Académique Documents

Professionnel Documents

Culture Documents

LPG Market Outlook

Transféré par

syaefTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LPG Market Outlook

Transféré par

syaefDroits d'auteur :

Formats disponibles

LPG Market Outlook

OCTOBER 2017

Export Snapshot (Million Tons) US export forecast rises due to higher production

Source

Nov 2017

Forecast

Nov 2018

Forecast

outlook

US 2.45 2.74 Poten expects US exports to increase by 2019 US LPG production forecast

5.5 million tonnes between 2017 and 2019 comparison

Middle East 3.26 3.47

due to increases in domestic production 15

Norway 0.39 0.38

that will not be accompanied by growth

Million tonnes

West Africa 0.33 0.34 in domestic demand. The major change 10

Algeria 0.71 0.73 to this month’s forecast is a revision of 5

production in the Marcellus/Utica region

Source: Poten

where the reaction to the start-up of the 0

Mariner East pipeline expansion will be a

step-change in production rather than a

Import Snapshot (Million Tons) gradual increase. September Forecast October Forecast

Source

Nov 2017 Nov 2018 PAGE 3 Source: Poten

Forecast Forecast

China 1.35 1.78 China’s imports to grow more rapidly with

Japan

India

0.87

1.09

0.88

1.06

additional petrochemical start-ups

South Korea 0.75 0.76 Poten has added two, new petrochemical Chinese LPG import forecast

NW Europe 1.00 0.99 units to its China forecast; the addition of 2.5

these units has resulted in an increase in the

Latin America 0.71 0.78

import requirements for the Chinese mar-

Million tonnes

2.0

Med. 1.00 0.99 ket with imports expected to total 25.3 mil-

lion tonnes in 2019, a 40% increase from

Source: Poten 1.5

2017 levels.

1.0

PAGE 4 Jan-17 Jul-17 Jan-18 Jul-18 Jan-19 Jul-19

Imports Annual Average

INSIDE SECTIONS PAGE Source: Poten

Global Summary 2

Japanese import demand to rise in winter due to

US 3 lower inventories

China 4 Japanese LPG inventory

Demand for LPG in Japan has a strong

3.0

Australia 5 seasonal component, and headed into the

winter months, storage numbers appear to 2.5

Million tonnes

Japan 6 be on the lower side of the five year min/

max range, indicating there may be a need 2.0

Southeast Asia 7 for additional cargoes to head to Japan to 1.5

Economics 8 make up this deficit.

1.0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

PAGE 6 5 Year Range 2016 2017 2018

Major Forecast Changes Source: Poten

Category Country Months Change Reason

Production US all +4% Increase in Northeast production outlook

Exports US all +6% Increase in production expectations

Demand China 3/2019 on +3% Added additional petchem units

Exports Australia 10/17 - 7/18 -17% Delay in startup of LNG projects

©2017 Poten & Partners

GLOBAL

LPG MARKET OUTLOOK | AUGUST 2017 SUMMARY

Global Summary Global LPG trade forecast

10.0

Global LPG trade is forecast to continue 9.5

increasing over the next two years, rising by

9.0

nearly 13 million tonnes between 2017 and

2019. The higher export volumes will come

Million tons

8.5

primarily from the US; however, increases 8.0

are expected in the Middle East with other

7.5

nations such as Australia contributing smaller

additions. 7.0

6.5

In September, global exports rose sharply as 6.0

the recovery from Hurricane Harvey pushed Jan-16 Jun-16 Nov-16 Apr-17 Sep-17 Feb-18 Jul-18 Dec-18 May-19 Oct-19

US exports higher than normal for this time Imports Exports

of year. Prior to the storm, total shipments Source: Poten

were expected to be low due to many can-

cellations, especially in the second half of Global export forecast comparison

the month. Exports out of the Middle East, 10.0

however, were lower than in recent months,

9.5

perhaps indicating the start of a trend similar

to last year’s Q3/Q4 where weaker volumes 9.0

were recorded out of the region.

