Académique Documents

Professionnel Documents

Culture Documents

026 - Francia v. IAC

Transféré par

Jaerelle HernandezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

026 - Francia v. IAC

Transféré par

Jaerelle HernandezDroits d'auteur :

Formats disponibles

FRANCIA v.

IAC o The circumstances of the case do not satisfy the following requirements

June 28, 1988 Gutierrez, Jr., J. | Distinguished from debts provided by Article 1279: (1) That each one of the obligors be bound

Digester: Venturanza, Maria principally and that he be at the same time a principal creditor of the other…

(3) that the two debts be due…

SUMMARY: A part of Francia’s property was expropriated by the government for the The Court has consistently ruled that there can be no offsetting of taxes against the

amount of P4,116. At the same, Francia failed to pay real estate taxes on the same claims that the taxpayer may have against the government. A person cannot refuse

property from 1963-1977. The property was eventually sold at public auction to satisfy a to pay a tax on the ground that the government owes him an amount equal to or

tax delinquency of P2,400. In this petition, Francia assails the validity of the public greater than the tax being collected. The collection of a tax cannot await the results

auction, mainly arguing that his obligation to pay tax delinquency was set-off by the of a lawsuit against the government.

amount which the government was indebted to him. The Court dismissed the petition, Republic v. Mambulao Lumber Co.: … The reason on which the general rule is based,

saying that there can be no offsetting of taxes against the claims that the taxpayer may is that taxes are not in the nature of contracts between the party and party but grow

have against the government. out of duty to, and are the positive acts of the government to the making and

DOCTRINE: Internal revenue taxes cannot be the subject of compensation. The enforcing of which, the personal consent of individual taxpayers is not required.

reason being that government and taxpayer are not mutually creditors and debtors of Corders v. Gonda: ... internal revenue taxes cannot be the subject of compensation.

each other under Article 1278 of the Civil Code, and a claim for taxes is not such a debt, The reason being that government and taxpayer are not mutually creditors and

demand, contract or judgment as is allowed to be set-off. debtors of each other under Article 1278 of the Civil Code, and a "claim for taxes is

not such a debt, demand, contract or judgment as is allowed to be set-off.”

FACTS:

Engracio Francia is the registered owner of a residential lot (328 sq. m.) and a two- Whether Francia was not properly and duly notified that an auction sale of his

story house built upon it situated at Pasay City. A portion (125 sq. m.) of the property was to take place – No.

property was expropriated by the Republic of the Philippines for P4,116.00. The Court agrees with Francia’s claim that Fernandez, as the purchaser at the

Since 1963 up to 1977, Francia failed to pay his real estate taxes. Thus, his property auction sale, has the burden of proof to show that there was compliance with the

was sold at public auction by the City Treasurer of Pasay City pursuant to Section prescribed requisite for a tax sale.

73 of P.D. No. 464 (Real Property Tax Code) in order to satisfy a tax delinquency However, even if the burden of proof lies with Fernandez, Francia cannot deny

of P2,400.00. Ho Fernandez was the highest bidder for the property. that he did received the notice for the auction sale. As admitted in his testimony,

Francia was not present during the auction sale since he was in Iligan City at that Francia received the notification for the auction sale. It was negligence on his part

time helping his uncle ship bananas. Thereafter, he received a notice of hearing of a to ignore such notice.

case filed by Fernandez, seeking the cancellation of the current TCT and issuance

of a new one. The auction sale and final bill of sale were both annotated at the Whether the price of the property paid by Hernandez was grossly inadequate,

back. making the auction sale void – NO.

Francia filed a complaint to annul the auction sale. Alleged gross inadequacy of price is not material when the law gives the owner the

Trial court dismissed the complaint and ordered a new TCT be issued in favor of right to redeem as when a sale is made at public auction, upon the theory that the

Hernandez. IAC affirmed the decision of the lower court in toto. lesser the price, the easier it is for the owner to effect redemption.

