Académique Documents

Professionnel Documents

Culture Documents

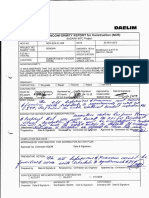

R - : I'ende4Kl/E Fo Ffi'upp1y/workof ', ' ,',: ' (Short

Transféré par

Mundakayam Substation KSEBTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

R - : I'ende4Kl/E Fo Ffi'upp1y/workof ', ' ,',: ' (Short

Transféré par

Mundakayam Substation KSEBDroits d'auteur :

Formats disponibles

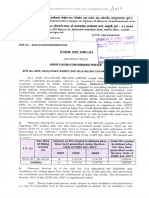

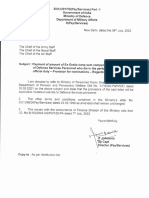

IJ}IDBRTAKI}IG BY BIDDER TOWARDS ANTI PROFITEERING

CLAUSE OF GST ACTSIRULES

(fo be submitled on Ietter head)

To

'lhe Depu) ahiel Engineer,

'fransmission Circle, KSEBL,

I(ottayam.

Sir'

Sub: GST- passjng olt the benefit of Inpul Crcdit - undertaking - reg

R€|:.I'ende4Kl/E€.fo.ffi'upp1y/workof......',.'..,',:....'.(short

description of work /suPPlY)

1. Wc................-......-....... ...-.....OJame of bidder with address) have submitted Bid

No..........................---.Dated........... . ..--------.... .against afoEsaid tender.

OR

WE....-...:..............,.......-..-.0\lame of contractor'$ith address) havq :t!e

WO/PONo.-......-............ ...................,..daaed......'..............'.......for dre above referred

u rl,/ u1'n11.

2- Accoftling to section 171 of cGsT Ao/sGsT Act, "any reduction i{ late of ta'\ on

any supplv of Goods or Services or the benefit ofinput tax credit shall be pas,scd on to

thc rccipielll by way ofcommensurate reduotion in pices".

3. Accordingiy we lrereby ofler a discount of-R3:......4 *!.k......;......J,......V'i on

quoted pr;ces d e to reddction in rate of ta:i or availabllib' of benefit of Input Ta'x'

Credit.

4. wc hereby confinn that above discount is maxi1num possible benefit available aDd is

in conpliaDcc \tilhthe aforcs€id Sectioo 171 ofCCST Aof/SCST Act

5. ln case iL is lbund at a iater stago that, any addltional benefit on account of GET is

6. ln casc of fsilure from our pan, ofpassing on the bercfit, we llelebygutltorise Kera a

State Elcct cily Board Limited to recover the adount froin any 4mount alueto !s, or

to take legal action against us fol recovery ofthe sa|De.

PIacq: Signatlre of Authorised Signalo;y of Bidder/Cont actor

Dale: Name FtT H \< t'aLPJaL'l

f AN.IT

ir c^. 3\

l!

'{'*t;".' t

q1

(,!

(v'

Vous aimerez peut-être aussi

- Report on Proposed Reforms to the System of Way Bills in Andhra PradeshDocument22 pagesReport on Proposed Reforms to the System of Way Bills in Andhra PradeshNitin K. ParekhPas encore d'évaluation

- L-27 (EE) 1ST MILESTONE BillDocument20 pagesL-27 (EE) 1ST MILESTONE BillGalsingh ChouhanPas encore d'évaluation

- 2006 05 16 - DR1Document1 page2006 05 16 - DR1Zach EdwardsPas encore d'évaluation

- NCR No.-6Document7 pagesNCR No.-6Galsingh ChouhanPas encore d'évaluation

- Subject Bmcing Date No. T8.o39.2 No. - Ocaiion Selor" L!o. NoDocument2 pagesSubject Bmcing Date No. T8.o39.2 No. - Ocaiion Selor" L!o. NoRamdan Pramedis SetyaPas encore d'évaluation

- CERTIFICATE OF INSP - LOAD TEST & EXAMINATION -KS-014-24 BERGIN #9 FORKLIFTDocument4 pagesCERTIFICATE OF INSP - LOAD TEST & EXAMINATION -KS-014-24 BERGIN #9 FORKLIFTshwsaymanPas encore d'évaluation

- Atal Pension Yojana (APY) - How to Voluntarily Close Your AccountDocument4 pagesAtal Pension Yojana (APY) - How to Voluntarily Close Your AccountTrivikram NayakPas encore d'évaluation

- Master Circular 0n Penalties and Disciplinary Authorities: Es QLQ U1anvfm Q (Irrrfic (FRDocument47 pagesMaster Circular 0n Penalties and Disciplinary Authorities: Es QLQ U1anvfm Q (Irrrfic (FRsridhar100% (1)

