Académique Documents

Professionnel Documents

Culture Documents

DT 0108 Annual Paye Deductions Return Form v1 2

Transféré par

Kwasi DankwaDescription originale:

Copyright

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

DT 0108 Annual Paye Deductions Return Form v1 2

Transféré par

Kwasi DankwaDroits d'auteur :

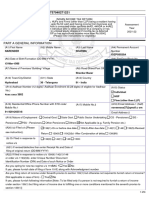

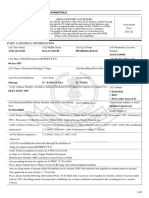

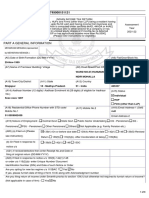

GHANA REVENUE AUTHORITY

DOMESTIC TAX REVENUE DIVISION

ANNUAL P.A.Y.E DEDUCTIONS RETURN

CURRENCY IN GHS

LTO MTO STO

CURRENT TAX OFFICE

(Tick One) Name of GRA Tax Office

FOR THE YEAR END

(yyyy)

NAME

TIN

(Please refer to the completion notes overleaf for guidance in completing this form)

If Return for the year is “NIL” tick HERE 1 then proceed to the DECLARATION

NUMBER OF TOTAL CASH

CATEGORY OF STAFF STAFF EMOLUMENT TAX DEDUCTED

EXPATRIATE /

MANAGEMENT

OTHERS (Senior, Junior

and Casual staff)

TOTAL

ATTACH THE FOLLOWING

EMPLOYEES’ ANNUAL SCHEDULES OF TAX DEDUCTION (DT 0108a)

ANNUAL EMPLOYEES’ INFORMATION SCHEDULE (DT 0108b)

STAFF MOVEMENT/POSITION

No. of Staff at the No. of Newly ENGAGED No. of DISENGAGED No. of staff at the

start of the Year Employees during the Year employees during the Year end of Year

DECLARATION:

I, ___________________________________________ hereby declare that the information provided above

Name is true and correct.

Position Signature Date

Internal Use Only

Vetted By

DT 0108 ver 1.2

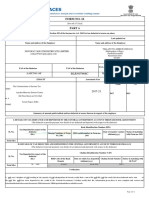

ANNUAL P.A.Y.E. DEDUCTIONS RETURN

COMPLETION NOTES

Please read the following notes carefully before completing the returns

If you need further clarification or assistance in completing this Return please contact your nearest Domestic Tax

Revenue Division Office, The Return should be completely filled. All boxes / columns should be completed, where

a response is not applicable enter n/a for text or zero (0) for value or number.

NOTE: Only one Return can be submitted per Employer.

This return is a summary of PAYE deductions for all categories of Employees rather than individual

employees within an employment set up. Fields to be completed are:

(1) Current Tax Office: Name of GRA Tax office assigned to Taxpayer

(2) Year: This is the calendar year in respect of which the return is being made.

(3) Name: This is the name of the Employer

(4) TIN: This is the eleven (11) character Taxpayer Identification Number of Employer

(5) Summary of PAYE Returns

(A) Category of Staff: This is made up of

(i) Expatriate / Management staff

(ii) Others (Senior, Junior and Casual staff)

(B) Number of Staff: This is the number of staff for each of the above Categories

(C) Total Cash Emolument: This is the sum of the basic salary and all cash allowances paid to the

employee for each of the above Categories

(D) Tax deducted: This is the total tax deducted for each of the above Categories

(E) Total: This is the sums of the number of staff, total cash emoluments and tax deducted respectively.

(6) Staff Movement/ POSITION: This section is an analysis of staff movements and is made up of :

(A) Number of staff from the beginning of the year

(B) Number of Staff engaged during the year

(C) Number of staff that left employment within during the year

(D) Number of staff remaining at the end of the year (A + B – C)

(7) Declaration: This section is to be completed by a responsible officer or Taxpayer (Sole Proprietorship)

showing Name, Designation / Position, Signature and Date

DT 0108 ver 1.2

Vous aimerez peut-être aussi

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesD'EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesPas encore d'évaluation

- DT 0107 Monthly Paye Deductions Return Form v1 2 PDFDocument2 pagesDT 0107 Monthly Paye Deductions Return Form v1 2 PDFpapapetroPas encore d'évaluation

- Ghana Revenue Authority: Company Self-Assessment FormDocument2 pagesGhana Revenue Authority: Company Self-Assessment FormDavid BiahPas encore d'évaluation

- Ghana Revenue Authority: Company Self-Assessment FormDocument2 pagesGhana Revenue Authority: Company Self-Assessment Formokatakyie1990Pas encore d'évaluation

- Ghana Revenue Authority: Company Self Assessment FormDocument2 pagesGhana Revenue Authority: Company Self Assessment Formokatakyie1990Pas encore d'évaluation

- GETFund NHIL VERSION 218AUG 2018Document2 pagesGETFund NHIL VERSION 218AUG 2018joseph borketeyPas encore d'évaluation