RULING: Petition dismissed. NOTES:

Other bases (only discussed in passing) why the Court ruled against Francia:

[Topic] Whether Francia’s obligation to pay tax delinquency was set-off by the 1. The tax was due to the city government while the expropriation was effected

amount which the government is indebted to the former – NO. by the national government.

Francia contends that his tax delinquency of P2,400.00 has been extinguished by 2. The amount of P4,116.00 paid by the national government for the 125 sq. m.

legal compensation. He claims that the government owed him P4,116.00 when a portion of his lot was deposited with the Philippine National Bank long

portion of his land was expropriated. Hence, his tax obligation had been set-off by before the sale at public auction of his remaining property.

operation of law. 3. Francia, as admitted in his testimony, received notice of the deposit.

There is no legal basis for the contention. By legal compensation, obligations of 4. Francia had one year within which to redeem his property although, as well be

persons, who in their own right are reciprocally debtors and creditors of each other, shown later, he claimed that he pocketed the notice of the auction sale

are extinguished (Art. 1278, Civil Code). without reading it.

Vous aimerez peut-être aussi

- 82.2 Francia V IACDocument1 page82.2 Francia V IACluigimanzanaresPas encore d'évaluation

- 10 - 133302-1988-Francia v. Intermediate Appellate Court20210505-11-X0x5r9Document7 pages10 - 133302-1988-Francia v. Intermediate Appellate Court20210505-11-X0x5r9liliana corpuz floresPas encore d'évaluation

- Obl Icon Cases 3Document3 pagesObl Icon Cases 3cmdelrioPas encore d'évaluation

- Francia vs. IacDocument7 pagesFrancia vs. IacLeBron DurantPas encore d'évaluation

- Supreme CourtDocument44 pagesSupreme CourtBeatta RamirezPas encore d'évaluation

- Francia Vs IAC FULLDocument4 pagesFrancia Vs IAC FULLristocratPas encore d'évaluation

- Francia Vs IACDocument6 pagesFrancia Vs IACRoberto ValerioPas encore d'évaluation

- Francia v. Iac - 162 Scra 753 (1988)Document6 pagesFrancia v. Iac - 162 Scra 753 (1988)Nikki Estores GonzalesPas encore d'évaluation

- Taxation I CasesDocument135 pagesTaxation I CasesETHEL JOYCE BAUTISTA. SUMERGIDOPas encore d'évaluation

- Francia vs. Intermediate Appellate Court, 162 SCRA 753, No. L-67649, June 28, 1988 Francia v. IAC, 162 SCRA 753Document8 pagesFrancia vs. Intermediate Appellate Court, 162 SCRA 753, No. L-67649, June 28, 1988 Francia v. IAC, 162 SCRA 753Rey Belano TacsayPas encore d'évaluation

- Francia Vs IACDocument6 pagesFrancia Vs IACVeah CaabayPas encore d'évaluation

- Francia vs. IACDocument5 pagesFrancia vs. IACJohn ArthurPas encore d'évaluation

- 10 Francia vs. IACDocument2 pages10 Francia vs. IACmaggiPas encore d'évaluation

- Francia Intermediate Appellate Court, G.R. No. 76749Document5 pagesFrancia Intermediate Appellate Court, G.R. No. 76749Mp CasPas encore d'évaluation

- 01 Engracio Francia V Intermediate Appellate Court and Ho Fernandez GR L 67649 June 28 1988Document1 page01 Engracio Francia V Intermediate Appellate Court and Ho Fernandez GR L 67649 June 28 1988Nojoma PangandamanPas encore d'évaluation

- Francia vs. IACDocument1 pageFrancia vs. IACEmma S. Ventura-DaezPas encore d'évaluation

- CASE # 57 KEY LESSON: Mandatory and Directory Provisions of Tax Laws and Meaning of Taxation and TaxesDocument2 pagesCASE # 57 KEY LESSON: Mandatory and Directory Provisions of Tax Laws and Meaning of Taxation and TaxesPaulo SantosPas encore d'évaluation

- Francia vs. IACDocument2 pagesFrancia vs. IACMark BeltranPas encore d'évaluation

