Académique Documents

Professionnel Documents

Culture Documents

Ch.6 Corporate Social Responsibility: Basic Premises of CSR

Transféré par

Adrian Dale DavidDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ch.6 Corporate Social Responsibility: Basic Premises of CSR

Transféré par

Adrian Dale DavidDroits d'auteur :

Formats disponibles

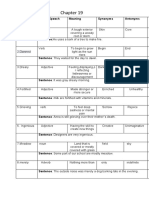

CH.

6 CORPORATE SOCIAL members which are the consequences of

RESPONSIBILITY organizational pronouncement.

BASIC PREMISES OF CSR : • Ethical decision making – is the process

of trying to established organizational

• Business leaders - understand that long values from which ethical decisions will be

term company value is based on the based from

capability of the enterprise to respond to

society’s changing needs The following may help decision makers of

organizations lay down decisions aligned with

• Consumers - search for products of

their CSR principles:

companies they believe are doing the right

thing in terms of consumer protection, 1. Withdraw

human rights and the environment. 2. Be an Archivist

• Employees – have a preference to work for 3. The option of doing nothing

companies whom they share similar mission 4. Be conscious of long term effects

and values and where they can make 5. Consider legalities and ethics

contribution to society.

6. Ask around

• Investors - look for companies that 7. Be Comprehensively sensitive

recognize and manage their risks and are

8. Do not be a dangerous “alpha make”

entrepreneurial in terms of attitude in

identifying emerging and promising 9. Find a win-win solution

business opportunities.

Myths about organizational ethics

• Local communities - wants to know that

businesses are being good citizens. • Being Ethical is Easy – being ethical is not

• Media - expose some examples of best and easy considering that to be ethical means

worst practices to spotlight. that business conduct most of the time has

to be beyond the minimum legal

• NGO’s – expose these examples of requirement.

irresponsible corporate conduct and

campaign for greater corporate • Being ethical is not part of doing

accountability and transparency business – it should be something that

• Regulators – want to make certain that comes with the existence of the enterprise

business activities not only generate • Being ethical brings no benefit – it is not

business opportunities, job and economic true that being ethical has no reward.

growth but also solve serious problems. Arguably, the only investment without any

SPECIFIC RELEVANCE OF CSR loss is being ethical.

1. Changing Social Expectations What ethics is not

2. Competitive labor markets

• Ethics is not the same as feelings – some

3. Disclosure demands by stakeholders people have highly developed habits that

4. Dwindling Government Role make them feel bad when they do

5. Globalization something wrong but many people feel

6. Pressure from investors good even though they are doing something

7. Supplier Relations wrong.

8. Wealth and Vulnerabilities • Ethics is not religion - many religions are

9. Ethical Leadership not religious but ethics applies to everyone.

ETHICAL DECISION MAKING PROCESS IN

ORGANIZATIONS • Ethics is not just following the laws - a

good system of laws does incorporate many

• Ethics – is an organization refers to system, ethical standards but law can deviate from

values, philosophies and principles that what is ethics.

govern the behavior of organization

F440 aka GRADWAITING

• Ethics is not following culturally – Develops future workforce contributing

accepted norms – some cultures are quite to a sustainable company

ethical but others become corrupt or bind to

certain ethical concerns C. Benefits to the community

• Ethics is not science – science may – Improves quality of life of the community

provide and explanations for what humans members

are like. But ethics provides reasons for how – Provides human and capital resources to

human ought to act. non-profit organizations

CORPORATE CITIZENSHIP SOCIAL SCREENING OF INVESTMENTS

• Corporate citizenship – refers to the For social screening of investment, the following

acceptance by business of a conscious strategies might corporate decision makers:

effort in focusing and in satisfying the

economic, legal, ethical, philanthropic and • “SCARE-OFF FROM” STRATEGY – it can

social responsibilities and other acts be characterized by hard policies such as

expected from the corporation to do to its no investment to those companies with

stakeholders. questionable environmental records, those

engaged in child labor discrimination, those

Corporate citizenship has the following key who use animals in product testing and

elements many other anti-earth and anti-green

policies.

• Commitment to quality

• Ethical legal compliance • Impact mitigation – this approach is

• Stewardship and governance founded upon the idea that for everything

the company does there is always an

• Superior employee relation

impact to the stakeholders.

• Social advocacy

• Community involvement • Whoever is the best - this strategy involves

PHILANTROPHY OF SOCIAL INCENTIVES a kind of free market model where a

companies within the same industries

• Philanthropy – is the practice of giving compete with one another for the best

money and time to help better for other records on a variety of social issues.

people

• Main or derivative connections – this

• Corporate philanthropy - refers to the strategy requires investors to decide

giving of the company’s profit directly to whether or not they are concerned if an

charitable organization or to individual in investment has a secondary involvement

need with the intention of helping and with a social problem.

improving the quality of the different

corporate stakeholders GREENWASHING

Benefits of corporate philanthropy • Greenwashing - refers to the practice of

companies characterized by deceptively

A. Benefits to business making it appear that their products,

– Enhances corporate reputation services and policies are environmentally

– Improves relations with the government, friendly by projecting cost cuts as reduction

the community and the key in use of resources or investment in “green

stakeholders concerns” like in areas of ecology and

– Support a company’s strategic environment

business goal

• Sin of the hidden trade-off

– “energy-efficient” electronics that

B. Benefits to stakeholders

contains hazardous material

– Build employee morale and

– Candies, drinks, beverages and other

engagements

sweets with “no sugar” label

– Enlarges sense of community and

social obligations

F440 aka GRADWAITING

• Sin of no proof CORPRATE SOCIAL RESPONSIBILITY IN A

– Shampoos claiming to be “certified GLOBAL CONTEXT

organic” but with no verifiable certification

• Sin of vagueness • CSR AND DEVELOPING COUNTRY

– Products claiming to be 100% natural

when many naturally-occurring CSR aims to examine the role of business in

substances are hazardous like arsenic society and to maximize the positive societal

and formaldehyde outcomes of business activity.

