Académique Documents

Professionnel Documents

Culture Documents

Matrix Stores Inc. Is Considering Leasing A Building and Buying The Necessary Equipment To Operate A Public Warehouse

Transféré par

Kailash KumarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Matrix Stores Inc. Is Considering Leasing A Building and Buying The Necessary Equipment To Operate A Public Warehouse

Transféré par

Kailash KumarDroits d'auteur :

Formats disponibles

Invest us treasury 151600

rate 6%

cost 151600

life 16

residual value 17400

yearly costs 56500

revenue

1-7 74600 8

8-14 70400 8

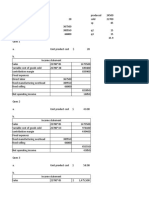

Ques 1

Proposal to Operate Warehouse

1-Jul-18

Differential revenue from alternatives:

Revenue from operating warehouse 1160000 (74600*8+70400*8)

Revenue from investment in bonds 145536 (151600*6%*16)

Differential revenue from operating warehouse 1014464

Differential cost of alternatives:

Costs to operate warehouse 904000 (56500*16)

Cost of equipment less residual value 134200 (151600-17400)

Differential cost of operating warehouse 1038200

Differential income from operating warehouse -23736

Ques 2

reject the case since differential income is negative

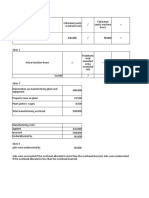

Ques 3

Total estimated revenue from operating warehouse 1160000

Total estimated expenses to operate warehouse:

Costs to operate warehouse, excluding depreciation 904000

Cost of equipment less residual value 134200 1038200

Total estimated income from operating warehouse 121800

Or you could also calculate It by

Investment income forgone 145536

Add:Income from operating warehouse -23736

Total estimated income from operating warehouse 121800

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Fernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Document3 pagesFernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Kailash KumarPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Silven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsDocument5 pagesSilven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsKailash KumarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- (Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Document4 pages(Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Kailash KumarPas encore d'évaluation

- Is A Construction Company Specializing in Custom PatiosDocument8 pagesIs A Construction Company Specializing in Custom PatiosKailash KumarPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Thompson Industrial Products Inc Is A DiversifiedDocument4 pagesThompson Industrial Products Inc Is A DiversifiedKailash KumarPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Jennys FroyoDocument16 pagesJennys FroyoKailash Kumar100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Prince Corporation Acquired 100 Percent of Sword CompanyDocument2 pagesPrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Pastore Drycleaners Has Capacity To Clean UpDocument4 pagesPastore Drycleaners Has Capacity To Clean UpKailash KumarPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocument17 pagesOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Paragraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Document2 pagesParagraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Kailash KumarPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- O-Level Accounting Paper 2 Topical and yDocument343 pagesO-Level Accounting Paper 2 Topical and yKailash Kumar100% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument2 pagesCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Bracey Company Manufactures and Sells One ProductDocument2 pagesBracey Company Manufactures and Sells One ProductKailash KumarPas encore d'évaluation

- La Femme Accessories Inc Produces Womens HandbagsDocument1 pageLa Femme Accessories Inc Produces Womens HandbagsKailash KumarPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Diamond Hardware Uses The Periodic Inventory SystemDocument7 pagesDiamond Hardware Uses The Periodic Inventory SystemKailash KumarPas encore d'évaluation

- Tristar Production Company Began Operations On SeptemberDocument2 pagesTristar Production Company Began Operations On SeptemberKailash KumarPas encore d'évaluation

- Kristen Lu Purchased A Used Automobile ForDocument1 pageKristen Lu Purchased A Used Automobile ForKailash KumarPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowDocument4 pagesThe Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowKailash KumarPas encore d'évaluation

- Bethany's Bicycle CorporationDocument15 pagesBethany's Bicycle CorporationKailash Kumar100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Smith Foundry in Colomus Ohio Uses A PredeterminedDocument2 pagesSmith Foundry in Colomus Ohio Uses A PredeterminedKailash KumarPas encore d'évaluation

- James Kimberley President of National Motors Receives A BonusDocument1 pageJames Kimberley President of National Motors Receives A BonusKailash KumarPas encore d'évaluation

- 2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderDocument2 pages2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderKailash KumarPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)