Académique Documents

Professionnel Documents

Culture Documents

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Transféré par

Kristian AguilarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Transféré par

Kristian AguilarDroits d'auteur :

Formats disponibles

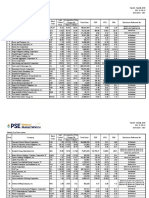

Jan 28 - Feb 01, 2019

VOL. VI NO. 5

ISSN 2013 - 1351

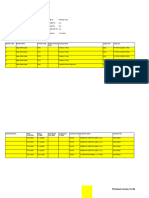

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Premiere Horizon Alliance Corporation PHA 1.62 54.29 398.46 2,970,423,820 121.07 0.01 6.23 C00530-2019

2 Zeus Holdings, Inc. ZHI 0.345 51.32 52.65 13,984,400 (1,128.47) (0.0003) 6,316.60 No Disclosure

3 Holcim Philippines, Inc. HLCM 9.35 47.48 61.49 297,966,309 28.34 0.33 2.82 C00499-2019

4 Greenergy Holdings Incorporated GREEN 2.96 35.78 41.63 1,091,323,310 67.74 0.04 4.85 C00560-2019, C00572-2019

CR00865-2019, CR00830-2019,

5 Xurpas Inc. X 1.66 26.72 (5.68) 158,107,690 (13.02) (0.13) 0.90 C00527-2019, C00528-2019

6 Cemex Holdings Philippines, Inc. CHP 2.72 17.24 38.07 629,649,540 (22.29) (0.12) 0.48 C00590-2019, C00553-2019, C00554-2019

7 Boulevard Holdings, Inc. BHI 0.062 16.98 10.71 17,492,060 (3,399.65) (0.00002) 0.40 No Disclosure

8 Benguet Corporation "A" BC 1.50 16.28 15.38 178,350 (8.97) (0.17) 0.26 No Disclosure

9 Victorias Milling Company, Inc. VMC 2.70 14.41 15.88 5,418,220 9.67 0.28 1.16 CR00864-2019, C00476-2019, CR00826-2019

10 Lepanto Consolidated Mining Company "A" LC 0.136 14.29 10.57 9,441,140 (10.38) (0.01) 1.20 No Disclosure

C00615-2019, C00616-2019,

11 8990 Holdings, Inc. HOUSE 10.00 13.90 19.05 136,812,524 10.86 0.92 1.94 C00617-2019, C00618-2019

12 Philippine Business Bank PBB 14.18 13.44 14.54 21,530,650 11.27 1.26 0.82 C00483-2019

13 iPeople, Inc. IPO 11.92 12.03 3.83 2,603,268 44.90 0.27 1.57 C00609-2019, CR00849-2019

14 Metro Alliance Holdings & Equities Corporation "B" MAHB 2.32 11.54 2.20 169,500 158.47 0.01 6.20 No Disclosure

15 MacroAsia Corporation MAC 19.90 10.56 8.98 304,514,292 35.13 0.57 6.13 No Disclosure

16 Integrated Micro-Electronics, Inc. IMI 13.00 10.17 17.33 61,159,848 11.17 1.16 1.33 C00614-2019, C00577-2019

17 GT Capital Holdings, Inc. GTCAP 1,119.00 9.71 12.46 634,827,800 15.60 71.75 1.42 No Disclosure

18 Philippine Bank of Communications PBC 23.00 9.52 13.86 127,485 14.49 1.59 1.09 No Disclosure

19 D.M. Wenceslao & Associates, Incorporated DMW 9.48 9.34 19.70 99,445,988 19.96 0.48 1.72 C00570-2019

19 MJC Investments Corporation MJIC 2.81 9.34 9.77 16,860 (11.44) (0.25) 7.52 No Disclosure

21 Asiabest Group International Inc. ABG 28.70 8.51 4.36 41,941,990 147,149.30 0.0002 32.03 C00485-2019, CR00823-2019

22 Oriental Petroleum and Minerals Corporation "A" OPM 0.013 8.33 - 708,500 18.98 0.001 0.54 No Disclosure

C00604-2019, C00610-2019, CR00839-2019,

23 ISM Communications Corporation ISM 6.47 8.19 2.37 994,901,340 (52.32) (0.12) 5.86 CR00840-2019, CR00842-2019, CR00844-2019,

