Académique Documents

Professionnel Documents

Culture Documents

EBank Case Study

Transféré par

Anonymous SVFXqbNCopyright

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentEBank Case Study

Transféré par

Anonymous SVFXqbNS tudy

C ase

EBank

EBank Achieves Digital Transformation of

Services with Fiorano's Core Banking Integration

Fiorano Enterprise Service Bus seamlessly integrates EBank’s

Temenos T24 core banking system with 3rd party suppliers and

channels facilitating its vision of financial inclusion in record time.

Customer Profile areas with little access to banking services. Since its launch,

the bank has focused on building its retail partner network,

Namibia is a challenging market where a relatively small enabling clients to choose where they bank whilst doing

population is scattered over an unusually large geography. their shopping. “Our aim is to make life easy for our clients,

Pointbreak, a Namibian financial services group, provides specifically making it easier for people to bank and move

investment management and wealth management services money around,” said Bronwen Chase, head of sales and

to the private, corporate and institutional markets, managing distribution for EBank in an interview to “The Namibian”.

more than N$8 billion of third party capital. Pointbreak

wanted to make innovative use of the latest banking

technology to provide an efficient and accessible banking ...We want to provide every Namibian with a bank

solution to the wider Namibian public with the goal of account that is so accessible and affordable that they

are willing to replace physical cash almost entirely with

financial inclusion. With this vision, it established EBank

this banking solution. At the very least, this will require

Limited in 2013 and soon received the full banking license

giving every client a low-cost account, free cash

from the Namibian Reserve Bank allowing it to launch its deposits at a wide variety of points, low cost transfers

transactional banking model for the public, focusing on of money as well as free information on their accounts.

personal banking products. These price points are only achievable if we are able to

convince clients to adopt the EBank solution en-masse

By 2015, just two years after its launch, EBank and to use it as their primary channel for mobile

revolutionized banking in Namibia, providing bank accounts commerce particularly in buying airtime and electricity.

to over 70,000 Namibians and growing its network of retail

partners to 120 outlets. EBank now delivers innovative Mr. Gerald Riedel,

inclusive banking to its clients, many of whom are in rural CFO, EBank

Business Challenge Solution

Case Stu

dy EBank's business model is built around Initial analysis of integration platforms at EBank pointed out

the requirement to quickly and efficiently that the required combination of high flexibility with low

integrate with third-party suppliers and resource consumption was not commonly found.

vendors, to provide clients with a wide

EBank chose Fiorano over other vendors based on:

range of services and enable them to complete banking

transactions at the retail outlets that have partnered and Ability to handle multiple different integration

integrated with EBank. language protocols

User friendliness

Ebank runs its Temenos Core banking, T24, on a Microsoft

Improved Go to Market time with the ease of

Server Environment using VMware hosting databases on

configuration

SQL. The EBank environment core processes about 3,000 Ease of Use with a low learning curve resulting

transactions a day and there are 7 applications talking to in Limited in-department development skills

each other. The exchange of data is done in various formats, required to operate the environment

including xml, ISO8583 and ISO20021 with 30 internal users Fiorano's responsive and professional Support &

operating on the environment. Service

As such, EBank was looking for an integration platform that Accelerated Return on Investment with quick

would allow for seamless integration using a multitude of deployment and lower hardware requirements

interface language protocols without having to perform and competitive pricing

development on the core banking system (CBS) itself. In EBank implemented Fiorano Enterprise Service Bus (ESB)

addition, EBank's philosophy of offering affordable banking together with a new core banking instance from Temenos. The

services to its clients dictated that EBank had to contain its implementation commenced in June 2016 and EBank went

spend on infrastructure capacity. EBank, therefore was live with all systems at the beginning of March 2017, within a

looking for an integration platform which was not resource period of 8 months from project commencement.

intensive and had a low cost of operation and maintenance.

