Académique Documents

Professionnel Documents

Culture Documents

R S T I: Esidence and Cope of Otal Ncome

Transféré par

Mnk BhkDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

R S T I: Esidence and Cope of Otal Ncome

Transféré par

Mnk BhkDroits d'auteur :

Formats disponibles

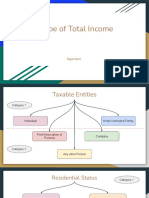

RESIDENCE AND SCOPE OF TOTAL INCOME

Scope of Total Income and Tax incidence on an assessee depends on his residential status. For instance, whether

an income earned by a person in India or outside India, is taxable or not in India depends upon the residential

status of the person in India. Similarly, whether an income earned by a foreign national in India or outside India,

is taxable or not in India depends on the residential status of the individual in India, rather than on his citizenship.

Therefore, the determination of the residential status of a person is very significant in order to find out his tax

liability.

CONCEPT OF RESIDENTIAL STATUS

The following norms one has to keep in mind while deciding the residential status of an assessee;

1]. Different Taxable Entities – All taxable entities are divided in the following categories for the purpose of

determining residential status;

i]. An individual;

ii]. A Hindu undivided family;

iii]. A firm or an association of persons;

iv]. A company; and

v]. Every other person.

2]. Different Residential Status – An assessee is either;

i]. Resident in India, or

ii]. Non-resident in India.

However, a resident individual or a Hindu undivided family can be;

(a) Resident and Ordinarily Resident, or

(b) Resident but Not Ordinarily Resident.

Therefore, an Individual and a Hindu Undivided Family can either be; (i) resident and ordinarily resident in

India; or (ii) resident but not ordinarily resident in India; or (iii) non-resident in India.

All other assessees (viz., a Firm, an Association of Persons, a Company and Every Other Person) can either be;

(i) resident in India; or (ii) non-resident in India.

3]. Residential status for each Previous Year – Residential status of an assessee is to be determined in respect

of each previous year as it may vary from previous year to previous year.

4]. Different residential status for different Assessment Years – An assessee may enjoy different residential

status for different assessment years. For instance, an individual who has been regularly assessed as resident

and ordinarily resident has to be treated as non-resident in a particular assessment year if he satisfies none

of the conditions of section 6(1).

CA Pinky Agarwal Page 1

5]. Resident in India and Abroad – It is not necessary that a person, who is “resident” in India, cannot become

“resident” in any other country for the same assessment year. A person may be resident in two (or more)

countries at the same time. It is, therefore, not necessary that a person who is resident in India will be non-

resident in all other countries for the same assessment year.

RESIDENTIAL STATUS OF AN INDIVIDUAL [SECTION 6(1)]

Resident & Ordinarily Resident Resident but Not Ordinarily Non Resident (NR)

(ROR) Resident (RNOR)

Must satisfy at least one of the Must satisfy at least one of basic Not satisfy any of the basic

basic conditions & both the conditions & satisfy one or none of conditions

additional conditions the additional conditions

BASIC CONDITIONS AT A GLANCE

(a) He is in India in the previous year for a period of 182 days or more;

(b) He is in India for a period of 60 days or more during the previous year and 365 days or more during 4 years

immediately preceding the previous year.

However, in the following two cases, an individual needs to be present in India for a minimum of 182 days or

more in order to become resident in India

i]. An Indian citizen who leaves India during the previous year for the purpose of taking employment outside

India or an Indian citizen leaving India during the previous year as a member of the crew of an Indian ship.

ii]. An Indian citizen or a person of Indian origin who comes on visit to India during the previous year (a person

is said to be of Indian origin if either he or any of his parents or any of his grand parents was born in

undivided India).

ADDITIONAL CONDITIONS [SECTION 6(6)]

i]. He has been resident in India in at least 2 out of 10 previous years [according to basic condition noted

above] immediately preceding the relevant previous year.

ii]. He has been in India for a period of 730 days or more during 7 years immediately preceding the relevant

previous year.

It will be worthwhile to note the following propositions;

➔ It is not essential that the stay should be at the same place. It is equally not necessary that the stay should

be continuous. Similarly, the place of stay or the purpose of stay is also not material.

➔ Where a person is in India only for a part of a day, the calculation of physical presence in India in respect of

such broken period should be made on an hourly basis. A total of 24 hours of stay spread over a number of

days is to be counted as being equivalent to the stay of one day.

