Académique Documents

Professionnel Documents

Culture Documents

Ofltr 4311063 181103114418718 1 3

Transféré par

폴로 쥰 차Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ofltr 4311063 181103114418718 1 3

Transféré par

폴로 쥰 차Droits d'auteur :

Formats disponibles

FIRST FLOOR, VIJAI SAI TOWERS

H NO 12-6-11/1/104, VIVEK NAGAR, KUKATPALY , HYDERABAD

PH:64632500, E-MAIL:URHOMEGUIDE.HYDERABAD@HDFC.COM

File No: 636941349/MINAK Offer Date: 02-NOV-2018

Service Center: KUKATPALLY

Place Of Service: KUKATPALLY

MR POLOJU NARSIMHA CHARY

PLOT NO 1275-1279

FLAT NO 204

LOTUS ANASUYA APT,PRAGATHI NAG

PRAGATHI NAGAR

HYDERABAD-AP - 500090

e

MRS POLOJU LAVANYA LATHA

Dear Sir/Madam,

at

We are pleased to inform you that we have in principle, approved a HOUSING LOAN as per the terms and

conditions mentioned below, special conditions if any, and other conditions mentioned overleaf.

lic

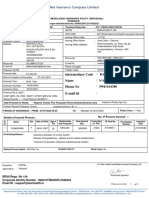

Amount Approved Rs. 9500000

Rate of Interest 9.05% p.a. on a Variable Rate basis **

Term 17 Years ***

Repayment Terms:

up

Rest Frequency Monthly Rest

Equated Monthly Instalment Rs. 91379 per month ***

Payable in 204 instalments ***

Processing Fee payable Rs. 11800

Processing Fee received Rs. 11800

D

** The interest rate announced by HDFC from time to time as its Retail Prime Lending Rate (RPLR) shall be

applicable to your loan with spread, if any. The current applicable rate of interest with spread, if any, is 9.05%

per annum.

*** This is subject to the provisions for variation thereof in terms of the loan agreement to be executed by you.

THIS LOAN APPROVAL IS SUBJECT TO LEGAL AND TECHNICAL CLEARANCE OF THE PROPERTY

BEING FINANCED; INCLUDING VALUATION OF THE PROPERTY AS ASSESSED BY HDFC LTD.

File No: 636941349 / 1 / MINAK Page No: 1 of 3

SPECIAL CONDITIONS:

1 THE LOAN AMOUNT WILL BE SUBJECT TO VALUATION OF THE PROPERTY, AS ASSESSED BY

HDFC LTD.

2 As per your request, this offer is being made to you under HDFC's ADJUSTABLE RATE HOME LOAN

scheme.

3 The rate of interest mentioned above is based on the currently prevailing RPLR and the same may vary

at the time of disbursement of the loan as well as during its pendency in terms of the said Loan

Agreement.

4 As a result of the variations in the interest rate the number of EMI's is liable to vary from time to time.

5 Loan will be disbursed subject to legal and technical clearance of the property financed.

6 You will be required to provide NACH mandate Form duly signed by you and all the other bank account

holders, authorizing your above Bank to debit the above mentioned account with the amount of the EMI

7 Stamp Duty on Memorandum of Deposit(MOD)of Title Deeds is payable as per the Telangana/Andhra

e

Pradesh Stamp Act at the rate of 0.50% of Loan Amount subject to maximum of Rs.50,000/- to be paid at

the time of or before first disbursement of Loan. MOD has to be duly Franked in Sub-Registrar office by

paying applicable stamp duty and the same has to be submitted as mentioned above

8

9 at

Repayment of the Loan in Equated Monthly Instalments (EMIs) will be from your Savings Bank a/c no