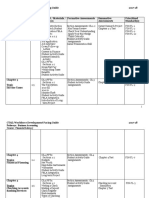

Overview of EBank

T24 Core Banking System Structure

Card

Processor ACH: Namclear

USSD

Payments Hub

for EFT Ecode Engine

MNO: Airtime

Retailer Retailer Retailer

Aggregator:

Electricity

Internet Banking (TCIB T24)

AML (T24)

Core Banking System T24

(Temenos)

Account Origination App

The implementation included the integration for switching of internally and only on limited occasions

electronic fund transfers between local banks and integration sourced expert input from Fiorano to Case Stu

dy

of debit card interfaces for local and international resolve a complex integration matters.

transactions. A significant contributor to this swift

implementation was the flexibility and

EBank also wanted to onboard a full USSD menu to enable

ease of use that the Fiorano Integration

customers to perform a full suite of banking transactions from

layer offered.

their mobile phone without the need to have internet

connectivity. The integration of the ECode engine would

facilitate the switching of cash-in, cash-out and mobile

payment transactions conducted at retail outlets, as well as

the onboarding of airtime and electricity suppliers to enable

" We at EBank are impressed with the flexibility of the

customers buy utilities directly off their EBank account.

Fiorano ESB, Enterprise Service Bus. The application is user

friendly, highly agile and enables EBank to quickly and

Fiorano ESB assisted EBank in: securely set up connections with third party systems.

The Fiorano ESB consumes a fraction of the resources

1. Account Origination: EBank provides a simple normally required by similar applications thus mitigating the

mechanism for creating accounts using a USSD code need to heavily invest in server infrastructure."

approach. All the information entered on the mobile screen is

Mr. Gerald Riedel,

captured at ESB and once the user enters all the data, it is CFO,

EBank

pushed to the Core Banking System (CBS) for account

origination.

Solution Highlights

2. Mobile Banking: All the mobile banking services such as

The Fiorano Integration Platform provides several powerful

cash in(deposit)/cash out(withdrawal)/Purchase Air

features that make business process automation simple and

Time/Purchase Electricity/Fund Transfer/Change PIN/Link

efficient.

Cards etc., are implemented in Fiorano ESB. The ease of use

of the platform helped EBank to integrate with new partners Core Banking Integration: Fiorano ESB, effortlessly

very easily (ex. Integration with Olusheno). integrates Core Banking applications with multiple systems

making Fiorano a fundamental part of the banking architecture.

3. Fund Transfer: All the Fund Transfers generated across

Fiorano's solution supports an incremental deployment model,

channels (BackOffice, Internet Banking, USSD) are routed via

enabling modular and standardized implementations with lower

the ESB to Namclear to do the settlements. Several types of

risk and expense.

EFTs (SAMEDAY, DATED) are supported. A client can

perform a DATED EFT where in the transaction is posted to Peer-to-peer architecture: Fiorano's distributed, peer-to-peer

Namclear on the specified date. Services are exposed in architecture linearly increases performance as it supports in-

Fiorano to receive incoming EFTs from Namclear which are built messaging at the end-points with a direct end to end

posted to CBS and the response is sent back to Namclear. communication and enables parallel data-flows. This provides

the capability to handle an increasing number of users with no

4. Card Services: All Card Processing transactions are degradation in performance.

carried out via Fiorano ESB. ATM Transactions/POS

Transactions are routed via ESB to CBS. Linking a Card to an Codeless Integration through Fiorano prebuilt Temenos

account / Suspend a card is handled by Fiorano. T24 Adaptors: Fiorano, in collaboration with Temenos, offers

T24 adaptors enabling codeless integration with the T24 Core

Before implementing Fiorano, EBank was dependent on third Banking applications server thus dramatically reducing the

party providers to develop integrations between the EBank implementation time.

system and third-party suppliers. With the implementation of

Fiorano and through the provision of thorough training by Increase Business Agility: Fiorano simplifies application

Fiorano consultants, EBank managed to upskill its internal maintenance and new application development, resulting in

resources within a period of three months. Since then, EBank dramatically reduced likelihood of outages.

