.comPas encore d'évaluation

- KAMM Notes Taxation Bar 2021Document115 pagesKAMM Notes Taxation Bar 2021Bai MonadinPas encore d'évaluation

- Dividend Decision Analysis at Zen MoneyDocument100 pagesDividend Decision Analysis at Zen MoneyRoji0% (1)

- Academic Word List PDFDocument28 pagesAcademic Word List PDFukchaudharyPas encore d'évaluation

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocument2 pagesPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersPas encore d'évaluation

- PT Gudang Garam TBK.: (Million Rupiah) 2005 2006 2007Document2 pagesPT Gudang Garam TBK.: (Million Rupiah) 2005 2006 2007patriaPas encore d'évaluation

- GGRM - Icmd 2011 (B02)Document2 pagesGGRM - Icmd 2011 (B02)annisa lahjiePas encore d'évaluation

- HMSP - Icmd 2011 (B02)Document2 pagesHMSP - Icmd 2011 (B02)annisa lahjiePas encore d'évaluation

- PT Gozco Plantations TBK.: Summary of Financial StatementDocument2 pagesPT Gozco Plantations TBK.: Summary of Financial StatementMaradewiPas encore d'évaluation

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocument2 pagesPT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanPas encore d'évaluation

- Ades 2007Document2 pagesAdes 2007Mhd FadilPas encore d'évaluation

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial Statementkurnia murni utamiPas encore d'évaluation

- PT Ades Waters Indonesia TBKDocument2 pagesPT Ades Waters Indonesia TBKMhd FadilPas encore d'évaluation

- Rmba - Icmd 2011 (B02)Document2 pagesRmba - Icmd 2011 (B02)annisa lahjiePas encore d'évaluation

- IcbpDocument2 pagesIcbpdennyaikiPas encore d'évaluation

- Inru ICMD 2009Document2 pagesInru ICMD 2009abdillahtantowyjauhariPas encore d'évaluation

- Kbri ICMD 2009Document2 pagesKbri ICMD 2009abdillahtantowyjauhariPas encore d'évaluation

- Saip ICMD 2009Document2 pagesSaip ICMD 2009abdillahtantowyjauhariPas encore d'évaluation

- PT Inti Agri ResourcestbkDocument2 pagesPT Inti Agri ResourcestbkmeilindaPas encore d'évaluation

- Abmm PDFDocument2 pagesAbmm PDFTRI HASTUTIPas encore d'évaluation

- PT Mustika Ratu TBK.: Summary of Financial StatementDocument2 pagesPT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiPas encore d'évaluation

- 1st Quarter Financial Statements 2020Document13 pages1st Quarter Financial Statements 2020Ahm FerdousPas encore d'évaluation

- Trade and PaymentsDocument17 pagesTrade and PaymentsmazamniaziPas encore d'évaluation

- Singer 2nd Quarter Financial Statements 2019 - WebsiteDocument12 pagesSinger 2nd Quarter Financial Statements 2019 - WebsiteAhm FerdousPas encore d'évaluation

- 1) Termasuk Modal Cadangan: Statistik Ekonomi Dan Keuangan Indonesia Bank IndonesiaDocument2 pages1) Termasuk Modal Cadangan: Statistik Ekonomi Dan Keuangan Indonesia Bank Indonesiadarma bonarPas encore d'évaluation

- Gita AgricultureDocument20 pagesGita AgriculturemrigendrarimalPas encore d'évaluation

- Financial Statement Analysis of Kohat Cement Company LimitedDocument67 pagesFinancial Statement Analysis of Kohat Cement Company LimitedSaif Ali Khan BalouchPas encore d'évaluation

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial StatementIntan Maulida SuryaningsihPas encore d'évaluation

- Abda PDFDocument2 pagesAbda PDFTRI HASTUTIPas encore d'évaluation

- Knitware Ms FormatDocument29 pagesKnitware Ms FormatMD. Borhan UddinPas encore d'évaluation

