Académique Documents

Professionnel Documents

Culture Documents

Figure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional Players

Transféré par

Eno CasmiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Figure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional Players

Transféré par

Eno CasmiDroits d'auteur :

Formats disponibles

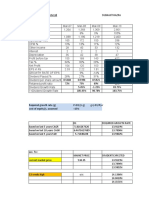

Figure 35: Comparison between JSMR's growth profile and valuation vs regional players

Price Mkt Cap Revenue EBITDA EBITDA margin EBITDA growth EV/EBITDA (x) Dividend EPS growth (%) P/E (x) P/B (x) ROE (%)

Company Ticker Rating (local) US$ mn 17E 18E 17E 18E 17E 18E 17E 18E 17E 18E yield 17E 18E 17E 18E 17E 18E 17E 18E

Jasa Marga JSMR.JK O 5,550 3,024 762 878 442 510 58% 58% 17% 15% 13.0 12.8 2% 18% 28% 17.8 17.5 2.5 2.3 14% 13%

CCR CCRO3.SA n/a 17.1 11,079 2,572 2,666 1,597 1,781 62% 67% 7% 12% 9.4 8.0 4% -20% 40% 25.8 18.4 7.7 7.7 30% 42%

Zhejiang Express 0576.HK NC 9.9 5,473 1,530 1,630 1,052 1,118 69% 69% 10% 6% 5.7 5.1 5% 4% 8% 11.6 10.8 1.9 1.7 17% 17%

Bangkok Expressway and Metro PLC BEM.BK O 7.4 3,404 445 482 263 288 59% 60% 22% 10% 17.7 17.0 1% 26% 10% 32.7 29.8 3.5 3.4 11% 11%

Promotora y Operadora de

PINFRA.MX O 202.1 4,741 577 473 330 307 57% 65% -2% -7% 10.5 11.1 0% 8% 1% 16.8 16.7 2.6 2.6 16% 16%

Infraestructura, S.A.B. d

OHL Mexico OHLMEX.MX NC 25.7 2,496 1,161 1,061 942 831 81% 78% 12% -12% 4.2 4.9 2% 36% 14% 4.6 4.0 0.6 0.5 12% 11%

Jiangsu Expwy 0177.HK NC 11.4 1,776 1,414 1,489 913 963 65% 65% 7% 5% 3.4 3.4 5% 5% 6% 13.9 13.1 2.1 2.0 16% 16%

SZ Expressway 0548.HK NC 7.0 668 721 782 503 550 70% 70% -5% 9% 2.5 2.5 4% 7% 9% 10.4 9.6 1.0 0.9 10% 10%

Sector Average (ex-JSMR) 4233.8 1202.8 1226.1 799.9 834.0 66% 68% 7% 3% 7.6 7.4 3% 9% 12% 16.5 14.6 2.8 2.7 16% 18%

Source: Note: Priced as of Aug 2, 2017. O = Outperform, N = Neutral, U = Underperform, NC = Not Covered.

Source: RAVE, Company data

Vous aimerez peut-être aussi

- Ambuja Cements: NeutralDocument8 pagesAmbuja Cements: Neutral张迪Pas encore d'évaluation

- Harga Wajar DBIDocument40 pagesHarga Wajar DBISeptiawanPas encore d'évaluation

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalPas encore d'évaluation

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2srijokoPas encore d'évaluation

- Matriks Valuasi Saham 22 Juni 2020 PDFDocument2 pagesMatriks Valuasi Saham 22 Juni 2020 PDFbala gamerPas encore d'évaluation

- Matriks Valuasi Saham 21 Juli 2020Document2 pagesMatriks Valuasi Saham 21 Juli 2020jnn sPas encore d'évaluation

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2WidiasNastitiPas encore d'évaluation

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Kadek ArdianaPas encore d'évaluation

- Matriks Valuasi Saham Sharia 18 May 2020Document1 pageMatriks Valuasi Saham Sharia 18 May 2020hendarwinPas encore d'évaluation

- Danamon No More: DBS GroupDocument6 pagesDanamon No More: DBS GroupphuawlPas encore d'évaluation

- TT KPI Rate 1 2 3: I Ingame StatisticDocument5 pagesTT KPI Rate 1 2 3: I Ingame StatisticNguyễn Duy TùngPas encore d'évaluation

- Matriks Valuasi Saham Syariah 23112020Document2 pagesMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aPas encore d'évaluation

- Matriks Valuasi Saham 18 May 2020Document2 pagesMatriks Valuasi Saham 18 May 2020hendarwinPas encore d'évaluation

