Académique Documents

Professionnel Documents

Culture Documents

SAMSUNG CONSTRUCTION Vs FEBTC

Transféré par

Mary Joyce Lacambra AquinoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SAMSUNG CONSTRUCTION Vs FEBTC

Transféré par

Mary Joyce Lacambra AquinoDroits d'auteur :

Formats disponibles

Samsung Construction Corporation, Inc. v.

Far East Bank and Trust Company

FACTS:

Samsung Construction held an account with Far East Bank. One day, a check worth P999,500 payable to cash was

presented by a certain Roberto Gonzaga to the Makati Branch of Far East Bank. The check was certified to be true by

Jose Sempio, the assistant accountant of Samsung, who also happened to be present in the bank during the time that the

check was presented.

Three bank personnel (teller, Assistant Cashier, and another bank officer) examined the check and compared the

signature appearing on the check with the specimen signatures of Samsung’s President Jong. After ascertaining that the

signature was genuine, and that the account had sufficient funds, Gonzaga was asked to submit 3 proof of his identity.

Eventually, Gonzaga was able to encash the check.

When Samsung discovered the unauthorized withdrawal, it filed a complaint against FEBTC for violation of Sec 23

of the Negotiable Instruments Law.

RTC rendered judgment in favor of Samsung, holding FEBTC liable. It gave more credence to the testimony of NBI

Examiner Flores. CA reversed the RTC and absolved FEBTC from any liability.

ISSUES: WON Samsung could set up the defense of forgery in Sec. 23

RULING:

Yes. The general rule is to the effect that a forged signature is wholly inoperative, and payment made through or

under such signature is ineffectual or does not discharge the instrument. If payment is made, the drawee cannot charge

it to the drawer’s account. The traditional justification for the result is that the drawee is in a superior position to detect

a forgery because he has the maker’s signature and is expected to know and compare it.

Under Sec 23 of the Negotiable Instruments Law, forgery is a real or absolute defense by the party whose signature

is forged. Such liability attaches even if the bank exerts due diligence and care in preventing such faulty discharge.

Although the Court recognized that Sec 23 bars a party from setting up the defense of forgery if it is guilty of

negligence, it was unable to conclude that Samsung was guilty of negligence.

o The bare fact that the forgery was committed by an employee of the party whose signature was forged cannot

necessarily imply that such party’s negligence was the cause for the forgery.

o Admittedly, the record does not establish what measures Samsung employed to safeguard its blank checks.

Jong’s testimony regarding the use of a safety box by Kyu was considered hearsay. But when CA ruled that

Samsung was negligent, it did not really explain how and why.

o In the absence of evidence to the contrary, the court concluded that there was no negligence, the presumption

being that every person takes ordinary care of his concerns.

The CA Decision extensively discussed the FEBTC’s efforts in establishing that there no negligence on its part in

the acceptance and payment of the forged check. However, the degree of diligence exercised by the bank would be

irrelevant if the drawer is not precluded from setting up the defense of forgery under Sec 23 by his own negligence.

Vous aimerez peut-être aussi

- Brazil V StiDocument9 pagesBrazil V StiMary Joyce Lacambra AquinoPas encore d'évaluation

- Arsiga V ManiwangDocument3 pagesArsiga V ManiwangMary Joyce Lacambra AquinoPas encore d'évaluation

- Alcaraz V CaDocument4 pagesAlcaraz V CaMary Joyce Lacambra AquinoPas encore d'évaluation

- Noble VS AbadaDocument6 pagesNoble VS AbadaMary Joyce Lacambra AquinoPas encore d'évaluation

- Valdez v. AquilizanDocument5 pagesValdez v. AquilizanMary Joyce Lacambra AquinoPas encore d'évaluation

- Amores Vs Hret and VillanuevaDocument1 pageAmores Vs Hret and VillanuevaMary Joyce Lacambra AquinoPas encore d'évaluation

- Amores Vs Hret and VillanuevaDocument2 pagesAmores Vs Hret and VillanuevaMary Joyce Lacambra AquinoPas encore d'évaluation

- Sample Answer With CounterclaimDocument3 pagesSample Answer With CounterclaimMary Joyce Lacambra AquinoPas encore d'évaluation

- Angara vs. Electoral CommissionDocument28 pagesAngara vs. Electoral CommissionMary Joyce Lacambra AquinoPas encore d'évaluation

- 14) Belgica Vs Executive Secretary Paquito OchoaDocument281 pages14) Belgica Vs Executive Secretary Paquito OchoaMary Joyce Lacambra AquinoPas encore d'évaluation

- Batangas CATV Vs CADocument10 pagesBatangas CATV Vs CAMary Joyce Lacambra AquinoPas encore d'évaluation

- Lapanday Vs AngalaDocument4 pagesLapanday Vs AngalaMary Joyce Lacambra AquinoPas encore d'évaluation

- Phil Bank of Commerce Vs CADocument7 pagesPhil Bank of Commerce Vs CAMary Joyce Lacambra AquinoPas encore d'évaluation

- Negotiable Instruments Law Case ListDocument3 pagesNegotiable Instruments Law Case ListMary Joyce Lacambra AquinoPas encore d'évaluation

- Ethics and Swim OfficiatingDocument14 pagesEthics and Swim OfficiatingMary Joyce Lacambra AquinoPas encore d'évaluation

- Affidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hand This 18Document1 pageAffidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hand This 18Mary Joyce Lacambra AquinoPas encore d'évaluation

- Kinship and DescentDocument8 pagesKinship and DescentMary Joyce Lacambra AquinoPas encore d'évaluation

- REL 108 (Lesson 1 & 2)Document2 pagesREL 108 (Lesson 1 & 2)Mary Joyce Lacambra AquinoPas encore d'évaluation