CA Pinky Agarwal Page 2

➔ If, however, data is not available to calculate the period of stay of an individual in India in terms of hours,

then the day on which he enters India as well as the day on which he leaves India shall be taken into account

as stay of the individual in India.

RESIDENTIAL STATUS OF A HINDU UNDIVIDED FAMILY [HUF] [SECTION 6(2)]

A Hindu undivided family is said to be Resident (ROR/RNOR) in India if control and management of its affairs is

wholly or partly situated in India. A Hindu undivided family is non-resident (NR) in India if control and

management of its affairs is wholly situated outside India.

➔ Control and management means de facto control and management and not merely the right to control or

manage. Control and management is situated at a place where the head, the seat and the directing power

are situated.

➔ If the HUF is resident, then the status of the Karta determines whether it is resident and ordinarily resident

or resident but not ordinarily resident. If the karta is resident and ordinarily resident, then the HUF is resident

and ordinarily resident and if the karta is resident but not ordinarily resident, then HUF is resident but not

ordinarily resident.

RESIDENTIAL STATUS OF FIRM AND ASSOCIATION OF PERSONS [SECTION 6(2)]

A partnership firm and an association of persons are said to be resident in India if control and management of

their affairs are wholly or partly situated within India during the relevant previous year. They are, however,

treated as non-resident in India if control and management of their affairs are situated wholly outside India.

RESIDENTIAL STATUS OF A COMPANY [SECTION 6(3)]

➔ An Indian company is always resident in India.

➔ its place of effective management, in that year, is in India.

“Place of effective management”(POEM) has been defined to mean a place where key management and

commercial decisions that are necessary for the conduct of the business of an entity as a whole are, in

substance, made.

Guiding Principles for determining POEM of a company were issued by Circular No.6 of 2017 on 24th

January, 2017. Press Release on POEM guidelines dated 24th January, 2017 has, inter alia, stated that the

POEM guidelines shall not apply to a company having turnover or gross receipts of Rs. 50 crores or less in a

financial year under clause (ii) of sub section (3) of section 6 of the Act

RESIDENTIAL STATUS OF EVERY OTHER PERSON [SECTION 6(4)]

Every other person is resident in India if control and management of his affairs is, wholly or partly, situated within

India during the relevant previous year. On the other hand, every other person is non-resident in India if control

and management of its affairs is wholly situated outside India.

CA Pinky Agarwal Page 3

SCOPE OF INCOME AND INCIDENCE OF TAX [SECTION 5]

Scope of Income and incidence of tax on a taxpayer depends on his residential status and also on the place and

time of accrual or receipt of income. The following table summarizes the incidence of tax;

Whether tax incidence arises in the case

of

ROR RNOR NR

[1] Income received in India (for the 1st time) whether accrued in Yes Yes Yes

India or outside India

[2] Income deemed to be received in India whether accrued in India Yes Yes Yes

or outside India

[3] Income accruing or arising in India whether received in India or Yes Yes Yes

Outside India

[4] Income deemed to accrue or arise in India whether received in Yes Yes Yes

India or Outside India

[5] Income received and accrued outside India from a business Yes Yes No

controlled in or a profession set up in India

[6] Income received and accrued outside India from a business Yes No No

controlled from outside India or a profession set up outside India

[7] Income earned and received outside India for an earlier year, No No No

but remitted to India in the current year – Tax incidence at the

time or remittance [as earlier taxed on accrual or due basis]

From the above, following broad conclusions can be drawn;

A]. Indian Income [case (1) to (4)] –

Taxable in India irrespective of the residential status of the taxpayer.

B]. Foreign Income [case 5 & 6] –

i]. Taxable, in the hands of resident (in case of a firm, an association of persons, a joint stock company and

every other person) or resident and ordinarily resident (in case of an individual and a Hindu undivided

family) in India.

ii]. Not taxable, in the hands of non-resident in India.

iii]. Taxable, in the hands of resident but not ordinarily resident taxpayer only if it is (a) business income and

business is controlled from India, or (b) professional income from a profession which is set up in India.

CA Pinky Agarwal Page 4

In any other case, foreign income is not taxable in the hands of resident but not ordinarily resident

taxpayers.

