Académique Documents

Professionnel Documents

Culture Documents

Internal Audit For Finance Sector

Transféré par

SURYA STitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Internal Audit For Finance Sector

Transféré par

SURYA SDroits d'auteur :

Formats disponibles

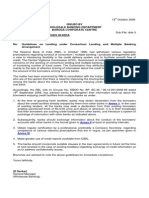

SURYA CONSULTANTS & ADVISORS S.

SURYANARAYANAN

Surya Consultants & Advisors (SCA)is founded by Mr.S.Suryanarayanan, who is backed by a rich

experience gained over a period of around 20 years in various audits viz., Internal Audit, Statutory

Audit, Management Audit, Inventory Audit, Stock Audit, Banking and Finance sector Audit, Facility

Audit, Documentary audit etc., SCA was born with wish to put forth the experience and the multifarious

exposure the founder had, into best use and eager to see the results working towards the success and

growth of the organisation.

The Internal Audit (IA) will function independently verifying, inter-alia, the accounting processes and

functions. In brief nutshell the functions of the Internal Audit will be as follows:

I. Basic voucher aspects: Checking the approvals of the vouchers, correctness of the

vouchers, segregating unsigned, unapproved vouchers are few to name with.

II. Verification of the loan agreements, DPN, sanction papers as to their correctness and

enforceability.

III. Verification of the documents that are available in support of the loan sanctioned viz.,

collateral property documents & deeds, Individual and Corporate guarantees, etc.,

IV. Correctness of classification of loans and advances into PSL and others agri and non-agri

etc.,

V. Verification of adherence to the organisation’s policies regarding sanction, disbursal and

stage release conditions etc.,

VI. Correctness of classification of loans and advances as per the Prudential Norms specified

by RBI, as applicable.

VII. Verification of the provisioning required as per RBI norms.

VIII. Verification of customer outstanding and adequacy of follow-up measures taken and

suggestions to improve the same.

IX. Verification of the safe custody of the securities available against the loans & advances

including valuables.

X. Verification of the finance obtained by the organisation from Banks as to its adequacy vis-

a-vis its optimal deployment towards loans to clients.

XI. Ensuring the BRS preparation by the Accounts is timely and obtains the clarifications form

Banks and Financial Institutions.

XII. Setting up Internal Control processes viz., control policies, devising hierarchical approval

structure, department wise internal control procedures, identifying areas for pre-audit, if

any, framing the broader outline of IA department and discuss with the management to

identify and add more areas as required by them.

XIII. Ensuring the Accounts department complies with all statutory requirements – be it GST,

TDS, PF/ESI, Professional tax etc., by evolving a step by step process that culminates with

the filing of relevant copies with IA department also to ensure proper control.

XIV. Identification of risk and fraud prone areas and mitigation measures.

XV. Evolving an overall solution and remedial in case of deviations of any of the above.

XVI. Ensuring timely preparation of all financial statements by Accounts.

XVII. Conducting of periodical Orientation, Knowledge updation and motivation classes to staff.

XVIII. Any other functions as may be decided by the management.

S.Suryanarayanan

Mentor & strategist

Surya Consultants & Advisors

Chennai.

Contact details: 8610511075 mail: sunsarvaas@gmail.com

Vous aimerez peut-être aussi

- Credit Appraisal in MuthootDocument30 pagesCredit Appraisal in MuthootNISHI1994100% (1)

- Finland's rich history and culture revealedDocument76 pagesFinland's rich history and culture revealedMarius AlexandruPas encore d'évaluation

- NAAIP Valerie B. Jarrett W SignaDocument3 pagesNAAIP Valerie B. Jarrett W SignaNATIONAL ASSOCIATION for the ADVANCEMENT of INDIGENOUS PEOPLE100% (2)

- Critical Financial Review: Understanding Corporate Financial InformationD'EverandCritical Financial Review: Understanding Corporate Financial InformationPas encore d'évaluation

- Introduction To Financial Statement AuditDocument63 pagesIntroduction To Financial Statement AuditRica RegorisPas encore d'évaluation

- 2.forensic Audit ReportDocument20 pages2.forensic Audit ReportChartered Accountant100% (1)

- Motion To Revive-FBRDocument3 pagesMotion To Revive-FBRreyvichel100% (2)

