Académique Documents

Professionnel Documents

Culture Documents

Types of Audits

Transféré par

koteswararaoavula0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues9 pagesThere are many types of audits that provide varying levels of assurance. Some key types include external audits conducted by independent audit firms, internal audits that evaluate internal controls and risks, statutory audits required by law, financial audits of financial statements, tax audits by government authorities, and compliance audits to ensure adherence to policies and regulations. Audits differ in their objectives, scope, procedures, and standards used to provide assurance to stakeholders.

Description originale:

Titre original

Types of Audits.docx

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThere are many types of audits that provide varying levels of assurance. Some key types include external audits conducted by independent audit firms, internal audits that evaluate internal controls and risks, statutory audits required by law, financial audits of financial statements, tax audits by government authorities, and compliance audits to ensure adherence to policies and regulations. Audits differ in their objectives, scope, procedures, and standards used to provide assurance to stakeholders.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues9 pagesTypes of Audits

Transféré par

koteswararaoavulaThere are many types of audits that provide varying levels of assurance. Some key types include external audits conducted by independent audit firms, internal audits that evaluate internal controls and risks, statutory audits required by law, financial audits of financial statements, tax audits by government authorities, and compliance audits to ensure adherence to policies and regulations. Audits differ in their objectives, scope, procedures, and standards used to provide assurance to stakeholders.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 9

Types of Audits:

Overview Types of Audits:

Audit is an art of systematic and independence review and

investigation on Financial Statements, Management Accounts,

Management Reports, Accounting Records, Operational Reports,

Revenues Reports, and Expenses Reports etc. The result of

reviewing and investigation will be reported to shareholders and

others key internal stakeholders of the entity.

Audit reports sometime submit to others stakeholders like

government, banks, creditors or public. Audit is classified into

many different types and level of assurance according to the

objectives, scopes, purposes and the procedures of how auditing

is performed.

The execution of an financial statements auditing is normally in

accordance with International Standards on Auditing (ISA) as well

as others local auditing standards. There are many types of audit

including financial audit, operational audit, statutory

audit, compliance audit and so on.

In this article, we will explain the 14 types of audits that being

perform in the current audit industry or practices.

Here are the list of 14 Types of Audits and Level of Assurance:

#1: External Audit

External audit is type of audit service that audit firm provides

Assurance Service, Consultant Service, Tax Service, Legal

Service, Financial Advisory, and Risk Management Advisory. The

best example of external auditing are the services that providing

by these big four audit firm including KPMG, PWC, EY and

Deloitte.

External auditors are normally referring to audit staffs who are

working in audit firms. These kind of firms are sometime called

CPA firms as they required by law to hold CPA qualification on

order to be able to run audit firm and issue the audit reports.

This type of audit required to maintain professional code of ethic

and strictly follow International Standards on Auditing and/or local

standards as required by local law.

The firms are working independently from auditing clients that

they are auditing and if the conflict of interest is occurred, proper

procedures need to take action to minimize the conflicts. The form

should consider withdraw from audit engagement if the

impairment could not minimize to the acceptable level.

Noted: Some external audit firms are also offering internal audit

services. The popular services that offer by external audit firms

are audit on financial statements, tax consultant, and advisory

services.

#2: Internal Audit

Internal Auditing is an independence, and objectivity consulting

service which is design to add value to the business and improve

entity’s operation. It provides the systematic and discipline

approach on evaluating and assessing the risks management,

internal control and corporate governance.

Scope of internal audit is generally determine by audit committee,

board of directors or directors that have equivalence

authorization. And if there is no audit committee and board of

directors, internal audit normally report to owner of the company.

Internal audit activities is normally covered internal control

reviewing, operational reviewing, fraud investigation, compliant

reviewing, and others special tasks that assigned from audit

committee or BOD.

Related article Analytical Procedures: Definition, Use, and Types

#3: Forensic Audit

Forensic audit is normally performed by forensic accountant who

have the skill in both accounting and investigation. Forensic

Accounting is the type of engagement that undertaking the

Financial Investigation in response to a particular subject matter,

where the findings of the investigation normally be used as

evidence in court.