005710100018626 with ANDHRA BANK, through National Automated Clearing House (NACH) system

extent of funding will be subject to technical evaluation of the property financed and the policies prevailing

at the time of disbursement of the loan

lic

10 The loan amount shall not exceed 80% of the document/registered value of the property.

11 Subject to the property sale agreement / deed being executed as per the name/s mentioned in the KYC

document/s submitted by you to HDFC Ltd. In the event of any difference in the name/s mentioned in the

property sale agreement / deed and the KYC document/s, you will need to submit a duly notarized dual

up

name affidavit as per HDFC format before first disbursement of the loan

12 As required under new section 194-IA of the Income tax act w.e.f from 1st June 2013 the

Purchaser/Transfree/Buyer of property is required to deduct tax at source of 1%(higher rate in case PAN

number is not available) on behalf of the Vendor/Transferor/Seller on the consideration (if it is Rs 50 lacs

or more) for the transfer of the property. In view of the same, you will be required to provide necessary

evidence of having deducted the same and remitted to the Government Authorities before availing the

D

disbursement of the loan.

13 As required under new section 194-IA of the Income tax act w.e.f from 1st June 2013 the

Purchaser/Transfree/Buyer of property is required to deduct tax at source of 1%(higher rate in case PAN

number is not available) on behalf of the Vendor/Transferor/Seller on the consideration (if it is Rs 50 lacs

or more) for the transfer of the property. In view of the same, you will be required to provide necessary

evidence of having deducted the same and remitted to the Government Authorities before availing the

disbursement of the loan.

14 Disbursement of the loan will also be subject to submission of attested copies of documents in connection

with Proof of Residence and Proof of Identity as mentioned in the Application Form and HDFC finding the

same satisfactory.

15 For purposes of KYC Verification, MR POLOJU NARSIMHA CHARY will be required to carry the following

original documents : AADHAAR CARD / AADHAAR LETTER as Identity and Address Proof when he

visits us for availing of loan disbursement or prior to that.

File No: 636941349 / 1 / MINAK Page No: 2 of 3

16 For purposes of KYC Verification, MRS POLOJU LAVANYA LATHA will be required to carry the following

original documents : AADHAAR CARD / AADHAAR LETTER as Identity and Address Proof when she

visits us for availing of loan disbursement or prior to that.

You shall be required to bear and pay applicable stamp duty, all charges levied by the Central Registry of

Securitization Asset Reconstruction and Security Interest of India (CERSAI) and all statutory / regulatory

charges / taxes on account of the Loan or the Security, that are presently applicable and as may be made

applicable from time to time, during the pendency of the loan. These charges are non- refundable in nature

and payable at the point of disbursement / applicability and thereafter as and when due and payable at the

rate as applicable on such date of disbursement / applicability.

The current charges stipulated by CERSAI are as under:

(1) For loans upto Rs 5.00 Lakhs (for an original filing and for modification): Rs.50 (per filing/modification)

(2) For loans above Rs 5.00 Lakhs (for an original filing and for modification): Rs.100 (per filing/modification)

e

at

We will be happy to expedite disbursement of this loan and request you to contact KISHORE VALIVETI on

040- 48539201 at our KUKATPALLY office to complete the necessary formalities required by HDFC.

lic

We look forward to hearing from you.

Yours faithfully,

For Housing Development Finance Corporation Limited,

up

Authorised Signatory

D

File No: 636941349 / 1 / MINAK Page No: 3 of 3

Vous aimerez peut-être aussi

- Duplicate: 1 of Page No: File No: / 1 / 2Document2 pagesDuplicate: 1 of Page No: File No: / 1 / 2Anand AdkarPas encore d'évaluation

- D JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219Document2 pagesD JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219amardeepjassal85Pas encore d'évaluation

- Welcome Letter - 203319753 PDFDocument6 pagesWelcome Letter - 203319753 PDFRITIK DESHBHRATARPas encore d'évaluation

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentRohit chavanPas encore d'évaluation

- 2018091800024Document3 pages2018091800024Gunjan ShahPas encore d'évaluation

- 4 PDFDocument4 pages4 PDFsatish sharmaPas encore d'évaluation

- HDFC Loan Approval for Consumer Durable PurchaseDocument1 pageHDFC Loan Approval for Consumer Durable PurchaseSâñjây Bîñd0% (1)

- No Objetion Certificate (NOC) - 171527283Document1 pageNo Objetion Certificate (NOC) - 171527283sk.iliyas riyasPas encore d'évaluation

