Académique Documents

Professionnel Documents

Culture Documents

Scan 0053

Transféré par

Zeyad El-sayedTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Scan 0053

Transféré par

Zeyad El-sayedDroits d'auteur :

Formats disponibles

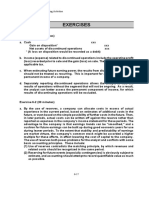

MODULE 33 TAXES: INDIVIDUAL 461

chandise is an income producing factor, inventories must be ness, Mock may reduce total sales by the cost of goods sold,

maintained to clearly reflect income. If merchandise in- and thus is allowed to deduct the cost of merchandise in

reatories are necessary to clearly determine income, only calculating business income.

the accrual method of tax reporting can be used for pur-

62. (b) The requirement is to determine the percentage

chases and sales.

of business meals expense that Banks Corp. can deduct for

57. (d) The requirement is to determine the amount of 2009. Generally, only 50% of business meals and enter-

salary taxable to Burg in 2009. Since Burg is a cash-basis tainment is deductible. When an employer reimburses its

taxpayer, salary is taxable to Burg when actually or con- employees' substantiated qualifying business meal expenses,

structively received, whichever is earlier. Since the $30,000 the 50% limitation on deductibility applies to the employer.

of unpaid salary was unqualifiedly available to Burg during

63. (a) The requirement is to determine which of the

2009, Burg is considered to have constructively received it.

costs is not included in inventory under the Uniform Capi-

Thus, Burg must report a total of $80,000 of salary for 2009;

talization (UNICAP) rules for goods manufactured by a

the $50,000 actually received plus $30,000 constructively

taxpayer. UNICAP rules require that specified overhead

received.

items must be included in inventory including factory repairs

58. (d) The requirement is to determine the 2009 medi- and maintenance, factory administration and officers' sala-

cal practice net income for a cash basis physician. Dr. Ber- ries related to production, taxes (other than income taxes),

ger's income consists of the $200:000 received from patients the costs of quality control and inspection, current and past

and the $30,000 received from third-party reimbursers dur- service costs of pension and profit-sharing plans, and service

ing 2009. His 2009 deductions include the $20,000 of sala- support such as purchasing, payroll, and warehousing costs.

ries and $24,000 of other expenses paid in 2009. The year- Nonmanufacturing costs such as selling, advertising, and

end bonuses will be deductible for 2010. research and experimental costs are not required to be in-

cluded in inventory.

59. (c) The requirement is to determine which taxpayer

may use the cash method of accounting for tax purposes. 64. (d) If no exceptions are met, the uniform capitaliza-

The cash method generally cannot be used (and the accrual tion rules generally require that all costs incurred in pur-

method must be used to measure sales and cost of goods chasing or holding inventory for resale must be capitalized

sold) if inventories are necessary to clearly determine in- as part of the cost of the inventory. Costs that must be capi-

come. Additionally, the cash method generally cannot gen- talized with respect to inventory include the ,costs of pur-

erally be used by (1) a corporation (other than an S corpora- chasing, handling, processing, repackaging and assembly,

tion), (2) a partnership with a corporation as a partner, and and off-site storage. An off-site storage facility is one that is

(3) a tax shelter. However, this prohibition against the use not physically attached to, and an integral part of, a retail

of the cash method in the preceding sentence does not apply sales facility. Service costs such as marketing, selling, ad-

to a farming business, a qualified personal service corpora- vertising, and general management are immediately deducti-

tion (e.g., a corporation performing services in health, law,

ble and need not be capitalized as part of the cost of inven-

engineering, architecture, accounting, actuarial science, per-

tory.

forming arts, or consulting), and a corporation or partnership

(that is not a tax shelter) that does not have inventories and 65. (d) The requirement is to determine the correct

whose average annual gross receipts for the most recent statement regarding the deduction for bad debts in the case

three-year period do not exceed $5 million, , of a corporation that is not a financial institution. Except for