– The use of paper bags, cups and other • JUSTIFICATION FOR CSR

packaging and capitalized the term

“biodegradable” to improve company Two broad set of justifications for public sector

image. actors in the middle and low-income countries:

• Sin of irrelevance 1. Defensive – relates to minimizing the

– Products claiming to be CFC-free even potential adverse effects of CSR on local

though CFCs were banned 20 yrs. ago. communities, environments and markets

when it is imposed through international

• Sin of fibbing supply chains and investment

– Product falsely claiming to be certified by 2. Proactive – for public sector actors to

an internationally recognized engage with CSR is provided by the

environmental standard like ecologo, opportunity to increase the domestic public

energy star or green seal benefits of CSR practices in economic,

social and environmental terms.

• Sin of lesser of two evils

– Organic cigarettes of “environmentally • POTENTIAL ROLES OF GOVERNMENT

friendly” pesticides IN -THE CSR AGENDA

• Sin of worshipping false labels A first broadly defined goal of the public

– this is perpetrated by a product wherein engagement in CSR is the alignment of business

by either words or images activities and public policy to achieve societal goals.

• THE MULTIPLICITY OF POLICY

WAYS ON HOW TO SPOT GREENWASHING

INSTRUMENT

• Poor use of scientific facts

• The use of buzz words like “carbon CSR Practice 5 distinctive roles for public

intensity”, “sustainable development”, sector engagement:

“carbon offsets”, and “clean technology”. 1. Regulation

• Look at the environmental label on the 2. Facilitation

product. Save those that are backed by a 3. Partnership

strict independent certification. 4. Endorsement

• Never abandon common sense 5. Demonstration

• Look out for negligible green claims, mainly

when a company focuses on one small Factors that may determine the course of

green attribute when the rest of the action taken by any individual government:

company or product is not green. • Capacity Constraints

• The size of domestic markets for product

CH 7 CORPORATE SOCIAL potentially affected by CSR concerns

RESPONSIBILITY AND CORRUPTION IN A • The degree of export orientation of the

GLOBAL CONTEXT economy in sectors affected by international

CSR drivers (e.g. agriculture, textiles,

CORPORATE SOCIAL RESPONSIBILITY - A pharmaceuticals)

comprehensive set of policies practices, programs • The presence of enterprises willing to

that are integrated into business operations, supply champion charge

chains and decision making processes throughout • The degree of which different stakeholders

the company and include responsibilities for current are comfortable working in partnership for

and past actions as well as adequate attention to commonly defined outcomes.

future impacts.

F440 aka GRADWAITING

CSR IN INTERNATIONAL BUSINESS • Benefiting The Company, Not The

Country - Bribing high-level officials

Multinational enterprises’ activities are faced with ensures profits and helps off-load risks.

diverse legal system in each country coupled with

new public opinion, more demands on social • Bypassing Local Democratic Processes -

responsibility, sustainability and transparency. Bribery can be a useful way of getting

around local opposition to a project and of

• SUSTAINABLE DEVELOPMENT AND

bypassing the usual democratic processes

ENVIRONMENT - New economic

involved with awarding contracts.

development model that would secure the

needs of the current generation.

• Destroying the Environment and Getting

• HUMAN LABOR RIGHTS - The operational

Around Regulations - Some companies

conduct of the enterprise should not be

use bribes as a way of getting round

lower than the standards of the host country.

environmental regulations.

In affirmation to this, the entrepreneurial strategy of

these large enterprises should be based on the • Promoting Arms Sales - Half of the bribery

following CSR demands: complaints received by the US Commerce

a. Be Compliant Department concerns international defense

b. Be Consistent contracts.

• LOCAL ECONOMY AND SOCIETY - It is HIDING THE LOOT

undeniable that large international enterprises

• Western Banks and Third World Assets -

can bring extraordinary impact on the

Private banking services and offshore

development of less-developed countries.

financial centers are the major conduits and

• TRANSPARENCY - is a form of deep-rooted

repositories for bribes and corrupt gains.

managerial initiative which evolved into a

philosophy of removing walls and facilitating free

• Private Banking - used for confidential

• LEGALITY - set of laws in force is the minimum

services to international elites and is

requirement

experiencing phenomenal growth.

• CONSUMER - increasing support of the scientist

who denounced the harmfulness of some

• Offshore Banks and Companies - They

productions for the mankind and the

impose little or no taxes, offer themselves to

environment.

non-residents to escape taxation in their

• SUPPLY CHAIN - The critical point for own country, do not exchange information,

enterprises that have chosen to adopt a socially- lack transparency, and attract shell

responsible conduct. companies-businesses with no substantial

CORRUPTION IN INTERNATIONAL BUSINESS activities.

According to George Soros, International Financier

“There is always somebody who pays, and RECOVERING STOLEN WEALTH

international business is generally the main source Return money which has been stolen from the

of corruption.” public treasuries and stashed away in Western

banks and offshore tax havens.

GLOBALIZATION OF CORRUPTION

Corruption – is the abuse of public power for CLOSING THE LOOPHOLES

private benefit.

Closing down offshore centers is vital to stopping

the laundering of corrupt money and the draining of

EXPORTING CORRUPTION

resources from the Third World.

They undermine development, inequality, and

poverty. They disadvantage smaller domestic firms. BLACKLISTING COMPANIES

Blacklisting – action of group or authority

• Increasing Debt - Bribes increase the compiling a list of people to be avoided or

prices of projects. distrusted.

F440 aka GRADWAITING

GOVERNMENT ACTION • Armed Forced Savings and Loan

Action programs need to be designed to meet the Association Incorporated (AFSLAI)

expectations of citizens who need to be informed of

the national strategy to combat corruption TYPES OF INSTITUTIONAL INVESTORS

DETERRENTS a) Hedge Fund – an investment account open to a

narrow range of investors that take on a wider

Deterrents refers to discouragement. World range of investment and trading activities in the

deterrents means world discouragement. additional to traditional long-term investment

funds.