C00569-2019, C00571-2019

24 Shakey's Pizza Asia Ventures, Inc. PIZZA 13.00 8.15 8.33 31,474,856 25.10 0.52 4.57 No Disclosure

25 Premium Leisure Corp. PLC 0.97 7.78 18.29 74,555,260 14.74 0.07 1.88 No Disclosure

26 Prime Orion Philippines, Inc. POPI 2.61 7.41 6.53 7,048,270 136.09 0.02 1.44 No Disclosure

27 Philex Mining Corporation PX 4.17 6.92 9.74 47,951,130 18.79 0.22 0.83 C00566-2019

28 Bloomberry Resorts Corporation BLOOM 11.10 6.73 14.43 610,362,312 18.59 0.60 3.44 C00598-2019

29 STI Education Systems Holdings, Inc. STI 0.80 6.67 (1.23) 147,350,560 15.98 0.05 0.91 No Disclosure

30 DMCI Holdings, Inc. DMC 12.76 6.33 (0.16) 254,895,594 11.66 1.09 2.09 No Disclosure

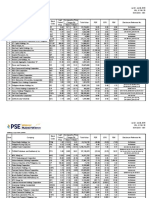

Jan 28 - Feb 01, 2019

VOL. VI NO. 5

ISSN 2013 - 1351

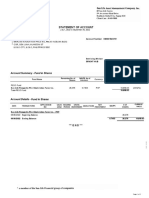

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Vitarich Corporation VITA 1.80 (15.09) (7.22) 201,447,260 77.23 0.02 3.69 CR00846-2019, CR00847-2019, C00574-2019

2 Grand Plaza Hotel Corporation GPH 10.36 (13.52) (6.16) 15,848 (12.33) (0.84) 0.63 No Disclosure

3 PH Resorts Group Holdings, Inc. PHR 6.08 (10.59) 7.23 37,246,394 1,104.13 0.01 57.24 C00475-2019

4 NiHAO Mineral Resources International, Inc. NI 1.04 (9.57) (3.70) 2,681,200 (38.81) (0.03) 1.15 No Disclosure

5 Arthaland Corporation ALCO 0.88 (9.28) (12.00) 16,437,740 39.37 0.02 0.93 No Disclosure

6 Marcventures Holdings, Inc. MARC 1.08 (9.24) (16.92) 11,636,800 (29.73) (0.04) 0.76 No Disclosure

7 Easycall Communications Philippines, Inc. ECP 15.10 (9.04) (1.05) 21,107,582 235.10 0.06 15.33 CR00861-2019, CR00862-2019