Million tons

8.5

8.0

The global export forecast is similar to last

month’s with only slight changes seen due to 7.5

modifications of timing of start-ups and new 7.0

demand units added. Australia’s increase in 6.5

exports was delayed due to updated timing

6.0

for the start-up of LNG projects. In China,

Jan-16 Jun-16 Nov-16 Apr-17 Sep-17 Feb-18 Jul-18 Dec-18 May-19 Oct-19

additional PDH/BDH units were added to

October Forecast September Forecast

the forecast, increasing demand from petro-

chemicals during 2019. In the US, additional Source: Poten

exports were added as production expecta-

tions for the northeastern US rose. Please see Global LPG imports by country/region

the country-specific sections for additional 100%

details on these changes. 90%

80%

Northeast Asia will remain the largest im- Other

porting region in the world, accounting for 70%

India

Million tons

23% of total global demand for LPG imports. 60%

Europe/Med

In China, there has been little seasonality to 50%

demand with increases in import demand Latin America

40%

occurring regardless of the time of year. In 30%

Other NEA

Japan and Korea, there is more seasonality, Japan

20%

and Poten expects that demand in Japan will

10% China

be 10% higher over the next six months than

in the previous six, peaking in January when 0%

more than 1 million tonnes are forecast to be Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 Jan-19 Jul-19

Source: Poten

imported.

Editor: Kristen Holmquist Sales, Asia Pacific: Ashrafe Hanifar

+1 713-263-3412 | kholmquist@poten.com +65 6221 1413 | ahanifar@poten.com SUPPORT

Telephone: +1 (212) 230-2000

Sales, Americas: Dana Litwiller Sales, Europe, Middle East, Africa: Stephen Park Email: portaladmin@poten.com

+1 713-263-3408 | dgreer@poten.com +44 (20) 3747-4800 | spark@poten.com

2 ©2017 Poten & Partners

LPG MARKET OUTLOOK | AUGUST 2017 US

US exports to increase due to higher production

outlook

2019 US LPG production forecast comparison US LPG export forecast comparison

16 9% 3.4

14 8% 3.2

12 7% 3.0

6% 2.8

Million Tonnes

Million tonnes

10

% Change

5% 2.6

8

4% 2.4

6

3% 2.2

4 2% 2.0

2 1% 1.8

0 0%

1.6

Northeast Oklahoma Permian Eagle Ford Rockies Bakken

Jan-17 May-17 Sep-17 Jan-18 May-18 Sep-18 Jan-19 May-19 Sep-19

September Forecast October Forecast % Change

October 2017 Forecast September 2017 Forecast

Source: Poten Source: EIA/Poten

US propane ratio to WTI US propane days of demand in inventory

0.9 80

0.8 70

60

0.7 Million Tonnes

Ratio to WTI

50

0.6

40

0.5

30

0.4 20

0.3 10

0.2 0

2011 2012 2013 2014 2015 2016 2017 2018 January March May July September November

Forecast Range Propane/WTI Five Year Range 2017 2018 2019

Source: Reuters/Poten Source: Poten

Between 2017 and 2019, total US LPG due to limits on LPG takeaway capacity that region will remain lower than in the

production is forecast to increase by 7.7 ramp up. This bump up in production, rest of the country.

million tonnes to 65.6 million tonnes. combined with a base line increase in over-

Roughly 5.5 million tonnes of this addi- all production, has led to an increase in the Given the aggressive outlook for LPG ex-

tional production is forecast to be exported forecast for the Marcellus/Utica volumes ports, US prices for LPG are forecast to re-

with the balance going into US petro- (shown as “Northeast” in the graph on main high relative to crude oil. The graph

chemicals. Both the total US production the top left) of 1.1 million tonnes in 2019 on the bottom right shows the US propane

outlook and outlook for US exports have or 8% for October’s forecast compared to ratio to crude oil from January 2011

increased primarily due to changes in the September’s. through today with a forecast through the

outlook for the Marcellus/Utica region of end of 2018. Given that overall storage

the US. Given the increase in LPG production, levels and the number of days of demand

total export volumes out of the US have in inventory are expected to remain low,

The expected increase in the production increased as well with total export volumes upward pressure on prices will continue.

is due to a revised view on the impact of out of the US in 2019 forecast to be 1.8

the Mariner East pipeline expansion in the million tonnes higher than previously The only way for prices to come down

northeastern United States. This project shown. This increase is only partly a would be a sustained period of cancel-

will expand the existing pipeline system result of the change in the Northeastern lations out of the US. The export levels

which transports propane production forecast as total production volumes in currently forecast, especially during the

from the Marcellus/Utica area to the coast 2019 have changed for the rest of the US summer months, already include some

for export. The new pipeline is expected to as well. Outside of the Northeast, the cancellations; however, an additional three

start-up in late Q1/early Q2 with the first largest volume increase is in the Permian VLGC cargoes a month would have to be

tenders for LPG exports expected during where approximately a third of the total US cancelled to bring the US storage levels

that period. With the start-up of this pipe- drilling rigs are currently operating. The to a more normal range. Three cargoes a

line, LPG production in the northeastern largest percentage change is in the Bakken; month may not sound like many, but over

US is expected to increase as producers however, the total volume of LPG out of the course of a year it would equal more

that have been holding back production than 2 million tonnes of LPG that does not