- Leyte-Samar Sales Co. vs. Cea and LastrillaDocument7 pagesLeyte-Samar Sales Co. vs. Cea and LastrillaVeepee PanzoPas encore d'évaluation

- Rivera Family Property Dispute ResolvedDocument1 pageRivera Family Property Dispute ResolvedMalen Crisostomo Arquillo-SantosPas encore d'évaluation

- Drugstores Association of The Philippines, Inc. v. National Council On Disability AffairsDocument8 pagesDrugstores Association of The Philippines, Inc. v. National Council On Disability AffairsPatricia BautistaPas encore d'évaluation

- Taningco v. Fernandez, Gr. No. 215615, December 9,2020Document3 pagesTaningco v. Fernandez, Gr. No. 215615, December 9,2020Jemielle Patriece Narcida100% (1)

- Lovishbajaj 97Document80 pagesLovishbajaj 97Mohan KumarPas encore d'évaluation

- 1.Q: Explain The Functions of Merchant Banking. FunctionsDocument56 pages1.Q: Explain The Functions of Merchant Banking. FunctionsmayurgadaPas encore d'évaluation

- Course Content UgafodeDocument2 pagesCourse Content UgafodeN Bavvai PassyPas encore d'évaluation

- C C I C C! " C # $ C # C$ C # C %$ C # $ & & ' (# +& & $ % (,-& " ./ & ! 0 1/ 2# 3 & '4 " "&$" +"5 !Document62 pagesC C I C C! " C # $ C # C$ C # C %$ C # $ & & ' (# +& & $ % (,-& " ./ & ! 0 1/ 2# 3 & '4 " "&$" +"5 !Joheb ZamanPas encore d'évaluation

- Audit Report of Axis BankDocument51 pagesAudit Report of Axis BanksangeethaPas encore d'évaluation

- Merchant Banking Functions GuideDocument78 pagesMerchant Banking Functions GuidedrchitramohanPas encore d'évaluation

- Merchant Banking: Prepared By: Suraj DasDocument17 pagesMerchant Banking: Prepared By: Suraj DasSuraj DasPas encore d'évaluation

- Presentation On Merchant BankingDocument19 pagesPresentation On Merchant BankingSneha SumanPas encore d'évaluation

- Chapter 1Document21 pagesChapter 1Alice LowPas encore d'évaluation

- Secretary's Certificate for Bank TransactionsDocument4 pagesSecretary's Certificate for Bank TransactionsRegine TeodoroPas encore d'évaluation

- AuditDocument90 pagesAuditSailesh GoenkkaPas encore d'évaluation

- Terms of Reference of Audit CommitteeDocument3 pagesTerms of Reference of Audit CommitteeApoo100% (1)

- Projects On Bank AuditDocument95 pagesProjects On Bank Auditloveaute1575% (4)

- Role of Merchant BankingDocument10 pagesRole of Merchant BankingAadil KakarPas encore d'évaluation

- Axis Bank - Corporate GovernanceDocument7 pagesAxis Bank - Corporate GovernancesampritcPas encore d'évaluation

- 4 Banking Operations - AFB - Module DDocument44 pages4 Banking Operations - AFB - Module Dwaste mailPas encore d'évaluation

- Merchant Banking: What Is It and What Do They DoDocument38 pagesMerchant Banking: What Is It and What Do They DoSmitha K BPas encore d'évaluation

- Merchant banking services and functionsDocument33 pagesMerchant banking services and functionsGinu George VarghesePas encore d'évaluation

- Analysis of Loan Process and Competitors of Magma FincorpDocument39 pagesAnalysis of Loan Process and Competitors of Magma Fincorp983858nandini80% (5)

- Issue Management and UnderwritingDocument11 pagesIssue Management and Underwritingrthi04Pas encore d'évaluation

- SRINATHJI Forensic Audit of The Accounts ReceivableDocument8 pagesSRINATHJI Forensic Audit of The Accounts Receivableanita.pariharPas encore d'évaluation

- 1 Objective PDFDocument37 pages1 Objective PDFsamaadhuPas encore d'évaluation

- Regulatory Alert: Tracking ChangeDocument6 pagesRegulatory Alert: Tracking ChangepradeepPas encore d'évaluation

- Auditor's Report on Non-ProfitDocument5 pagesAuditor's Report on Non-ProfitVIJAY PAREEKPas encore d'évaluation

