Académique Documents

Professionnel Documents

Culture Documents

Medicard Philippines Vs CIR Facts: MEDICARD Is A Health Maintenance Organization (HMO) That Provides

Transféré par

JesstonieCastañaresDamayo100%(1)100% ont trouvé ce document utile (1 vote)

260 vues4 pagesDigest

Titre original

Medicard vs CIR

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDigest

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

260 vues4 pagesMedicard Philippines Vs CIR Facts: MEDICARD Is A Health Maintenance Organization (HMO) That Provides

Transféré par

JesstonieCastañaresDamayoDigest

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

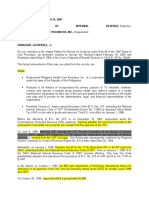

Medicard Philippines vs CIR

Facts: MEDICARD is a Health Maintenance Organization (HMO) that provides

prepaid health and medical insurance coverage to its clients. Individuals enrolled in

its health care programs pay an annual membership fee and are entitled to various

preventive, diagnostic and curative medical services provided by duly licensed

physicians, specialists and other professional technical staff participating in the

group practice health delivery system at a hospital or clinic owned, operated or

accredited by it. CIR issued a Preliminary Assessment Notice (PAN) and eventually

a Final Assessment Notice against MEDICARD for deficiency VAT.

According to the CIR, the taxable base of HMOs for VAT purposes is its gross

receipts without any deduction under Section 4.108.3(k) of Revenue Regulation

(RR) No. 16-2005. It stated that MEDICARD. does not actually provide medical

and/or hospital services, but merely arranges for the same, its services are not VAT

exempt.

The CTA Division held that: (1) the determination of deficiency VAT is not limited

to the issuance of Letter of Authority (LOA) alone as the CIR is granted vast powers

to perform examination and assessment functions; (2) in lieu of an LOA, an LN was

issued to MEDICARD informing it· of the discrepancies between its ITRs and VAT

Returns and this procedure is authorized under Revenue Memorandum Order

(RMO) No. 30-2003 and 42-2003; (3) MEDICARD is estopped from questioning

the validity of the assessment on the ground of lack of LOA since the assessment

issued against MEDICARD contained the requisite legal and factual bases that put

MEDICARD on notice of the deficiencies and it in fact availed of the remedies

provided by law without questioning the nullity of the assessment; (4) the amounts

that MEDICARD earmarked , and eventually paid to doctors, hospitals and clinics

cannot be excluded from · the computation of its gross receipts under the provisions

of RR No. 4-2007 because the act of earmarking or allocation is by itself an act of

ownership and management over the funds by MEDICARD which is beyond the

contemplation of RR No. 4-2007; (5) MEDICARD's earnings from its clinics and

laboratory facilities cannot be excluded from its gross receipts because the operation

of these clinics and laboratory is merely an incident to MEDICARD's main line of

business as HMO and there is no evidence that MEDICARD segregated the amounts

pertaining to this at the time it received the premium from its members; and (6)

MEDICARD was not able to substantiate the amount pertaining to its January 2006

income and therefore has no basis to impose a 10% VAT rate

Issue/s: 1. Whether or not the absence of the LOA is fatal; and

2. Whether the amounts that medicard earmarked and eventually paid to the medical

service providers should still form part of its gross receipts for vat purposes.

Ruling: 1.Yes, the absence of the LOA is fatal.

An LOA is the authority given to the appropriate revenue officer assigned to perform

assessment functions. It empowers or enables said revenue officer to examine the

books of account and other accounting records of a taxpayer for the purpose of

collecting the correct amount of tax. An LOA is premised on the fact that the

examination of a taxpayer who has already filed his tax returns is a power that

statutorily belongs only to the CIR himself or his duly authorized representatives

which is found in Section 6 of the NIRC. Hence, unless undertaken by the CIR

himself or his duly authorized representatives, other tax agents may not validly

conduct any of these kinds of examinations without prior authority.