The investigation is covering numbers of areas include fraud,

crime, insurance claims as well as dispute among shareholders.

Forensic audit is also need to have proper plan, procedure and

report like others audit engagement.

Forensic audit also need to for follow ethical guideline like an

audit of financial statements. This kind of engagement is not so

popular as an audit of financial statements or statutory auditing.

#4: Statutory Audit

Statutory audit is referring to an audit of financial statements for

specific type of entities that required by law or local authority. For

example, all banking sectors required their financial statements to

be audited by qualified audit firms that approved by their central

bank.

Statutory audit might be difference from financial statements

auditing as financial audit is referring to audit of all types of

entity’s financial statements including both meet or not meet the

government’s requirement.

However, statutory audit refer to only auditing of entity’s financial

statements that required by local law. The statutory audit is

normally performed by external audit firms and audit report will be

issued by auditor and submit to government body by entity. The

best example of the firm that offering statutory auditing are

KPMG, PWC, EY, …. ect.

The common criterias set by law that required entities to have

their financial statements auditing by qualified audit firm are

amount annual turnover, value of assets, and number of staffs.

Some countries may requires company in specific industries like

bank, mineral, and others based on their decision to have those

company’s financial statements audited.

Companies that listed in the stock exchange are generally

required and enforce by stock exchange authority to have

qualified audit form audited their financial statements.

#5: Financial Audit

Financial audit refer to audit of entity’s financial statements by an

independence auditor where audit opinion will be provided on

those financial statements. Financial audit normal perform by

external audit firm who hold CPA. Financial audit normally

perform annually and at the end of the accounting period. This

type of audit is also known as financial statements auditing.

But, sometime as require management, bank, security exchange,

regulation, or els, the financial audit is also performing on

quarterly as well. Most of the entity prepare its financial

statements based on IFRS, and some entity’s financial

statements are prepared based on local GAAP.

For example, the entity register in US, their financial statements

are prepared based on US GAAP. If the financial statements are

prepared based on IFRS, then financial audit need to be audit

against IFRS.

However, if the financial statements are prepared based local

GAAP, then audit need to be performed against those local

GAAP. The audit standards that use by auditor to conduct

financial audit need to adopt international standards and

requirement of local law.

Some country require audit firm to follow its audit standards while

some others countries have adopted the international standards

and transform it to be locally.

#6: Tax Audit

Tax audit is type of audit that performing by government tax

department or tax authority. Tax audit could be performed as the

result of in-compliant found by government agency or the

schedule set by government tax department.

Entity need not to invite or engage with tax authority to come to

perform tax audit. They will come by themselves. To minimize the

penalty as the result of tax audit, entity is recommended to follow

all the requirement set by tax law and for those areas that they

are not sure, entity should engagement with tax consulting firm for

advising.

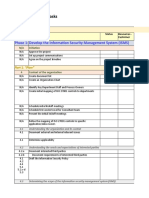

#7: Information System Audit or Information

Technology Audit (IT Audit)

Information system audit is sometime called IT audit. This type of

audit assess and check the reliability of security system,

information security structure, and integrity of system.

Sometime, financial auditing also require to has IT auditing as

now technology is increasing and most of client’s financial reports

are recording by complex accounting software. Audit approach

also changed due to the changing of management’s approach in

recording and reporting their entity’s financial information.

Normally, before relying on information system (software) that use

for producing financial statements, auditor required to have IT

audit team to test and review those information system first.

This kind of audit also offer and request separately from financial

audit. As you can may know, most of the big firms have this kind

of services. They are not only provide IT audit, but also offering

consultant on the information system areas.

#8: Compliance Audit

Compliance audit is type of audit that check against internal

policies and procedures as well as law and regulation. Law and

regulation here we mean the government’s law where the

business is operating.

For example, in the banking industry, there are many kind of

regulation required bankers to follow and complying with. Most of

the central banks required commercial banks to set up the

complaint review (assessment) or compliance audit to make sure

that they are complying those law and regulation set.

Entity may also assign its internal audit function to review whether

entity’s internal policies and procedures are complying and

effectively follow.

