Académique Documents

Professionnel Documents

Culture Documents

Bharat Forge Story

Transféré par

soni_rajendraDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bharat Forge Story

Transféré par

soni_rajendraDroits d'auteur :

Formats disponibles

Bharat Forge

2QFY2009 Result Update

BUY Performance Highlights

Price Rs103 Standalone Results: Bharat Forge (BFL) recorded 19.4% yoy growth in

Net Sales (Standalone) during 2QFY2009 largely on the back of 30.4%

Target Price Rs117 growth in its outside India operations and 7.4% yoy growth in the domestic

market. This growth has come as a surprise especially because the

Investment Period 12 months Automobile industry in India and US are struggling to recover from macro

slowdown and high input costs. In 2QFY2009, BFL clocked a decline in

Stock Info

Operating Margins by 311bp yoy to 24.1% (27.2%). Management had

Sector Auto Ancillary indicated in the last quarter that it was able to fully pass the increase in

input costs to its customers, which helped improve Margins and post higher

Market Cap (Rs cr) 2,283 Net Profit of Rs98.8cr (excluding Forex losses of Rs87.5cr) during

2QFY2009. Including Exceptional items however, BFL reported 83.4% yoy

Beta 0.8 decline in Net Profit to Rs11.3cr.

52 WK High / Low 390/100

Consolidated Results: BFL reported 28.8% yoy increase in Consolidated

Avg Daily Volume 106950 Net Sales to Rs1,347cr, which was higher than our estimate of Rs1,194cr,

aided by higher realisation. Consolidated Net Profit, excluding Foreign

Face Value (Rs) 2 currency loss and Exceptional items of Rs23.6cr, was up 69.4% to

Rs115.7cr (Rs68.29cr). The company has recognised forex loss of

BSE Sensex 8,701 Rs87.5cr (Rs10.9cr Profit in 2QFY2008) on revaluation of loans consequent

to depreciation of the Rupee. OPMs declined by 260bp to 14.4% (17%). Net

Nifty 2,584

Profit including Forex loss and Extraordinary item was down 94.2% yoy to

BSE Code 500493 Rs4.6cr. BFL’s consolidated numbers did not include FAW Bharat Forge,

BFL's joint venture in China.

NSE Code BHARATFORG

Diversifying market concentration and capacity addition on track:

Reuters Code BFRG.BO BFL’s initiatives to de-risk its Export Revenues have been paying off, with

its exports to the European markets growing rapidly. The company’s capex

Bloomberg Code BHFC@IN

for its Non-Auto business is also on track, with capacities at Baramati

Shareholding Pattern (%) expected to get commissioned in 3QFY2009. Trial production commenced

in Baramati during the quarter while the Mundhwa facility is expected to

Promoters begin trial runs from August 2008. Serial production in Mundhwa is likely to

40.6

commence six months thereafter. BFL, at present, has an Order book of

MF/Banks/Indian FIs around 75% for its combined Non-Auto Forging capacity (1,00,000 tonnes

14.6

p.a.) at the two plants. The company expects to generate Rs800-1,000cr at

FII/ NRIs/ OCBs

13.4 full capacity, and on planned capex of more than Rs400cr.

Indian Public

31.4

Key Financials (Consolidated)

Y/E March (Rs cr) FY2007 FY2008 FY2009E FY2010E

Abs. 3m 1yr 3yr Net Sales 4,148.9 4,597.5 5,128.9 5,898.2

Sensex (%) (41.1) (53.0) 9.9 % chg 39.6 10.8 11.6 15.0

Net Profit 299.4 302.4 344.7 400.1

BFL (%) (58.2) (66.1) (68.2) % chg 19.5 1.0 14.0 16.1

OPM (%) 14.6 14.1 14.1 14.9

Vaishali Jajoo EPS (Rs) 11.0 13.6 14.4 16.7

P/E (x) 9.4 7.6 7.1 6.2

Tel: 022 – 4040 3800 Ext: 344

RoE (%) 1.9 1.4 1.0 0.9

e-mail: vaishali.jajoo@angeltrade.com

RoCE (%) 19.0 17.6 13.8 14.5

P/BV (x) 12.2 12.1 12.7 13.0

EV/Sales (x) 0.7 0.7 0.6 0.5

EV/EBITDA (x) 5.2 4.8 4.3 3.6

Source: Company, Angel Research; Note:FY2009, FY2010 EPS on fully diluted Equity Shares.