I.E. Business Income and Deductions certain small banks that can use the experience method of

accounting for bad debts, all taxpayers (including those that

60. (a) Uniform capitalization rules generally require previously used the reserve method) are required to use the

that all costs incurred (both direct and indirect) in manufac- direct charge-off method of accounting for bad debts.

turing or constructing real or personal property, or in pur-

chasing or holding property for sale, must be capitalized as 66. (d) The requirement is to determine the amount of

part of the cost of the property. However, these rules do not life insurance premium that can be deducted in Ram Corp.'s .

apply to a "small retailer or wholesaler" who acquires per- income tax return. Generally, no deduction is allowed for

sonal property for resale if the retailer's or wholesaler's av- expenditures that produce tax-exempt income. Here, no

erage annual gross receipts for the three preceding taxable deduction is allowed for the $6,000 life insurance premium

years do not exceed $10 million. . because Ram is the beneficiary of the policy, and the pro-

ceeds of the policy will be excluded from Ram's income

61. (a) The requirement is to determine whether the cost when the officer dies.

of merchandise, and business expenses other than the cost of

merchandise, can be deducted in calculating Mock's busi- 67. (a) The requirement is to determine the amount of

ness income from a retail business selling illegal narcotic bad debt deduction for a cash-basis taxpayer. Accounts re-

substances. Generally, business expenses that are incurred ceivable resulting from services rendered by a cash-basis

in an illegal activity are deductible if they are ordinary and taxpayer have a zero tax basis, because the income has not

necessary, and reasonable in amount. Under a special ex- yet been reported. Thus, failure to collect the receivable

ception, no deduction or credit is allowed for any amount results in a nondeductible loss.

that is paid or incurred in carrying on a trade or business 68. (c) The requirement is to determine the loss that

which consists of trafficking in controlled substances. How- Cook can claim as a result of the worthless note receivable

ever, this limitation that applies to expenditures in connec- in 2009. Cook's $1,000 loss will be treated as a nonbusiness

tion with the illegal sale of drugs does not alter the normal bad debt, deductible as a short-term capital loss. The loss is

definition of gross income (i.e., sales minus cost of goods not a business bad debt because Cook was not in the busi-

sold). As a result, in arriving at gross income from the busi-

Vous aimerez peut-être aussi

- KFC Supply Chain ManagementDocument3 pagesKFC Supply Chain ManagementIk Benne70% (33)

- Test Bank For McGraw Hills Taxation of Business Entities 2019 Edition 10th Edition by Brian C. SpilkerDocument19 pagesTest Bank For McGraw Hills Taxation of Business Entities 2019 Edition 10th Edition by Brian C. SpilkerTestbanks Here100% (1)

- Accounting Concepts Case Study and SolutionDocument8 pagesAccounting Concepts Case Study and SolutionAlok Biswas100% (1)

- GSK Operations ManagementDocument20 pagesGSK Operations ManagementMaira Hassan80% (5)

- Business Finance 2nd QuarterDocument50 pagesBusiness Finance 2nd QuarterIt's me Ghie-ann67% (3)

- Lawn King IncDocument7 pagesLawn King IncSato April100% (1)

- IIPL's ERP Features ListDocument2 pagesIIPL's ERP Features ListAnkit ShridharPas encore d'évaluation

- MOD L S: Corporat: U E AXE EDocument2 pagesMOD L S: Corporat: U E AXE EAnonymous JqimV1EPas encore d'évaluation

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03Pas encore d'évaluation

- Taxation Law 1 - Notes Co: Less: DeductionsDocument24 pagesTaxation Law 1 - Notes Co: Less: DeductionsClint Lou Matthew EstapiaPas encore d'évaluation

- Minimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Document48 pagesMinimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Andrea Renice S. FerriolPas encore d'évaluation

- Accounting Theory PDFDocument61 pagesAccounting Theory PDFrabin khatriPas encore d'évaluation

- Chapter 15Document88 pagesChapter 15YukiPas encore d'évaluation

- BPP Revision Kit Sample Answers 1Document8 pagesBPP Revision Kit Sample Answers 1Kian TuckPas encore d'évaluation