- CA World - Jan 2024Document8 pagesCA World - Jan 2024Saket SwarnkarPas encore d'évaluation

- CA ACT & PROFESSIONAL ETHICSDocument93 pagesCA ACT & PROFESSIONAL ETHICSSrishti MohanPas encore d'évaluation

- Audit of BanksDocument13 pagesAudit of BanksAniket NirantalePas encore d'évaluation

- 5 6089364062007722879Document14 pages5 6089364062007722879Anubhav PareekPas encore d'évaluation

- BCC BR 100 289Document7 pagesBCC BR 100 289Dipak PrasadPas encore d'évaluation

- Bank Audit GuideDocument20 pagesBank Audit Guidesumi1992Pas encore d'évaluation

- Ifta FS 2020 - DFDDocument16 pagesIfta FS 2020 - DFDTaskeen AliPas encore d'évaluation

- Merchantbanking 090620022736 Phpapp02 PDFDocument15 pagesMerchantbanking 090620022736 Phpapp02 PDFPriya PriyaPas encore d'évaluation

- Merchant BankingDocument15 pagesMerchant BankingPriya PriyaPas encore d'évaluation

- CH 10Document25 pagesCH 10Eric Yao100% (1)

- Audit Assign May 1 (Paraphrased)Document11 pagesAudit Assign May 1 (Paraphrased)syedumarahmed52Pas encore d'évaluation

- A Study On "MSME & Credit Appraisal" With Reference To Different Credit Appraisal and Assessment System Used by United Bank of IndiaDocument16 pagesA Study On "MSME & Credit Appraisal" With Reference To Different Credit Appraisal and Assessment System Used by United Bank of IndiaHimanshiPas encore d'évaluation

- Basic Concepts in AuditingDocument29 pagesBasic Concepts in Auditinganon_672065362100% (1)

- AuditingDocument8 pagesAuditingravi ranjanPas encore d'évaluation

- Ankur Khandelwal: Kotak Mahindra Bank LTD, MumbaiDocument3 pagesAnkur Khandelwal: Kotak Mahindra Bank LTD, MumbaiHarshit BhatiaPas encore d'évaluation

- Requested To Present The Business Model of Company, Unique Aspects of Business, Future Prospects and The Investment ProposalDocument1 pageRequested To Present The Business Model of Company, Unique Aspects of Business, Future Prospects and The Investment ProposalGaurav SharmaPas encore d'évaluation

- Merchant Banking Services and RegulationsDocument30 pagesMerchant Banking Services and Regulationssai prabashPas encore d'évaluation

- Index: SR - No. Particulars SignatureDocument20 pagesIndex: SR - No. Particulars SignatureMohammedAhmedRazaPas encore d'évaluation

- Factors Affecting Customers' Insurance Investment DecisionsDocument19 pagesFactors Affecting Customers' Insurance Investment DecisionsChahat PartapPas encore d'évaluation

- Ib 2Document34 pagesIb 2ptselvakumarPas encore d'évaluation

- Chapter 2 Basic Concepts in Auditing PM PDFDocument25 pagesChapter 2 Basic Concepts in Auditing PM PDFViene CanlasPas encore d'évaluation

- Completing the Audit ProceduresDocument19 pagesCompleting the Audit ProceduresThe Brain Dump PHPas encore d'évaluation

- Legal Importance of Due Diligence ReportDocument6 pagesLegal Importance of Due Diligence Reportmanish88raiPas encore d'évaluation

- LFAR FormatDocument18 pagesLFAR FormatPrem Sebastián AntonyPas encore d'évaluation

- BANKING LAW AuditDocument6 pagesBANKING LAW AuditPRIYANKA JHAPas encore d'évaluation

- 6th Sessiom - Audit of Investment STUDENTDocument17 pages6th Sessiom - Audit of Investment STUDENTNIMOTHI LASEPas encore d'évaluation

- MB Unit 1Document51 pagesMB Unit 1Sivarama SubramanianPas encore d'évaluation

- VC PREPARATION: HIRING ADVISERS AND DEVELOPING KEY DOCUMENTSDocument11 pagesVC PREPARATION: HIRING ADVISERS AND DEVELOPING KEY DOCUMENTSkill_my_klonePas encore d'évaluation