3 ©2017 Poten & Partners

LPG MARKET OUTLOOK | AUGUST 2017 CHINA

Chinese demand forecast rises with additional

petrochemical start-ups

Chinese LPG demand forecast LPG demand scenario - additional petrochemical facility

construction

6.0 10%

70 7%

8%

5.5

6% 65 6%

4%

5.0

Million tonnes

5%

2% 60

Million tonnes

% Change

4.5 0% 4%

-2% 55

4.0 3%

-4%

50

-6% 2%

3.5

-8% 45 1%

3.0 -10%

Jan-17 May-17 Sep-17 Jan-18 May-18 Sep-18 Jan-19 May-19 Sep-19 40 0%

September Forecast October Forecast % Change 2017 2018 2019

Base Case High Scenario % Change

Source: Poten Source: Poten

China LPG import forecast Chinese demand growth by source - 2017 vs. 2019

2.6

2.4

Other demand

2.2 37%

Million tonnes

2.0

1.8

1.6

1.4

Petrochemical

1.2 63%

1.0

Jan-17 May-17 Sep-17 Jan-18 May-18 Sep-18 Jan-19 May-19 Sep-19

Imports Annual Average

Source: Poten Source: Poten

There have been two major changes to unclear whether these units will go number or 41% higher. Much of this

the Chinese demand forecast. The first forward; certainly for a unit to start-up demand growth is from increasing pet-

is the delay of the startup of China Soft in 2018, construction must already have rochemical demand, but there is rapid

Packaging’s 660,000 tonne per year PDH begun. However, there is the potential growth in other segments as well. The

unit. The unit is now forecast to start-up for additional demand from the petro- pie graph on the bottom right shows the

in mid-2018 rather than in late-2017/ chemical sector should one or more of source of demand growth in China bro-

early-2018. This unit consumes rough- these units move from planned to start- ken down between petrochemicals and

ly 800,000 tonnes per year of propane up between now and 2019. The graph on other demand, primarily for residential

when operating at full rates. That is why the top right compares the demand for use in cooking and home heating with

the October forecast for demand is lower LPG under the base case scenario com- some commercial applications.

than the September forecast as shown in pared to a scenario where two additional

the graph on the top right. The second PDH units start-up during the forecast There is some downside risk to this fore-

is the addition of a new PDH/BDH unit period, one in late 2018 and one in mid- cast. New and existing petrochemical

expected to start-up in Q3 2019. This 2019. Were these two units to start-up, units (particularly PDH units) will run

unit is expected to consume 600,000 demand for LPG would increase by 3% at lower rates if the economics are not

tonnes per year of propane/butane when in 2019 or 1.7 million metric tonnes. beneficial. In today’s market, integrated

operating at full rates. In 2019, there is All of this additional material would be PDH plants are making positive mar-

another PDH unit expected to start- imported and would equal about 3.5 gins; however, any shifts in the global

up. In addition, the country’s first LPG VLGCs per month of additional imports. polymer market could threaten those

cracker is forecast to start-up late in the Meeting this additional demand is economics. BDH plants are less suscep-

year. This unit could consume as much certainly possible; however, it would put tible to LPG price swings as their end-

as one million tonnes per year of LPG. further strain on an already tight market. use into gasoline tends to consistently

provide positive economics. In addition,

Based on Poten’s research there are In the base case, total exports for 2019 a slowdown in conversion to LPG use in

as many as five PDH units current- are expected to be 25.3 million tonnes, residential and commercial applications

ly “planned” for 2018 and 2019. It is up 7.4 million tonnes from the 2017 would dampen growth in demand.

4 ©2017 Poten & Partners

LPG MARKET OUTLOOK | AUGUST 2017 AUSTRALIA

Australia’s LPG exports to increase in 2018

The new LNG projects starting up in Australia Australia LPG gas plant production forecast

in 2018 will bring with them increased LPG

0.4

exports. Two of the three projects starting

up have associated LPG production with as 0.3

much as 1.6 million tonnes available, primar-

0.3

ily, to the export market. The most recent

Million tonnes

Poten forecast has updated the timing of these 0.2

projects, reflecting the start-up of Ichthys in 0.2

mid-2018 rather than late-2017. The graph

on the top right compares the newest supply 0.1

forecast to the previous one. 0.1

As a result of this change, Australia’s exports 0.0

1/1/2017 7/1/2017 1/1/2018 7/1/2018 1/1/2019 7/1/2019

for 2017 are forecast to be 1.4 million tonnes,

up only 0.2 million tonnes from 2016. In September Forecast October Forecast

2018, on the other hand, exports are forecast Source: Australian Government/Poten

to grow to almost 2.5 million tonnes. Nearly

all of these additional exports will head to Australia annual LPG exports

Northeast Asia, specifically Japan. Growth

will continue in 2019 as the first full year 3.5

of operations for the new units takes place.