The following differences between an LOA and LN are crucial. First, an LOA

addressed to a revenue officer is specifically required under the NIRC before an

examination of a taxpayer may be had while an LN is not found in the NIRC and is

only for the purpose of notifying the taxpayer that a discrepancy is found based on

the BIR's RELIEF System. Second, an LOA is valid only for 30 days from date of

issue while an LN has no such limitation. Third, an LOA gives the revenue officer

only a period of 10days from receipt of LOA to conduct his examination of the

taxpayer whereas an LN does not contain such a limitation. Simply put, LN is

entirely different and serves a different purpose than an LOA. Due process demands,

as recognized under RMO No. 32-2005, that after an LN has serve its purpose, the

revenue officer should have properly secured an LOA before proceeding with the

further examination and assessment of the petitioner. Unfortunarely, this was not

done in this case.

2. No, the amounts earmarked and eventually paid by MEDICARD to the medical

service providers do not form part of gross receipts for VAT purposes.

MEDICARD argues that the CTA en banc seriously erred in affirming the ruling of

the CT A Division that the gross receipts of an HMO for VAT purposes shall be the

total amount of money or its equivalent actually received from members

undiminished by any amount paid or payable to the owners/operators of hospitals,

clinics and medical and dental practitioners. MEDICARD explains that its business

as an HMO involves two different although interrelated contracts. One is between a

corporate client and MEDICARD, with the corporate client's employees being

considered as MEDICARD members; and the other is between the health care

institutions/healthcare professionals and MED ICARD.

Under the first, MEDICARD undertakes to make arrangements with healthcare

institutions/healthcare professionals for the coverage of MEDICARD members

under specific health related services for a specified period of time in exchange for

payment of a more or less fixed membership fee. Under its contract with its corporate

clients, MEDICARD expressly provides that 20% of the membership fees per

individual, regardless of the amount involved, already includes the VAT of

10%/20% excluding the remaining 80o/o because MED ICARD would earmark this

latter portion for medical utilization of its members. Lastly, MEDICARD also assails

CIR's inclusion in its gross receipts of its earnings from medical services which it

actually and directly rendered to its members.

Since an HMO like MEDICARD is primarily engaged m arranging for coverage or

designated managed care services that are needed by plan holders/members for fixed

prepaid membership fees and for a specified period of time, then MEDICARD is

principally engaged in the sale of services.

HMO's gross receipts shall be the total amount of money or its equivalent

representing the service fee actually or constructively received during the taxable

period for the services performed or to be performed for another person, excluding

the value-added tax. The compensation for their services representing their

service fee, is presumed to be the total amount received as enrollment fee from

their members plus other charges received.

RR No. 16-2005 merely presumed that the amount received by an HMO as

membership fee is the HMO's compensation for their services. As a mere

presumption, an HMO is, thus, allowed to establish that a portion of the amount it

received as membership fee does NOT actually compensate it but some other person,

which in this case are the medical service providers themselves.

In the course of its business as such, MED ICARD members can either avail of

medical services from MEDICARD's accredited healthcare providers or directly

from MEDICARD. In the former, MEDICARD members obviously knew that

beyond the agreement to pre-arrange the healthcare needs of its ·members,

MEDICARD would not actually be providing the actual healthcare service. Thus,

based on industry practice, MEDICARD informs its would-be member beforehand

that 80% of the amount would be earmarked for medical utilization and only the

remaining 20% comprises its service fee. In the latter case, MEDICARD's sale of its

services is exempt from VAT under Section 109(G). It is significant to note in this

regard that MEDICARD established that upon receipt of payment of membership

fee it actually issued two official receipts, one pertaining to the VAT able portion,

representing compensation for its services, and the other represents the non-vatable

portion pertaining to the amount earmarked for medical utilization

Vous aimerez peut-être aussi

- U2 All That You Can't Leave BehindDocument82 pagesU2 All That You Can't Leave BehindFranck UrsiniPas encore d'évaluation

- SPA To Buy General FormatDocument2 pagesSPA To Buy General FormatKatrina Farrah Pabellan Suarez-VicentePas encore d'évaluation

- Nachura Notes Public OfficersDocument26 pagesNachura Notes Public OfficersNowhere Man100% (13)

- CIR vs. Metro Star (TAX)Document3 pagesCIR vs. Metro Star (TAX)Teff QuibodPas encore d'évaluation

- Medicard Philippines vs. CirDocument2 pagesMedicard Philippines vs. CirAnalou Agustin VillezaPas encore d'évaluation

