Académique Documents

Professionnel Documents

Culture Documents

Employee benefits accounting standards

Transféré par

JAY AUBREY PINEDADescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Employee benefits accounting standards

Transféré par

JAY AUBREY PINEDADroits d'auteur :

Formats disponibles

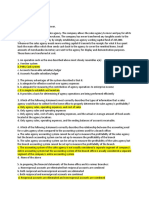

University of Santo Tomas

AMV – College of Accountancy

IAC 11 - Integrated Review in Financial Accounting and Reporting

EMPLOYEE BENEFITS (IAS 19)

Employee Benefits – all forms of consideration given by an entity in exchange for services

rendered by employees or for termination of employment.

Categories of Employment Benefits:

1. Short-term Employee Benefits

- Settled within 12 months after year end in which the employees render the related

service.

A. Accumulating Short-term Employee Benefits

Recognized as expense during the reporting period when the employee has

rendered the service, unless it forms part of the cost of another asset.

Liability for Compensation Absences (current liability)

Vesting or Non-vesting

a. Vesting – paid to employees upon leaving the entity and measured at the rate

expected to apply when the employee claims the entitlement.

b. Non-vesting - measured at year end taking into consideration the benefits that

the employees will most likely claim during the availment period; LIFO

approach.

B. Non-Accumulating Short-term Employee Benefits

Recognized as expense when the absences occur.

2. Post-Employment Benefits

- Formal or informal arrangements

- Payable after the completion of employment

Classification of Pension Plans

A. Contributory and Non-Contributory Plans

Contributory Plans - both employee1 and employer contribute

Non-contributory Plans – only the employer contributes

B. Funded and Unfunded Plans

Funded Plans – trustee (or funding agency) is designated to manage the fund

Unfunded Plans – employer manages the fund

C. Defined Contribution and Defined Benefit Plans

Defined Contribution Plans

- Specify the employer’s contribution based on a formula

- Employee bears actuarial and investment risk

- Post-Employment Benefit Expense = Gross Payroll x %

- Journal Entry:

Post-Employment Benefit Expense (Operating Expense) xx

Prepaid/Accrued Employee Benefit Cost (Current Liability) xx

Cash xx

Defined Benefit Plans

- Define the benefits the employees will receive at retirement based on a

formula

- Employer bears actuarial and investment risk

1 Through salary deductions.

- Requires actuarial assumptions (may result to Actuarial G/L)

- Measured on a discounted basis

Defined Benefit Defined Benefit Liability

Cost (Deficit) or Asset (Surplus)2

P/L OCI DBO FVPA

Beginning Balance xx xx

Current Service Cost xx xx

Interest Cost:

Interest on DBO xx xx

Expected Return on FVPA (xx) xx

Past Service Cost xx xx

Contributions xx

Benefits Paid (xx) (xx)

Remeasurements:

Actuarial Gain (xx) (xx) xx

Actuarial Loss __ xx xx (xx)

Ending Balance xx xx xx xx

- Defined Benefit Obligation (DBO) – Present value of expected future payments

to employees.

- Current Service Cost

o Increase in the present value of DBO resulting from employee service in

the current period.

o Discounts each year for the remaining years to maturity

o Computed using the Projected Unit Credit Method (PUCM) which uses

demographic and financial variables

- Future Value Factor:

o (increases @ 1/1) Years – 1

o (increases @ 12/31) Years – 2

- Interest Cost – uses discount rate by reference to market yields at the end of

the period on: (1) high quality corporate bonds, or (2) government bonds.

- Return on Plan Assets = Income + Unrealized & Realized Gain/Loss – Cost of

Managing Plan Assets – Tax Payable

- Settlement occurs when:

o Payment is made to plan participants; or

o Transfer of obligations under the plan to an insurance company

- Actuarial Gains/Losses result from:

o Change in the present value of the DBO

o Difference between actual and expected return on plan assets

- Defined Benefit Liability, end = Defined Benefit Liability, beg + Accrual of

Defined Benefit Cost – Contribution

- Asset Ceiling

o Present value of future economic benefits through: (1) reduction in

future contributions, or (2) refund from funding agency.

o Amount of the FVPA that will be shown in the SFP.

o Surplus, end – Asset Ceiling, end

- Surplus, beg – Asset Ceiling, beg

Total Adjustment to Defined Benefit Asset

o Total Adjustment to DBA is taken to:

2 Presented in the Statement of Financial Position (SFP).

a. P/L3 = (Surplus, beg – Asset Ceiling, beg) x Discount Rate

b. OCI = Excess

- Journal Entry:

Retirement Benefit Expense (P/L) xx

Remeasurement of Defined Benefit Asset/Liability (OCI) xx

Defined Benefit Asset/Liability xx

Defined Benefit Asset/ Liability xx

Cash xx

Funding (contribution to funding agency)

3. Other Long-term Employee Benefits

- Examples: Long-service leave/Sabbatical leave, Jubilee or other long-service benefits,

Long-term stability benefits, Profit sharing and bonuses, Deferred remunerations

- Same rules as those of a Defined Benefit Plan, except hat no part of remeasurement shall

be taken to OCI.

4. Termination Benefits

- Given in exchange for the termination of employment because of either: (1) an entity’s

decision, or (2) an employee’s decision.

- Recognize a liability and expense at the earlier of the following dates:

When the entity can no longer withdraw the offer of those benefits

When the entity recognizes cost for restructuring and involves the payment of

termination benefits.

Discounted if due more than 12 months after the end of the reporting period.

End of Handout.

3 As an adjustment to interest costs.

Vous aimerez peut-être aussi

- Shareholder's Equity Accounting FundamentalsDocument18 pagesShareholder's Equity Accounting FundamentalsAccounting FilesPas encore d'évaluation

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Chapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocument30 pagesChapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsChristian Romeroso Baldonanza76% (17)

- Aud Prob Part 1Document106 pagesAud Prob Part 1Ma. Hazel Donita DiazPas encore d'évaluation

- Accounting For Postemployment Benefits Summary PDFDocument3 pagesAccounting For Postemployment Benefits Summary PDFShaireen Prisco RojasPas encore d'évaluation

- Teaching and Learning ResourcesDocument4 pagesTeaching and Learning ResourcesTey Lee PohPas encore d'évaluation

- 1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Document10 pages1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Margaux Phoenix KimilatPas encore d'évaluation

- Special Production Issues On Lost Units and AccretionDocument47 pagesSpecial Production Issues On Lost Units and AccretionKuroko0% (1)

- p2 1405 FranchiseDocument3 pagesp2 1405 Franchiseattiva jadePas encore d'évaluation

- Mid Term Business Economy - Ayustina GiustiDocument9 pagesMid Term Business Economy - Ayustina GiustiAyustina Giusti100% (1)

- Accountancy Refresher Course on Quantitative TechniquesDocument4 pagesAccountancy Refresher Course on Quantitative Techniquesshamel marohom100% (2)

- Chapter 34 - Share-Based PaymentDocument18 pagesChapter 34 - Share-Based PaymentBin Saadun100% (1)

- RFBT Quiz 1 B45 PDFDocument5 pagesRFBT Quiz 1 B45 PDFrose annPas encore d'évaluation

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasPas encore d'évaluation

- Pa2.M-1403 Process CostingDocument16 pagesPa2.M-1403 Process CostingJeric Israel0% (3)

- Franchise Accounting - NotesDocument2 pagesFranchise Accounting - NotesBrunxAlabastro100% (6)

- 1Document11 pages1JAY AUBREY PINEDAPas encore d'évaluation

- Chapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSDocument3 pagesChapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSAlyssa BerangberangPas encore d'évaluation

- FBT Tax Rules ExplainedDocument3 pagesFBT Tax Rules ExplainedAnne Camille AlfonsoPas encore d'évaluation

- AMPOONDocument28 pagesAMPOONMelanie AmpoonPas encore d'évaluation

- V Ships Appln FormDocument6 pagesV Ships Appln Formkaushikbasu2010Pas encore d'évaluation

- Partnership ExercisesDocument37 pagesPartnership ExercisesAuroraPas encore d'évaluation

- Understanding IFRS 12 on Service Concession ArrangementsDocument7 pagesUnderstanding IFRS 12 on Service Concession ArrangementsPolinar Paul MarbenPas encore d'évaluation

- Sebu6918 03 00 AllDocument94 pagesSebu6918 03 00 AllAhmed Moustafa100% (1)

- GI Inclusions, Exclusions and DeductionsDocument16 pagesGI Inclusions, Exclusions and DeductionsBonDocEldRic100% (1)