8 Italpinas Development Corporation IDC 4.40 (8.71) (13.73) 16,770,690 20.15 0.22 3.23 No Disclosure

9 Now Corporation NOW 3.35 (7.71) (9.95) 63,640,720 379.01 0.01 3.72 No Disclosure

10 The Philodrill Corporation OV 0.012 (7.69) - 6,374,900 (61.30) (0.0002) 0.65 C00508-2019

11 Pacifica, Inc. PA 0.038 (7.32) - 3,714,900 (829.89) (0.00005) (244.39) No Disclosure

12 PAL Holdings, Inc. PAL 13.00 (6.74) 46.07 188,922,870 (21.59) (0.60) 37.20 C00515-2019

13 ABS-CBN Corporation ABS 23.30 (6.61) 14.50 34,429,355 7.88 2.96 0.58 No Disclosure

14 Philippine Infradev Holdings Inc. IRC 2.29 (6.15) (0.43) 144,576,860 (56.43) (0.04) 0.33 CR00853-2019

15 SOCResources, Inc. SOC 0.77 (6.10) 4.05 389,100 107.20 0.01 0.42 CR00828-2019

16 Bright Kindle Resources & Investments Inc. BKR 1.41 (6.00) (4.08) 2,398,830 (48.22) (0.03) 2.06 No Disclosure

17 Acesite (Phils.) Hotel Corporation ACE 1.31 (5.76) (2.24) 2,099,630 (3.33) (0.39) 0.31 No Disclosure

18 SFA Semicon Philippines Corporation SSP 1.39 (5.44) (7.33) 1,372,380 142.89 0.01 0.52 No Disclosure

19 Synergy Grid & Development Phils., Inc. SGP 440.20 (5.33) (17.87) 267,912 (38,779.11) (0.01) 3,001.36 No Disclosure

20 Harbor Star Shipping Services, Inc. TUGS 2.87 (5.28) (13.03) 30,655,720 25.07 0.11 1.52 C00595-2019, C00562-2019

21 Metro Retail Stores Group, Inc. MRSGI 2.56 (5.19) - 29,486,120 9.96 0.26 1.07 C00501-2019, C00537-2019

22 Vulcan Industrial & Mining Corporation VUL 1.47 (5.16) (11.45) 47,599,930 (776.87) (0.002) 2.51 No Disclosure

23 2GO Group, Inc. 2GO 13.20 (5.04) (7.95) 5,333,648 (29.43) (0.45) 11.32 C00511-2019

24 Anglo Philippine Holdings Corporation APO 0.76 (5.00) (13.64) 183,150 (5.64) (0.13) 0.37 No Disclosure

24 Millennium Global Holdings, Inc. MG 0.171 (5.00) (2.29) 365,600 51.51 0.003 2.02 No Disclosure

26 Travellers International Hotel Group, Inc. RWM 5.52 (4.99) 2.79 25,201,826 41.23 0.13 1.90 No Disclosure

27 Atok-Big Wedge Co., Inc. AB 13.78 (4.97) (16.48) 1,484,052 (2,267.00) (0.01) 55.34 No Disclosure

28 Suntrust Home Developers, Inc. SUN 0.70 (4.11) (2.78) 160,040 28.22 0.02 4.18 CR00841-2019

29 Petron Corporation PCOR 7.49 (3.97) (2.73) 129,716,654 5.36 1.40 0.81 No Disclosure

30 DFNN, Inc. DFNN 7.10 (3.92) (4.70) 577,325 24.87 0.29 2.00 No Disclosure

30 Dizon Copper-Silver Mines, Inc. DIZ 7.60 (3.92) (2.69) 174,254 (145.02) (0.05) (126.62) No Disclosure

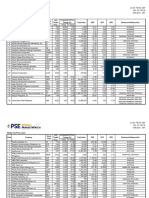

Jan 28 - Feb 01, 2019

VOL. VI NO. 5

ISSN 2013 - 1351

Weekly Market Statistics

(In pesos) January 21 - January 25 January 28 - February 01 Year-to-Date

Total Market Capitalization 17,254,028,294,346.40 17,356,201,742,411.50 17,356,201,742,411.50

Domestic Market Capitalization 14,538,023,963,972.80 14,703,879,399,591.20 14,703,879,399,591.20

Total Value Traded 34,218,390,005.13 46,748,842,495.81 199,817,838,473.02

Ave. Daily Value Traded 6,843,678,001.03 9,349,768,499.16 8,687,732,107.52

Foreign Buying 19,973,307,804.97 28,147,922,617.05 122,499,630,244.08

Foreign Selling 16,729,468,843.87 22,398,672,264.58 102,142,420,956.64

Net Foreign Buying/ (Selling) 3,243,838,961.11 5,749,250,352.48 20,357,209,287.44

% of Foreign to Total 54% 54% 56%

Number of Issues (Common shares):

107 - 119 - 21 126 - 99 - 23 164 - 83 - 10

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 8,144.16 1.13 4.94 9.08 19.45

All Shares Index 4,909.51 1.15 5.52 8.67 18.17

Financials Index 1,854.34 1.62 2.25 4.19 15.00

Industrial Index 11,824.03 0.39 5.10 7.97 16.22

Holding Firms Index 8,105.23 2.24 6.55 10.40 17.59

Property Index 4,005.76 (0.19) 3.31 10.41 21.18

Services Index 1,606.20 1.59 8.28 11.33 21.04

Mining and Oil Index 8,549.68 1.10 (3.63) 4.26 11.98

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may

be viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in

the symbol lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding

weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Corporate Planning & Research Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE

assumes no liability and responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and

advice from a securities professional is strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 688-7601 to 02, send a message through fax no. (632) 688-8818 or email pirs@pse.com.ph.