- Francia vs. IAC, G.R. No. L-67649, June 28, 1988Document8 pagesFrancia vs. IAC, G.R. No. L-67649, June 28, 1988KidMonkey2299Pas encore d'évaluation

- 008 Francia v. IACDocument2 pages008 Francia v. IACLoren Bea TulalianPas encore d'évaluation

- Francia vs. IAC G.R. L-67649 June 28, 1988Document4 pagesFrancia vs. IAC G.R. L-67649 June 28, 1988eunice demaclidPas encore d'évaluation

- 9 Francia v. IACDocument12 pages9 Francia v. IACMlaPas encore d'évaluation

- Francia vs. Intermediate Appellate CourtDocument5 pagesFrancia vs. Intermediate Appellate CourtARCHIE AJIASPas encore d'évaluation

- Republic V Mambulao Lumber: A Claim For Taxes Is Not Such A Debt, Demand, Contract or Judgment As IsDocument1 pageRepublic V Mambulao Lumber: A Claim For Taxes Is Not Such A Debt, Demand, Contract or Judgment As IsiptrinidadPas encore d'évaluation

- Engracio Francia VS Iac & Ho FernandezDocument7 pagesEngracio Francia VS Iac & Ho FernandezJeff CruzPas encore d'évaluation

- Case 9 - Francia vs. Intermediate Appellate Court 162 SCRA 753Document1 pageCase 9 - Francia vs. Intermediate Appellate Court 162 SCRA 753Eleazar CallantaPas encore d'évaluation

- G.R. No. L-67649Document3 pagesG.R. No. L-67649Rene ValentosPas encore d'évaluation

- Tax Case Digests (J. Bollozos) 1. Domingo V GarlitosDocument7 pagesTax Case Digests (J. Bollozos) 1. Domingo V GarlitosOro Chamber SecretariatPas encore d'évaluation

- G.R. No. L-67649 June 28, 1988 Engracio FRANCIA, Petitioner, Intermediate Appellate Court and Ho Fernandez, RespondentsDocument5 pagesG.R. No. L-67649 June 28, 1988 Engracio FRANCIA, Petitioner, Intermediate Appellate Court and Ho Fernandez, RespondentsJoanna RodriguezPas encore d'évaluation

- ICR V IACDocument1 pageICR V IACSteven CasaisPas encore d'évaluation

- Francia v. IAC - G.R. No. L-67649Document5 pagesFrancia v. IAC - G.R. No. L-67649Ash SatoshiPas encore d'évaluation

- Francia vs. Intermediate Appellate Court (G.R. No. 67649, June 28,1988)Document1 pageFrancia vs. Intermediate Appellate Court (G.R. No. 67649, June 28,1988)Kent UgaldePas encore d'évaluation

- Engracio Francia vs. IacDocument2 pagesEngracio Francia vs. IacMarilyn Padrones PerezPas encore d'évaluation

- Facto Release The Contracting Partners From Their Respective Obligations To Each OtherDocument24 pagesFacto Release The Contracting Partners From Their Respective Obligations To Each OtherRaymart L. MaralitPas encore d'évaluation

- 23 - Francia v. Intermediate Appellate CourtDocument13 pages23 - Francia v. Intermediate Appellate CourtGfor FirefoxonlyPas encore d'évaluation

- Torres vs. CADocument8 pagesTorres vs. CALorjyll Shyne Luberanes TomarongPas encore d'évaluation

- Engracia v. IACDocument2 pagesEngracia v. IACFred GoPas encore d'évaluation

- Cases Title IX Partnership General Provisions (1) Art. 1767 1.1 Partnership Defined Evangelista, Et Al vs. CIR Decided 15 October 1957Document9 pagesCases Title IX Partnership General Provisions (1) Art. 1767 1.1 Partnership Defined Evangelista, Et Al vs. CIR Decided 15 October 1957Edward Kenneth Kung100% (1)

- Case DigestDocument4 pagesCase DigestSamii JoPas encore d'évaluation

- H DigestedCasesDocument9 pagesH DigestedCasesChocola Vi BriataniaPas encore d'évaluation