- DT 0108a Employer Annual Tax Deduction Schedule v1 2Document1 pageDT 0108a Employer Annual Tax Deduction Schedule v1 2joseph borketeyPas encore d'évaluation

- New Itr Forms NotifiedDocument2 pagesNew Itr Forms NotifiedmahenderreddybPas encore d'évaluation

- WHVAT ReturnDocument6 pagesWHVAT ReturnbatuchemPas encore d'évaluation

- TaxAdministration - PHP 2Document2 pagesTaxAdministration - PHP 2Marcia BlessPas encore d'évaluation

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraPas encore d'évaluation

- Ghana Revenue Authority: Monthly Vat & Nhil Flat Rate ReturnDocument2 pagesGhana Revenue Authority: Monthly Vat & Nhil Flat Rate Returnokatakyie1990Pas encore d'évaluation

- All in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Document24 pagesAll in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Pranab BanerjeePas encore d'évaluation

- DT 0107a Employer Monthly Tax Deductions Schedule v1 2Document2 pagesDT 0107a Employer Monthly Tax Deductions Schedule v1 2Gael OrtizPas encore d'évaluation

- Form 16Document3 pagesForm 16Bijay TiwariPas encore d'évaluation

- PAYE Return SampleDocument42 pagesPAYE Return Sampleoyesigye DennisPas encore d'évaluation

- 1701 January 2018 Consov4Document2 pages1701 January 2018 Consov4Donabelle MarimonPas encore d'évaluation

- Federal Democratic Republic of Ethiopia Ethiopian Revenue and Customs AuthorityDocument1 pageFederal Democratic Republic of Ethiopia Ethiopian Revenue and Customs Authorityashe100% (1)

- Dol 4 NDocument3 pagesDol 4 Njobs1526Pas encore d'évaluation

- US Internal Revenue Service: F940ez - 1994Document4 pagesUS Internal Revenue Service: F940ez - 1994IRSPas encore d'évaluation

- US Internal Revenue Service: f940 - 2003Document2 pagesUS Internal Revenue Service: f940 - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSPas encore d'évaluation

- PAYE ReturnDocument164 pagesPAYE Returnmulabbi brianPas encore d'évaluation

- Private Org. Pension Form AyanyuDocument3 pagesPrivate Org. Pension Form Ayanyugirma1299Pas encore d'évaluation

- US Internal Revenue Service: F940ez - 1997Document4 pagesUS Internal Revenue Service: F940ez - 1997IRSPas encore d'évaluation

- Form PDF 465757040271221Document8 pagesForm PDF 465757040271221cfaprep040Pas encore d'évaluation

- 1604 CFDocument6 pages1604 CFromarcambriPas encore d'évaluation

- SRA Tax Return GuideDocument8 pagesSRA Tax Return Guidechopp7510Pas encore d'évaluation

- Form PDF 345858330310722Document10 pagesForm PDF 345858330310722narasimhahanPas encore d'évaluation

- ComputationDocument10 pagesComputationRaghav SharmaPas encore d'évaluation

- US Internal Revenue Service: F940ez - 1992Document4 pagesUS Internal Revenue Service: F940ez - 1992IRSPas encore d'évaluation

- MIRA 303 BPT Interim Payment (English) FillableDocument2 pagesMIRA 303 BPT Interim Payment (English) FillableEman MahrynPas encore d'évaluation

- FCT IRS Form H1 Organization Name PeriodDocument1 pageFCT IRS Form H1 Organization Name PeriodNwogboji EmmanuelPas encore d'évaluation

- Form PDF 494190400281221Document8 pagesForm PDF 494190400281221Suprava MishraPas encore d'évaluation

- US Internal Revenue Service: F940ez - 1991Document4 pagesUS Internal Revenue Service: F940ez - 1991IRSPas encore d'évaluation

- (Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearDocument5 pages(Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearRoui Jean VillarPas encore d'évaluation

- US Internal Revenue Service: f940 - 2001Document2 pagesUS Internal Revenue Service: f940 - 2001IRSPas encore d'évaluation

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvPas encore d'évaluation

- Part B PDFDocument6 pagesPart B PDFRJS612Pas encore d'évaluation

- 1604e 2018Document2 pages1604e 2018FedsPas encore d'évaluation

- File GSTR-9: Getting Details For Annual ReturnsDocument30 pagesFile GSTR-9: Getting Details For Annual ReturnsHarendra KumarPas encore d'évaluation

- Form PDF 344472690310722Document11 pagesForm PDF 344472690310722NandhakumarPas encore d'évaluation

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaPas encore d'évaluation

- Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 pageMonthly Remittance Return: of Income Taxes Withheld On CompensationSafferon SaffronPas encore d'évaluation

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahPas encore d'évaluation

- Umesh C-Form16 - 2020-21Document10 pagesUmesh C-Form16 - 2020-21Umesh CPas encore d'évaluation

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilPas encore d'évaluation

- 1701 Attachment Jan 2018 ENCSv3Document2 pages1701 Attachment Jan 2018 ENCSv3Clark de GuzmanPas encore d'évaluation

