Académique Documents

Professionnel Documents

Culture Documents

Ore Limita MyBRD Mobile Si MyBRD Net en

Transféré par

Edu MarianaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ore Limita MyBRD Mobile Si MyBRD Net en

Transféré par

Edu MarianaDroits d'auteur :

Formats disponibles

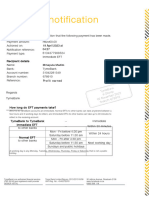

BRD – GSG Internal Cut-off Times for Receiving Operations

in Order to Execute them through MyBRD Mobile and MyBRD Net

Date of recording the

Receiving Cut-off Date of crediting the

Operation Type operation on the payer

Time beneficiary account

account

1. RON Payments

1 Until 21:30 T T

Intrabanking

After 21:30 T+1 T+1

Until 14:30 T T

i

2 Between 14:31 and T T / T+1

Small value interbanking

14:59

After 15:00 T+1 T+1

Until 15:00 T T

i

3 Between 15:01 and T T / T+1

High value interbanking

15:29

After 15:30 T+1 T+1

2. Payment Orders in FCY

Until 21:30 T T

Intrabanking

After 21:30 T+1 T+1

Until 13:55 T Acc. to the interbank

Interbanking

After 13:55 T+1 transfer rules

3. Foreign Exchanges

7:00 – 21:30 T T

Buy/ Sell/ Cross

After 21:30 T+1 T+1

4. Term Deposits *

Until 21:30 T T

Deposit creation / termination

After 21:30 T+1 T+1

5. Current and saving accounts *

Open current account 7:00 – 21:30 T T

7:00 – 21:30 T T

Open saving account

After 21:30 T+1 T+1

* The options of creating or terminating a deposit are available only for users that access the service as

individuals.

N o te :

- T represents the due date of the operation initiated by the client and T+1 represents the following banking day,

excepting the intra-banking payments for which T+1 is the following day;

- Inter-banking payments are transfers initiated in favor of a commercial bank participant in the national payment

system or State Budget;

- In case of initiating or liquidating a deposit in a non-banking day, this will be processed in the following working day,

according to processing rules and communicated cut-off times;

- In case a foreign exchange order is initiated in a non-banking day, this will be processed with the exchange rate

available in the previous working day, according to processing rules and communicated cut-off times.

i

The day of crediting the beneficiary account depends of the cut-off times in SENT and Regis systems.

1

Intrabanking payments will be processed also in the non-banking days, excepting payments to agreed billers.

2

Small value inter-banking RON payments are processed through SENT system (value < 50.000 RON) according to

extablished processing rules.

3

High value inter-banking RON payments are processed through Regis system (value ≥ 50.000 RON) according to

extablished processing rules.

- August 2016 -

Vous aimerez peut-être aussi

- Lumpsum PaymentsDocument1 pageLumpsum Paymentsvinod ybPas encore d'évaluation

- Disclosure of Payment OptionDocument1 pageDisclosure of Payment Optionpiku86Pas encore d'évaluation

- Lecture Fixed Income 1Document12 pagesLecture Fixed Income 1Darrell PassiguePas encore d'évaluation

- Tulare County Transient Occupany Tax FAQ SheetDocument2 pagesTulare County Transient Occupany Tax FAQ SheetterryngeigerPas encore d'évaluation

- Za 0390 2015 Limits For Executing TransfersDocument2 pagesZa 0390 2015 Limits For Executing Transferswolfstreet737Pas encore d'évaluation

- CR Bank List Final 3Document2 pagesCR Bank List Final 3drsukhwaniPas encore d'évaluation

- Counter SlidesDocument10 pagesCounter Slidessanjeevani rawatPas encore d'évaluation

- B 1 Forwards FoundationsDocument21 pagesB 1 Forwards FoundationsJean BoncruPas encore d'évaluation

- Chapter 5: INTEREST RATE Derivatives: Forwards and SwapsDocument69 pagesChapter 5: INTEREST RATE Derivatives: Forwards and SwapsDarshan raoPas encore d'évaluation

- Img PDFDocument1 pageImg PDFCerita KehidupanPas encore d'évaluation

- Electronic Devices: Diodes and ApplicationsDocument54 pagesElectronic Devices: Diodes and ApplicationsMuhammad Azam RajpootPas encore d'évaluation

- Electronic Devices 10th CH02Document73 pagesElectronic Devices 10th CH02Muhammad qamarPas encore d'évaluation

- More Configuration of ChoppersDocument51 pagesMore Configuration of ChoppersSur ShriPas encore d'évaluation

- L3-2 Forward and Futures II - PricingDocument9 pagesL3-2 Forward and Futures II - PricingOmar 11Pas encore d'évaluation

- InvoiceDocument1 pageInvoiceJatlaya SonsPas encore d'évaluation

- ACDocument25 pagesACChauhan DharmendraPas encore d'évaluation

- PrintpdfDocument1 pagePrintpdfChequePas encore d'évaluation

- Section 194C: TDS On ContractDocument5 pagesSection 194C: TDS On ContractwaghulePas encore d'évaluation