Vous aimerez peut-être aussi

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- wk35 Sep2022mktwatchDocument3 pageswk35 Sep2022mktwatchcraftersxPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaPas encore d'évaluation

- wk05 Jan2024mktwatchDocument3 pageswk05 Jan2024mktwatchMacxie Baldonado QuibuyenPas encore d'évaluation

- 2019 11 20 PH D PDFDocument5 pages2019 11 20 PH D PDFJPas encore d'évaluation

- Fund Performance ActiveDocument12 pagesFund Performance ActiveFortunePas encore d'évaluation

- UTIMCO Feb2023Document36 pagesUTIMCO Feb2023Manish Singh100% (3)

- AFSADocument17 pagesAFSAshreya sarkarPas encore d'évaluation

- Estimari Dividende 2019 22.11.2019Document4 pagesEstimari Dividende 2019 22.11.2019Bogdan BoicuPas encore d'évaluation

- Top Stories:: THU 19 AUG 2021Document7 pagesTop Stories:: THU 19 AUG 2021Elcano MirandaPas encore d'évaluation

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasPas encore d'évaluation

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxPas encore d'évaluation

- wk39 Sep2022mktwatchDocument3 pageswk39 Sep2022mktwatchcraftersxPas encore d'évaluation

- QuarterlyTop50 4Q 2009Document5 pagesQuarterlyTop50 4Q 2009Franz Carla NavarroPas encore d'évaluation

- Investment GuideDocument2 pagesInvestment Guidegundam busterPas encore d'évaluation

- Top Story:: MON 14 JUN 2021Document4 pagesTop Story:: MON 14 JUN 2021JajahinaPas encore d'évaluation

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroPas encore d'évaluation

- Venture Fund PerformanceDocument12 pagesVenture Fund PerformanceTechCrunch100% (1)

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupDocument4 pagesTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristinePas encore d'évaluation

- Top Story:: Ubp: Manageable Increase Npls in May Maintain HoldDocument7 pagesTop Story:: Ubp: Manageable Increase Npls in May Maintain HoldJajahinaPas encore d'évaluation

- Gross To Net RI Report - 01182024 080036Document6 pagesGross To Net RI Report - 01182024 080036abineshabi0123Pas encore d'évaluation

- U.S. Dividend Champions: End-Of-Month Update atDocument26 pagesU.S. Dividend Champions: End-Of-Month Update atALFONSO ARREOLAPas encore d'évaluation

- CF 01Document2 pagesCF 01John Alex SelorioPas encore d'évaluation

- Top Stories:: FRI 27 AUG 2021Document7 pagesTop Stories:: FRI 27 AUG 2021Elcano MirandaPas encore d'évaluation

- Top Stories:: TUE 17 AUG 2021Document14 pagesTop Stories:: TUE 17 AUG 2021Elcano MirandaPas encore d'évaluation

- Wirdawati-B2092221017-Tugas Statistik Untuk BisnisDocument5 pagesWirdawati-B2092221017-Tugas Statistik Untuk BisnisEMI PURWANIPas encore d'évaluation

- Bab IVDocument44 pagesBab IVIlyasa YusufPas encore d'évaluation

- Top Stories:: WED 11 AUG 2021Document11 pagesTop Stories:: WED 11 AUG 2021Elcano MirandaPas encore d'évaluation

- Ventura Securities Limited CIN NO.:U67120MH1994PLC082048Document3 pagesVentura Securities Limited CIN NO.:U67120MH1994PLC082048vennapuPas encore d'évaluation

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyPas encore d'évaluation

- Investment GuideDocument2 pagesInvestment GuideMichael MontinolaPas encore d'évaluation

- Valuation For Nestlé Lanka PLCDocument20 pagesValuation For Nestlé Lanka PLCErandika Lakmali GamagePas encore d'évaluation