October 25, 2008 1

Bharat Forge

Auto Ancillary

Key Highlights and Business Outlook

• The Indian Automobile industry has witnessed a drop in activity and demand due to the

difficult economic conditions coupled with the high oil prices and hardening of Interest

rates. This has resulted in a drop in production across segments.

• Although the demand from major geographies continued to be sluggish, BFL registered

a stable performance in 2QFY2009 with Top-line growing by 28.8% on consolidated

basis. This was aided, to some extent, by the Rupee depreciation against major

currencies. Among the subsidiaries, BFA had experienced a difficult 1HFY2009 due to

prolonged shutdown at one of its key customer facilities and due to the severe slow

down in the US economy.

• The company has taken simple forward covers against Export receivables. To

recognise impact of forex fluctuation arising out of instruments acquired to hedge

highly probable transactions in appropriate accounting periods, the company has from

this year decided to apply the principles of recognition set out in the International

Accounting Standards (IAS) as suggested by the ICAI, which is also reflected in the

Accounting Standard-30- Financial Instruments - Recognition and Measurement. As a

result, impact of unrealised loss (net) consequent to foreign currency fluctuation in

respect of effective hedging instruments, to hedge future exports, aggregating

Rs21.7cr for the quarter and Rs47.2cr year-to-date are carried as a Hedging Reserve

to be ultimately settled when the underlying transaction arises, in the Profit and Loss

account as against the practice of recognising the same in the Profit and Loss account,

on valuation at the end of each period. Hence, previous period / year figures are not

strictly comparable.

• Other Foreign currency financial assets, liabilities, receivables etc. that do not qualify

for hedge accounting have been revalued at the period end rate and resultant Net Loss

of Rs87.5cr for the quarter and Rs156.9cr year-to-date has been debited to the Profit

and Loss account and treated as Exceptional Items in the above results on account of

the wide fluctuation in foreign exchange rates witnessed during the quarter/ period. Out

of this loss Rs73.6cr for the quarter and Rs130.4cr year-to-date is with respect to the

FCCBs, which if not converted are repayable from April 2010 to April 2013 and Rs14cr

for the quarter and Rs26.5cr year-to-date is with respect to other loans, etc.

• Due to breakdown of the crankshaft at the press during February 2007, one of the

wholly-owned subsidiaries of the company, acknowledged claims from its customers

for reimbursement of all costs, expenses, loss and damage incurred by an alleged

failure to deliver. The said subsidiary filed a claim with the Insurance company for

business interruption and material damages for an amount of Rs32.9cr. The claim with

the Insurance company is yet to be settled. BFL acknowledged Rs24.1cr against this

damage in 2QFY2009.

• Emerging opportunities in Non-Automotive Business: BFL sees a lot of

opportunity in its Non-Automotive business also and is focusing on six sectors, viz.,

Marine, Power, Aerospace, Construction Equipment, Locomotive and Railways. BFL

expects its Non-Automotive business to contribute around 40% of its global revenues

over the next four years. Over the last two years, BFL announced fresh investments to

the tune of Rs490cr (Rs350cr in Baramati and Rs140cr in Pune) to set up capacity to

cater to the opportunities arising in its Non-Automotive business. Currently, the

company’s Non-Automotive business accounts for around 17% of its consolidated

revenues. Going ahead, it expects to increase it to 25% once new capacities become

operational in Baramati. Margins in this segment are also expected to be superior

compared to the Auto segment.

October 24, 2008 2

Bharat Forge

Auto Ancillary

Valuation

At the CMP of Rs103, the stock is trading at 7.1x FY2009E and 6.2x FY2010E

consolidated Earnings. Foreign currency convertible bond (FCCB) loans make up a major

portion of the company’s loan book. Out of a total of Rs730cr in FCCB loans, Rs410cr is

due in April 2010. Since the exercise price is way above the current market price, it looks

unlikely that it would be converted to equities. Hence, the company may have to raise fresh

loans thereby increasing its Interest costs.