- Note For Investment Operation CommitteeDocument4 pagesNote For Investment Operation CommitteeAyushi somaniPas encore d'évaluation

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniPas encore d'évaluation

- Bronch AdDocument23 pagesBronch AdAbdelrahman NazmiPas encore d'évaluation

- Ashok Leyland: CMP: INR115 TP: INR134 (+17%)Document10 pagesAshok Leyland: CMP: INR115 TP: INR134 (+17%)Jitendra GaglaniPas encore d'évaluation

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARPas encore d'évaluation

- Nifty50 Q2 FY18 Quarterly EstimatesDocument8 pagesNifty50 Q2 FY18 Quarterly Estimatessrinivas NPas encore d'évaluation

- Reliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Document18 pagesReliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Abhiroop DasPas encore d'évaluation

- Matrix Valuasi Saham Syariah 1 Mar 21Document1 pageMatrix Valuasi Saham Syariah 1 Mar 21haji atinPas encore d'évaluation

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaPas encore d'évaluation

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingPas encore d'évaluation

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngPas encore d'évaluation

- Mahindra & Mahindra: 3 August 2009Document8 pagesMahindra & Mahindra: 3 August 2009Chandni OzaPas encore d'évaluation

- Analisa Agen No RepeatDocument1 pageAnalisa Agen No Repeatirfan edisonPas encore d'évaluation

- Interglobe Aviation: CMP: Inr926 TP: Inr1,018 (+10%)Document12 pagesInterglobe Aviation: CMP: Inr926 TP: Inr1,018 (+10%)Madhuchanda DeyPas encore d'évaluation

- Submission v2Document32 pagesSubmission v2MUKESH KUMARPas encore d'évaluation

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Breaking Events: Building MaterialsDocument5 pagesBreaking Events: Building Materialsapi-26443191Pas encore d'évaluation

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Equity Valuation: REDS-Research Equity Database System Page 1 of 6Document6 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 6Kadek ArdianaPas encore d'évaluation

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaPas encore d'évaluation

- Smelling of Roses in London: Ho Bee InvestmentsDocument7 pagesSmelling of Roses in London: Ho Bee InvestmentsphuawlPas encore d'évaluation

- Perkembangan Ekspor Dan Impor Indonesia September 2018Document2 pagesPerkembangan Ekspor Dan Impor Indonesia September 2018januar baharuliPas encore d'évaluation

- Q1FY23 - Result Update: Future Growth IntactDocument10 pagesQ1FY23 - Result Update: Future Growth IntactResearch ReportsPas encore d'évaluation

- Matriks Valuasi Saham Sharia 11 May 2020Document4 pagesMatriks Valuasi Saham Sharia 11 May 2020hendarwinPas encore d'évaluation

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςDocument43 pagesΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςagis.condtPas encore d'évaluation

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghPas encore d'évaluation

- InvestmentGuide PDFDocument2 pagesInvestmentGuide PDFMon CuiPas encore d'évaluation

- UPS1Document6 pagesUPS1Joana BarbaronaPas encore d'évaluation

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingPas encore d'évaluation

- Investment GuideDocument2 pagesInvestment Guidegundam busterPas encore d'évaluation

- Manappuram Finance Investor PresentationDocument43 pagesManappuram Finance Investor PresentationabmahendruPas encore d'évaluation

- Tata MotorsDocument5 pagesTata Motorsinsurana73Pas encore d'évaluation

- Y-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%Document7 pagesY-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%muralyyPas encore d'évaluation

- Presentación CTS Ven 290817Document22 pagesPresentación CTS Ven 290817Tecno Industrias C.A.Pas encore d'évaluation

- 3 Stage Model Coca-ColaDocument9 pages3 Stage Model Coca-Colaaditya agarwalPas encore d'évaluation

- Informe de Gestión MLP - Agosto 2023Document16 pagesInforme de Gestión MLP - Agosto 2023Ignacio AnsalaPas encore d'évaluation

- FM Assigment 14 FebDocument6 pagesFM Assigment 14 FebSubhajit HazraPas encore d'évaluation

- Investment - Trend For 2022 - Michael T. TjoajadiDocument14 pagesInvestment - Trend For 2022 - Michael T. TjoajadiIwan AgusPas encore d'évaluation

- Update Harga: Real-Time: QualityDocument40 pagesUpdate Harga: Real-Time: Qualitymatumbaman 212Pas encore d'évaluation

- Union Bank of IndiaDocument11 pagesUnion Bank of IndiaAngel BrokingPas encore d'évaluation