- Date: 28/05/2021 Current Price: 101,000 VND The Highest: 103,000 VND The Shortest: 100,800 VND Transaction Volume: 8,505,700Document6 pagesDate: 28/05/2021 Current Price: 101,000 VND The Highest: 103,000 VND The Shortest: 100,800 VND Transaction Volume: 8,505,700Vi TrươngPas encore d'évaluation

- Saham-Saham Berpotensi Utk Trade Mid Term - Invest Long TermDocument12 pagesSaham-Saham Berpotensi Utk Trade Mid Term - Invest Long Termhart azacPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- SdfasdfasdfDocument9 pagesSdfasdfasdfsimonPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarPas encore d'évaluation

- Scribd DL1Document1 pageScribd DL1Kristian AguilarPas encore d'évaluation

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarPas encore d'évaluation

- Pinoy Millionaire Game Plan The BlueprintDocument22 pagesPinoy Millionaire Game Plan The BlueprintKristian AguilarPas encore d'évaluation

- Scribd DL3Document1 pageScribd DL3Kristian AguilarPas encore d'évaluation

- SdfasdfasdfDocument9 pagesSdfasdfasdfsimonPas encore d'évaluation

- SdfasdfasdfDocument9 pagesSdfasdfasdfsimonPas encore d'évaluation

- Asdasdsafsdfcsdfsdf SDF SDF Sdfs DF GRT Htyjk Uig Lol HiDocument1 pageAsdasdsafsdfcsdfsdf SDF SDF Sdfs DF GRT Htyjk Uig Lol HiKristian AguilarPas encore d'évaluation

- Asdasdsafsdfcsdfsdf SDF SDF Sdfs DF GRT Htyjk Uig Lol HiDocument1 pageAsdasdsafsdfcsdfsdf SDF SDF Sdfs DF GRT Htyjk Uig Lol HiKristian AguilarPas encore d'évaluation

- Scribd 2Document1 pageScribd 2Kristian AguilarPas encore d'évaluation

- Scribd DL2Document1 pageScribd DL2Kristian AguilarPas encore d'évaluation

- Scribd DL1Document1 pageScribd DL1Kristian AguilarPas encore d'évaluation

- Scribd DL4Document1 pageScribd DL4Kristian AguilarPas encore d'évaluation

- SdfasdfasdfDocument9 pagesSdfasdfasdfsimonPas encore d'évaluation

- Branch V Subsidiary CorporationDocument4 pagesBranch V Subsidiary CorporationKristian AguilarPas encore d'évaluation

- CIR V Soriano DigestDocument4 pagesCIR V Soriano DigestKristian AguilarPas encore d'évaluation

- FC-pascual Vs Cir (1988)Document6 pagesFC-pascual Vs Cir (1988)Abbot ReyesPas encore d'évaluation

- Herewego 23Document2 pagesHerewego 23Kristian AguilarPas encore d'évaluation

- Herewego 59Document6 pagesHerewego 59Kristian AguilarPas encore d'évaluation

- A Review On Different Yogas Used in The Management of Mandali Damsa Vrana W.S.R. To KriyakaumudiDocument11 pagesA Review On Different Yogas Used in The Management of Mandali Damsa Vrana W.S.R. To KriyakaumudiTiya TiwariPas encore d'évaluation

- Misc Ar2019Document207 pagesMisc Ar2019Sharon12 ArulsamyPas encore d'évaluation

- CA-idms Ads Alive User Guide 15.0Document142 pagesCA-idms Ads Alive User Guide 15.0svdonthaPas encore d'évaluation

- Bell Single-Sleeve Shrug Crochet PatternDocument2 pagesBell Single-Sleeve Shrug Crochet PatternsicksoxPas encore d'évaluation

- JAMB Syllabus For BiologyDocument27 pagesJAMB Syllabus For BiologyOluebube UchennaPas encore d'évaluation

- Part 1. Question 1-7. Complete The Notes Below. Write NO MORE THAN THREE WORDS AND/OR A NUMBER For Each AnswerDocument13 pagesPart 1. Question 1-7. Complete The Notes Below. Write NO MORE THAN THREE WORDS AND/OR A NUMBER For Each Answerahmad amdaPas encore d'évaluation

