Académique Documents

Professionnel Documents

Culture Documents

Break Even Analysis (Atul)

Transféré par

Rahul GajbhiyeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Break Even Analysis (Atul)

Transféré par

Rahul GajbhiyeDroits d'auteur :

Formats disponibles

1

A

PROJECT

ON

“BREAK EVEN ANALYSIS”

Of “GIMA Tex Ind. Pvt. Ltd. Hinganghat”

Submitted to RTM Nagpur University, Nagpur in partial fulfilment of

the requirement for the degree Master of Business Administration.

Submitted By

Mr. Atul R. Gaulkar

Under the guidance of

Prof. R. B. Gajbhiye

DEPARTMENT OF MANAGEMENT STUDIES

Bapurao Deshmukh College of Engineering, Sevagram.

(Session 2010-2011)

Department Of Management Studies, BDCE, Sevagram.

2

DEPARTMENT OF MANAGEMENT STUDIES

B. D. College of Engineering, Sevagram

CERTIFICATE

This is to certify that Mr. Atul R. Gaulkar is a bonafied student of M.B.A.

IV Semester in Department of Management Studies, Bapurao Deshmukh

College of Engineering, Sevagram for the Session 2010-2011 has

completed his project work entitled “BREAK EVEN ANALYSIS OF GIMA

TEX. IND. PVT. LTD, HINGANGHAT” under the guidance of Prof. R. B.

Gajbhiye.

The Project Report is being submitted to Rashtrasant Tukadoji Maharaj

Nagpur University, Nagpur in partial fulfilment of the requirement for the degree

of Master of Business Administration.

Dr. S. S. Khandare

Principal

(B.D.C.E SEVAGRAM)

Prof. Dr. S. V. Deshmukh Prof. R. O.Panchariya

Co- ordinator Project In-charge

(D.M.S.B.D.C.E SEVAGRAM) (D.M.S.B.D.C.E SEVAGRAM)

Date: ___/___/2011

Place: SEVAGRAM

Department Of Management Studies, BDCE, Sevagram.

3

DECLARATION

I hereby declare that the project work entitled “BREAK EVEN ANALYSIS

OF GIMA TEX. IND. PVT. LTD, Hinganghat” submitted to the Rashtra Sant

Tukdoji Maharaj Nagpur University, Nagpur, is a record of an original work

done by me under the guidance of Prof. R. B. Gajbhiye, Bapurao Deshmukh

College of Engineering, Department of Management studies, Sevagram, and

this project work has not performed the basis for the award of any Degree or

diploma/associate ship/fellowship and similar project if any

Mr. Atul R. Gaulkar

NU/A7/42728

ACKNOWLEDGEMENTS

Department Of Management Studies, BDCE, Sevagram.

4

“I owe a great many thanks to a great many people who have helped and

Supported me during the making of my Project “

I derive immense pleasure in expressing my sincere gratitude to my project

guide and faculty Prof R. B. Gajbhiye for giving his valuable time and

attention towards successful completion of my project. He has taken pain to

go through the project and make necessary correction as and when needed.

I would also like to extend my deepest thanks to Prof. Dr. S.S.Khandare

(Principal, BDCOE) and Prof. Dr. S.V. Deshmukh (Co-ordinator, DMS,

BDCOE) without whose kind permission it would not have been possible to

complete my project.

This project bears an imprint of many people. Thus, I extend my heartfelt

thanks to Mr.S.N Pathre (Finance Manager, Gimatex Ind. Pvt. Ltd

Hinganghat)

Mr. Vinit Kumar Mohota (Director, Gimatex Ind. Pvt. Ltd Hinganghat) for

their kind attention and continues support towards my project.

Atul R. Gaulkar

Department Of Management Studies, BDCE, Sevagram.

5

EXECUTIVE SUMMARY

The project report covers all the aspects relating to financial decision making

through the eye of Break-even-analysis this has become imperative as the

Gimatex Industries Pvt.Ltd is plunging headlong into a plus area that is profit.

Break even analysis is an important technique in profit planning and managerial

decision making. It is based on the relationship between sales, revenue, and

variable cost to determine the level of operation. The point to be reached is a

state where the cost equalizes sales revenue and the result is no profit or no loss.

The employees of the Gimatex Industries have passed the management or the

management has passed the employees or both have passed with a support of

Gimatex Industries which is a profit making organization. To begin with

information was collected from primary and secondary sources. In the case of

Gimatex Industries, the Break Even point which generally is usual in a profit

making organization could not be reached as it is loss incurring organization

because of actual sales is greater than BEP sales it indicates that the profitability

of an organization. Financial statement of the organization bear testimony to what

has been stated above enclosed.

INDEX

Department Of Management Studies, BDCE, Sevagram.

6

CHAPTER I

INTRODUCTION

CHAPTER PARTICULAR PAGE NO.

NO.

1. INTRODUCTION

2. COMPANY PROFILE

3. OBJECTIVE

4. HYPOTHESIS

5. NEEDS AND SCOPE OF STUDY

6. RESEARCH METHODOLOGY

7. BREAK EVEN CHART

8. BREAK EVENPOINT

FACTORS

TOOLS

9. DATA ANALYSIS AND

INTERPRETATION

10. RESULT ANALYSIS

11. CONCLUSION

12. SUGGESTIONS

13. BIBLIOGRAPHY

Break Even Analysis

Break even analysis is a popular form of cost – volume – profit

relationship. Sometimes the words break even analysis and ‘cost - volume - profit

analysis are used interchangeably, as some of the cost – accountants consider

the analysis beyond the determination of break – even point as ‘cost – volume –

Department Of Management Studies, BDCE, Sevagram.

7

profits analysis’. This system in its narrower sense restricts itself only to the

determination of ‘no profit – no loss’ or ‘break – even points’, while in its broader

sense it covers the determination of profits at any level of activity. A break even

analysis indicates at what level cost and revenue are in equilibrium. It is a simple

and easily understandable.

Break even analysis refers to ascertainment of level of operations

where total revenue equals to total costs. It is an analysis used to determine the

probable profit or loss at any levels of operations. Break – even analysis is a

methods of studying the relationship among sales revenue, variable cost and

fixed cost to determine the level of operation at which all the costs are equal to its

sales revenue and it is the no profit no loss situation. This is an important

technique used in profit planning and managerial decision making. Break even

analysis is also known as cost volume profit analysis. The analysis is a tool of

financial analysis whereby the impact on profit of the changes in volume, price,

cost and mix can be estimated with reasonable accuracy.

The break - even point and break even chart are to by –products of break

even analysis. In a narrow sense, it is concerned with the break even point and a

broad sense; it is concerned with break even chart. Break even analysis is also

known as cost volume profit analysis. The analysis is a tool of financial analysis

whereby the impact on profit of the changes in volume, prices, cost can be

estimated with reasonable accuracy. Break even point is equilibrium point or

balancing point of no- profit no- loss. This is a point at which loss cases and profit

begins. This point is where income is exactly equal to expenditure.

Department Of Management Studies, BDCE, Sevagram.

8

These three elements are important for determining the break – even analysis.

BREAK EVEN

ANALYSIS

VARIABLE

SALES FIXED COST

COST

Break-even analysis is a technique widely used by production

management and management accountants. It is based on categorizing

production costs between those which are "variable" (costs that change when the

production output changes) and those that are "fixed" (costs not directly related to

the volume of production).

Break-even analysis is another accounting tool developed by business

owners to help plan and control the business operations. Thus, this analysis

shows the relationship between cost profit and volume clearly, which is very

helpful for profitability analysis. For this reason this analysis also known as cost –

volume – profit analysis.

Department Of Management Studies, BDCE, Sevagram.

9

ADVANTAGES OF BREAK EVEN ANALYSIS

Break even analysis will show the variable costs, fixed costs and total

costs.

Sales can be known.

Margin of safety can be known.

Profit or loss can be known.

It is useful for forecasting plans and profit.

Inter- firm comparison is possible.

It is helpful for cost control.