- Aries Computer Repair SolutionsDocument9 pagesAries Computer Repair SolutionsedalzurcPas encore d'évaluation

- 26 Contex Vs CIRDocument2 pages26 Contex Vs CIRIvan Romeo100% (1)

- Civil Service Exam Clerical Operations QuestionsDocument5 pagesCivil Service Exam Clerical Operations QuestionsJeniGatelaGatillo100% (3)

- AZNAR Vs CTADocument2 pagesAZNAR Vs CTAMCPas encore d'évaluation

- Sy Po vs. CTADocument4 pagesSy Po vs. CTAVan John MagallanesPas encore d'évaluation

- Embryology-Nervous System DevelopmentDocument157 pagesEmbryology-Nervous System DevelopmentGheavita Chandra DewiPas encore d'évaluation

- Land Titles and Deeds ReviewerDocument26 pagesLand Titles and Deeds ReviewerAd Altiora TendoPas encore d'évaluation

- CIR v. CA: Non-retroactive application of BIR rulings absent bad faithDocument2 pagesCIR v. CA: Non-retroactive application of BIR rulings absent bad faithJames Ryan AlbaPas encore d'évaluation

- Supreme Court oversight of lower courtsDocument17 pagesSupreme Court oversight of lower courtsבנדר-עלי אימאם טינגאו בתולהPas encore d'évaluation

- My Digest - Medicard vs. CIRDocument11 pagesMy Digest - Medicard vs. CIRGuiller MagsumbolPas encore d'évaluation

- 73 CIR v. Ayala SecuritiesDocument3 pages73 CIR v. Ayala SecuritiesAnthony ChoiPas encore d'évaluation

- Validity of FDDA issued to Liquigaz Philippines Corp. for 2005Document3 pagesValidity of FDDA issued to Liquigaz Philippines Corp. for 2005Rhea CaguetePas encore d'évaluation

- Nodalo - Medicard vs. CirDocument3 pagesNodalo - Medicard vs. CirGenebva Mica NodaloPas encore d'évaluation

- CIR vs CA and COMASERCO - Ruling on VAT Assessment for Services Rendered to AffiliatesDocument16 pagesCIR vs CA and COMASERCO - Ruling on VAT Assessment for Services Rendered to AffiliatesDeb BiePas encore d'évaluation

- Business Case PresentationDocument27 pagesBusiness Case Presentationapi-253435256Pas encore d'évaluation

- CIR vs ICC Ruling on Expense DeductionsDocument1 pageCIR vs ICC Ruling on Expense DeductionsNatsu DragneelPas encore d'évaluation

- Marshall Stability Test AnalysisDocument5 pagesMarshall Stability Test AnalysisZick Zickry50% (2)

- CIR v. Acesite Hotel CorporationDocument2 pagesCIR v. Acesite Hotel CorporationJemima FalinchaoPas encore d'évaluation

- 136 CIR vs. Vda de PrietoDocument2 pages136 CIR vs. Vda de PrietoMiw Cortes100% (1)

- CIR Vs Euro-Philippines Airline ServicesDocument10 pagesCIR Vs Euro-Philippines Airline ServicesBeltran KathPas encore d'évaluation

- PAGCOR VAT Exemption UpheldDocument2 pagesPAGCOR VAT Exemption UpheldGem S. Alegado33% (3)

- VAT Tax CasesDocument12 pagesVAT Tax CasesAnna AbadPas encore d'évaluation

- Taxation Ii CasesDocument10 pagesTaxation Ii CasesIrish Bianca Usob LunaPas encore d'évaluation

- NDC V CIRDocument5 pagesNDC V CIRjonbelzaPas encore d'évaluation

- South African Airways Tax Case ExplainedDocument2 pagesSouth African Airways Tax Case ExplainedAlyanna ApaciblePas encore d'évaluation

- CIR Vs Fitness by Design - Case DigestDocument2 pagesCIR Vs Fitness by Design - Case DigestKaren Mae ServanPas encore d'évaluation

- Mrs. Universe PH - Empowering Women, Inspiring ChildrenDocument2 pagesMrs. Universe PH - Empowering Women, Inspiring ChildrenKate PestanasPas encore d'évaluation

- Case Digests - Taxation IDocument5 pagesCase Digests - Taxation IFatima Sarpina HinayPas encore d'évaluation