- Ce 1000 Pts - StockMockDocument15 pagesCe 1000 Pts - StockMockRakesh CPas encore d'évaluation

- Axis MF NAV ApplicabilityDocument1 pageAxis MF NAV ApplicabilityAbhishekPas encore d'évaluation

- Proof of PaymentDocument1 pageProof of Paymentyarec79954Pas encore d'évaluation

- InteretDocument3 pagesInteretDridi Wiem b9Pas encore d'évaluation

- Ccbcsetyme Bank ProofDocument1 pageCcbcsetyme Bank ProofMaiyani EdzaniPas encore d'évaluation

- Trial Balance and Rectification of Errors Class 11 NotesDocument43 pagesTrial Balance and Rectification of Errors Class 11 NotesAkhil SaxenaPas encore d'évaluation

- Rules BM Securities Schedule 1-7 29apr2019Document8 pagesRules BM Securities Schedule 1-7 29apr2019Sya KirahPas encore d'évaluation

- PrintpdfDocument1 pagePrintpdfnongcebomajola4lyfPas encore d'évaluation

- TMT Private Agreement ContractDocument25 pagesTMT Private Agreement ContractNadir Valerio Barbò100% (1)

- Adobe Scan 2021年7月5日Document1 pageAdobe Scan 2021年7月5日Linus HarriPas encore d'évaluation

- En Eurusd 20201130 MDocument2 pagesEn Eurusd 20201130 MAnime Trailers RemadePas encore d'évaluation

- En Eurusd 20180130 MDocument2 pagesEn Eurusd 20180130 MAnasHafsiPas encore d'évaluation

- ReynoldDocument9 pagesReynoldPhineas sehoanaPas encore d'évaluation

- Snteng 4 ADocument2 pagesSnteng 4 ARolando Edgar Pairumani MedranoPas encore d'évaluation

- Belts Systems, Types of Belts Systems (Flat Belt Drives) : January 2016Document9 pagesBelts Systems, Types of Belts Systems (Flat Belt Drives) : January 2016Abdel ChawkiPas encore d'évaluation

- PrintpdfDocument1 pagePrintpdfnongcebomajola4lyfPas encore d'évaluation

- Derivatives InformationDocument7 pagesDerivatives InformationShubham GuptaPas encore d'évaluation

- Adverb Clause of TimeDocument6 pagesAdverb Clause of Timevyntt23409aPas encore d'évaluation

- Mechanical BeltsDocument9 pagesMechanical BeltsgpkpaperPas encore d'évaluation

- ANNEX 1: Securities Settlement Cycles in Selected Countries of The EEADocument3 pagesANNEX 1: Securities Settlement Cycles in Selected Countries of The EEANuno PintoPas encore d'évaluation

- Poisson-Process Jahid SirDocument21 pagesPoisson-Process Jahid SirAkashPas encore d'évaluation

- Circular 21 of 2020Document8 pagesCircular 21 of 2020NESL WebsitePas encore d'évaluation

- To at Pos Cards (On-: Government of Lndia Ministry of Communications Department Posts Division)Document2 pagesTo at Pos Cards (On-: Government of Lndia Ministry of Communications Department Posts Division)Tapan Kumar SahuPas encore d'évaluation

- Cynthia Vargas Ocampo: Sumar Las Siguientes Expresiones en Ternario Balanceado. 1TT11T11 + 11T100T1Document4 pagesCynthia Vargas Ocampo: Sumar Las Siguientes Expresiones en Ternario Balanceado. 1TT11T11 + 11T100T1tormenta AzulPas encore d'évaluation

- TDS BROCHURE Final PDFDocument16 pagesTDS BROCHURE Final PDFCA Hiralal ArsiddhaPas encore d'évaluation

- Swap and SwaptionsDocument21 pagesSwap and SwaptionsMalkeet SinghPas encore d'évaluation

- Bagian Pekerjaan Yang DisubkontrakkanDocument34 pagesBagian Pekerjaan Yang DisubkontrakkandamekalbuhadiPas encore d'évaluation

- Nature of Trading System in NepseDocument23 pagesNature of Trading System in NepseNista ShresthaPas encore d'évaluation

- DR: Temp Revenue Account - NT0001 - 500 - IUAFDocument2 pagesDR: Temp Revenue Account - NT0001 - 500 - IUAFTan TrinhPas encore d'évaluation

- All About Tax Deducted at SourceDocument3 pagesAll About Tax Deducted at SourceBala VinayagamPas encore d'évaluation

- Web NotificationDocument8 pagesWeb NotificationMaitri Auto Electrical East AfricaPas encore d'évaluation

- Chapter 1: Interest Rates and Related ContractsDocument13 pagesChapter 1: Interest Rates and Related ContractsMirelia Kathlin Loayza TapiaPas encore d'évaluation

- Chapter 1: Interest Rates and Related ContractsDocument13 pagesChapter 1: Interest Rates and Related ContractsMirelia Kathlin Loayza TapiaPas encore d'évaluation