To decide changes in capacity.

To measure the effect of changes in profit factors.

To choose the most profitable alternative.

To determine the sales required to offset price reduction.

LIMITATIONS OF BREAK EVEN ANALYSIS

The break – even analysis requires that all costs should be separated into

fixed and variable components.

It is assumed that all fixed cost remain constant at various level of activity

But in practice, it may not be fixed in the long-run.

Another assumption is that variable costs are really variable and changes

in direct proportion to the volume of output. It means that variable cost per

unit of product remain constant- in practice variable cost are not necessary

strictly variable with output.

Break – even analysis ignore the capital employed in business, which is

one of the important fact in determination of profitability of the organisation

and its products.

It is assumed that productivity , operating efficiency, product specification

and method of manufacture sale will not under go any change – in actual

situation, the operating efficiency and productivity depends upon the man

power, it is impractical to assume that this factor remain constant.

Department Of Management Studies, BDCE, Sevagram.

10

ASSUMPTION OF BREAK EVEN ANALYSIS

There are several assumption of Break even analysis. These are as follows.

Cost can be classified into fixed and variable categories.

The principle of cost variability is valid.

Fixed cost will remain constant at all levels or volumes and variable costs

will fluctuate in direct proportion to volume.

There is a linear relationship among different costs.

Selling price will remain constant get full volume of sales.

Price of input factors will remain the same.

Cost control will be neither weakened not strengthened.

Market is sufficient to absorb to entire output.

Either there is only one product or if several products are being

manufactured and sold the sale mix will remain constant.

Department Of Management Studies, BDCE, Sevagram.

11

a) Industrial Profile-

India Textile Industry is one of the leading textile industries in the world. Though

was predominantly unorganized industry even a few years back, but the scenario

started changing after the economic liberalization of Indian economy in 1991. The

opening up of economy gave the much-needed thrust to the Indian textile

industry, which has now successfully become one of the largest in the world.

India textile industry largely depends upon the textile manufacturing and export.

It also plays a major role in the economy of the country. India earns about 27%

of its total foreign exchange through textile exports. Further, the textile industry of

India also contributes nearly 14% of the total industrial production of the country.

It also contributes around 3% to the GDP of the country. India textile industry is

also the largest in the country in terms of employment generation. It not only

generates jobs in its own industry, but also opens up scopes for the other

ancillary sectors. India textile industry currently generates employment to more

than 35 million people. It is also estimated that, the industry will generate 12

million new jobs by the year 2010.

Various Categories:

Indian textile industry can be divided into several segments, some of which can

be listed as below:

Cotton Textiles

Silk Textiles

Woollens Textiles

Readymade Garments

Hand-crafted Textiles

Jute and Coir

The Industry

India textile industry is one of the leading in the world. Currently it is estimated to

be around US$ 52 billion and is also projected to be around US$ 115 billion by

the year 2012. The current domestic market of textile in India is expected to be

increased to US$ 60 billion by 2012 from the current US$ 34.6 billion. The textile

export of the country was around US$ 19.14 billion in 2006-07, which saw a stiff

rise to reach US$ 22.13 in 2007-08. The share of exports is also expected to

increase from 4% to 7% within 2012. Following are area, production and

productivity of cotton in India during the last six decades:

Department Of Management Studies, BDCE, Sevagram.

12

Area in lakhs Production in lakhs bales of Yield kgs per

Year

hectares 170 kgs hectare

1950-51 56.48 30.62 92

1960-61 76.78 56.41 124

1970-71 76.05 47.63 106

1980-81 78.24 78.60 170

1990-91 74.39 117.00 267

2000-01 85.76 140.00 278

2001-02 87.30 158.00 308

2002-03 76.67 136.00 302

2003-04 76.30 179.00 399

2004-05 87.86 243.00 470

2005-06 86.77 244.00 478

2006-07 91.44 280.00 521

2007-08 94.39 315.00 567

2008-09 93.73 290.00 526

Though during the year 2008-09, the industry had to face adverse agro-climatic

conditions, it succeeded in producing 290 lakhs bales of cotton comparing to 315

lakhs bales last year, yet managed to retain its position as world's second highest

cotton producer.

Strengths:

Vast textile production capacity

Large pool of skilled and cheap work force

Entrepreneurial skills

Efficient multi-fibre raw material manufacturing capacity

Large domestic market

Enormous export potential

Very low import content

Flexible textile manufacturing systems

Department Of Management Studies, BDCE, Sevagram.

13

Weaknesses:

Increased global competition in the post 2005 trade regime under WTO

Imports of cheap textiles from other Asian neighbours

Use of outdated manufacturing technology

Poor supply chain management

Huge unorganized and decentralized sector

High production cost with respect to other Asian competitors

Cotton Exports from India

Year Quantity (in lakhs bales of 170 kgs) Value (in Rs./Crores)

1996-97 16.82 1655.00

1997-98 3.50 313.62

1998-99 1.01 86.72

1999-00 0.65 52.15

2000-01 0.60 51.43

2001-02 0.50 44.40

2002-03 0.83 66.31

2003-04 12.11 1089.15

2004-05 9.14 657.34

2005-06 47.00 3951.35

2006-07 58.00 5267.08

2007-08 85.00 8365.98

2008-09 50.00 N.A.

Current Facts on India Textile Industry

India retained its position as world’s second highest cotton producer.

Acreage under cotton reduced about 1% during 2008-09.

The productivity of cotton which was growing up over the years has

decreased in 2008-09.

Substantial increase of Minimum Support Prices (MSPs).

Cotton exports couldn't pick up owing to disparity in domestic and

international cotton prices.

Department Of Management Studies, BDCE, Sevagram.

14

Imports of cotton were limited to shortage in supply of Extra Long staple

cottons.

b) ORGANISATION

PROFILE –

Gimatex Industries Pvt Ltd. (Erstwhile RSR, Wani unit) was set up 1994 as a

sister concern to “The Raisaheb Rekhchand Mohota Spg. & Wvg. Mills Ltd.

(Popularly known as RSR)” in central part of India at Hinganghat. It germinated

with a vision to provide premium quality textile products to its customers using the

latest in textile technology.

An ISO 9000: 2001 Gimatex industries manufacture premium quality of varieties

of yarns and fabrics suitable for ready made garments.

The Mohota group commenced its operation in the year 1898 by setting up its

flagship company Raisaheb Rekhchand Mohota Spg. & Wvg. Mills Ltd. in the

cotton belt of central India. This integrated company converting the basic fibre to

rich fabrics is one of the very few composite units to withstand all the challenges

and threats thrown at it for more than 100 years. In the recent management

restructuring, part of RSR Mohota Mills has been separately formed into a new

company rechristened as Gimatex Industries Pvt. Ltd. Administered by a highly

dynamic and experienced management and executed by a strong skilled

workforce of 3000 people.

In the year 1994, Gimatex industries (Erstwhile RSR Wani) embarked on its

mission by commencing operations at multiple state-of-the-art manufacturing

locations. It has continuously pioneered in improvement of its processes and

systems and today with implementation of ERP the company has successfully

streamlines its operations. Its ceaseless drive to cater to quality conscious buyers

with multiple choices of products has helped company carve a niche in the yarn

manufacturing arena.

The group is a firm believer in the values of innovation, quality, and ethical

practices. Gimatex has thrived using these concepts as pillars of growth.

Organizations, business and people dealing with Gimatex continue their dealing

Department Of Management Studies, BDCE, Sevagram.

15

with the Company on a long term basis. The relationship flourishes in the

environment of mutual trust that reciprocates between the company and its

business allies. Our ever-growing sales figures and export demand is a testimony

to our customer-centric approach

The Reasons for the success of the mill are:-

Our loyal employee

Standard new work norms

Effective HR policy

Various welfare schemes for the workers.

Implementation of ERP

OBJECTIVES OF Gima Tex Pvt. Ltd.

The main objectives of the company can be generally stated as manufacturing

and selling of cotton yarn and cotton fabrics.

To manufacture and market cotton yarns.

