Académique Documents

Professionnel Documents

Culture Documents

21 Colgate V Gimenez

Transféré par

Pu PujalteTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

21 Colgate V Gimenez

Transféré par

Pu PujalteDroits d'auteur :

Formats disponibles

Case Number 21 only to those used in the preparation or manufacture of food or

COLGATE-PALMOLIVE PHIL, v GIMENEZ food products.

January 29, 1961 | Gutierrez David J | Limitations of ejusdem generis Thus, this petition for review

PETITIONER: Colgate-Palmolive Philippines, Inc.

ISSUES: Whether or not the term “stabilizer and flavors” as used in the law refers

RESPONDENT: Hon.Pedro M. Gimenez, Auditor General and Ismael Mathay, only to those materials actually used in the preparation or manufacture of food and

Auditor of the Central Bank of the Philippines food products is based

DOCTRINE: The rule of ejusdem generis does not require the rejection of the HELD

general terms entirely. The rule is intended merely as an aid in ascertaining the Since the law does not distinguish between "stabilizer and flavors" used in

intention of the legislature and is taken in connection with the other rules of the preparation of food and those used in the manufacture of toothpaste or

construction. dental cream, we are not authorized to make any distinction and must

construe the words in their general sense.

FACTS The rule of construction (ejusdem generis) that general and unlimited terms

Colgate-Palmolive Philippines, Inc., is engaged in the manufacture of toilet are restrained and limited by particular recitals when used in connection

preparations and household remedies, it imported from abroad various with them, does not require the rejection of general terms entirely. It is

materials such as irish moss extract, sodium benzoate, sodium saccharinate, intended merely as an aid in ascertaining the intention of the legislature and

precipitated calcium carbonate and dicalcium phosphate, for use as is to be taken in connection with other rules of construction.

stabilizers and flavoring of the dental cream it manufactures.

For every importation made of these materials, the petitioner paid to the WHEREFORE, the decision under review is reversed and the respondents are hereby

Central Bank of the Philippines the 17% special excise tax on the foreign ordered to audit petitioner's applications for refund which were approved by the

exchange used for the payment of the cost, transportation and other charges Officer-In-Charge of the Exchange Tax Administration in the total amount of

incident thereto, pursuant to Republic Act No. 601, as amended, commonly P23,958.13.

known as the Exchange Tax Law.

On March 14, 1956, the petitioner filed with the Central Bank three

applications for refund of the 17% special excise tax it had paid in the

aggregate sum of P113,343.99.

The claim for refund was based on section 2 of Republic Act 601, which

provides that "foreign exchange used for the payment of the cost,

transportation and/or other charges incident to the importation into the

Philippines of . . . stabilizer and flavors . . . shall be refunded to any

importer making application therefor, upon satisfactory proof of actual

importation under the rules and regulations to be promulgated pursuant to

section seven thereof."

The Officer in-Charge of the Exchange Tax Administration of the Central

Bank petitioner that of the total sum of P113,343.99 claimed by it for

refund, the amount of P23,958.13 representing the 17% special excise tax

on the foreign exchange used to import irish moss extract, sodium benzoate

and precipitated calcium carbonate had been approved.

The Auditor of the Central Bank REFUSED ITS CLAIMS FOR REFUND

on the theory that toothpaste stabilizers and flavors are not exempt under

Sec.2 of the Exchange Tax Law.

o The Petitioner appealed

o But the Auditor General maintaining that the term "stabilizer and

flavors" mentioned in section 2 of the Exchange Tax Law refers

Vous aimerez peut-être aussi

- G.R. No. L-14787Document2 pagesG.R. No. L-14787Vijanes BeltransPas encore d'évaluation

- Tria Vs ECCDocument4 pagesTria Vs ECCJocelyn HerreraPas encore d'évaluation

- Stat Con Cases PrelimsDocument19 pagesStat Con Cases PrelimsKen BaxPas encore d'évaluation

- Southern Luzon Drug Corporation Petitioner Vs DSWD, NCDA, DOF, BIR RespondentsDocument30 pagesSouthern Luzon Drug Corporation Petitioner Vs DSWD, NCDA, DOF, BIR RespondentsAsleah MangudadatuPas encore d'évaluation

- 267857-2020-Fuertes v. Senate of The Philippines20210424-14-Rvf6o4Document34 pages267857-2020-Fuertes v. Senate of The Philippines20210424-14-Rvf6o4Judy Ann ShengPas encore d'évaluation

- Notes On Statutory Con.Document64 pagesNotes On Statutory Con.Marj Reña Luna100% (1)