- Francia Vs Intermediate Appellate Court GR No L-67649Document4 pagesFrancia Vs Intermediate Appellate Court GR No L-67649Ren Magallon100% (1)

- Compilation Case Digests Tax 2Document15 pagesCompilation Case Digests Tax 2rgomez_940509Pas encore d'évaluation

- Aclub - Case DigestDocument109 pagesAclub - Case Digestsam0% (1)

- 06.02 - Dorado Vda. de Delfin vs. Dollota, 542 SCRA 397 (2008)Document4 pages06.02 - Dorado Vda. de Delfin vs. Dollota, 542 SCRA 397 (2008)JMarcPas encore d'évaluation

- Assignment CasesDocument8 pagesAssignment CasesLalj BernabecuPas encore d'évaluation

- FranciaDocument1 pageFranciatantum ergumPas encore d'évaluation

- Francia Vs IAC - Compensation and Set-Off (Mangaliag Tax 1)Document1 pageFrancia Vs IAC - Compensation and Set-Off (Mangaliag Tax 1)Aj MangaliagPas encore d'évaluation

- GSIS v. Heirs of Caballero, G.R. No. 158090, October 4, 2010.Document2 pagesGSIS v. Heirs of Caballero, G.R. No. 158090, October 4, 2010.Caleb Josh PacanaPas encore d'évaluation

- Francia v. IAC-Compensation and Set-OffDocument1 pageFrancia v. IAC-Compensation and Set-OffMistakenPas encore d'évaluation

- Mahusay vs. B.E. San Diego, IncDocument2 pagesMahusay vs. B.E. San Diego, IncJenine Quiambao100% (1)

- 99 - Francia Vs IACDocument2 pages99 - Francia Vs IACbarrev2020Pas encore d'évaluation

- Torres vs. CADocument7 pagesTorres vs. CAmichelle limjapPas encore d'évaluation

- Torres Vs CADocument6 pagesTorres Vs CA001noonePas encore d'évaluation

- Molina Versus CADocument8 pagesMolina Versus CAAnskee TejamPas encore d'évaluation

- Republic Vs Ker & CompanyDocument17 pagesRepublic Vs Ker & Companycode4salePas encore d'évaluation

- Collector of Internal Revenue v. Campos RuedaDocument4 pagesCollector of Internal Revenue v. Campos RuedaVonn GuintoPas encore d'évaluation

- Facto Release The Contracting Partners From Their Respective Obligations To Each OtherDocument24 pagesFacto Release The Contracting Partners From Their Respective Obligations To Each OtherRaymart L. MaralitPas encore d'évaluation

- Torres Vs CADocument6 pagesTorres Vs CANew YorkPas encore d'évaluation

- Simple Guide for Drafting of Civil Suits in IndiaD'EverandSimple Guide for Drafting of Civil Suits in IndiaÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- California Supreme Court Petition: S173448 – Denied Without OpinionD'EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionÉvaluation : 4 sur 5 étoiles4/5 (1)

- Topacio v. Ong DigestDocument2 pagesTopacio v. Ong DigestJaerelle HernandezPas encore d'évaluation

- Gios-Samar, Inc. v. DOTC-DigestDocument4 pagesGios-Samar, Inc. v. DOTC-DigestJaerelle Hernandez100% (3)

- Magallona v. Ermita (Sample)Document3 pagesMagallona v. Ermita (Sample)Jaerelle HernandezPas encore d'évaluation

- Ople vs. TorresDocument60 pagesOple vs. TorresJaerelle HernandezPas encore d'évaluation

- In The Matter of Save The Supreme Court Judicial Independence and Fiscal Autonomy Movement v. Abolition of Judiciary Development Fund (JDF) and Reduction of Fiscal Autonomy-DigestDocument2 pagesIn The Matter of Save The Supreme Court Judicial Independence and Fiscal Autonomy Movement v. Abolition of Judiciary Development Fund (JDF) and Reduction of Fiscal Autonomy-DigestJaerelle HernandezPas encore d'évaluation

- Imbong V Ochoa DigestDocument9 pagesImbong V Ochoa DigestJaerelle HernandezPas encore d'évaluation