- PO Westco Casing TongDocument6 pagesPO Westco Casing Tongcrni rokoPas encore d'évaluation

- Replacement of Power Transformer at 66/11 KV StationDocument6 pagesReplacement of Power Transformer at 66/11 KV Stationrafikul123Pas encore d'évaluation

- RR No. 20-2020 PDFDocument2 pagesRR No. 20-2020 PDFBobby Olavides SebastianPas encore d'évaluation

- 5th & 8th Form 2024Document2 pages5th & 8th Form 2024Aditya SharmaPas encore d'évaluation

- Service Agreement PaperDocument7 pagesService Agreement PaperSurya rohitPas encore d'évaluation

- F T I '"". U .: DisclosureDocument4 pagesF T I '"". U .: DisclosureZach EdwardsPas encore d'évaluation

- Vko Recel Mol T Y - S. Ccéf C Ofxl ' Iots: T L - Oj J) .J (5, (Dear Chi Eflust I Ce and Associ at E Justi CesDocument11 pagesVko Recel Mol T Y - S. Ccéf C Ofxl ' Iots: T L - Oj J) .J (5, (Dear Chi Eflust I Ce and Associ at E Justi CesEquality Case FilesPas encore d'évaluation

- F, A& %-,ffi'lk) : Lli'//'l'lDocument3 pagesF, A& %-,ffi'lk) : Lli'//'l'lMobile LegendsPas encore d'évaluation

- IMG_20240320_0001Document3 pagesIMG_20240320_0001dilliprout.caplet2016Pas encore d'évaluation

- RMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFDocument2 pagesRMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFKriszan ManiponPas encore d'évaluation

- RMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFDocument2 pagesRMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFKriszan ManiponPas encore d'évaluation

- Charging of GST on Estimated Cost of Utility Shifting WorksDocument12 pagesCharging of GST on Estimated Cost of Utility Shifting WorksJoseph Antony SahayarajPas encore d'évaluation

- Ajay15 GDocument1 pageAjay15 Gsurendra singh kachhavaPas encore d'évaluation

- Disini SamplexDocument16 pagesDisini SamplexenitsirhcPas encore d'évaluation

- 81&ii Ant, Nkfu: GRN S/tu/at UvDocument19 pages81&ii Ant, Nkfu: GRN S/tu/at UvZach EdwardsPas encore d'évaluation

- 2010 05 11 DR 1Document1 page2010 05 11 DR 1Zach EdwardsPas encore d'évaluation

- t0ll JAFI - H PH 3: 2t : For Instructions See Back of FormDocument1 paget0ll JAFI - H PH 3: 2t : For Instructions See Back of FormZach EdwardsPas encore d'évaluation

- Tax Incentives Transparency Act of 2015 summaryDocument6 pagesTax Incentives Transparency Act of 2015 summaryAnna Leigh AnilloPas encore d'évaluation

- Adobe Scan 14 Feb 2024Document2 pagesAdobe Scan 14 Feb 2024anusha.veldandiPas encore d'évaluation

- Circularno.02-2020-Income Tax Ofcbdtdt03012020Document3 pagesCircularno.02-2020-Income Tax Ofcbdtdt03012020Shyam Lal MandhyanPas encore d'évaluation

- 2011 01 18 - DR 1Document1 page2011 01 18 - DR 1Zach EdwardsPas encore d'évaluation

- Loi TPL PKG 77-02aDocument2 pagesLoi TPL PKG 77-02aPooja TripathiPas encore d'évaluation

- CS (MA) Order - HaryanaDocument1 pageCS (MA) Order - HaryanaPWD Subrata sir's class DA-2017 batchPas encore d'évaluation

- Chemtrol Docs Invoice 009 HSS-InR (PO-B1F170110, B1F170164) - MinDocument27 pagesChemtrol Docs Invoice 009 HSS-InR (PO-B1F170110, B1F170164) - MinRaj N Eesh VatsPas encore d'évaluation

- Ry-Ff, Tlil:: +R+FRQ, Iir6r (RRLST), RilnrqDocument4 pagesRy-Ff, Tlil:: +R+FRQ, Iir6r (RRLST), Rilnrqcalmincometax36Pas encore d'évaluation

- Check List and Other DocumentsDocument14 pagesCheck List and Other DocumentsmanzarsamanposPas encore d'évaluation

- Bates V Post Office: Generic Defence and CounterclaimDocument75 pagesBates V Post Office: Generic Defence and CounterclaimNick Wallis100% (1)

- Rajasthan Victim Compensation Scheme 2011Document6 pagesRajasthan Victim Compensation Scheme 2011Latest Laws TeamPas encore d'évaluation