- Navarro Vs Judge DumagtoyDocument3 pagesNavarro Vs Judge DumagtoyJeraldine Tatiana PiñarPas encore d'évaluation

- Claims Arising From Violations of The Conditions For TheDocument13 pagesClaims Arising From Violations of The Conditions For TheAnaliza Matildo100% (3)

- ABAD vs. GoldloopDocument4 pagesABAD vs. GoldloopNJ GeertsPas encore d'évaluation

- PFR AssignmentDocument6 pagesPFR AssignmentToni YingPas encore d'évaluation

- Stat Con Digest 01Document4 pagesStat Con Digest 01Dales BatoctoyPas encore d'évaluation

- Municipal Judge vs Regional Trial Court Ruling on Belated Unverified AnswerDocument43 pagesMunicipal Judge vs Regional Trial Court Ruling on Belated Unverified Answercredit analystPas encore d'évaluation

- Statute Construed as a Whole in Nunez vs GSISDocument8 pagesStatute Construed as a Whole in Nunez vs GSISDales BatoctoyPas encore d'évaluation

- Three Tests To Determine The Nationality of A CorporationDocument2 pagesThree Tests To Determine The Nationality of A CorporationSZPas encore d'évaluation

- 1 Tanada Vs TuveraDocument1 page1 Tanada Vs TuveraJoyce Sumagang ReyesPas encore d'évaluation

- Title Four Chapter One: Criminal Law (Articles 89-99 Notes)Document16 pagesTitle Four Chapter One: Criminal Law (Articles 89-99 Notes)ZHYRRA LOUISE BITUINPas encore d'évaluation

- Legal Research PDFDocument32 pagesLegal Research PDFJames GonzalesPas encore d'évaluation

- Buenaseda Vs FlavierDocument1 pageBuenaseda Vs Flavierpipay04Pas encore d'évaluation

- S. D. MARTINEZ and His Wife, CARMEN ONG DE MARTINEZ, Plaintiffs-Appellees, vs. WILLIAM VAN BUSKIRK, Defendant-AppellantDocument4 pagesS. D. MARTINEZ and His Wife, CARMEN ONG DE MARTINEZ, Plaintiffs-Appellees, vs. WILLIAM VAN BUSKIRK, Defendant-AppellantLester AgoncilloPas encore d'évaluation

- StatCon Latin Maxims and Construction PrinciplesDocument2 pagesStatCon Latin Maxims and Construction PrinciplesNikita DaceraPas encore d'évaluation

- Statcon Digests Chapter 9Document16 pagesStatcon Digests Chapter 9Ramon T. Conducto IIPas encore d'évaluation

- Supreme Court Reverses Illegal Possession ConvictionDocument2 pagesSupreme Court Reverses Illegal Possession ConvictionPam Otic-ReyesPas encore d'évaluation

- Lawyer Deceit Scam Lands in CourtDocument17 pagesLawyer Deceit Scam Lands in CourtsejinmaPas encore d'évaluation

- Tanjanco Vs CADocument4 pagesTanjanco Vs CAOnireblabas Yor OsicranPas encore d'évaluation

- 1C PFR Compiled Case Digest (I. Void Marriages, II. Voidable Marriages)Document102 pages1C PFR Compiled Case Digest (I. Void Marriages, II. Voidable Marriages)Amando III JayonaPas encore d'évaluation

- NFA Not Liable for Security Guards' Other Wage BenefitsDocument22 pagesNFA Not Liable for Security Guards' Other Wage BenefitsJanine IsmaelPas encore d'évaluation

- 01 Tanada V TuveraDocument2 pages01 Tanada V TuveraMicah Manalo100% (2)

- CTA Rules Semirara Mining Corporation Entitled to VAT RefundDocument7 pagesCTA Rules Semirara Mining Corporation Entitled to VAT Refundnathalie velasquezPas encore d'évaluation

- Globe Mackay Vs NLRCDocument1 pageGlobe Mackay Vs NLRCKelly EstradaPas encore d'évaluation

- STATUTORY CONSTRUCTION AND BANKING CASESDocument14 pagesSTATUTORY CONSTRUCTION AND BANKING CASESJui Aquino ProvidoPas encore d'évaluation

- Homeworkping.c Om: Get Homework/Assignment DoneDocument100 pagesHomeworkping.c Om: Get Homework/Assignment DoneSHARONPas encore d'évaluation

- City of Baguio Vs MarcosDocument1 pageCity of Baguio Vs MarcosQuinnee Elissa FernandoPas encore d'évaluation

