Académique Documents

Professionnel Documents

Culture Documents

Taxation Trends in The European Union - 2012 191

Transféré par

d05registerTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Taxation Trends in The European Union - 2012 191

Transféré par

d05registerDroits d'auteur :

Formats disponibles

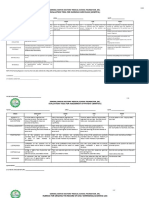

Annex A Tables

Table 11: Indirect Taxes as % of GDP - Other taxes on Products (incl. import duties)

(2)

Difference(1) Ranking Revenue

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 1995 to 2010 2000 to 2010 2010 2010

BE 2.0 2.1 2.2 2.2 2.2 2.2 2.2 2.1 2.2 2.2 2.3 2.4 2.4 2.3 2.1 2.2 0.3 0.0 4 7 826

BG 2.4 2.2 2.1 2.0 1.3 1.0 0.8 0.8 0.8 0.9 1.0 1.1 0.4 0.4 0.4 0.3 -2.1 -0.7 26 121

CZ 1.4 1.4 1.1 1.0 0.9 0.9 0.7 0.7 0.7 0.5 0.5 0.5 0.5 0.5 0.4 0.4 -1.0 -0.5 24 612

DK 2.3 2.3 2.4 2.7 2.5 2.0 1.8 2.0 1.9 2.2 2.6 2.6 2.5 2.2 1.5 1.6 -0.7 -0.3 8 3 826

DE 1.1 0.9 1.0 1.0 1.0 0.9 0.9 0.9 0.9 0.9 0.9 0.9 1.0 0.9 0.9 0.9 -0.2 0.0 16 22 120

EE 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.3 0.4 0.4 0.4 0.4 0.3 0.4 0.2 0.2 25 58

IE 2.0 2.0 2.0 2.0 2.2 2.3 2.0 1.7 1.9 2.2 2.5 3.0 2.6 1.8 1.1 1.1 -0.9 -1.1 13 1 761

(3)