We believe Industry valuations are likely to remain subdued in the near term due to overall

slowdown in the sector. A substantial portion of the company’s Revenue comes from the

Commercial Vehicle segment, where recovery looks unlikely in the near term. Further, a

major portion of the company’s consolidated Revenue comes from the US and European

markets, which is almost in recessionary mode, indicting further underperformance for the

stock. In view of all these, we lower our Target multiple to 4x (earlier 5.5x) FY2010E

EV/EBITDA and P/E to 7x (earlier 12x) FY2010E Earnings. We maintain a Buy on the

stock, with a revised Target Price of Rs117 (Rs218).

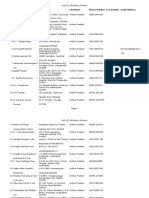

Exhibit 2: 2QFY2009 Performance (Standalone)

Y/E Mar (Rs cr) 2QFY2009 2QFY2008 % chg 1HFY2009 1HFY2008 % chg

Net Sales 654.5 548.1 19.4 1,291.8 1,045.0 23.6

Other Income 10.2 14.4 (29.0) 22.3 34.4 (35.2)

Total Income 664.7 562.5 18.2 1,314.1 1,079.4 21.7

EBITDA 157.7 149.2 5.8 313.7 250.4 25.3

OPM (%) 24.1 27.2 24.3 24.0

Interest 23.6 27.3 (13.7) 43.1 50.7 (14.9)

Depreciation 38.9 35.1 10.8 76.6 68.0 12.7

Profit Before Tax 18.0 101.2 (82.2) 59.4 199.5 (70.2)

Tax 6.7 33.4 (79.8) 21.6 66.9 (67.7)

Profit After Tax 11.3 67.8 (83.4) 37.8 132.6 (71.5)

EPS (Rs) 0.5 3.0 1.7 6.0

Source: Company, Angel Research

Exhibit 3: 2QFY2009 Performance (Consolidated)

Y/E Mar (Rs cr) 2QFY2009 2QFY2008 % chg 1HFY2009 1HFY2008 % chg

Net Sales 1,346.6 1,045.2 28.8 2,657.9 2,106.6 26.2

Other Income 13.2 15.2 (13.3) 25.7 35.8 (28.2)

Total Income 1,359.8 1,060.4 28.2 2,683.6 2,142.4 25.3

EBITDA 193.8 177.6 9.1 398.4 324.2 22.9

OPM (%) 14.4 17.0 15.0 15.4

Interest 28.9 30.0 (3.7) 54.2 56.7 (4.3)

Depreciation 60.8 54.3 11.9 120.9 106.8 13.2

Profit Before Tax 29.8 119.4 (75.0) 92.1 240.8 (61.8)

Tax 1.6 40.2 (95.9) 23.0 81.2 (71.7)

Profit After Tax 4.6 79.2 (94.2) 45.5 159.6 (71.5)

EPS (Rs) 0.2 3.6 2.0 7.2

Source: Company, Angel Research

October 24, 2008 3

Bharat Forge

Auto Ancillary

TM

Angel Broking Limited

Research Team Tel: 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose

possession this document may come are required to observe these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to

change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every

effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use

the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive

at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the

merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -

futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying

charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its

subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that

may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without

notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of

the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect

to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies

referred to in this report, as on the date of this report or in the past.

Sebi Registration No : INB 010996539

October 24, 2008 4

Vous aimerez peut-être aussi

- New Python Basics AssignmentDocument5 pagesNew Python Basics AssignmentRAHUL SONI0% (1)

- Email CampaignDocument1 252 pagesEmail Campaignvenkatesh_182980% (5)

- Answer Key: Entry TestDocument4 pagesAnswer Key: Entry TestMaciej BialyPas encore d'évaluation

- Aggregate Production PlanningDocument5 pagesAggregate Production PlanningSarbani SahuPas encore d'évaluation

- Bharat Forge: Performance HighlightsDocument13 pagesBharat Forge: Performance HighlightsarikuldeepPas encore d'évaluation