• Economic punishments- some of the most

effective deterrents to corruption b) Investment Banking – refers to a financial

institution that helps out corporations and

The Potential for Corruption, a problem before the government in raising capital by underwriting

new system, is minimized by a commitment to and acting as the agent in the issuance of both

transparency and openness of all documents and equity and debt securities.

decisions.

c) Investment Trust – refers to investors’ money

RESISTANCE

being pooled together from the sale of a fixed

Fighting corruption is increasingly engaging the number of shares a trust issues in its first

energies of civil society groups around the world. offering.

To be effective, they must: d) Mutual Fund – a professionally managed type

of collective investment scheme that pools

1. Mobilize Ordinary People - Civil society money from many investors and invests.

groups need to be prepared to take on

governments in innovative and sometimes e) Pension Fund – a collection of assets forming a

confrontational ways. Need to be committed to separate legal entity that came into being from

being transparent and accountable contribution to a pension plan for the exclusive

2. Push for Freedom of Information (FOI) - purpose of financing pension plan benefits.

enable ordinary people to use information , if

they have the relevant knowledge the citizens Cross Listing – refers to the listing of equity

hold their governments accountable and shares of a company in more than one stock

ensure that resources that belong to them are exchange countries.

used in a right way.

3. Help Increase Citizen Participation in MOTIVES FOR CROSS-LISTING

Decision Making 1. To improve liquidity.

2. To increase its share price.

CH 8 CORPORATE GOVERNANCE 3. To increase firm’s visibility and acceptance.

4. To support takeover bids.

Corporate Governance – is the set of processes, 5. To support share and opinions plans.

customs, policies, laws, and institution affecting the

way a corporation is directed, administrated or ROLES OF INSTIUTIONAL INVESTORS IN THE

controlled. GOVERNANCE

Corporations – are created as legal person by the A. Monitoring – close monitoring of corporate

laws and regulations of a particular jurisdiction. performance from institutional investors is

expected considering that investment from these

Institutional Investors - can be described as

type of investors usually involve large amount of

organization that buy and sell securities in large

money.

volume of share quantities or amounts that made

them qualify sometimes for preferential treatment

B. Driver of Agent’s Performance – when the

and lower commission cuts.

share of investment by institutional investor

Examples: is so huge that the balance sheet figure will

• Social Security System (SSS) significantly suffer without its investment,

• Government Service Insurance System agents in the corporation will at all times, be

(GSIS) in pursuit of pleasing its principal in terms of

performance.

F440 aka GRADWAITING

C. Good Activist – institutional investors together the governments of countries

especially those whose investment is committed to democracy and the market

significant enough to earn a board seat can economy from around the world to :

be the fearless fiscalizers on the corporate

policies. • Support sustainable economic growth

• Boost employment

D. Principal-Agent Role (Duality) – when an • Raise living standards

investor has already a huge influence in the • Maintain financial stability

corporation, he can have the power to elect • Assist other countries’ economic development

the officers for the investee corporation. • Contribute to the growth in the world trade

E. Deterrent to Opportunism – there are a lot Investment promotion and facilitation

of challenges to consider when one

engages in activities for purpose of Useful instruments to attract new investors,

deterring opportunism. One needs especially in smaller, remote markets or in those

something to counter self-interested countries with a recent history of macroeconomic

behavior of the agents. One of the best and political instability.

antidotes to opportunism is to have a voice

in the board. SARBANES-OXLEY ACT OF 2002 SUMMARY

A. Metrics-based corporate governance

CORPORATE GOVERNANCE ORGANIZATIONS 1. It seeks to lay the ground for a culture

proactive management of risks going

1) International Chamber of Commerce (ICC) beyond the reactive approach

– an organization focusing on promoting 2. It ensures that the senior executives have

growth and prosperity, spreading business greater responsibility as well as the means

expertise and advocate for international to meet them.

business. 3. It provides for checks and balances that

were not available in the past.

2) International Corporate Governance 4. It seeks to make companies more

Network (ICGN) – an investor-led transparent and vigilant by requiring the

organization of governance professionals, reporting of operational risks and internal

ICGN’s mission is to inspire and promote controls.

effective standards of corporate governance 5. It seeks to focus the attention of companies

to advance efficient markets and economies on fortifying their companies.

world-wide.

B. Board of Directors

3) Asian Development Bank (ADB) – an - Non-management directors should hold

international development finance institute regular sessions without participation of

whose mission is to help its developing management for brainstorming without

member countries reduce poverty and biased.

improve the quality of life of these people.

C. Disclosures

4) International Federation of Accountants - Companies are required to provide

– the global organization for the quantitative measures to reconcile the pro-

accountancy profession. It works with its forma statements with GAAP financial

159 members and associates in124 statements.

countries and jurisdictions to protect the

public interest by encouraging high quality D. Fraud

practices by the world’s accountants. - Internal controls should be able to prevent,

deter and detect fraud.

5) United Nations Conference on Trade and

Development - promotes the development- E. Government Policies

friendly integration of developing countries - Set up a governance committee which will

into the world economy. spell out the governance principles which

will be used to evaluate the board and

6) Organization for Economic Co-Operation government.

and Development (OECD) - brings

F440 aka GRADWAITING

F. Executive Compensation • Bread and Butter focused principle of

- Requires a company which restates its corporate governance issues such as voting,

financial statements due to noncompliance, nomination and election of board members.

misconduct, or with any financial

requirements by the CEO or CFO. CH. 9 FOREIGN DIRECT INVESTMENT,

PRIVATIZATION, INSOLVENCY REGIMES

G. Protection of whistleblowers

- Added protection to whistleblowers who FOREIGN DIRECT INVESTMENT - refers to the

can establish a prima facie case of direct investment in productive assets by a

retaliation when they report malfeasance in company incorporated or un-incorporated in a

the company foreign country to the host country

H. Compensation Committees Entry of Multinational Corporations (MNCs) - is

- Requires the board to form independent important source of international capital and

technology

compensation committees which have the

authority to decide on compensation Two broad classifications of technological

policies consistent with the business goals spillovers from FDI to domestic firms:

of the companies.