- 7 CIR vs. Mirant Pagbilao Corporation - ConsolidatedDocument20 pages7 CIR vs. Mirant Pagbilao Corporation - ConsolidatedGoodyPas encore d'évaluation

- Winebrenner Vs CIRDocument1 pageWinebrenner Vs CIRRodney SantiagoPas encore d'évaluation

- Medicard v. CirDocument1 pageMedicard v. CirLizzy WayPas encore d'évaluation

- Medicard Vs Cir Case DigestDocument1 pageMedicard Vs Cir Case DigestjovifactorPas encore d'évaluation

- Samar-1 Electric Coop. v. CirDocument1 pageSamar-1 Electric Coop. v. CirLoPas encore d'évaluation

- Medicard vs. CirDocument5 pagesMedicard vs. CirTogz Mape100% (2)

- Philamlife Vs Sec of FinanceDocument4 pagesPhilamlife Vs Sec of FinanceJesstonieCastañaresDamayoPas encore d'évaluation

- Lung Center VS Quezon CityDocument4 pagesLung Center VS Quezon CityJesstonieCastañaresDamayoPas encore d'évaluation

- Tax Digest VatDocument7 pagesTax Digest Vatma.catherine merillenoPas encore d'évaluation

- People vs. Sandiganbayan, 467 SCRA 137, August 16, 2005Document28 pagesPeople vs. Sandiganbayan, 467 SCRA 137, August 16, 2005j0d3100% (1)

- Cir Vs HantexDocument2 pagesCir Vs HantexMichael C. Payumo100% (1)

- Benjamin Gomez challenges constitutionality of anti-TB stamp requirementDocument1 pageBenjamin Gomez challenges constitutionality of anti-TB stamp requirementanonPas encore d'évaluation

- Tan VS. Honasan (G.R. 190846)Document2 pagesTan VS. Honasan (G.R. 190846)Jose CedroPas encore d'évaluation

- Fort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012Document3 pagesFort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012GracePas encore d'évaluation

- Lascona Land vs CIR Tax Assessment AppealDocument2 pagesLascona Land vs CIR Tax Assessment AppealJesstonieCastañaresDamayo100% (1)

- Cir V Ayala Cir v. WanderDocument4 pagesCir V Ayala Cir v. WanderPhilip Frantz Guerrero100% (1)

- Petition For Administrative Reconstitution of TitleDocument4 pagesPetition For Administrative Reconstitution of TitleJesstonieCastañaresDamayo100% (3)

- Tax 1 Case DigestsDocument50 pagesTax 1 Case Digestso6739Pas encore d'évaluation

- CIR Vs Toshiba Information EquipmentDocument1 pageCIR Vs Toshiba Information EquipmentKayee KatPas encore d'évaluation

- Medicard Phil Inc. vs. CIRDocument2 pagesMedicard Phil Inc. vs. CIRhigoremso giensdksPas encore d'évaluation

- Case: Systra Phils vs. CirDocument1 pageCase: Systra Phils vs. CirRaquel DoqueniaPas encore d'évaluation

- Prac Res Q2 Module 1Document14 pagesPrac Res Q2 Module 1oea aoueoPas encore d'évaluation

- Tax Assessment - X. CIR Vs Philippine Daily InquirerDocument3 pagesTax Assessment - X. CIR Vs Philippine Daily InquirerLouisse OcampoPas encore d'évaluation

- CHINA BANK CAPITAL LOSS DEDUCTIONDocument7 pagesCHINA BANK CAPITAL LOSS DEDUCTIONNikko SterlingPas encore d'évaluation

- Mindanao II Geothermal Partnership vs. CIR G.R. 193301, 11 March 2013Document1 pageMindanao II Geothermal Partnership vs. CIR G.R. 193301, 11 March 2013Gela Bea Barrios100% (1)

- Tan vs. Del Rosario Et Al G.R. No. 109289Document4 pagesTan vs. Del Rosario Et Al G.R. No. 109289ZeusKimPas encore d'évaluation

- CIR V CADocument2 pagesCIR V CAAlan GultiaPas encore d'évaluation

- CIR v. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Document8 pagesCIR v. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007rizel_adlawanPas encore d'évaluation

