Académique Documents

Professionnel Documents

Culture Documents

Pricing and Performance of IPOs - Evidence From Indian Stock Market

Transféré par

Tarun KatariaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pricing and Performance of IPOs - Evidence From Indian Stock Market

Transféré par

Tarun KatariaDroits d'auteur :

Formats disponibles

Title - Pricing and performance of IPOs: Evidence from Indian stock market

Summary

The paper talks about the IPO underpricing and long-term under-performance of the newly issued

companies relative to the comparable stocks in the market. The study has been done for the Indian

Stock Market. The study consists a 15-year period (from 2001 to 2015). The study treats the Book-Built

and Fixed Price Offers IPOs separately. The sample of 464 IPOs (365 book-built IPOs and 99 fixed-price

IPOs) that went public from the financial year 2001 to 2011 are selected for the study.

The literature review of the paper is broken down into two sections –

1. Listing Day Underpricing – The paper initially talks about two different Information Asymmetry

Theories – Baron’s and Rocks’. Then it discusses the Signaling Model for the underpricing. There is also a

brief about the Herding Theory by Welch. A study has also found that underpricing is negatively related

to the rate of allocation to the uninformed investors, conforming the adverse selection. The paper also

mention the Lawsuit Avoidance Theory of IPO Underpricing. Studies have found that firms with greater

underpricing are associated with weaker future earnings performance, fewer and smaller dividend

initiations, and less frequent trips to the capital market. It has also been found that found that initial

returns (underpricing) are directly related to information production and inversely related to

institutional allocations. A study done for Indian market suggest that the extent of oversubscription

determines the first day gain; signals that lead to oversubscription are market index during the period of

IPO, type and nature of business, foreign collaboration, or the track record of promoters/company.

2. Long Run Performance – The literature review talks about the long-term under-performance of the

firms with newly issue IPOs as compared to the matching firms. Various studies in different countries

have found the results as mentioned above. A study has found that firms which initially had superior

projected growth substantially underperformed indicating that investors appear to believe the inflated

long-term growth projections. A study reported that market-adjusted underperformance of IPOs over

the three-year holding period is less severe for IPOs which are handled by more prestigious

underwriters. It is also found that underperformance primarily is concentrated among small firms with

low book-to-market ratios.

Objectives of the study:

1. To ascertain the listing day performance (underpricing) of IPOs in India.

2. To analyze listing day performance of book-built and fixed-price IPOs, separately.

3. To ascertain post-listing aftermarket performance of IPOs in India.

4. To analyze post-listing aftermarket performance of book-built and fixed-price IPOs, separately.

Hypotheses:

1. The IPOs are not underpriced based on the listing day performance.

2. Investors cannot earn abnormal returns from IPOs in the post-listing period performance.

Methodology

1. Listing Day Underpricing:

Adjusted Initial Day Return – Average AIR –

t-statistic – Standard Error –

2. Long Run Performance:

a) Raw return on security on day t – b) Market returns on day t –

c) Benchmark Adjusted Return for stock i on day t –

d) Average benchmark-adjusted return on a portfolio of n stocks for day t –

e) Cumulative benchmark-adjusted aftermarket performance from day u to day v –

Findings:

The study finds that Indian IPOs are underpriced based on their performance on first trading day. Using

the closing price on the listing day, book-built issues are underpriced by about 21-22% while the fixed-

price issues are underpriced by about 53-54%.

Analysis of three months’ post listing performance of IPOs reveals that soon after listing Indian IPOs

underperform the market. Even beyond three-month post listing, IPOs have consistently

underperformed their benchmark.

Consequently, this leads us to reject the hypothesis—that investors cannot earn abnormal returns in the

long run. Such positive performance of fixed-price issues is, in fact, the reason why the

underperformance for the whole sample is less severe when compared to that of book-built issues in

the long run.