1. Horizontal spill (intra-industry) – refers to the

I. Audit Committee effect the presence of MNCs has on domestic

- Composed of directors and have the firms in the same sector.

responsibility to ensure that financial 2. Vertical spill (inter-industry) – from FDI occurs

statements and internal controls are as a result of the interaction between domestic

consistent with the regulatory policies. and foreign firms that are not in the same

industry.

J. Departures from the past

- Recognizes that the mode of compensation, Foreign Direct Investment in Developing

increasing share of equity and equity option, Countries - increasing foreign investment can be

in the packages that executives received one of the indicators that the host country’s

as responsible for frauds that were economy is growing and in general, opening its

committed. windows on globalization.

Enterprise Risk Management Multinational Enterprises (MNEs) – own and

• Operational Risks – such as fraud, create control operations abroad to benefit from diverse

liquidity crisis for companies production location and globalization of market.

• Business Risks - such as loss of intellectual 4 Types of FDI

property could lead to bankruptcy. • Resource seeking

• Enterprise Risk Dashboards - help • Import substituting

communicate potential threats and galvanize • Export platform

organizations to react rapidly before a crisis • Rationalized or vertically disintegrated

goes out of control.

CHALLENGES CONFRONTING INSTITUTIONAL KEY FEATURES OF THE INVESTMENT

INVESTORS CLIMATE

• Diversification is driven by prudential A. Access to Finance and International

regulations such as capping the percentage Integration – access to finance considerably

of a company’s equity that can be held by influences a firm’s tendency to invest.

investors. B. Governance – govern interactions between

• Institutional Investors act as agents for business and government determine the

ultimate beneficiaries are very often and no burden that firms face in complying with

directly remunerated on the basis of government regulations.

performance of portfolio.

• Patient Family Owners takes too much C. Infrastructure – the better the infrastructure

time and effort in trying to solve short- of the host economy, the more attractive it is

termism appeal. to foreign investors.

F440 aka GRADWAITING

D. Skilled Labor Force – one of the essential • Tainted Purpose – an industry may be run or

requirements for economic growth of a used by the government mainly as vehicles in

country is its knowledge infrastructure and satisfying political goals.

the level of human development.

• No More Subsidies – efficiency can bring in

E. Macroeconomics Factors – investment is profits

motivated by profit, and foreign investors

will always choose a country with an • Natural Monopolies – existence of natural

optimistic business sector which is monopolies does not mean that these sectors

measured in terms of Gross Domestic must be state-owned.

Product (GDP) growth rate, inflation rate,

level of industrialization, etc. • Political Influence – nationalized industries

are prone to interference from politicians for

F. Political Stability – political certainty and political or populist reasons.

transparency is a very important

determinant for developing countries to • Profits – private companies are poised to earn

attract FDI. profits by being in the best position to serve the

needs of their targeted consumers.

G. Technological Factor – technological

progress cast an important role in economic • Security – government have had the tendency

growth, which encourages innovation and to “bailout” poorly run businesses, often due to

attracts FDI the sensitivity of job losses, when economically,

it may be better to let the business fold.

PRIVATIZATION

ANTI-PRIVATIZATION

PRIVATIZATION – a stage or course of action of

transferring in whole or in part the ownership of a Opponents of certain privatization believe certain

business, agency or public service from the public parts of the social terrain should remain closed to

sector to the private sector. market forces in order to protect them from the

unpredictability and ruthlessness of the market.

Pro-privatization – proponents of privatization • Accountability – the public does not have any

believed that private entities can more efficiently control or oversight of private companies.

deliver goods and/or service government due to

free market rivalry.

• Capital – government can raise money in the

• Accountability – managers of privately-owned financial markets more cheaply to re-lend to

enterprises are answerable to their state-owned enterprises.

shareholders and to consumers.

• Concentration of Wealth – profits from

• Funds – private companies have easy access successful enterprises end up in private, often

of investment capital in the financial markets foreign, hands instead of being available for

more especially when the said markets are the common good.

appropriately liquid.

• Cuts in Essential Services – governments

• Dispersion of Resources – availability of have chosen to keep certain

investment to a good number of entities will companies/industries under public ownership

ignite the capital market, promotes activities, because of their strategies importance or

and adds more spin to the economy in the sensitive nature.

process. • Downsizing – private companies often face a

conflict between profitability and service levels,

• Corruption – a government monopoly is prone and could over-react to short-term events.

to corruption considering that some decisions

are made primarily on the basis of decision • Goals – the government may seek to use state

maker’s personal gain. companies as instruments to further social for

the benefit of the nation as a whole.

F440 aka GRADWAITING

• Job Loss – due to the additional financial FEATURES OF INSOLVENCY LAW

burden placed on privatized companies to

succeed without any government help, unlike Rehabilitative – suspension of payment provision

the public companies, jobs could be lost to which allows the restructuring of debtor’s obligation

keep more money in the company. to enable it to continue its operation

Distributive – equitable distribution of properties

• Natural Monopolies – privatization will not

among the creditors and benefit the debtor by

result in true competition if a natural monopoly

discharging him of his obligation

exists.

REHABILITATION LAW (THE PROCESS)

• Political Influence – government can easily

exert pressure on state-owned firms to help Stay order – any creditors holding at least 25% of

implement a government policy. the debtor’s total liabilities, can petition to the

Regional Trial Court to place the debtor under

• Privatization and Poverty – it is rehabilitation.

acknowledged by many studies that there are

winners and losers with privatization. Adequate Protection – a secured creditor may ask

relief from the stay order if he lacks adequate

• Profit – a private company will serve the needs protection.

of those who are most willing to pay, as

A creditor is considered as lacking adequate

opposed to the needs of the majority, and thus

protection if it can be shown that:

anti-democratic.