- Research and Development ExpenduresDocument2 pagesResearch and Development ExpenduresMeghan Kaye LiwenPas encore d'évaluation

- CHAPTER 1 Account ReciavableDocument41 pagesCHAPTER 1 Account Reciavablegm29Pas encore d'évaluation

- Problems & SolutionsDocument436 pagesProblems & Solutionsmelissa100% (1)

- Taxation Unit 7 - Concept Questions 2023Document6 pagesTaxation Unit 7 - Concept Questions 2023havengroupnaPas encore d'évaluation

- 42 As Past QuestionsDocument61 pages42 As Past QuestionsAjay RavindranPas encore d'évaluation

- Taxes: Corporate: F F@. e 'LDocument1 pageTaxes: Corporate: F F@. e 'LZeyad El-sayedPas encore d'évaluation

- M U Taxes IND Vidual: OD LE: IDocument1 pageM U Taxes IND Vidual: OD LE: IZeyad El-sayedPas encore d'évaluation

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaePas encore d'évaluation

- !masb9 1Document25 pages!masb9 1aizatarief2015Pas encore d'évaluation

- ActDocument436 pagesActRoshan KaharPas encore d'évaluation

- JW MarriottDocument4 pagesJW MarriottroshanPas encore d'évaluation

- Kunci Jawaban Intermediate AccountingDocument41 pagesKunci Jawaban Intermediate AccountingsiaaswanPas encore d'évaluation

- Accounting StandardsDocument45 pagesAccounting StandardsBhavin PathakPas encore d'évaluation

- S C6Document7 pagesS C6Duy LêPas encore d'évaluation

- Profit Gains of Business and Profession PDFDocument43 pagesProfit Gains of Business and Profession PDFYogita VishwakarmaPas encore d'évaluation

- Chapter 20 Impairment of AssetsDocument10 pagesChapter 20 Impairment of AssetsEllen MaskariñoPas encore d'évaluation

- DOW ACCOUNTING Jan 11,2021Document8 pagesDOW ACCOUNTING Jan 11,2021Hira SialPas encore d'évaluation

- MCQ On Financial ManagementDocument28 pagesMCQ On Financial ManagementibrahimPas encore d'évaluation

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonPas encore d'évaluation

- IAS 19, Employee Benefits - Publications - Members - ACCADocument3 pagesIAS 19, Employee Benefits - Publications - Members - ACCAWaqas Ahmad KhanPas encore d'évaluation

- Chapter 6 Multiple Choice T F Test QuestionsDocument6 pagesChapter 6 Multiple Choice T F Test QuestionsAnh LýPas encore d'évaluation

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocument10 pagesCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaPas encore d'évaluation

- IAS 36 Impairment of AssetsDocument29 pagesIAS 36 Impairment of AssetsziyuPas encore d'évaluation

- Iaet Section 29 NIRCDocument1 pageIaet Section 29 NIRCregine rose bantilanPas encore d'évaluation

- Advanced Accounting May 1996 Nov 2010Document533 pagesAdvanced Accounting May 1996 Nov 2010Rakesh Krishnamoorthy100% (1)

- Chapter 4Document18 pagesChapter 4Shevon FortunePas encore d'évaluation

- Set OffDocument9 pagesSet OffAditya MehtaniPas encore d'évaluation

- Income Tax 11-14 PDFDocument1 pageIncome Tax 11-14 PDFJemna AryanaPas encore d'évaluation

- SM CHDocument53 pagesSM CHInderjeet JeedPas encore d'évaluation

- Chapter 32 - AnswerDocument11 pagesChapter 32 - AnswerKathleen LeynesPas encore d'évaluation

- Audit NotesDocument11 pagesAudit NotesNavjyoti SinghPas encore d'évaluation

- CCI - Guidelines For ValuationDocument13 pagesCCI - Guidelines For Valuationsujit0577Pas encore d'évaluation

- Accounting Standard 9Document8 pagesAccounting Standard 9GAURAV JAINPas encore d'évaluation

- Accounting Principles and ConceptsDocument36 pagesAccounting Principles and Conceptsoliver OduyaPas encore d'évaluation