Compliance audit is part of the system that use by entity’s

management to enforce the effectiveness of implementation of

government’s law and regulation, and entity’s internal policies and

procedures.

#9: Value For Money Audit

Value for money audit refer to audit activities that perform in

assessing and evaluating three main difference factors: Economy,

Efficiency, and Effectiveness.

Economy, auditor assess and evaluate whether the resources

that entity purchases are at the low cost with acceptable quality

where efficiency audit, auditor check whether resources that entity

use have better conversion ratio.

Effectiveness by the way look at the big picture of objective

whether entity using the resources meet it objective or not.

Auditor might review entity’s purchasing system to assess and

evaluate whether it is helping entity to purchase materials or

services at the low costs or not.

#10: Review Financial Statements

Review Financial Statements is type of negative engagement

where auditors are engaging to review the financial statements of

entity. At the end of reviewing, audit are not going to express

whether financial statements are true and fair view and free from

material.

But, auditor will issue the opinion to say that there is nothings

come to their attention that financial statements are not prepare

true and fair view and free from material.

Related article Account payable confirmation

This kind of service is normally required when entity borrow

money from the bank. And the banks, as part of their policy

require entity to provide financial statements that reviewed by

external auditor.

#11: Agreed Up on Procedures (AUP)

Agreed up on procedure is type of negative engagement

where auditors perform their review on the procedures that

agreed with client. This type of engagement is called limited

assurance.

Even though the procedures are setted by client, but auditors will

also need to make sure that the firm have enough resources to

perform the job and fee are not low-balling.

Auditors will also need to make sure that there is no conflict of

interest between audit team and client management team. If the

auditor found that there is conflict of interest, the safe guide need

to check and introduce to reduce the conflict.

#12: Integrated Audit

Integrate audit is happen when there are two different areas of

audit require. For example, there is financial audit along with

social audit or there are some areas need to be confirmed with

financial audit.

For example, the NGO require their financial statements to be

audited along with technical areas that those NGO spending the

money for.

For example, NGO is working on public health and most of the

money spend are related to the public health. Beside the

expenses reports that present the expenses that NGO paid for

and need to be audited by financial auditor, there are number of

technical reports like health reports which need to be verified by

technical auditors that have experienced in assessing health

report.

This is call integrated audit. Integrated audit also happen when

the entity operate in many different countries and the financial

statements are audit by different audit firms.

#13: Special Audit

Special audit is type of audit assignment that normally done by

internal auditor. This is happened when there is the problem/case

occurred in the organization like fraud, business case or others

special case.

For example, there is fraud occurred in the payroll department

and this concern raise to audit committee or board of director or

sometime there is the request from CEO to have special audit on

this areas. Special audit is a bit different from forensic audit as

special audit done by internal staff of entity.

#14: Operational audit

Operational audit is types of audit services that the review is

mainly focus on the key processes, procedures, system, as well

as internal control which main objective is to improve the

productivity, as well as efficiency and effectiveness of operation.

Operation audit is also targeted the leak of key control and

processes that cause waste of resources and then recommend

for improvement.

Operational audit is the part of internal audit and their main aim is

to add value to the business their professional services.

Systematic and highly discipline is also the part that help to make

sure the operational audit add value to the organization.

Vous aimerez peut-être aussi

- Role of Auditors in Ensuring Good Corporate GovernanceDocument9 pagesRole of Auditors in Ensuring Good Corporate GovernanceDevansh SrivastavaPas encore d'évaluation

- Credit Rating FinalDocument32 pagesCredit Rating FinaldevrajkinjalPas encore d'évaluation

- Audit Working PaperDocument10 pagesAudit Working PaperKetan JainPas encore d'évaluation

- Practical AuditingDocument77 pagesPractical AuditingVijay KumarPas encore d'évaluation

- ProjectDocument22 pagesProjectlipikaPas encore d'évaluation

- Verification and Valuation of Assets and Liabilities - Chapter-8Document8 pagesVerification and Valuation of Assets and Liabilities - Chapter-8Tareq90% (10)