- ICICI Bank Result UpdatedDocument15 pagesICICI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Years Variable (x1) Variable (x2) Variable (x3) Variable (x4) Assessed Value (Y)Document18 pagesYears Variable (x1) Variable (x2) Variable (x3) Variable (x4) Assessed Value (Y)emzedayPas encore d'évaluation

- Reliance Communication Result UpdatedDocument11 pagesReliance Communication Result UpdatedAngel BrokingPas encore d'évaluation

- Roches ExcelDocument4 pagesRoches ExcelJaydeep ShetePas encore d'évaluation

- Q3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleDocument12 pagesQ3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleSAGAR VAZIRANIPas encore d'évaluation

- XLS EngDocument4 pagesXLS EngShubhangi JainPas encore d'évaluation

- MarketingPlan NikeDocument32 pagesMarketingPlan NikeArnin OwonPas encore d'évaluation

- Ekonomi Dan Kebijakan Publik Indonesia: Formulasi Strategi Daya Saing Indonesia Di Asean Menggunakan Matriks TowsDocument18 pagesEkonomi Dan Kebijakan Publik Indonesia: Formulasi Strategi Daya Saing Indonesia Di Asean Menggunakan Matriks TowsEno CasmiPas encore d'évaluation

- Credit Risk and Banking Stability A Comparative Study Between Islamicand Conventional Banks 2375 4516 1000193Document7 pagesCredit Risk and Banking Stability A Comparative Study Between Islamicand Conventional Banks 2375 4516 1000193Eno CasmiPas encore d'évaluation

- Credit Risk and Banking Stability A Comparative Study Between Islamicand Conventional Banks 2375 4516 1000193Document7 pagesCredit Risk and Banking Stability A Comparative Study Between Islamicand Conventional Banks 2375 4516 1000193Eno CasmiPas encore d'évaluation

- RegressDocument6 pagesRegressEno CasmiPas encore d'évaluation

- Public Finance Indicators and The Value of InvestmDocument25 pagesPublic Finance Indicators and The Value of InvestmEno CasmiPas encore d'évaluation

- 1 Page Marketing Plan PDFDocument5 pages1 Page Marketing Plan PDFEno CasmiPas encore d'évaluation

- Artificial Intelligence High Technology PowerPoint TemplatesDocument48 pagesArtificial Intelligence High Technology PowerPoint TemplatesBagas Putra PratamaPas encore d'évaluation

- LiteracyDocument9 pagesLiteracyEno CasmiPas encore d'évaluation

- BS in Medical Technology Denver University Class of 2019Document1 pageBS in Medical Technology Denver University Class of 2019Eno CasmiPas encore d'évaluation

- ch02Document38 pagesch02DheerendraPandeyPas encore d'évaluation

- MULTINATIONAL FINANCIAL Case2Document5 pagesMULTINATIONAL FINANCIAL Case2Eno CasmiPas encore d'évaluation

- LiteracyDocument9 pagesLiteracyEno CasmiPas encore d'évaluation

- Meet The Digital Leader & Business Meet Up 2019Document15 pagesMeet The Digital Leader & Business Meet Up 2019Eno CasmiPas encore d'évaluation

- 24 79 2 PBDocument17 pages24 79 2 PBEno CasmiPas encore d'évaluation

- Jawaban Strtegi Sosal Dan BudayaDocument22 pagesJawaban Strtegi Sosal Dan BudayaEno CasmiPas encore d'évaluation

- 72Document1 page72Eno CasmiPas encore d'évaluation

- Operating ExposureDocument15 pagesOperating Exposureleo_lac3Pas encore d'évaluation

- Operating ExposureDocument15 pagesOperating Exposureleo_lac3Pas encore d'évaluation

- Ch11 SolutionsDocument21 pagesCh11 SolutionsEno CasmiPas encore d'évaluation

- Strategic Managemen Case FordDocument9 pagesStrategic Managemen Case FordEno CasmiPas encore d'évaluation

- MULTINATIONAL FINANCIAL Case2Document5 pagesMULTINATIONAL FINANCIAL Case2Eno CasmiPas encore d'évaluation

- BOND Concept Valuation StrategyDocument56 pagesBOND Concept Valuation StrategyEno CasmiPas encore d'évaluation

- Presenting Insights and Findings: Written Reports: CHAPTER 19 - 20Document20 pagesPresenting Insights and Findings: Written Reports: CHAPTER 19 - 20Eno CasmiPas encore d'évaluation