**t-critical = 1.65

Vous aimerez peut-être aussi

- Research MethodologyDocument11 pagesResearch MethodologyBalram SoniPas encore d'évaluation

- On Going CP 1Document27 pagesOn Going CP 1Anonymous eveICfPas encore d'évaluation

- After Market Pricing Performance of Initial PublicDocument18 pagesAfter Market Pricing Performance of Initial PublicAzim BawaPas encore d'évaluation

- LR 10 ReportsDocument10 pagesLR 10 ReportsHari PriyaPas encore d'évaluation

- Long-run IPO performance analysis of UK and German firmsDocument5 pagesLong-run IPO performance analysis of UK and German firmsOm PatelPas encore d'évaluation

- Investment Banks in India & IPO Under Pricing - Case StudyDocument17 pagesInvestment Banks in India & IPO Under Pricing - Case StudyAkshay BhatnagarPas encore d'évaluation

- The Short-And Long-Run Effects of Going Public: Evidence From IPO FirmsDocument18 pagesThe Short-And Long-Run Effects of Going Public: Evidence From IPO FirmsMohit SonyPas encore d'évaluation

- Maarbhar Seshav IpoDocument17 pagesMaarbhar Seshav IpoNoel OommenPas encore d'évaluation

- Vik354 03 ResSahooDocument17 pagesVik354 03 ResSahoosanjeev_mskPas encore d'évaluation

- Trends and Return of Ipo in Indian Market (Capstone Project)Document11 pagesTrends and Return of Ipo in Indian Market (Capstone Project)singhalveenuPas encore d'évaluation

- A S I P O T N S E O I: Tudy of Nitial Ublic Fferings On HE Ational Tock Xchange F NdiaDocument33 pagesA S I P O T N S E O I: Tudy of Nitial Ublic Fferings On HE Ational Tock Xchange F NdiarhtmhrPas encore d'évaluation

- Lead Lag Relationship Between Rating of A Company and Performance of The Company On Investor's WealthDocument6 pagesLead Lag Relationship Between Rating of A Company and Performance of The Company On Investor's WealthMohammadimran ShaikhPas encore d'évaluation

- A Study On Performance of Indian Ipo'S During The FINANCIAL YEAR 2010-2011Document11 pagesA Study On Performance of Indian Ipo'S During The FINANCIAL YEAR 2010-2011guptakingdom90Pas encore d'évaluation

- PHD Thesis AwardDocument2 pagesPHD Thesis Awarduday123Pas encore d'évaluation

- Fundamental Analysis of FMCG Companies. (New)Document67 pagesFundamental Analysis of FMCG Companies. (New)AKKI REDDYPas encore d'évaluation

- A Study On The Performance of Initial Public Sarliya (1) 111Document14 pagesA Study On The Performance of Initial Public Sarliya (1) 111sarliyaPas encore d'évaluation

- IPO Performance and Pricing Factors on Indian Stock ExchangesDocument15 pagesIPO Performance and Pricing Factors on Indian Stock ExchangesSunil KumarPas encore d'évaluation

- Initial Performance of Ipos in India: Evidence From 2010-2014Document10 pagesInitial Performance of Ipos in India: Evidence From 2010-2014AaronPas encore d'évaluation

- Empirical Evidence of Market ReactionDocument20 pagesEmpirical Evidence of Market ReactionBhavdeepsinh JadejaPas encore d'évaluation

- Ipo Performance in IndiaDocument13 pagesIpo Performance in Indiapoket 3337Pas encore d'évaluation

- Value Investing in Thailand Outperforms MarketDocument13 pagesValue Investing in Thailand Outperforms MarketmytheePas encore d'évaluation

- Performance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisD'EverandPerformance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisPas encore d'évaluation

- Blackbook ValuationDocument63 pagesBlackbook Valuationsmit sangoiPas encore d'évaluation

- Security Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Document17 pagesSecurity Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Sukanya ShridharPas encore d'évaluation

- IPO Chinese StyleDocument72 pagesIPO Chinese StyleAriSBPas encore d'évaluation

- Comp Paper 194Document20 pagesComp Paper 194Gourav JenaPas encore d'évaluation

- Economic Analysis of Ipo Underpricing in Stock MarDocument8 pagesEconomic Analysis of Ipo Underpricing in Stock MarRishita RajPas encore d'évaluation

- Simsr International Finance Conference (SIFICODocument8 pagesSimsr International Finance Conference (SIFICOTamalPas encore d'évaluation