- Soriano vs. Sec of FinDocument84 pagesSoriano vs. Sec of FinJaerelle HernandezPas encore d'évaluation

- 07 Arigo V Swift Dela CruzDocument5 pages07 Arigo V Swift Dela CruzJaerelle HernandezPas encore d'évaluation

- Abakada vs. Executive SecretaryDocument309 pagesAbakada vs. Executive SecretaryJaerelle HernandezPas encore d'évaluation

- 136 - Lopez v. Pan AmDocument4 pages136 - Lopez v. Pan AmJaerelle HernandezPas encore d'évaluation

- Ang Nars Vs Executive SecretaryDocument43 pagesAng Nars Vs Executive SecretaryJaerelle Hernandez100% (1)

- Imbong V Ochoa DigestDocument9 pagesImbong V Ochoa DigestJaerelle HernandezPas encore d'évaluation

- Court Locator PDFDocument327 pagesCourt Locator PDFJaerelle HernandezPas encore d'évaluation

- 135 - Air France V CarrascosoDocument3 pages135 - Air France V CarrascosoJaerelle HernandezPas encore d'évaluation

- Philip Morris V CA DigestDocument5 pagesPhilip Morris V CA DigestJaerelle Hernandez100% (1)

- 134 - Fores v. MirandaDocument3 pages134 - Fores v. MirandaJaerelle HernandezPas encore d'évaluation

- 4 Remedies of The AccusedDocument1 page4 Remedies of The AccusedJaerelle HernandezPas encore d'évaluation

- 01 Manliclic vs. CalaunanDocument25 pages01 Manliclic vs. CalaunanJaerelle HernandezPas encore d'évaluation

- Tsai v. CADocument11 pagesTsai v. CAJaerelle HernandezPas encore d'évaluation

- 108 - Sps. Belen V Hon. ChavezDocument3 pages108 - Sps. Belen V Hon. ChavezJaerelle HernandezPas encore d'évaluation

- First Day DigestsDocument58 pagesFirst Day DigestsJaerelle HernandezPas encore d'évaluation

- 033 - ESSO v. CIRDocument2 pages033 - ESSO v. CIRJaerelle HernandezPas encore d'évaluation

- EJERCITO V. Sandiganbayan PDFDocument3 pagesEJERCITO V. Sandiganbayan PDFJaerelle HernandezPas encore d'évaluation

- Rosario Textile Mills V Home Bankers Savings and Trust Company GDocument3 pagesRosario Textile Mills V Home Bankers Savings and Trust Company GJaerelle HernandezPas encore d'évaluation

- 034 Roman Catholic Bishop of Jaro v. Dela PeñaDocument1 page034 Roman Catholic Bishop of Jaro v. Dela PeñaJaerelle HernandezPas encore d'évaluation

- 091 - People's Bank & Trust Co. V Dahican LumberDocument2 pages091 - People's Bank & Trust Co. V Dahican LumberJaerelle HernandezPas encore d'évaluation

- MHP Garments, Inc. vs. Court of Appeals, 236 SCRA 227, September 02, 1994Document14 pagesMHP Garments, Inc. vs. Court of Appeals, 236 SCRA 227, September 02, 1994KPPPas encore d'évaluation

- Revilla V Sandiganbayan - Digest Not SureDocument2 pagesRevilla V Sandiganbayan - Digest Not SureNylaPas encore d'évaluation

- Pci Leasing V TrojanDocument3 pagesPci Leasing V TrojanJaerelle HernandezPas encore d'évaluation

- PAC - BABE - UserManualDocument15 pagesPAC - BABE - UserManualAvinash AviPas encore d'évaluation

- DOLE - DO 174 RenewalDocument5 pagesDOLE - DO 174 Renewalamadieu50% (2)

- SolutionsDocument24 pagesSolutionsapi-38170720% (1)

- Week 13 - Local Government (Ra 7160) and DecentralizationDocument4 pagesWeek 13 - Local Government (Ra 7160) and DecentralizationElaina JoyPas encore d'évaluation