- Ericson vs. City of PasigDocument9 pagesEricson vs. City of PasigDario G. TorresPas encore d'évaluation

- Cir Vs Fitness by Design, Nc. GR NO. 215957 NOVEMEBER 9, 2016Document2 pagesCir Vs Fitness by Design, Nc. GR NO. 215957 NOVEMEBER 9, 2016Axel MendozaPas encore d'évaluation

- SILKAIR vs CIR FACTS: Who can claim tax refund - International carrier or domestic oil companyDocument2 pagesSILKAIR vs CIR FACTS: Who can claim tax refund - International carrier or domestic oil companyNage Constantino100% (1)

- CIR v. First Express PawnshopDocument1 pageCIR v. First Express PawnshopAnnePas encore d'évaluation

- 66 CIR Vs LednickyDocument9 pages66 CIR Vs LednickyYaz CarlomanPas encore d'évaluation

- Liability of Shipowners and Masters for Maritime AccidentsDocument6 pagesLiability of Shipowners and Masters for Maritime AccidentsBam BathanPas encore d'évaluation

- Silkair vs. BIR: Proper Party for Excise Tax RefundDocument2 pagesSilkair vs. BIR: Proper Party for Excise Tax RefundmenforeverPas encore d'évaluation

- Declaratory Relief On The Validity of BIR RMC No. 65-2012Document25 pagesDeclaratory Relief On The Validity of BIR RMC No. 65-2012CJPas encore d'évaluation

- Juan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeDocument2 pagesJuan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeLucifer MorningPas encore d'évaluation

- Phil. Home Assurance Corp vs. CADocument1 pagePhil. Home Assurance Corp vs. CACaroline A. LegaspinoPas encore d'évaluation

- Tax Digests Set1Document4 pagesTax Digests Set1KR ReborosoPas encore d'évaluation

- de Castro Vs de CastroDocument2 pagesde Castro Vs de CastroDaryl YuPas encore d'évaluation

- 7 Diego Vs SandiganbayanDocument3 pages7 Diego Vs SandiganbayanSusan LazoPas encore d'évaluation

- Lingkod Manggagawa Sa Rubberworld Vs Rubberworld Inc. G.R. No. 153882 January 29, 2007Document2 pagesLingkod Manggagawa Sa Rubberworld Vs Rubberworld Inc. G.R. No. 153882 January 29, 2007LRBPas encore d'évaluation

- Republic Vs SandiganbayanDocument29 pagesRepublic Vs SandiganbayanJesstonieCastañaresDamayoPas encore d'évaluation

- Pacquiao Loses Controversial Decision to Horn in Front of 51KDocument1 pagePacquiao Loses Controversial Decision to Horn in Front of 51KJesstonieCastañaresDamayoPas encore d'évaluation

- Amelia Mary Earhart (: (1) (Note 1) (3) (Note 2)Document1 pageAmelia Mary Earhart (: (1) (Note 1) (3) (Note 2)JesstonieCastañaresDamayoPas encore d'évaluation

- Mary MagdaleneDocument1 pageMary MagdaleneJesstonieCastañaresDamayoPas encore d'évaluation

- 123Document1 page123JesstonieCastañaresDamayoPas encore d'évaluation

- SC Rules No Unfair Competition in Using "St. FrancisDocument3 pagesSC Rules No Unfair Competition in Using "St. FrancisJesstonieCastañaresDamayoPas encore d'évaluation

- 123Document1 page123JesstonieCastañaresDamayoPas encore d'évaluation

- KO Glass vs. ValenzuelaDocument7 pagesKO Glass vs. ValenzuelaNxxxPas encore d'évaluation

- Camaya Vs PatulandongDocument5 pagesCamaya Vs PatulandongJesstonieCastañaresDamayoPas encore d'évaluation

- 3Document1 page3JesstonieCastañaresDamayoPas encore d'évaluation

- SC Rules No Unfair Competition in Using "St. FrancisDocument3 pagesSC Rules No Unfair Competition in Using "St. FrancisJesstonieCastañaresDamayoPas encore d'évaluation

- Lung Center Vs Quezon CityDocument8 pagesLung Center Vs Quezon CityJesstonieCastañaresDamayoPas encore d'évaluation