****

CA Pinky Agarwal Page 5

Vous aimerez peut-être aussi

- Joint Hindu Family BusinessDocument17 pagesJoint Hindu Family BusinessSanjay Chinnala75% (4)

- Residential Status and Tax IncidenceDocument46 pagesResidential Status and Tax IncidenceÄbhíñävJäíñPas encore d'évaluation

- Income TaxDocument14 pagesIncome Taxankit srivastavaPas encore d'évaluation

- Residential Status DC 2023-24Document11 pagesResidential Status DC 2023-24avinashhpv7785Pas encore d'évaluation

- Residential Status Under Income-Tax Act, 1961Document6 pagesResidential Status Under Income-Tax Act, 1961Bharat Tailor100% (1)

- Chapter-2 Residential StatusDocument5 pagesChapter-2 Residential StatusBrinda RPas encore d'évaluation

- Section 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersonDocument8 pagesSection 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersondipxxxPas encore d'évaluation

- Income Tax and Law UNIT-1 Part2Document26 pagesIncome Tax and Law UNIT-1 Part2rashmianand712Pas encore d'évaluation

- Residential Status and Tax IncedenceDocument46 pagesResidential Status and Tax IncedenceAmit YadavPas encore d'évaluation

- DTP 2nd ModuleDocument6 pagesDTP 2nd ModuleVeena GowdaPas encore d'évaluation

- B71fedca 95fa 4b5b B32e A2fa493fbdeaDocument22 pagesB71fedca 95fa 4b5b B32e A2fa493fbdeaRaj DasPas encore d'évaluation

- It - Lesson 3Document14 pagesIt - Lesson 3Sugandha AgarwalPas encore d'évaluation

- 2 Residential StatusDocument30 pages2 Residential StatusVEDANT SAINIPas encore d'évaluation

- Direct Tax Summary NotesDocument88 pagesDirect Tax Summary NotesAlisha LukePas encore d'évaluation

- Residential Status: Presented ByDocument17 pagesResidential Status: Presented ByRohit SinghPas encore d'évaluation

- TaxassignmentDocument7 pagesTaxassignmentMuditPas encore d'évaluation

- e Book PDF PDFDocument91 pagese Book PDF PDFGiri SukumarPas encore d'évaluation

- Residential Status and Tax IncidenceDocument4 pagesResidential Status and Tax IncidenceAshok Kumar MehetaPas encore d'évaluation

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax IncidenceAshok Kumar Meheta0% (1)

- Residential Status and Incidence of Tax On Income Under Income Tax ActDocument6 pagesResidential Status and Incidence of Tax On Income Under Income Tax ActhaseefaPas encore d'évaluation

- Residential Status and Tax Incidence: Dr. Niti SaxenaDocument11 pagesResidential Status and Tax Incidence: Dr. Niti SaxenaYusufPas encore d'évaluation

- Residential StatusDocument40 pagesResidential StatusSankalp ShuklaPas encore d'évaluation

- Model Answers Law of TaxationDocument46 pagesModel Answers Law of Taxationlavkush1234Pas encore d'évaluation

- Caa0eresidential StatusDocument13 pagesCaa0eresidential StatusShashwat MishraPas encore d'évaluation

- Residential StatusDocument9 pagesResidential Statussadhana20bbaPas encore d'évaluation

- Residential Status ppt1Document17 pagesResidential Status ppt1Reddy ReddyPas encore d'évaluation

- Residential Status ppt1Document17 pagesResidential Status ppt1Prasanna ReddyPas encore d'évaluation

- MB FM 03 TAX PLANNING AND FINANCIAL REPORTING New-1Document70 pagesMB FM 03 TAX PLANNING AND FINANCIAL REPORTING New-1Khushboo SinghPas encore d'évaluation

- TaxassignmentDocument7 pagesTaxassignmentMuditPas encore d'évaluation

- Types of Residents: Resident Non-ResidentDocument25 pagesTypes of Residents: Resident Non-ResidentPJ 123Pas encore d'évaluation

- Unit 3Document20 pagesUnit 3Ram KrishnaPas encore d'évaluation

- 4thSem-Taxation-1-Residential Status by Avinash K Prasad - 26Apr2020-DayDocument9 pages4thSem-Taxation-1-Residential Status by Avinash K Prasad - 26Apr2020-Dayvijay anandPas encore d'évaluation

- Resdential Status Questionsby Garun Kumar GDCM SrikakulamDocument9 pagesResdential Status Questionsby Garun Kumar GDCM Srikakulamgeddadaarun100% (1)

- Law of Taxation Law of Taxation Class Notes CompressDocument48 pagesLaw of Taxation Law of Taxation Class Notes CompressThrishul MaheshPas encore d'évaluation