- The Auditing ProfessionDocument10 pagesThe Auditing Professionmqondisi nkabindePas encore d'évaluation

- Audit Case Study AGODocument5 pagesAudit Case Study AGOAlifah SalwaPas encore d'évaluation

- HR Audit SMU MU0013Document8 pagesHR Audit SMU MU0013Abdullah AzadPas encore d'évaluation

- Internal Audit Statutory Audit 1) AppointmentDocument3 pagesInternal Audit Statutory Audit 1) AppointmentSamiksha AngrePas encore d'évaluation

- Unit Iv-Vouching, Verification and ValuationDocument25 pagesUnit Iv-Vouching, Verification and ValuationJABEZ SMITH100% (1)

- The Chief Audit Executive-Understanding The Role and Professional Obligations of A CAE PDFDocument18 pagesThe Chief Audit Executive-Understanding The Role and Professional Obligations of A CAE PDFRexBodotaPas encore d'évaluation

- MBE PPT Unit IV Anna Universit Syllabus 2009 RegulationDocument16 pagesMBE PPT Unit IV Anna Universit Syllabus 2009 RegulationstandalonembaPas encore d'évaluation

- Consumer Behavior StagesDocument16 pagesConsumer Behavior StagesPriyanka Zalpuri100% (1)

- Auditing Notes.Document55 pagesAuditing Notes.Viraja Guru50% (2)

- Project On Audit Plan and Programme & Special AuditDocument11 pagesProject On Audit Plan and Programme & Special AuditPriyank SolankiPas encore d'évaluation

- Differences between Auditor's Report and CertificateDocument1 pageDifferences between Auditor's Report and CertificateAkshansh MahajanPas encore d'évaluation

- Internet Enabled RetailingDocument36 pagesInternet Enabled RetailingvijaybhaskarreddymeePas encore d'évaluation

- CORPORATE GOVERNANCE ppt-1Document26 pagesCORPORATE GOVERNANCE ppt-1lakshmiPas encore d'évaluation

- AuditingDocument626 pagesAuditingAbdulrehman567Pas encore d'évaluation

- Chapter 4Document5 pagesChapter 4Bonn GeorgePas encore d'évaluation

- Comprehensively_Prepared_Document_of_the_Questions_and_Answers_for_the_Interview_of_Senior_Auditor.docx_filename_= UTF-8''Comprehensively Prepared Document of the Questions and Answers for the Interview of Senior AuDocument42 pagesComprehensively_Prepared_Document_of_the_Questions_and_Answers_for_the_Interview_of_Senior_Auditor.docx_filename_= UTF-8''Comprehensively Prepared Document of the Questions and Answers for the Interview of Senior AumalaknisarkakarPas encore d'évaluation

- Essay On AuditingDocument7 pagesEssay On AuditingAndy Rdz0% (1)

- Management Audit DefinationDocument3 pagesManagement Audit DefinationshilpabinaPas encore d'évaluation

- Audit OF Public Sector Undertakings: Learning OutcomesDocument36 pagesAudit OF Public Sector Undertakings: Learning OutcomesMenuka SiwaPas encore d'évaluation

- Principles of VerificationDocument3 pagesPrinciples of Verificationpathan1990Pas encore d'évaluation

- Audit Case Trolley DodgersDocument2 pagesAudit Case Trolley Dodgerstramychiquita860% (1)

- Approaches of Designing TerritoriesDocument10 pagesApproaches of Designing TerritoriesshashankPas encore d'évaluation

- The Audit Process - Final ReviewDocument5 pagesThe Audit Process - Final ReviewFazlan Muallif ResnuliusPas encore d'évaluation

- CIA P1 SII Independence and ObjectivityDocument47 pagesCIA P1 SII Independence and ObjectivityJayAr Dela Rosa100% (1)

- AUDIT BasicDocument10 pagesAUDIT BasicKingo StreamPas encore d'évaluation

- Audit ProjectDocument22 pagesAudit ProjectJashan100% (1)

- Auditing Lecture Slides Introduction.Document30 pagesAuditing Lecture Slides Introduction.MoniquePas encore d'évaluation