• The debtor is not honoring a pre-existing

INSOLVENCY REGIMES agreement to keep the property insured.

INSOLVENCY – refers to the inability of a person • The debtor if failing to take commercially

or an entity to pay its debts as they fall due. reasonable steps to maintain the property.

• The depreciation of the property is increasing to

2 aspects from which insolvency can be defined: the extent that the creditor becomes under-

secured.

1. Cash flow liquidity - inability pay debts as

they fall due. Rehabilitation Receiver – oversees and monitors

2. Asset insolvency – a state where the the operations of the debtor pending proceeding.

entity’s asset is lesser than its liabilities.

“Equality is Equity” Principle – states that once a

Measures taken to keep the company financially company goes under rehabilitation, all creditors,

afloat at least: whether secured or unsecured, should be placed

• Using existing lines of credit to borrow money on equal footing.

• Selling off assets to other companies

Cram Down – in rehabilitation, the court may

• Take over from a larger corporation impose terms, conditions or restrictions for its

effective implementation or for the protection of

CONSEQUENCE OF INSOLVENCY

creditors if the plan fails.

Business turnaround or business recovery –

In case of failure of the rehabilitation plan, the court

remodeling financial and organizational structure of

may terminate the proceedings.

the corporation experiencing financial distress so

as to permit the rehabilitation and continuation of FORMS OF DEBT RELIEF

the business

• Suspension of payments – provides a

INSOLVENCY LAW AND BUSINESS company a moratorium on debt payments while

REHABILITATION it negotiates an out-of-court arrangement with is

creditors.

The Philippine insolvency law which was enacted in

1909 has three (3) principal subjects:

1. Suspension of payments • Fast-Track Rehabilitation – involves the

2. Voluntary insolvency transfer of the assets of the debtor into a new

3. Involuntary insolvency company which will be owned by creditors in

exchange for their credit.

F440 aka GRADWAITING

• Court-Supervised Rehabilitation – the the export of outputs are important for the

legislation establishes minimum standards for operations of production networks.

the plan to maintain transparency and fairness.

• Capacity Building and Adequate Funding for

• Pre-Negotiated Rehabilitation – it allows a the Department of Trade and Industry and

debtor to establish a comprehensive plan Board of Investments’ Competitiveness ad

without needing to obtain unanimity, so long as Linkages Program – Strengthen the capacity of

the minimal standards in the legislation are met. the staff and provide adequate resources for the

effective implementation of the programs to be

• Dissolution and Liquidation – the final designed to improve industry competitiveness

resort under the legislation and linkages between domestic firms and MNCs.

Proceeds remaining from sale and non- • Conversion and Transfer Policies – the

mortgage property are distributed as follows: central bank has worked to relax and streamline

1. To meet unpaid administrative expenses the Philippines foreign exchange regulatory

2. To workers for back wages framework.

3. To the government for back taxes

4. To all creditors not specifically mentioned • Expropriation and Compensation – Philippine

5. To creditors whose claims are subordinated law allows for expropriation of private property

by law or agreement. for public use or in the interest of national

welfare or defense

ASSESSMENT OF FDI SPILLOVER EFFECTS

• Dispute Settlement – In July 2012, former Pres.

POLICY RECOMMENDATIONS

Aquino signed an executive order requiring all

To improve the competitiveness, the government government contracts to include provisions for

should adopt comprehensive approach to create an alternative dispute resolution and the goal is to

environment conducive to the creation and make resolving disputes less expensive, tedious,

expansion of FDI-related spillovers. The following and time-consuming.

policies are suggested:

PERFORMANCE REQUIREMENTS AND

• Human Resource and Development Training INCENTIVES

– implement reforms in all stages of education

Established by the BOI for investors who are

and training system to raise the learning granted incentives and are based on the approved

capabilities of firms and upgrade labor skills. project proposal.

• Industrial and Technology Upgrading – to Incentives – fiscal incentives rationalization

move up the technology scale, design and publicly and listed fiscal incentives reform as a

development skills and technological capabilities priority legislative measure.

must be improved.

Right to Private Ownership and Establishment –

• SME Financial Support Programs – the lack of Phil. law recognizes the private right to acquire and

access to financing has severely constrained the dispose of property or business interacts, subject to

growth of SMEs. foreign nationality caps specified in the Philippine

Constitution and other laws

• Linkages Improvement and Promotion of

Subcontracting and Outsourcing Activities – Protection of Property Rights – the Philippines

It is important to develop a program to provide has established procedures for registering claims n

information exchange to local firms to make property but delays and uncertainty caused by

strategic linkages with MNCs. judicial system remain a problem

Transparency of the Regulatory System – Phil.

• Improvement of Infrastructure and Logistics national agencies are required by law to develop

and Overall Investment Climate – Good regulations via a public consultation process, often

infrastructure and logistics that lower production involving public hearings

cost and facilitate the easy supply chain

management from the procurement of inputs to Efficient Capital Markets and Portfolio

Investment – Non-residents may purchase

F440 aka GRADWAITING

domestically-issued securities and invest in equities interpretative disputes, and enforcing taxes of both

and money market instruments. countries.

Philippine Stock Exchanges – Membership in the OPIC and Other Investments Insurance

PSE is open to foreign-controlled stock brokerages Programs – the Overseas Private Investment

incorporated under Phil. law Corporation (OPIC) can provide US investors with

political risk insurance against risks of expropriation,

Banking – the Central Bank has worked to inconvertibility and transfer, and political violence,

strengthen banks’ capital bases, reporting pursuant to the US-Philippines Investment

requirements, corporate governance and risk Incentive Agreement that enables OPIC to support

management systems. investment in the country.