- AC414 - Audit and Investigations II - Audit Finalisation and ReviewDocument26 pagesAC414 - Audit and Investigations II - Audit Finalisation and ReviewTsitsi AbigailPas encore d'évaluation

- Merchant BankingDocument55 pagesMerchant Bankingsuhaspatel84Pas encore d'évaluation

- Auditing Banks and Financial InstitutionsDocument8 pagesAuditing Banks and Financial InstitutionsziahnepostreliPas encore d'évaluation

- Surgery SOPDocument179 pagesSurgery SOPSURYA SPas encore d'évaluation

- 11 Shivam Modules Product SaleDocument4 pages11 Shivam Modules Product SaleSURYA SPas encore d'évaluation

- Vendorisation of QC Process - RFIDocument10 pagesVendorisation of QC Process - RFISURYA SPas encore d'évaluation

- TPS 900 SpecsDocument1 pageTPS 900 SpecsSURYA SPas encore d'évaluation

- It Staffing ContDocument5 pagesIt Staffing ContSURYA SPas encore d'évaluation

- Tiploa LMD Fim 1904 010 1Document2 pagesTiploa LMD Fim 1904 010 1SURYA SPas encore d'évaluation

- Req For Business ProfileDocument3 pagesReq For Business ProfileSURYA SPas encore d'évaluation

- Chap 003Document58 pagesChap 003islampakistan100% (1)

- Foreign Contribution-FDocument10 pagesForeign Contribution-FSURYA SPas encore d'évaluation

- RMO RequiredDocument1 pageRMO RequiredSURYA SPas encore d'évaluation

- Channel Offer Devices 160920Document2 pagesChannel Offer Devices 160920SURYA SPas encore d'évaluation

- SOP PresentDocument9 pagesSOP PresentSURYA SPas encore d'évaluation

- Micro Finance Audited Financial StatementDocument20 pagesMicro Finance Audited Financial StatementSURYA SPas encore d'évaluation

- TNIFMC Building Proposal AnalysisDocument44 pagesTNIFMC Building Proposal AnalysisSURYA SPas encore d'évaluation

- Service Agreement SummaryDocument16 pagesService Agreement SummarySURYA SPas encore d'évaluation

- Agreement For ATM Only 2.16 (1) 6.39 P.M 01.06.2020Document14 pagesAgreement For ATM Only 2.16 (1) 6.39 P.M 01.06.2020SURYA SPas encore d'évaluation

- Agreement For ATM Only 2.16 01.06.2020Document13 pagesAgreement For ATM Only 2.16 01.06.2020SURYA SPas encore d'évaluation

- Agreement WLATMDocument10 pagesAgreement WLATMSURYA SPas encore d'évaluation

- TSCL - Balance SheetDocument52 pagesTSCL - Balance SheetSURYA SPas encore d'évaluation

- Draft LLP AgreementDocument7 pagesDraft LLP AgreementSURYA SPas encore d'évaluation

- CARO and General Udit Report For All PVT CosDocument5 pagesCARO and General Udit Report For All PVT CosSURYA SPas encore d'évaluation

- (I) All Developments, Redevelopments, Erection or Re-Erection, Design, Construction or Reconstruction and Additions and Alterations To A BuildingDocument11 pages(I) All Developments, Redevelopments, Erection or Re-Erection, Design, Construction or Reconstruction and Additions and Alterations To A BuildingadvocacyindyaPas encore d'évaluation

- Empanelment of Firms of Chartered Accountants As Internal AUDITORS FOR THE YEARS 2019-20 TO 2021-22Document16 pagesEmpanelment of Firms of Chartered Accountants As Internal AUDITORS FOR THE YEARS 2019-20 TO 2021-22SURYA SPas encore d'évaluation

- HFCs (NHB) - Directions 2010Document78 pagesHFCs (NHB) - Directions 2010SURYA SPas encore d'évaluation

- Audit Report With CARO For PVT LTDDocument5 pagesAudit Report With CARO For PVT LTDSURYA SPas encore d'évaluation

- DurgaDocument30 pagesDurgaGanesan MurusamyPas encore d'évaluation

- Companies Act 2013 Applicable IAR For PVT CompanyDocument5 pagesCompanies Act 2013 Applicable IAR For PVT CompanySURYA SPas encore d'évaluation