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Document2 pagesPT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Mila DiasPas encore d'évaluation

- Abda ICMD 2009Document2 pagesAbda ICMD 2009abdillahtantowyjauhariPas encore d'évaluation

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Document2 pagesPT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Mhd FadilPas encore d'évaluation

- A. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VIDocument32 pagesA. Currents Assets 29,760,685 24,261,892: I. II. Iii. IV. V. I. II. Iii. IV. V. VITammy DaoPas encore d'évaluation

- Rev6 - LK BKP Per Mar 2021 Per Table (ENG)Document14 pagesRev6 - LK BKP Per Mar 2021 Per Table (ENG)IPutuAdi SaputraPas encore d'évaluation

- Abba PDFDocument2 pagesAbba PDFAndriPigeonPas encore d'évaluation

- CF-Export-05-03-2024 12Document12 pagesCF-Export-05-03-2024 12v4d4f8hkc2Pas encore d'évaluation

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaPas encore d'évaluation

- AnalysisDocument20 pagesAnalysisSAHEB SAHAPas encore d'évaluation

- Fasw ICMD 2009Document2 pagesFasw ICMD 2009abdillahtantowyjauhariPas encore d'évaluation

- Caso Ceres en ClaseDocument4 pagesCaso Ceres en ClaseAdrian PeranPas encore d'évaluation

- Icmd 2010Document2 pagesIcmd 2010meilindaPas encore d'évaluation

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaPas encore d'évaluation

- 4019 XLS EngDocument4 pages4019 XLS EngAnonymous 1997Pas encore d'évaluation

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalDocument3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalaPas encore d'évaluation

- Caso Ceres en ClaseDocument6 pagesCaso Ceres en ClaseYerly DescansePas encore d'évaluation

- JohnsonDocument12 pagesJohnsonJannah Victoria AmoraPas encore d'évaluation

- TABLE 5.1 Components of Monetary AssetsDocument9 pagesTABLE 5.1 Components of Monetary AssetsfaysalPas encore d'évaluation

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaPas encore d'évaluation

- Pakistan Balance of PaymentsDocument94 pagesPakistan Balance of PaymentsHamzaPas encore d'évaluation

- Spma ICMD 2009Document2 pagesSpma ICMD 2009abdillahtantowyjauhariPas encore d'évaluation

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54Pas encore d'évaluation

- Datasets 523573 961112 Costco-DataDocument4 pagesDatasets 523573 961112 Costco-DataAnish DalmiaPas encore d'évaluation

- PT Hexindo Adiperkasa TBK.: Summary of Financial StatementDocument2 pagesPT Hexindo Adiperkasa TBK.: Summary of Financial StatementMaradewiPas encore d'évaluation

- Statements of Financial Position PT Bank Rakyat Indonesia (Persero) TBK As of June 30, 2021 and December 31, 2020 (In Million Rupiah)Document14 pagesStatements of Financial Position PT Bank Rakyat Indonesia (Persero) TBK As of June 30, 2021 and December 31, 2020 (In Million Rupiah)vivian rainsaniPas encore d'évaluation

- Love Verma Ceres Gardening SubmissionDocument8 pagesLove Verma Ceres Gardening Submissionlove vermaPas encore d'évaluation

- PT ESS1217 - Mapping Report Break LinkDocument392 pagesPT ESS1217 - Mapping Report Break Linkricho naiborhuPas encore d'évaluation

- Citra Maharlika Nusantara Corpora TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesCitra Maharlika Nusantara Corpora TBK.: Company Report: January 2017 As of 31 January 2017Ita SulistianiPas encore d'évaluation

- TcidDocument2 pagesTciddennyaikiPas encore d'évaluation

- GTR TyreDocument3 pagesGTR TyreABUBAKAR FawadPas encore d'évaluation

- Singer 1st Quarter 2019 Financial StatementsDocument12 pagesSinger 1st Quarter 2019 Financial StatementsAhm FerdousPas encore d'évaluation