Anti-Money Laundering and Information Labor –The Department of Labor and Employment

Exchange – Paris-based Financial Action Task (DOLE) has responsibility for safety inspection, but

Force (FATF) continues to monitor implementation severe shortage of inspectors makes enforcement

of the Philippine Anti-Money Laundering Act extremely difficult. Congress passed the

through the Anti-Money Laundering Council. FATF Kasambahay Bill which provides more benefits and

moved the Philippines from its “dark gray” to “gray” protection to domestic workers.

list of following the enactment of key laws allowing

inquiry into bank deposits/investments and making Foreign Trade Zones/Free Ports – enterprises

terrorist financing a stand-alone crime. located in ecozones are considered to be outside

the customs territory and are allowed to import

Accounting Standards – the Philippines started to capital equipment and raw materials free from

fully adopt the Philippine Financial Reporting custom duties, taxes, and other import restrictions.

Standards patterned after the International

Financial Reporting Standards issued by the Philippine Economic Zone Authority (PEZA) –

International Accounting Standards Board (IASB).. there are 273 operating ecozones in PEZA,

composed primarily of manufacturing. PEZA

Outward Investments – there are no generally no manages three government-owned export-

restrictions on outward investments by Philippine processing zones (Mactan, Baguio, and Cavite)

residents and administers incentives to enterprises located in

the other 270 privately-owned and operated

Competition from State-Owned Enterprises – ecozones.

private and state-owned enterprises generally

compete equally, with some clear exceptions. The Bases Conversion Development Authority

government’s National Food Authority (NFA)

allowed the private sector to import rice. 1. Clark Freeport Zone

2. John Hay Special Economic Zone

Corporate Social Responsibility – constitutes a 3. Poro Point Freeport Zone

basic aspect of most significant business 4. Bataan Technology Park

operations in the Philippines. 5. Subic Bay Freeport Zone

Political Violence – the New People’s Army (NPA),

the military arm of the Communist Party of the Other Zones

Philippines, is responsible for general civil

disturbance through assassinations of public 1. Zamboanga City Economic Zone and

officials, bombings, and other tactics. Freeport

2. Cagayan Special Economic Zone and

Corruption – is pervasive and long-standing Freeport

problem in the Philippines.

Bilateral Investment Agreement – the Philippines Foreign Direct Investment Statistics – the

has signed bilateral investment agreements with 40 Philippine SEC, BOI, NEDA and Central Bank each

countries such as Argentina, Australia, Austria, generate direct investment statistics. SEC, BOI and

Bahrain, Bangladesh, etc. NEDA record investments approvals.

Taxes/Bilateral Tax Treaty – The Philippines has

a tax treaty with US for the purposes of avoiding

double taxation, providing procedures for resolving

F440 aka GRADWAITING

Vous aimerez peut-être aussi

- SpecPro Rule 77Document13 pagesSpecPro Rule 77angelescrishannePas encore d'évaluation

- Patrick Gray & John D. Cox - Shakespeare and Renaissance EthicsDocument322 pagesPatrick Gray & John D. Cox - Shakespeare and Renaissance EthicsEveraldo TeixeiraPas encore d'évaluation

- Balag Vs Senate, G.R. No. 234608, July 3, 2018Document3 pagesBalag Vs Senate, G.R. No. 234608, July 3, 2018Irish Salinas100% (1)

- Contract: Abdul Majid Khalil (LL.M, UK)Document26 pagesContract: Abdul Majid Khalil (LL.M, UK)shershahPas encore d'évaluation

- Accuracy of Eye Witness TestimonyDocument5 pagesAccuracy of Eye Witness Testimonyaniket chaudhary100% (1)

- Getting To Yes SummaryDocument5 pagesGetting To Yes SummarycamilledungogPas encore d'évaluation

- Professional Ethics - Course PresentationDocument53 pagesProfessional Ethics - Course PresentationMichael MwatePas encore d'évaluation

- The Roots of The Filipino People: The EpilogueDocument16 pagesThe Roots of The Filipino People: The EpilogueSteve B. Salonga100% (1)

- FV Entrepreneurship Qtr1 Wk1-1Document8 pagesFV Entrepreneurship Qtr1 Wk1-1MheraldyneFaith MaderaPas encore d'évaluation

- Module EntrepreneurshipDocument11 pagesModule EntrepreneurshipALMA MORENAPas encore d'évaluation

- 7ps of MarketingDocument13 pages7ps of MarketingMelody LiwanagPas encore d'évaluation

- Mindfulness at Work Resource ModelDocument19 pagesMindfulness at Work Resource Modeleman khalidPas encore d'évaluation

- Identification, Evaluation and Selection of Business OpportunityDocument9 pagesIdentification, Evaluation and Selection of Business OpportunityZazliana IzattiPas encore d'évaluation

- A Review of Comparative Advantage Assessment Approaches in Relation To Aquaculture DevelopmentDocument23 pagesA Review of Comparative Advantage Assessment Approaches in Relation To Aquaculture DevelopmentJomit C PPas encore d'évaluation

- MGT4B Human Resource Management SyllabusDocument10 pagesMGT4B Human Resource Management SyllabusJoswe BaguioPas encore d'évaluation

- Applied Economic Quarter 2 Module 7 Week7Document14 pagesApplied Economic Quarter 2 Module 7 Week7Jije bere PerezPas encore d'évaluation

- DigitalGenius Guide Customer Service and Artificial Intelligence PDFDocument11 pagesDigitalGenius Guide Customer Service and Artificial Intelligence PDFraphaelPas encore d'évaluation

- Environmental Analysis: Business Opportunity IdentificationDocument27 pagesEnvironmental Analysis: Business Opportunity IdentificationShane Barles100% (1)

- O&m PPT Module 3 2022 2023Document27 pagesO&m PPT Module 3 2022 2023Jaslor LavinaPas encore d'évaluation

- Business Ethics: "It Is The Mark of An Educated Mind To Be Able To Entertain A Thought Without Accepting It."Document23 pagesBusiness Ethics: "It Is The Mark of An Educated Mind To Be Able To Entertain A Thought Without Accepting It."Jotdeep SinghPas encore d'évaluation