- Motherson Sumi System DataDocument4 pagesMotherson Sumi System DataNishaVishwanathPas encore d'évaluation

- Alembic Angel 020810Document12 pagesAlembic Angel 020810giridesh3Pas encore d'évaluation

- Angel Broking M&MDocument5 pagesAngel Broking M&Mbunny711Pas encore d'évaluation

- Cipla: Performance HighlightsDocument8 pagesCipla: Performance HighlightsKapil AthwaniPas encore d'évaluation

- Ashok Leyland: Performance HighlightsDocument9 pagesAshok Leyland: Performance HighlightsSandeep ManglikPas encore d'évaluation

- Angel Broking - BHELDocument5 pagesAngel Broking - BHELFirdaus JahanPas encore d'évaluation

- IVRCL Infrastructure: Performance HighlightsDocument7 pagesIVRCL Infrastructure: Performance Highlightsanudeep05Pas encore d'évaluation

- Vascon Engineers - Kotak PCG PDFDocument7 pagesVascon Engineers - Kotak PCG PDFdarshanmadePas encore d'évaluation

- Peninsula+Land 10-6-08 PLDocument3 pagesPeninsula+Land 10-6-08 PLapi-3862995Pas encore d'évaluation

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21Pas encore d'évaluation

- IVRCL Infrastructure: Performance HighlightsDocument11 pagesIVRCL Infrastructure: Performance HighlightsPratik GanatraPas encore d'évaluation

- Inox RU4QFY2008 110608Document4 pagesInox RU4QFY2008 110608api-3862995Pas encore d'évaluation

- Blue Star: Performance HighlightsDocument8 pagesBlue Star: Performance HighlightskasimimudassarPas encore d'évaluation

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaPas encore d'évaluation

- Tata Motors: Performance HighlightsDocument10 pagesTata Motors: Performance HighlightsandrewpereiraPas encore d'évaluation

- Endurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Document10 pagesEndurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Live NIftyPas encore d'évaluation

- Laurus MoslDocument10 pagesLaurus MoslAlokesh PhukanPas encore d'évaluation

- Exide Industries: Performance HighlightsDocument4 pagesExide Industries: Performance HighlightsMaulik ChhedaPas encore d'évaluation

- Amara Raja Batteries: Performance HighlightsDocument10 pagesAmara Raja Batteries: Performance HighlightssuneshsPas encore d'évaluation

- Tata Steel: Performance HighlightsDocument13 pagesTata Steel: Performance HighlightssunnysmvduPas encore d'évaluation

- Bharat Forge (BHFC IN) : Q4FY21 Result UpdateDocument6 pagesBharat Forge (BHFC IN) : Q4FY21 Result UpdateEquity NestPas encore d'évaluation

- 1 BHEL 13nov23 Kotak InstDocument10 pages1 BHEL 13nov23 Kotak InstRajesh SinghPas encore d'évaluation

- Stock Report On Baja Auto in India Ma 23 2020Document12 pagesStock Report On Baja Auto in India Ma 23 2020PranavPillaiPas encore d'évaluation

- Amara Raja Batteries LTD: 1Q FY11 ResultsDocument5 pagesAmara Raja Batteries LTD: 1Q FY11 ResultsveguruprasadPas encore d'évaluation

- Edel - EQDocument13 pagesEdel - EQarhagarPas encore d'évaluation

- JBM Auto (Q2FY21 Result Update)Document7 pagesJBM Auto (Q2FY21 Result Update)krippuPas encore d'évaluation

- Voltas Aug 19 - 1QFY20 Result - YES SecuritiesDocument5 pagesVoltas Aug 19 - 1QFY20 Result - YES SecuritiesdarshanmadePas encore d'évaluation

- Kirloskar Oil Engines: Performance HighlightsDocument12 pagesKirloskar Oil Engines: Performance Highlightsjetorres1Pas encore d'évaluation

- Iiww 300710Document4 pagesIiww 300710joshichirag77Pas encore d'évaluation

- Tata Elxsi 4qfy19 Result Update19Document6 pagesTata Elxsi 4qfy19 Result Update19Ashutosh GuptaPas encore d'évaluation