- MULTINATIONAL FINANCIAL Case2Document5 pagesMULTINATIONAL FINANCIAL Case2Eno CasmiPas encore d'évaluation

- JFMM 11 2017 0118Document18 pagesJFMM 11 2017 0118Eno CasmiPas encore d'évaluation

- 1 s2.0 S0148296316304222 MainDocument9 pages1 s2.0 S0148296316304222 MainEno CasmiPas encore d'évaluation

- Silabus SM Reguler 2018Document3 pagesSilabus SM Reguler 2018Eno CasmiPas encore d'évaluation

- YouTube VloggersDocument8 pagesYouTube VloggersMomil FatimaPas encore d'évaluation

- BCG Growth-Share MatrixDocument3 pagesBCG Growth-Share Matrixabhishek kunalPas encore d'évaluation

- ICICI Pru Signature Online BrochureDocument30 pagesICICI Pru Signature Online Brochuremyhomemitv2uPas encore d'évaluation

- Financial Controller Job DescriptionDocument3 pagesFinancial Controller Job Descriptionrahulxtc100% (2)

- AASB 112 Fact SheetDocument4 pagesAASB 112 Fact SheetCeleste LimPas encore d'évaluation

- Stanford Federal Credit Union - Start A BusinessDocument15 pagesStanford Federal Credit Union - Start A BusinessBayCreativePas encore d'évaluation

- Engineering EconomyDocument19 pagesEngineering EconomyGreg Calibo LidasanPas encore d'évaluation

- Mis 442Document9 pagesMis 442mirfaiyazkabir2000Pas encore d'évaluation

- Annual Report 2019 - 0Document116 pagesAnnual Report 2019 - 0Junaid MalikPas encore d'évaluation

- Invty EstimationDocument6 pagesInvty EstimationdmiahalPas encore d'évaluation

- 10 - Gallardo vs. MoralesDocument6 pages10 - Gallardo vs. MoralesjiePas encore d'évaluation

- PBCom V CA, G.R. No. 118552, February 5, 1996Document6 pagesPBCom V CA, G.R. No. 118552, February 5, 1996ademarPas encore d'évaluation

- CashflowFK Broad Game 1Document24 pagesCashflowFK Broad Game 1TerencePas encore d'évaluation

- Chapter 7Document6 pagesChapter 7Pranshu GuptaPas encore d'évaluation

- Ministry of Revenues: Tax Audit ManualDocument304 pagesMinistry of Revenues: Tax Audit ManualYoPas encore d'évaluation

- Accounting HandbookDocument42 pagesAccounting Handbookinfoyazid5Pas encore d'évaluation

- Bansi Khakhkhar PDFDocument74 pagesBansi Khakhkhar PDFVishu MakwanaPas encore d'évaluation

- Financial DerivativesDocument31 pagesFinancial DerivativesSyed Roshan JavedPas encore d'évaluation

- Iskal ArnoDocument37 pagesIskal ArnoRuan0% (1)

- Entrepreneurial Finance - Luisa AlemanyDocument648 pagesEntrepreneurial Finance - Luisa Alemanytea.liuyudanPas encore d'évaluation

- HINCOL - EMULSION - Chennai (16 10 2022)Document1 pageHINCOL - EMULSION - Chennai (16 10 2022)praveen kumar sainiPas encore d'évaluation

- Axis Smallcap FundDocument1 pageAxis Smallcap FundManoj JainPas encore d'évaluation

- Unit 1 - IS-LM-PCDocument27 pagesUnit 1 - IS-LM-PCGunjan ChoudharyPas encore d'évaluation

- Form 16Document6 pagesForm 16Pulkit Gupta100% (1)

- Chapter 6 Mankiw (Macroeconomics)Document36 pagesChapter 6 Mankiw (Macroeconomics)andrew myintmyat100% (1)

- Slide Commission SecuritiesDocument4 pagesSlide Commission SecuritiesNADHIRAH DIYANA BINTI AHMAD LATFIPas encore d'évaluation

- Irreversible InvestmentDocument11 pagesIrreversible InvestmentRaju RajendranPas encore d'évaluation

- Arvog Finance Corporate Presentation 2022Document9 pagesArvog Finance Corporate Presentation 2022Dinesh KandpalPas encore d'évaluation

- Taizya RevisionDocument2 pagesTaizya Revisiongostavis chilamoPas encore d'évaluation

- List of Courses 20-21 - 1Document19 pagesList of Courses 20-21 - 1Why WhyPas encore d'évaluation

- La Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisDocument5 pagesLa Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisF. O.Pas encore d'évaluation