- LIC's New Bima Gold policy detailsDocument1 pageLIC's New Bima Gold policy detailsN Swamy DivitiPas encore d'évaluation

- DIA'PHY1-23-Report On Investigations On The Implementation of The Intelligent Transport Monitoring System by M's Joint Stock Company Global SecurityDocument48 pagesDIA'PHY1-23-Report On Investigations On The Implementation of The Intelligent Transport Monitoring System by M's Joint Stock Company Global SecurityEdgar Mugarura100% (1)

- Law of ContractDocument3 pagesLaw of ContractSujayPas encore d'évaluation

- Anexe J Inarra: Hauti) Partie Contractante High ContractantaDocument1 pageAnexe J Inarra: Hauti) Partie Contractante High ContractantaBelba ConstantinPas encore d'évaluation

- SMU Garuda To TonasDocument1 pageSMU Garuda To Tonasikhsan umarPas encore d'évaluation

- National Transmission Corporation Concession Agreement SummaryDocument80 pagesNational Transmission Corporation Concession Agreement Summaryjerikaye law100% (1)

- M - TN Hezr 'T/M - Ilrclr7nqrl "FF - O,"",-Orr : DisclosureDocument2 pagesM - TN Hezr 'T/M - Ilrclr7nqrl "FF - O,"",-Orr : DisclosureZach EdwardsPas encore d'évaluation

- MITAOE CRPC T&PPlacement Offer Letter Single 17-18Document826 pagesMITAOE CRPC T&PPlacement Offer Letter Single 17-18revanthic445Pas encore d'évaluation

- Criminal Acts Against Civil Aviation: OfficeDocument82 pagesCriminal Acts Against Civil Aviation: OfficejehobuPas encore d'évaluation

- NCR SampleDocument1 pageNCR SampleMd ShariquePas encore d'évaluation

- 08 September 2015 SDR CircularDocument7 pages08 September 2015 SDR CircularAtul YadavPas encore d'évaluation

- Minutes Committee: As CIA HasDocument6 pagesMinutes Committee: As CIA HasRajesh Kumar SharmaPas encore d'évaluation

- Payment of Ammount of Ex GratiaDocument6 pagesPayment of Ammount of Ex GratiaGauravPas encore d'évaluation

- Receive: DisclosureDocument2 pagesReceive: DisclosureZach EdwardsPas encore d'évaluation

- Contrato PDFDocument5 pagesContrato PDFAna Crystell VillegasPas encore d'évaluation

- Notice On Signboard 220221118 - 11264341Document1 pageNotice On Signboard 220221118 - 11264341Petrik PunzalanPas encore d'évaluation

- 2009 10 15 - DR SfaDocument1 page2009 10 15 - DR SfaZach EdwardsPas encore d'évaluation

- FSA Fod6E1nDocument1 pageFSA Fod6E1nAlfred SorenPas encore d'évaluation

- GCC For Epc 2022Document221 pagesGCC For Epc 2022Project Manager IIT Kanpur CPWDPas encore d'évaluation

- Clarification on Issuing eCARs for Multiple Property TransactionsDocument1 pageClarification on Issuing eCARs for Multiple Property TransactionsCarlu YooPas encore d'évaluation

- 2010 06 03 - DR 1Document1 page2010 06 03 - DR 1Zach EdwardsPas encore d'évaluation

- Stock Stament FormatDocument11 pagesStock Stament FormatAnkit SoniPas encore d'évaluation

- Untitled 1Document1 pageUntitled 1Mundakayam Substation KSEBPas encore d'évaluation

- OperatorsDocument16 pagesOperatorsMundakayam Substation KSEBPas encore d'évaluation

- Comparison StatementDocument4 pagesComparison StatementMundakayam Substation KSEBPas encore d'évaluation

- Interuptn MDKM Dec JanDocument2 pagesInteruptn MDKM Dec JanMundakayam Substation KSEBPas encore d'évaluation

- Ladder 1: LST of Safety Equipments Available in Various Substations Under Substation Subdivision, PalaDocument2 pagesLadder 1: LST of Safety Equipments Available in Various Substations Under Substation Subdivision, PalaMundakayam Substation KSEBPas encore d'évaluation

- Bill - Operators 2017Document1 pageBill - Operators 2017Mundakayam Substation KSEBPas encore d'évaluation

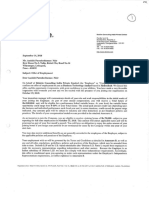

- GST Under TakingDocument1 pageGST Under TakingMundakayam Substation KSEBPas encore d'évaluation

- Workexp FencingDocument166 pagesWorkexp FencingMundakayam Substation KSEBPas encore d'évaluation

- 44.0 - Traffic Management and Logistics v3.0 EnglishDocument14 pages44.0 - Traffic Management and Logistics v3.0 EnglishEyob Yimer100% (1)