- Commercial Cards Add A Cardholder FormDocument3 pagesCommercial Cards Add A Cardholder FormsurePas encore d'évaluation

- Cbo Score of The Aca - FinalDocument364 pagesCbo Score of The Aca - FinalruttegurPas encore d'évaluation

- Brokenshire College: Form C. Informed Consent Assessment FormDocument2 pagesBrokenshire College: Form C. Informed Consent Assessment Formgeng gengPas encore d'évaluation

- Indian Council Act, 1892Document18 pagesIndian Council Act, 1892Khan PurPas encore d'évaluation

- Background Check and Consent Form For Amazon IndiaDocument3 pagesBackground Check and Consent Form For Amazon Indiaanamika vermaPas encore d'évaluation

- CD - Holy See vs. Rosario 238 SCRA 524Document3 pagesCD - Holy See vs. Rosario 238 SCRA 524Sai Pastrana100% (2)

- Minimum Wages ActDocument31 pagesMinimum Wages ActanithaPas encore d'évaluation

- Motion For Bill of ParticularsDocument3 pagesMotion For Bill of ParticularsPaulo Villarin67% (3)

- 7P's of Axis Bank - Final ReportDocument21 pages7P's of Axis Bank - Final ReportRajkumar RXzPas encore d'évaluation

- The Mysterious Benedict Society and The Prisoner's Dilemma (Book 3) by Trenton Lee Stewart (Preview)Document47 pagesThe Mysterious Benedict Society and The Prisoner's Dilemma (Book 3) by Trenton Lee Stewart (Preview)Little, Brown Books for Young Readers63% (16)

- Top Ten IT FailuresDocument1 pageTop Ten IT Failuresjason_carter_33Pas encore d'évaluation

- R Vs L.P.Document79 pagesR Vs L.P.NunatsiaqNews100% (1)

- Ntf-Elcac Joint Memorandum CIRCULAR NO. 01, S. 2019Document24 pagesNtf-Elcac Joint Memorandum CIRCULAR NO. 01, S. 2019Jereille Gayaso100% (1)

- Transaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalanceDocument2 pagesTransaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running Balancesylvereye07Pas encore d'évaluation

- Philippine SEC OGC Opinion 09-33Document3 pagesPhilippine SEC OGC Opinion 09-33froilanrocasPas encore d'évaluation

- HNFZ Global Services: Resit RasmiDocument4 pagesHNFZ Global Services: Resit RasmiLy NazPas encore d'évaluation

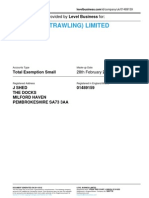

- RAWLINGS (TRAWLING) LIMITED - Company Accounts From Level BusinessDocument7 pagesRAWLINGS (TRAWLING) LIMITED - Company Accounts From Level BusinessLevel BusinessPas encore d'évaluation

- Philippines Commonly Used ObjectionsDocument1 pagePhilippines Commonly Used ObjectionsEllen DebutonPas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepavans25Pas encore d'évaluation

- Resume Sonal KDocument3 pagesResume Sonal Ksonali khedekarPas encore d'évaluation

- Cortes Constitutional Foundations of Privacy in Emerging Trends in LawDocument3 pagesCortes Constitutional Foundations of Privacy in Emerging Trends in LawAce Reblora IIPas encore d'évaluation

- Partnership DeedDocument13 pagesPartnership DeedChintan NaikwadePas encore d'évaluation

- Expression of Interest For The Supervising Consultant 2Document3 pagesExpression of Interest For The Supervising Consultant 2Anonymous GmxOg53j8Pas encore d'évaluation

- The Advantages and Disadvantages of The MSDS Authoring SoftwareDocument3 pagesThe Advantages and Disadvantages of The MSDS Authoring SoftwareatoxinfoPas encore d'évaluation

- Consti - People Vs de LarDocument1 pageConsti - People Vs de LarLu CasPas encore d'évaluation

- EFPS Home - EFiling and Payment SystemDocument1 pageEFPS Home - EFiling and Payment SystemIra MejiaPas encore d'évaluation