- Residential Status and Incidence of Tax - Study MaterialDocument6 pagesResidential Status and Incidence of Tax - Study MaterialEmeline SoroPas encore d'évaluation

- Day4 Residential Status and Incidence of Tax (9 Oct)Document12 pagesDay4 Residential Status and Incidence of Tax (9 Oct)1986anuPas encore d'évaluation

- E Text Week 1 Module 1.5Document5 pagesE Text Week 1 Module 1.5bsc slpPas encore d'évaluation

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Document47 pagesModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Samata BohraPas encore d'évaluation

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Document44 pagesModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Tejasvini KhemajiPas encore d'évaluation

- Residential Status: Vaibhav BanjanDocument14 pagesResidential Status: Vaibhav Banjandeepika gawasPas encore d'évaluation

- Taxation 13Document14 pagesTaxation 13Ayush RainaPas encore d'évaluation

- Residential Status: Vaibhav BanjanDocument14 pagesResidential Status: Vaibhav BanjanAnmolPas encore d'évaluation

- Residential Status: A Project On Residential Status in India and The Effects of Tax On It. Made By: Somrita PalDocument17 pagesResidential Status: A Project On Residential Status in India and The Effects of Tax On It. Made By: Somrita Palsousam2387Pas encore d'évaluation

- Presentation On Residential Status & Its Incidence On Tax LiabilityDocument13 pagesPresentation On Residential Status & Its Incidence On Tax LiabilitypriyaniPas encore d'évaluation

- Scope of Total Income U/S. 5: Presented To:-Prof. SeemaDocument17 pagesScope of Total Income U/S. 5: Presented To:-Prof. SeemaRaksha ShettyPas encore d'évaluation

- Tax Residential Status and Its Effect On Tax IncidenceDocument10 pagesTax Residential Status and Its Effect On Tax IncidenceAtul AgrawalPas encore d'évaluation

- 1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee IsDocument14 pages1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee Isdhananjay7Pas encore d'évaluation

- Residential Status and Scope of Total IncomeDocument19 pagesResidential Status and Scope of Total IncomeSamyak JainPas encore d'évaluation

- Residential Status Cma IndaDocument10 pagesResidential Status Cma IndaKiran ChristyPas encore d'évaluation

- Residential StatusDocument20 pagesResidential StatusroopamPas encore d'évaluation

- Residential Status and Scope of Total Income - AY 2023 - 24Document12 pagesResidential Status and Scope of Total Income - AY 2023 - 24Rajan SundararajanPas encore d'évaluation

- Corporate Tax Planning: Unit IDocument35 pagesCorporate Tax Planning: Unit ILavanya KasettyPas encore d'évaluation

- Taxation Final ProjectDocument12 pagesTaxation Final ProjectShreya KalyaniPas encore d'évaluation

- Residential Status (Individual) : 1. Basic Condition 2. Additional Condition (Subsequent Condition)Document5 pagesResidential Status (Individual) : 1. Basic Condition 2. Additional Condition (Subsequent Condition)Ali NadafPas encore d'évaluation

- Residence Status and Tax LiabilityDocument14 pagesResidence Status and Tax LiabilityDrafts StoragePas encore d'évaluation

- TAX Planning AssigmentDocument11 pagesTAX Planning AssigmentKaba TidianePas encore d'évaluation

- IT-02 Residential StatusDocument26 pagesIT-02 Residential StatusAkshat GoyalPas encore d'évaluation

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax Incidenceambarishan mrPas encore d'évaluation

- Scope of Total IncomeDocument17 pagesScope of Total IncomeAvishiPas encore d'évaluation

- Residentail StatusDocument11 pagesResidentail StatusRashmi JayaprakashPas encore d'évaluation

- M&A Process Hostile Takeover & Takeover Defenses Valuation of IntangiblesDocument30 pagesM&A Process Hostile Takeover & Takeover Defenses Valuation of IntangiblesMnk BhkPas encore d'évaluation

- Basics of Islamic BankingDocument6 pagesBasics of Islamic BankingMnk BhkPas encore d'évaluation

- Control of Industrial PollutionDocument8 pagesControl of Industrial PollutionMnk BhkPas encore d'évaluation

- Study Material For Final ExamsDocument16 pagesStudy Material For Final ExamsMnk BhkPas encore d'évaluation

- Corporate Law ProjectDocument14 pagesCorporate Law Projectruchikajha18Pas encore d'évaluation