- SLHT Grade 7 CSS Week 5 Without Answer KeyDocument6 pagesSLHT Grade 7 CSS Week 5 Without Answer KeyprinceyahwePas encore d'évaluation

- UniFi Quick GuideDocument2 pagesUniFi Quick GuideAndhika TharunaPas encore d'évaluation

- 28 ESL Discussion Topics Adult StudentsDocument14 pages28 ESL Discussion Topics Adult StudentsniallPas encore d'évaluation

- Electric Machinery and Transformers - I. L. Kosow PDFDocument413 pagesElectric Machinery and Transformers - I. L. Kosow PDFzcjswordPas encore d'évaluation

- Writing Short StoriesDocument10 pagesWriting Short StoriesRodiatun YooPas encore d'évaluation

- Classical Encryption TechniqueDocument18 pagesClassical Encryption TechniquetalebmuhsinPas encore d'évaluation

- Advancement of SGDocument2 pagesAdvancement of SGkailasasundaramPas encore d'évaluation

- Gel Electrophoresis Worksheet Teacher AnswersDocument3 pagesGel Electrophoresis Worksheet Teacher AnswersChris FalokunPas encore d'évaluation

- Syllabus - Building Rehabilitation Anfd Forensic en - 220825 - 181244Document3 pagesSyllabus - Building Rehabilitation Anfd Forensic en - 220825 - 181244M O H A N A V E LPas encore d'évaluation

- 01 C. Toolbar and Message BoxDocument10 pages01 C. Toolbar and Message Boxradu.iacobPas encore d'évaluation

- Business EthicsDocument10 pagesBusiness EthicsTeguh HardiPas encore d'évaluation

- E Commerce and Its Influence in Changing in Purchasing Behavior of Modern ConsumersDocument13 pagesE Commerce and Its Influence in Changing in Purchasing Behavior of Modern ConsumersRichard VillanuevaPas encore d'évaluation

- Auburn Bsci ThesisDocument5 pagesAuburn Bsci Thesisafksaplhfowdff100% (1)

- WebMethods System Requirements 8xDocument7 pagesWebMethods System Requirements 8xmaxprincePas encore d'évaluation

- Complex Poly (Lactic Acid) - Based - 1Document20 pagesComplex Poly (Lactic Acid) - Based - 1Irina PaslaruPas encore d'évaluation

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiPas encore d'évaluation

- Supermini200 (Hi-Res Book) Brochure en Ver1 00Document4 pagesSupermini200 (Hi-Res Book) Brochure en Ver1 00PauloValdiviesoPas encore d'évaluation

- Hazop Close Out ReportDocument6 pagesHazop Close Out ReportKailash PandeyPas encore d'évaluation

- Buy Wholesale China Popular Outdoor Football Boot For Teenagers Casual High Quality Soccer Shoes FG Ag Graffiti Style & FootballDocument1 pageBuy Wholesale China Popular Outdoor Football Boot For Teenagers Casual High Quality Soccer Shoes FG Ag Graffiti Style & Footballjcdc9chh8dPas encore d'évaluation

- AMX Prodigy Install ManualDocument13 pagesAMX Prodigy Install Manualsundevil2010usa4605Pas encore d'évaluation

- Talent-Olympiad 9 Science SampleDocument12 pagesTalent-Olympiad 9 Science SampleFire GamingPas encore d'évaluation

- The Impact of Social Networking Sites To The Academic Performance of The College Students of Lyceum of The Philippines - LagunaDocument15 pagesThe Impact of Social Networking Sites To The Academic Performance of The College Students of Lyceum of The Philippines - LagunaAasvogel Felodese Carnivora64% (14)

- Asme Bladder Accumulator DatasheetDocument3 pagesAsme Bladder Accumulator DatasheetSamad A BakarPas encore d'évaluation

- Check List For Design Program of A Parish ChurchDocument11 pagesCheck List For Design Program of A Parish ChurchQuinn HarlowePas encore d'évaluation