To manufacture and market cotton fabrics.

To protect the interest of the employees through welfare measures.

To modernize the mills and its systems including computerization.

Corporate Social Responsibility

We believe that all the achievements that we have attained are a result of steady

enduring support from the society. Acknowledging this fact, the company engages

into the development of civilization by providing better infrastructure for

education, fairs, awarding scholarship for bright students, arranging health camps

etc. Also the company understands its responsibility towards maintaining a clean

and balanced eco-friendly environment and hence performs treatment of all the

outgoing water, maintains pollution levels below the statutory norms etc with the

aid of proper effluent treatment plants.

Following are the charitable institutions run by the group

• Seth Mathuradas Mohota religious and charitable trust

• Seth Mathuradas Mohota Science College, Nagpur

• Gangabai Bulakidas Mohota High School, Hinganghat

• Shrimati Sirekunwar Devi Mohota Kanya Vidyalaya, Hinganghat

• Shrimati Sirekunwar Devi Mohota memorial charitable trust

Department Of Management Studies, BDCE, Sevagram.

16

Plant and Machinery

In sync with its policy to deliver high value added quality products to discerning

customers, Gimatex has always opted for the latest technologies with state of the

art machineries imported from Europe & Japan. The working environment is

specifically controlled with the aid of advanced humidification and air conditioning

systems. Our testing facility houses best in class quality control laboratory which

ensures defect free end product. These products are then packed in suitable

packaging material to deliver on our promise of right product every time.

Our TMC approved Ginning and Pressing unit is fully modernized to cater to the

requirement of high quality, contamination free, low trash Cotton bales. These

cotton bales along with other man made fibers are used in our existing spinning

facilities having total production capacity of 15000 tonnes / annum of yarns in

various varieties.

Carding Machine

Our quest for quality production continues a step further into weaving with our

production capacities being 4 million meters / annum of fabrics. These capacities

are continuously augmented with major expansion plans.

Yarn Division

Blowroom – LMW & Trutzchler with Automatic Bale Plucker, Unimix, CVT

Contamination Detector - Uster Securomat SP-S

Carding – LMW 300 A& Trutzchler DK 800

Department Of Management Studies, BDCE, Sevagram.

17

Drawing – LMW RSB 851 & Reiter RSB D-35

Combing - LMW LK 250 & Reiter E65

Speed Frame - LMW LF 1400 A & Zinser 68i

Ring Frame - LMW LR6/S & Reiter COM 4

Humidification – Luwa

Testing – UT-4, Uster Classimat Quantum, HVI, Statex Strength system.

Packing – Pallete packing , Carton packing

Fabric Division

Warping – Beninger

Sizing – Beninger

Looms – Toyoda JAT 710

Humidification – Luwa

Ring Frame Machine

Quality Assurance

Gimatex Industries Pvt Ltd, Hinganghat is a ISO 9001 – 2000 certified company.

Our quality policy is to consistently meet or exceed our customer's expectation for

quality product & performance by continual improvement of our processes &

systems.

This is achieved through Implementing & maintaining ISO 9001-2000

Quality Management System through out the organization.

Creating and nourishing competencies among the people to increase

awareness, motivation and involvement.

Encouraging questioning of status quo and establishing continual

improvement as an objective for improved result.

Planning for changing customer needs, innovating new product and

upgrading technology to meet the desired result.

Department Of Management Studies, BDCE, Sevagram.

18

The group has carved a niche for itself by investing in lean manufacturing

processes appropriate information technology tools & operation research tools.

Further, state-of-the-art manufacturing facility and quality monitoring system

ensures the delivery of superior total value to the customer.

Department Of Management Studies, BDCE, Sevagram.

19

Certification

Department Of Management Studies, BDCE, Sevagram.

20

Our quality assurance personnel are well qualified & experienced in quality

control and are devoted all the time for collecting & analyzing data from online

and offline quality monitoring system.

Department Of Management Studies, BDCE, Sevagram.

21

Focus on quality right from incoming materials to the delivery of product to the

customer.

Appropriate Fibre sourcing from quality conscious suppliers domestically and

internationally.

Inspection test plans devised statistically such that all the potential vulnerable

points are checked for quality within a short period.

100% bales of contamination-free cotton fibre testing before taking them for

mixing.

Consistent fibre selection for manufacturing a particular count to avoid any

variation over a span of time.

Systematic productive and preventive maintenance to avoid exigencies.

100 % online quality monitoring with all the Autoconers connected through

Conerpilot to clear objectionable faults.

Final physical inspection by quality assurance personal of every cone prior to

packing with the aid of UV light

Along with this a 24 feeder single jersey knitting machine is used to verify the

performance of the yarn in knitting application.

Export Markets

Department Of Management Studies, BDCE, Sevagram.

22

Our Export Market expands to the following countries:

United Kingdom , Italy , Portugal , Poland , Brazil , Turkey , Egypt , Israel

Kenya , Mauritius , Oman , Korea , Vietnam , Sri Lanka , Bangladesh , Nepal ,

Argentina

Domestic Markets

Department Of Management Studies, BDCE, Sevagram.

23

Our Local Market expands mainly to the following locations in India:

Siyaram Silk Mills Mumbai

Reliance Industries Ltd.

S Kumar’s Nationwide

Reid & Taylor

Doner Industries Ltd. Mumbai

Banswara Syntex Ltd.

BSL Ltd. Bhilwara

Bombay Dying & Mfg. Co. Ltd. Mumbai

Suzuki Textiles, Bhilwara

Arwind Mills Ltd, Ahmadabad

Yarn Syndicate Ltd, Mumbai

Sangam Spinners, Bhilwara

Euro Vista Trading Co.Ltd. Mumbai

GHCL Ltd.

Alok Industries Ltd.

Nahar Textiles, Mumbai

Santosh Fine Fab Ltd. Mumbai

Alicom Synthetics, Mumbai

ATF Clothing Pvt. Ltd. Mumbai

Mahajan Silk Mills, Mumbai

Park Synthetics, Mumbai

Arviva Industries(Ind.) Ltd. Mumbai

Ambika Synthetics, Mumbai

Lamos(Ind.)Export Pvt. Ltd. Mumbai

Subh Laxmi Syntex Ltd. Bhilwara

Baldva Textiles Ltd. Bhilwara

Chhabra Syncotex, Bhilwara

Selection Synthetics, Bhilwara

Swagat Synthetics, Bhilwara

Titan Tex Fab Pvt. Ltd. Bhilwara

Sharda Spuntex(P) Ltd. Bhilwara

Ranjan Suitings Pvt. Ltd. Bhilwara

Trilobal Textiles, Bhilwara

Ashok Synthetics, Ludhiana

Department Of Management Studies, BDCE, Sevagram.

24

Management Body –

Basant Kumar Mohota ( Chairman ) +91-9326800006 bkmohota@gimatex.co.in

Prashant Kumar Mohota ( MD ) +91-9326111103 prashant@gimatex.co.in

Vineet Kumar Mohota ( Director) +91-9373107411 vineet@gimatex.co.in

A.K. Barik (Vice President) +91-9370012059 akbarik@gimatex.co.in

C. L. Parikh ( AVP- Yarn Sales) +91-9322284359 mho@gimatex.co.in

Girish Kochar ( AVP - Yarn Sales ) +91-9326800009 gkochar@gimatex.co.in

Dwarkadas Daga ( GM - Fabric Sales +91-9326810003

) ddaga@gimatex.co.in

G.K.Rajpuria (DGM – Cotton sales) +91-9422140760 info@gimatex.co.in

Rajiv Sharma (HR Manager) +91 -9325378319 hrd@gimatex.co.in

e-mail:info@gimatex.co.inmho@gimatex.co.in

Branches of Gimatex-

Factory At Hinganghat Mumbai Office

Gimatex Industries P. Ltd Gimatex Industries P. Ltd

Post Box No.1, Block No. 15,

Hinganghat - 442301 3RD Floor, Gate No.2,

Maharashtra (India) DevKaran Mansion,

Phone :+91-7153-320969 63,Princess Street

Fax : +91-7153-245158 Mumbai - 400 002 ( India)

Email : info@gimatex.co.in Phone : +91-22-22014711, +91-22-

22019541

Factory At Wani Fax : +91-22-22081556

Gimatex Industries P. Ltd Email : mho@gimatex.co.in

7 km. Mile Stone,

N. H. No. 7, Nagpur office

Village - Wani, Gimatex Industries P. Ltd

Tah. Hinganghat 12, Popular Cloth Market,

Dist.Wardha (M.S.)-442301 Gandhibagh, Nagpur 02,

Phone :+91-7153-320799 Phone : +91-712-2768410

Fax : +91-7153-256341

Email : info@gimatex.co.in

Department Of Management Studies, BDCE, Sevagram.