- Norms On Eligibilityempanelment 4.1.2016Document3 pagesNorms On Eligibilityempanelment 4.1.2016SURYA SPas encore d'évaluation

- Tirumala Mutt InfoDocument4 pagesTirumala Mutt InfoSURYA SPas encore d'évaluation

- Form 842 PDFDocument34 pagesForm 842 PDFEhsan Ehsan100% (1)

- San Miguel Corporation v. MonasterioDocument6 pagesSan Miguel Corporation v. MonasterioAlyssaOgao-ogaoPas encore d'évaluation

- PwC Webinar on the Extractive Sector Transparency Measures Act (ESTMADocument40 pagesPwC Webinar on the Extractive Sector Transparency Measures Act (ESTMAShravan EtikalaPas encore d'évaluation

- Pecson V CA (1995)Document4 pagesPecson V CA (1995)Zan BillonesPas encore d'évaluation

- Jurisdiction over AFPCES dismissal caseDocument2 pagesJurisdiction over AFPCES dismissal caseKDPas encore d'évaluation

- Broadway Centrum Condominium Corp vs. Tropical HutDocument9 pagesBroadway Centrum Condominium Corp vs. Tropical HutVeraNataaPas encore d'évaluation

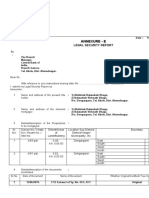

- Annexure - E: Legal Security ReportDocument7 pagesAnnexure - E: Legal Security Reportadv Balasaheb vaidyaPas encore d'évaluation

- JUNE22 - ACT InvoiceDocument2 pagesJUNE22 - ACT InvoiceSamarth HandurPas encore d'évaluation

- REVUP Notes in Criminal LawDocument28 pagesREVUP Notes in Criminal LawAndrea Klein LechugaPas encore d'évaluation

- Redea Vs CADocument3 pagesRedea Vs CAana ortizPas encore d'évaluation

- Comparing Free Speech - United States v. United KingdomDocument5 pagesComparing Free Speech - United States v. United KingdomMayank RajpootPas encore d'évaluation

- Contract ManagementDocument26 pagesContract ManagementGK TiwariPas encore d'évaluation

- Today's Supreme Court Ruling on Interest for Past Tax DeficienciesDocument1 pageToday's Supreme Court Ruling on Interest for Past Tax DeficienciesChou TakahiroPas encore d'évaluation

- NCSBE 2023 Order Implementation Funding Letter - 2023-05-12Document3 pagesNCSBE 2023 Order Implementation Funding Letter - 2023-05-12Daniel WaltonPas encore d'évaluation

- California Bar Examination: February 2018 Essay Questions 1, 2 and 3Document23 pagesCalifornia Bar Examination: February 2018 Essay Questions 1, 2 and 3Trial UserPas encore d'évaluation

- Employment Contract Know All Men by These Presents:: WHEREAS, The EMPLOYER Is Engage in The Business ofDocument3 pagesEmployment Contract Know All Men by These Presents:: WHEREAS, The EMPLOYER Is Engage in The Business ofHoney Lyn CoPas encore d'évaluation

- Right To Life and Personal Liberty Under The Constitution of India: A Strive For JusticeDocument12 pagesRight To Life and Personal Liberty Under The Constitution of India: A Strive For JusticeDIPESH RANJAN DASPas encore d'évaluation

- M783 & Prem CF Ammo Rebate FORMDocument1 pageM783 & Prem CF Ammo Rebate FORMdunhamssports1Pas encore d'évaluation

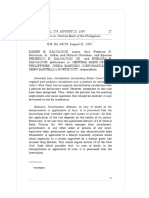

- Salvacion vs. Central BankDocument19 pagesSalvacion vs. Central BankEvan NervezaPas encore d'évaluation

- Case Briefing Assingment#1Document2 pagesCase Briefing Assingment#1Puruda AmitPas encore d'évaluation

- Plato and Rule of LawDocument23 pagesPlato and Rule of LawIshitaPas encore d'évaluation

- Cazo Juan ValdezDocument26 pagesCazo Juan Valdezux20nr091Pas encore d'évaluation

- Zapanta Vs PeopleDocument7 pagesZapanta Vs PeopleEricson Sarmiento Dela CruzPas encore d'évaluation