EL 1.9 2.0 2.6 2.7 3.1 3.3 2.7 2.4 2.3 2.2 2.2 2.7 2.6 2.7 2.1 1.6 -0.3 -1.7 9 3 638

ES 1.7 1.5 1.6 1.8 1.9 1.9 1.9 2.0 2.3 2.5 2.8 2.9 2.6 1.7 1.4 1.4 -0.2 -0.5 10 14 960

FR 1.7 1.7 1.7 1.7 1.7 1.7 1.6 1.6 1.6 1.8 1.9 1.7 1.7 1.6 1.6 1.7 0.1 0.1 7 33 245

IT 2.5 2.6 2.6 2.9 2.9 2.7 2.5 2.6 2.5 2.9 2.7 3.0 3.0 2.9 3.0 2.9 0.4 0.2 2 45 598

CY 2.9 2.7 2.3 2.0 1.9 3.1 2.7 2.4 2.0 1.7 1.4 1.4 1.9 1.6 1.1 0.9 -2.0 -2.2 15 156

LV 0.8 0.7 0.7 0.6 0.6 0.5 0.4 0.4 0.5 0.5 0.5 0.5 0.8 0.6 0.5 0.4 -0.4 0.0 21 79

LT 1.8 1.7 1.7 1.5 1.4 1.2 1.0 1.2 1.1 1.1 0.8 0.4 0.4 0.4 0.4 0.4 -1.4 -0.7 23 118

LU 1.2 1.2 1.3 1.4 1.4 1.5 1.3 1.1 1.1 1.1 1.2 1.1 1.3 1.0 0.8 0.8 -0.4 -0.7 18 321

HU 5.6 5.2 3.6 3.2 3.5 3.3 3.2 3.1 3.4 3.5 3.5 3.7 4.0 4.0 3.9 4.1 -1.5 0.8 1 3 989

MT 4.1 3.7 3.7 3.6 4.0 3.6 3.6 3.5 3.5 3.9 3.5 3.7 3.6 3.3 2.8 2.6 -1.5 -1.0 3 161

NL 1.4 1.6 1.8 1.8 1.9 2.0 2.1 1.9 1.9 2.0 2.1 2.2 2.0 2.0 1.8 1.8 0.4 -0.2 6 10 420

AT 1.2 1.2 1.2 1.2 1.2 1.2 1.2 1.1 1.2 1.1 1.1 1.2 1.1 1.1 1.1 1.1 -0.1 -0.2 14 3 093

PL 1.8 1.6 1.5 1.1 0.9 0.8 0.6 0.6 0.6 0.4 0.3 0.3 0.4 0.4 0.3 0.3 -1.5 -0.5 27 1 001

PT 2.5 2.4 2.4 2.6 2.9 2.7 2.6 2.5 2.3 2.4 2.6 2.7 2.7 2.4 2.2 2.1 -0.3 -0.6 5 3 664

RO 2.0 2.2 2.3 2.3 2.3 2.2 1.6 1.3 1.0 1.0 1.0 1.2 0.7 0.6 0.4 0.4 -1.5 -1.8 22 526

SI 14.9 14.6 13.6 14.0 8.0 1.8 1.3 1.3 1.3 1.1 0.9 0.9 1.1 1.0 0.8 0.8 -14.1 -1.0 17 284

SK 1.7 1.7 2.0 1.7 1.8 1.7 0.7 0.7 0.7 0.5 0.3 0.3 0.4 0.4 0.4 0.4 -1.3 -1.3 20 290

FI 1.5 1.4 1.4 1.4 1.3 1.2 1.2 1.2 1.2 1.3 1.3 1.3 1.3 1.2 1.3 1.3 -0.3 0.0 11 2 314

SE 0.9 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.8 0.7 0.7 -0.1 0.1 19 2 544

UK 1.1 1.0 1.2 1.3 1.4 1.6 1.4 1.3 1.2 1.3 1.3 1.5 1.5 1.2 1.0 1.2 0.1 -0.4 12 20 017

NO 2.6 2.7 2.5 2.5 2.2 1.9 1.8 1.7 1.7 1.8 1.6 1.6 1.6 1.4 1.3 1.5 -1.2 -0.4 4 572

IS 2.7 2.7 2.6 1.9 1.9 1.9 1.7 1.9 2.1 2.3 2.4 2.1 2.2 1.7 1.6 1.7 -1.1 -0.2 157

EU-27 averages 182 741

weighted 1.6 1.5 1.6 1.7 1.7 1.7 1.6 1.6 1.6 1.7 1.7 1.8 1.8 1.6 1.5 1.5 -0.1 -0.2

arithmetic 2.4 2.3 2.3 2.3 2.0 1.8 1.6 1.5 1.5 1.6 1.6 1.6 1.6 1.5 1.3 1.3 -1.1 -0.5

EA-17 averages 149 909

weighted 1.6 1.6 1.7 1.8 1.8 1.7 1.7 1.7 1.7 1.8 1.9 2.0 1.9 1.7 1.6 1.6 0.0 -0.1

arithmetic 2.6 2.6 2.6 2.6 2.3 2.0 1.8 1.7 1.7 1.8 1.8 1.9 1.9 1.7 1.5 1.4 -1.2 -0.6

EU-25 averages

weighted 1.6 1.5 1.6 1.7 1.7 1.7 1.6 1.6 1.6 1.7 1.7 1.8 1.8 1.6 1.5 1.5 -0.1 -0.1

arithmetic 2.4 2.3 2.3 2.3 2.0 1.8 1.6 1.6 1.6 1.6 1.6 1.7 1.7 1.5 1.3 1.3 -1.1 -0.5

(1) In percentage points

(2) In millions of euro

(3) Data for Greece is provisional for years 2003-2010

See explanatory notes in Annex B

Source: Eurostat (online data code gov_a_tax_ag)

Date of extraction: 13/01/2012

190 Taxation trends in the European Union

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 190Document1 pageTaxation Trends in The European Union - 2012 190d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 192Document1 pageTaxation Trends in The European Union - 2012 192d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 188Document1 pageTaxation Trends in The European Union - 2012 188d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 186Document1 pageTaxation Trends in The European Union - 2012 186d05registerPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Music 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Document4 pagesMusic 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Kate Mary50% (2)