- STATUTORY CONSTRUCTION PRINCIPLESDocument20 pagesSTATUTORY CONSTRUCTION PRINCIPLESrafPas encore d'évaluation

- Albenson V CADocument6 pagesAlbenson V CAZeusKimPas encore d'évaluation

- II C Agustin V Court of Appeals 338 Phil 171 1997Document2 pagesII C Agustin V Court of Appeals 338 Phil 171 1997Kristell FerrerPas encore d'évaluation

- Cocofed vs. RepublicDocument2 pagesCocofed vs. RepublicEm AlayzaPas encore d'évaluation

- Labor Law Case DigestsDocument10 pagesLabor Law Case DigestsLiz BellenPas encore d'évaluation

- Agcaoili v. Suguitan ruling on applicability of statutory provisionDocument6 pagesAgcaoili v. Suguitan ruling on applicability of statutory provisionAnonymous B0aR9GdNPas encore d'évaluation

- Statcon Case Digest 1Document24 pagesStatcon Case Digest 1credit analystPas encore d'évaluation

- CASE No. 52 Polly Cayetano vs. Hon. Tomas T. Leonidas Et AlDocument1 pageCASE No. 52 Polly Cayetano vs. Hon. Tomas T. Leonidas Et AlJonel L. SembranaPas encore d'évaluation

- Magallona vs. Ermita G.R. No 187167Document23 pagesMagallona vs. Ermita G.R. No 187167ChristianneDominiqueGravosoPas encore d'évaluation

- COA vs. Province of Cebu: Scholarship grants not chargeable to SEFDocument1 pageCOA vs. Province of Cebu: Scholarship grants not chargeable to SEFMargie Marj GalbanPas encore d'évaluation

- Property RegimesDocument4 pagesProperty RegimesmaelynsummerPas encore d'évaluation

- Florante F. Manacop, Petitioner, vs. Court of Appeals and E & L MERCANTILE, INC., Respondents. Decision Panganiban, J.Document4 pagesFlorante F. Manacop, Petitioner, vs. Court of Appeals and E & L MERCANTILE, INC., Respondents. Decision Panganiban, J.DonaldDeLeonPas encore d'évaluation

- People vs. Vidal, Jr.Document18 pagesPeople vs. Vidal, Jr.Mikki ManiegoPas encore d'évaluation

- Executive Dept CasesDocument11 pagesExecutive Dept CasesLeft Hook OlekPas encore d'évaluation

- Philippines Civil Code overviewDocument8 pagesPhilippines Civil Code overviewRikka ReyesPas encore d'évaluation

- Application of Laws and The Law On Human Relations ART. 2 - Effectivity of LawsDocument30 pagesApplication of Laws and The Law On Human Relations ART. 2 - Effectivity of LawsgabPas encore d'évaluation

- Quiz 1 terms and casesDocument13 pagesQuiz 1 terms and casessleepyhead1412Pas encore d'évaluation

- EB Villarosa & Partner Co., LTD., vs. BenitoDocument13 pagesEB Villarosa & Partner Co., LTD., vs. BenitoGerald HernandezPas encore d'évaluation

- Rochi vs. Department of EnergyDocument32 pagesRochi vs. Department of EnergyRozaiinePas encore d'évaluation

- Philippine Family Law BasicsDocument24 pagesPhilippine Family Law BasicsSOPHIA AMORPas encore d'évaluation

- Dimaporo Vs MitraDocument20 pagesDimaporo Vs MitraLara MagultaPas encore d'évaluation

- 421 Francisco vs. PermskulDocument2 pages421 Francisco vs. PermskulKrisha Marie CarlosPas encore d'évaluation

- Amores vs. Hret, 622 Scra 593Document11 pagesAmores vs. Hret, 622 Scra 593lawchifaiPas encore d'évaluation

- Nicolas Lewis Vs COMELEC, GR No. 162759, Aug. 4, 2006Document7 pagesNicolas Lewis Vs COMELEC, GR No. 162759, Aug. 4, 2006Marianne Shen PetillaPas encore d'évaluation

- Co Kim Cham vs. ValdezDocument16 pagesCo Kim Cham vs. ValdezJames OcampoPas encore d'évaluation

- Colgate-Palmolive Philippines, Inc. vs. Gimenez STATCON1B OCT.17, 2017Document1 pageColgate-Palmolive Philippines, Inc. vs. Gimenez STATCON1B OCT.17, 2017Yui RecintoPas encore d'évaluation