25

c) Product profile-

Gimatex Industries has a state of art manufacturing unit for making grey fabric.

Building upon its strength in yarn manufacturing the weaving division was set up

in the year 2006 with versatile and latest machine largely imported from Japan,

Europe.

Gimatex engages into the activity of manufacturing premium quality of cotton

bales, yarns and fabrics for domestic as well as export markets. The facilities

have been arranged to ensure capability to provide wide variety of products

suitable for divergent needs of the customer. An ISO 9000: 2001 Gimatex

industries manufacture premium quality of varieties of yarns and fabrics suitable

for ready made garments.

A. Yarn

Gimatex engages into the activity of manufacturing premium quality of cotton

bales, yarns and fabrics for domestic as well as export markets. The facilities

have been arranged to ensure capability to provide wide variety of products

suitable for divergent needs of the customer.

Organic Cotton mixings, imported cotton mixings along with various cottons

available domestically particularly DCH, MCU, S-6, Bunny etc. are used for

cotton yarns depending on the end use.

Semi Dull, Optical white, SHT, Micro Denier, Cationic are the different varieties of

Polyester that are used for polyester yarns and blends.

Modal, Viscose-Plus and Viscose find their application in all our viscose yarns

and blends with other fibre.

These yarns are prepared in the following shades

• Grey

• Black

• Mélange

Following types of yarn are produced in various count and blend ranges in single

or multiple plies

• Cotton

• Polyester

• Viscose

• Polyester / Viscose

• Polyester / Cotton

• Cotton / Modal

• Cotton / Viscose

• Poly / Viscose / Texturised

Department Of Management Studies, BDCE, Sevagram.

26

Fabric

Gimatex Industries has a state of art manufacturing unit for making grey fabric.

Building upon its strength in yarn manufacturing the weaving division was set up

in the year 2006 with versatile and latest machine largely imported from Japan,

Europe.

Also special attention is given to developing procedures and systems to match

the service requirements of the biggest fabric buyers in the world.

Intensive Quality Control Procedures & Systems also ensure total customer

satisfaction. Training programmes are conducted aiming on educating the staff on

Total Quality Management & First Time Right method of working.

Gimatex makes Bottom weights and shirting fabric catering to the growing

demands of the top end of apparel and r m g segment

We manufacture fabric from count range of 10 to 100s counts with weight from 75

gsm to 400 gsm.

We have in-house designing and desk loom for sampling.

Laboratory for checking various fabric parameters.

Advantages of Sourcing Fabric from Gimatex

In-house yarn manufacturing which helps in controlling contamination and

other quality parameters

Strong team of professionals from Indian Textile Majors

Short lead time

Quality Control

Yarn testing carried out before utilization to check for all critical parameters

Fabric inspected as per norms of American 4 point system.

Systematic Machine maintenance with the aim of manufacturing defect

free fabric

Fabric Manufacturing Machinery

Looms - Toyota Airjets JAT 710 , Picanol Gamma Rapiers

Sizing - Benninger

Department Of Management Studies, BDCE, Sevagram.

27

Warping - Beninger

Humidification - LUWA

Fabric Product Mix

Varieties - Cotton / PC / Cotton Flax / Cotton Lycra / Dobbies

Types - Griege

End use - Shirts / Trousers

Maximum width - 69” grey

Packing - Roll form

Inspection - American 4 point system

Annual production - 8.5 million mts p.a of which the capacity for Dobby

fabric being 1.5 million mts p.a.

Fabric Processing Unit

Department Of Management Studies, BDCE, Sevagram.

28

OBJECTIVES

The objectives are:-

To study of Break – even point analysis.

To analyse various parameters of BEP.

To study the Break even analysis and chart.

Estimation of break even point of GIMA Tex Ind. Pvt. Ltd. Hinganghat.

Department Of Management Studies, BDCE, Sevagram.

29

HYPOTHESIS

The hypotheses are:-

All cost and expenses can be separated into fixed and variable

components.

Variable cost is directly proportional to the volume of production.

The fixed cost is also fluctuating on yearly basis.

Profit volume ratio depends upon the contribution of the firm.

Department Of Management Studies, BDCE, Sevagram.

30

NEED OF STUDY

Gimatex industry is profit making organisation. Break even analysis is one of the

methods by which the financial health of the organisation can judged. With the

help of break even analysis the level of sales can be measured to shoot up the

sales step can be measured.

The present study has been undertaken to analyse the working of Gimatex

industry Pvt. Ltd. Hinganghat. It’s a profit making organisation and this is enquiry

into the reasons therefore. Break even analysis is a tool or a plank used to

enquire into the reasons for continued profit from year to year and a plus area

does not seem to be insight whether the conversion from loss to profit is not

impossible. Every aspect has been thoroughly analysed and keeping in view the

financial health of the company and its vision suggestions have been made.

SCOPE OF THE STUDY

The scope of the project is intended to cover the terms connected with

break - even analysis and to co - relate them with the GIMA Tex Ind. Pvt. Ltd.

Hinganghat.

Department Of Management Studies, BDCE, Sevagram.

31

RESEARCH METHODOLOGY

DATA COLLECTION

The study is primarily based on secondary data. The information of GIMA

Tex Ind. Pvt. Ltd. Hinganghat. Is of present project is carried on with the co-

operation of the management of the GIMA Tex Ind. Pvt. Ltd. Hinganghat, who

permitted me to carry out study to provide with the requisite data. The data is

collected from two sources.

PRIMARY DATA

The data collected self by the researchers is the primary data.

The information related to GIMA Tex Ind. Pvt. Ltd. Hinganghat. is collected

from the internal interview and discussion and concerned execution of

account department.

SECONDARY DATA

Secondary data may be defined as data that has been collected

earlier for some purpose other than the purpose related object of present

study. Any data that is available prior to the commandment of the research

project is secondary data.

The information of study is collected from the various books of

financial management and also, the information collected from Audited

report from 2006 – 2008.

RESEARCH DESIGN

In this case, the in depth studies of the break even analysis of GIMA Tex

Ind. Pvt. Ltd. Hinganghat.

TYPE OF RESEARCH STUDY

The research shall be explorative in nature.

Department Of Management Studies, BDCE, Sevagram.

32

EXPLORATORY RESEARCH DESIGN

The primary objective of exploratory research is to provide insights into,

and an understanding of problem confronting the researcher. Exploratory

research is used in cases when you must define the problem more precisely,

identify relevant courses of action, or gain additional insights before an approach

can be developed. The information needed is loosely defined at this stage, and

the research process that is adopted is flexible and unstructured. For example, it

may consist of personal interviews with organisation experts. The samples,

selected to generate maximum in sights is ' small and non-representative. The

primary data are qualitative in nature and are analyzed accordingly.

Period of Study-

The duration used for this project report is two & half month.

Department Of Management Studies, BDCE, Sevagram.

33

BREAK EVEN CHART

The break - even chart and breakeven point are to by –products of break

even analysis. In a narrow sense, it is concerned with the breakeven point and a

broad sense; it is concerned with break even chart.