- LIABILITIES and EQUITY ALASTOY BSA 2Document91 pagesLIABILITIES and EQUITY ALASTOY BSA 2JAY AUBREY PINEDAPas encore d'évaluation

- Ch13 Current Liab and ContigenciesDocument46 pagesCh13 Current Liab and ContigenciesJane Masigan100% (1)

- 2016-08-03 Iot Global Forecast Analysis 2015-2025Document65 pages2016-08-03 Iot Global Forecast Analysis 2015-2025Hoang ThanhhPas encore d'évaluation

- Costing Problems SolutionsDocument16 pagesCosting Problems SolutionsJAY AUBREY PINEDA50% (2)

- Module 1 Relevant CostingDocument6 pagesModule 1 Relevant CostingJohn Rey Bantay RodriguezPas encore d'évaluation

- Responsibility Accounting: Acctg 205: Management ScienceDocument34 pagesResponsibility Accounting: Acctg 205: Management ScienceElisePas encore d'évaluation

- Accounting for employment benefitsDocument5 pagesAccounting for employment benefitsiamacrusaderPas encore d'évaluation

- Chapter 35-Impairment of Asset Cash Generating Unit: (PFRS 36, Par. 76)Document5 pagesChapter 35-Impairment of Asset Cash Generating Unit: (PFRS 36, Par. 76)Konrad Lorenz Madriaga UychocoPas encore d'évaluation

- Notes and Loans ReceivableDocument10 pagesNotes and Loans ReceivableKent TumulakPas encore d'évaluation

- BFINMAX Handout - Gross Profit Variance AnalysisDocument6 pagesBFINMAX Handout - Gross Profit Variance AnalysisDeo CoronaPas encore d'évaluation

- MSU College of Business Administration and Accountancy Operating Leases StudyDocument4 pagesMSU College of Business Administration and Accountancy Operating Leases StudyJayr BVPas encore d'évaluation

- PFRS 2 Share-Based CompensationDocument4 pagesPFRS 2 Share-Based CompensationBeatrice TehPas encore d'évaluation

- IA2 06 - Handout - 1 PDFDocument5 pagesIA2 06 - Handout - 1 PDFMelchie RepospoloPas encore d'évaluation

- Joint Product CostingDocument3 pagesJoint Product CostingClint-Daniel AbenojaPas encore d'évaluation

- Shareholders' Equity Review QuestionsDocument18 pagesShareholders' Equity Review QuestionsAdrianBrionesGallardoPas encore d'évaluation

- Chapt 23 Current LiabilitiesDocument47 pagesChapt 23 Current LiabilitiesMikaela SamontePas encore d'évaluation

- Accounting For Income Tax-1Document4 pagesAccounting For Income Tax-1CAIPas encore d'évaluation

- Post-Employment BenefitsDocument2 pagesPost-Employment BenefitsJustz LimPas encore d'évaluation

- Business Combinations Notes Ch 1-3Document4 pagesBusiness Combinations Notes Ch 1-3Mary Jescho Vidal AmpilPas encore d'évaluation

- EXERCISES On EARNINGS PER SHAREDocument4 pagesEXERCISES On EARNINGS PER SHAREChristine AltamarinoPas encore d'évaluation

- Chapter 34 PFRS 15 Revenue From Contracts With CustomersDocument3 pagesChapter 34 PFRS 15 Revenue From Contracts With Customersjeanette lampitocPas encore d'évaluation

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesPas encore d'évaluation

- Long Term Construction Contracts AssignmentDocument10 pagesLong Term Construction Contracts AssignmentAlleli Cruz100% (2)

- Discontinued Operations ProblemsDocument4 pagesDiscontinued Operations ProblemsJeane Mae BooPas encore d'évaluation

- MODULE 2 CVP AnalysisDocument8 pagesMODULE 2 CVP Analysissharielles /Pas encore d'évaluation

- Government Accounting'Document22 pagesGovernment Accounting'Jayvee FelipePas encore d'évaluation

- Manage Receivables & Inventory EffectivelyDocument4 pagesManage Receivables & Inventory EffectivelyClaudine DuhapaPas encore d'évaluation

- Ias 12Document32 pagesIas 12Cat ValentinePas encore d'évaluation

- Abc 2Document2 pagesAbc 2Kath LeynesPas encore d'évaluation

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodPas encore d'évaluation

- Fringe Benefit Tax - Nov 06Document27 pagesFringe Benefit Tax - Nov 06Renievave TorculasPas encore d'évaluation