- Define Ethics: Dictionary Definition of EthicsDocument18 pagesDefine Ethics: Dictionary Definition of EthicsPrudhvinadh KopparapuPas encore d'évaluation

- ENTREPmoduleDocument6 pagesENTREPmoduleElla MaxinePas encore d'évaluation

- Technology and Livelihood Education: EntrepreneurshipDocument8 pagesTechnology and Livelihood Education: EntrepreneurshipMari Ella NakantengPas encore d'évaluation

- Core Principles O F Fairness, Accou Ntability, and Tra NsparencyDocument8 pagesCore Principles O F Fairness, Accou Ntability, and Tra Nsparencymarissa casareno almuetePas encore d'évaluation

- ICS-Transmile Group BerhadDocument36 pagesICS-Transmile Group Berhadhaliza amirah93% (14)

- Common Practices in Business OrganizationsDocument6 pagesCommon Practices in Business OrganizationssPas encore d'évaluation

- Lesson1 Nature and Forms of Business OrganizationsDocument16 pagesLesson1 Nature and Forms of Business OrganizationsMarykay BermeoPas encore d'évaluation

- Dlp-Om WK3Document5 pagesDlp-Om WK3Emily A. AneñonPas encore d'évaluation

- Moral Reasoning in BusinessDocument21 pagesMoral Reasoning in BusinessPaul S. ViolandaPas encore d'évaluation

- Unit 2 Consumer BehaviourDocument23 pagesUnit 2 Consumer BehaviourDr Priyanka TripathyPas encore d'évaluation

- An Analysis of Medium Is The Message by Marshall McluhanDocument4 pagesAn Analysis of Medium Is The Message by Marshall McluhanZeus LegaspiPas encore d'évaluation

- Getting To Know The MarketDocument37 pagesGetting To Know The MarketLorrane SubaPas encore d'évaluation

- Mental Health Nursing Assignment Sample: WWW - Newessays.co - UkDocument15 pagesMental Health Nursing Assignment Sample: WWW - Newessays.co - UkAriadne MangondatoPas encore d'évaluation

- Explaining The Consumer Decision-Making Process Critical Literature Review JIBRM PDFDocument8 pagesExplaining The Consumer Decision-Making Process Critical Literature Review JIBRM PDFNikhil PatilPas encore d'évaluation

- Competitive Strategy and Advantage in The Marketplace: Chapter Learning ObjectivesDocument23 pagesCompetitive Strategy and Advantage in The Marketplace: Chapter Learning ObjectivesStacie SimmonsPas encore d'évaluation

- L5 Ethical Issues and Problems in Corporate WorldDocument11 pagesL5 Ethical Issues and Problems in Corporate WorldMia FayePas encore d'évaluation

- Key Term COGNITIVE THEORY AND THERAPYDocument24 pagesKey Term COGNITIVE THEORY AND THERAPYAimar SyazniPas encore d'évaluation

- Priciples of Marketing by Philip Kotler and Gary ArmstrongDocument36 pagesPriciples of Marketing by Philip Kotler and Gary ArmstrongoverkilledPas encore d'évaluation

- M2Business EthicsDocument58 pagesM2Business EthicsMairene CastroPas encore d'évaluation

- RIZAL ReviewerDocument6 pagesRIZAL ReviewerAdrian Dale David100% (5)

- Almirez Vs Infinite Loop TechnologyDocument2 pagesAlmirez Vs Infinite Loop TechnologyJulian DubaPas encore d'évaluation

- ETHICSDocument43 pagesETHICSAnjhelica MendozaPas encore d'évaluation

- Detailed Lesson Plan in EntrepreneurshipDocument5 pagesDetailed Lesson Plan in Entrepreneurshipserra.georgiaalexandriaPas encore d'évaluation

- Belief System StudDocument37 pagesBelief System StudAlfred Jornalero CartaPas encore d'évaluation

- Code of Ethics in BusinessDocument4 pagesCode of Ethics in BusinessJannah Nicole Devera RazonablePas encore d'évaluation

- Marketing Ethics 2Document73 pagesMarketing Ethics 2athiraPas encore d'évaluation

- Lecture 2 Business Ethics, Corporate Governance & CSRDocument23 pagesLecture 2 Business Ethics, Corporate Governance & CSRARUNA SHARMA100% (1)

- The Learners Demonstrate An Understanding Of: The Learners Shall Be Able To: The LearnersDocument5 pagesThe Learners Demonstrate An Understanding Of: The Learners Shall Be Able To: The LearnersCristy Ramboyong0% (1)

- Creating and Sustaining An Ethical Workplace CultureDocument59 pagesCreating and Sustaining An Ethical Workplace CultureSadiq Sagheer100% (1)

- Ethics and Social ResponsibilityDocument37 pagesEthics and Social ResponsibilityYogesh DhandhariaPas encore d'évaluation

- Ethical Business Issues and SolutionsDocument7 pagesEthical Business Issues and SolutionsSakthi0% (1)

- Business Ethics SeminarDocument35 pagesBusiness Ethics SeminarPines Macapagal100% (1)

- Layout DecisionDocument5 pagesLayout DecisionMarjon VillanuevaPas encore d'évaluation

- ITM - Inventory ManagementDocument13 pagesITM - Inventory ManagementsiddharthkjPas encore d'évaluation

- Segmentation, Targeting, Positioning (STP)Document6 pagesSegmentation, Targeting, Positioning (STP)Surbhit SinhaPas encore d'évaluation

- MAN385.23 - Entrepreneurial Management - Graebner - 04470Document15 pagesMAN385.23 - Entrepreneurial Management - Graebner - 04470Dimitra TaslimPas encore d'évaluation

- Lesson 4 - Orgma-Business OrganizationDocument23 pagesLesson 4 - Orgma-Business OrganizationCharlon Garganta100% (1)

- Chapter 8 Social Responsibility of EntrepreneursDocument9 pagesChapter 8 Social Responsibility of EntrepreneursColin KmPas encore d'évaluation