- Welcome LetterDocument4 pagesWelcome LetterChetan ChoudharyPas encore d'évaluation

- Loan Sanction-Letter181240016761170869Document3 pagesLoan Sanction-Letter181240016761170869Sanjay MohapatraPas encore d'évaluation

- Policy Protection PlanDocument36 pagesPolicy Protection Plankrishna_1238Pas encore d'évaluation

- Gade Sanction LetterDocument1 pageGade Sanction LetterSwapnil Gade007Pas encore d'évaluation

- Sanction Letter SpecimenDocument25 pagesSanction Letter SpecimenJoyson JoyPas encore d'évaluation

- Branch Code 05999 Home Loan Interest CertificateDocument1 pageBranch Code 05999 Home Loan Interest CertificateKRIS BARSAGADE100% (1)

- Life Motors: Shantanu BLDG, Shop No8/9, Pawar Nagar, Thane (West), Thane:400601Document2 pagesLife Motors: Shantanu BLDG, Shop No8/9, Pawar Nagar, Thane (West), Thane:400601abhishek pandeyPas encore d'évaluation

- HDFC Loan EMI Payment ReceiptDocument1 pageHDFC Loan EMI Payment ReceiptPrasadPas encore d'évaluation

- IBL Noc LETTERDocument2 pagesIBL Noc LETTERrshyamsolanki1488Pas encore d'évaluation

- No Objection Certificate PDFDocument1 pageNo Objection Certificate PDFpropvisor real estate100% (1)

- Img PDFDocument2 pagesImg PDFlalit chhabraPas encore d'évaluation

- Credit Card Bill Payments Rs 130.38 IndusIndDocument1 pageCredit Card Bill Payments Rs 130.38 IndusIndPriyanka VermaPas encore d'évaluation

- Higher Education Loans BoardDocument8 pagesHigher Education Loans BoardDON ONNYANGOPas encore d'évaluation

- Loan AgreementDocument20 pagesLoan AgreementRANJIT BISWAL (Ranjit)Pas encore d'évaluation

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinPas encore d'évaluation

- E Sign DocDocument26 pagesE Sign DocShaik ShabanaPas encore d'évaluation

- Bajaj Finserv Loan ApprovalDocument2 pagesBajaj Finserv Loan Approvalprsnjt11Pas encore d'évaluation

- Variable Rate Home Loan Interest DeductionDocument1 pageVariable Rate Home Loan Interest DeductionSelvakumaran GPas encore d'évaluation

- Loan Details: TWO - Wheeler Sandhya Automotives, KURNOOLDocument1 pageLoan Details: TWO - Wheeler Sandhya Automotives, KURNOOLmohammed rafiPas encore d'évaluation

- 9473667098713233264Document1 page9473667098713233264Parth NayakPas encore d'évaluation

- Acknowledgement Slip: Fixed DepositDocument1 pageAcknowledgement Slip: Fixed DepositAneesh BangiaPas encore d'évaluation

- Bussan Auto FinanceDocument1 pageBussan Auto FinanceBaskoro MahendraPas encore d'évaluation

- Ratankumar Singha PDFDocument2 pagesRatankumar Singha PDFRatan Kumar SinghaPas encore d'évaluation

- 11 September, 2023 The Manager State Bank of India Jagtial 7-6-248, ASHOK NAGAR, JAGTIAL, Telangana 505327Document1 page11 September, 2023 The Manager State Bank of India Jagtial 7-6-248, ASHOK NAGAR, JAGTIAL, Telangana 505327For InsurancePas encore d'évaluation

- Muthoot Finance Loan Sanction LetterDocument30 pagesMuthoot Finance Loan Sanction LetterTHE PHILOSOPHER MADDYPas encore d'évaluation

- Rate of Interest (% P.a.)Document2 pagesRate of Interest (% P.a.)MeePas encore d'évaluation

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshPas encore d'évaluation

- Registered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Document1 pageRegistered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Khushi Jain100% (1)

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- Star HealthDocument1 pageStar HealthpalanivelPas encore d'évaluation

- No Objection CertificateDocument1 pageNo Objection CertificateSenthil KumarPas encore d'évaluation