- PI IndustriesDocument8 pagesPI IndustriesSarvagya GopalPas encore d'évaluation

- CD Equisearchpvt LTD CD Equisearchpvt LTD: Quarterly HighlightsDocument10 pagesCD Equisearchpvt LTD CD Equisearchpvt LTD: Quarterly HighlightsBhaveek OstwalPas encore d'évaluation

- NRB Bearing ILFSDocument3 pagesNRB Bearing ILFSapi-3775500Pas encore d'évaluation

- Maruti Suzuki India LTD: ResearchDocument5 pagesMaruti Suzuki India LTD: ResearchgreatnavneetPas encore d'évaluation

- Himatsingka Seide - 1QFY20 Result - EdelDocument12 pagesHimatsingka Seide - 1QFY20 Result - EdeldarshanmadePas encore d'évaluation

- Motilal Oswal Financial Services 3Document11 pagesMotilal Oswal Financial Services 3gunesh somayaPas encore d'évaluation

- Dolat Capital - UB - Report - June - 2020Document11 pagesDolat Capital - UB - Report - June - 2020dnwekfnkfnknf skkjdbPas encore d'évaluation

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldePas encore d'évaluation

- LKP Researce - Hero MotoCorp Errclub - Volume Trend To Be Strong, Margins To Move Up But at A Lower PaceDocument4 pagesLKP Researce - Hero MotoCorp Errclub - Volume Trend To Be Strong, Margins To Move Up But at A Lower PaceAbhishek JainPas encore d'évaluation

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315Pas encore d'évaluation

- Vinati Organics LTD: Expansions and New Project To Drive Earnings GrowthDocument6 pagesVinati Organics LTD: Expansions and New Project To Drive Earnings GrowthBhaveek OstwalPas encore d'évaluation

- Tata Steel: Performance HighlightsDocument6 pagesTata Steel: Performance Highlightsmd.iet87Pas encore d'évaluation

- 1 31 2008 (Edelweiss) Page Industries-Result Up - Edw02410Document4 pages1 31 2008 (Edelweiss) Page Industries-Result Up - Edw02410api-3740729Pas encore d'évaluation

- Annual Report of Info Edge by Icici SecurityDocument12 pagesAnnual Report of Info Edge by Icici SecurityGobind yPas encore d'évaluation

- HMCL 20240211 Mosl Ru PG012Document12 pagesHMCL 20240211 Mosl Ru PG012Realm PhangchoPas encore d'évaluation

- Gati 250108Document7 pagesGati 250108api-3836349Pas encore d'évaluation

- Sbkuch 1Document8 pagesSbkuch 1vishalpaul31Pas encore d'évaluation

- Digitally Signed by VIVEK Pritamlal Raizada Date: 2020.05.11 17:25:48 +05'30'Document20 pagesDigitally Signed by VIVEK Pritamlal Raizada Date: 2020.05.11 17:25:48 +05'30'DIPAN BISWASPas encore d'évaluation

- ABG+Shipyard 11-6-08 PLDocument3 pagesABG+Shipyard 11-6-08 PLapi-3862995Pas encore d'évaluation

- KEI Industries Limited: CMP: INR450 TP: INR563 (+25%) BuyDocument7 pagesKEI Industries Limited: CMP: INR450 TP: INR563 (+25%) BuygreyistariPas encore d'évaluation

- Bajaj Hindusthan: Performance HighlightsDocument9 pagesBajaj Hindusthan: Performance HighlightsAshish PokharnaPas encore d'évaluation

- Balrampur Chini 29092010Document2 pagesBalrampur Chini 29092010Prina H DoshiPas encore d'évaluation

- Dalmia BharatDocument10 pagesDalmia BharatRanjan BeheraPas encore d'évaluation

- Airtel AnalysisDocument15 pagesAirtel AnalysisPriyanshi JainPas encore d'évaluation

- BUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisDocument9 pagesBUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisjigarchhatrolaPas encore d'évaluation

- SH Kelkar: All-Round Performance Outlook Remains StrongDocument8 pagesSH Kelkar: All-Round Performance Outlook Remains StrongJehan BhadhaPas encore d'évaluation