- Corporate Accounting: (K.M& V Olrqfu"B Á'UDocument42 pagesCorporate Accounting: (K.M& V Olrqfu"B Á'UVarathajayasudha JeganathanPas encore d'évaluation

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- Types of AuditDocument14 pagesTypes of Auditbhaveshjaiin50% (6)

- Basic Principles Governing An AuditDocument15 pagesBasic Principles Governing An Audithumanity firstPas encore d'évaluation

- Independence, Objectivity and Due CareDocument38 pagesIndependence, Objectivity and Due CareDanica Austria DimalibotPas encore d'évaluation

- KPMG GRCS Job DescriptionDocument2 pagesKPMG GRCS Job DescriptionAadarsh GuptaPas encore d'évaluation

- Book Multiple Choice QuestionsDocument10 pagesBook Multiple Choice Questionszitorocksmyheart0% (1)

- BBA 603 Entrepreneurship GuideDocument20 pagesBBA 603 Entrepreneurship Guideaditya mishraPas encore d'évaluation

- Audit Programme - Manufacturing - Procure To PayDocument23 pagesAudit Programme - Manufacturing - Procure To PayJessmin DacilloPas encore d'évaluation

- Supreme Audit Institution Performance Measurement Framework (SAI PMF)Document39 pagesSupreme Audit Institution Performance Measurement Framework (SAI PMF)International Consortium on Governmental Financial Management100% (1)

- ACC311-Fundamental of Auditing: Solved Midterm MCQ'sDocument5 pagesACC311-Fundamental of Auditing: Solved Midterm MCQ'sZeePas encore d'évaluation

- Strategic and Operational ControlDocument9 pagesStrategic and Operational ControlRohanPas encore d'évaluation

- PSA 315: ASSESSINGDocument23 pagesPSA 315: ASSESSINGamirPas encore d'évaluation

- Ethical Dilemma Corporate SpyingDocument2 pagesEthical Dilemma Corporate SpyingRana Usama0% (1)

- Seminar Topics of AuditingDocument2 pagesSeminar Topics of AuditingNIDHIN RAJPas encore d'évaluation

- Internal Audit Key Performance Indicators (KPIs)Document15 pagesInternal Audit Key Performance Indicators (KPIs)Oumayma Niz100% (1)

- Business EnvironmentDocument18 pagesBusiness EnvironmentShaifaliChauhanPas encore d'évaluation

- Marginal Costing: Definition: (CIMA London)Document4 pagesMarginal Costing: Definition: (CIMA London)Pankaj2cPas encore d'évaluation

- Verification of Plant & Machinery, Patents andDocument9 pagesVerification of Plant & Machinery, Patents andKarun NairPas encore d'évaluation

- CIA Exam NotesDocument1 pageCIA Exam NotesMahesh ToppaePas encore d'évaluation

- Liabilities of An Auditor For Negligence and MisfeasanceDocument3 pagesLiabilities of An Auditor For Negligence and Misfeasancejamila fatima100% (2)

- Office Tools For CA Firm PDFDocument108 pagesOffice Tools For CA Firm PDFLakshmiNarayanaPinapatruniPas encore d'évaluation

- ch1 BPP Slide f1 ACCADocument95 pagesch1 BPP Slide f1 ACCAIskandar Budiono100% (1)

- International Strategic Management A Complete Guide - 2020 EditionD'EverandInternational Strategic Management A Complete Guide - 2020 EditionPas encore d'évaluation

- MRO Procurement Solutions A Complete Guide - 2020 EditionD'EverandMRO Procurement Solutions A Complete Guide - 2020 EditionPas encore d'évaluation

- BRC Management ReviewDocument8 pagesBRC Management ReviewTamar MakhviladzePas encore d'évaluation

- ISO 9000-2008 AuditingDocument23 pagesISO 9000-2008 AuditingMohamed ShabirPas encore d'évaluation

- AS9100 QMS Process ManualDocument33 pagesAS9100 QMS Process ManuallpelessPas encore d'évaluation

- Beerbal & Co Profile PDFDocument14 pagesBeerbal & Co Profile PDFIrshad murtazaPas encore d'évaluation