- AC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsDocument78 pagesAC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsmerryPas encore d'évaluation

- Bonds Payable ConceptsDocument20 pagesBonds Payable ConceptsThalia Rhine AbertePas encore d'évaluation

- Book Value Per Share Basic Earnings PerDocument61 pagesBook Value Per Share Basic Earnings Perayagomez100% (1)

- PFRS 14 15 16Document3 pagesPFRS 14 15 16kara mPas encore d'évaluation

- Labor Law EssentialsDocument7 pagesLabor Law EssentialsHads LunaPas encore d'évaluation

- Sales Agency Accounting SystemDocument1 pageSales Agency Accounting Systemalmira garciaPas encore d'évaluation

- 015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Document3 pages015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Zatsumono YamamotoPas encore d'évaluation

- Chap 07 - Study GuideDocument8 pagesChap 07 - Study Guidedimitra triantosPas encore d'évaluation

- Dealings in PropertyDocument62 pagesDealings in PropertyDonna May CacayorinPas encore d'évaluation

- Prelim Exam Discussion: Priority of OrderDocument3 pagesPrelim Exam Discussion: Priority of OrderMarianne Portia Sumabat100% (1)

- Fin AcctgDocument9 pagesFin AcctgCarl Angelo0% (1)

- Postemployment Benefits ExplainedDocument4 pagesPostemployment Benefits ExplainedEidel PantaleonPas encore d'évaluation

- Employee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Document10 pagesEmployee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Mica DelaCruzPas encore d'évaluation

- Employee Benefits AccountingDocument10 pagesEmployee Benefits AccountingFujoshi BeePas encore d'évaluation

- Acquiring New Knowledge: Module 5 Employee Benefits Learning ObjectivesDocument11 pagesAcquiring New Knowledge: Module 5 Employee Benefits Learning ObjectivesErine ContranoPas encore d'évaluation

- At 04Document35 pagesAt 04JAY AUBREY PINEDAPas encore d'évaluation

- Law On CorporationsDocument23 pagesLaw On CorporationsTyra Joyce RevadaviaPas encore d'évaluation

- Chapter 14Document33 pagesChapter 14Nuts42080% (5)

- Orca Share Media1506255759817Document156 pagesOrca Share Media1506255759817Pauline Kisha Castro86% (7)

- Non Current LiabilityDocument4 pagesNon Current LiabilityJAY AUBREY PINEDAPas encore d'évaluation

- Fundamentals of Assurance Services (Unfinished)Document2 pagesFundamentals of Assurance Services (Unfinished)JAY AUBREY PINEDAPas encore d'évaluation

- Income TaxesDocument2 pagesIncome TaxesJAY AUBREY PINEDAPas encore d'évaluation

- Employee sign-in sheet templateDocument1 pageEmployee sign-in sheet templateJAY AUBREY PINEDAPas encore d'évaluation

- Assurance EngagementDocument24 pagesAssurance EngagementLuke ShawPas encore d'évaluation

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- Source DocumentDocument1 pageSource DocumentJAY AUBREY PINEDAPas encore d'évaluation

- Chapter 17 Test BankDocument29 pagesChapter 17 Test BankIvhy Cruz Estrella100% (1)

- Income TaxesDocument2 pagesIncome TaxesJAY AUBREY PINEDAPas encore d'évaluation

- UST AMV College Accountancy IAC 11 ReviewDocument1 pageUST AMV College Accountancy IAC 11 ReviewJAY AUBREY PINEDAPas encore d'évaluation

- Non Current LiabilityDocument4 pagesNon Current LiabilityJAY AUBREY PINEDAPas encore d'évaluation

- CVP2016IIDocument2 pagesCVP2016IIPauline Kisha CastroPas encore d'évaluation

- Obligations (Unfinished)Document3 pagesObligations (Unfinished)JAY AUBREY PINEDAPas encore d'évaluation

- Fundamentals of Assurance Services (Unfinished)Document2 pagesFundamentals of Assurance Services (Unfinished)JAY AUBREY PINEDAPas encore d'évaluation

- Management Advisory Services RoleDocument15 pagesManagement Advisory Services RoleJAY AUBREY PINEDAPas encore d'évaluation