- Negotiable Instruments ReviewerDocument18 pagesNegotiable Instruments ReviewerMary Joyce Lacambra AquinoPas encore d'évaluation

- Defining 21 Century Literature: Prepared By: Lovely Joy O. Ruiz Literature InstructorDocument5 pagesDefining 21 Century Literature: Prepared By: Lovely Joy O. Ruiz Literature InstructorMary Joyce Lacambra AquinoPas encore d'évaluation

- Mechanics of Due ProcessDocument4 pagesMechanics of Due ProcessMary Joyce Lacambra AquinoPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- DU TOIT V ATKINSONDocument6 pagesDU TOIT V ATKINSONdanielaschultz3Pas encore d'évaluation

- Bsa26 Cased Digestn05 de JesusDocument13 pagesBsa26 Cased Digestn05 de JesusDarid De JesusPas encore d'évaluation

- Pilar Cañeda Braga Vs Abaya G.R. No. 223076Document2 pagesPilar Cañeda Braga Vs Abaya G.R. No. 223076Ars Moriendi100% (4)

- SMCHAP025Document29 pagesSMCHAP025testbank100% (3)

- People vs. AgapinayDocument10 pagesPeople vs. AgapinayRaezel Louise VelayoPas encore d'évaluation

- Judge Denies New York's States Two Week Extension in GOA's Case Challenging The CCIADocument2 pagesJudge Denies New York's States Two Week Extension in GOA's Case Challenging The CCIAAmmoLand Shooting Sports NewsPas encore d'évaluation

- Administrative Law Case DigestsDocument8 pagesAdministrative Law Case DigestsEqui TinPas encore d'évaluation

- Corrections To UPL Response, Ghunise Coaxum, UPL Bar CounselDocument58 pagesCorrections To UPL Response, Ghunise Coaxum, UPL Bar CounselNeil GillespiePas encore d'évaluation

- Notice LettersDocument4 pagesNotice LettersLuke100% (2)

- Ooi Siew Yook & Ors. v. Lim Kar Bee: - Whether Court Has JurisdictionDocument2 pagesOoi Siew Yook & Ors. v. Lim Kar Bee: - Whether Court Has JurisdictionAvk vkPas encore d'évaluation

- People v. Mario Mariano 75 OG 482Document18 pagesPeople v. Mario Mariano 75 OG 482AnonymousPas encore d'évaluation

- Complaint For Declaration of Nullity of Foreclosure Proceedings October 1 2012 FinalDocument19 pagesComplaint For Declaration of Nullity of Foreclosure Proceedings October 1 2012 FinalAmado Vallejo III100% (1)

- Matt Klug Tort Claim v. Portland Police, Charles Andrew Hales Et AlDocument12 pagesMatt Klug Tort Claim v. Portland Police, Charles Andrew Hales Et Almary engPas encore d'évaluation

- China Jiangsu International Namibia LTD and J. Schneiders Builders CCDocument17 pagesChina Jiangsu International Namibia LTD and J. Schneiders Builders CCAndré Le RouxPas encore d'évaluation

- Ssangyong Engineering & Construction Co. Ltd. vs. National Highways Authority of India (NHAI)Document6 pagesSsangyong Engineering & Construction Co. Ltd. vs. National Highways Authority of India (NHAI)Pronita JanaPas encore d'évaluation

- Passing OffDocument29 pagesPassing Offpshubham65_551720227Pas encore d'évaluation

- 1 G.R. No. L 37379 PDFDocument1 page1 G.R. No. L 37379 PDFMaricar MendozaPas encore d'évaluation

- (@ffite CF T e Attcrnel! Q ) Eneral: ( - Ja, IUDocument1 page(@ffite CF T e Attcrnel! Q ) Eneral: ( - Ja, IUWJZPas encore d'évaluation

- Passport Ending TreasonDocument21 pagesPassport Ending TreasonBrien Jefferson100% (1)

- Offences Relating To Currency Notes and Bank NotesDocument7 pagesOffences Relating To Currency Notes and Bank NotesAnuja JacobPas encore d'évaluation

- Witness Affidavit of Emeteria B, ZuasolaDocument4 pagesWitness Affidavit of Emeteria B, ZuasolaNadin MorgadoPas encore d'évaluation

- SpecPro FlowchartDocument10 pagesSpecPro FlowchartSara AvillonPas encore d'évaluation

- Debate Materials - Death Penalty For CorruptorsDocument9 pagesDebate Materials - Death Penalty For CorruptorsPandagulung100% (1)

- Law of Evidence AssignmentDocument15 pagesLaw of Evidence AssignmentApoorvPas encore d'évaluation

- HSAC Case Form No. 4 SPA TO FILE CASE OR ANSWERDocument2 pagesHSAC Case Form No. 4 SPA TO FILE CASE OR ANSWERWilliam DaleyPas encore d'évaluation

- Quiz TechwiteDocument2 pagesQuiz TechwiteBalatibat Jessabel PascuaPas encore d'évaluation

- Criminal Procedure I OutlineDocument30 pagesCriminal Procedure I OutlineJessica AehnlichPas encore d'évaluation

- Court ProceedingDocument7 pagesCourt ProceedingSuijuris Sovereign Freeman100% (1)

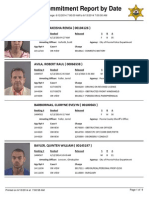

- Peoria County Booking Sheet 06/13/14Document9 pagesPeoria County Booking Sheet 06/13/14Journal Star police documents100% (1)

- Persons and Family RelationsDocument21 pagesPersons and Family RelationsAJDV AJDVPas encore d'évaluation