The Break-Even Chart

Break even chart indicates approximate profit or loss at variable costs and

sales volume within a limited range. The break – even chart shows at what

volume the firm first covers all cost with revenue of break – even. The break-

even chart shows the profitability or otherwise of an undertaking at various level

of activity, and indicates the point at which neither profit or nor loss is made.

Breakeven point is known as “No profit no loss point”. So the chart is also known

as break - even chart. At this point, the total costs are recovered and profit

business.

In its simplest form, the break-even chart is a graphical representation of

costs at various levels of activity shown on the same chart as the variation of

income (or sales, revenue) with the same variation in activity. The point at which

neither profit nor loss is made is known as the "break-even point" and is

represented on the chart below by the intersection of the two lines:

The Essential Factors to prepare break even chart

BREAK EVEN POINT :-

Break – even point is a point where the total sales are equal to total cost.

In this point there is no profit or loss in the volume of sales. Total variable and

fixed costs are compared with sales revenue in order to determine the level of

sales volume, sales value or production at which the business makes neither a

profit nor a loss (the "break-even point").

Department Of Management Studies, BDCE, Sevagram.

34

FIXED COST :-

The fixed cost is a cost that tends to be a unaffected by changes in the

level of activity during a given period of time. The fixed costs remain constant in

total regardless of changes in volume up to a certain level of output. There are

not affected by changes in the volume of production. There is an inverse

relationship between volume and fixed cost per unit.

VARIABLE COST:-

The variable cost is a cost that tends to very in accordance with level of

activity within the relevant range and within a given period of time. The prime

product cost i.e.: direct material, direct labour and direct expenses tend to very in

direct proportion to the level of activity an increase in the volume means a

proportionate increase in the total variable cost and a decrease in volume while

lead to a proportionate decline in the total variable cost.

TOTAL COST:-

Expenditure incurred in production of material for the purpose of sale can

be divided into fixed cost or variable cost. Total of variable cost or fixed cost is

total cost.

SALES:-

The exchange of anything for money is called sale. After goods or

manufactured they are sold with a view to earning profit and cover the cost

incurred in the process. The result may be a profit or a loss. To find out the

breakeven point sale is an important aspect. The result of sales enables an

organisation to find out whether there is profit or loss. This is directly connected

with the ascertainment of breakeven point.

Department Of Management Studies, BDCE, Sevagram.

35

BREAK EVEN CHART

Department Of Management Studies, BDCE, Sevagram.

36

SIGNIFICANCE OF BREAK EVEN CHART

It will show the variable costs, fixed costs and total costs.

Sales and value can be known.

Profit or loss can be known.

Margin of safety can be known.

Angle of incidence or the intersection of sales line with costs line can also

be known. Thus, it is very useful for managerial decision.

LIMITATIONS OF BREAK EVEN CHART

Exact and accurate classification of cost into fixed and variable is not

possible.

Detailed information cannot be known from the chart. To known all the

information about fixed cost, variable cost and selling price, a number of

charts must be drawn.

Constant selling price is not true.

No importance is given to opening and closing stocks.

Cost, volume and profit relation can be known; capital amount, market

aspects, effect of govt. policy etc, which are important for decision -

making cannot be considered from break – even chart.

Department Of Management Studies, BDCE, Sevagram.

37

BREAK –EVEN- POINT

Definition of break - even point

Break – even point is a point where the total sales are equal to total cost.

In this point there is no profit or loss in the volume of sales.

The breakeven point is that point of sales volume at which total revenue is

equal to total cost. It is a no profit, no loss point.

This is a result indicates where there is no profit or loss is called BEP.

Where sales total is equal to total cost that point is Called break even point there

may be some profit which is including in total cost.

Introduction of break - even point

Break - even point helps in assessing the viability of the organization and

to take the decision in profit planning and cost control. Break - even point is the

point of zero income I.e., the level of sales is just equal to its costs. Cost includes

both fixed and variable costs. It is used as a useful tool in financial planning to

recover cost and maximize profits. The changing in operating condition such as,

sales, fixed cost, and variable cost will change the break - even point.

The Factors of the break-Even Point

The break-even point is the point at which the income from sales will cover

all costs with no profits. The business owner or manager usually considers

several factors when studying break-even analysis:

The capital structure of the company.

Fixed expenses such as rent, insurance, heat, and light.

Setup of the organization.

Department Of Management Studies, BDCE, Sevagram.

38

Variable expenses.

The inventory, personnel, and space required to operate properly.

The study of these factors will inform the business owner of the

possibilities of lowering the break-even point and increasing the gross profit

margins. When attempting to determine the prospect of success for a new

operation, the analysis of the break-even point may indicate the advantages or

disadvantages in modifying the proposed level of operation.

The break-even point informs the business owner of the level of sales at

which the business will realize neither a profit nor a loss. It can be expressed in

numbers or by the use of graphs. To arrive at the break-even point using either

method, we need to calculate the projected and fixed manufacturing, selling, and

administrative expenses, and the expected ratios of sales for each category of

expenses.

Break-Even Point Formulas:-

To determine the break-even point, we should use the following formula:

Breakeven point = Fixed cost

Profit volume ratio

OR

Breakeven point (In unit) = Fixed cost

Contribution per unit

OR

Breakeven point = Fixed cost

(×) Total sale

Total contribution

Department Of Management Studies, BDCE, Sevagram.

39

TOOLS OF BREAK EVEN POINT

PROFIT VOLUME RATIO OR P/V RATIO

Definition of profit volume ratio

Profit volume ratio commonly known as P/v ratio is the ratio of contribution

to sales. This ratio is known as “marginal income ratio” ‘contribution ratio’ or

‘Variable profit ratio’.

The ratio may be expressed in terms of percentages (%) indicating the

relative profitability of different products. The profit of a business can be

increased by improving P/V ratio. As such management will make efforts to

improve the ratio. A higher ratio means a greater profitability and vice versa. So

management will increase the P/V ratio. How to improve profit volume ratio:-

PVR ratio is an index of sound financial health of company’s product. Profit

volume ratio can be improved, if contribution is improved. Contribution can be

improved by taking any of the following steps.

By increasing selling price.

By decreasing variable cost.

By increasing the production of product which is having a high P/V ratio

and vice versa.

Profit volume ratio is very important in decision making. It can be used for

the calculation of B.E.P and in problems regarding profit sales relationship.

Department Of Management Studies, BDCE, Sevagram.

40

The formula for computing the P/V ratio is given below.

Profit volume ratio = Sales (-) Variable cost

× 100

Sales

OR

Profit volume ratio = Contribution

× 100

Sales

OR

Profit volume ratio = Fixed cost (+) Profit

×100

Sales

Application of profit volume ratio

A Profit volume ratio may be used for the following.

Ascertaining B.E.P. and margin of safety.

Ascertaining the variable cost for any volume of sales.

Fixing the selling price

Ascertaining profit for a particular volume of sales.

Ascertaining the volume of sales for a desired profit.

Department Of Management Studies, BDCE, Sevagram.

41

Selecting the most profitable lines of products particular when there is

no key factor.

CONTRIBUTION

Definition of contribution

Contribution is the difference between sales and variable cost or marginal

cost of sales. It may also be defined as the excess of selling price of variable cost

per unit. Contribution is also known as “contribution margin” or Gross margin”

contribution being the excess of sales over variable cost is the amount that is

contributed towards fixed expenses and profit.

Contribution formulas:-

Contribution = sales (-) marginal cost

Contribution = sales (-)Variable cost

Contribution = Fixed cost (+) Profit

Contribution = Fixed cost (- ) Loss

Contribution (per unit) = Selling price (-) Variable or (marginal cost per unit)

Advantages of contribution

It helps the management in the fixation of selling price.

It assists in determining the break - even - point.

It helps management in the selection of a suitable, product mix for profit

maximization.

Department Of Management Studies, BDCE, Sevagram.

42

It helps in choosing from among alternative methods of production the

method which gives highest contribution per limiting factor is adopted.

It helps in taking a decision as regards to adding a new product in the market.