- ##1) An Overview of Insurance Audit in Bangladesh (Document10 pages##1) An Overview of Insurance Audit in Bangladesh (Asc RaihanPas encore d'évaluation

- TAX Budget2012 Annexa4Document40 pagesTAX Budget2012 Annexa4Fiona Jinn NPas encore d'évaluation

- Income From BusinessDocument14 pagesIncome From BusinessPreeti ShresthaPas encore d'évaluation

- Chap 2 - Business ExpensesDocument185 pagesChap 2 - Business Expenseshippop kPas encore d'évaluation

- Corporate Reporting (International) : P2CR-MT2A-X09-A Answers & Marking SchemeDocument11 pagesCorporate Reporting (International) : P2CR-MT2A-X09-A Answers & Marking SchemeKyaw Htin WinPas encore d'évaluation

- Allowable Deductions (Taxation Review)Document82 pagesAllowable Deductions (Taxation Review)Prie DitucalanPas encore d'évaluation

- Tax 2 Finals Exam ReviewerDocument64 pagesTax 2 Finals Exam ReviewerFlorence RosetePas encore d'évaluation

- 5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36Document16 pages5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36RITZ BROWNPas encore d'évaluation

- FINALDocument3 pagesFINALSherlene Antenor SolisPas encore d'évaluation

- SBR Assigment-Liam'sDocument7 pagesSBR Assigment-Liam'sbuls eyePas encore d'évaluation

- Kuis RQDocument5 pagesKuis RQPrayogi GunawanPas encore d'évaluation

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DocePas encore d'évaluation

- Solutions Chapter 24Document5 pagesSolutions Chapter 24Avi SeligPas encore d'évaluation

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeWenjunPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- 1040 Exam Prep Module X: Small Business Income and ExpensesD'Everand1040 Exam Prep Module X: Small Business Income and ExpensesPas encore d'évaluation

- Scan 0089Document2 pagesScan 0089Anonymous JqimV1EPas encore d'évaluation

- Module 36 Taxes: Corporate: RationDocument2 pagesModule 36 Taxes: Corporate: RationAnonymous JqimV1EPas encore d'évaluation

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Document2 pagesTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1EPas encore d'évaluation

- Module 36 Taxes: Corporate: RationDocument2 pagesModule 36 Taxes: Corporate: RationAnonymous JqimV1EPas encore d'évaluation

- Module 36 Taxes: CorporateDocument2 pagesModule 36 Taxes: CorporateAnonymous JqimV1EPas encore d'évaluation

- Scan 0090Document2 pagesScan 0090Anonymous JqimV1EPas encore d'évaluation

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Document2 pagesTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1EPas encore d'évaluation

- Scan 0084Document2 pagesScan 0084Anonymous JqimV1EPas encore d'évaluation

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1EPas encore d'évaluation

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1EPas encore d'évaluation

- Taxes: Corporate: Sio ZSCDocument2 pagesTaxes: Corporate: Sio ZSCAnonymous JqimV1EPas encore d'évaluation

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1EPas encore d'évaluation

- Module 36 Taxes Corporat: Multipl - HOI E RSDocument2 pagesModule 36 Taxes Corporat: Multipl - HOI E RSAnonymous JqimV1EPas encore d'évaluation

- U I T U: Module 33 Taxes I Divi UALDocument1 pageU I T U: Module 33 Taxes I Divi UALAnonymous JqimV1EPas encore d'évaluation

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1EPas encore d'évaluation

- K. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsDocument2 pagesK. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsAnonymous JqimV1EPas encore d'évaluation

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1EPas encore d'évaluation

- I.C. Items To Be Included in Gross Income: ( (. y - , V A Ed SDocument1 pageI.C. Items To Be Included in Gross Income: ( (. y - , V A Ed SAnonymous JqimV1EPas encore d'évaluation

- Module 35 Taxes: PartnershipsDocument3 pagesModule 35 Taxes: PartnershipsAnonymous JqimV1EPas encore d'évaluation