- Models and Framework of Social Responsibility in The Practice of Sound BusinessDocument10 pagesModels and Framework of Social Responsibility in The Practice of Sound Business침침DianePas encore d'évaluation

- Entrepreneurship Unit 3 Part 2Document21 pagesEntrepreneurship Unit 3 Part 2Michaela BrisenioPas encore d'évaluation

- CSRDocument43 pagesCSRNgo Dan Quang100% (1)

- Entrepreneurship Development Programme (EDP) For Micro EntrepreneursDocument10 pagesEntrepreneurship Development Programme (EDP) For Micro EntrepreneursPradhyuman S LakhawatPas encore d'évaluation

- Knight RidersDocument13 pagesKnight RidersTamrika TyagiPas encore d'évaluation

- Challenges in Social Entrepreneurship: Dr. N.Rajendhiran and C.SilambarasanDocument3 pagesChallenges in Social Entrepreneurship: Dr. N.Rajendhiran and C.SilambarasanalokPas encore d'évaluation

- Summary - Module # 4 - Compensation and Benefits - 2021Document1 pageSummary - Module # 4 - Compensation and Benefits - 2021Anamika Gputa100% (1)

- Business Model CanvasDocument1 pageBusiness Model CanvasErikaNicoleDumoranGumilinPas encore d'évaluation

- Chapter-Two: Competitiveness, Strategies, and Productivity in OperationsDocument63 pagesChapter-Two: Competitiveness, Strategies, and Productivity in OperationsChernet AyenewPas encore d'évaluation

- MPU2103U2 Final Project Rubric PDFDocument1 pageMPU2103U2 Final Project Rubric PDFDaud Farook IIPas encore d'évaluation

- Iponan, Cagayan de Oro City Grade 11 Organization & ManagementDocument4 pagesIponan, Cagayan de Oro City Grade 11 Organization & ManagementJarven SaguinPas encore d'évaluation

- MBA Social Responsibility & Good Governance August 27, 2020Document6 pagesMBA Social Responsibility & Good Governance August 27, 2020Ping Tengco Lopez100% (1)

- Busines Ethics Chapter FiveDocument7 pagesBusines Ethics Chapter Fivedro landPas encore d'évaluation

- 4Ps of Marketing and USPDocument53 pages4Ps of Marketing and USPMonria FernandoPas encore d'évaluation

- Lesson 6Document5 pagesLesson 6Jeliemay VergaraPas encore d'évaluation

- Angeles City, Pampanga SY: 2016-2017: Holy Angel UniversityDocument5 pagesAngeles City, Pampanga SY: 2016-2017: Holy Angel UniversityAdrian Dale DavidPas encore d'évaluation

- Table of Contents PDFDocument5 pagesTable of Contents PDFAdrian Dale DavidPas encore d'évaluation

- A Voyage Through The: BrainDocument25 pagesA Voyage Through The: BrainAdrian Dale DavidPas encore d'évaluation

- Unmet Need For Modern Contraception Is High and Unintended Pregnancy Is CommonDocument7 pagesUnmet Need For Modern Contraception Is High and Unintended Pregnancy Is CommonAdrian Dale DavidPas encore d'évaluation

- Vs Indsoc 04 Better SocietyDocument2 pagesVs Indsoc 04 Better Societyapi-377276404Pas encore d'évaluation

- MacArthur Principal Letter To ParentsDocument2 pagesMacArthur Principal Letter To ParentsRobert WilonskyPas encore d'évaluation

- What Is Your Philosophy in LifeDocument3 pagesWhat Is Your Philosophy in LifeArvin EleuterioPas encore d'évaluation

- The Brave Little Parrot: Literal ComprehensionDocument2 pagesThe Brave Little Parrot: Literal ComprehensionBigyan BasaulaPas encore d'évaluation

- Afzal Test 2Document18 pagesAfzal Test 2Amit Singh ChandelPas encore d'évaluation

- Summary of Evidence: Chicago Police Torture TrialDocument118 pagesSummary of Evidence: Chicago Police Torture TrialAndres100% (1)

- Tom Sawyer Vocabulary.1681608284879Document22 pagesTom Sawyer Vocabulary.1681608284879Vhone NeyraPas encore d'évaluation

- Rule 71Document28 pagesRule 71Vin BautistaPas encore d'évaluation

- Academic Honesty Statement: Writing at Carson-Newman CollegeDocument1 pageAcademic Honesty Statement: Writing at Carson-Newman CollegeGlenn TaduranPas encore d'évaluation

- G.R. No. 225973, November 08, 2016 Ocampo V EnriquezDocument22 pagesG.R. No. 225973, November 08, 2016 Ocampo V EnriquezLex Mike PinagpalaPas encore d'évaluation

- Book - OT Manager - Chap 57 Organizational EthicsDocument9 pagesBook - OT Manager - Chap 57 Organizational EthicsWhitney JosephPas encore d'évaluation

- Outline of Plato's Republic Book 1Document2 pagesOutline of Plato's Republic Book 1priv8joy100% (1)

- Deed of Assignment SM DavaoDocument2 pagesDeed of Assignment SM DavaoFrancisquetePas encore d'évaluation

- BA Third Year Syllabus Com English IIDocument3 pagesBA Third Year Syllabus Com English IIA Samanya KeToPas encore d'évaluation

- FLW Cronon Inconstant Unity Passion PDFDocument25 pagesFLW Cronon Inconstant Unity Passion PDFAlexandraBarbieruPas encore d'évaluation

- A Tale of Two Managers Sequel-TNDocument3 pagesA Tale of Two Managers Sequel-TNRosarioPas encore d'évaluation

- Virtue As ExcellenceDocument2 pagesVirtue As ExcellenceMelissa AlexandraPas encore d'évaluation

- Effective Listening: CPT Nelson Joseph C Fabre ProfDocument38 pagesEffective Listening: CPT Nelson Joseph C Fabre ProfDONG PADIKSPas encore d'évaluation