- OutputDocument1 pageOutputKhaerudin RangersPas encore d'évaluation

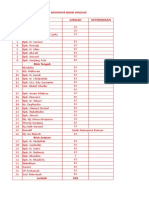

- Daftar Donatur Baesi Khusus NO Nama Jumlah Keterangan Blok UtaraDocument1 pageDaftar Donatur Baesi Khusus NO Nama Jumlah Keterangan Blok UtaraKhaerudin RangersPas encore d'évaluation

- KLBFDocument2 pagesKLBFKhaerudin RangersPas encore d'évaluation

- Asii PDFDocument2 pagesAsii PDFKhaerudin RangersPas encore d'évaluation

- Sohrabi 2019Document42 pagesSohrabi 2019Brayan TillaguangoPas encore d'évaluation

- Promotional Strategies of Kotak Life InsuranceDocument88 pagesPromotional Strategies of Kotak Life InsuranceMayank AhujaPas encore d'évaluation

- Miga Professionals Program PDFDocument2 pagesMiga Professionals Program PDFPaul Ivan Beppe a Yombo Paul IvanPas encore d'évaluation

- 5 Structured Products Forum 2007 Hong KongDocument11 pages5 Structured Products Forum 2007 Hong KongroversamPas encore d'évaluation

- 0304 Boudreau Beyond HRDocument17 pages0304 Boudreau Beyond HRasha_tatapudiPas encore d'évaluation

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra50% (2)

- Gap Thesis and The Survival of Informal Financial Sector in NigeriaDocument6 pagesGap Thesis and The Survival of Informal Financial Sector in NigeriaMadiha MunirPas encore d'évaluation

- B1 How To Deal With Money LIU006: WWW - English-Practice - atDocument1 pageB1 How To Deal With Money LIU006: WWW - English-Practice - atIoana-Daniela PîrvuPas encore d'évaluation

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalPas encore d'évaluation

- NBFCDocument52 pagesNBFCDrRajdeep SinghPas encore d'évaluation

- Factors Affecting Valuation of SharesDocument6 pagesFactors Affecting Valuation of SharesSneha ChavanPas encore d'évaluation

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDocument28 pagesYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunPas encore d'évaluation

- Balance Sheet AnalysisDocument2 pagesBalance Sheet AnalysisAishaPas encore d'évaluation

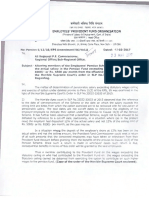

- EPF Circular On Pension For Full Salary 23.3.17Document11 pagesEPF Circular On Pension For Full Salary 23.3.17Vishal InglePas encore d'évaluation

- Engineering Economy1Document13 pagesEngineering Economy1Roselyn MatienzoPas encore d'évaluation

- Mahindra & Mahindra Acquires SSanYongDocument11 pagesMahindra & Mahindra Acquires SSanYongShivam BajajPas encore d'évaluation

- Payment 4310725205Document1 pagePayment 4310725205Radoslav TsvetkovPas encore d'évaluation

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocument5 pagesAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingPas encore d'évaluation

- List of Project Topics For Accountancy DDocument4 pagesList of Project Topics For Accountancy DnebiyuPas encore d'évaluation

- Notice To Loan RepaymentDocument2 pagesNotice To Loan RepaymentDebasish NathPas encore d'évaluation

- Employees' Provident Fund Scheme: (0.18 %)Document9 pagesEmployees' Provident Fund Scheme: (0.18 %)Shubhabrata BanerjeePas encore d'évaluation

- Finex ServicesDocument3 pagesFinex Servicesggn08Pas encore d'évaluation

- World Bank (IBRD & IDA)Document5 pagesWorld Bank (IBRD & IDA)prankyaquariusPas encore d'évaluation

- Perspectivespaper ESGinBusinessValuationDocument12 pagesPerspectivespaper ESGinBusinessValuationsreerahPas encore d'évaluation

- Etf Playbook 1Document12 pagesEtf Playbook 1langlinglung1985Pas encore d'évaluation