- Module 33 Taxes: I Dividual: I F e R C ADocument2 pagesModule 33 Taxes: I Dividual: I F e R C AAnonymous JqimV1EPas encore d'évaluation

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1EPas encore d'évaluation

- Scan 0054Document2 pagesScan 0054Anonymous JqimV1EPas encore d'évaluation

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1EPas encore d'évaluation

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'Anonymous JqimV1EPas encore d'évaluation

- B 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceDocument1 pageB 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceAnonymous JqimV1EPas encore d'évaluation

- Module 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOODocument1 pageModule 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOAnonymous JqimV1EPas encore d'évaluation

- Scan 0049Document2 pagesScan 0049Anonymous JqimV1EPas encore d'évaluation

- B 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceDocument1 pageB 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceAnonymous JqimV1EPas encore d'évaluation

- Inventory and Production ManagementDocument31 pagesInventory and Production ManagementChelsea Anne VidalloPas encore d'évaluation

- Unit - 8: Lean SystemsDocument13 pagesUnit - 8: Lean SystemsChandanN81Pas encore d'évaluation

- Chinhoyi University of TechnologyDocument17 pagesChinhoyi University of TechnologyRunyararo ChitsaPas encore d'évaluation

- Wolfpeak Case AnalysisDocument4 pagesWolfpeak Case AnalysisLeia Nada MarohombsarPas encore d'évaluation

- Audit InventoriesDocument22 pagesAudit InventoriesAngelica CastilloPas encore d'évaluation

- Final EXIT 2015Document110 pagesFinal EXIT 2015naolmeseret22Pas encore d'évaluation

- PWP MPDocument13 pagesPWP MPPrathamesh SodagePas encore d'évaluation

- Branches and Agencies - OdtDocument9 pagesBranches and Agencies - OdtEunice BernalPas encore d'évaluation

- Test CostingDocument186 pagesTest CostingMohammad FiqiPas encore d'évaluation

- Mahindra Logistics Corporate ProfileDocument45 pagesMahindra Logistics Corporate ProfileSaksham Sharma100% (1)

- Cost Accountin Couse Out LineDocument3 pagesCost Accountin Couse Out Linem_waseem_bariPas encore d'évaluation

- Cross DockingDocument14 pagesCross Dockingiftikhar AhmedPas encore d'évaluation

- OA QuestionnairesDocument3 pagesOA Questionnairesjeremigon0Pas encore d'évaluation

- Oracle Collaborative PlanningDocument4 pagesOracle Collaborative PlanningBabu PandeyPas encore d'évaluation

- Report Format - FFMDocument6 pagesReport Format - FFMMuhammad MansoorPas encore d'évaluation

- PPC MCQ QB 29.03.21Document20 pagesPPC MCQ QB 29.03.21jvanandhPas encore d'évaluation

- GrafTech Investor Relations Package - Apr 2014 Lo Res-RDocument282 pagesGrafTech Investor Relations Package - Apr 2014 Lo Res-RffccllPas encore d'évaluation

- NAME XXXXXXX: Personal StatementDocument3 pagesNAME XXXXXXX: Personal Statement끄저긔Pas encore d'évaluation

- FM112 Chapter III Receivables Inventory ManagementDocument19 pagesFM112 Chapter III Receivables Inventory ManagementThricia Mae IgnacioPas encore d'évaluation

- Project On Working Capital ManagementDocument39 pagesProject On Working Capital ManagementDevidas Sapat100% (1)

- DocxDocument10 pagesDocxJohnnoff BagacinaPas encore d'évaluation

- Inventoty ManagementDocument74 pagesInventoty ManagementorsurajPas encore d'évaluation

- Oracle SCM Cloud: Ge Ing Started With Your Maintenance ImplementationDocument32 pagesOracle SCM Cloud: Ge Ing Started With Your Maintenance ImplementationKrasimir TodorovPas encore d'évaluation

- Tema 5-2 - Inventory Management Planning PurchasingDocument65 pagesTema 5-2 - Inventory Management Planning PurchasingTinna CondrachePas encore d'évaluation