- DHLF - Loan Sanction LetterDocument2 pagesDHLF - Loan Sanction LetterRaju BhaiPas encore d'évaluation

- Branch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRavi Kumar100% (1)

- No Objection CertificateDocument1 pageNo Objection CertificateKhalid Mohammad Khalid Tanwiri67% (3)

- PAYMENT RECEIPT DETAILSDocument1 pagePAYMENT RECEIPT DETAILSSivaPas encore d'évaluation

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiPas encore d'évaluation

- Certificate of Registration-Form 23Document1 pageCertificate of Registration-Form 23Joy GudivadaPas encore d'évaluation

- Car Loan Interest RateDocument9 pagesCar Loan Interest RateOnkar ChavanPas encore d'évaluation

- No Objetion Certificate (NOC) - 002138377: Download NowDocument6 pagesNo Objetion Certificate (NOC) - 002138377: Download NowSolar ShopePas encore d'évaluation

- Branch Code:04789 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:04789 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificatekabuldasPas encore d'évaluation

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07Pas encore d'évaluation

- Gold Loan-33000-NOCDocument1 pageGold Loan-33000-NOCDipra DasPas encore d'évaluation

- Ganga Prasad's 8.5% Fixed Deposit Maturing in Sep 2014Document1 pageGanga Prasad's 8.5% Fixed Deposit Maturing in Sep 2014dpk0Pas encore d'évaluation

- HDFC Home Loan Deduction StatementDocument1 pageHDFC Home Loan Deduction StatementArunPas encore d'évaluation

- Hlintcertificate BIDHAN64 PDFDocument1 pageHlintcertificate BIDHAN64 PDFBIDHANPas encore d'évaluation

- Prepayment of Your ICICI Bank Loan Account:XXXXXXXXXXXX1963Document2 pagesPrepayment of Your ICICI Bank Loan Account:XXXXXXXXXXXX1963LavSainiPas encore d'évaluation

- Provisional Fy 20-21Document1 pageProvisional Fy 20-21Kedar YadavPas encore d'évaluation

- Sample E-Sanction LetterDocument1 pageSample E-Sanction LettersamPas encore d'évaluation

- Insta Overdraft Facility (Insta Od) Application FormDocument8 pagesInsta Overdraft Facility (Insta Od) Application Formsanjay sharmaPas encore d'évaluation

- Ofltr 11396303 230505060649878 1 1Document3 pagesOfltr 11396303 230505060649878 1 1mazhar shaikhPas encore d'évaluation

- Maruti, Rekhi House A-2/7 Safdardarjung Enclave Opp B Cama Place 0 Gurgaon Haryana 0Document1 pageMaruti, Rekhi House A-2/7 Safdardarjung Enclave Opp B Cama Place 0 Gurgaon Haryana 0pardeep sanwalPas encore d'évaluation

- Quality - in - Construction With Case Studies ConclusionsDocument12 pagesQuality - in - Construction With Case Studies Conclusions폴로 쥰 차Pas encore d'évaluation

- Epi Bang 2019 Ot Q 20 01Document6 pagesEpi Bang 2019 Ot Q 20 01폴로 쥰 차Pas encore d'évaluation

- RFP For APSCLDocument114 pagesRFP For APSCL폴로 쥰 차Pas encore d'évaluation

- Map ElasticDocument6 pagesMap Elastic폴로 쥰 차Pas encore d'évaluation

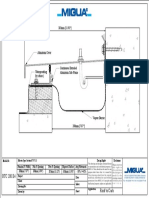

- Mapegroutt 60Document4 pagesMapegroutt 60폴로 쥰 차Pas encore d'évaluation

- Concrete Technology by Prof Manu Santhanam IITMDocument23 pagesConcrete Technology by Prof Manu Santhanam IITM폴로 쥰 차Pas encore d'évaluation

- Migumax RTC 200 E4Document1 pageMigumax RTC 200 E4폴로 쥰 차Pas encore d'évaluation

- Introduction To SSIDocument45 pagesIntroduction To SSIalshaijiPas encore d'évaluation