3.0

Following 2019, the growth in exports and

domestic production is expected to be ex- 2.5

tremely small. Poten is forecasting an increase

Million tonnes

in exports of less than 1% between 2019 and 2.0

2020.

1.5

In 2017 through September, Australia has sent 1.0

23% of its exports to Japan. Over the past sev-

eral months, additional material has been go- 0.5

ing to China, accounting for 26% of Australia’s

0.0

total exports for 2017. For comparison, in the 2016 2017 2018 2019 2020

first nine months of 2016, 37% of Australia’s

exports went to Japan with 27% going to Source: Australian Government/Poten

China. The total export volume is higher

with 980,000 tonnes exported in the first nine

Australia LPG exports by destination

months of 2017 compared to 880,000 tonnes

during the same period in 2016. Many of 200

the contracts for the new exports are with Other

180

Japanese firms, so the total volume headed

that direction is expected to increase as the 160

Southeast

new projects start up. 140

Thousand tonnes

Asia

120

In addition to exporting LPG from the West Taiwan

100

Coast, Australia imports LPG into its East

80

Coast. VLGCs arrive from destinations South

around the world, including the US. Total 60 Korea

2017 imports are expected to be around 40 Japan

500,000 tonnes, roughly equal to the total in 20

2016. Poten does not expect these import vol- China

0

umes to increase much in the coming years as

Jan-15 Jun-15 Nov-15 Apr-16 Sep-16 Feb-17 Jul-17

growth in domestic LPG markets is sluggish.

Source: Poten/Reuters

5 ©2017 Poten & Partners

LPG MARKET OUTLOOK | AUGUST 2017 JAPAN

Japanese demand for imports to rise in winter due to

lower inventories

Japanese seasonal LPG demand comparison

Japanese demand for LPG has a strong

seasonal component. The top graph com-

9.0

pares the demand for the six months between

October and March to demand from April 8.5

to September, labelled here as winter and 8.0

summer months. There is a strong variation

Million Tonnes

7.5

in demand between these seasons, consistent

across all time periods. In general, demand for 7.0

LPG is 15% higher in the winter months than 6.5

in the summer months. Demand in the sum-

6.0

mer of 2017 was higher than in the summer of

2016, but slightly lower than in 2015 at around 5.5

6.9 million tonnes. Demand for this coming 5.0

winter is expected to be roughly equal to last Summer Winter Summer Winter Summer Winter

year’s at 8.4 million tonnes. 2015 2015/2016 2016 2016/2017 2017 2017/2018

The inventory position going into this winter, Source: METI/Poten

however, is not very strong. The green line in

the middle chart shows estimated storage vol- Japanese LPG inventory

ume in Japan using METI’s reported numbers 2.8

as a baseline. Using these estimates, Japan 2.6

appears to be headed into winter with storage

2.4

on the lower side of average, certainly lower

than the high figures seen in 2016. Given the 2.2

Million tonnes

current expectations for demand and import 2.0

volumes, inventories at the end of the year may 1.8

be lower than normal, toward the low point of

1.6

the five year range.

1.4

Because of this lower storage, Poten is fore- 1.2

casting slightly stronger import volumes this 1.0

winter than last year. There may be room Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

for additional material to head toward Japan, 5 Year Range 2016 2017 2018

especially in January and February when the

Source:METI/ Poten

total volume in storage is expected to be lower

than is typical for that time of year. If addition-

al material moves into Japan, however, it will Japan LPG import forecast

be coming from an already tight global market 1.2

and the price point may be high. That said,

if there is a colder winter than normal, these 1.1

additional tons may be required to balance the

market. 1.0

Million tonnes

In 2019, no major shocks to demand in Japan 0.9

are expected. There is not much room for ad-

ditional growth in the retail segment and pet- 0.8

rochemical demand, at least for now, seems to

be steady. There is room for propane to move 0.7

into steam crackers; however, it is not clear if

those economics are positive given today’s high 0.6

propane price environment. Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18

Source: Poten

6 ©2017 Poten & Partners

SOUTHEAST

LPG MARKET OUTLOOK | AUGUST 2017 ASIA

Southeast Asian demand heats up as economies expand

beyond traditional fuels

Demand in Southeast Asia will contin- Southeast Asia LPG imports

ue growing over the next several years, 1.6

especially in Thailand, Vietnam and the

Philippines. Indonesia is the dominant 1.4

country in the region, taking more than 1.2

4.5 million tonnes of imports in 2017;