- Colgate Palmolive v. JimenezDocument2 pagesColgate Palmolive v. JimenezbrownboomerangPas encore d'évaluation

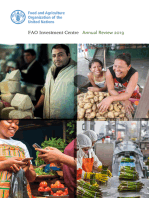

- FAO Investment Centre Annual Review 2019D'EverandFAO Investment Centre Annual Review 2019Pas encore d'évaluation

- Nerwin V Pnoc DigestDocument2 pagesNerwin V Pnoc DigestMark Rainer Yongis LozaresPas encore d'évaluation

- Zulueta Vs CADocument5 pagesZulueta Vs CArobina56Pas encore d'évaluation

- People Vs ComadreDocument1 pagePeople Vs ComadreMeAnn Tumbaga50% (2)

- Nursing Leadership EssayDocument2 pagesNursing Leadership EssayPu PujaltePas encore d'évaluation

- Carandang v. SantiagoDocument3 pagesCarandang v. SantiagoPu Pujalte0% (1)

- Spouses Go v. Colegio de San Juan de LetranDocument7 pagesSpouses Go v. Colegio de San Juan de LetranPu PujaltePas encore d'évaluation

- Rednotes - Political LawDocument95 pagesRednotes - Political Lawjojitus86% (7)

- Magtajas v. Pryce PropertiesDocument3 pagesMagtajas v. Pryce PropertiesPu Pujalte100% (1)

- 167610-2012-Spouses Go v. Colegio de San Juan de LetranDocument11 pages167610-2012-Spouses Go v. Colegio de San Juan de LetranjrPas encore d'évaluation

- Pormento V Pontevedra LEGETHICSDocument1 pagePormento V Pontevedra LEGETHICSmitsudayo_Pas encore d'évaluation

- RULE 140 Charges Against Judges of First InstanceDocument2 pagesRULE 140 Charges Against Judges of First InstancePu PujaltePas encore d'évaluation

- Labo V COMELECDocument16 pagesLabo V COMELECPu PujaltePas encore d'évaluation

- International Humanitarian LawDocument100 pagesInternational Humanitarian LawMuhd Ariffin Nordin100% (1)

- People V ZetaDocument3 pagesPeople V ZetaPu PujaltePas encore d'évaluation

- RULE 140 Charges Against Judges of First InstanceDocument2 pagesRULE 140 Charges Against Judges of First InstancePu PujaltePas encore d'évaluation

- 2019 Bar Exams Legal Ethics and Judicial CodeDocument2 pages2019 Bar Exams Legal Ethics and Judicial CodeclarizzzPas encore d'évaluation

- Final MTQDocument15 pagesFinal MTQPu PujaltePas encore d'évaluation

- Nikko Hotel Vs Reyes - Art19-21Document3 pagesNikko Hotel Vs Reyes - Art19-21biancaPas encore d'évaluation

- Mosqueda V Pilipino Banana Growers FULLDocument47 pagesMosqueda V Pilipino Banana Growers FULLPu Pujalte100% (1)

- CIR Vs American Express InternationalDocument2 pagesCIR Vs American Express InternationalCheryl Churl100% (2)

- People Vs ManeroDocument1 pagePeople Vs ManeroPu PujaltePas encore d'évaluation

- Republic of The Philippines Regional Trial Court National Capital Judicial Region Branch 100, Makati CityDocument3 pagesRepublic of The Philippines Regional Trial Court National Capital Judicial Region Branch 100, Makati CityPu PujaltePas encore d'évaluation

- Crim 2 Title IIIDocument41 pagesCrim 2 Title IIIPu PujaltePas encore d'évaluation

- US Vs EstapiaDocument2 pagesUS Vs EstapiaPu PujaltePas encore d'évaluation

- Obando V Figueras FULLDocument10 pagesObando V Figueras FULLPu PujaltePas encore d'évaluation

- Agpalo Notes 2003Document84 pagesAgpalo Notes 2003ducati99d395% (19)

- CPRDocument5 pagesCPRPu PujaltePas encore d'évaluation

- 2016 Revised Rules On Small Claims - Sample FormsDocument33 pages2016 Revised Rules On Small Claims - Sample FormsEliEliPas encore d'évaluation

- Angat Vs RepublicDocument6 pagesAngat Vs RepublicPu PujaltePas encore d'évaluation

- Collection Suit: Bettina Castello, Justine Gaverza, Bianca Pujalte, Gem VillavirayDocument26 pagesCollection Suit: Bettina Castello, Justine Gaverza, Bianca Pujalte, Gem VillavirayPu PujaltePas encore d'évaluation