has performed all integrations with third party applications

Result and Benefits Faster response to internal business needs -

Case Stu Automatically configuring the underlying middleware

dy Expeditious launch of services -

allows the logical process design to be mapped directly to

This offers the benefit of reducing

physical services distributed across the ESB, empowering

project integration timelines and

non-technical business-users to compose, deploy, and

enables EBank to quicker adapt to

modify event-driven business processes.

market needs and launch new services." to "This offers the

benefit of reducing project integration timelines and Agility and Reliability - EBank can now easily

enables EBank to quickly adapt to market needs and change/update any service or workflow without any

launch new services. negative impact on the overall system. The underlying

messaging broker guarantees message delivery and

Efficient issue escalation and resolution - In case

provides message interception capabilities to alter the

of a functional breakdown, the Fiorano platform alerts the

processes during runtime.

functional team in real time, avoiding any business

disruptions, quickening the process of issue escalation.

Improved bottom line - EBank saved significantly on Note: - The Pointbreak Group, including EBank, were acquired by FNB

Namibia Holdings effective 30 March 2017. EBank and First National Bank

development costs as Fiorano ESB is a codeless integration of Namibia have a similar vision of achieving inclusive and broad-based

banking in Namibia, primarily utilizing technology and cell phone banking

platform. Moreover, Fiorano ESB obviated the need to invest capabilities. As part of the integration of EBank's business into First

National Bank of Namibia, EBank's business operations will be migrated to

in additional software resulting in reduction in overall costs. the FNB core banking platform and it will shut down its core banking

system and will not be using T24.

ABOUT FIORANO SOFTWARE

Founded in 1995, Silicon Valley based Fiorano is a USA (California) Corporation, a trusted provider of Digital Business Backplane and enterprise

integration middleware, high performance messaging and peer-to-peer distributed systems. Fiorano powers real time, digital enterprises with

bimodal integration and API Management strategy that leverages the best of systematic (centralized, high-control) and adaptive (federated,

high-speed) approaches to deliver solutions across cloud, on-premise and hybrid environments.

Fiorano operates through its worldwide offices and a global network of technology partners and value-added resellers.

Global leaders including AT&T Wireless, Boeing, British Telecom, Federal Bank, L'Oréal, McKesson, NASA, POSCO, Rabobank, Royal Bank of

Scotland, Schlumberger, US Coast Guard and Vodafone have deployed Fiorano to drive innovation through open, standards-based, event-driven

real-time solutions yielding unprecedented productivity.

To find out more about how Fiorano can help you meet your enterprise integration objectives, visit www.fiorano.com or e-mail sales@fiorano.com

AMERICAS EMEA APAC

Fiorano Software, Inc. Fiorano Software Ltd Fiorano Software Pte. Ltd.

230 California Avenue, Suite 3000 Hillswood Drive Level 42, Suntec Tower Three

www.fiorano.com 103, Palo Alto, CA 94306 USA Hillswood Business Park 8 Temasek Boulevard

Tel: +1 650 326 1136 Chertsey Surrey KT16 0RS UK 038988 Singapore

Fax: +1 646 607 5875 Tel: +44 (0) 1932 895005 Tel: +65 6829 2234

Toll-Free: +1 800 663 3621 Fax: +44 (0) 1932 325413 Fax: +65 6826 4015

Email: info@fiorano.com Email: info_uk@fiorano.com Email: info_asiapac@fiorano.com

Copyright © 2000-2017 Fiorano Software Pte. Ltd. and affiliates. All rights reserved. Fiorano SOA Platform, Fiorano ESB, FioranoMQ, Fiorano JMS Server, Fiorano Cloud Platform, Fiorano ITK,

11/17

Fiorano B2B, Fiorano Middleware Platform, Fiorano API Management, Enabling change at the speed of thought and the Fiorano logo are trademarks or registered trademarks of Fiorano or its

affiliates worldwide. All other trademarks are the property of their respective owners. Information contained herein is subject to change without prior notice.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Texas Senate Subcommitte Report - LendingDocument53 pagesTexas Senate Subcommitte Report - LendingCalvin Glenn M.Pas encore d'évaluation