- ACI318-19 Public Discussion Draft PDFDocument988 pagesACI318-19 Public Discussion Draft PDFMauro FragosoPas encore d'évaluation

- ACI 318-19 Updates Simplified Shear ProvisionsDocument52 pagesACI 318-19 Updates Simplified Shear Provisions폴로 쥰 차Pas encore d'évaluation

- DBR Rev G 26th Sept PDFDocument51 pagesDBR Rev G 26th Sept PDF폴로 쥰 차Pas encore d'évaluation

- Fema 273Document435 pagesFema 273Kali Bahadur Shahi100% (1)

- Node Spring Calculation For 500mm Dia Pile-MOWS: Reference Bore Hole: BH-04 0.50 Node-1 Clay 1.00 1.00 11 147 25Document64 pagesNode Spring Calculation For 500mm Dia Pile-MOWS: Reference Bore Hole: BH-04 0.50 Node-1 Clay 1.00 1.00 11 147 25폴로 쥰 차Pas encore d'évaluation

- CED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and ConcreteDocument97 pagesCED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and Concrete폴로 쥰 차Pas encore d'évaluation

- Draft Discussions On 4TH Amendment of Is 456Document6 pagesDraft Discussions On 4TH Amendment of Is 456Santhosh Kumar BaswaPas encore d'évaluation

- EQTip 08Document2 pagesEQTip 08raj_ferrariPas encore d'évaluation

- Fema 450Document356 pagesFema 450Gabriel Patilea100% (2)

- Draft Is 1893 Part 1 Proposed Code and Commentary1Document151 pagesDraft Is 1893 Part 1 Proposed Code and Commentary1Anonymous Fg64UhXzilPas encore d'évaluation

- Hal Testrig - Design Report PDFDocument154 pagesHal Testrig - Design Report PDF폴로 쥰 차Pas encore d'évaluation

- CED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and ConcreteDocument97 pagesCED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and Concrete폴로 쥰 차Pas encore d'évaluation

- ACI 355.4 Modifications to Adhesive Anchor StandardDocument3 pagesACI 355.4 Modifications to Adhesive Anchor Standard폴로 쥰 차Pas encore d'évaluation

- Structural Design Narrative 10.10.18Document10 pagesStructural Design Narrative 10.10.18폴로 쥰 차Pas encore d'évaluation

- CED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and ConcreteDocument97 pagesCED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and Concrete폴로 쥰 차Pas encore d'évaluation

- ACI 355.4 Modifications to Adhesive Anchor StandardDocument3 pagesACI 355.4 Modifications to Adhesive Anchor Standard폴로 쥰 차Pas encore d'évaluation

- Uss-04-Ddp 2017Document5 pagesUss-04-Ddp 2017폴로 쥰 차Pas encore d'évaluation

- IS 11384-Comments-JustificationDocument4 pagesIS 11384-Comments-Justification폴로 쥰 차Pas encore d'évaluation

- Floor Response Spectrum Analysis in STAAD.ProDocument7 pagesFloor Response Spectrum Analysis in STAAD.Pro폴로 쥰 차Pas encore d'évaluation

- CED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and ConcreteDocument97 pagesCED 38 (13455) WC Draft Revision of IS 11384 Code of Practice for Composite Construction in Structural Steel and Concrete폴로 쥰 차Pas encore d'évaluation

- Deterioration and Restoration of Concret PDFDocument10 pagesDeterioration and Restoration of Concret PDF폴로 쥰 차Pas encore d'évaluation

- Structural Design Narrative 10.10.18Document50 pagesStructural Design Narrative 10.10.18폴로 쥰 차Pas encore d'évaluation

- 2015 SALN Form BLANK 1 Annex 35 For Saln 2022Document2 pages2015 SALN Form BLANK 1 Annex 35 For Saln 2022Bediones Econ ClassPas encore d'évaluation

- Advanced ExcelDocument6 pagesAdvanced ExcelKeith Parker100% (4)

- Time Value of Money CalculatorDocument22 pagesTime Value of Money CalculatorSuganyaPas encore d'évaluation