- Apollo TyreDocument12 pagesApollo TyrePriyanshu GuptaPas encore d'évaluation

- Sunp 20200206 Mosl Ru PG010Document10 pagesSunp 20200206 Mosl Ru PG010darshanmaldePas encore d'évaluation

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsD'EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsPas encore d'évaluation

- Sinhagad Diwali Edition - Low ResoulationDocument27 pagesSinhagad Diwali Edition - Low Resoulationsoni_rajendraPas encore d'évaluation

- Africa: World Trade Organisation - Geneva 2012Document10 pagesAfrica: World Trade Organisation - Geneva 2012zzdzjhzjdPas encore d'évaluation

- Chapter 62 PDFDocument131 pagesChapter 62 PDFsoni_rajendraPas encore d'évaluation

- JOGS 2017 Show GuideDocument162 pagesJOGS 2017 Show Guidesoni_rajendraPas encore d'évaluation

- Satara Road Edition-CompressedDocument27 pagesSatara Road Edition-Compressedsoni_rajendraPas encore d'évaluation

- Readership Data Bank 29 08 2013Document1 190 pagesReadership Data Bank 29 08 2013anon_981731217Pas encore d'évaluation

- 5897383645list of Growers, Manufacturers, Exporters and TradersDocument826 pages5897383645list of Growers, Manufacturers, Exporters and Traderssoni_rajendraPas encore d'évaluation

- Project of Business Environment On Slept Analysis For A FirmDocument24 pagesProject of Business Environment On Slept Analysis For A Firmsoni_rajendraPas encore d'évaluation

- Wedding & Event PlanningDocument46 pagesWedding & Event Planningsoni_rajendra100% (2)

- Stress MANAGEMENTDocument18 pagesStress MANAGEMENTsoni_rajendraPas encore d'évaluation

- Case Study (QUEUING MODEL)Document21 pagesCase Study (QUEUING MODEL)soni_rajendraPas encore d'évaluation

- Ch04 Politics and LawDocument20 pagesCh04 Politics and Lawsoni_rajendraPas encore d'évaluation

- 04 AcknowledgementsDocument3 pages04 Acknowledgementssoni_rajendraPas encore d'évaluation

- ApplicationDocument10 pagesApplicationsoni_rajendraPas encore d'évaluation

- Systemcalls PDFDocument5 pagesSystemcalls PDFsoni_rajendra100% (1)

- Pharma DirectoryDocument934 pagesPharma Directoryarun23088578% (9)

- Indo Africa Indianparticipants-09Document14 pagesIndo Africa Indianparticipants-09Neelesh ShettyPas encore d'évaluation

- Job Analysis DefinitionDocument1 pageJob Analysis Definitionsoni_rajendraPas encore d'évaluation

- Ril Ar 2015-16Document404 pagesRil Ar 2015-16vipinscms4008Pas encore d'évaluation

- Auction SaleDocument12 pagesAuction Salesoni_rajendraPas encore d'évaluation

- Basel LiveDocument162 pagesBasel Livesoni_rajendraPas encore d'évaluation

- Ch02 CultureDocument30 pagesCh02 Culturesoni_rajendraPas encore d'évaluation

- List of Members of SMPICDocument7 pagesList of Members of SMPICsoni_rajendraPas encore d'évaluation

- Hrpractices of Wipro 130717052505 Phpapp02 PDFDocument42 pagesHrpractices of Wipro 130717052505 Phpapp02 PDFSakshi VermaPas encore d'évaluation

- Exporters DirectoryDocument21 pagesExporters Directorysoni_rajendra0% (1)

- Simulation ReportDocument1 pageSimulation Reportsoni_rajendraPas encore d'évaluation

- Toys ManufacturersDocument40 pagesToys Manufacturerssoni_rajendra0% (1)

- Eyerise Technologies Web Development Services Package HostingDocument33 pagesEyerise Technologies Web Development Services Package Hostingsoni_rajendraPas encore d'évaluation

- Industry DataBase Oct 2012Document254 pagesIndustry DataBase Oct 2012DcStrokerehabPas encore d'évaluation