Million tonnes

1.0

however, these countries also play an im- Thailand

portant part in the dynamics of the region. 0.8

Philippines

0.6

In Thailand, demand fell by more than Vietnam

40% in 2016 after the removal of subsidies 0.4

from LPG. However, so far in 2017, im-

0.2

port volumes have rebounded slightly, up

for the year by 3%. In the coming years, 0.0

Poten expects demand for LPG to con- 2015 2016 2017 2018 2019

tinue growing at a moderate pace as LPG Source: Poten

use inches higher. In the Philippines and

Vietnam, on the other hand, demand is

expected to grow at a rapid pace, growing Thailand, Vietnam and Philippines import sources, 2017 YTD

by 8% in each country between 2017 and 120%

2019. The demand growth is pushed by

the continued switching from traditional

fuel sources to cleaner LPG.

Iran

80%

Million tonnes

The bulk of LPG into these three countries Saudi Arabia

comes from the Middle East, in particular Indonesia

the UAE which accounts for 14% of the to-

Qatar

tal imports. Other major trading partners 40%

include Qatar, Indonesia (which loads UAE

smaller cargoes), and Saudi Arabia. The Other

import growth in the coming years will be

sourced primarily from Middle Eastern 0%

nations with opportunistic shipments Thailand Vietnam Philippines

from the US and West Africa as econom- Source: Poten

ics dictate. Rarely do any of these nations

take full VLGC cargoes, splitting large Thailand gas plant production

cargoes with China, Japan or Korea in

many cases. 0.36

0.34

Thailand is the only nation of these three

0.32

with a sizeable gas plant production base.

Million tonnes

Poten estimates that gas plant production 0.30

of LPG is about 3.3 million tonnes per 0.28

year; however, this volume has been de- 0.26

creasing and is expected to continue going

down by about 1-2% per year during the 0.24

forecast. This decline will increase the 0.22

need for imports slightly; however, until a 0.20

rigorous subsidy program is reintroduced 1/1/2017 7/1/2017 1/1/2018 7/1/2018 1/1/2019 7/1/2019

in Thailand, demand growth is expected to Production Annual Average

remain slow.

Source: Poten

7 ©2017 Poten & Partners

LPG MARKET OUTLOOK | AUGUST 2017 ECONOMICS

Globally, arbitrage economics are negative for the

next six months

Global arbitrage economics are pretty poor USGC to Asia arb calculations

in today’s market based on swaps and fu-

10

ture freight estimates. The only bright spot

seems to be a positive arbitrage for deals

0

being done in April 2018 via the Panama

Canal; however, the margin for that is slim

-10

and will likely depend on the actual freight

including any Panama Canal premiums

$/ton

-20 PC

priced into the deal. One interesting item

COGH

to note is that based on current market -30

futures, the economics to Asia via the Cape

of Good Hope for March 2018 are better -40

than those via the Panama Canal. This

has to do with the differing delivery times. -50

Shipments made in March 2018 to Asia Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18

via the Cape will arrive in mid-April or

Source: Poten, freights calculated

early May compared to a March arrival for

those via the Canal. As a result, the longer

USGC to Europe arb calculations

route is more attractive. Or in this case it

might be better to say the deals look less 10

unattractive.

5

Arbitrage economics from the USGC to 0

North Europe are negative for all time pe- -5

riods shown. This is consistent with what

-10

$/ton

has been seen for the majority of this year.

According to Poten’s shiptracking models, -15

roughly 650,000 tonnes of LPG have left -20

the USGC headed toward North Europe -25

from January 2017 through October 16.

-30

For comparison, 1.5 million tonnes left for

North Europe during the first ten months -35

of 2016. The difficult economics for the Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18

next six months indicate that those ship-

ments are likely to remain low with little to Source: Poten, freights calculated

no volume leaving each month.

North Europe to Asia arb calculations

Economics from Europe to Asia are also 10

faring poorly as shown in the bottom

5

graph. Shipments from Europe to the East

are not done on a regular basis; however, 0

370,000 tonnes have been shipped so far -5

in 2017 compared to 250,000 tonnes for -10

$/ton

all of 2016. In August, three vessels left

North Europe headed for Northeast Asia -15

one headed for South Korea and two for -20

China. Despite a short period of positive -25

economics in September, no vessels have

-30

left since then.