- Flyposting OrdinanceDocument2 pagesFlyposting OrdinanceJunil LagardePas encore d'évaluation

- Ublox - 2007 - ANTARIS 4 GPS Modules System Integration Manual PDFDocument187 pagesUblox - 2007 - ANTARIS 4 GPS Modules System Integration Manual PDFCenascenascenascenasPas encore d'évaluation

- CIS Union Access Update 2021Document6 pagesCIS Union Access Update 2021Fernando Manholér100% (3)

- The Little Girl and The Cigarette by Benoit DuteurtreDocument15 pagesThe Little Girl and The Cigarette by Benoit DuteurtreMelville HousePas encore d'évaluation

- Quotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesDocument7 pagesQuotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesTawanda KurasaPas encore d'évaluation

- DOJ Manila Criminal Complaint Against Robbery SuspectsDocument2 pagesDOJ Manila Criminal Complaint Against Robbery SuspectsDahn UyPas encore d'évaluation

- Remote Access Security Best PracticesDocument5 pagesRemote Access Security Best PracticesAhmed M. SOUISSIPas encore d'évaluation

- Bentham, Jeremy - Offences Against One's SelfDocument25 pagesBentham, Jeremy - Offences Against One's SelfprotonpseudoPas encore d'évaluation

- DAC88094423Document1 pageDAC88094423Heemel D RigelPas encore d'évaluation

- Specification For Low-Alloy Steel Electrodes and Rods For Gas Shielded Arc WeldingDocument9 pagesSpecification For Low-Alloy Steel Electrodes and Rods For Gas Shielded Arc WeldingSilvanaPas encore d'évaluation

- Criminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodeDocument27 pagesCriminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodePrabhash ChandPas encore d'évaluation

- Muzaffarnagar Riots Report - The Jat PerspectiveDocument11 pagesMuzaffarnagar Riots Report - The Jat Perspectivedharma nextPas encore d'évaluation

- Austerity Doesn't Work - Vote For A Real Alternative: YoungerDocument1 pageAusterity Doesn't Work - Vote For A Real Alternative: YoungerpastetablePas encore d'évaluation

- Test 1. Answer SheetDocument3 pagesTest 1. Answer SheetAdi AlshtiwiPas encore d'évaluation

- Trilogy Monthly Income Trust PDS 22 July 2015 WEBDocument56 pagesTrilogy Monthly Income Trust PDS 22 July 2015 WEBRoger AllanPas encore d'évaluation

- MC No. 005.22Document5 pagesMC No. 005.22raymund pabilarioPas encore d'évaluation

- GhostwritingDocument6 pagesGhostwritingUdaipur IndiaPas encore d'évaluation

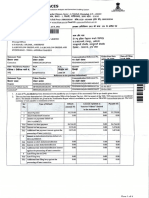

- Tax Invoice for 100 Mbps Home InternetDocument1 pageTax Invoice for 100 Mbps Home Internetpriyank31Pas encore d'évaluation

- X-000009-1603383942652-50963-BBE - Assignment 01Document66 pagesX-000009-1603383942652-50963-BBE - Assignment 01PeuJp75% (4)

- John Hankinson AffidavitDocument16 pagesJohn Hankinson AffidavitRtrForumPas encore d'évaluation

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- 2019 Graduation MessagesDocument4 pages2019 Graduation MessagesKevin ProvendidoPas encore d'évaluation

- Ibn Mujahid and Seven Established Reading of The Quran PDFDocument19 pagesIbn Mujahid and Seven Established Reading of The Quran PDFMoPas encore d'évaluation

- Notes in Comparative Police System Unit 1 Basic TermsDocument26 pagesNotes in Comparative Police System Unit 1 Basic TermsEarl Jann LaurencioPas encore d'évaluation

- Unit-1 - AR ACTDocument174 pagesUnit-1 - AR ACTgeorgianaborzaPas encore d'évaluation

- Puss in Boots Esl Printable Reading Comprehension Questions Worksheet For KidsDocument2 pagesPuss in Boots Esl Printable Reading Comprehension Questions Worksheet For KidsauraPas encore d'évaluation

- Miller Deliveries June transactions analysisDocument7 pagesMiller Deliveries June transactions analysisMD SHAFIN AHMEDPas encore d'évaluation

- QNet FAQDocument2 pagesQNet FAQDeepak GoelPas encore d'évaluation

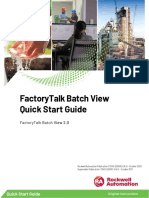

- Factorytalk Batch View Quick Start GuideDocument22 pagesFactorytalk Batch View Quick Start GuideNelsonPas encore d'évaluation