- RTGS Timing ExtensionDocument2 pagesRTGS Timing ExtensionTripura SundariPas encore d'évaluation

- Belts Systems, Types of Belts Systems (Flat Belt Drives) : January 2016Document9 pagesBelts Systems, Types of Belts Systems (Flat Belt Drives) : January 2016Jalil Al RasyidPas encore d'évaluation

- HAND OVER Protocol - enDocument4 pagesHAND OVER Protocol - enKorab KastratiPas encore d'évaluation

- Interest Rate DerivativesDocument6 pagesInterest Rate DerivativeshvenkiPas encore d'évaluation

- FIN4003 Lecture 02Document32 pagesFIN4003 Lecture 02jason leePas encore d'évaluation

- Royal Loans: D D D D D D 0 O D D DDocument2 pagesRoyal Loans: D D D D D D 0 O D D DJAY-R OSUMOPas encore d'évaluation

- AC and EM Waves JEE NotesDocument43 pagesAC and EM Waves JEE NotesgetsugoshimuraPas encore d'évaluation

- Digital NotesDocument204 pagesDigital NoteslvsaruPas encore d'évaluation

- 5310 16909 1 PBDocument13 pages5310 16909 1 PBgunaPas encore d'évaluation

- Alerts SummaryDocument31 pagesAlerts SummaryMau F-Marinay BadilloPas encore d'évaluation

- Traxis Fund Confidential: Performance Review - February 28Document17 pagesTraxis Fund Confidential: Performance Review - February 28ZerohedgePas encore d'évaluation

- Ethiopia Country Energy Fact SheetDocument3 pagesEthiopia Country Energy Fact SheetMengistu MamuyiePas encore d'évaluation

- Pension Scheme After 2004 For ChhattisgarhDocument4 pagesPension Scheme After 2004 For ChhattisgarhSaksham SrivastavPas encore d'évaluation

- 2015 HSC EconomicsDocument28 pages2015 HSC EconomicsKelvin ChenPas encore d'évaluation

- Statement of AccountDocument12 pagesStatement of AccountAaaa BbbbPas encore d'évaluation

- India's Banking System:: Introduction To Indian Banking IndustryDocument3 pagesIndia's Banking System:: Introduction To Indian Banking IndustrySathish KumarPas encore d'évaluation

- India, Nepal Sign Pacts On Energy, TransportDocument2 pagesIndia, Nepal Sign Pacts On Energy, TransportVijay DesaiPas encore d'évaluation

- Topic 10 EXIM Bank Trade Facilities - PPT (Compatibility Mode)Document4 pagesTopic 10 EXIM Bank Trade Facilities - PPT (Compatibility Mode)Felicia EePas encore d'évaluation

- OPECDocument10 pagesOPECParnami KrishnaPas encore d'évaluation

- NRI News Letter From SBI Thiruvananthapuram CircleDocument5 pagesNRI News Letter From SBI Thiruvananthapuram CircleDev RajPas encore d'évaluation

- Growth of Cement Industry in India - InfographicDocument5 pagesGrowth of Cement Industry in India - Infographicnandhini chokkanathanPas encore d'évaluation

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanVaghasiyaBipinPas encore d'évaluation

- XGD13 PieceDocument2 pagesXGD13 PiecejjgPas encore d'évaluation

- Dharam Classes 12 GsebDocument2 pagesDharam Classes 12 GsebHank SmokesPas encore d'évaluation

- Gu 189344Document1 pageGu 189344Liau Zhan HongPas encore d'évaluation

- 5 Forms of International Business - IbtDocument3 pages5 Forms of International Business - IbtGilbert CastroPas encore d'évaluation

- 7Document2 pages7Jen Bernadette CiegoPas encore d'évaluation

- Unit I - Student Learnings ObjectivesDocument7 pagesUnit I - Student Learnings ObjectivesErlene LinsanganPas encore d'évaluation

- Economic Reforms Since 1991Document12 pagesEconomic Reforms Since 1991Sampann KumarPas encore d'évaluation

- Make in IndiaDocument10 pagesMake in IndiaRajeshsharmapurangPas encore d'évaluation

- Economic Globalization and Factors That Facilitates ItDocument24 pagesEconomic Globalization and Factors That Facilitates ItMelo fi6Pas encore d'évaluation

- Banking PPT SidbiDocument19 pagesBanking PPT SidbiMayank RajPas encore d'évaluation

- Economics Sample Paper-2Document17 pagesEconomics Sample Paper-2gamacode132Pas encore d'évaluation

- Globalization PDFDocument20 pagesGlobalization PDFGeorge Villadolid100% (3)

- Mba50 Wa4 Key 202223Document7 pagesMba50 Wa4 Key 202223serepasfPas encore d'évaluation

- Five Years Plans of Pakistani EconomyDocument17 pagesFive Years Plans of Pakistani EconomyMoiz Sheikh OfficialPas encore d'évaluation

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedBarath BiberPas encore d'évaluation

- Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Document1 pageCambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013RedrioxPas encore d'évaluation