- Management Advisory Services RoleDocument15 pagesManagement Advisory Services RoleJAY AUBREY PINEDAPas encore d'évaluation

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- DocDocument8 pagesDocJAY AUBREY PINEDAPas encore d'évaluation

- Relevant Cost - Part1Document7 pagesRelevant Cost - Part1JAY AUBREY PINEDAPas encore d'évaluation

- Cambridge IGCSE: Computer Science 0478/12Document16 pagesCambridge IGCSE: Computer Science 0478/12Rodolph Smith100% (2)

- MCS Adopts Milyli Software Redaction Tool BlackoutDocument3 pagesMCS Adopts Milyli Software Redaction Tool BlackoutPR.comPas encore d'évaluation

- SBLO Jepp Charts PDFDocument12 pagesSBLO Jepp Charts PDFElton CacefoPas encore d'évaluation

- Schedule For Semester III, Class of 2021Document7 pagesSchedule For Semester III, Class of 2021Jay PatelPas encore d'évaluation

- Bylaw 16232 High Park RezoningDocument9 pagesBylaw 16232 High Park RezoningJamie_PostPas encore d'évaluation

- Dice Resume CV Narendhar ReddyDocument5 pagesDice Resume CV Narendhar ReddyjaniPas encore d'évaluation

- Organized Educator Seeks New OpportunityDocument1 pageOrganized Educator Seeks New OpportunityCaren Pogoy ManiquezPas encore d'évaluation

- Conics, Parametric Equations, and Polar CoordinatesDocument34 pagesConics, Parametric Equations, and Polar CoordinatesGARO OHANOGLUPas encore d'évaluation

- Uvas CaractDocument10 pagesUvas CaractgondeluPas encore d'évaluation

- Making An Appointment PaperDocument12 pagesMaking An Appointment PaperNabila PramestiPas encore d'évaluation

- Or Medallist Results WorldSkills Scale and 100 ScaleDocument39 pagesOr Medallist Results WorldSkills Scale and 100 ScaleJosePas encore d'évaluation

- Eladio Dieste's Free-Standing Barrel VaultsDocument18 pagesEladio Dieste's Free-Standing Barrel Vaultssoniamoise100% (1)

- PuppetsDocument11 pagesPuppetsShar Nur JeanPas encore d'évaluation

- WFP-Remote Household Food Security Survey Brief-Sri Lanka Aug 2022Document18 pagesWFP-Remote Household Food Security Survey Brief-Sri Lanka Aug 2022Adaderana OnlinePas encore d'évaluation

- Effects of Zero Moment of Truth On Consumer Behavior For FMCGDocument14 pagesEffects of Zero Moment of Truth On Consumer Behavior For FMCGBoogii EnkhboldPas encore d'évaluation

- Alarm Management Second Ed - Hollifield Habibi - IntroductionDocument6 pagesAlarm Management Second Ed - Hollifield Habibi - IntroductionDavid DuranPas encore d'évaluation

- A-00 IndexDocument10 pagesA-00 IndexNizarHamrouniPas encore d'évaluation

- Communication in Application: WhatsappDocument18 pagesCommunication in Application: WhatsappNurul SuhanaPas encore d'évaluation

- An IDEAL FLOW Has A Non-Zero Tangential Velocity at A Solid SurfaceDocument46 pagesAn IDEAL FLOW Has A Non-Zero Tangential Velocity at A Solid SurfaceJayant SisodiaPas encore d'évaluation

- CVCITC Smoke-Free Workplace Policy & ProgramDocument2 pagesCVCITC Smoke-Free Workplace Policy & ProgramKristine Joy CabujatPas encore d'évaluation

- Me2404 Set1Document16 pagesMe2404 Set1sakthivelsvsPas encore d'évaluation

- Research Chapter 1Document7 pagesResearch Chapter 1Aryando Mocali TampubolonPas encore d'évaluation

- 10 Compactness in Function Spaces: Ascoli-Arzel A TheoremDocument5 pages10 Compactness in Function Spaces: Ascoli-Arzel A TheoremronalduckPas encore d'évaluation

- Applied SciencesDocument25 pagesApplied SciencesMario BarbarossaPas encore d'évaluation

- Investigation Report on Engine Room Fire on Ferry BerlinDocument63 pagesInvestigation Report on Engine Room Fire on Ferry Berlin卓文翔Pas encore d'évaluation