- Crima Şi Criminalitateaameninţare Gravă A Dezvoltării Armonioase Şi Echilibrate A Statului RomânDocument262 pagesCrima Şi Criminalitateaameninţare Gravă A Dezvoltării Armonioase Şi Echilibrate A Statului RomânAlexandra Ana IenovanPas encore d'évaluation

- PMU Letter - Regading Construction Work - Uyanga TranslationDocument2 pagesPMU Letter - Regading Construction Work - Uyanga TranslationУянга ВеганPas encore d'évaluation

- 050 SJS v. DDB 570 SCRA 410Document15 pages050 SJS v. DDB 570 SCRA 410JPas encore d'évaluation

- Bir Ruling No 263-13Document3 pagesBir Ruling No 263-13Rafael JuicoPas encore d'évaluation

- ContractsDocument29 pagesContractsattyeram9199Pas encore d'évaluation

- Republic Vs AsuncionDocument2 pagesRepublic Vs AsuncionZniv Savs100% (1)

- Khap PanchayatsDocument22 pagesKhap Panchayatsdikshu mukerjeePas encore d'évaluation

- UNITED STATES Vs ExaltacionDocument3 pagesUNITED STATES Vs Exaltacionautumn moonPas encore d'évaluation

- Sample Declaration For CaliforniaDocument2 pagesSample Declaration For CaliforniaStan Burman88% (32)

- Rosario Vs Victory Ricemill - G.R. No. 147572. February 19, 2003Document8 pagesRosario Vs Victory Ricemill - G.R. No. 147572. February 19, 2003Ebbe DyPas encore d'évaluation

- 1963 Republican ConstitutionDocument7 pages1963 Republican ConstitutionThe Empress VeePas encore d'évaluation

- Nicolas V Romulo DigestDocument4 pagesNicolas V Romulo DigestJei Mercado Estremadura0% (1)

- Hindu Law - GuardianDocument5 pagesHindu Law - GuardianSanjana RaoPas encore d'évaluation

- AFGE Local 3981 and Bureau of Prisons, 7-7-14, 9-5-14Document35 pagesAFGE Local 3981 and Bureau of Prisons, 7-7-14, 9-5-14E Frank CorneliusPas encore d'évaluation

- (A) Civic KnowledgeDocument9 pages(A) Civic KnowledgepodderPas encore d'évaluation

- Not PrecedentialDocument10 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- Islamphobia Rep May 2010 To April 2011 enDocument74 pagesIslamphobia Rep May 2010 To April 2011 enSi Bungkuk PorePas encore d'évaluation

- The Kashmir IssueDocument2 pagesThe Kashmir IssueSaadat LarikPas encore d'évaluation

- Tolstoy's Christian Non-ResistanceDocument3 pagesTolstoy's Christian Non-Resistancejoachimjack100% (1)

- Affidavit of Authorization To Act For Property OwnerDocument1 pageAffidavit of Authorization To Act For Property Ownerapril awananPas encore d'évaluation

- Reign of Terror Lesson Plan 0Document11 pagesReign of Terror Lesson Plan 0api-270328839Pas encore d'évaluation

- Del Castillo Vs PeopleDocument2 pagesDel Castillo Vs PeopleKristine Garcia100% (1)

- Case Vs Heirs of TuasonDocument4 pagesCase Vs Heirs of TuasonattycpajfccPas encore d'évaluation

- GVPT 200 Intro to IR TheoryDocument6 pagesGVPT 200 Intro to IR Theory123lorenzoPas encore d'évaluation

- Office of Profit: A Constitutional Disqualification for LegislatorsDocument17 pagesOffice of Profit: A Constitutional Disqualification for Legislatorssiddharth0603Pas encore d'évaluation

- Motion To Deem Brief Timely Filed - PettigrewDocument2 pagesMotion To Deem Brief Timely Filed - PettigrewDenise Jensen0% (1)

- NDA SE2 - Agreement To Maintain ConfidentialityDocument2 pagesNDA SE2 - Agreement To Maintain ConfidentialitySanket UttarwarPas encore d'évaluation

- Affidavit of Nicholas BalaDocument97 pagesAffidavit of Nicholas BalaborninbrooklynPas encore d'évaluation

- Neil Smith Neo-Critical Geography PDFDocument13 pagesNeil Smith Neo-Critical Geography PDFDaniel Barbe FarrePas encore d'évaluation

- Justice & RevengeDocument10 pagesJustice & RevengeFarimah FarahaniPas encore d'évaluation