- Investor sentiment and its impact on IPO pricing and performanceDocument26 pagesInvestor sentiment and its impact on IPO pricing and performanceFatouma Ahmed IbrahimPas encore d'évaluation

- Capital Market Trading in NewTechnologyDocument47 pagesCapital Market Trading in NewTechnologyArefin RokonPas encore d'évaluation

- Fundamental AnalysisDocument3 pagesFundamental AnalysisAsia AsiaPas encore d'évaluation

- Ipo Underpricing: A Literature ReviewDocument17 pagesIpo Underpricing: A Literature Reviewroshan2310Pas encore d'évaluation

- Evidence On Changes in Stock Returns Around Rights Issue Announcement: Banking Sector AnalysisDocument10 pagesEvidence On Changes in Stock Returns Around Rights Issue Announcement: Banking Sector AnalysisaijbmPas encore d'évaluation

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaPas encore d'évaluation

- IPO Performance AnalysisDocument80 pagesIPO Performance AnalysisSHAIK YASINPas encore d'évaluation

- TWE Kamil Zielinski Long Run Stock Performance of Initial Public OfferingsDocument18 pagesTWE Kamil Zielinski Long Run Stock Performance of Initial Public Offeringsgogayin869Pas encore d'évaluation

- IPO Performance on KSEDocument31 pagesIPO Performance on KSEpoket 3337Pas encore d'évaluation

- Anchor Investors in IPOs PDFDocument45 pagesAnchor Investors in IPOs PDFShesharaPas encore d'évaluation

- Ipo Performance in India: January 2013Document13 pagesIpo Performance in India: January 2013Sai VarunPas encore d'évaluation

- CHAPTER 1 IPO's Performance Including MonthlyDocument107 pagesCHAPTER 1 IPO's Performance Including MonthlySandeep CharanPas encore d'évaluation

- Group AssignmentDocument5 pagesGroup AssignmentHayley LePas encore d'évaluation

- Foreign Direct Investment and Initial Public Offerings: Exploring The Roads Less TravelledDocument10 pagesForeign Direct Investment and Initial Public Offerings: Exploring The Roads Less TravelledmashardyPas encore d'évaluation

- The Impact of Mergers and Acquisitions On Acquirer PerformanceDocument10 pagesThe Impact of Mergers and Acquisitions On Acquirer Performancemadnansajid87650% (1)

- Short Run and Long Run Performance of Indian Initial Public Offerings (Ipos) During 2007-2012Document9 pagesShort Run and Long Run Performance of Indian Initial Public Offerings (Ipos) During 2007-2012Anonymous sHJU8tqkn9Pas encore d'évaluation

- Literature Review On Ipo UnderpricingDocument5 pagesLiterature Review On Ipo Underpricingaflskkcez100% (1)

- Accuracy of Forecast Information Disclosed in The IPO Prospectuses of Hong Kong CompaniesDocument19 pagesAccuracy of Forecast Information Disclosed in The IPO Prospectuses of Hong Kong Companiesgogayin869Pas encore d'évaluation

- SynopsisDocument3 pagesSynopsisVishu R VishwaPas encore d'évaluation

- A Study On The Performance of Ipo'S Listed in Nse, Indian IndexDocument13 pagesA Study On The Performance of Ipo'S Listed in Nse, Indian IndexGamer ArenaPas encore d'évaluation

- Value Investing in ThailandDocument14 pagesValue Investing in ThailandOhm BussarakulPas encore d'évaluation

- Determinants of Under Pricing of IPOs Regarding FDocument13 pagesDeterminants of Under Pricing of IPOs Regarding FReact EmotPas encore d'évaluation

- Is The Market Surprised by Poor Earnings Realizations Following Seasoned Equity Offerings?Document41 pagesIs The Market Surprised by Poor Earnings Realizations Following Seasoned Equity Offerings?cipsfuyPas encore d'évaluation

- Some Insights Into IPO Underpricing in IndiaDocument2 pagesSome Insights Into IPO Underpricing in IndiaSuneesh LazarPas encore d'évaluation