- Atlantean Dolphins PDFDocument40 pagesAtlantean Dolphins PDFBethany DayPas encore d'évaluation

- PEDIA OPD RubricsDocument11 pagesPEDIA OPD RubricsKylle AlimosaPas encore d'évaluation

- Quizo Yupanqui StoryDocument8 pagesQuizo Yupanqui StoryrickfrombrooklynPas encore d'évaluation

- Complete Cocker Spaniel Guide 009 PDFDocument119 pagesComplete Cocker Spaniel Guide 009 PDFElmo RPas encore d'évaluation

- Appendix I - Plant TissuesDocument24 pagesAppendix I - Plant TissuesAmeera ChaitramPas encore d'évaluation

- University of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveDocument4 pagesUniversity of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveSupriyo BiswasPas encore d'évaluation

- Syllabus For Final Examination, Class 9Document5 pagesSyllabus For Final Examination, Class 9shubham guptaPas encore d'évaluation

- Hayat ProposalDocument22 pagesHayat Proposalsebehadinahmed1992Pas encore d'évaluation

- BROADCAST Visual CultureDocument3 pagesBROADCAST Visual CultureDilgrace KaurPas encore d'évaluation

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocument332 pagesList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedPas encore d'évaluation

- IsaiahDocument7 pagesIsaiahJett Rovee Navarro100% (1)

- 5 Point Scale PowerpointDocument40 pages5 Point Scale PowerpointMíchílín Ní Threasaigh100% (1)

- Peptic UlcerDocument48 pagesPeptic Ulcerscribd225Pas encore d'évaluation

- Tateni Home Care ServicesDocument2 pagesTateni Home Care ServicesAlejandro CardonaPas encore d'évaluation

- Internship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeDocument45 pagesInternship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeVIRAL DOSHIPas encore d'évaluation

- A Novel Visual Clue For The Diagnosis of Hypertrophic Lichen PlanusDocument1 pageA Novel Visual Clue For The Diagnosis of Hypertrophic Lichen Planus600WPMPOPas encore d'évaluation

- Civil and Environmental EngineeringDocument510 pagesCivil and Environmental EngineeringAhmed KaleemuddinPas encore d'évaluation

- WIKADocument10 pagesWIKAPatnubay B TiamsonPas encore d'évaluation

- Evolution Epidemiology and Etiology of Temporomandibular Joint DisordersDocument6 pagesEvolution Epidemiology and Etiology of Temporomandibular Joint DisordersCM Panda CedeesPas encore d'évaluation

- EMP Step 2 6 Week CalendarDocument3 pagesEMP Step 2 6 Week CalendarN VPas encore d'évaluation

- Didhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersDocument20 pagesDidhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersAndré Le RouxPas encore d'évaluation

- 1 Intro To Society, Community and EducationDocument29 pages1 Intro To Society, Community and EducationMaria Michelle A. Helar100% (1)

- College PrepDocument2 pagesCollege Prepapi-322377992Pas encore d'évaluation

- 755th RSBDocument32 pages755th RSBNancy CunninghamPas encore d'évaluation

- 03-Volume II-A The MIPS64 Instruction Set (MD00087)Document793 pages03-Volume II-A The MIPS64 Instruction Set (MD00087)miguel gonzalezPas encore d'évaluation

- أثر البحث والتطوير على النمو الاقتصادي - دراسة قياسية لحالة الجزائر (1990 -2014)Document17 pagesأثر البحث والتطوير على النمو الاقتصادي - دراسة قياسية لحالة الجزائر (1990 -2014)Star FleurPas encore d'évaluation

- Techniques of Demand ForecastingDocument6 pagesTechniques of Demand Forecastingrealguy789Pas encore d'évaluation

- Adobe Scan Sep 06, 2023Document1 pageAdobe Scan Sep 06, 2023ANkit Singh MaanPas encore d'évaluation

- Agrarian ReformDocument40 pagesAgrarian ReformYannel Villaber100% (2)