MARGINAL COSTING

The term ‘Marginal costing’ is comparatively new area in the field of

accounting. It is becoming gradually a more popular term. So it is very important

and essential in the business for studying marginal cost. Marginal cost is also

known as ‘Direct cost’, ‘Variable cost’, etc.It is a only technique to be used in

taking managerial decisions.

Meaning of marginal costing

The term ‘marginal costing’ makes it necessary to distinguish between

fixed and variable costs. The behavior of variable cost is similar to marginal cost.

Two types of expenses are incurred in the production of any commodity. These

are fixed and variable expenses. Fixed expenses are those which do not vary

with the increase or decrease in the volume of production. These remain constant

regardless of the level of output. On the other hand, variable expenses very in

direct proportion to the volume of output. If the production comes down, they also

come down.

Definition of marginal costing

The institute of cost and Management Accountant (ICMA) London has

define marginal costing as, “The ascertainment of marginal costs and of the effect

on profit of changes in volume or type of output by differentiating between fixed

costs and variable costs”

According to Dr. Joseph, “Marginal costing is a technique of determining

the amount of change in the aggregate costs due to an increase of one unit over

the existing level of production. As such, it arises from the production of the

behaviors of costs with changes in the volume of output.

Department Of Management Studies, BDCE, Sevagram.

43

Marginal costing formula:-

“Marginal costing” is a technique to determine “Marginal cost”. This concept of

marginal cost can easily be explained with following equation.

Marginal cost = Prime cost (+) Total variable overheads

Marginal cost = Total cost (-) Fixed cost

Features of marginal costing

Marginal costing is a technique or working of costing which is used to

conjunction with other methods of costing.

Fixed and variable costs are kept separate at every stage. Semi – variable

costs are also separated into fixed and variable.

When evaluation of finished goods and work in progress are taken into

account they will be only variable cost.

As fixed costs are period costs, they are charged to profit and loss account

during the period in which they are incurred. They are not carried forward

to the next year’s income.

Marginal income or marginal contribution is known as income of the profit.

The difference between the contribution and fixed costs is the net profit or

loss.

Fixed costs remain constant, irrespective of level activity.

Sales price and variable cost per unit remain the same.

Department Of Management Studies, BDCE, Sevagram.

44

Cost volume profit (CVP) relationship is fully employed to reveal the state

of profitability at various level of activity.

Department Of Management Studies, BDCE, Sevagram.

45

Merits of Marginal costing

The following are the main merits of marginal costing.

No doubt marginal costing is easy and simple to understand and produces

a better performance. If the same is used with the help of standard costing

and budgetary control.

Such fixed overheads are excluded from marginal cost; greater control

over cost is possible. Thus the management can concentrate on marginal

cost which is nothing but a constant ratio.

As fixed cost are excluded it eliminates the difficulties which allocating

apportioning and absorbing overheads, so under and over recovery of

fixed overheads will not create any complication.

Need less to mention that if different varieties of product are manufactured

a comparative profitability statement can be prepared with the help of

marginal costing which help the management to take proper decision

about the products.

Marginal costing also helps the management to take any valuable decision

like price, to make or buy, selecting the more profitable product etc.

Other advantages to be taken – (1) Introducing a new products( 2)

Reduction of price during depression or competition (3)Selecting the most

profitable product (4) Alternative course of action (5)Profit planning with

the help of break even chart (6) Selecting the most profitable activity etc.

Department Of Management Studies, BDCE, Sevagram.

46

Demerits of marginal costing

The following are the demerits of marginal costing.

It is not an easy task to segregate the overheads into fixed and variable

due to the fact that many overheads considered to be fixed or variable

may not exactly be the same at various level of production.

We know that in marginal costing, concept of semi variable overheads

which are segregated into fixed and variable is absent. There it is very

difficult to segregate semi – variable overheads.

Sometimes decision taken on the basis of marginal costing is found to be

dangerous.

Another significant factors which is totally neglected in marginal costing.

Another significant snag of marginal costing is the procedure of valuation

of inventories i.e. work in progress, finished goods and transfer from one

process to another etc.

Standard costing and budgetary control technique also help to control

cost. Standard costing with the help of volume variances. Show the effect

of changes in output on fixed cost and as such variation of cost is found.

Department Of Management Studies, BDCE, Sevagram.

47

MARGIN OF SAFETY (M.S)

Definition of margin of safety

The total sales minus the sales at Break – even – point is known as the

margin of safety.

That is margin of safety is the excess of normal or actual sales over sales

at Break – even –point. In other words sales over and above break even sales

are known as Margin of safety. The margin of safety refers to the amount by

which sales revenue can fall before a loss incurred. That is, it is the difference

between the actual sales and sales at B.E.P. If the margin of safety is large, it is a

sign of soundness of the business and vice versa. The margin of safety serves as

a guide is a reliable indicator of the business strength and soundness. Margin of

safety can be expressed in absolute sales amount or in percentage.

High margin of safety indicates the soundness of a business because

even with substantial fall in sale or fall in production, some profit shall be made.

Small margin of safety on the other hand is an indicator of the weak position of

the business and even small reduction of the business. Margin of safety can be

increased by:-

Decreasing the fixed cost

Decreasing the variable cost

Increasing the selling price

Increasing output and sales

Changing to product mix that improve P/V ratio

Department Of Management Studies, BDCE, Sevagram.

48

Margin of safety can be computed with the help of following formulae.

Margin of safety = Actual Sales (-) Sales at B.E.P

OR

Margin of safety = Profit

Contribution

OR

Margin of safety = Profit

P/V Ratio

Margin of safety can also express as percentage on sales:-

Margin of safety = Margin of safety

× 100

Total sales

Department Of Management Studies, BDCE, Sevagram.

49

DATA ANALYSIS & INTERPRETATION

GIMA TEX IND. PVT. LTD. HINGANGHAT.

SALES

Particular 2007-08 2008-09 2009-10

(Rs in crore) (Rs in crore) (Rs in crore)

Yarn-Domestic 90.85 124.17 147.39

Yarn-Export 34.15 24.01 31.10

Grey cloth Domestic 20.52 34.05 35.02

Grey cloth Export ----- 0.29 0.37

TOTAL SALE 145.52 182.52 213.88

258.83

211.61

180.78 Interpretation:- sales in the year 2009 is greater than the sales in the year 2008 and sales

in year 2008 is greater than sales in the year 2007, so it indicates that sales increases in

every year.

Department Of Management Studies, BDCE, Sevagram.

50

VARIABLE COST

Particular 2007 2008 2008

Variable Expenses 112.17 134.11 150.82

Total (in Rs. Crore) 112.17 134.11 150.82

Interpretation -

The variable cost has increased in every year.

Department Of Management Studies, BDCE, Sevagram.

51

FIXED COST

Particular 2007 2008 2009

Fixed Expenses 21.47 27.85 33.83

Total (in Rs. Crore) 21.47 27.85 33.83

Interpretation:-

The fixed cost increased in the year 2009 as compare to the year 2007 and 2008.

Department Of Management Studies, BDCE, Sevagram.

52

PROFIT VOLUME RATIO

Profit volume ratio is the ratio of contribution to sales. PVR ratio is an index of sound

Financial health of company’s product.

Profit volume ratio = Sales – Variable cost

× 100

Sales

Particular 2007 2008 2009

P.V.R. 22.76% 26.52% 29.48%

Interpretation: -

The profit volume ratio is fluctuating every year. So the organisation should

try to maintain p .v. ratio.

Department Of Management Studies, BDCE, Sevagram.

53

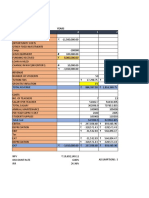

BREAK – EVEN POINT

Where sales total is equal to total cost that point is Called break – even point

there may be some profit which is including in total cost.

Break - even point = Fixed cost

P.V Ratio

Particular 2007 2008 2009

B.E.P (Rs. In Crore) 94.33 105.02 114.76

Interpretation: -

The sale of the organisation in the year 2007 is greater than B.E.P. and also

in the year 2008 or 2009 the sale is greater than B.E.P. Hence, in the year 2007,

2008 and 2009 the organisation was in profit.