-35

Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18

Source: Poten, freights calculated

8 ©2017 Poten & Partners

Vous aimerez peut-être aussi

- China Oil Weekly - 2 Nov 2022Document40 pagesChina Oil Weekly - 2 Nov 2022phang.zhaoying.darrenPas encore d'évaluation

- Sour Times: Outlook - 6 Mar 2020Document19 pagesSour Times: Outlook - 6 Mar 2020Franco Camacho CanchariPas encore d'évaluation

- Week31 Market ReportDocument24 pagesWeek31 Market Reportmahdi fathabadiPas encore d'évaluation

- Global Chemicals Outlook 2020 1 PDFDocument99 pagesGlobal Chemicals Outlook 2020 1 PDFRayavarapu LaxmanraoPas encore d'évaluation

- February 26: Reading Tanker Tea LeavesDocument1 pageFebruary 26: Reading Tanker Tea LeavesSandesh GhandatPas encore d'évaluation

- ITMA Bulletin - September 2017Document11 pagesITMA Bulletin - September 2017Dhaval JobanputraPas encore d'évaluation

- Summary and Policy Implications: Eiichi KusanoDocument15 pagesSummary and Policy Implications: Eiichi KusanoaenafaqihPas encore d'évaluation

- Argus China PetroleumDocument32 pagesArgus China PetroleumBhagoo HatheyPas encore d'évaluation

- Nickel Asia Corporation: The University of Santo TomasDocument4 pagesNickel Asia Corporation: The University of Santo TomasMANJIT KAUR SINGHPas encore d'évaluation

- ENMPOOCT19 KuwaitDocument2 pagesENMPOOCT19 KuwaitfdsfdsaPas encore d'évaluation

- JUL 29 DBS Daily Breakfast SpreadDocument8 pagesJUL 29 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- Investor Digest: HighlightDocument14 pagesInvestor Digest: HighlightYua GeorgeusPas encore d'évaluation

- Covestro Q4 2018 IR PresentationDocument34 pagesCovestro Q4 2018 IR PresentationVictor XiangPas encore d'évaluation

- Quarterly July2017Document18 pagesQuarterly July2017Sahludheen N HPas encore d'évaluation

- Pet Chem BuzzDocument2 pagesPet Chem BuzzNirmit DavePas encore d'évaluation

- Deficit Led by Rise in Imports: 14 AUGUST 2020Document3 pagesDeficit Led by Rise in Imports: 14 AUGUST 2020Deepak Saheb GuptaPas encore d'évaluation

- MGSSI Japan Economic Quarterly October 2017Document4 pagesMGSSI Japan Economic Quarterly October 2017Romy Bennouli TambunanPas encore d'évaluation

- Activity at Vaca Muerta Play: June-July 2021Document95 pagesActivity at Vaca Muerta Play: June-July 2021pdasneves1Pas encore d'évaluation

- Fundamental AnalysisDocument5 pagesFundamental AnalysisSudheer JagarlapudiPas encore d'évaluation

- Tata Consultancy Services LTD.: Result UpdateDocument7 pagesTata Consultancy Services LTD.: Result UpdateanjugaduPas encore d'évaluation

- Industrial Production: Low Growth, But Better Than Hoped ForDocument9 pagesIndustrial Production: Low Growth, But Better Than Hoped FornnsriniPas encore d'évaluation

- Recovery For The Paraxylene Industry or Temporary Reprieve?: Chemicals Research & AnalysisDocument9 pagesRecovery For The Paraxylene Industry or Temporary Reprieve?: Chemicals Research & AnalysisJuan Jose SossaPas encore d'évaluation

- Westpack JUN 21 Weekly CommentaryDocument7 pagesWestpack JUN 21 Weekly CommentaryMiir ViirPas encore d'évaluation

- US Industrial MarketBeat Q417Document11 pagesUS Industrial MarketBeat Q417pradoPas encore d'évaluation

- Westpac Weekly Commentary May 31 2010Document10 pagesWestpac Weekly Commentary May 31 2010Miir ViirPas encore d'évaluation

- Real GDPTracking SlidesDocument5 pagesReal GDPTracking SlidesmbidPas encore d'évaluation

- JUN 08 Westpack Weekly CommentaryDocument8 pagesJUN 08 Westpack Weekly CommentaryMiir ViirPas encore d'évaluation

- Natural Gas Information 2019 OverviewDocument8 pagesNatural Gas Information 2019 OverviewAli KhanPas encore d'évaluation

- Qe Co ForecastDocument9 pagesQe Co ForecastJudithRavelloPas encore d'évaluation

- CMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistDocument5 pagesCMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistVikrant SadanaPas encore d'évaluation

- O&G Price Forecast Q4 enDocument28 pagesO&G Price Forecast Q4 enCTV CalgaryPas encore d'évaluation