- Abundo Vs ComelecDocument3 pagesAbundo Vs ComelecJesstonieCastañaresDamayoPas encore d'évaluation

- British Tobacco Vs CamachoDocument3 pagesBritish Tobacco Vs CamachoJesstonieCastañaresDamayoPas encore d'évaluation

- SEC ruling on derivative suit filed against publishing company directorsDocument11 pagesSEC ruling on derivative suit filed against publishing company directorsJesstonieCastañaresDamayoPas encore d'évaluation

- Transnational LawDocument24 pagesTransnational LawJesstonieCastañaresDamayoPas encore d'évaluation

- Case DigestDocument2 pagesCase DigestJesstonieCastañaresDamayoPas encore d'évaluation

- SC Rules No Unfair Competition in Using "St. FrancisDocument3 pagesSC Rules No Unfair Competition in Using "St. FrancisJesstonieCastañaresDamayoPas encore d'évaluation

- Ohio V Helvering Case DigestDocument4 pagesOhio V Helvering Case DigestJesstonieCastañaresDamayoPas encore d'évaluation

- Dacoycoy Vs CADocument4 pagesDacoycoy Vs CAKier Christian Montuerto InventoPas encore d'évaluation

- 2-Singapore Airlines Vs CADocument4 pages2-Singapore Airlines Vs CAJesstonieCastañaresDamayoPas encore d'évaluation

- Custom Search: Today Is Tuesday, December 12, 2017Document2 pagesCustom Search: Today Is Tuesday, December 12, 2017JesstonieCastañaresDamayoPas encore d'évaluation

- ArDocument26 pagesArSegunda ManoPas encore d'évaluation

- Form 709 United States Gift Tax ReturnDocument5 pagesForm 709 United States Gift Tax ReturnBogdan PraščevićPas encore d'évaluation

- 4 Factor DoeDocument5 pages4 Factor Doeapi-516384896Pas encore d'évaluation

- Lab StoryDocument21 pagesLab StoryAbdul QadirPas encore d'évaluation

- Pemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchDocument16 pagesPemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchAri HendriawanPas encore d'évaluation

- SNC 2p1 Course Overview 2015Document2 pagesSNC 2p1 Course Overview 2015api-212901753Pas encore d'évaluation

- Ielts Practice Tests: ListeningDocument19 pagesIelts Practice Tests: ListeningKadek Santiari DewiPas encore d'évaluation

- Assignment - Final TestDocument3 pagesAssignment - Final TestbahilashPas encore d'évaluation

- IQ CommandDocument6 pagesIQ CommandkuoliusPas encore d'évaluation

- Ofper 1 Application For Seagoing AppointmentDocument4 pagesOfper 1 Application For Seagoing AppointmentNarayana ReddyPas encore d'évaluation

- SDS OU1060 IPeptideDocument6 pagesSDS OU1060 IPeptideSaowalak PhonseePas encore d'évaluation

- A Reconfigurable Wing For Biomimetic AircraftDocument12 pagesA Reconfigurable Wing For Biomimetic AircraftMoses DevaprasannaPas encore d'évaluation

- Jesd8 15aDocument22 pagesJesd8 15aSridhar PonnurangamPas encore d'évaluation

- Sinclair User 1 Apr 1982Document68 pagesSinclair User 1 Apr 1982JasonWhite99Pas encore d'évaluation

- Revit 2010 ESPAÑOLDocument380 pagesRevit 2010 ESPAÑOLEmilio Castañon50% (2)

- Chapter 4 DeterminantsDocument3 pagesChapter 4 Determinantssraj68Pas encore d'évaluation

- Statistical Decision AnalysisDocument3 pagesStatistical Decision AnalysisTewfic SeidPas encore d'évaluation

- Philippine Population 2009Document6 pagesPhilippine Population 2009mahyoolPas encore d'évaluation

- Rapport DharaviDocument23 pagesRapport DharaviUrbanistes du MondePas encore d'évaluation

- Gabinete STS Activity1Document2 pagesGabinete STS Activity1Anthony GabinetePas encore d'évaluation

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument2 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledCesar ValeraPas encore d'évaluation

- Dolni VestoniceDocument34 pagesDolni VestoniceOlha PodufalovaPas encore d'évaluation