- Stock Split EffectsDocument25 pagesStock Split EffectsRahul PujariPas encore d'évaluation

- Ijirt153776 PaperDocument6 pagesIjirt153776 PaperGaurav KushwahPas encore d'évaluation

- Chapter 5 - The Value Relevance of Accounting Information (Group 3 Presentation)Document19 pagesChapter 5 - The Value Relevance of Accounting Information (Group 3 Presentation)Shintia Cristin Min DalaPas encore d'évaluation

- Fundamental AnalysisDocument6 pagesFundamental Analysisumasahithi91Pas encore d'évaluation

- Objectives: TITLE: Size and Return A Study On Indian Stock Market COMPANY NAME: SharewealthDocument5 pagesObjectives: TITLE: Size and Return A Study On Indian Stock Market COMPANY NAME: Sharewealthanon_578178848Pas encore d'évaluation

- IPO Performance ReviewDocument6 pagesIPO Performance ReviewAditya SinghPas encore d'évaluation

- Vol.2 No.2Document123 pagesVol.2 No.2syeda uzmaPas encore d'évaluation

- Equity Analysis Pharma and It SectorDocument88 pagesEquity Analysis Pharma and It SectorcityPas encore d'évaluation

- Risk Analysis of BOT SchemeDocument6 pagesRisk Analysis of BOT SchemeTarun KatariaPas encore d'évaluation

- P1765 Web PDFDocument108 pagesP1765 Web PDFTarun KatariaPas encore d'évaluation

- Data Year-End Common Stock Price: Ratios SolutionDocument2 pagesData Year-End Common Stock Price: Ratios SolutionTarun KatariaPas encore d'évaluation

- Second Order Constant Coefficient Homogeneous Linear Differential EquationsDocument32 pagesSecond Order Constant Coefficient Homogeneous Linear Differential EquationsTarun KatariaPas encore d'évaluation

- Risk Management Framework for BOT Projects in KuwaitDocument51 pagesRisk Management Framework for BOT Projects in KuwaitTarun KatariaPas encore d'évaluation

- 1,2,3,4Document7 pages1,2,3,4Tarun KatariaPas encore d'évaluation

- Wednesday Thursday Wednesday: Sweet Corn Veg SoupDocument2 pagesWednesday Thursday Wednesday: Sweet Corn Veg SoupTarun KatariaPas encore d'évaluation

- Lec 4 Second Order Linear Differential EquationsDocument51 pagesLec 4 Second Order Linear Differential EquationsTarun KatariaPas encore d'évaluation

- MicroDocument3 pagesMicroTarun KatariaPas encore d'évaluation

- 6,7,8Document3 pages6,7,8Tarun KatariaPas encore d'évaluation

- Spring 2014 Exam 2: Uncovered Topics in Practice TestsDocument1 pageSpring 2014 Exam 2: Uncovered Topics in Practice TestsBashar Abu HijlehPas encore d'évaluation

- ST RD TH TH TH TH TH TH TH TH TH TH TH TH TH THDocument2 pagesST RD TH TH TH TH TH TH TH TH TH TH TH TH TH THTarun KatariaPas encore d'évaluation

- New Doc 2017-04-14Document26 pagesNew Doc 2017-04-14Tarun KatariaPas encore d'évaluation

- Summer Internship-Organizational Study at Ashok Leyland, ChennaiDocument71 pagesSummer Internship-Organizational Study at Ashok Leyland, ChennaiNaganathan Ganapathy93% (42)

- Pava NotesDocument26 pagesPava NotesTarun KatariaPas encore d'évaluation

- 3.preparatory Steps For Report WritingDocument31 pages3.preparatory Steps For Report WritingTarun KatariaPas encore d'évaluation

- Invoice #100 for Project or Service DescriptionDocument1 pageInvoice #100 for Project or Service DescriptionsonetPas encore d'évaluation

- Breaking The Time Barrier PDFDocument70 pagesBreaking The Time Barrier PDFCalypso LearnerPas encore d'évaluation

- Fertilizer - Urea Offtake Update - AHLDocument3 pagesFertilizer - Urea Offtake Update - AHLmuddasir1980Pas encore d'évaluation