- Independence Checkpoint FAQsDocument6 pagesIndependence Checkpoint FAQsAtanu PanPas encore d'évaluation

- Yanapuma - Spanish Schools in QuitoDocument9 pagesYanapuma - Spanish Schools in QuitoYanapuma SpanishPas encore d'évaluation

- MyTW Bill 900032858649 21 02 2022Document5 pagesMyTW Bill 900032858649 21 02 2022avelik ukPas encore d'évaluation

- Compensation System of DBL & UCBLDocument53 pagesCompensation System of DBL & UCBLAhsanul Hoque83% (6)

- 2012 Jiao vs. NLRCDocument2 pages2012 Jiao vs. NLRCMa Gabriellen Quijada-Tabuñag100% (1)

- Retail BankingDocument25 pagesRetail BankingTrusha Hodiwala80% (5)

- MGT202 Lecture 02.ppsxDocument12 pagesMGT202 Lecture 02.ppsxBashir Ahmad100% (1)

- Vat Rate (Up To Finance Act 2013-2014)Document38 pagesVat Rate (Up To Finance Act 2013-2014)Sakib Ahmed AnikPas encore d'évaluation

- Euro MarketDocument35 pagesEuro MarketPari GanganPas encore d'évaluation

- National Bank of PakistanDocument27 pagesNational Bank of Pakistansara243910% (1)

- Foreign Exchange On First Security Islami Bank LTDDocument60 pagesForeign Exchange On First Security Islami Bank LTDAhadul Islam100% (2)

- Kartik - Double EnteryDocument17 pagesKartik - Double EnterySathya SeelanPas encore d'évaluation

- Future Value ProblemsDocument2 pagesFuture Value Problemsrohitrgt4uPas encore d'évaluation

- GuggenheimDocument5 pagesGuggenheimRochester Democrat and ChroniclePas encore d'évaluation

- Emv2000 L2 2.0Document623 pagesEmv2000 L2 2.0OgarSkaliPas encore d'évaluation

- BSA2A WrittenReports Thrift-BanksDocument5 pagesBSA2A WrittenReports Thrift-Banksrobert pilapilPas encore d'évaluation

- Philacor Credit Corporation vs. Commissioner of Internal Revenue (February 6, 2013)Document9 pagesPhilacor Credit Corporation vs. Commissioner of Internal Revenue (February 6, 2013)Vince LeidoPas encore d'évaluation

- State Common Entrance Test Cell, Maharashtra, MumbaiDocument1 pageState Common Entrance Test Cell, Maharashtra, MumbaiPushpak NikosePas encore d'évaluation

- SCB GarudaDocument34 pagesSCB Garudaisham1989Pas encore d'évaluation

- Month Wise Checklist For Submission of Various ReturnsDocument3 pagesMonth Wise Checklist For Submission of Various Returnsadith24Pas encore d'évaluation

- Application of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsDocument6 pagesApplication of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsmizaelledPas encore d'évaluation

- Kerala State Electricity Board Limited: Demand Cum Disconnection NoticeDocument2 pagesKerala State Electricity Board Limited: Demand Cum Disconnection Noticeroyal mspPas encore d'évaluation

- Economy Questions in UPSC Prelims (2022-2011)Document42 pagesEconomy Questions in UPSC Prelims (2022-2011)annu14307Pas encore d'évaluation

- Share MicrofinDocument68 pagesShare MicrofinMubeenPas encore d'évaluation

- Client AgreementDocument10 pagesClient AgreementAnonymous 4B1M0nwvvPas encore d'évaluation

- The Rise and Plummet of APP's Widjaja Family - WSJDocument10 pagesThe Rise and Plummet of APP's Widjaja Family - WSJEdgar BrownPas encore d'évaluation

- Icici Bank ProjectDocument70 pagesIcici Bank ProjectSonu Dhangar100% (2)

- PremiumDocument5 pagesPremiumSamaPas encore d'évaluation

- Pacing Guide-Financial LiteracyDocument6 pagesPacing Guide-Financial Literacyapi-377548294Pas encore d'évaluation