- Internal Audit of MS1480 2019 HACCPDocument3 pagesInternal Audit of MS1480 2019 HACCPrevival195Pas encore d'évaluation

- IATF 16949:2016 vs. ISO/TS 16949:2009 MatrixDocument26 pagesIATF 16949:2016 vs. ISO/TS 16949:2009 MatrixP.NAVEENAN50% (2)

- Auditing and Taxation: Ty Bcom - Auditing and Taxation - MCQ - Question Bank - Compiled by Manoj VoraDocument7 pagesAuditing and Taxation: Ty Bcom - Auditing and Taxation - MCQ - Question Bank - Compiled by Manoj VoraSample Use67% (3)

- ISO/IEC 17025:2017 Awareness and Auditor TrainingDocument8 pagesISO/IEC 17025:2017 Awareness and Auditor TrainingGlobal Manager Group94% (31)

- Comair AnnualReportDocument76 pagesComair AnnualReportJanus CoetzeePas encore d'évaluation

- Client ReportDocument9 pagesClient Reportade purwansyahPas encore d'évaluation

- Unit 1 Ans With Explanation Part2Document15 pagesUnit 1 Ans With Explanation Part2El Aachraoui Salah EddinePas encore d'évaluation

- Kumar Mangalam Birla CommitteeDocument24 pagesKumar Mangalam Birla CommitteeRoshni Bhatia100% (1)

- Overview of Operations Auditing - MARPDocument7 pagesOverview of Operations Auditing - MARPRPas encore d'évaluation

- Advanced Auditing and EDP: QUEENS College School of Post Graduate Studies Department of ACCOUNTING and FinanceDocument53 pagesAdvanced Auditing and EDP: QUEENS College School of Post Graduate Studies Department of ACCOUNTING and FinanceRas Dawit100% (1)

- Corporate Governance ReportDocument17 pagesCorporate Governance ReportIqbal LalaniPas encore d'évaluation

- Contribution of Internal Control System To The Financial Performance of Financial Institution A Case of People'S Bank of Zanzibar LTDDocument94 pagesContribution of Internal Control System To The Financial Performance of Financial Institution A Case of People'S Bank of Zanzibar LTDSuleiman AbdulPas encore d'évaluation

- @4 Auditing and Assurance Services - WSUDocument125 pages@4 Auditing and Assurance Services - WSUOUSMAN SEIDPas encore d'évaluation

- CH01: Overview of Internal Auditing FunctionsDocument9 pagesCH01: Overview of Internal Auditing FunctionsFarah Fazli100% (1)

- Risk Management Standard 030820Document18 pagesRisk Management Standard 030820complete9jbPas encore d'évaluation

- Internal QMS Auditor (IRCA Certified Course - Reg. NoDocument2 pagesInternal QMS Auditor (IRCA Certified Course - Reg. NoSubramanian SaravananPas encore d'évaluation

- Managing The System Development Life CycleDocument6 pagesManaging The System Development Life Cyclefathma azzahroPas encore d'évaluation

- Internal AuditDocument24 pagesInternal AuditShah Rukh N. BashirPas encore d'évaluation

- Arens Auditing16e SM 01Document14 pagesArens Auditing16e SM 01Ji RenPas encore d'évaluation

- ISO 27001 Project Tasks and Status TrackingDocument85 pagesISO 27001 Project Tasks and Status TrackingMe100% (1)

- CLAP - Brief To MentorsDocument19 pagesCLAP - Brief To Mentorsd2687681Pas encore d'évaluation

- Quality ManualDocument47 pagesQuality ManualJojokiba YosPas encore d'évaluation

- Internal Audit Report of Ratnaafin Insurance BrokingDocument49 pagesInternal Audit Report of Ratnaafin Insurance BrokingTulsi ThakarPas encore d'évaluation

- Cgia Compendium 2021 EditionDocument348 pagesCgia Compendium 2021 EditionCG LTJG GUERRERO PRECIOUS LEANELLIE UPas encore d'évaluation

- AuditingDocument10 pagesAuditingEzra PhiriPas encore d'évaluation