Académique Documents

Professionnel Documents

Culture Documents

Jale

Transféré par

Jaleann Español0 évaluation0% ont trouvé ce document utile (0 vote)

3 vues1 pageTitre original

jale.docx

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

3 vues1 pageJale

Transféré par

Jaleann EspañolDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

The phenomenon is all about the care of Perez vs.

Commissioner of Internal Revenue in

determining the true meaning of damages of the SC. The determination of which is important in

arriving with the taxable amount against the petitions compensation

As a background, Perez decided to engage in egg donation company as a misnomer and agreed

to undergo physical pain, and suffering in exchange for $20,000.00 which she believe was tax

free.

On the other hand, CIR, the respondent alleging and invoking Sec. 1.104- 1(c01), Income Tax

Regs. Definition of damage, says that Perez should pay for tax and that her risk and Suffering is

not included in the better of Section (046) (2) of ITR.

B.) Nichelle Perez is the Petitioner in this case. She was a misnomer who underwent series of

physical pain and suffering in exchange for the money she believed to be tax free. It turns out,

the CIR destroyed her contention to the Same and even sent her a notice of deficiency in

nonpayment of tax. From then, the case went on.

The commissioner of Internal Revenue. The commissioner himself, representing the

commission was the respondent of the case. His role thereby is to set the exact definition of

damages w/c is the key issue of the case. Bringing up other cases on provisions in support for

his defense made the case interesting and informative.

Supreme court who derived at a very wise and lardlike decision.

C.) Scope and Definition of damages

In the court ruling, they were able to cite Sec. 1-104 – 1 (c) (1), the definition of damages as a

xxx an amount received through prosecution of legal recit or action, or through a settlement

agreement entered into in lien of prosecution “The issue above became a determinant and

measure of whether or not what Perez claim of damages are excludable in the prevent

interpretation of Section 104 (a) (2) of ITR.

Vous aimerez peut-être aussi

- Atty. Alvaro T. Antonio: Office of The Provincial AdministratorDocument1 pageAtty. Alvaro T. Antonio: Office of The Provincial AdministratorJaleann EspañolPas encore d'évaluation

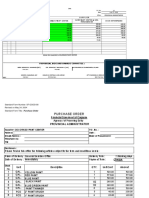

- Abstract of Price Quotation: Supplier ParticularsDocument2 pagesAbstract of Price Quotation: Supplier ParticularsJaleann EspañolPas encore d'évaluation

- Hon. Manuel N. Mamba, M.D.: Office of The Provincial AdministratorDocument1 pageHon. Manuel N. Mamba, M.D.: Office of The Provincial AdministratorJaleann EspañolPas encore d'évaluation

- Hon. Manuel N. Mamba: Office of The Provincial AdministratorDocument1 pageHon. Manuel N. Mamba: Office of The Provincial AdministratorJaleann EspañolPas encore d'évaluation

- Abstract of Price Quotation: Supplier ParticularsDocument2 pagesAbstract of Price Quotation: Supplier ParticularsJaleann EspañolPas encore d'évaluation

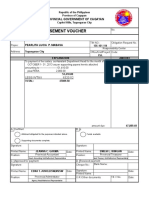

- Disbursement Voucher: Provincial Government of CagayanDocument1 pageDisbursement Voucher: Provincial Government of CagayanJaleann EspañolPas encore d'évaluation

- Gas Slip Gas Slip: Office of The Provincial Administrator Office of The Provincial AdministratorDocument1 pageGas Slip Gas Slip: Office of The Provincial Administrator Office of The Provincial AdministratorJaleann EspañolPas encore d'évaluation

- African Savanna Ecosystem Illustration KeyDocument1 pageAfrican Savanna Ecosystem Illustration KeyJaleann EspañolPas encore d'évaluation

- Abstract of Price Quotation: Supplier ParticularsDocument2 pagesAbstract of Price Quotation: Supplier ParticularsJaleann EspañolPas encore d'évaluation

- Obligation Request: Provincial Government of CagayanDocument3 pagesObligation Request: Provincial Government of CagayanJaleann EspañolPas encore d'évaluation

- Canvass Newest PpoDocument6 pagesCanvass Newest PpoJaleann EspañolPas encore d'évaluation

- Obligation Request: Provincial Government of CagayanDocument1 pageObligation Request: Provincial Government of CagayanJaleann EspañolPas encore d'évaluation

- Request For Quotation: 1 Cheesy Eggdesal PC 25 2 Hot Choco PC 25Document3 pagesRequest For Quotation: 1 Cheesy Eggdesal PC 25 2 Hot Choco PC 25Jaleann EspañolPas encore d'évaluation

- Purchase Request: Provincial Government of CagayanDocument5 pagesPurchase Request: Provincial Government of CagayanJaleann EspañolPas encore d'évaluation

- Abstract, Canvass Etc..Document22 pagesAbstract, Canvass Etc..Jaleann EspañolPas encore d'évaluation

- Salaries and Wages Utility ExpensesDocument4 pagesSalaries and Wages Utility ExpensesJaleann EspañolPas encore d'évaluation

- Disbursement Voucher: Provincial Government of CagayanDocument3 pagesDisbursement Voucher: Provincial Government of CagayanJaleann Español100% (1)

- AssessorsDocument1 pageAssessorsJaleann EspañolPas encore d'évaluation

- Abulug Barangay Recepients AmountDocument9 pagesAbulug Barangay Recepients AmountJaleann EspañolPas encore d'évaluation

- Individual Performance Commitment and Review (IPCR) FORMDocument3 pagesIndividual Performance Commitment and Review (IPCR) FORMJaleann EspañolPas encore d'évaluation

- Certificate of Emergency Purchase: Province of Cagayan Office of The Provincial AdministratorDocument1 pageCertificate of Emergency Purchase: Province of Cagayan Office of The Provincial AdministratorJaleann EspañolPas encore d'évaluation

- Succession: General Provisions Art. 774. Distinction Between Inheritance and SuccessionDocument11 pagesSuccession: General Provisions Art. 774. Distinction Between Inheritance and SuccessionJaleann Español100% (1)

- Assesment WardenDocument3 pagesAssesment WardenJaleann EspañolPas encore d'évaluation

- Purchase Request: Provincial Government of CagayanDocument4 pagesPurchase Request: Provincial Government of CagayanJaleann EspañolPas encore d'évaluation

- Annual Procurement Plan 2019Document13 pagesAnnual Procurement Plan 2019Jaleann EspañolPas encore d'évaluation

- Hon. Manuel Mamba: Mercie A. CoboDocument1 pageHon. Manuel Mamba: Mercie A. CoboJaleann EspañolPas encore d'évaluation

- Application Dela CruzDocument1 pageApplication Dela CruzJaleann EspañolPas encore d'évaluation

- UCV bLAWck ScreeningDocument3 pagesUCV bLAWck ScreeningJaleann EspañolPas encore d'évaluation

- Certification of Travel LupoDocument1 pageCertification of Travel LupoJaleann EspañolPas encore d'évaluation

- Mciaa Vs Marcos (Tax)Document9 pagesMciaa Vs Marcos (Tax)Jaleann EspañolPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)