- Family Law 2 Unit 1 Joint Hindu Family: KartaDocument7 pagesFamily Law 2 Unit 1 Joint Hindu Family: Kartamilan singhPas encore d'évaluation

- Hindu LawDocument17 pagesHindu LawSundeep RauPas encore d'évaluation

- Residential Status of A Person Determines Whether The Person's Income Is Chargeable To Tax in India or NotDocument22 pagesResidential Status of A Person Determines Whether The Person's Income Is Chargeable To Tax in India or Notkshitizjain07Pas encore d'évaluation

- Family Law Project Final PDFDocument13 pagesFamily Law Project Final PDFDevesh AroraPas encore d'évaluation

- Family Law IIDocument26 pagesFamily Law IISIA GANJUPas encore d'évaluation

- CA Final Direct Tax Laws - MCQ On HUFDocument3 pagesCA Final Direct Tax Laws - MCQ On HUFAadish JainPas encore d'évaluation

- A Hindu Joint Family or Hindu Undivided FamilyDocument5 pagesA Hindu Joint Family or Hindu Undivided Familyurs3012Pas encore d'évaluation

- Aligarh Muslim University Department of Law GCT-1Document12 pagesAligarh Muslim University Department of Law GCT-1MOHAMAMD ZIYA ANSARIPas encore d'évaluation

- IT-02 Residential StatusDocument26 pagesIT-02 Residential StatusAkshat GoyalPas encore d'évaluation

- By Kavita Singh Associate Professor Nliu: Hindu Joint FamilyDocument20 pagesBy Kavita Singh Associate Professor Nliu: Hindu Joint FamilyRadheyPas encore d'évaluation

- Aligarh Muslim University Department of Law GCT-1Document12 pagesAligarh Muslim University Department of Law GCT-1MOHAMAMD ZIYA ANSARIPas encore d'évaluation

- Family Law Notes: What Are The Types of Property That Are Dealt With Under The Law of Succession?Document4 pagesFamily Law Notes: What Are The Types of Property That Are Dealt With Under The Law of Succession?Varun RoyPas encore d'évaluation

- Commissioner of Income Tax, Bombay v. Gomedalli LakshminarayanDocument16 pagesCommissioner of Income Tax, Bombay v. Gomedalli LakshminarayankareenaPas encore d'évaluation

- Vested, Contingent InterestDocument7 pagesVested, Contingent InterestShivam KumarPas encore d'évaluation

- GDDocument7 pagesGDKrishna PriyaPas encore d'évaluation

- Power of Sole Surviving Coparcener Over Ancestral PropertyDocument15 pagesPower of Sole Surviving Coparcener Over Ancestral PropertyRavi PrakashPas encore d'évaluation

- Karnataka Land Reforms Circulars CollectionsDocument74 pagesKarnataka Land Reforms Circulars CollectionsSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (8)

- Faculty of Law, Jamia Millia Islamia Project Report On Hindu Joint Family 2018-2019Document17 pagesFaculty of Law, Jamia Millia Islamia Project Report On Hindu Joint Family 2018-2019Harshit AgarwalPas encore d'évaluation

- Joint Family PropertyDocument9 pagesJoint Family PropertyP TejeswariPas encore d'évaluation

- Joint Hindu Family BusinessDocument3 pagesJoint Hindu Family BusinessAshraf Khan100% (1)

- Explain in Detail The Character of Mitakshara and Dayabhaga CoparcenaryDocument8 pagesExplain in Detail The Character of Mitakshara and Dayabhaga CoparcenarySamiksha Pawar100% (1)

- CH 1 TestDocument21 pagesCH 1 TestVK ACCAPas encore d'évaluation

- Aayaksh ChadhaFamilyLawProjectDocument18 pagesAayaksh ChadhaFamilyLawProjectaayaksh chadhaPas encore d'évaluation

- Joint Hindu Family BusinessDocument16 pagesJoint Hindu Family BusinessRagulPas encore d'évaluation

- Karta: Position, Duties and PowersDocument9 pagesKarta: Position, Duties and PowersSamiksha PawarPas encore d'évaluation

- Family Law ProjectDocument23 pagesFamily Law ProjectAJIT SHARMAPas encore d'évaluation

- 1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee IsDocument14 pages1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee Isdhananjay7Pas encore d'évaluation

- Family ProjectDocument20 pagesFamily ProjectpraharshithaPas encore d'évaluation