- Market Report January 2021.01Document4 pagesMarket Report January 2021.01Anonymous 6OPLC9UPas encore d'évaluation

- 2022 - Jll-Q1-2022-Market-Intelligence-Update-Mea-ConstructionDocument5 pages2022 - Jll-Q1-2022-Market-Intelligence-Update-Mea-ConstructionYi JiePas encore d'évaluation

- Asia Petrochemical Outlook: Petrochemicals Special ReportDocument17 pagesAsia Petrochemical Outlook: Petrochemicals Special ReportAndrea ManzoniPas encore d'évaluation

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- Table 1.1: Selected Economic Indicators FY15 FY16 FY17: Growth Rate (Percent)Document7 pagesTable 1.1: Selected Economic Indicators FY15 FY16 FY17: Growth Rate (Percent)FatimaIjazPas encore d'évaluation

- Lithium Research Note: Lithium's Price ParadoxDocument6 pagesLithium Research Note: Lithium's Price ParadoxMildoggPas encore d'évaluation

- Investment Fact Sheet: For The Month of April 2018Document7 pagesInvestment Fact Sheet: For The Month of April 2018MehboobUrRehmanPas encore d'évaluation

- Oil Demand Uncertainties Linger: Economic and Financial AnalysisDocument6 pagesOil Demand Uncertainties Linger: Economic and Financial AnalysisOwm Close CorporationPas encore d'évaluation

- PT Mag Statue of Unity Sep 2018Document23 pagesPT Mag Statue of Unity Sep 2018Yogesh GopalPas encore d'évaluation

- AngelTopPicks October 2020 PDFDocument12 pagesAngelTopPicks October 2020 PDFRony GeorgePas encore d'évaluation

- IndiaDocument11 pagesIndiaMd Riz ZamaPas encore d'évaluation

- Emerging From The Downturn: A New Business Environment For Refining?Document16 pagesEmerging From The Downturn: A New Business Environment For Refining?Lindsey BondPas encore d'évaluation

- Natural Gas Supply-Demand Situation and Prospect in China: SciencedirectDocument10 pagesNatural Gas Supply-Demand Situation and Prospect in China: SciencedirectMuhammad Imran KhanPas encore d'évaluation

- Investor Digest: Equity Research - 18 May 2020Document15 pagesInvestor Digest: Equity Research - 18 May 2020helmy muktiPas encore d'évaluation

- Reserve Bank May 2011 Economic OutlookDocument6 pagesReserve Bank May 2011 Economic Outlookpeter_martin9335Pas encore d'évaluation

- Plantation - Feb 18 - Inventory Declines Mom On Lower CPO ProductionDocument4 pagesPlantation - Feb 18 - Inventory Declines Mom On Lower CPO ProductionRiksan RiksanPas encore d'évaluation

- 1222024tda NamDocument12 pages1222024tda Nambright.sock2093Pas encore d'évaluation

- Natural Gas - India-June 2019Document4 pagesNatural Gas - India-June 2019Ankit JainPas encore d'évaluation

- 2021-04-12 Market OverviewDocument12 pages2021-04-12 Market Overviewadelafuente2012Pas encore d'évaluation

- Director ReportDocument48 pagesDirector ReportAakash DasPas encore d'évaluation

- SugarDocument8 pagesSugar夏哲林Pas encore d'évaluation

- China'S Economy at A Glance: JUNE 2020Document9 pagesChina'S Economy at A Glance: JUNE 2020Minh NguyenPas encore d'évaluation

- Chapter 01Document9 pagesChapter 01Ahmed maljPas encore d'évaluation

- Mozambique: Gas Supplier To The World?Document38 pagesMozambique: Gas Supplier To The World?YouzhnyPas encore d'évaluation

- Soyabean: Supply Demand AnalysisDocument12 pagesSoyabean: Supply Demand AnalysisMudit ChauhanPas encore d'évaluation

- Asia Insights: Indonesia: Q2 GDP Growth Picked Up FurtherDocument6 pagesAsia Insights: Indonesia: Q2 GDP Growth Picked Up FurtherDyah MaharaniPas encore d'évaluation

- IDirect RallisInd CoUpdate Apr17Document4 pagesIDirect RallisInd CoUpdate Apr17saran21Pas encore d'évaluation

- Economic Highlights - Exports Picked Up Strongly in March - 5/5/2010Document4 pagesEconomic Highlights - Exports Picked Up Strongly in March - 5/5/2010Rhb InvestPas encore d'évaluation

- IV. Network Modeling, Simple SystemDocument16 pagesIV. Network Modeling, Simple SystemJaya BayuPas encore d'évaluation