- Mechanical Power FormulaDocument9 pagesMechanical Power FormulaEzeBorjesPas encore d'évaluation

- Chiba International, IncDocument15 pagesChiba International, IncMiklós SzerdahelyiPas encore d'évaluation

- English Examination 1-Bdsi-XiDocument1 pageEnglish Examination 1-Bdsi-XiHarsuni Winarti100% (1)

- MC0085 MQPDocument20 pagesMC0085 MQPUtpal KantPas encore d'évaluation

- AppendixA LaplaceDocument12 pagesAppendixA LaplaceSunny SunPas encore d'évaluation

- Lab 08: SR Flip Flop FundamentalsDocument6 pagesLab 08: SR Flip Flop Fundamentalsjitu123456789Pas encore d'évaluation

- Case Study StarbucksDocument2 pagesCase Study StarbucksSonal Agarwal100% (2)

- PDF Cambridge Experience Readers American English Starter A Little Trouble in California Sample Chapter PDF CompressDocument11 pagesPDF Cambridge Experience Readers American English Starter A Little Trouble in California Sample Chapter PDF CompressSandra MacchiaPas encore d'évaluation

- UTM Firewalls: AR3050S and AR4050SDocument8 pagesUTM Firewalls: AR3050S and AR4050SChristian Javier Lopez DuranPas encore d'évaluation

- MSC 200Document18 pagesMSC 200Amit KumarPas encore d'évaluation

- 127 Bba-204Document3 pages127 Bba-204Ghanshyam SharmaPas encore d'évaluation

- Faithful Love: Guitar SoloDocument3 pagesFaithful Love: Guitar SoloCarol Goldburg33% (3)

- Transportation Engineering Unit I Part I CTLPDocument60 pagesTransportation Engineering Unit I Part I CTLPMadhu Ane NenuPas encore d'évaluation

- Compressed Air Source BookDocument128 pagesCompressed Air Source Bookgfollert100% (1)

- TMIS07 - Kalam Internship - S7 Tesla MindsDocument3 pagesTMIS07 - Kalam Internship - S7 Tesla MindsDMJ JonesPas encore d'évaluation

- The Latest Open Source Software Available and The Latest Development in IctDocument10 pagesThe Latest Open Source Software Available and The Latest Development in IctShafirahFameiJZPas encore d'évaluation

- Grammar and Oral Language Development (GOLD) : Reported By: Melyn A. Bacolcol Kate Batac Julie Ann OcampoDocument17 pagesGrammar and Oral Language Development (GOLD) : Reported By: Melyn A. Bacolcol Kate Batac Julie Ann Ocampoclara dupitasPas encore d'évaluation

- Finite Element Method For Eigenvalue Problems in ElectromagneticsDocument38 pagesFinite Element Method For Eigenvalue Problems in ElectromagneticsBhargav BikkaniPas encore d'évaluation

- 12 Layer PCB Manufacturing and Stack Up OptionsDocument12 pages12 Layer PCB Manufacturing and Stack Up OptionsjackPas encore d'évaluation

- English ExerciseDocument2 pagesEnglish ExercisePankhuri Agarwal100% (1)

- Rubber DamDocument78 pagesRubber DamDevanshi Sharma100% (1)

- Fuel Injection PDFDocument11 pagesFuel Injection PDFscaniaPas encore d'évaluation

- Stadium and Club Tours - Senior Tour GuideDocument4 pagesStadium and Club Tours - Senior Tour GuidebizmbuuPas encore d'évaluation

- Veris Case StudyDocument2 pagesVeris Case StudyPankaj GargPas encore d'évaluation

- Portfolio Sandwich Game Lesson PlanDocument2 pagesPortfolio Sandwich Game Lesson Planapi-252005239Pas encore d'évaluation

- Yusuf Mahmood CVDocument3 pagesYusuf Mahmood CVapi-527941238Pas encore d'évaluation

- 1.2.2.5 Packet Tracer - Connecting Devices To Build IoTDocument4 pages1.2.2.5 Packet Tracer - Connecting Devices To Build IoTyayasan dharamabharataPas encore d'évaluation