- A Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeDocument143 pagesA Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeRathod JayeshPas encore d'évaluation

- FP&A Interview Q TechnicalDocument17 pagesFP&A Interview Q Technicalsonu malikPas encore d'évaluation

- Technopreneurship in Small Medium EnterprisegrouptwoDocument50 pagesTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraPas encore d'évaluation

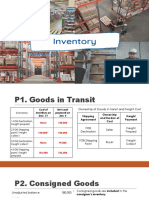

- 8 Inventory ManagementDocument19 pages8 Inventory ManagementMohammad DwidarPas encore d'évaluation

- MCQ Banking, Finance and Economy TestDocument7 pagesMCQ Banking, Finance and Economy Testarun xornorPas encore d'évaluation

- FAR NotesDocument11 pagesFAR NotesJhem Montoya OlendanPas encore d'évaluation

- Case-Digest-28 Inchausti Vs YuloDocument8 pagesCase-Digest-28 Inchausti Vs YuloAiemiel ZyrranePas encore d'évaluation

- Low Cost Housing Options for Bhutanese RefugeesDocument21 pagesLow Cost Housing Options for Bhutanese RefugeesBala ChandarPas encore d'évaluation

- Free Accounting Firm Business PlanDocument1 pageFree Accounting Firm Business PlansolomonPas encore d'évaluation

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Document15 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Kyrie IrvingPas encore d'évaluation

- Policy On Emergency LoanDocument3 pagesPolicy On Emergency LoanLancemachang EugenioPas encore d'évaluation

- Corporate Finance Problem Set 5Document2 pagesCorporate Finance Problem Set 5MAPas encore d'évaluation

- Finance ProblemsDocument5 pagesFinance Problemsstannis69420Pas encore d'évaluation

- Debit Note PDFDocument3 pagesDebit Note PDFMani ShuklaPas encore d'évaluation

- Travis Kalanick and UberDocument3 pagesTravis Kalanick and UberHarsh GadhiyaPas encore d'évaluation

- BPI's Opposition to Sarabia Manor's Rehabilitation PlanDocument2 pagesBPI's Opposition to Sarabia Manor's Rehabilitation PlanJean Mary AutoPas encore d'évaluation

- Blank - Nota SiasatanDocument41 pagesBlank - Nota SiasatanprinceofkedahPas encore d'évaluation

- Patrick Morgan: HighlightsDocument1 pagePatrick Morgan: HighlightsGhazni ProvincePas encore d'évaluation

- Palepu - Chapter 5Document33 pagesPalepu - Chapter 5Dương Quốc TuấnPas encore d'évaluation

- Online Transfer Claim FormDocument2 pagesOnline Transfer Claim FormSudhakar JannaPas encore d'évaluation

- FBL Annual Report 2019Document130 pagesFBL Annual Report 2019Fuaad DodooPas encore d'évaluation

- Upkar Dhawan Fy 2016-17Document3 pagesUpkar Dhawan Fy 2016-17amit22505Pas encore d'évaluation

- DataQuick® Signed Purchase Agreement To Acquire Wells Fargo's ATI Title Companies, Dba Rels Title (Wells Fargo's Entity Oversight FFIEC - GOV and ATI and RELS TITLE SERVICES LLCDocument12 pagesDataQuick® Signed Purchase Agreement To Acquire Wells Fargo's ATI Title Companies, Dba Rels Title (Wells Fargo's Entity Oversight FFIEC - GOV and ATI and RELS TITLE SERVICES LLCMaryEllenCochranePas encore d'évaluation

- 2011HB 06651 R00 HBDocument350 pages2011HB 06651 R00 HBPatricia DillonPas encore d'évaluation

- BCOMQPOCT18Document383 pagesBCOMQPOCT18SHRIKANT C. DUDHALPas encore d'évaluation

- Vajiram & Ravi Civil Services Exam Details for Sept 2022-23Document3 pagesVajiram & Ravi Civil Services Exam Details for Sept 2022-23Appu MansaPas encore d'évaluation

- SS 2 SlidesDocument31 pagesSS 2 SlidesDart BanePas encore d'évaluation