- Chapter 3Document24 pagesChapter 3kietlet0Pas encore d'évaluation

- 103 162-34-102-PT PBI TBK Konsol Juni 2021 FinalDocument103 pages103 162-34-102-PT PBI TBK Konsol Juni 2021 FinalArio PramestiPas encore d'évaluation

- Corporate Finance Chapter 1-2 SummaryDocument140 pagesCorporate Finance Chapter 1-2 SummarySebastian Manfred StreyffertPas encore d'évaluation

- Accounting A Level Teacher Notes SeriesDocument47 pagesAccounting A Level Teacher Notes SeriesStad100% (1)

- Salary Loan/Advance - Application Form: Personal InformationDocument2 pagesSalary Loan/Advance - Application Form: Personal InformationJohn Ray Velasco100% (1)

- Section 14 Unab Rid Dged Written VersionDocument17 pagesSection 14 Unab Rid Dged Written VersionPrashant TrivediPas encore d'évaluation

- Mini MBA 2020 12 Month ProgrammeDocument8 pagesMini MBA 2020 12 Month Programmelaice100% (1)

- Credit RiskDocument30 pagesCredit RiskVineeta HPas encore d'évaluation

- Compendium of PNB Products & ServicesDocument125 pagesCompendium of PNB Products & ServicesRomanshu PorwalPas encore d'évaluation

- ACC For LEASEDocument11 pagesACC For LEASETanya PiaPas encore d'évaluation

- AS-AD ModelDocument5 pagesAS-AD ModelSunil VuppalaPas encore d'évaluation

- NIDHI CementpVT LTD MBA Project Report Prince DudhatraDocument50 pagesNIDHI CementpVT LTD MBA Project Report Prince DudhatrapRiNcE DuDhAtRaPas encore d'évaluation

- Chen 2020Document20 pagesChen 2020KANA BITTAQIYYAPas encore d'évaluation

- Authorized Real-Time Data Vendors ListDocument1 pageAuthorized Real-Time Data Vendors ListjrladduPas encore d'évaluation

- SSRN Id923557 PDFDocument11 pagesSSRN Id923557 PDFMuhammad Ali HaiderPas encore d'évaluation

- ABM 12 (Cash Flow Statement) CFSDocument6 pagesABM 12 (Cash Flow Statement) CFSWella LozadaPas encore d'évaluation

- 052181782XDocument343 pages052181782Xbishalsigdel100% (2)

- Anti Bouncing Law, Pdic, Bank Secrecy Law and Truth in Lending Act.Document12 pagesAnti Bouncing Law, Pdic, Bank Secrecy Law and Truth in Lending Act.dash zarinaPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raj MehtaPas encore d'évaluation

- ONGC Standalone Balance SheetDocument6 pagesONGC Standalone Balance SheetSHUBHI MAKHIJANIPas encore d'évaluation

- K-Pop Album and Merchandise Order SummaryDocument13 pagesK-Pop Album and Merchandise Order SummaryDodger AmarinePas encore d'évaluation

- Valuation of BondsDocument7 pagesValuation of BondsHannah Louise Gutang PortilloPas encore d'évaluation

- Does Credit Growth Impact Credit Quality of Commercial Banks in Dong Nai, VietnamDocument7 pagesDoes Credit Growth Impact Credit Quality of Commercial Banks in Dong Nai, VietnamViệt Vi VuPas encore d'évaluation

- Examples of CRS Entity TypesDocument2 pagesExamples of CRS Entity TypesBill KelsoPas encore d'évaluation

- Understand The Flows of Significant Classes of Transactions, Including Walk-Through - Cash DisbursementsDocument11 pagesUnderstand The Flows of Significant Classes of Transactions, Including Walk-Through - Cash DisbursementsmohihsanPas encore d'évaluation

- Fairfax-Backed Fairchem Speciality To Restructure Business: Insolvency DemergerDocument40 pagesFairfax-Backed Fairchem Speciality To Restructure Business: Insolvency Demergerpriyanka valechhaPas encore d'évaluation

- Tugas 1 Akuntansi PengantarDocument6 pagesTugas 1 Akuntansi PengantarblademasterPas encore d'évaluation