- Table Equivalent Schedule 40 Steel PipeDocument1 pageTable Equivalent Schedule 40 Steel PipeorisPas encore d'évaluation

- Napoleonic WargamingDocument13 pagesNapoleonic WargamingandyPas encore d'évaluation

- 123 09-Printable Menu VORDocument2 pages123 09-Printable Menu VORArmstrong TowerPas encore d'évaluation

- Safe Lorry Loader Crane OperationsDocument4 pagesSafe Lorry Loader Crane Operationsjdmultimodal sdn bhdPas encore d'évaluation

- DISPOSABLE GLOVES CATALOG 2023npDocument4 pagesDISPOSABLE GLOVES CATALOG 2023npTeodylee CruzPas encore d'évaluation

- BC-6000 Installation Guide V7.0 enDocument111 pagesBC-6000 Installation Guide V7.0 enmentule88Pas encore d'évaluation

- Introduction To LCCDocument32 pagesIntroduction To LCCGonzalo LopezPas encore d'évaluation

- SambongDocument3 pagesSambongNica Del GallegoPas encore d'évaluation

- Material Specification - 077154C-000-JSS-1700-009 - DDocument13 pagesMaterial Specification - 077154C-000-JSS-1700-009 - DStructures ProductionPas encore d'évaluation

- JRC JFE-680 Instruct ManualDocument86 pagesJRC JFE-680 Instruct ManualMark Dominic FedericoPas encore d'évaluation

- Flow Chart - QCDocument2 pagesFlow Chart - QCKarthikeyan Shanmugavel100% (1)

- Updated G10 Class Routine Effective From 12 January 2023Document1 pageUpdated G10 Class Routine Effective From 12 January 2023NiloyPas encore d'évaluation

- Training Report On Self Contained Breathing ApparatusDocument4 pagesTraining Report On Self Contained Breathing ApparatusHiren MahetaPas encore d'évaluation

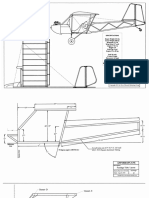

- Plans PDFDocument49 pagesPlans PDFEstevam Gomes de Azevedo85% (34)

- GP1 Q1 Week-1Document18 pagesGP1 Q1 Week-1kickyknacksPas encore d'évaluation

- Halfen Cast-In Channels: HTA-CE 50/30P HTA-CE 40/22PDocument92 pagesHalfen Cast-In Channels: HTA-CE 50/30P HTA-CE 40/22PTulusPas encore d'évaluation

- Technical Information: Range-Free Controller FA-M3 System Upgrade GuideDocument33 pagesTechnical Information: Range-Free Controller FA-M3 System Upgrade GuideAddaPas encore d'évaluation

- Lesson 1 Chapter 9 ErosiondepositionDocument1 pageLesson 1 Chapter 9 Erosiondepositionapi-249320969Pas encore d'évaluation

- Sony Cdm82a 82b Cmt-hpx11d Hcd-hpx11d Mechanical OperationDocument12 pagesSony Cdm82a 82b Cmt-hpx11d Hcd-hpx11d Mechanical OperationDanPas encore d'évaluation

- Eldritch HighDocument39 pagesEldritch Highteam_moPas encore d'évaluation

- Socialized HousingDocument48 pagesSocialized HousingJessieReiVicedoPas encore d'évaluation

- Port Name: Port of BaltimoreDocument17 pagesPort Name: Port of Baltimoremohd1khairul1anuarPas encore d'évaluation

- Process Costing Exercises Series 1Document23 pagesProcess Costing Exercises Series 1sarahbeePas encore d'évaluation

- Tuberculosis PowerpointDocument69 pagesTuberculosis PowerpointCeline Villo100% (1)

- Solutions GoldsteinDocument10 pagesSolutions GoldsteinAnyiPas encore d'évaluation

- Release From Destructive Covenants - D. K. OlukoyaDocument178 pagesRelease From Destructive Covenants - D. K. OlukoyaJemima Manzo100% (1)

- Contemporary Philippine Arts From The Regions: Quarter 2 - Module 9 Different Contemporary Art Techniques and PerformanceDocument25 pagesContemporary Philippine Arts From The Regions: Quarter 2 - Module 9 Different Contemporary Art Techniques and PerformanceGrace06 Labin100% (7)

- CapstoneDocument23 pagesCapstoneA - CAYAGA, Kirby, C 12 - HermonPas encore d'évaluation

- Manual Wire Rope Winches Wall-Mounted Wire Rope Winch SW-W: Equipment and ProcessingDocument1 pageManual Wire Rope Winches Wall-Mounted Wire Rope Winch SW-W: Equipment and Processingdrg gocPas encore d'évaluation