- 2017-2018 Associations Income Tax Return With Instructions - EnglishDocument18 pages2017-2018 Associations Income Tax Return With Instructions - EnglishAung Aung OoPas encore d'évaluation

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainPas encore d'évaluation

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilPas encore d'évaluation

- IT 2 Return2010witoutFormulas (Draft)Document7 pagesIT 2 Return2010witoutFormulas (Draft)abdakbarPas encore d'évaluation

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongrePas encore d'évaluation

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaPas encore d'évaluation

- Form PDF 592155080270921Document8 pagesForm PDF 592155080270921AnilKumarPas encore d'évaluation

- 433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)Document4 pages433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)douglas jonesPas encore d'évaluation

- Form PDF 831749000151121Document8 pagesForm PDF 831749000151121Steve BurnsPas encore d'évaluation

- 1604-CFDocument8 pages1604-CFmamasita25Pas encore d'évaluation

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuPas encore d'évaluation

- Manpower Key InformationDocument2 pagesManpower Key InformationAhmed OUADAHIPas encore d'évaluation

- Processing A Bas: Using Your MYOB SoftwareDocument24 pagesProcessing A Bas: Using Your MYOB SoftwaresharankchahalPas encore d'évaluation

- Shipping Industry Almanac 2012 - Final PDFDocument516 pagesShipping Industry Almanac 2012 - Final PDFEmmanuelMichePas encore d'évaluation

- What Is A ABNDocument2 pagesWhat Is A ABNdelobdPas encore d'évaluation

- Egypt - Taxation of International Executives - KPMG GlobalDocument29 pagesEgypt - Taxation of International Executives - KPMG GlobalKhalil El AssaadPas encore d'évaluation

- Uk PayslipDocument3 pagesUk Paysliphari haranPas encore d'évaluation

- Eon & Son Iso 9001-2015 QMS Implementation Status Summary As at 30.06.2021Document7 pagesEon & Son Iso 9001-2015 QMS Implementation Status Summary As at 30.06.2021john rukorioPas encore d'évaluation

- TPR Guidelines 1.2 EDocument13 pagesTPR Guidelines 1.2 EhvalolaPas encore d'évaluation

- Form P50 Income Tax PDFDocument2 pagesForm P50 Income Tax PDFemesjotPas encore d'évaluation

- Employee Handbook For LMSDocument40 pagesEmployee Handbook For LMSmitchtanz0% (1)

- School Audit Focus ChecklistDocument18 pagesSchool Audit Focus ChecklistKesavan Thiviya100% (2)

- Profession Tax Technician MembershipDocument4 pagesProfession Tax Technician MembershipAnonymous l62lIqPas encore d'évaluation

- Nigeria: Economy ProfileDocument104 pagesNigeria: Economy ProfileNitin KeshavPas encore d'évaluation

- Gertificate: P60-s6g of YearDocument3 pagesGertificate: P60-s6g of Year13KARATPas encore d'évaluation

- Step 1 Step 2: Notice of AssessmentDocument1 pageStep 1 Step 2: Notice of Assessmentabinash manandharPas encore d'évaluation

- Tra Past ReportDocument27 pagesTra Past ReportZamda Haroun100% (1)

- Loading AU Calculation Cards Using HCM Data LoaderDocument45 pagesLoading AU Calculation Cards Using HCM Data Loadersachanpreeti100% (1)

- Icpau Tax Proposals For Fy 2023-24 BudgetDocument12 pagesIcpau Tax Proposals For Fy 2023-24 BudgetByamukama RobertPas encore d'évaluation

- Tax Tables For Charge Year 2021.Document405 pagesTax Tables For Charge Year 2021.EwanPas encore d'évaluation

- Personal Income Tax in NigeriaDocument118 pagesPersonal Income Tax in NigeriaOsho Olumide100% (8)

- Taxau316 CSGDocument732 pagesTaxau316 CSGBb 8Pas encore d'évaluation

- BSBFIM601 Manage Finances: ASSESSMENT 1 - Written QuestionsDocument41 pagesBSBFIM601 Manage Finances: ASSESSMENT 1 - Written QuestionsPriyanka Aggarwal75% (4)

- PWC Ghana Tax Facts and FiguresDocument38 pagesPWC Ghana Tax Facts and FiguresAsare KenaPas encore d'évaluation

- F6mwi 2008 Dec ADocument12 pagesF6mwi 2008 Dec AangaPas encore d'évaluation

- Mock f6 Dec19Document11 pagesMock f6 Dec19Abdul Waheed100% (1)

- Exam Reports TX UK AccADocument7 pagesExam Reports TX UK AccAAk FazilPas encore d'évaluation

- CURRENT Cancellation Form (JOINED AFTER 1 JULY 17)Document2 pagesCURRENT Cancellation Form (JOINED AFTER 1 JULY 17)Y PakPas encore d'évaluation

- 2-3mwi 2004 Dec ADocument13 pages2-3mwi 2004 Dec Aanga100% (1)

- ch09 SM Carlon 5eDocument41 pagesch09 SM Carlon 5eKyle100% (1)