Department Of Management Studies, BDCE, Sevagram.

54

RESULT ANALYSIS

The sales in year 2009 is greater than the sale in year 2008 and sales in the

year 2008 is greater than year 2007.This may be because of decreased

price of product or more demand for products or any other factors.

Variable cost is directly related to no. Of unit produced .The V. C. has

increased by 38.65 crore in year 2009 and by 21.94 crore in year 2008 as

compare to year 2007, and this may be because of increased price of raw

material or increased labour cost.

Fixed cost has increased in the year by year. This may be because of

management has given the bonus or any other monetary benefits to the

worker of an organisation.

The profit volume ratio is fluctuating every year. Because of the P.V.R has

increased in past three year. A higher P.V R means higher profitability.

The sales of the organisation in the year 2007 is greater than B.E.P. and also

the year 2008 & 2009, the sale is greater than B.E.P. which suggest to

makes it profit making organisation.

B.E.P sales in year 2007 was 94.33 crore and it increased in 2008 by 10.69

crore which was 105.02 crore and it again increased in 2009 by 9.74 crore

which was 114.76 crore.

Department Of Management Studies, BDCE, Sevagram.

55

CONCLUSION

After the analysis it is found that the gross profit of the organisation is high

due to that profit volume ratio is also high. Hence, the break even sale is less than

the actual sale of an organisation which indicates that the organisation is in the

profit from last three years.

Hence the organisation tries to maintain the same position in the future and

company should concentrate on increasing their sales and to earn more profit.

Department Of Management Studies, BDCE, Sevagram.

56

SUGGESTIONS

The organisation should maintain their organisational developing policies.

The organisation should try to improve profit volume ratio, because a

higher profit volume ratio means higher profitability.

Organisation should increase its sales.

.

Organisation should reduce its variable cost.

The organisation should try to increase publicity.

The organisation should provide quality product at reasonable price to the

customer.

Department Of Management Studies, BDCE, Sevagram.

57

BIBLIOGRAPHY

Cost management accounting - Ravi M. Kishore

Management accounting - R.S .N Pillai & Bagavathi

Research Methodology - C.R. Kothari

www.gimatex.co.in

Final accounts of organisation Profit & Loss Account and Balance Sheet

for the Accounting Year 2006-07, 2007-08, 2008 – 2009.

Department Of Management Studies, BDCE, Sevagram.

Vous aimerez peut-être aussi

- Apparel Retail in IndiaDocument83 pagesApparel Retail in IndiaAnuranjanSinha91% (11)

- Bright Flexi International Private Limited, PadubidireDocument9 pagesBright Flexi International Private Limited, PadubidirePratheek PoojaryPas encore d'évaluation

- Apollo Tyres FSADocument12 pagesApollo Tyres FSAChirag GugnaniPas encore d'évaluation

- Godrej ConsumerDocument7 pagesGodrej ConsumermuralyyPas encore d'évaluation

- Project Report On MarutiDocument36 pagesProject Report On Marutiishan2i20080% (2)

- Meerut Adventure Company CV1Document9 pagesMeerut Adventure Company CV1Ayushi GuptaPas encore d'évaluation

- Goa Sahakar BhandarDocument18 pagesGoa Sahakar BhandarSimon Alan Correia100% (1)

- Production and Operation Management of A RMG FactoryDocument14 pagesProduction and Operation Management of A RMG FactorySaidusSalekinSirajeePas encore d'évaluation

- Indian Paper Industry PDFDocument6 pagesIndian Paper Industry PDFP Vinayakam0% (1)

- Phaneesh Murthy Sexual Harassment CaseDocument20 pagesPhaneesh Murthy Sexual Harassment CaseJacob Toms NalleparampilPas encore d'évaluation

- GradedDocument6 pagesGradedYagnik prajapatiPas encore d'évaluation

- A Dissertation On Green MarketingDocument7 pagesA Dissertation On Green MarketingMukesh ChauhanPas encore d'évaluation

- Tata Cost SheetDocument6 pagesTata Cost SheetDebanjan BanerjeePas encore d'évaluation

- Dhanuka Agritech: LimitedDocument224 pagesDhanuka Agritech: LimitedPradeep HPas encore d'évaluation

- OverviewDocument2 pagesOverviewHdkakaksjsbPas encore d'évaluation

- Asian Paint Cost AnalysisDocument22 pagesAsian Paint Cost AnalysisRadhika ChhabraPas encore d'évaluation

- Project Ginning FactoryDocument28 pagesProject Ginning FactoryGirish Agarwal0% (1)

- A Study On Financial Performance Analysis Ppt-MuthusamiDocument16 pagesA Study On Financial Performance Analysis Ppt-MuthusamiSwarna RavichandranPas encore d'évaluation

- Multi Tech Case AnalysisDocument4 pagesMulti Tech Case AnalysissimplymesmPas encore d'évaluation

- Brand Management Quiz 1 PDFDocument1 pageBrand Management Quiz 1 PDFSamin Yasar ShoupalPas encore d'évaluation

- Strategic FinanceDocument72 pagesStrategic FinanceNinu MolPas encore d'évaluation

- To Study The Capital Structure of Wipro in Comparison To Industry Standard SynopsisDocument4 pagesTo Study The Capital Structure of Wipro in Comparison To Industry Standard SynopsisAssise ThankappanPas encore d'évaluation

- Black Book Summer InternshipDocument52 pagesBlack Book Summer InternshipDhwani PrajapatiPas encore d'évaluation

- Vegetron ExcelDocument21 pagesVegetron Excelanirudh03467% (3)

- CECDocument4 pagesCECJyoti Berwal0% (3)

- List of ExhibitorsDocument7 pagesList of ExhibitorsdeepakmukhiPas encore d'évaluation

- Swot Analysis of IimkDocument9 pagesSwot Analysis of IimkAMAL ARAVINDPas encore d'évaluation

- Percentage and Profit & Loss: Aptitude AdvancedDocument8 pagesPercentage and Profit & Loss: Aptitude AdvancedshreyaPas encore d'évaluation

- ST Clement'S School Case Study: YearsDocument8 pagesST Clement'S School Case Study: YearsTin Bernadette DominicoPas encore d'évaluation

- Tax Planning & JV AbroadDocument16 pagesTax Planning & JV AbroadAmit KapoorPas encore d'évaluation

- Managerial Economics: Geetika, Piyali Ghosh & Purbaroy ChoudhuryDocument3 pagesManagerial Economics: Geetika, Piyali Ghosh & Purbaroy ChoudhuryVidya Hegde KavitasphurtiPas encore d'évaluation

- HR and Hygiene Questions PDFDocument7 pagesHR and Hygiene Questions PDFHarshal RahatePas encore d'évaluation

- TATA Motors Fundamental AnalysisDocument17 pagesTATA Motors Fundamental AnalysisMitali AgrawalPas encore d'évaluation

- Interpretation of Comparative Balance Sheet and Income StatementDocument4 pagesInterpretation of Comparative Balance Sheet and Income Statementshruti jainPas encore d'évaluation

- Project RitesDocument72 pagesProject RitesSachin ChadhaPas encore d'évaluation

- TATA Nano Cost SheetDocument3 pagesTATA Nano Cost SheetOnkar SawantPas encore d'évaluation

- Textile IndustryDocument32 pagesTextile Industrygill27888Pas encore d'évaluation

- Samyak Agarwal (M-703) - Vaibhav Agarwal (M-704)Document31 pagesSamyak Agarwal (M-703) - Vaibhav Agarwal (M-704)Vaibhav AgarwalPas encore d'évaluation

- GUPTA - Export Import Management-MC GRAW HILL INDIA (2017)Document354 pagesGUPTA - Export Import Management-MC GRAW HILL INDIA (2017)rUTHPas encore d'évaluation

- Business Plan For EdTech Startup - LearnSmart Case Study (Lecture 2)Document4 pagesBusiness Plan For EdTech Startup - LearnSmart Case Study (Lecture 2)BISMA RAFIQPas encore d'évaluation

