Académique Documents

Professionnel Documents

Culture Documents

Madoff Securities Written Report2

Transféré par

Micka EllahTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Madoff Securities Written Report2

Transféré par

Micka EllahDroits d'auteur :

Formats disponibles

Madoff Securities

Bernard Lawrence Madoff was born on April 29, 1938, in Queens, New York, to parents

Ralph and Sylvia Madoff. Records of Madoff's financial dealings show they were less than

successful with the trade. His mother registered as a broker-dealer in the 1960s, listing

the Madoffs' home address in Queens as the office for a company called Gibraltar

Securities. The SEC forced the closure of the business for failing to report its financial

condition. The couple's house also had a tax lien of more than $13,000, which went

unpaid from 1956 until 1965. Many suggested that the company and the loans were all a

front for Ralph's underhanded dealings. Young Madoff showed little interest in finance

during this time

After graduating from high school in 1956, Madoff headed to the University of Alabama,

where he stayed for one year before transferring to Hofstra University in Long Island. In

1959, he married his high school sweetheart, Ruth, who was attending nearby Queens

College.

Madoff earned his bachelor's degree in political science from Hofstra in 1960 and enrolled

at Brooklyn Law School, but he didn't last long in that endeavor; that year, using the

$5,000 he saved from his lifeguarding job and a side gig installing sprinkler systems, as

well as an additional $50,000 borrowed from his in-laws, he and Ruth founded an

investment firm called Bernard L. Madoff Investment Securities, LLC.

Initially, Madoff’s brokerage firm traded only securities of small over-the-counter

companies, securities commonly referred to as “penny stocks.” At the time, the securities

of most large companies were traded on the New York Stock Exchange (NYSE). The

rules of that exchange made it extremely difficult for small brokerage firms such as

Madoff’s to compete with the cartel of large brokerage firms that effectively controlled

Wall Street. Madoff and many other small brokers insisted that the NYSE’s rules were

anticompetitive and inconsistent with a free market economy. Madoff was also convinced

that the major brokerage firms kept securities transaction costs artificially high to produce

windfall profits for themselves to the detriment of investors, particularly small investors

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Itlogan Sa Dabaw FarmDocument15 pagesItlogan Sa Dabaw FarmMicka EllahPas encore d'évaluation

- Chicken Ipr Jan Jun2015Document21 pagesChicken Ipr Jan Jun2015Micka EllahPas encore d'évaluation

- Finding A Cryptocurrency Transaction ID (TXID) : What Is A Bitcoin Account?Document3 pagesFinding A Cryptocurrency Transaction ID (TXID) : What Is A Bitcoin Account?Micka EllahPas encore d'évaluation

- Student Factors Affecting Retention Rate of Bachelor of Science in AccountancyDocument29 pagesStudent Factors Affecting Retention Rate of Bachelor of Science in AccountancyMicka EllahPas encore d'évaluation

- Questions BroodingDocument5 pagesQuestions BroodingMicka EllahPas encore d'évaluation

- NameDocument1 pageNameMicka EllahPas encore d'évaluation

- Implementing Strategies: Management & Operations IssuesDocument33 pagesImplementing Strategies: Management & Operations IssuesMicka EllahPas encore d'évaluation

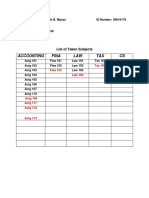

- Accounting Fina LAW TAX CS: List of Taken SubjectsDocument3 pagesAccounting Fina LAW TAX CS: List of Taken SubjectsMicka EllahPas encore d'évaluation

- RRLDocument3 pagesRRLMicka EllahPas encore d'évaluation

- Independent Auditor'S Report: Responsibilities For The Audit of The Consolidated Financial Statements Section of OurDocument10 pagesIndependent Auditor'S Report: Responsibilities For The Audit of The Consolidated Financial Statements Section of OurMicka EllahPas encore d'évaluation

- Pɒnzi/ Fraud Investors Profits Funds: Martin Chuzzlewit Little DorritDocument1 pagePɒnzi/ Fraud Investors Profits Funds: Martin Chuzzlewit Little DorritMicka EllahPas encore d'évaluation

- Nfjpia Nmbe MS 2017 AnsDocument9 pagesNfjpia Nmbe MS 2017 AnsMicka EllahPas encore d'évaluation

- Madoff Securities: Sequence of EventsDocument7 pagesMadoff Securities: Sequence of EventsMicka EllahPas encore d'évaluation

- 2017 Internal Auditor ReportDocument3 pages2017 Internal Auditor ReportMicka EllahPas encore d'évaluation

- What Is An Irregular Verb?: D Ed IedDocument11 pagesWhat Is An Irregular Verb?: D Ed IedMicka EllahPas encore d'évaluation

- Louella Joyce A. SinadjanDocument2 pagesLouella Joyce A. SinadjanMicka EllahPas encore d'évaluation

- Nature and Scope of Human BehaviorDocument5 pagesNature and Scope of Human BehaviorMicka EllahPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)