- Assignment-3 Case: Oliver Optics Company: Submitted ByDocument3 pagesAssignment-3 Case: Oliver Optics Company: Submitted ByChandu KamathPas encore d'évaluation

- VLCCDocument18 pagesVLCCAbhinav NigamPas encore d'évaluation

- (Rs MN.) : Case 10.1: Hind Petrochemicals CompanyDocument1 page(Rs MN.) : Case 10.1: Hind Petrochemicals Companylefteris82Pas encore d'évaluation

- Case Study 2Document5 pagesCase Study 2what_the_fukPas encore d'évaluation

- Schweppes Case StudyDocument10 pagesSchweppes Case StudyPam UrsolinoPas encore d'évaluation

- Turnkey Case StudyDocument20 pagesTurnkey Case Studyharsh kumarPas encore d'évaluation

- A Case Study On Team Work Challenges On Stryker Corporation.Document11 pagesA Case Study On Team Work Challenges On Stryker Corporation.GYANASARATHI PRADHANPas encore d'évaluation

- Vdocuments - MX - Iternship R On Meghna Petroleum LimitemiliDocument46 pagesVdocuments - MX - Iternship R On Meghna Petroleum Limitemiliরবি আলমPas encore d'évaluation

- Internship Report: University of DhakaDocument45 pagesInternship Report: University of Dhakaketan dontamsettiPas encore d'évaluation

- Ratio Analysis 1Document66 pagesRatio Analysis 1Radha ChoudhariPas encore d'évaluation

- Brannigan FoodsDocument5 pagesBrannigan FoodsBhagyashree GanatraPas encore d'évaluation

- Tata Motors Dupont and Altman Z-Score AnalysisDocument4 pagesTata Motors Dupont and Altman Z-Score AnalysisLAKHAN TRIVEDIPas encore d'évaluation

- Tata Sampann MPC 1Document28 pagesTata Sampann MPC 1anshuman sharmaPas encore d'évaluation

- 162-Cement Industry in IndiaDocument33 pages162-Cement Industry in Indiapiyushbhatia10_28338100% (2)

- Cost Analysis and Control Hero 2017Document81 pagesCost Analysis and Control Hero 2017aurorashiva1Pas encore d'évaluation

- Summer Internship ProgrammeDocument61 pagesSummer Internship Programmebirbal singhPas encore d'évaluation

- A Comprehensive Study On Financial Analysis of Bharat Heavy Electricals LimitedDocument52 pagesA Comprehensive Study On Financial Analysis of Bharat Heavy Electricals LimitedRounak BasuPas encore d'évaluation

- Prashant ProjectDocument58 pagesPrashant ProjectPrashant raskarPas encore d'évaluation

- A Study On Cost Benefit AnalysisDocument8 pagesA Study On Cost Benefit AnalysisPoojaMBPas encore d'évaluation

- Deep ProjectDocument59 pagesDeep ProjectVikrant KhandalePas encore d'évaluation

- Airway Bill NumberDocument10 pagesAirway Bill NumberVasant KothariPas encore d'évaluation

- WP Contentuploads201911Electric Savings PDFDocument8 pagesWP Contentuploads201911Electric Savings PDFTyler DevonPas encore d'évaluation

- Mathematics SBADocument6 pagesMathematics SBASeifer Rattan67% (3)

- Report On Consumer Car Buying BehaviorDocument26 pagesReport On Consumer Car Buying BehaviorSaurabh Sharma86% (7)

- SBI PO Prelims Memory Based Paper (Held On 17th December 2022 Shift 1) (English)Document26 pagesSBI PO Prelims Memory Based Paper (Held On 17th December 2022 Shift 1) (English)dragondevilgod999Pas encore d'évaluation

- Effect of Agricultural Transformation Agenda Support Program Phase 1 Atasp 1 On Farmers' Performance in Southeast, NigeriaDocument12 pagesEffect of Agricultural Transformation Agenda Support Program Phase 1 Atasp 1 On Farmers' Performance in Southeast, NigeriaEditor IJTSRDPas encore d'évaluation

- IPRS - PGP Finals 2020Document26 pagesIPRS - PGP Finals 2020RANJAN RAJPas encore d'évaluation

- An Analysis of The Marketing of Onion in Monguno Local Government Area of Borno State, NigeriaDocument6 pagesAn Analysis of The Marketing of Onion in Monguno Local Government Area of Borno State, Nigeriakristi althea gramataPas encore d'évaluation

- India ConsultantsDocument72 pagesIndia Consultantsgt2000Pas encore d'évaluation

- Gul Ahmed-1Document13 pagesGul Ahmed-1Kushboo IoBMPas encore d'évaluation

- Loan Account Statement: Generated byDocument7 pagesLoan Account Statement: Generated byShaoon HowladerPas encore d'évaluation

- 9A. HDFC DEC2018 EstatementDocument8 pages9A. HDFC DEC2018 EstatementNanu PatelPas encore d'évaluation

- SalatrioDocument4 pagesSalatriodaselknamPas encore d'évaluation

- Aif & PmfmeDocument62 pagesAif & PmfmeAkshara PanickerPas encore d'évaluation

- Amazon Fresh Refrigerated Box Truck Analysis: Jacob Gourlay - ConsultantDocument15 pagesAmazon Fresh Refrigerated Box Truck Analysis: Jacob Gourlay - ConsultantJakePas encore d'évaluation

- Curriculum VitaeDocument3 pagesCurriculum Vitaepradeep jaya100% (1)

- Chapter 3 - POHRDocument29 pagesChapter 3 - POHRNehal SalemPas encore d'évaluation

- Fruit Farming Business PlanDocument20 pagesFruit Farming Business Plankehabtemaryam bayleyegnPas encore d'évaluation

- Transfer Personnel BasketDocument6 pagesTransfer Personnel BasketDwi Agung AriyonoPas encore d'évaluation

- Permaculture, Upaya Meningkatkan Pendapatan Pentani Kecil: Permaculture, Effort For Increasing Income of Local FarmersDocument4 pagesPermaculture, Upaya Meningkatkan Pendapatan Pentani Kecil: Permaculture, Effort For Increasing Income of Local FarmersOoh LidaaPas encore d'évaluation

- Raci Group6Document4 pagesRaci Group6Amandeep SinghPas encore d'évaluation

- MS-35 Precast Conc ManholesDocument2 pagesMS-35 Precast Conc ManholesMahaboob PashaPas encore d'évaluation

- Vegetable Marketing System in Bangladesh A Study On Dinajpur DistrictDocument34 pagesVegetable Marketing System in Bangladesh A Study On Dinajpur DistrictMD. EANPas encore d'évaluation

- Cost of Farming Onions Per Acre in Kenya You Must Know - Check Farm TipsDocument10 pagesCost of Farming Onions Per Acre in Kenya You Must Know - Check Farm TipsCustomWritingPas encore d'évaluation

- Cash Payment JournalDocument8 pagesCash Payment JournalEka WiraPas encore d'évaluation

- Procurement Winners' Chronicles: Case Studies of Successful Procurement TurnaroundDocument14 pagesProcurement Winners' Chronicles: Case Studies of Successful Procurement TurnaroundAbdullah NabilPas encore d'évaluation

- Organic Food Business in India A Survey of CompaniDocument19 pagesOrganic Food Business in India A Survey of CompaniShravan KemturPas encore d'évaluation

- Volume Avg More Than 20, Technical Analysis ScannerDocument2 pagesVolume Avg More Than 20, Technical Analysis ScannerH3muPlayzGamez YTPas encore d'évaluation

- Top 100 Volume Robocallers April 2021-CombinedDocument6 pagesTop 100 Volume Robocallers April 2021-CombinedAnonymous Pb39klJ0% (1)

- Carrefour Annual Report 2018 EN - 1 PDFDocument32 pagesCarrefour Annual Report 2018 EN - 1 PDFMarina GonzálezPas encore d'évaluation